Deck 18: Introduction to Accounting for State and Local Governmental Units

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/34

العب

ملء الشاشة (f)

Deck 18: Introduction to Accounting for State and Local Governmental Units

1

Repayments from the funds responsible for a particular expenditure to the funds that initially paid for them are interfund:

A) loans.

B) services provided and used.

C) transfers.

D) reimbursements.

A) loans.

B) services provided and used.

C) transfers.

D) reimbursements.

D

2

Encumbrances would NOT appear in which fund?

A) General

B) Enterprise

C) Capital projects

D) Special revenue

A) General

B) Enterprise

C) Capital projects

D) Special revenue

B

3

Part of the general obligation bond proceeds from a new issuance was used to pay for the cost of a new city hall as soon as construction was completed. The remainder of the proceeds was transferred to repay the debt. Entries are needed to record these transactions in the:

A) general fund and capital projects fund.

B) general fund and debt-service fund.

C) trust fund and debt-service fund.

D) debt-service fund and capital projects fund.

A) general fund and capital projects fund.

B) general fund and debt-service fund.

C) trust fund and debt-service fund.

D) debt-service fund and capital projects fund.

D

4

Internal Service Fund billings to government departments for services rendered is an example of interfund:

A) reimbursements.

B) transfers.

C) services provided and used.

D) loans.

A) reimbursements.

B) transfers.

C) services provided and used.

D) loans.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 34 في هذه المجموعة.

فتح الحزمة

k this deck

5

Which of the following funds of a governmental unit recognizes revenues and expenditures under the same basis of accounting as the general fund?

A) Debt service

B) Enterprise

C) Internal service

D) Nonexpendable trust

A) Debt service

B) Enterprise

C) Internal service

D) Nonexpendable trust

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 34 في هذه المجموعة.

فتح الحزمة

k this deck

6

For state and local government units, the full accrual basis of accounting should be used for what type of fund?

A) Special revenue

B) General

C) Debt service

D) Internal service

A) Special revenue

B) General

C) Debt service

D) Internal service

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 34 في هذه المجموعة.

فتح الحزمة

k this deck

7

One of the differences between accounting for a governmental unit and a commercial unit is that a governmental unit should:

A) not record depreciation expense in any of its funds.

B) always establish and maintain complete self-balancing accounts for each fund.

C) use only the cash basis of accounting.

D) use only the modified accrual basis of accounting.

A) not record depreciation expense in any of its funds.

B) always establish and maintain complete self-balancing accounts for each fund.

C) use only the cash basis of accounting.

D) use only the modified accrual basis of accounting.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 34 في هذه المجموعة.

فتح الحزمة

k this deck

8

Which of the following funds frequently does NOT have a fund balance?

A) General fund

B) Agency fund

C) Special revenue fund

D) Capital projects fund

A) General fund

B) Agency fund

C) Special revenue fund

D) Capital projects fund

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 34 في هذه المجموعة.

فتح الحزمة

k this deck

9

Fixed assets and noncurrent liabilities are accounted for in the records of:

A) governmental funds

B) expendable funds

C) proprietary funds

D) both governmental and expendable funds.

A) governmental funds

B) expendable funds

C) proprietary funds

D) both governmental and expendable funds.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 34 في هذه المجموعة.

فتح الحزمة

k this deck

10

A city should record depreciation as an expense in its:

A) general fund and enterprise fund.

B) internal service fund and general fund.

C) enterprise fund and internal service fund.

D) enterprise fund and capital projects fund.

A) general fund and enterprise fund.

B) internal service fund and general fund.

C) enterprise fund and internal service fund.

D) enterprise fund and capital projects fund.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 34 في هذه المجموعة.

فتح الحزمة

k this deck

11

Which of the following funds would account for operations that are financed and operated in a manner similar to private business enterprises?

A) Debt Service Fund

B) Enterprise Fund

C) Internal Service Fund

D) Special Revenue Fund

A) Debt Service Fund

B) Enterprise Fund

C) Internal Service Fund

D) Special Revenue Fund

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 34 في هذه المجموعة.

فتح الحزمة

k this deck

12

All of the following are Governmental (Expendable) Fund Entities EXCEPT the:

A) Capital Projects Fund.

B) Debt Service Fund.

C) Internal Service Fund.

D) Special Revenue Fund.

A) Capital Projects Fund.

B) Debt Service Fund.

C) Internal Service Fund.

D) Special Revenue Fund.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 34 في هذه المجموعة.

فتح الحزمة

k this deck

13

The highest level of priority of pronouncements that a government entity should look to for accounting and reporting guidance is:

A) GASB Technical Bulletins.

B) GASB Concepts Statements.

C) AICPA Industry Accounting Guides.

D) GASB Statements.

A) GASB Technical Bulletins.

B) GASB Concepts Statements.

C) AICPA Industry Accounting Guides.

D) GASB Statements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 34 في هذه المجموعة.

فتح الحزمة

k this deck

14

Which type of fund can be either expendable or nonexpendable?

A) Debt service

B) Enterprise

C) Trust

D) Special revenues

A) Debt service

B) Enterprise

C) Trust

D) Special revenues

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 34 في هذه المجموعة.

فتح الحزمة

k this deck

15

The liability for general obligation long-term debt is reported in the:

A) Debt Service Fund.

B) Capital Projects Fund.

C) Enterprise Fund.

D) none of these.

A) Debt Service Fund.

B) Capital Projects Fund.

C) Enterprise Fund.

D) none of these.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 34 في هذه المجموعة.

فتح الحزمة

k this deck

16

Which of the following should be accrued as revenues by the general fund of a local government?

A) Sales tax held by the state which will be remitted to the local government:

B) Parking meter revenues

C) Sales tax collected by merchants

D) Income taxes currently due

A) Sales tax held by the state which will be remitted to the local government:

B) Parking meter revenues

C) Sales tax collected by merchants

D) Income taxes currently due

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 34 في هذه المجموعة.

فتح الحزمة

k this deck

17

The activities of a central computer facility should be accounted for in the:

A) General Fund.

B) Internal Service Fund.

C) Enterprise Fund.

D) Capital Projects Fund.

A) General Fund.

B) Internal Service Fund.

C) Enterprise Fund.

D) Capital Projects Fund.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 34 في هذه المجموعة.

فتح الحزمة

k this deck

18

The activities of a municipal airport should be accounted for in the:

A) General Fund.

B) Internal Service Fund.

C) Special Revenue Fund.

D) Enterprise Fund.

A) General Fund.

B) Internal Service Fund.

C) Special Revenue Fund.

D) Enterprise Fund.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 34 في هذه المجموعة.

فتح الحزمة

k this deck

19

When a truck is received by a governmental unit, it should be recorded in the General Fund as a(n):

A) appropriation.

B) encumbrance.

C) expenditure.

D) fixed asset.

A) appropriation.

B) encumbrance.

C) expenditure.

D) fixed asset.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 34 في هذه المجموعة.

فتح الحزمة

k this deck

20

A nonrecurring contribution from the General Fund to the Enterprise Fund is an example of an interfund:

A) reimbursement.

B) transfer.

C) services provided and used.

D) loan.

A) reimbursement.

B) transfer.

C) services provided and used.

D) loan.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 34 في هذه المجموعة.

فتح الحزمة

k this deck

21

There are eleven categories of government fund entities that fall under three subheadings. What are the subheadings of government fund entities? What are the main characteristics that set these three subheadings apart?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 34 في هذه المجموعة.

فتح الحزمة

k this deck

22

Which of the following is NOT a budgetary account?

A) Appropriations

B) Estimated Revenues

C) Encumbrances

D) Reserve for Encumbrances

A) Appropriations

B) Estimated Revenues

C) Encumbrances

D) Reserve for Encumbrances

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 34 في هذه المجموعة.

فتح الحزمة

k this deck

23

The following events take place:

1. Interest payments in the amount of $20,000 that are the responsibility of the Debt Service Fund are paid by the General Fund.

2. The Internal Service Fund bills the Special Revenue Fund $25,000 for services performed.

3. The Special Revenue Fund transfers $10,000 to the Internal Service Fund as a temporary loan.

4. The General Fund transfers $150,000 to start an Internal Service Fund.

Required:

Identify the interfund activity as a loan, services provided and used, interfund transfer, or interfund reimbursement and prepare entries in general journal form to record the transactions on the records of the fund involved.

1. Interest payments in the amount of $20,000 that are the responsibility of the Debt Service Fund are paid by the General Fund.

2. The Internal Service Fund bills the Special Revenue Fund $25,000 for services performed.

3. The Special Revenue Fund transfers $10,000 to the Internal Service Fund as a temporary loan.

4. The General Fund transfers $150,000 to start an Internal Service Fund.

Required:

Identify the interfund activity as a loan, services provided and used, interfund transfer, or interfund reimbursement and prepare entries in general journal form to record the transactions on the records of the fund involved.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 34 في هذه المجموعة.

فتح الحزمة

k this deck

24

What is the underlying reason a governmental unit uses separate funds to account for its transactions?

A) Governmental units are so large that it would be unduly cumbersome to account for all transactions as a single unit.

B) Because of the diverse nature of the services offered and legal provisions regarding activities of a governmental unit, it is necessary to segregate activities by functional nature.

C) Generally accepted accounting principles require that nonbusiness entities report on a funds basis.

D) Many activities carried on by governmental units are short-lived and their inclusion in a general set of accounts could cause undue probability of error and omission.

A) Governmental units are so large that it would be unduly cumbersome to account for all transactions as a single unit.

B) Because of the diverse nature of the services offered and legal provisions regarding activities of a governmental unit, it is necessary to segregate activities by functional nature.

C) Generally accepted accounting principles require that nonbusiness entities report on a funds basis.

D) Many activities carried on by governmental units are short-lived and their inclusion in a general set of accounts could cause undue probability of error and omission.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 34 في هذه المجموعة.

فتح الحزمة

k this deck

25

The following activities and transactions are typical of those which may affect the various funds used by a municipal government.

Required:

Prepare journal entries to record each transaction and identify the fund in which each entry is recorded.

1. The Sparta City Council passed a resolution approving a general operating budget of $6,800,000 for the fiscal year. Total revenues are estimated at $5,800,000.

2. The Sparta City Council passed an ordinance providing a property tax levy of $3.50 per $100 of assessed valuation for the fiscal year. Total property valuation in Sparta City is $320,000,000. Property is assessed at 30% of current property valuation. Property tax bills are mailed to property owners. An estimated 5% will be uncollectible.

3. Sparta City sold a general obligation term bond issue for $1,000,000 at 104 to a major brokerage firm. The stated interest rate is 10%. Construction of a new Municipal Courts Building will be financed by the bond issue proceeds.

4. The premium on bond sale in (3) above is transferred to the Debt Service Fund.

5. At the end of fiscal year, the Sparta City Council approves the write-off of $55,000 of uncollected taxes because of inability to locate the property owners.

6. The Sparta City Municipal Courts Building (3 above) is completed. Contracts and expenses total $1,190,000, and all have been paid and recorded in the Capital Projects Fund. Prepare entries to close this project and record the completion of the project in all other funds and/or account groups affected. Any balance in the Capital Projects Fund is to be applied to payment of interest and principal of the bond issue.

7. On March 1, Sparta City issued 10% serial bonds at par to finance streetlights in an area recently incorporated in the city limits. The face amount of the bonds is $900,000; interest is payable annually, and bonds are to be retired in equal amounts over 6 years from collections from assessments against property affected. In case of default by the property owners, the bond principal will be paid by the city.

a. Record the issuance of the bonds on March 1 of the current year.

b. Record the payment to bondholders on March 1 of the next year.

8. The street lighting project in (7) above was completed on September 30 at a total cost of $840,000. Record summary entries for expenditure transactions from March 1 - September 30, and on completion of the project.

Required:

Prepare journal entries to record each transaction and identify the fund in which each entry is recorded.

1. The Sparta City Council passed a resolution approving a general operating budget of $6,800,000 for the fiscal year. Total revenues are estimated at $5,800,000.

2. The Sparta City Council passed an ordinance providing a property tax levy of $3.50 per $100 of assessed valuation for the fiscal year. Total property valuation in Sparta City is $320,000,000. Property is assessed at 30% of current property valuation. Property tax bills are mailed to property owners. An estimated 5% will be uncollectible.

3. Sparta City sold a general obligation term bond issue for $1,000,000 at 104 to a major brokerage firm. The stated interest rate is 10%. Construction of a new Municipal Courts Building will be financed by the bond issue proceeds.

4. The premium on bond sale in (3) above is transferred to the Debt Service Fund.

5. At the end of fiscal year, the Sparta City Council approves the write-off of $55,000 of uncollected taxes because of inability to locate the property owners.

6. The Sparta City Municipal Courts Building (3 above) is completed. Contracts and expenses total $1,190,000, and all have been paid and recorded in the Capital Projects Fund. Prepare entries to close this project and record the completion of the project in all other funds and/or account groups affected. Any balance in the Capital Projects Fund is to be applied to payment of interest and principal of the bond issue.

7. On March 1, Sparta City issued 10% serial bonds at par to finance streetlights in an area recently incorporated in the city limits. The face amount of the bonds is $900,000; interest is payable annually, and bonds are to be retired in equal amounts over 6 years from collections from assessments against property affected. In case of default by the property owners, the bond principal will be paid by the city.

a. Record the issuance of the bonds on March 1 of the current year.

b. Record the payment to bondholders on March 1 of the next year.

8. The street lighting project in (7) above was completed on September 30 at a total cost of $840,000. Record summary entries for expenditure transactions from March 1 - September 30, and on completion of the project.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 34 في هذه المجموعة.

فتح الحزمة

k this deck

26

The following transactions take place:

1. On January 1, the city issued 9% general obligation bonds with a face value of $4,000,000 payable in 10 years to finance the construction of city offices. Total proceeds were $4,500,000.

2. On December 20, construction was completed and occupancy taken of the city offices. The full cost of $3,900,000 was paid to the contractor, and appropriate closing entries were made with regard to the project.

3. The General Fund repaid the Special Revenue Fund a loan of $15,000 plus $900 in interest on the loan.

Required:

Prepare entries in general journal form to record these transactions in the proper fund(s). Designate the fund in which each entry is recorded.

1. On January 1, the city issued 9% general obligation bonds with a face value of $4,000,000 payable in 10 years to finance the construction of city offices. Total proceeds were $4,500,000.

2. On December 20, construction was completed and occupancy taken of the city offices. The full cost of $3,900,000 was paid to the contractor, and appropriate closing entries were made with regard to the project.

3. The General Fund repaid the Special Revenue Fund a loan of $15,000 plus $900 in interest on the loan.

Required:

Prepare entries in general journal form to record these transactions in the proper fund(s). Designate the fund in which each entry is recorded.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 34 في هذه المجموعة.

فتح الحزمة

k this deck

27

It is proper to recognize revenues or expenditures resulting from which of the following classifications of interfund activity?

A) Interfund loans and interfund transfers

B) Interfund services provided/used and interfund reimbursements

C) Interfund reimbursements and interfund loans

D) Interfund services provided/used and interfund transfers

A) Interfund loans and interfund transfers

B) Interfund services provided/used and interfund reimbursements

C) Interfund reimbursements and interfund loans

D) Interfund services provided/used and interfund transfers

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 34 في هذه المجموعة.

فتح الحزمة

k this deck

28

During 2013, the City of Atlantis started a street paving project. The project is being financed by the proceeds from the issue of five-year, 6% special assessment bonds payable at a face value of $3,000,000. The bonds were issued July 1, 2013 at their par value. One-fifth of the principal plus interest is payable on June 30 of each year beginning June 30, 2014. Property owners are assessed to provide the funds to pay the principal and interest on the debt.

The following transactions occurred during 2013 and 2014:

1. The bonds for the paving of the streets were issued.

2. The street paving was completed at a cost of $3,000,000.

3. Property owners were assessed and billed for the first installment of principal and interest on the special assessment debt.

4. Assessments for the first installment of principal and interest on the special assessment debt were collected. The June 30, 2014, payment of principal and interest was made.

Required:

Prepare all journal entries for the preceding transactions that are necessary for the City of Atlantis assuming:

A. The City of Atlantis has not obligated itself in any manner to the holders of the special assessment bonds.

B. The City of Atlantis has made a commitment to the holders of the special assessment bonds to assure the full payment of principal and interest on the due dates.

The following transactions occurred during 2013 and 2014:

1. The bonds for the paving of the streets were issued.

2. The street paving was completed at a cost of $3,000,000.

3. Property owners were assessed and billed for the first installment of principal and interest on the special assessment debt.

4. Assessments for the first installment of principal and interest on the special assessment debt were collected. The June 30, 2014, payment of principal and interest was made.

Required:

Prepare all journal entries for the preceding transactions that are necessary for the City of Atlantis assuming:

A. The City of Atlantis has not obligated itself in any manner to the holders of the special assessment bonds.

B. The City of Atlantis has made a commitment to the holders of the special assessment bonds to assure the full payment of principal and interest on the due dates.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 34 في هذه المجموعة.

فتح الحزمة

k this deck

29

An interfund transfer should be reported in a governmental fund operating statement as a(n):

A) due from (to) other funds

B) other financing source (use)

C) revenue or expenditure

D) none of these

A) due from (to) other funds

B) other financing source (use)

C) revenue or expenditure

D) none of these

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 34 في هذه المجموعة.

فتح الحزمة

k this deck

30

GASB Statement No. 34 specifies how governments report capital assets. Describe where capital assets are reported in government financial statements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 34 في هذه المجموعة.

فتح الحزمة

k this deck

31

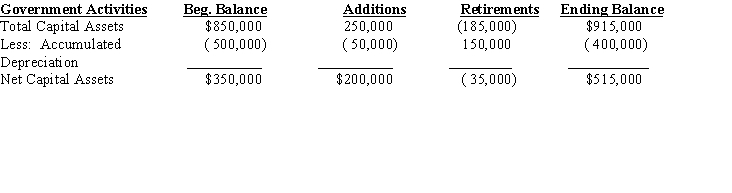

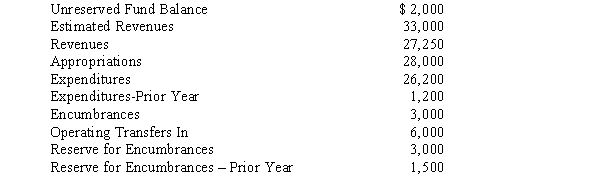

The following schedule of capital assets was prepared for Johnson County.  All capital asset acquisitions were made in the capital projects fund and paid in cash. An asset was sold by the general fund for $40,000 cash.

All capital asset acquisitions were made in the capital projects fund and paid in cash. An asset was sold by the general fund for $40,000 cash.

Required:

Determine how the above information will be reflected on each of the following statements for the year 2014.

A. The governmental funds' statement of revenues, expenditures, and changes in fund balances. List the governmental fund and then list the dollar amount within the appropriate heading on the statement (such as Revenues, Expenditures, or Other Financing Sources (Uses)).

B. The government-wide statement of net assets.

C. The government-wide statement of activities.

All capital asset acquisitions were made in the capital projects fund and paid in cash. An asset was sold by the general fund for $40,000 cash.

All capital asset acquisitions were made in the capital projects fund and paid in cash. An asset was sold by the general fund for $40,000 cash.Required:

Determine how the above information will be reflected on each of the following statements for the year 2014.

A. The governmental funds' statement of revenues, expenditures, and changes in fund balances. List the governmental fund and then list the dollar amount within the appropriate heading on the statement (such as Revenues, Expenditures, or Other Financing Sources (Uses)).

B. The government-wide statement of net assets.

C. The government-wide statement of activities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 34 في هذه المجموعة.

فتح الحزمة

k this deck

32

Revenues of a special revenue fund of a governmental unit should be recognized in the period in which the:

A) revenues become available and measurable.

B) revenues become available and appropriated.

C) revenues are billable.

D) cash is received.

A) revenues become available and measurable.

B) revenues become available and appropriated.

C) revenues are billable.

D) cash is received.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 34 في هذه المجموعة.

فتح الحزمة

k this deck

33

Prepare entries, in general journal form, to record the following transactions in the proper fund(s) and/or account group(s). Designate the fund or account group in which each entry is recorded.

1. Bond proceeds of $2,000,000 were received to be used in constructing a new City Jail. An equal amount is contributed from general revenues.

2. Serial bonds in the amount of $300,000 matured. Interest of $75,000 was paid on these and other serial bonds outstanding.

3. Insurance proceeds amounting to $19,000 were received as a result of the accidental destruction of a garbage truck costing $33,000. Accumulated depreciation on the truck was $21,000.

4. The City Parks Endowment Fund transferred $160,000 in expendable funds to the City Parks Special Revenue Fund.

5. Proceeds of $21,000 were received from the sale of equipment which had been purchased from general revenues at a cost of $100,000. Accumulated depreciation on the equipment was $75,000.

6. The City Power Company (an enterprise fund) issued a bill for $400,000 for electricity provided to municipal government buildings.

7. The City Power Company transferred excess funds of $90,000 to the General Fund.

8. A central data processing center was established by a contribution of $400,000 from the General Fund, a long-term loan of $130,000 from the City Parks Special Revenue Fund, and general obligation bond proceeds of $180,000.

9. The Data Processing Fund billed the General Fund $20,000 and the City Parks Special Revenue Fund $8,500 for data processing services.

10. The City Power Company received $7,000 as customer deposits during the year. The monies are to be held in trust until customers request that their services be discontinued and final bills are collected.

11. In order to retire general obligation term bonds when they become due, it is determined that the Debt Service Fund will require annual contributions of $40,000 and earnings in the current year of $3,000.

1. Bond proceeds of $2,000,000 were received to be used in constructing a new City Jail. An equal amount is contributed from general revenues.

2. Serial bonds in the amount of $300,000 matured. Interest of $75,000 was paid on these and other serial bonds outstanding.

3. Insurance proceeds amounting to $19,000 were received as a result of the accidental destruction of a garbage truck costing $33,000. Accumulated depreciation on the truck was $21,000.

4. The City Parks Endowment Fund transferred $160,000 in expendable funds to the City Parks Special Revenue Fund.

5. Proceeds of $21,000 were received from the sale of equipment which had been purchased from general revenues at a cost of $100,000. Accumulated depreciation on the equipment was $75,000.

6. The City Power Company (an enterprise fund) issued a bill for $400,000 for electricity provided to municipal government buildings.

7. The City Power Company transferred excess funds of $90,000 to the General Fund.

8. A central data processing center was established by a contribution of $400,000 from the General Fund, a long-term loan of $130,000 from the City Parks Special Revenue Fund, and general obligation bond proceeds of $180,000.

9. The Data Processing Fund billed the General Fund $20,000 and the City Parks Special Revenue Fund $8,500 for data processing services.

10. The City Power Company received $7,000 as customer deposits during the year. The monies are to be held in trust until customers request that their services be discontinued and final bills are collected.

11. In order to retire general obligation term bonds when they become due, it is determined that the Debt Service Fund will require annual contributions of $40,000 and earnings in the current year of $3,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 34 في هذه المجموعة.

فتح الحزمة

k this deck

34

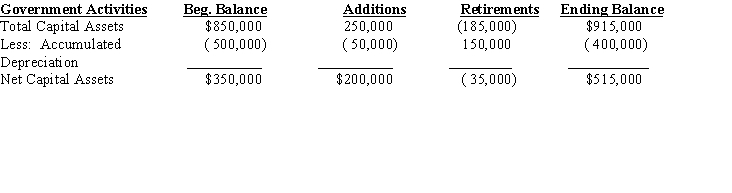

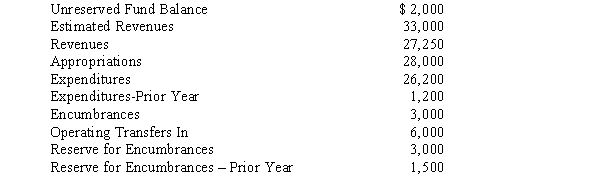

The general fund trial balance for Model City held the following balances at June 30, 2014, just before closing entries were made:  Required:

Required:

Prepare the necessary closing entries.

Required:

Required:Prepare the necessary closing entries.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 34 في هذه المجموعة.

فتح الحزمة

k this deck