Deck 19: Corporations: Stock Values, Dividends, Treasury Stocks,

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/122

العب

ملء الشاشة (f)

Deck 19: Corporations: Stock Values, Dividends, Treasury Stocks,

1

Market Value is defined as:

A) the price a corporation pays when it reserves the right to retire or redeem stock at a specific price.

B) the price at which shares are bought and sold on the open market.

C) the total stockholders' equity minus total amount assigned to preferred stock.

D) the total of stockholders' equity (when only common stock exists) divided by the number of shares issued.

A) the price a corporation pays when it reserves the right to retire or redeem stock at a specific price.

B) the price at which shares are bought and sold on the open market.

C) the total stockholders' equity minus total amount assigned to preferred stock.

D) the total of stockholders' equity (when only common stock exists) divided by the number of shares issued.

B

2

Book Value per Share is defined as:

A) the price a corporation pays when it reserves the right to retire or redeem stock at a specific price.

B) the price at which shares are bought and sold on the open market.

C) the total stockholders' equity minus total amount assigned to preferred stock.

D) the total of stockholders' equity (when only common stock exists) divided by the number of shares issued.

A) the price a corporation pays when it reserves the right to retire or redeem stock at a specific price.

B) the price at which shares are bought and sold on the open market.

C) the total stockholders' equity minus total amount assigned to preferred stock.

D) the total of stockholders' equity (when only common stock exists) divided by the number of shares issued.

D

3

Dexter Corporation has total paid-in capital of $180,000 and retained earnings of $130,000. It has 4,000 shares of $20 preferred stock outstanding with no dividends in arrears and 11,000 shares of $30 par value common stock outstanding. The book value of each share of common stock is: (Round your answer to the nearest cent.)

A) $20.91.

B) $2.09.

C) $28.18.

D) $20.67.

A) $20.91.

B) $2.09.

C) $28.18.

D) $20.67.

A

4

Before common stock per share is computed, preferred stock is considered.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

5

If dividends in arrears are $1,500,000 preferred stock redemption value of 60,000, and 2,400 preferred shares outstanding, what is the book value per share of preferred stock? (Round the final answer to the nearest cent.)

A) $25.00

B) $2.50

C) $250.00

D) $12.50

A) $25.00

B) $2.50

C) $250.00

D) $12.50

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

6

Patterson Research has 200 shares of 10%, $107 par value, preferred stock, and 2,000 shares of $17 par value common stock outstanding. Total paid-in capital is $50,000, and retained earnings are $0. There are one-year dividends in arrears on preferred stock. The book value per share on common stock is: (Round your answer to the nearest cent.)

A) $13.23.

B) $23.93.

C) $25.00.

D) $22.73.

A) $13.23.

B) $23.93.

C) $25.00.

D) $22.73.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

7

Redemption of stock allows the corporation to repurchase or retire stock at the issued price per share.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

8

Book value per share is not the same as par value per share.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

9

Redemption value is determined at the time stock is issued.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

10

Ariel Investigations has total paid-in capital of $74,000 and retained earnings of $40,000. It has 300 shares of $100 par value common stock outstanding, and no preferred shares outstanding. The book value of each share of common stock is: (Round your answer to the nearest cent.)

A) $133.33.

B) $246.67.

C) $380.00.

D) $280.00.

A) $133.33.

B) $246.67.

C) $380.00.

D) $280.00.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

11

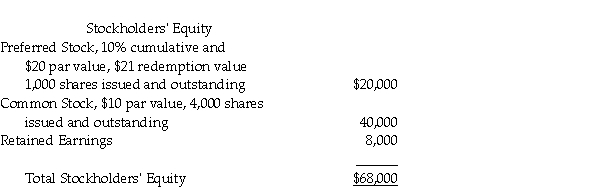

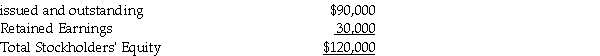

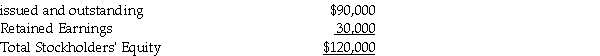

From the following, determine the book value per share for preferred and common stocks, assuming $2,000 of dividends are in arrears on the preferred stock.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

12

What are the annual dividends on preferred stock, $31 par, 2,200 shares authorized, 1,200 shares issued, and a dividend rate of 3%? (Round your answer to the nearest dollar.)

