Deck 25: Manufacturing Accounting

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

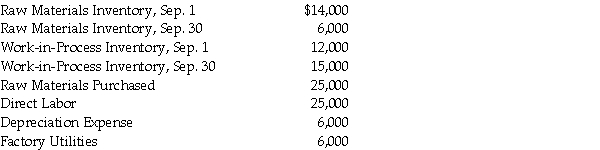

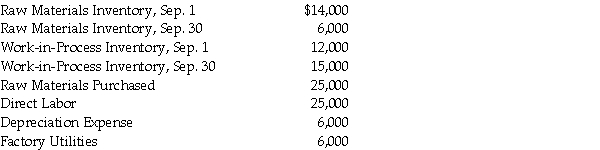

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

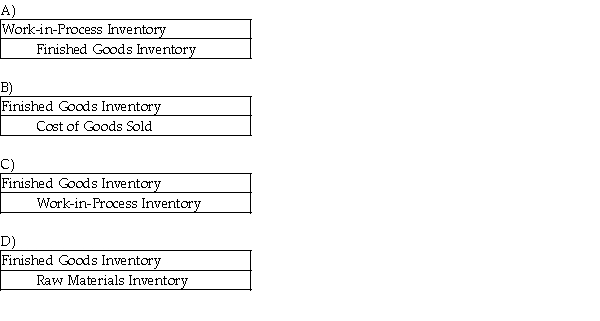

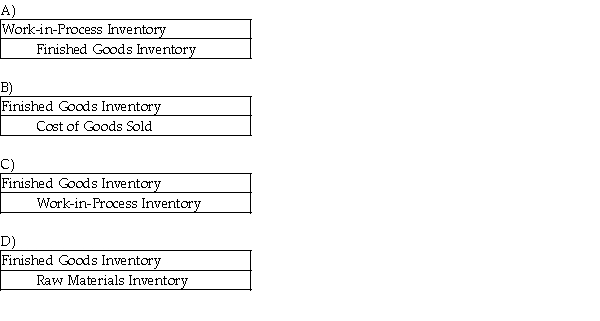

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

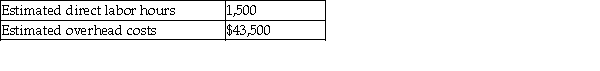

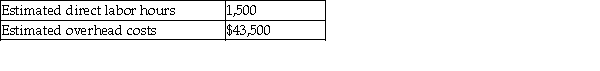

سؤال

سؤال

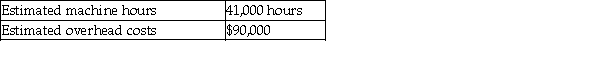

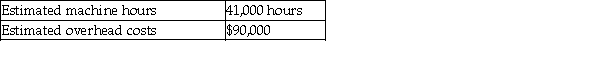

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/126

العب

ملء الشاشة (f)

Deck 25: Manufacturing Accounting

1

What inventories are included in determining total manufacturing costs?

A) Beginning and ending finished goods

B) Beginning and ending raw materials

C) Beginning and ending work-in-process

D) None of the above answers is correct.

A) Beginning and ending finished goods

B) Beginning and ending raw materials

C) Beginning and ending work-in-process

D) None of the above answers is correct.

B

2

Which inventory account consists of manufacturing cost of goods that are complete?

A) Work-in-Process Inventory

B) Raw Materials Inventory

C) Manufacturing Overhead

D) Finished Goods Inventory

A) Work-in-Process Inventory

B) Raw Materials Inventory

C) Manufacturing Overhead

D) Finished Goods Inventory

D

3

The formula for cost of goods manufactured is:

A) raw materials plus direct labor minus overhead plus beginning work-in-process inventory plus ending work-in-process inventory.

B) raw materials minus direct labor plus overhead plus beginning work-in-process inventory plus ending work-in-process inventory.

C) beginning work-in-process plus total manufacturing cost minus ending work-in-process.

D) raw materials plus direct labor less overhead plus beginning work-in-process inventory less ending work-in-process inventory.

A) raw materials plus direct labor minus overhead plus beginning work-in-process inventory plus ending work-in-process inventory.

B) raw materials minus direct labor plus overhead plus beginning work-in-process inventory plus ending work-in-process inventory.

C) beginning work-in-process plus total manufacturing cost minus ending work-in-process.

D) raw materials plus direct labor less overhead plus beginning work-in-process inventory less ending work-in-process inventory.

C

4

Total manufacturing costs incurred include:

A) direct labor costs.

B) raw materials costs.

C) manufacturing overhead.

D) All of the above

A) direct labor costs.

B) raw materials costs.

C) manufacturing overhead.

D) All of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

5

Manufacturing overhead includes all manufacturing costs except which of the following?

A) Raw materials

B) Maintenance supplies

C) Direct labor

D) Both A and C

A) Raw materials

B) Maintenance supplies

C) Direct labor

D) Both A and C

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

6

The statement of cost of goods manufactured does NOT include:

A) direct labor costs.

B) selling and administrative costs.

C) manufacturing overhead.

D) All of the above are included.

A) direct labor costs.

B) selling and administrative costs.

C) manufacturing overhead.

D) All of the above are included.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

7

The three major manufacturing inventories do NOT include which of the following?

A) Supplies

B) Work-in-process

C) Raw materials

D) Finished goods

A) Supplies

B) Work-in-process

C) Raw materials

D) Finished goods

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

8

Metal used in construction of a tank is part of:

A) raw material costs.

B) labor costs.

C) manufacturing overhead.

D) depreciation expense.

A) raw material costs.

B) labor costs.

C) manufacturing overhead.

D) depreciation expense.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

9

The three manufacturing inventories are raw materials, work-in-process, and finished goods inventory.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

10

Screws, electricity for manufacturing, and production supervisor salary are examples of:

A) raw materials.

B) direct labor.

C) manufacturing overhead.

D) None of the above

A) raw materials.

B) direct labor.

C) manufacturing overhead.

D) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

11

When manufacturing a product, direct labor includes the wages of:

A) an hourly worker producing the product.

B) the shop foreman.

C) maintenance workers.

D) sales staff.

A) an hourly worker producing the product.

B) the shop foreman.

C) maintenance workers.

D) sales staff.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

12

Paint used in painting the final product would be considered work-in-process inventory.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

13

Calculate the cost of goods sold when beginning finished goods inventory equals $87,000, ending finished goods inventory $75,000, and cost of goods manufactured $640,000.

A) $652,000

B) $482,000

C) $727,000

D) $628,000

A) $652,000

B) $482,000

C) $727,000

D) $628,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

14

Ending finished goods inventory is subtracted from cost of goods available for sale to get:

A) cost of goods manufactured.

B) cost of goods sold.

C) gross profit.

D) None of the above

A) cost of goods manufactured.

B) cost of goods sold.

C) gross profit.

D) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

15

Which inventory account consists of products currently being processed?

A) Finished Goods Inventory

B) Work-in-Process Inventory

C) Manufacturing Overhead Inventory

D) Supplies expense

A) Finished Goods Inventory

B) Work-in-Process Inventory

C) Manufacturing Overhead Inventory

D) Supplies expense

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

16

Raw Materials Inventory appears on the:

A) balance sheet.

B) income statement.

C) cost of goods manufactured statement.

D) Both A and C are correct.

A) balance sheet.

B) income statement.

C) cost of goods manufactured statement.

D) Both A and C are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

17

Under a perpetual inventory system, freight costs to bring the raw materials in should be charged to:

A) Work-in-Process Inventory.

B) Delivery Expense.

C) Raw Materials Inventory.

D) Manufacturing overhead.

A) Work-in-Process Inventory.

B) Delivery Expense.

C) Raw Materials Inventory.

D) Manufacturing overhead.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

18

What inventories are included in determining the cost of goods sold?

A) Beginning and ending finished goods

B) Beginning and ending raw materials

C) Beginning and ending work-in-process

D) Supplies.

A) Beginning and ending finished goods

B) Beginning and ending raw materials

C) Beginning and ending work-in-process

D) Supplies.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

19

The first step in determining total manufacturing costs is to calculate:

A) the raw material used for the month.

B) the direct labor cost for the month.

C) factory overhead cost for the month.

D) finished inventory - ending balance.

A) the raw material used for the month.

B) the direct labor cost for the month.

C) factory overhead cost for the month.

D) finished inventory - ending balance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

20

Manufacturing costs do NOT include:

A) raw material.

B) delivery expenses.

C) manufacturing overhead.

D) All of these answers are correct.

A) raw material.

B) delivery expenses.

C) manufacturing overhead.

D) All of these answers are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

21

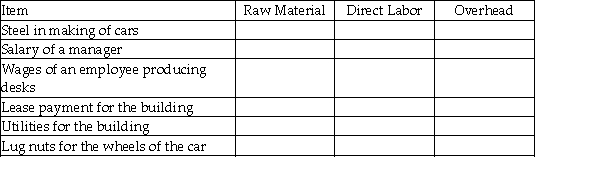

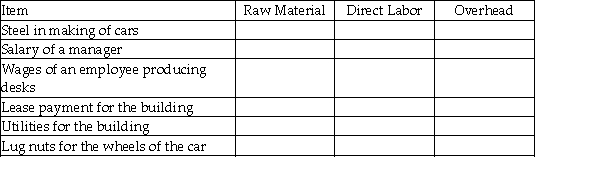

Classify each of the following as raw materials, direct labor, or overhead:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

22

The balance sheet reports the work in process inventory.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

23

A shop foreman's salary is considered indirect labor.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

24

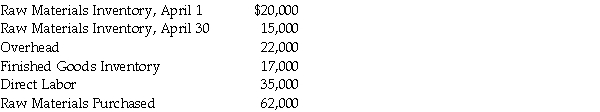

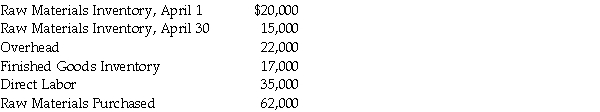

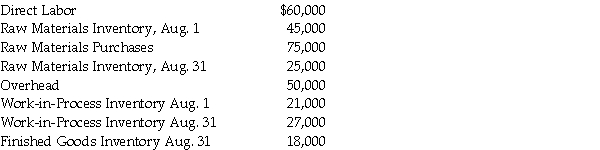

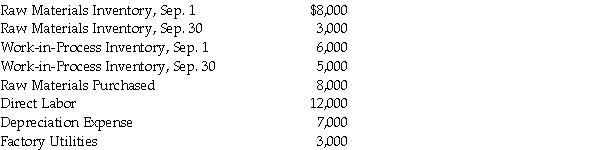

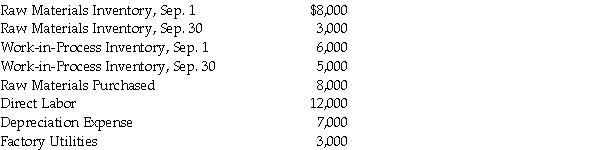

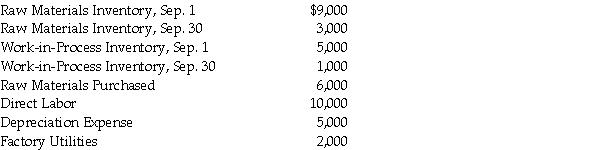

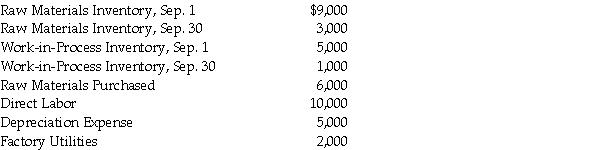

From the following information, calculate (a) cost of raw materials used and (b) total manufacturing costs.  a. ________

a. ________

b. ________

a. ________

a. ________b. ________

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

25

Hourly wages of production line employees are one of the costs included in the manufacturing overhead.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

26

A cost of goods manufactured statement should be prepared after the income statement has been prepared.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

27

Overhead includes labor costs of assembly line supervisors but not the assembly workers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

28

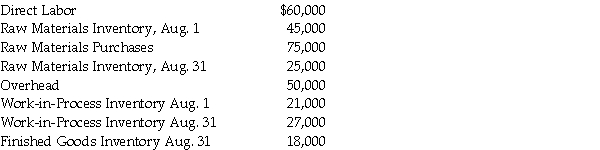

Chelsie Interiors produces artist supplies. Listed below are the costs of production and inventory.  Compute:

Compute:

a. Cost of raw materials used in production

b. Total manufacturing costs

c. Total cost of goods manufactured

Compute:

Compute:a. Cost of raw materials used in production

b. Total manufacturing costs

c. Total cost of goods manufactured

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

29

The steps of the accounting cycle for a manufacturing company are different from those used for a merchandise company.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

30

Cost of goods manufactured is determined before the income statement can be completed.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

31

If a company had a beginning balance of $8,000 in Finished Goods Inventory, an ending balance of $5,000 in Finished Goods Inventory and cost of goods manufactured was $41,000 during the month, then the cost of goods sold for the month was $44,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

32

The second step in the preparation of the statement of cost of goods manufactured is to add in and subtract out the two raw material inventory balances.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

33

All expenses are listed on the income statement of a manufacturer.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

34

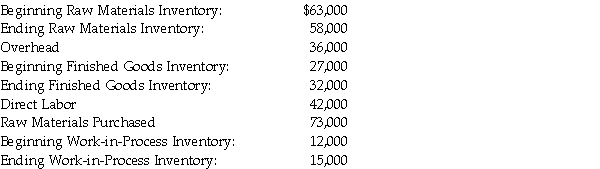

Calculate the (a) cost of raw materials used and (b) total manufacturing costs from the following information.  a. ________

a. ________

b. ________

a. ________

a. ________b. ________

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

35

If a company had a beginning balance of $5,000 in Work-in-Process Inventory, an ending balance of $7,000 in Work-in-Process Inventory and incurred direct labor costs of $8,000 and overhead costs of $4,000, then the cost of goods manufactured during the month was $20,000. Raw Materials used were $10,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

36

Work in Process inventory includes the total costs of manufacturing a product.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

37

Calculate the cost of goods manufactured from the following information.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

38

If a company had a beginning balance of $5,000 in Raw Materials, an ending balance of $3,000 and purchased $27,000 of materials during the month, then the raw material used for the month was $29,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

39

Finished goods inventory is listed on the schedule of cost of goods sold.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

40

From the following, calculate the cost of raw materials used and total manufacturing costs:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

41

A lot ticket is a:

A) document prepared to show the movement of materials or products between departments.

B) document used to order materials or supplies from the storeroom.

C) document used for charging material to production.

D) document used to identify an inventory location.

A) document prepared to show the movement of materials or products between departments.

B) document used to order materials or supplies from the storeroom.

C) document used for charging material to production.

D) document used to identify an inventory location.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

42

A material requisition is a:

A) document prepared to show the movement of materials or products between departments.

B) document used to order materials or supplies from the vendor or supplier.

C) document used for charging material to production.

D) document used to record receipt of materials or supplies from the vendor or supplier.

A) document prepared to show the movement of materials or products between departments.

B) document used to order materials or supplies from the vendor or supplier.

C) document used for charging material to production.

D) document used to record receipt of materials or supplies from the vendor or supplier.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

43

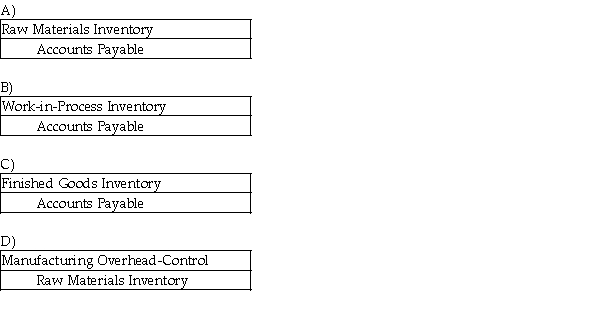

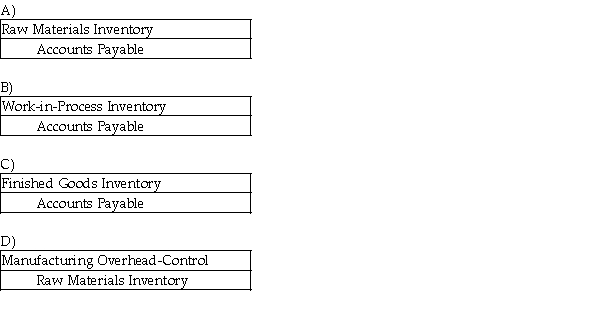

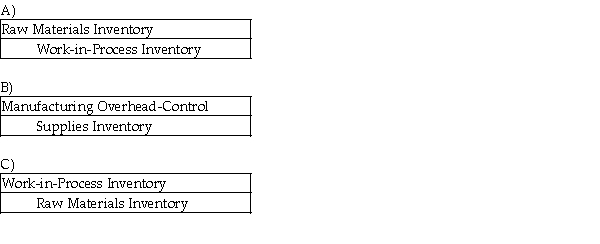

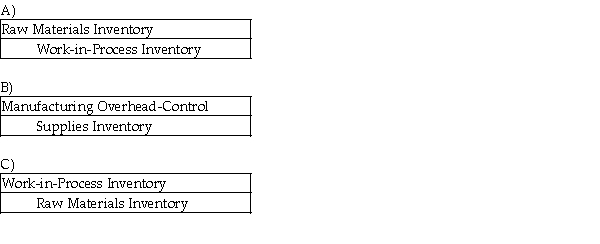

In a manufacturing company, the purchase of raw materials on account should be recorded as follows:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

44

The journal entry to record issuing raw materials from the storeroom would include a:

A) credit to Raw Materials Inventory.

B) credit to Supplies.

C) debit to Work-in-Process Inventory.

D) Both A and C

A) credit to Raw Materials Inventory.

B) credit to Supplies.

C) debit to Work-in-Process Inventory.

D) Both A and C

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

45

The Manufacturing Overhead-Control account is used for the:

A) application of overhead to production and it has a debit balance.

B) accumulation of all actual overhead costs and it has a credit balance.

C) application of overhead to production and it has a credit balance.

D) accumulation of all actual overhead costs and it has a debit balance.

A) application of overhead to production and it has a debit balance.

B) accumulation of all actual overhead costs and it has a credit balance.

C) application of overhead to production and it has a credit balance.

D) accumulation of all actual overhead costs and it has a debit balance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

46

Chico.com sold 65 jet skis on account for $7,700 which cost $5,500. The entry to record the sale would include a:

A) credit to Finished Goods Inventory $5,500.

B) credit to Account Receivable for $7,700.

C) debit to Cost of Goods Sold for $7,700.

D) All of the above

A) credit to Finished Goods Inventory $5,500.

B) credit to Account Receivable for $7,700.

C) debit to Cost of Goods Sold for $7,700.

D) All of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

47

Journal entries crediting Payroll Payable and debiting Work-in-Process Inventory are made for:

A) administrative salaries.

B) hourly manufacturing labor.

C) foremen's salaries.

D) raw materials.

A) administrative salaries.

B) hourly manufacturing labor.

C) foremen's salaries.

D) raw materials.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

48

Describe the three elements of manufacturing cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

49

A clock card is:

A) the basis for payroll.

B) the basis for charging cost of goods sold.

C) a document to show movement of materials.

D) a document used to order materials.

A) the basis for payroll.

B) the basis for charging cost of goods sold.

C) a document to show movement of materials.

D) a document used to order materials.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

50

The entry to record the requisition of supplies from the storeroom would include a:

A) debit to Raw Materials Inventory.

B) debit to Manufacturing Overhead-Control.

C) debit to Supplies Inventory.

D) debit to Work in Process Inventory.

A) debit to Raw Materials Inventory.

B) debit to Manufacturing Overhead-Control.

C) debit to Supplies Inventory.

D) debit to Work in Process Inventory.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

51

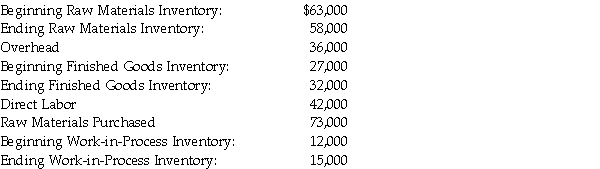

From the following information calculate total manufacturing costs and cost of goods manufactured.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

52

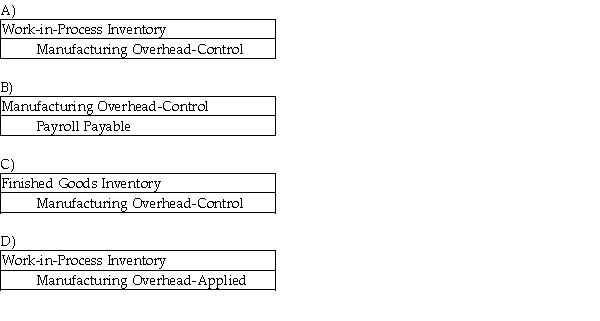

The entry for indirect materials (such as glue, etc.) requisitioned for use in production is:

D) None of these answers is correct.

D) None of these answers is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

53

The journal entry to record the direct labor summarized on the labor distribution report would include a:

A) debit to Payroll Expense.

B) debit to Work-in-Process Inventory.

C) credit to Payroll Payable.

D) Both B and C

A) debit to Payroll Expense.

B) debit to Work-in-Process Inventory.

C) credit to Payroll Payable.

D) Both B and C

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

54

The journal entry to record issuing supplies from the storeroom would include a:

A) debit to Manufacturing Overhead-Applied.

B) credit to Raw Materials Inventory.

C) credit to Manufacturing Overhead-Applied.

D) debit to Manufacturing Overhead-Control.

A) debit to Manufacturing Overhead-Applied.

B) credit to Raw Materials Inventory.

C) credit to Manufacturing Overhead-Applied.

D) debit to Manufacturing Overhead-Control.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

55

A report issued by the payroll department to categorize all the types of labor incurred during the week is a:

A) labor distribution report.

B) receiving report.

C) payable register.

D) None of these answers is correct.

A) labor distribution report.

B) receiving report.

C) payable register.

D) None of these answers is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

56

Rockland completed the manufacturing process. The entry to transfer the product to finished goods is:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

57

A document that is prepared to show how items have been shipped to customers is a:

A) receiving report.

B) bill of lading.

C) lot ticket.

D) clock card.

A) receiving report.

B) bill of lading.

C) lot ticket.

D) clock card.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

58

During the week ended November 30, total factory payroll incurred was $8,600. Of this total, 60% was for direct labor. The entry to record the payroll distribution would include:

A) debit Work-in-Process Inventory for $5,160 and Manufacturing Overhead-Control for $3,440.

B) debit Work-in-Process Inventory for $8,600.

C) debit Work-in-Process Inventory for $5,160 and Manufacturing Overhead-Applied for $3,440.

D) debit Work-in-Process Inventory for $5,160 and Indirect Labor Expense for $3,440.

A) debit Work-in-Process Inventory for $5,160 and Manufacturing Overhead-Control for $3,440.

B) debit Work-in-Process Inventory for $8,600.

C) debit Work-in-Process Inventory for $5,160 and Manufacturing Overhead-Applied for $3,440.

D) debit Work-in-Process Inventory for $5,160 and Indirect Labor Expense for $3,440.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

59

From the following, calculate the cost of raw materials used, total manufacturing costs and cost of goods manufactured:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

60

Which is NOT an example of a source document?

A) Clock card

B) Bill of lading

C) Lot ticket

D) All are source documents.

A) Clock card

B) Bill of lading

C) Lot ticket

D) All are source documents.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

61

If the overhead applied rate based on direct labor hours is $10.00 and the actual labor hours are 520, what is the amount credited to Manufacturing Overhead-Applied?

A) $5,200

B) $520

C) $52,000

D) None of the above

A) $5,200

B) $520

C) $52,000

D) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

62

Work-in-Process Inventory is credited when goods are transferred to finished goods.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

63

The overhead application rate may be based on:

A) machine hours.

B) direct labor hours.

C) direct labor dollars.

D) All of these answers are correct.

A) machine hours.

B) direct labor hours.

C) direct labor dollars.

D) All of these answers are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

64

The entry to record selling a product that cost $22,000 would be a credit to Finished Goods Inventory $22,000, and a debit to Cost of Goods Sold $22,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

65

In entries to record the movement of material, labor, and overhead through the operation of a company, the credit is the destination and the debit is the source.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

66

Caper Manufacturing applies overhead based on direct labor hours. At the beginning of the year, it estimated that overhead costs would be $153,000 and direct labor hours would be 16,000. The applied overhead rate per direct labor hour is: (Round your answer to the nearest cent.)

A) $7.17.

B) $14.34.

C) $9.56.

D) None of the above

A) $7.17.

B) $14.34.

C) $9.56.

D) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

67

Brooks Manufacturing is using a manufacturing overhead application rate of 180% of machine cost. A job uses 43 machine hours at $17/hour. How much overhead should be applied to the job? (Round your answer to the nearest dollar.)

A) $731

B) $1,316

C) ($1,316)

D) ($731)

A) $731

B) $1,316

C) ($1,316)

D) ($731)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

68

If direct labor for the month is $105,000, and overhead is applied based on 65% of direct labor dollars, what is the entry to apply overhead?

A) Debit Work-in-Process Inventory $68,250; credit Payroll Payable $68,250

B) Debit Overhead-Applied $68,250; credit Work-in-Process Inventory $68,250

C) Debit Work-in-Process Inventory $68,250; credit Manufacturing Overhead-Applied $68,250

D) Debit Work-in-Process Inventory $105,000; credit Manufacturing Overhead-Applied $105,000

A) Debit Work-in-Process Inventory $68,250; credit Payroll Payable $68,250

B) Debit Overhead-Applied $68,250; credit Work-in-Process Inventory $68,250

C) Debit Work-in-Process Inventory $68,250; credit Manufacturing Overhead-Applied $68,250

D) Debit Work-in-Process Inventory $105,000; credit Manufacturing Overhead-Applied $105,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

69

The Overhead-Applied account is used for the:

A) application of overhead to production and it has a credit balance.

B) accumulation of all actual overhead costs and it has a credit balance.

C) application of overhead to production and it has a debit balance.

D) accumulation of all actual overhead costs and it has a debit balance.

A) application of overhead to production and it has a credit balance.

B) accumulation of all actual overhead costs and it has a credit balance.

C) application of overhead to production and it has a debit balance.

D) accumulation of all actual overhead costs and it has a debit balance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

70

Estimated manufacturing overhead costs were $65,000 and the number of estimated machine hours was 30,000. Actual overhead costs were $64,000 and the actual number of machine hours used was 28,500. Based on machine hours, the overhead application rate per hour is: (Round your answer to the nearest cent.)

A) $2.17.

B) $2.28.

C) $2.25.

D) $2.13.

A) $2.17.

B) $2.28.

C) $2.25.

D) $2.13.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

71

The bill of lading is a formal document issued to the carrier for shipping the finished product to a customer.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

72

Direct labor for the month is $52,000, and overhead is applied based on direct labor cost. Annual overhead is estimated to be $530,000, and annual direct labor is estimated to be $810,000. What is the entry to apply overhead to production? (Round intermediary calculations to two decimal places and your final calculations to the nearest whole dollar.)

A) Debit Work-in-Process Inventory $33,800; credit Payroll Payable $33,800

B) Debit Manufacturing Overhead-Applied $33,800; credit Work-in-Process Inventory $33,800

C) Debit Work-in-Process Inventory $33,800 credit Manufacturing Overhead-Applied $33,800

D) Debit Work-in-Process Inventory $52,000; credit Manufacturing Overhead-Applied $52,000

A) Debit Work-in-Process Inventory $33,800; credit Payroll Payable $33,800

B) Debit Manufacturing Overhead-Applied $33,800; credit Work-in-Process Inventory $33,800

C) Debit Work-in-Process Inventory $33,800 credit Manufacturing Overhead-Applied $33,800

D) Debit Work-in-Process Inventory $52,000; credit Manufacturing Overhead-Applied $52,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

73

Baker Manufacturing has estimated manufacturing overhead at $133,000 and has estimated direct labor of 10,000 direct labor hours at $19 per hour. The overhead rate per direct labor dollar would be: (Round your answer to the nearest cent.)

A) $1.43.

B) $13.30.

C) $0.70.

D) $5.70.

A) $1.43.

B) $13.30.

C) $0.70.

D) $5.70.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

74

The entry to record rent expense $14,000, supervision expense $24,000 and depreciation expense $15,000 to overhead is:

A) debit Manufacturing Overhead-Applied $53,000; credit Rent Expense $14,000, Supervision $24,000, Depreciation Expense $15,000.

B) debit Work in Process Inventory $53,000; credit Rent Expense $14,000, Supervision $24,000, Depreciation Expense $15,000.

C) debit Manufacturing Overhead-Applied $53,000; credit Manufacturing Overhead-Control $53,000.

D) None of these answers is correct.

A) debit Manufacturing Overhead-Applied $53,000; credit Rent Expense $14,000, Supervision $24,000, Depreciation Expense $15,000.

B) debit Work in Process Inventory $53,000; credit Rent Expense $14,000, Supervision $24,000, Depreciation Expense $15,000.

C) debit Manufacturing Overhead-Applied $53,000; credit Manufacturing Overhead-Control $53,000.

D) None of these answers is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

75

ZTY Company has direct labor for the month of $44,000. ZTY's annual overhead is $660,000 and annual direct labor cost is $1,070,000. Overhead is applied based on direct labor. What is the entry to charge direct labor to production? (Round your answer to the nearest dollar.)

A) Debit Work-in-Process Inventory $44,000; credit Payroll Payable $44,000

B) Debit Manufacturing Overhead-Applied $44,000; credit Work-in-Process Inventory $44,000

C) Debit Work-in-Process Inventory $27,140; credit Manufacturing Overhead-Applied $27,140

D) Debit Work-in-Process Inventory $71,333; credit Manufacturing Overhead-Applied $71,333

A) Debit Work-in-Process Inventory $44,000; credit Payroll Payable $44,000

B) Debit Manufacturing Overhead-Applied $44,000; credit Work-in-Process Inventory $44,000

C) Debit Work-in-Process Inventory $27,140; credit Manufacturing Overhead-Applied $27,140

D) Debit Work-in-Process Inventory $71,333; credit Manufacturing Overhead-Applied $71,333

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

76

The following data are available for Starbrite Corporation:  If overhead is applied based on direct labor hours, the predetermined overhead rate is: (Round your answer to the nearest cent.)

If overhead is applied based on direct labor hours, the predetermined overhead rate is: (Round your answer to the nearest cent.)

A) $20.91.

B) $29.00.

C) $209.13.

D) $290.00.

If overhead is applied based on direct labor hours, the predetermined overhead rate is: (Round your answer to the nearest cent.)

If overhead is applied based on direct labor hours, the predetermined overhead rate is: (Round your answer to the nearest cent.)A) $20.91.

B) $29.00.

C) $209.13.

D) $290.00.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

77

The estimated manufacturing overhead cost was $26,000 and estimated machine hours were 14,000. Actual manufacturing overhead cost was $30,000 and actual machine hours were 12,000. The overhead application rate per hour based on machine hours is: (Round your answer to the nearest cent.)

A) $1.86.

B) $2.50.

C) $2.14.

D) $2.17.

A) $1.86.

B) $2.50.

C) $2.14.

D) $2.17.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

78

The following data are available for Skyway:  If overhead is applied based on machine hours, the predetermined overhead rate is: (Round your answer two decimal places.)

If overhead is applied based on machine hours, the predetermined overhead rate is: (Round your answer two decimal places.)

A) $2.20.

B) $21.95.

C) $0.46.

D) 219.51%.

If overhead is applied based on machine hours, the predetermined overhead rate is: (Round your answer two decimal places.)

If overhead is applied based on machine hours, the predetermined overhead rate is: (Round your answer two decimal places.)A) $2.20.

B) $21.95.

C) $0.46.

D) 219.51%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

79

Jackson Manufacturing is using a manufacturing overhead application rate of 130% of direct labor dollars. A job uses 17 direct labor hours at $27 per hour. How much overhead should be applied to the job? (Round your answer to the nearest dollar.)

A) $353

B) $298

C) $597

D) $459

A) $353

B) $298

C) $597

D) $459

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

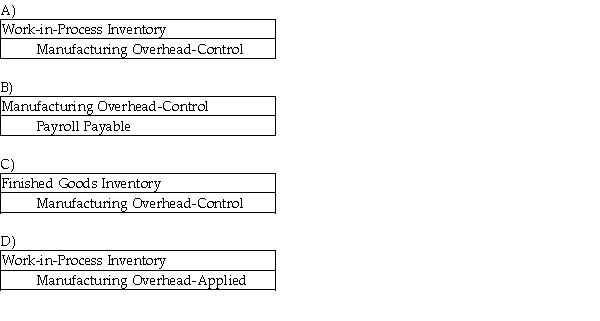

80

Which of the following journal entries would be made to apply the cost of indirect labor to production?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck