Deck 17: Introduction to Fund Accounting

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/29

العب

ملء الشاشة (f)

Deck 17: Introduction to Fund Accounting

1

The entry to close appropriations, expenditures, and encumbrances accounts includes a debit to:

A) Appropriations.

B) Expenditures.

C) Encumbrances.

D) both Appropriations and Encumbrances.

A) Appropriations.

B) Expenditures.

C) Encumbrances.

D) both Appropriations and Encumbrances.

A

2

The two basic statements prepared for expendable fund entities are a balance sheet and a(n):

A) income statement.

B) statement of revenue.

C) statement of expenditures and encumbrances.

D) none of these.

A) income statement.

B) statement of revenue.

C) statement of expenditures and encumbrances.

D) none of these.

D

3

The reserve for encumbrances account is properly considered to be a:

A) current liability if payable within a year; otherwise, long-term debt.

B) fixed liability.

C) floating debt.

D) reservation of the fund's equity.

A) current liability if payable within a year; otherwise, long-term debt.

B) fixed liability.

C) floating debt.

D) reservation of the fund's equity.

D

4

The "reserve for encumbrances-prior year" account represents amounts recorded by a governmental unit for:

A) anticipated expenditures in the next year.

B) expenditures for which purchase orders were made in the prior year but disbursement will be in the current year.

C) excess expenditures in the prior year that will be offset against the current-year budgeted amounts.

D) unanticipated expenditures of the prior year that become evident in the current year.

A) anticipated expenditures in the next year.

B) expenditures for which purchase orders were made in the prior year but disbursement will be in the current year.

C) excess expenditures in the prior year that will be offset against the current-year budgeted amounts.

D) unanticipated expenditures of the prior year that become evident in the current year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 29 في هذه المجموعة.

فتح الحزمة

k this deck

5

Which type of fund entities are used to account for the activities of nonbusiness organizations that are similar to those of business enterprises?

A) Expendable fund entities

B) Proprietary fund entities

C) Budgetary fund entities

D) Restricted fund entities

A) Expendable fund entities

B) Proprietary fund entities

C) Budgetary fund entities

D) Restricted fund entities

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 29 في هذه المجموعة.

فتح الحزمة

k this deck

6

What journal entry should be made at the end of the fiscal year to close out encumbrances for which goods and services have not been received?

A) Debit reserve for encumbrance and credit encumbrances.

B) Debit reserve for encumbrances and credit fund balance.

C) Debit fund balance and credit encumbrances.

D) Debit encumbrances and credit reserve for encumbrances.

A) Debit reserve for encumbrance and credit encumbrances.

B) Debit reserve for encumbrances and credit fund balance.

C) Debit fund balance and credit encumbrances.

D) Debit encumbrances and credit reserve for encumbrances.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 29 في هذه المجموعة.

فتح الحزمة

k this deck

7

Which of the following requires the use of the encumbrance system?

A) Capital projects fund

B) Debt service fund

C) Internal service fund

D) Enterprise fund

A) Capital projects fund

B) Debt service fund

C) Internal service fund

D) Enterprise fund

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 29 في هذه المجموعة.

فتح الحزمة

k this deck

8

Customers' meter deposits which cannot be spent for normal operating purposes would be classified as restricted cash in the balance sheet of which fund?

A) Internal Service

B) Trust

C) Agency

D) Enterprise

A) Internal Service

B) Trust

C) Agency

D) Enterprise

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 29 في هذه المجموعة.

فتح الحزمة

k this deck

9

Governmental units include all of the following EXCEPT:

A) counties.

B) school districts.

C) industrial development districts.

D) voluntary health and welfare organizations.

A) counties.

B) school districts.

C) industrial development districts.

D) voluntary health and welfare organizations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 29 في هذه المجموعة.

فتح الحزمة

k this deck

10

When budgeted expenditures are enacted into law, they are referred to as:

A) estimated expenditures.

B) encumbrances.

C) appropriations.

D) expenditures.

A) estimated expenditures.

B) encumbrances.

C) appropriations.