A) $1,116

B) $30

C) $2,046

D) $930

A) $1,116

B) $30

C) $2,046

D) $930

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

13

Buck Company has $200,000 of preferred stock redemption value and $900,000 of dividends in arrears. If 100,000 preferred shares are outstanding, what is the book value per share of preferred stock? (Round the final answer to the nearest cent.)

A) $11.00 per share

B) $9.00 per share

C) $2.00 per share

D) $7.00 per share

A) $11.00 per share

B) $9.00 per share

C) $2.00 per share

D) $7.00 per share

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

14

Redemption Value is defined as:

A) the price a corporation pays when it reserves the right to retire or redeem stock at a specific price.

B) the price at which shares are bought and sold on the open market.

C) the total stockholders' equity minus total amount assigned to preferred stock.

D) the total of stockholders' equity (when only common stock exists) divided by the number of shares issued.

A) the price a corporation pays when it reserves the right to retire or redeem stock at a specific price.

B) the price at which shares are bought and sold on the open market.

C) the total stockholders' equity minus total amount assigned to preferred stock.

D) the total of stockholders' equity (when only common stock exists) divided by the number of shares issued.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

15

Discuss and describe the major differences among the following common stock values:

a. Par value

b. Stated value

c. Redemption value

d. Market value

e. Book value

a. Par value

b. Stated value

c. Redemption value

d. Market value

e. Book value

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

16

Book value per share is found by dividing total assets by total stockholders' equity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

17

To calculate book value per share of preferred stock, the following is calculated:

A) redemption value and common stock par value.

B) redemption value and dividends in arrears.

C) common stock redemption value.

D) total stockholders' equity.

A) redemption value and common stock par value.

B) redemption value and dividends in arrears.

C) common stock redemption value.

D) total stockholders' equity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

18

Dividends in arrears are considered in the calculation for book value per share of preferred stock.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

19

If total stockholders' equity is $160,000 with 13,000 common shares outstanding, what is the book value per share of common stock? (Assume no preferred stock is outstanding. Round your answer to the nearest cent.)

A) $15.31

B) $36.92

C) $12.31

D) $9.31

A) $15.31

B) $36.92

C) $12.31

D) $9.31

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

20

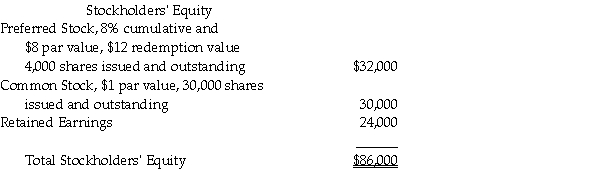

From the following, determine the book value per share for preferred and common stocks; no dividends are in arrears on the preferred stock.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

21

Which of the following dividend dates gets a formal journal entry?

A) Date of payment

B) Date of claim

C) Date of record

D) All receive formal journal entries.

A) Date of payment

B) Date of claim

C) Date of record

D) All receive formal journal entries.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

22

On June 7, Ramirez Incorporated paid a $6.25 cash dividend per share on 3,200 shares issued and outstanding. What is the journal entry to record this transaction?

A) Increase to Dividends Payable and a decrease to cash for $20,000

B) Increase to Dividends Payable and a decrease to Retained Earnings for $20,000

C) Decrease to Cash and a decrease to Retained Earnings for $20,000

D) Decrease to Cash and a decrease to Dividends Payable for $20,000

A) Increase to Dividends Payable and a decrease to cash for $20,000

B) Increase to Dividends Payable and a decrease to Retained Earnings for $20,000

C) Decrease to Cash and a decrease to Retained Earnings for $20,000

D) Decrease to Cash and a decrease to Dividends Payable for $20,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

23

The journal entry to pay a cash dividend is to:

A) debit Retained Earnings; credit Dividends Payable.

B) debit Dividends Payable; credit Cash.

C) debit Retained Earnings; credit Cash.

D) debit Dividends Payable; credit Retained Earnings.

A) debit Retained Earnings; credit Dividends Payable.

B) debit Dividends Payable; credit Cash.

C) debit Retained Earnings; credit Cash.

D) debit Dividends Payable; credit Retained Earnings.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

24

What are the annual dividends on preferred stock, $20 par, 560 authorized, 310 shares issued, and a dividend rate of 11%? (Round your answer to the nearest dollar.)

