Deck 11: International Financial Reporting Standards

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/28

العب

ملء الشاشة (f)

Deck 11: International Financial Reporting Standards

1

SFAS No.162, the Accounting Standards Codification, is directed to:

A) auditors.

B) Boards of Directors.

C) securities regulators.

D) entities.

A) auditors.

B) Boards of Directors.

C) securities regulators.

D) entities.

D

2

In accounting for liabilities, IFRS interprets "probable" as:

A) likely.

B) more likely than not.

C) somewhat possible.

D) possible and not remote.

A) likely.

B) more likely than not.

C) somewhat possible.

D) possible and not remote.

B

3

IFRS and US GAAP differ with regard to financial statement presentation in all of the following EXCEPT:

A) IFRS generally requires that assets be listed in order of increasing liquidity while US GAAP requires that assets be listed in order of decreasing liquidity.

B) US GAAP requires expenses to be listed by function while IFRS requires expenses to be listed by nature.

C) IFRS prohibits extraordinary items which are allowed by US GAAP.

D) IFRS requires two years of comparative income statements while under US GAAP, three years of income statements are required.

A) IFRS generally requires that assets be listed in order of increasing liquidity while US GAAP requires that assets be listed in order of decreasing liquidity.

B) US GAAP requires expenses to be listed by function while IFRS requires expenses to be listed by nature.

C) IFRS prohibits extraordinary items which are allowed by US GAAP.

D) IFRS requires two years of comparative income statements while under US GAAP, three years of income statements are required.

B

4

Which of the following is true about the FASB after the mandatory adoption of IFRS by US companies?

A) The FASB will serve in an advisory capacity to the IASB.

B) The FASB will remain the designated standard-setter for US companies, but incorporate IFRS into US GAAP.

C) The role of the FASB post-IFRS adoption has not been determined.

D) The FASB will cease to exist.

A) The FASB will serve in an advisory capacity to the IASB.

B) The FASB will remain the designated standard-setter for US companies, but incorporate IFRS into US GAAP.

C) The role of the FASB post-IFRS adoption has not been determined.

D) The FASB will cease to exist.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 28 في هذه المجموعة.

فتح الحزمة

k this deck

5

Which of the following statements is true regarding the IASC?

A) The IASC is a public-sector, not-for-profit organization.

B) The IASC is accountable to an international securities regulator.

C) The IASC is a stand-alone, private-sector organization.

D) The IASC funds the operations of the IASB through filing fees paid to national securities regulators.

A) The IASC is a public-sector, not-for-profit organization.

B) The IASC is accountable to an international securities regulator.

C) The IASC is a stand-alone, private-sector organization.

D) The IASC funds the operations of the IASB through filing fees paid to national securities regulators.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 28 في هذه المجموعة.

فتح الحزمة

k this deck

6

In accounting for research and development costs.

A) the general rule under both US GAAP and IFRS is that research and development costs should be expensed as incurred .

B) IFRS generally expenses all research and development costs while US GAAP expenses research costs as incurred but capitalizes development costs once technological and economic feasibility has been demonstrated.

C) US GAAP generally expenses all research and development costs while IFRS expenses research costs as incurred but capitalizes development costs once technological and economic feasibility has been demonstrated.

D) both US GAAP and IFRS expense research costs as incurred but capitalize development costs once technological and economic feasibility has been demonstrated.

A) the general rule under both US GAAP and IFRS is that research and development costs should be expensed as incurred .

B) IFRS generally expenses all research and development costs while US GAAP expenses research costs as incurred but capitalizes development costs once technological and economic feasibility has been demonstrated.

C) US GAAP generally expenses all research and development costs while IFRS expenses research costs as incurred but capitalizes development costs once technological and economic feasibility has been demonstrated.

D) both US GAAP and IFRS expense research costs as incurred but capitalize development costs once technological and economic feasibility has been demonstrated.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 28 في هذه المجموعة.

فتح الحزمة

k this deck

7

The major difference between IFRS and US GAAP in accounting for inventories is that:

A) US GAAP prohibits the use of specific identification.

B) IFRS requires the use of the LIFO cost flow assumption.

C) US GAAP prohibits the use of the LIFO cost flow assumption

D) US GAAP allows the use of the LIFO cost flow assumption.

A) US GAAP prohibits the use of specific identification.

B) IFRS requires the use of the LIFO cost flow assumption.

C) US GAAP prohibits the use of the LIFO cost flow assumption

D) US GAAP allows the use of the LIFO cost flow assumption.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 28 في هذه المجموعة.

فتح الحزمة

k this deck

8

The goals of the International Accounting Standards Committee include all of the following EXCEPT:

A) To improve international accounting.

B) To formulate a single set of auditing standards to be applied in all countries.

C) To promote global acceptance of its standards.

D) To harmonize accounting practices between countries.

A) To improve international accounting.

B) To formulate a single set of auditing standards to be applied in all countries.

C) To promote global acceptance of its standards.

D) To harmonize accounting practices between countries.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 28 في هذه المجموعة.

فتح الحزمة

k this deck

9

Benefits of the FASB Accounting Standards Codification (ASC) include all of the following EXCEPT:

A) increases the independence of the FASB.

B) aids in the convergence of US GAAP with IFRS.

C) reduces time and effort required to research accounting issues.

D) clearly distinguishes between authoritative and non-authoritative guidance.

A) increases the independence of the FASB.

B) aids in the convergence of US GAAP with IFRS.

C) reduces time and effort required to research accounting issues.

D) clearly distinguishes between authoritative and non-authoritative guidance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 28 في هذه المجموعة.

فتح الحزمة

k this deck

10

One difference between IFRS and GAAP in valuing inventories is that:

A) IFRS, but not GAAP, allows reversals so that inventories written down under lower-of-cost-or-market can be written back up to the original cost.

B) GAAP defines market value as replacement cost where IFRS defines market as the selling price.

C) GAAP strictly adheres to the historical cost concept and does not allow for write-downs of inventory values while IFRS embraces fair value.

D) IFRS, but not GAAP, requires that inventories be valued at the lower of cost or market.

A) IFRS, but not GAAP, allows reversals so that inventories written down under lower-of-cost-or-market can be written back up to the original cost.

B) GAAP defines market value as replacement cost where IFRS defines market as the selling price.

C) GAAP strictly adheres to the historical cost concept and does not allow for write-downs of inventory values while IFRS embraces fair value.

D) IFRS, but not GAAP, requires that inventories be valued at the lower of cost or market.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 28 في هذه المجموعة.

فتح الحزمة

k this deck

11

Accounting under IFRS and US GAAP is similar for all of the following topics EXCEPT:

A) changes in estimates.

B) related party transactions.

C) research and development costs.

D) changes in methods.

A) changes in estimates.

B) related party transactions.

C) research and development costs.

D) changes in methods.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 28 في هذه المجموعة.

فتح الحزمة

k this deck

12

The amount of a long-lived asset impairment loss is generally determined by comparing:

A) the asset's carrying amount and its fair value under US GAAP.

B) the asset's carrying amount and its discounted future cash flows less cost to sell under IFRS.

C) the asset's carrying amount and its undiscounted future cash flows under US GAAP.

D) the asset's carrying amount and its undiscounted future cash flows less disposal cost under IFRS.

A) the asset's carrying amount and its fair value under US GAAP.

B) the asset's carrying amount and its discounted future cash flows less cost to sell under IFRS.

C) the asset's carrying amount and its undiscounted future cash flows under US GAAP.

D) the asset's carrying amount and its undiscounted future cash flows less disposal cost under IFRS.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 28 في هذه المجموعة.

فتح الحزمة

k this deck

13

Accounting terminology that differs between IFRS and US GAAP include all of the following EXCEPT:

A) the use by IFRS of "turnover" for revenue.

B) the use by IFRS of "share premium" for additional paid-in-capital.

C) the use by IFRS of "other capital reserves" for retained earnings.

D) the use by IFRS of "issued capital" for common stock.

A) the use by IFRS of "turnover" for revenue.

B) the use by IFRS of "share premium" for additional paid-in-capital.

C) the use by IFRS of "other capital reserves" for retained earnings.

D) the use by IFRS of "issued capital" for common stock.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 28 في هذه المجموعة.

فتح الحزمة

k this deck

14

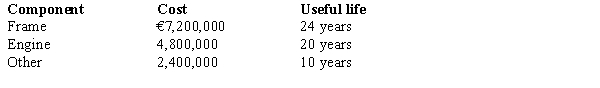

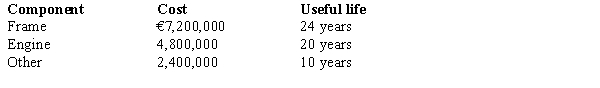

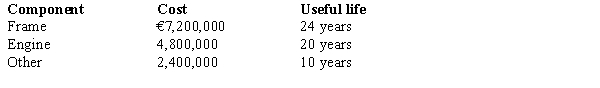

On January 1, 2016, BelgianAir purchases an airplane for €14,400,000. The components of the airplane and their useful lives are as follows:  BelgianAir uses the straight-line method of depreciation. The asset is assumed to have no salvage value. Under US GAAP, the entry to record depreciation expense on the asset at December 31, 2017 will include

BelgianAir uses the straight-line method of depreciation. The asset is assumed to have no salvage value. Under US GAAP, the entry to record depreciation expense on the asset at December 31, 2017 will include

A) a credit to accumulated depreciation of €1,200,000.