D) expenditures.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 29 في هذه المجموعة.

فتح الحزمة

k this deck

11

The expendable fund entity's measurement focus is on:

A) the flow of current financial resources.

B) the flow of economic resources.

C) the flow of revenue, expenses, and net income.

D) none of these.

A) the flow of current financial resources.

B) the flow of economic resources.

C) the flow of revenue, expenses, and net income.

D) none of these.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 29 في هذه المجموعة.

فتح الحزمة

k this deck

12

In accounting for and reporting inventory in the financial statements, the "Reserve for Inventory" account is used under:

A) the consumption method.

B) the purchase method.

C) both the consumption and purchase methods.

D) none of these.

A) the consumption method.

B) the purchase method.

C) both the consumption and purchase methods.

D) none of these.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 29 في هذه المجموعة.

فتح الحزمة

k this deck

13

Under GASB Statement No. 34, a government-wide financial statement should include a:

A) statement of revenues & and expenses.

B) statement of activities.

C) statement of financial position.

D) notes to the financial statements.

A) statement of revenues & and expenses.

B) statement of activities.

C) statement of financial position.

D) notes to the financial statements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 29 في هذه المجموعة.

فتح الحزمة

k this deck

14

If a credit was made to the fund balance in the process of recording a budget for a governmental unit, it can be assumed that:

A) estimated expenses exceed actual revenues.

B) actual expenses exceed estimated expenses.

C) estimated revenues exceed appropriations.

D) appropriations exceed estimated revenues.

A) estimated expenses exceed actual revenues.

B) actual expenses exceed estimated expenses.

C) estimated revenues exceed appropriations.

D) appropriations exceed estimated revenues.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 29 في هذه المجموعة.

فتح الحزمة

k this deck

15

In accounting for expendable fund entities, revenue is ordinarily not recognized until:

A) it can be objectively measured and it is available to finance expenditures of the current period.

B) a transaction has taken place and the earnings process is complete.

C) it has been received in cash.

D) none of these.

A) it can be objectively measured and it is available to finance expenditures of the current period.

B) a transaction has taken place and the earnings process is complete.

C) it has been received in cash.

D) none of these.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 29 في هذه المجموعة.

فتح الحزمة

k this deck

16

The term used to describe the application of accounting to expendable fund entities is the:

A) accrual method.

B) cash method.

C) modified cash method.

D) modified accrual method.

A) accrual method.

B) cash method.

C) modified cash method.

D) modified accrual method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 29 في هذه المجموعة.

فتح الحزمة

k this deck

17

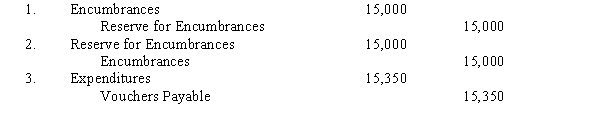

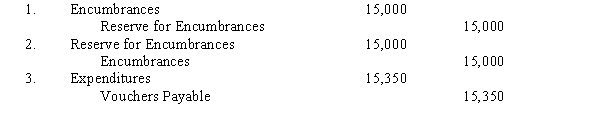

The following related entries were recorded in sequence in the general fund of a municipality:  The sequence of entries indicates that:

The sequence of entries indicates that:

A) an adverse event was foreseen and a reserve of $15,000 was created; later the reserve was cancelled and a liability for the item was acknowledged.

B) an order was placed for goods or services estimated to cost $15,000; the actual cost was $15,350 for which a liability was acknowledged upon receipt.

C) encumbrances were anticipated but later failed to materialize and were reversed. A liability of $15,350 was incurred.

D) the first entry was erroneous and was reversed; a liability of $15,350 was acknowledged.

The sequence of entries indicates that:

The sequence of entries indicates that:A) an adverse event was foreseen and a reserve of $15,000 was created; later the reserve was cancelled and a liability for the item was acknowledged.

B) an order was placed for goods or services estimated to cost $15,000; the actual cost was $15,350 for which a liability was acknowledged upon receipt.

C) encumbrances were anticipated but later failed to materialize and were reversed. A liability of $15,350 was incurred.

D) the first entry was erroneous and was reversed; a liability of $15,350 was acknowledged.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 29 في هذه المجموعة.

فتح الحزمة

k this deck

18

The entry to record the receipt of office equipment previously encumbered includes a debit to:

A) Office Equipment.

B) Encumbrances.

C) Reserve for Encumbrances.

D) both Office Equipment and Reserve for Encumbrances.

A) Office Equipment.

B) Encumbrances.

C) Reserve for Encumbrances.

D) both Office Equipment and Reserve for Encumbrances.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 29 في هذه المجموعة.

فتح الحزمة

k this deck

19

The Expenditures account of a governmental unit is debited when:

A) the budget is recorded.

B) supplies are ordered.

C) supplies encumbered are received.

D) the supplies invoice is paid.

A) the budget is recorded.

B) supplies are ordered.

C) supplies encumbered are received.

D) the supplies invoice is paid.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 29 في هذه المجموعة.

فتح الحزمة

k this deck

20

The GASB has the responsibility for establishing financial accounting standards for all of the following entities EXCEPT:

A) state and local government entities.

B) veterans hospitals.

C) school districts.

D) civic organizations.

A) state and local government entities.

B) veterans hospitals.

C) school districts.

D) civic organizations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 29 في هذه المجموعة.

فتح الحزمة

k this deck

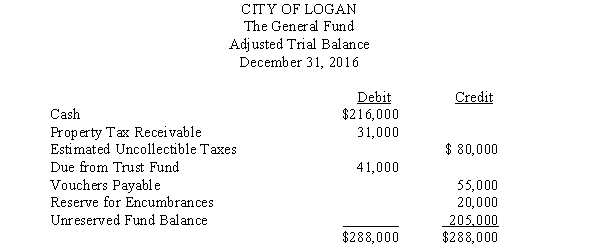

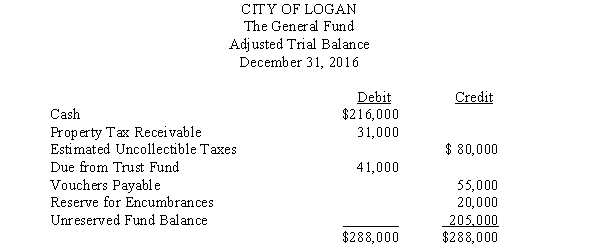

21

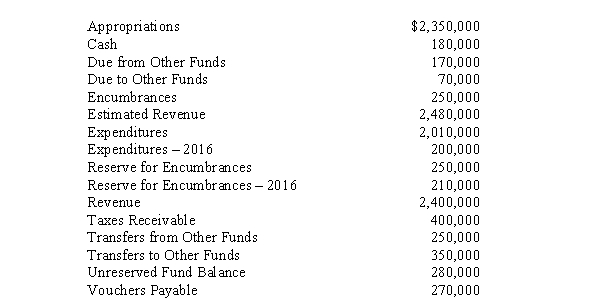

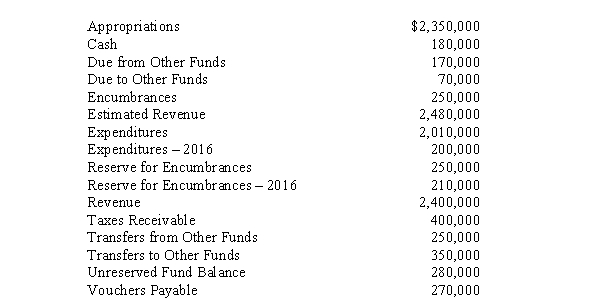

The trial balance for the General Fund of the City of Logan as of December 31, 2016, is presented below:  Transactions for the year ended December 31, 2017 are summarized as follows:

Transactions for the year ended December 31, 2017 are summarized as follows:

1. The City Council adopted a budget for the year with estimated revenue of $720,000 and appropriations of $710,000.

2. Property taxes in the amount of $495,000 were levied for the current year. It is estimated that $20,000 of the taxes levied will prove to be uncollectible.

3. Proceeds from the sale of equipment in the amount of $32,000 were received by the General Fund. The equipment was purchased four years ago with resources of the General Fund at a cost of $200,000. On the date it was purchased, it was estimated that the equipment had a useful life of six years.

4. Licenses and fees in the amount of $90,000 were collected.

5. The total amount of encumbrances against fund resources for the year was $595,000.

6. Vouchers in the amount of $445,000 were authorized for payment. This was $11,000 less than the amount originally encumbered for these purchases.

7. An invoice in the amount of $19,000 was received for goods ordered in 2016. The invoice was approved for payment.

8. Property taxes in the amount of $425,000 were collected.

9. Vouchers in the amount of $385,000 were paid.

10. Forty-one thousand dollars was transferred to the General Fund from the Trust Fund.

11. The City Council authorized the write-off of $15,000 in uncollected property taxes.

Required:

1. Prepare entries, in general journal form, to record the transactions for the year ended December 31, 2017.

2. Prepare the necessary closing entries for the year ending December 31, 2017.

Transactions for the year ended December 31, 2017 are summarized as follows:

Transactions for the year ended December 31, 2017 are summarized as follows:1. The City Council adopted a budget for the year with estimated revenue of $720,000 and appropriations of $710,000.

2. Property taxes in the amount of $495,000 were levied for the current year. It is estimated that $20,000 of the taxes levied will prove to be uncollectible.

3. Proceeds from the sale of equipment in the amount of $32,000 were received by the General Fund. The equipment was purchased four years ago with resources of the General Fund at a cost of $200,000. On the date it was purchased, it was estimated that the equipment had a useful life of six years.

4. Licenses and fees in the amount of $90,000 were collected.

5. The total amount of encumbrances against fund resources for the year was $595,000.

6. Vouchers in the amount of $445,000 were authorized for payment. This was $11,000 less than the amount originally encumbered for these purchases.

7. An invoice in the amount of $19,000 was received for goods ordered in 2016. The invoice was approved for payment.

8. Property taxes in the amount of $425,000 were collected.

9. Vouchers in the amount of $385,000 were paid.

10. Forty-one thousand dollars was transferred to the General Fund from the Trust Fund.

11. The City Council authorized the write-off of $15,000 in uncollected property taxes.

Required:

1. Prepare entries, in general journal form, to record the transactions for the year ended December 31, 2017.

2. Prepare the necessary closing entries for the year ending December 31, 2017.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 29 في هذه المجموعة.

فتح الحزمة

k this deck

22

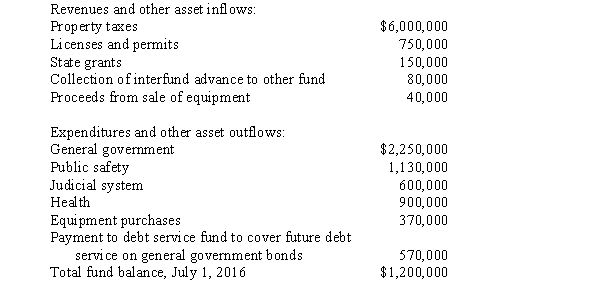

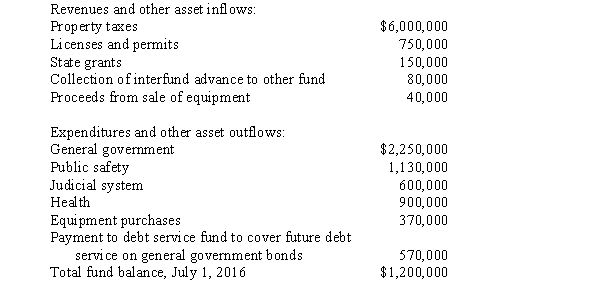

The following information regarding the fiscal year ended June 30, 2017, was drawn from the accounts and records of the Johnson County general fund:  Required:

Required:

Prepare a statement of revenues, expenditures, and changes in fund balance for the Johnson County general fund for the year ended June 30, 2017.

Required:

Required:Prepare a statement of revenues, expenditures, and changes in fund balance for the Johnson County general fund for the year ended June 30, 2017.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 29 في هذه المجموعة.

فتح الحزمة

k this deck

23

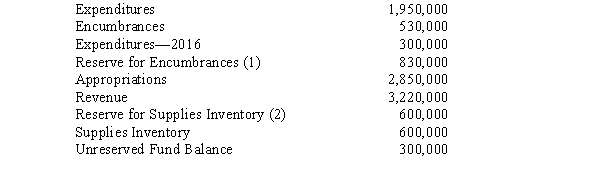

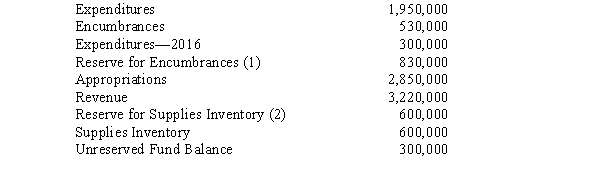

On December 31, 2017, the following account balances, among others, were included in the preclosing trial balance of the General Fund of the City of Springfield.

Estimated Revenue $2,960,000 (1) The balance in this account was $270,000 on January 1, 2017. Purchase orders outstanding on December 2017 total $530,000.

(1) The balance in this account was $270,000 on January 1, 2017. Purchase orders outstanding on December 2017 total $530,000.

(2) Supplies on hand on December 31, 2017, amount to $380,000.

Required:

1. What was the balance in the Unreserved Fund Balance account on December 31, 2016? What was the total Fund Balance on December 31, 2016?

2. Prepare the necessary adjusting and closing entries for the year ended December 31, 2017. Springfield uses the purchase method to account for supplies.

Estimated Revenue $2,960,000

(1) The balance in this account was $270,000 on January 1, 2017. Purchase orders outstanding on December 2017 total $530,000.

(1) The balance in this account was $270,000 on January 1, 2017. Purchase orders outstanding on December 2017 total $530,000.(2) Supplies on hand on December 31, 2017, amount to $380,000.

Required:

1. What was the balance in the Unreserved Fund Balance account on December 31, 2016? What was the total Fund Balance on December 31, 2016?

2. Prepare the necessary adjusting and closing entries for the year ended December 31, 2017. Springfield uses the purchase method to account for supplies.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 29 في هذه المجموعة.

فتح الحزمة

k this deck

24

The following account balances, among others, were included in the preclosing trial balance of the General Fund of the City of Baxter on December 31, 2017.  Required:

Required:

a. Prepare the necessary closing entries on December 31, 2017.

b. Calculate the amount of both the unreserved fund balance and the total fund balance in the balance sheet (1) on December 31, 2016, and (2) on December 31, 2017.

Required:

Required:a. Prepare the necessary closing entries on December 31, 2017.

b. Calculate the amount of both the unreserved fund balance and the total fund balance in the balance sheet (1) on December 31, 2016, and (2) on December 31, 2017.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 29 في هذه المجموعة.

فتح الحزمة

k this deck

25

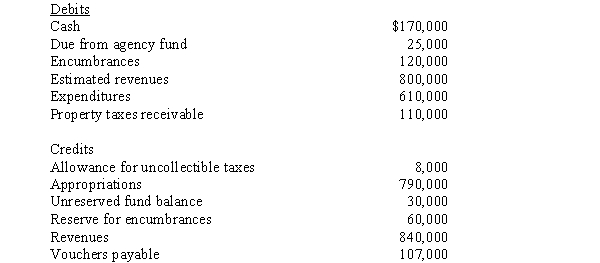

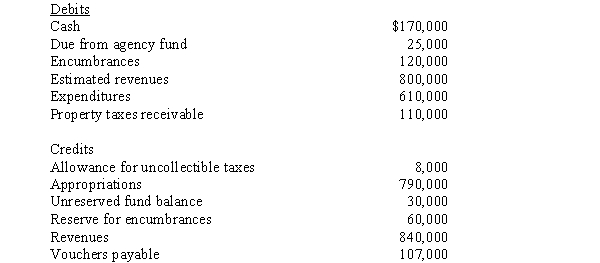

The unadjusted trial balance for the general fund of the City of Hog's Breath at June 30, 2017, is as follows:  Supplies on hand at June 30, 2017, totaled $8,000. The $120,000 encumbrance relates to equipment ordered but not received by fiscal year-end.

Supplies on hand at June 30, 2017, totaled $8,000. The $120,000 encumbrance relates to equipment ordered but not received by fiscal year-end.

Required:

Prepare a balance sheet for the general fund of the City of Hog's Breath at June 30, 2017.

Supplies on hand at June 30, 2017, totaled $8,000. The $120,000 encumbrance relates to equipment ordered but not received by fiscal year-end.

Supplies on hand at June 30, 2017, totaled $8,000. The $120,000 encumbrance relates to equipment ordered but not received by fiscal year-end.Required:

Prepare a balance sheet for the general fund of the City of Hog's Breath at June 30, 2017.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 29 في هذه المجموعة.

فتح الحزمة

k this deck

26

During 2017, the City of Party Beach was involved in the following transactions:

1. A budget consisting of estimated revenues of $1,500,000 and appropriations for expenditures of $1,550,000 was approved by the city council.

2. Statements of property tax assessments totaling $1,100,000 were mailed to property owners. Experience indicates that 2% of assessed taxes will be uncollectible.

3. Equipment costing $85,000 was purchased, and old equipment was sold for $15,000 at the end of its estimated useful life.

4. The city manager signed a contract to purchase a machine costing $25,000.

5. The city received a statement from the state indicating that the city's portion of the state sales tax is $50,000.

6. The machine ordered in (4) above is delivered and accepted. The invoice in the amount of $26,000 was approved for payment.

Required:

Prepare the journal entries needed to account for the preceding transactions.

1. A budget consisting of estimated revenues of $1,500,000 and appropriations for expenditures of $1,550,000 was approved by the city council.

2. Statements of property tax assessments totaling $1,100,000 were mailed to property owners. Experience indicates that 2% of assessed taxes will be uncollectible.

3. Equipment costing $85,000 was purchased, and old equipment was sold for $15,000 at the end of its estimated useful life.

4. The city manager signed a contract to purchase a machine costing $25,000.

5. The city received a statement from the state indicating that the city's portion of the state sales tax is $50,000.

6. The machine ordered in (4) above is delivered and accepted. The invoice in the amount of $26,000 was approved for payment.

Required:

Prepare the journal entries needed to account for the preceding transactions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 29 في هذه المجموعة.

فتح الحزمة

k this deck

27

Fund entities may be classified as expendable fund entities, fiduciary fund entities, and proprietary fund entities. Distinguish among expendable, fiduciary, and proprietary fund entities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 29 في هذه المجموعة.

فتح الحزمة

k this deck

28

Expendable fund entities prepare closing entries at the end of each period just as business enterprises do. Describe the necessary closing entries for expendable funds.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 29 في هذه المجموعة.

فتح الحزمة

k this deck

29

At the beginning of 2017, the City of Mauer reported an Unreserved Fund Balance of $890,000 and a supplies inventory balance of $280,000. During the year, Mauer purchased $360,000 in supplies and used $350,000 worth. The city will report a reserve for supplies inventory.

Required:

a. Prepare the journal entries needed to account for the supplies under the consumption method.

b. Prepare the necessary journal entries under the purchases method.

c. What would the December 31, 2017, balance in the Unreserved Fund Balance be under the consumption method, assuming that the only transactions of the fund are those involving the supplies?

Required:

a. Prepare the journal entries needed to account for the supplies under the consumption method.

b. Prepare the necessary journal entries under the purchases method.

c. What would the December 31, 2017, balance in the Unreserved Fund Balance be under the consumption method, assuming that the only transactions of the fund are those involving the supplies?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 29 في هذه المجموعة.

فتح الحزمة

k this deck