A) $682

B) $1,232

C) $550

D) $1,914

A) $682

B) $1,232

C) $550

D) $1,914

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

25

On the date of record, the journal entry would include:

A) a debit to Dividend Payable.

B) a credit to Dividend Payable.

C) a credit to Cash.

D) No entry is required on date of record.

A) a debit to Dividend Payable.

B) a credit to Dividend Payable.

C) a credit to Cash.

D) No entry is required on date of record.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

26

ABC Corporation issued a two-for-one stock split. The number of outstanding shares before the split was 20,000 and the par value was $24 per share. After the split, what was the par value per share and number of shares? (Round your answer to the nearest cent.)

A) 40,000 shares and $24 per share

B) 40,000 shares and $6.00 per share

C) 40,000 shares and $12.00 per share

D) 40,000 shares and $48 per share

A) 40,000 shares and $24 per share

B) 40,000 shares and $6.00 per share

C) 40,000 shares and $12.00 per share

D) 40,000 shares and $48 per share

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

27

Before a four-for-one stock split, the shares outstanding were 7,000 shares at $12 par. After the split, what was the par value per share and number of shares? (Round your answer to the nearest cent.)

A) 28,000 shares at $12 per share

B) 28,000 shares at $3.00 per share

C) 28,000 shares at $6.00 per share

D) 7,000 shares at $48 per share

A) 28,000 shares at $12 per share

B) 28,000 shares at $3.00 per share

C) 28,000 shares at $6.00 per share

D) 7,000 shares at $48 per share

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

28

The entry to record the payment of a cash dividend would include a:

A) debit to Dividends Payable.

B) debit to Retained Earnings.

C) credit to Cash.

D) Both A and C

A) debit to Dividends Payable.

B) debit to Retained Earnings.

C) credit to Cash.

D) Both A and C

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

29

Declaration of a cash dividend causes:

A) a decrease in stockholders' equity.

B) an increase in cash.

C) a decrease in liabilities.

D) None of these answers is correct.

A) a decrease in stockholders' equity.

B) an increase in cash.

C) a decrease in liabilities.

D) None of these answers is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

30

The entry to record the distribution of the stock dividend would include:

A) a debit to Common Stock.

B) a debit to Common Stock Dividend Distributable.

C) a debit to Retained Earnings.

D) None of these answers is correct.

A) a debit to Common Stock.

B) a debit to Common Stock Dividend Distributable.

C) a debit to Retained Earnings.

D) None of these answers is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

31

On March 8, Nunes Corporation declares a $3 cash dividend per share on 4,000 shares issued and outstanding. What is the journal entry to record this transaction?

A) Debit to Cash and credit to Dividends Payable

B) Debit to Retained Earnings and credit to Cash

C) Debit to Retained Earnings and credit to Dividends Payable

D) Debit to Dividends Payable and credit to Cash

A) Debit to Cash and credit to Dividends Payable

B) Debit to Retained Earnings and credit to Cash

C) Debit to Retained Earnings and credit to Dividends Payable

D) Debit to Dividends Payable and credit to Cash

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

32

The date of record for cash dividends is:

A) the date the board of directors pays a dividend.

B) the date established by the board of directors that determines who will receive dividends.

C) the date that creates a liability for the company.

D) None of these answers is correct.

A) the date the board of directors pays a dividend.

B) the date established by the board of directors that determines who will receive dividends.

C) the date that creates a liability for the company.

D) None of these answers is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

33

Michigan Steamers has 3,800 shares of $22 par value common stock outstanding. During the current year, the company distributed a 4% stock dividend. The market value of the stock at that time was $17 per share. Bailey's total stockholders' equity should increase or decrease by:

A) $0.

B) $3,344.

C) $2,584.

D) $(760).

A) $0.

B) $3,344.

C) $2,584.

D) $(760).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

34

Malcolm Corporation declared a dividend of $5 per share on 2,200 shares. The entry to record the transaction would be to:

A) debit Retained Earnings $11,000; credit Dividends Payable $11,000.

B) debit Retained Earnings $11,000; credit Cash $11,000.

C) debit Dividends Payable $11,000; credit Cash $11,000.

D) debit Dividends Expense $11,000; credit Cash $11,000.

A) debit Retained Earnings $11,000; credit Dividends Payable $11,000.

B) debit Retained Earnings $11,000; credit Cash $11,000.