B) a debit to depreciation expense of €1,440,000

C) a debit to depreciation expense of €780,000.

D) a credit to accumulated depreciation of €600,000.

BelgianAir uses the straight-line method of depreciation. The asset is assumed to have no salvage value. Under US GAAP, the entry to record depreciation expense on the asset at December 31, 2017 will include

BelgianAir uses the straight-line method of depreciation. The asset is assumed to have no salvage value. Under US GAAP, the entry to record depreciation expense on the asset at December 31, 2017 will includeA) a credit to accumulated depreciation of €1,200,000.

B) a debit to depreciation expense of €1,440,000

C) a debit to depreciation expense of €780,000.

D) a credit to accumulated depreciation of €600,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 28 في هذه المجموعة.

فتح الحزمة

k this deck

15

The roles of the IASC Foundation include:

A) establishing global standards for financial reporting.

B) coordinating the filing requirements of stock exchange regulatory agencies.

C) financing IASB operations.

D) all of these are roles of the IASC Foundation.

A) establishing global standards for financial reporting.

B) coordinating the filing requirements of stock exchange regulatory agencies.

C) financing IASB operations.

D) all of these are roles of the IASC Foundation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 28 في هذه المجموعة.

فتح الحزمة

k this deck

16

Which statement below concerning the accountability and funding of the IASC Foundation is correct?

A) The IASC Foundation independence is assured through a system of voluntary contributions from firms in the accounting profession.

B) The IASC Foundation is not controlled by any national securities regulators.

C) The SEC considers the accountability and funding mechanisms for the IASC Foundation to be satisfactory.

D) Appointments of IASC Foundation Trustees must be approved by the SEC.

A) The IASC Foundation independence is assured through a system of voluntary contributions from firms in the accounting profession.

B) The IASC Foundation is not controlled by any national securities regulators.

C) The SEC considers the accountability and funding mechanisms for the IASC Foundation to be satisfactory.

D) Appointments of IASC Foundation Trustees must be approved by the SEC.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 28 في هذه المجموعة.

فتح الحزمة

k this deck

17

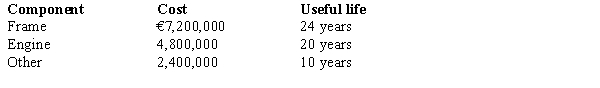

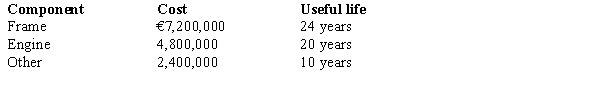

On January 1, 2016, BelgianAir purchases an airplane for €14,400,000. The components of the airplane and their useful lives are as follows:  BelgianAir uses the straight-line method of depreciation. The asset is assumed to have no salvage value. Under IFRS, the entry to record the acquisition of the airplane would include

BelgianAir uses the straight-line method of depreciation. The asset is assumed to have no salvage value. Under IFRS, the entry to record the acquisition of the airplane would include

A) a debit to Asset/ Airplane of €14,400,000.

B) a debit to Asset/ Airplane frame of €14,400,000.

C) a debit to Asset/ Airplane engine of €4,800,000.

D) cannot be determined from the information given.

BelgianAir uses the straight-line method of depreciation. The asset is assumed to have no salvage value. Under IFRS, the entry to record the acquisition of the airplane would include

BelgianAir uses the straight-line method of depreciation. The asset is assumed to have no salvage value. Under IFRS, the entry to record the acquisition of the airplane would includeA) a debit to Asset/ Airplane of €14,400,000.

B) a debit to Asset/ Airplane frame of €14,400,000.

C) a debit to Asset/ Airplane engine of €4,800,000.

D) cannot be determined from the information given.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 28 في هذه المجموعة.

فتح الحزمة

k this deck

18

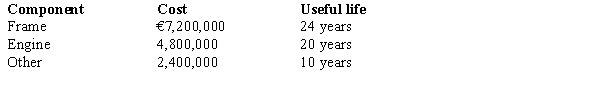

On January 1, 2016, BelgianAir purchases an airplane for €14,400,000. The components of the airplane and their useful lives are as follows:  BelgianAir uses the straight-line method of depreciation. The asset is assumed to have no salvage value. Under IFRS, the entry to record depreciation expense on the asset at December 31, 2017 will include a credit to accumulated depreciation of:

BelgianAir uses the straight-line method of depreciation. The asset is assumed to have no salvage value. Under IFRS, the entry to record depreciation expense on the asset at December 31, 2017 will include a credit to accumulated depreciation of:

A) €1,440,000.

B) €1,200,000

C) €780,000.

D) €600,000.

BelgianAir uses the straight-line method of depreciation. The asset is assumed to have no salvage value. Under IFRS, the entry to record depreciation expense on the asset at December 31, 2017 will include a credit to accumulated depreciation of:

BelgianAir uses the straight-line method of depreciation. The asset is assumed to have no salvage value. Under IFRS, the entry to record depreciation expense on the asset at December 31, 2017 will include a credit to accumulated depreciation of:A) €1,440,000.

B) €1,200,000

C) €780,000.

D) €600,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 28 في هذه المجموعة.

فتح الحزمة

k this deck

19

Property, plant and equipment are valued at:

A) historical cost under both IFRS and US GAAP.

B) historical cost or revalued amounts under both IFRS and US GAAP.

C) revalued amounts under IFRS.

D) historical cost under US GAAP while IFRS allows the assets to be valued at either historical cost or revalued amounts.

A) historical cost under both IFRS and US GAAP.

B) historical cost or revalued amounts under both IFRS and US GAAP.

C) revalued amounts under IFRS.

D) historical cost under US GAAP while IFRS allows the assets to be valued at either historical cost or revalued amounts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 28 في هذه المجموعة.

فتح الحزمة

k this deck

20

Milestones in the transition plan for mandatory adoption of IFRS by US companies include all of the following EXCEPT:

A) Improvements in accounting standards.

B) Limited early adoption of IFRS in an effort to enhance comparability for US investors

C) Mandatory use of IFRS by US entities.

D) All of the above are milestones in the transition plan for mandatory adoption of IFRS by US companies.

A) Improvements in accounting standards.

B) Limited early adoption of IFRS in an effort to enhance comparability for US investors

C) Mandatory use of IFRS by US entities.

D) All of the above are milestones in the transition plan for mandatory adoption of IFRS by US companies.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 28 في هذه المجموعة.

فتح الحزمة

k this deck

21

All of the following are options for non-US companies who wish to list securities on a US exchange EXCEPT:

A) The company can use either IFRS or their local GAAP.

B) If a company uses their local GAAP they must reconcile net income and shareholders' equity or fully disclose all financial information required of US companies.

C) If a company uses their local GAAP they must reconcile net income and shareholders' equity and fully disclose all financial information required of US companies

D) The company must file a form 20-F with the SEC.

A) The company can use either IFRS or their local GAAP.

B) If a company uses their local GAAP they must reconcile net income and shareholders' equity or fully disclose all financial information required of US companies.

C) If a company uses their local GAAP they must reconcile net income and shareholders' equity and fully disclose all financial information required of US companies

D) The company must file a form 20-F with the SEC.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 28 في هذه المجموعة.

فتح الحزمة

k this deck

22

Bruges Electronics Inc. offers one model of laptop computer for £1000 and a two-year warranty for £250. The retailer, as part of a Boxing Day promotion, offers a limited-time offer for the laptop, including delivery and the two-year warranty for £1,180. The cost of the computer to Bruges is £700. Any warranty repairs are assumed to be done ratably over time. Bruges accounts for transactions using the customer consideration model. In the first twelve months following the sale, Bruges incurred £980 of costs servicing the computers under warranty.

In the first twelve months, Bruges would record warranty expense of

A) £784.

B) £980

C) £1,180.

D) £1,380.

In the first twelve months, Bruges would record warranty expense of

A) £784.

B) £980

C) £1,180.

D) £1,380.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 28 في هذه المجموعة.

فتح الحزمة

k this deck

23

New terminology introduced under the joint IFRS- US GAAP Customer Consideration (Allocation) Model includes all of the following EXCEPT:

A) revenue recognition voids.

B) contract rights.

C) net contract asset/ liability.

D) performance obligations.

A) revenue recognition voids.

B) contract rights.

C) net contract asset/ liability.

D) performance obligations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 28 في هذه المجموعة.

فتح الحزمة

k this deck

24

Significant differences between IFRS and Chinese GAAP include all of the following EXCEPT:

A) Chinese GAAP allows the use of LIFO while IFRS prohibits it.

B) Chinese GAAP has different related party disclosure requirements.

C) Chinese GAAP follows the cost principle while IFRS allows for revaluations and recoveries of impairment losses.

D) Chinese GAAP uses the equity method of accounting for jointly controlled entities while IFRS also allows proportionate consolidation.

A) Chinese GAAP allows the use of LIFO while IFRS prohibits it.

B) Chinese GAAP has different related party disclosure requirements.

C) Chinese GAAP follows the cost principle while IFRS allows for revaluations and recoveries of impairment losses.

D) Chinese GAAP uses the equity method of accounting for jointly controlled entities while IFRS also allows proportionate consolidation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 28 في هذه المجموعة.

فتح الحزمة

k this deck

25

Under IFRS, the criteria to determine whether a lease should be capitalized include:

A) the present value of the minimum lease payments is 90% or more of the fair value of the asset at the inception of the lease.

B) the term of the lease is 75% or more of the economic life of the asset.

C) the term of the lease is equal to substantially all of the economic life of the asset.

D) the present value of the minimum lease payments is equal to substantially all of the fair value of the asset at the inception of the lease.

A) the present value of the minimum lease payments is 90% or more of the fair value of the asset at the inception of the lease.

B) the term of the lease is 75% or more of the economic life of the asset.

C) the term of the lease is equal to substantially all of the economic life of the asset.

D) the present value of the minimum lease payments is equal to substantially all of the fair value of the asset at the inception of the lease.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 28 في هذه المجموعة.

فتح الحزمة

k this deck

26

All of the following are true regarding American Depository Receipts (ADRs) EXCEPT:

A) Most ADRs are unsponsored, meaning that the DR bank creates a DR program without a formal agreement with the issuing non-US company.

B) An ADR is a derivative instrument traded in the US that usually represents a fixed number of publicly traded shares of a non-US company.

C) ADRs are denominated in US dollars.

D) A Level 1 sponsored ADR is the easiest way for a non-US company to access US markets.

A) Most ADRs are unsponsored, meaning that the DR bank creates a DR program without a formal agreement with the issuing non-US company.

B) An ADR is a derivative instrument traded in the US that usually represents a fixed number of publicly traded shares of a non-US company.

C) ADRs are denominated in US dollars.

D) A Level 1 sponsored ADR is the easiest way for a non-US company to access US markets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 28 في هذه المجموعة.

فتح الحزمة

k this deck

27

Bruges Electronics Inc. offers one model of laptop computer for £1000 and a two-year warranty for £250. The retailer, as part of a Boxing Day promotion, offers a limited-time offer for the laptop, including delivery and the two-year warranty for £1,180. The cost of the computer to Bruges is £700. Any warranty repairs are assumed to be done ratably over time. Bruges accounts for transactions using the customer consideration model. In the first twelve months following the sale, Bruges incurred £980 of costs servicing the computers under warranty.

Bruges sells ten laptops to Brussels Inc. under the limited-time promotion. Upon delivery of the laptops to Brussels, Bruges will recognize revenue of:

A) £9,300.

B) £9,440

C) £10,000.

D) £11,800.

Bruges sells ten laptops to Brussels Inc. under the limited-time promotion. Upon delivery of the laptops to Brussels, Bruges will recognize revenue of:

A) £9,300.

B) £9,440

C) £10,000.

D) £11,800.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 28 في هذه المجموعة.

فتح الحزمة

k this deck

28

Bruges Electronics Inc. offers one model of laptop computer for £1000 and a two-year warranty for £250. The retailer, as part of a Boxing Day promotion, offers a limited-time offer for the laptop, including delivery and the two-year warranty for £1,180. The cost of the computer to Bruges is £700. Any warranty repairs are assumed to be done ratably over time. Bruges accounts for transactions using the customer consideration model. In the first twelve months following the sale, Bruges incurred £980 of costs servicing the computers under warranty.

In the first twelve months following the sale, Bruges would reduce the Contract liability - warranty account by:

A) £784.

B) £980

C) £1,180.

D) £1,380.

In the first twelve months following the sale, Bruges would reduce the Contract liability - warranty account by:

A) £784.

B) £980

C) £1,180.

D) £1,380.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 28 في هذه المجموعة.

فتح الحزمة

k this deck