C) debit Dividends Payable $11,000; credit Cash $11,000.

D) debit Dividends Expense $11,000; credit Cash $11,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

35

The journal entry to record the issuance of a stock dividend is to:

A) debit Common Stock Dividend Distributable; credit Common Stock.

B) debit Common Stock Dividends Distributable; credit Dividends Payable.

C) debit Retained Earnings; credit Common Stock Dividends Distributable; credit Paid-in Capital in Excess of Par Value-Cash Dividend.

D) debit Common Stock Dividend Distributable; credit Cash.

A) debit Common Stock Dividend Distributable; credit Common Stock.

B) debit Common Stock Dividends Distributable; credit Dividends Payable.

C) debit Retained Earnings; credit Common Stock Dividends Distributable; credit Paid-in Capital in Excess of Par Value-Cash Dividend.

D) debit Common Stock Dividend Distributable; credit Cash.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

36

Payment of a cash dividend causes:

A) a decrease in liabilities.

B) an increase in an asset.

C) an increase in stockholders' equity.

D) All of the above are correct.

A) a decrease in liabilities.

B) an increase in an asset.

C) an increase in stockholders' equity.

D) All of the above are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

37

A distribution to stockholders in the form of stock is called a:

A) stock dividend.

B) stock split.

C) stock conversion.

D) cash dividend.

A) stock dividend.

B) stock split.

C) stock conversion.

D) cash dividend.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

38

Which of the following is the journal entry to record the declaration of a stock dividend?

A) Debit Common Stock Dividend Distributable (number of shares × par value common stock); credit Common Stock (same)

B) Debit Common Stock Dividend Distributable (number of shares × market value common stock); credit Common Stock (same)

C) Debit Retained Earnings (market value × number of shares); credit Common Stock Dividend Distributable (number of shares × par value); credit Paid-In Capital in Excess of Par Value Stock Dividend (market value - par value) × number of shares

D) Debit Common Stock (number of shares × par value); credit Cash

A) Debit Common Stock Dividend Distributable (number of shares × par value common stock); credit Common Stock (same)

B) Debit Common Stock Dividend Distributable (number of shares × market value common stock); credit Common Stock (same)

C) Debit Retained Earnings (market value × number of shares); credit Common Stock Dividend Distributable (number of shares × par value); credit Paid-In Capital in Excess of Par Value Stock Dividend (market value - par value) × number of shares

D) Debit Common Stock (number of shares × par value); credit Cash

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

39

The liability account showing the amount of cash dividend owed is:

A) Dividends.

B) Dividends Payable.

C) Retained Earnings.

D) Cash.

A) Dividends.

B) Dividends Payable.

C) Retained Earnings.

D) Cash.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

40

In the dividend process, the liability Dividend Payable is recognized on the:

A) date of declaration.

B) date of record.

C) date of payment.

D) date of stock issue.

A) date of declaration.

B) date of record.

C) date of payment.

D) date of stock issue.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

41

An exchange of one share of an old issue of stock for a multiple number of shares of a new issue of stock with reduced par value is known as a:

A) property dividend.

B) stock dividend.

C) stock split.

D) liquidating dividend.

A) property dividend.

B) stock dividend.

C) stock split.

D) liquidating dividend.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

42

On May 3, Bunny Unlimited paid a $4 cash dividend per share on $5,000 shares issued and outstanding. What is the journal entry to record this transaction?

A) A debit to Dividends Payable and a credit to Cash

B) A debit to Retained Earnings and a credit to Cash

C) A debit to Dividends Payable and a credit to Retained Earnings

D) A debit to Cash and a credit to Dividends Payable

A) A debit to Dividends Payable and a credit to Cash

B) A debit to Retained Earnings and a credit to Cash

C) A debit to Dividends Payable and a credit to Retained Earnings

D) A debit to Cash and a credit to Dividends Payable

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

43

Distribution of earnings to stockholders may be in the form of cash or stock.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

44

Common Stock Dividend Distributable is a stockholders' equity account that accumulates a stock dividend that has been declared but not yet issued and distributed.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

45

A dividend is declared by:

A) the board of directors.

B) president of the corporation.

C) CFO of the corporation.

D) stockholders.

A) the board of directors.

B) president of the corporation.

C) CFO of the corporation.

D) stockholders.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

46

Issuing a stock dividend would show a debit to Common Stock and a credit to Common Stock Dividends Distributable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

47

A cash dividend will reduce total stockholders' equity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

48

The retained earnings section after a two-for-one stock split will:

A) be one-half as much after the split.

B) be double as much after the split.

C) not change after the split.

D) Cannot be determined from the information given.

A) be one-half as much after the split.

B) be double as much after the split.

C) not change after the split.

D) Cannot be determined from the information given.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

49

Lamar Industries uses the legal capital approach and issues a stock dividend worth $40,000. What would be the journal entry to record this transaction?

A) $40,000 debit to Cash and credit Common Stock

B) $40,000 debit to Common Stock Dividend Distributable and credit to Cash

C) $40,000 debit to Common Stock Dividend Distributable and credit to Common Stock

D) $40,000 credit to Cash and debit to Retained Earnings

A) $40,000 debit to Cash and credit Common Stock

B) $40,000 debit to Common Stock Dividend Distributable and credit to Cash

C) $40,000 debit to Common Stock Dividend Distributable and credit to Common Stock

D) $40,000 credit to Cash and debit to Retained Earnings

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

50

A stock split has no effect on retained earnings.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

51

A corporation may issue a stock dividend for which of the following reasons?

A) May want to increase permanent capital in the business

B) May want to decrease market value

C) May be short of cash and unable to pay a cash dividend

D) All of the above are correct.

A) May want to increase permanent capital in the business

B) May want to decrease market value

C) May be short of cash and unable to pay a cash dividend

D) All of the above are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

52

Common Stock Dividend Distributable is an asset account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

53

Paid-In Capital in Excess of Par Value-Stock Dividend account is used when:

A) the stock's par value is lower than market value.

B) the stock's par value is higher than the market value.

C) the stock's par value is the same as market value.

D) None of the above are correct.

A) the stock's par value is lower than market value.

B) the stock's par value is higher than the market value.

C) the stock's par value is the same as market value.

D) None of the above are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

54

The board of Marpa, Inc. declared a $3 per share cash dividend on common stock. The corporation has 5,000 shares of common stock outstanding. The entry required to declare the dividend is:

A) debit Cash; credit Common Dividends Payable.

B) debit Cash Dividends; credit Common Dividends Payable.

C) debit Common Dividends Payable; credit Cash.

D) debit Retained Earnings; credit Dividends Payable.

A) debit Cash; credit Common Dividends Payable.

B) debit Cash Dividends; credit Common Dividends Payable.

C) debit Common Dividends Payable; credit Cash.

D) debit Retained Earnings; credit Dividends Payable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

55

Under the legal capital approach, issuance of a stock dividend would:

A) increase Cash and decrease Common Stock.

B) decrease Common Stock Dividend Distributable and increase Common Stock.

C) increase Common Stock Dividend Distributable and increase Cash.

D) decrease Cash and increase Common Stock.

A) increase Cash and decrease Common Stock.

B) decrease Common Stock Dividend Distributable and increase Common Stock.

C) increase Common Stock Dividend Distributable and increase Cash.

D) decrease Cash and increase Common Stock.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

56

After issuing a stock dividend, a stockholder will own a larger number of shares but:

A) the total ownership equity increases.

B) the total ownership equity decreases.

C) the total ownership equity stays the same.

D) None of the above are correct.

A) the total ownership equity increases.

B) the total ownership equity decreases.

C) the total ownership equity stays the same.

D) None of the above are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

57

The date of record determines who receives the declared dividends.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

58

May Corporation had 37,000 shares of $17 par value common stock outstanding with a market value of $30 per share. Gino announced a three-for-one stock split. After the split, the par value of the stock: (Round your answer to the nearest cent.)

A) remained the same as before the split.

B) was increased by $34.00 per share.

C) was reduced to $5.67 per share.

D) was reduced to $8.50 per share.

A) remained the same as before the split.

B) was increased by $34.00 per share.

C) was reduced to $5.67 per share.

D) was reduced to $8.50 per share.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

59

On April 3, Jim's Planters declares a $5 cash dividend per share on 6,000 shares issued and outstanding. What is the journal entry to record this transaction?

A) Increase to Cash for $30,000 and decrease to Dividends Payable for $30,000

B) Decrease to Retained Earnings for $30,000 and increase to Dividends Payable for $30,000

C) Increase to Retained Earnings for $30,000 and increase to Cash for $30,000

D) Increase to Dividends Payable for $30,000 and decrease to Cash for $30,000

A) Increase to Cash for $30,000 and decrease to Dividends Payable for $30,000

B) Decrease to Retained Earnings for $30,000 and increase to Dividends Payable for $30,000

C) Increase to Retained Earnings for $30,000 and increase to Cash for $30,000

D) Increase to Dividends Payable for $30,000 and decrease to Cash for $30,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

60

A stock split:

A) increases the number of shares outstanding.

B) reduces the par or stated value in proportion.

C) is the same as a cash dividend.

D) Both A and B are correct.

A) increases the number of shares outstanding.

B) reduces the par or stated value in proportion.

C) is the same as a cash dividend.

D) Both A and B are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

61

Using the following accounts:

Indicate the account(s) to be debited and credited to record the following transactions.

-Declared a stock dividend when the market price was above par.

Debit ________ Credit ________ & ________

A)Cash

B)Dividends payable

C)Preferred stock

D)Common stock

E)Common Stock dividend distributable

F)Paid-in capital in excess of par value-common

G)Paid-in capital in excess of par value - preferred

H)Paid-in capital from treasury stock

I)Retained earnings

J)Treasury stock

K)Paid-in capital in excess of par value-Stock dividend

Indicate the account(s) to be debited and credited to record the following transactions.

-Declared a stock dividend when the market price was above par.

Debit ________ Credit ________ & ________

A)Cash

B)Dividends payable

C)Preferred stock

D)Common stock

E)Common Stock dividend distributable

F)Paid-in capital in excess of par value-common

G)Paid-in capital in excess of par value - preferred

H)Paid-in capital from treasury stock

I)Retained earnings

J)Treasury stock

K)Paid-in capital in excess of par value-Stock dividend

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

62

Which of the following statements is true about treasury stock?

A) It carries no right to dividends.

B) It carries no right to vote.

C) It is stock that is outstanding.

D) A and B are correct.

A) It carries no right to dividends.

B) It carries no right to vote.

C) It is stock that is outstanding.

D) A and B are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

63

Using the following accounts:

Indicate the account(s) to be debited and credited to record the following transactions.

-Paid a cash dividend.

Debit ________ Credit ________

A)Cash

B)Dividends payable

C)Preferred stock

D)Common stock

E)Common Stock dividend distributable

F)Paid-in capital in excess of par value-common

G)Paid-in capital in excess of par value - preferred

H)Paid-in capital from treasury stock

I)Retained earnings

J)Treasury stock

K)Paid-in capital in excess of par value-Stock dividend

Indicate the account(s) to be debited and credited to record the following transactions.

-Paid a cash dividend.

Debit ________ Credit ________

A)Cash

B)Dividends payable

C)Preferred stock

D)Common stock

E)Common Stock dividend distributable

F)Paid-in capital in excess of par value-common

G)Paid-in capital in excess of par value - preferred

H)Paid-in capital from treasury stock

I)Retained earnings

J)Treasury stock

K)Paid-in capital in excess of par value-Stock dividend

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

64

Which of the following is NOT a characteristic of treasury stock?

A) The purchase of treasury stock does not change the amount of issued stock.

B) Treasury stock is the same thing as common and preferred stock.

C) Treasury stock does not have dividends or voting rights.

D) Treasury stock is a contra-stockholders' equity account.

A) The purchase of treasury stock does not change the amount of issued stock.

B) Treasury stock is the same thing as common and preferred stock.

C) Treasury stock does not have dividends or voting rights.

D) Treasury stock is a contra-stockholders' equity account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

65

On May 31, Mason Corporation has the following stockholders' equity:

Common Stock, $10 par value, 9,000 shares

The board of directors declared a 10% stock dividend on June 5 to the stockholders of record on June 15. The stock is to be distributed on June 30. On the date of declaration, the stock had a market value of $13 per share. Prepare the appropriate journal entries for these transactions.

Common Stock, $10 par value, 9,000 shares

The board of directors declared a 10% stock dividend on June 5 to the stockholders of record on June 15. The stock is to be distributed on June 30. On the date of declaration, the stock had a market value of $13 per share. Prepare the appropriate journal entries for these transactions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

66

Treasury stock is:

A) common stock that is issued in a stock dividend.

B) common or preferred stock that has been reacquired by the corporation.

C) previously issued common stock that has been canceled.

D) unissued, but authorized common stock.

A) common stock that is issued in a stock dividend.

B) common or preferred stock that has been reacquired by the corporation.

C) previously issued common stock that has been canceled.

D) unissued, but authorized common stock.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

67

Prepare the following stock dividend journal entries for Tamera, Inc.

June 19 Declared a 5% stock dividend to common stockholders. The stock has a par value of $13 and a current market value of $15. There are 50,000 shares of common stock outstanding.

July 2 The stock dividend is issued.

June 19 Declared a 5% stock dividend to common stockholders. The stock has a par value of $13 and a current market value of $15. There are 50,000 shares of common stock outstanding.

July 2 The stock dividend is issued.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

68

What is the correct journal entry for the following transaction? Melton Industries acquired 360 shares of its own $12 par common stock for $23.

A) Debit Treasury Stock-Common for $8,280 and Credit Cash for $8,280

B) Debit Treasury Stock-Common for $4,320 and Credit Cash for $4,320

C) Debit Cash for $8,280 and Credit Treasury Stock-Common for $8,280

D) Debit Cash for $4,320 and Credit Treasury Stock-Common for $4,320

A) Debit Treasury Stock-Common for $8,280 and Credit Cash for $8,280

B) Debit Treasury Stock-Common for $4,320 and Credit Cash for $4,320

C) Debit Cash for $8,280 and Credit Treasury Stock-Common for $8,280

D) Debit Cash for $4,320 and Credit Treasury Stock-Common for $4,320

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

69

The Tiger Football Corporation has 9,000 shares of $1.50 par value common stock issued and outstanding. The board of directors declared a 3-for-1 stock split May 10, distributable on June 15, to stockholders of record on June 1. The Retained Earnings account balance is $50,000 on May 10. Prepare the equity section of the balance sheet on May 10 and June 15, before and after the stock split.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

70

70 of the 350 treasury shares that Miles Inc. acquired at $4 par per common stock for $22, were reissued for $8 per share. What is the journal entry for the reissued shares?

A) Credit Cash for $560, Debit Treasury Stock-Common for $560.

B) Debit Cash for $1,540, Credit Paid-In Capital from Treasury Stock for $980, Credit Treasury Stock-Common for $560.

C) Debit Cash for $560, Debit Paid-In Capital from Treasury Stock for $980, Credit Treasury Stock-Common for $1,540.

D) Credit Cash for $980, Debit Treasury Stock-Common for $1,540, Credit Paid-In Capital from Treasury Stock for $560.

A) Credit Cash for $560, Debit Treasury Stock-Common for $560.

B) Debit Cash for $1,540, Credit Paid-In Capital from Treasury Stock for $980, Credit Treasury Stock-Common for $560.

C) Debit Cash for $560, Debit Paid-In Capital from Treasury Stock for $980, Credit Treasury Stock-Common for $1,540.

D) Credit Cash for $980, Debit Treasury Stock-Common for $1,540, Credit Paid-In Capital from Treasury Stock for $560.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

71

Using the following accounts:

Indicate the account(s) to be debited and credited to record the following transactions.

-Issuance of stock dividend.

Debit ________ Credit ________

A)Cash

B)Dividends payable

C)Preferred stock

D)Common stock

E)Common Stock dividend distributable

F)Paid-in capital in excess of par value-common

G)Paid-in capital in excess of par value - preferred

H)Paid-in capital from treasury stock

I)Retained earnings

J)Treasury stock

K)Paid-in capital in excess of par value-Stock dividend

Indicate the account(s) to be debited and credited to record the following transactions.

-Issuance of stock dividend.

Debit ________ Credit ________

A)Cash

B)Dividends payable

C)Preferred stock

D)Common stock

E)Common Stock dividend distributable

F)Paid-in capital in excess of par value-common

G)Paid-in capital in excess of par value - preferred

H)Paid-in capital from treasury stock

I)Retained earnings

J)Treasury stock

K)Paid-in capital in excess of par value-Stock dividend

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

72

Which of the following is NOT a reason why a corporation would reacquire previously issued stock?

A) A need to issue more stock for stock option plans

B) A need to issue more stock for use in acquiring other corporations

C) A desire to reduce the number of shares of stock outstanding

D) All of the above are correct reasons.

A) A need to issue more stock for stock option plans

B) A need to issue more stock for use in acquiring other corporations

C) A desire to reduce the number of shares of stock outstanding

D) All of the above are correct reasons.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

73

Prepare the following journal entries for Complex Company.

March 15 Declared the stated dividend on 8,000 shares of $12 par, 7% preferred stock.

April 15 Paid the dividend.

March 15 Declared the stated dividend on 8,000 shares of $12 par, 7% preferred stock.

April 15 Paid the dividend.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

74

Explain some possible reasons a company may declare a stock dividend instead of a cash dividend.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

75

40 of the 200 treasury shares that April Corporation acquired at $6 par per common stock that were originally issued at $24 par per share, were reissued for $8 per share. What is the journal entry for the reissued shares?

A) Debit Cash for $320; debit Paid-In Capital from Treasury Stock for $640; credit Treasury Stock-Common for $960.

B) Debit Cash for $960; credit Paid-In Capital from Treasury Stock for $640; credit Treasury Stock-Common for $320.

C) Debit Treasury Stock-Common for $320; credit Cash for $320.

D) Debit Treasury Stock-Common for $960; credit Cash for $640; credit Paid-In Capital from Treasury Stock for $320.

A) Debit Cash for $320; debit Paid-In Capital from Treasury Stock for $640; credit Treasury Stock-Common for $960.

B) Debit Cash for $960; credit Paid-In Capital from Treasury Stock for $640; credit Treasury Stock-Common for $320.

C) Debit Treasury Stock-Common for $320; credit Cash for $320.

D) Debit Treasury Stock-Common for $960; credit Cash for $640; credit Paid-In Capital from Treasury Stock for $320.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

76

Quinn Corporation has 4,500 shares of common stock issued and outstanding. The board of directors declared a $3.25 per share cash dividend on January 25, payable on March 25, to stockholders of record on February 25. Prepare the appropriate journal entries for the declaration and payment of the dividend.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

77

Using the following accounts:

Indicate the account(s) to be debited and credited to record the following transactions.

-Declared a cash dividend.

Debit ________ Credit ________

A)Cash

B)Dividends payable

C)Preferred stock

D)Common stock

E)Common Stock dividend distributable

F)Paid-in capital in excess of par value-common

G)Paid-in capital in excess of par value - preferred

H)Paid-in capital from treasury stock

I)Retained earnings

J)Treasury stock

K)Paid-in capital in excess of par value-Stock dividend

Indicate the account(s) to be debited and credited to record the following transactions.

-Declared a cash dividend.

Debit ________ Credit ________

A)Cash

B)Dividends payable

C)Preferred stock

D)Common stock

E)Common Stock dividend distributable

F)Paid-in capital in excess of par value-common

G)Paid-in capital in excess of par value - preferred

H)Paid-in capital from treasury stock

I)Retained earnings

J)Treasury stock

K)Paid-in capital in excess of par value-Stock dividend

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

78

The date of payment is the date established by the board of directors that determines which stockholders will receive the dividend.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

79

To record the purchase of treasury stock:

A) debit Treasury Stock-Common (par value); credit Cash (same).

B) debit Treasury Stock-Common (purchase price); credit Cash (same).

C) debit Treasury Stock-Common (par value); debit any difference to Paid-in Capital; credit Cash (purchase price).

D) None of these answers is correct.

A) debit Treasury Stock-Common (par value); credit Cash (same).

B) debit Treasury Stock-Common (purchase price); credit Cash (same).

C) debit Treasury Stock-Common (par value); debit any difference to Paid-in Capital; credit Cash (purchase price).

D) None of these answers is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

80

What is the correct journal entry for the following transaction? Airline Express acquired 290 shares of its own $8 par common stock for $21.

A) Debit Treasury Stock-Common for $2,320 and credit Cash for $2,320

B) Debit Treasury Stock-Common for $6,090 and credit Cash for $6,090

C) Debit Cash for $2,320 and credit Treasury Stock-Common for $2,320

D) Debit Cash for $6,090 and credit Treasury Stock-Common for $6,090

A) Debit Treasury Stock-Common for $2,320 and credit Cash for $2,320

B) Debit Treasury Stock-Common for $6,090 and credit Cash for $6,090

C) Debit Cash for $2,320 and credit Treasury Stock-Common for $2,320

D) Debit Cash for $6,090 and credit Treasury Stock-Common for $6,090

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck