Deck 9: Joint Product and By-Product Costing

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

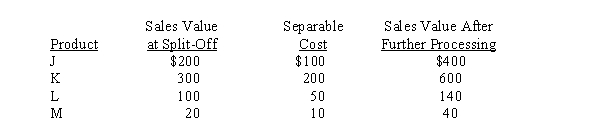

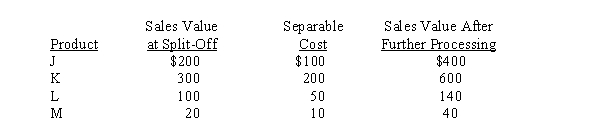

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

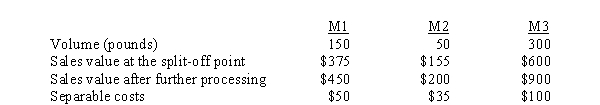

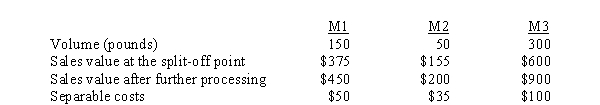

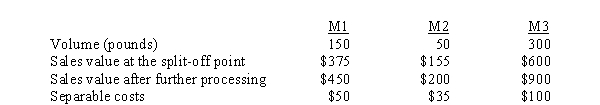

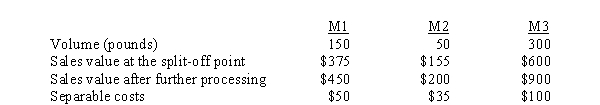

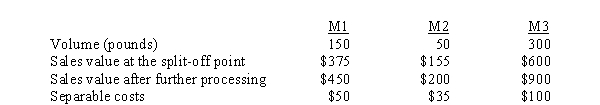

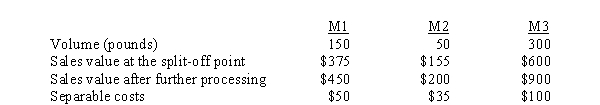

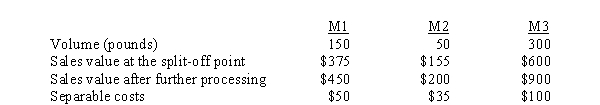

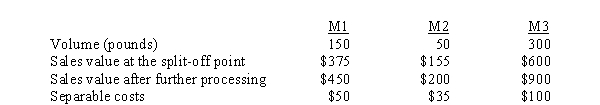

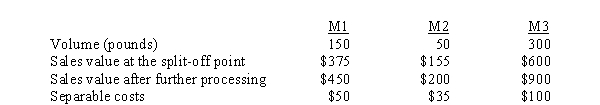

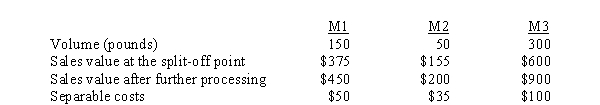

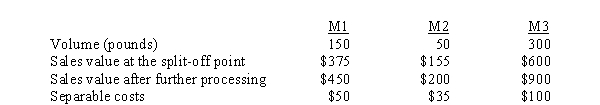

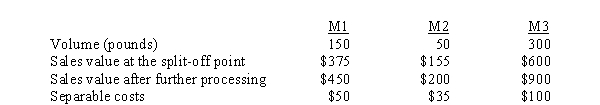

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

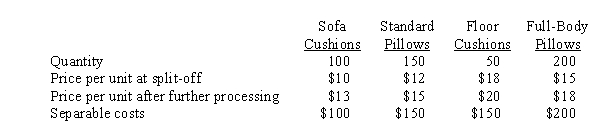

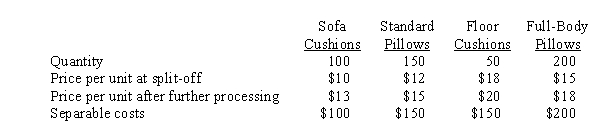

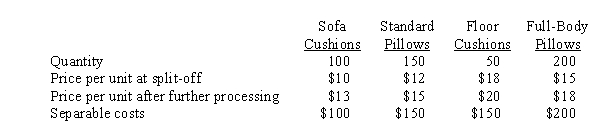

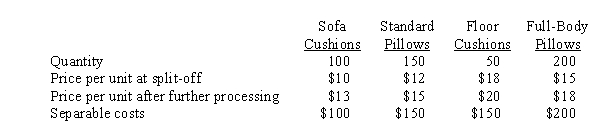

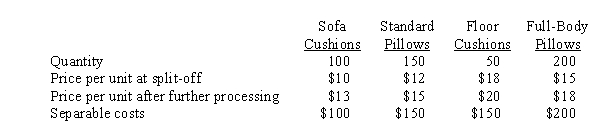

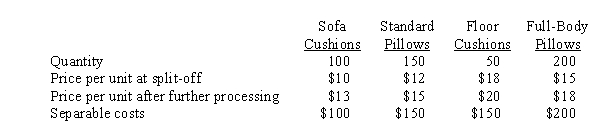

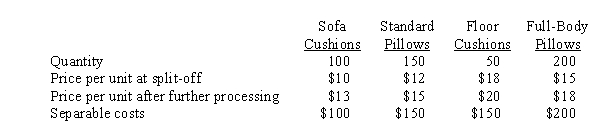

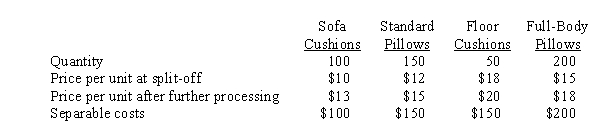

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/136

العب

ملء الشاشة (f)

Deck 9: Joint Product and By-Product Costing

1

Managers choose from a variety of logical joint cost allocation methods, but the allocation process itself is always arbitrary.

True

2

Different joint cost allocation methods cause products to show different contribution margins.

True

3

Managers normally differentiate main products from by-products based on their sales values.

True

4

The sales value at split-off point method of joint cost allocation avoids the problem of negative contribution margins for some products.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

5

Costs allocated to joint products are generally referred to as separable costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

6

The physical output method of joint cost allocation is seldom used in practice because of its measurement difficulties.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

7

Only companies in manufacturing industries produce joint products.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

8

Managers who want to avoid arbitrary joint cost allocations should use the physical output method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

9

Managers should choose a joint cost allocation method to avoid giving the impression that one or more products are sold at a loss when they actually contribute to profitability.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

10

Joint costs are always incurred before the split-off point.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

11

Managers normally differentiate main products from by-products based on their weight.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

12

Joint costs are common to all joint products.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

13

The constant gross margin NRV method of allocating joint costs results in all joint products having equal gross profit percentages (gross profit / sales).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

14

Costs incurred after the split-off point are referred to as split-off costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

15

A company can increase or decrease its total gross margin by using different joint cost allocation methods.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

16

The choice of joint cost allocation method depends somewhat on the nature of the products' characteristics.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

17

In the beef production industry, bones sold for dogs can generally be considered a by-product.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

18

Separable costs generally must be allocated to joint products because they are difficult to trace directly.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

19

The physical output method is appropriate when products are sold in units of similar size and their net realizable values are similar.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

20

The constant gross margin NRV method of allocating joint costs results in all joint products having equal gross margins (in dollars).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

21

By-products can only be recognized at the time of sale.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

22

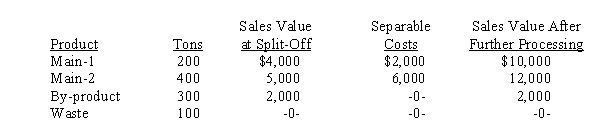

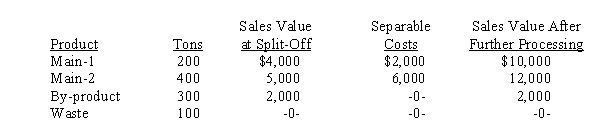

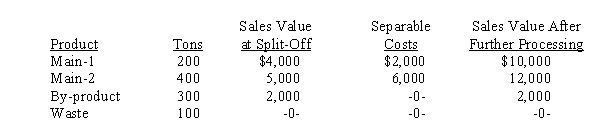

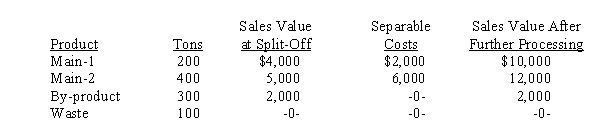

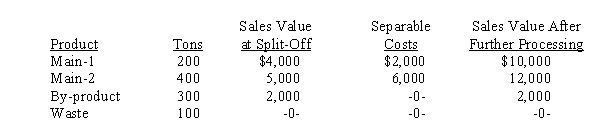

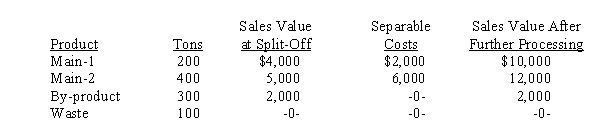

Use the following information for the next 3 questions.

Recyclers, Inc. reprocesses paper and obtains 2 main products, a by-product, and waste. By-product revenues are treated as a reduction in joint costs. During the period, 1,000 tons were processed at a cost of $12,000 for materials and processing, resulting in the following:

If the firm allocates joint costs to the main products using the sales value at split-off point method, how much will be allocated to Main-2?

A) $5,556

B) $4,545

C) $5,333

D) $6,666

Recyclers, Inc. reprocesses paper and obtains 2 main products, a by-product, and waste. By-product revenues are treated as a reduction in joint costs. During the period, 1,000 tons were processed at a cost of $12,000 for materials and processing, resulting in the following:

If the firm allocates joint costs to the main products using the sales value at split-off point method, how much will be allocated to Main-2?

A) $5,556

B) $4,545

C) $5,333

D) $6,666

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

23

Use the following information for the next 3 questions.

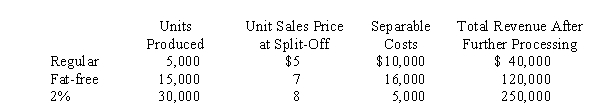

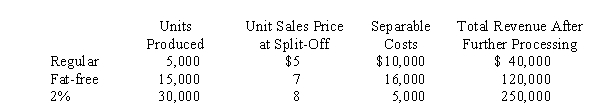

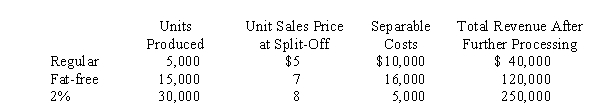

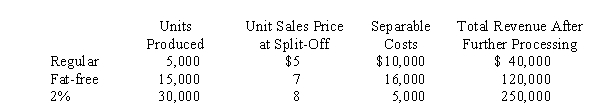

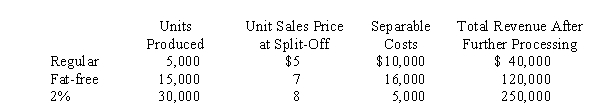

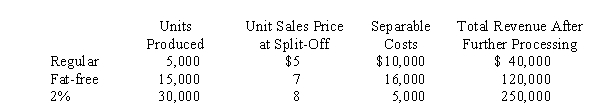

Balley, Inc. produces three milk products (all are main products) from a joint process costing $200,000. Data from the current period's operation follow:

If Balley produces and sells the best mix, what is the total gross margin?

A) $195,000

B) $210,000

C) $180,000

D) $164,000

Balley, Inc. produces three milk products (all are main products) from a joint process costing $200,000. Data from the current period's operation follow:

If Balley produces and sells the best mix, what is the total gross margin?

A) $195,000

B) $210,000

C) $180,000

D) $164,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

24

Joint product cost allocation information can be used for financial reporting and for short-term decisions such as whether to process the product further.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

25

Use the following information for the next 3 questions.

Balley, Inc. produces three milk products (all are main products) from a joint process costing $200,000. Data from the current period's operation follow:

If Balley allocates joint costs using the physical output method instead of the net realizable value method, income will be

A) higher

B) lower

C) unchanged

D) unable to determine from data given

Balley, Inc. produces three milk products (all are main products) from a joint process costing $200,000. Data from the current period's operation follow:

If Balley allocates joint costs using the physical output method instead of the net realizable value method, income will be

A) higher

B) lower

C) unchanged

D) unable to determine from data given

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

26

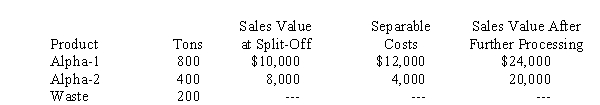

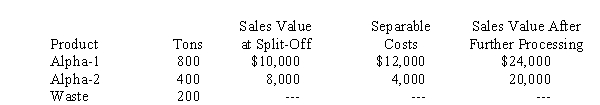

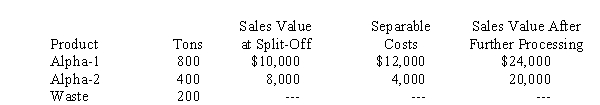

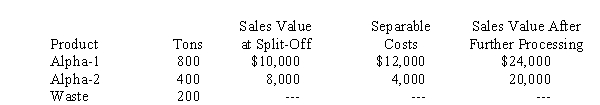

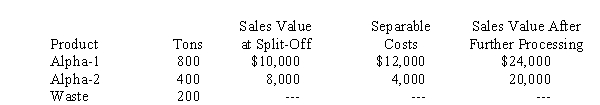

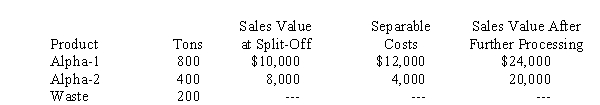

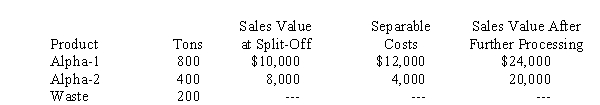

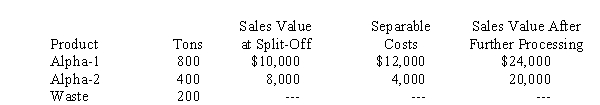

Use the following information for the next 5 questions.

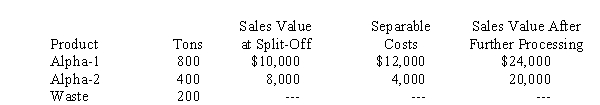

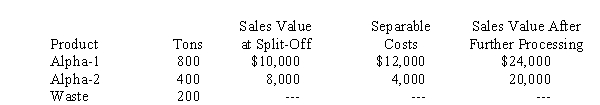

Jordan, Inc. produces 2 products from a joint process costing $24,000. The results from the most recent period follow:

If Jordan uses the physical output method, the joint costs allocated to Alpha-1 were

A) $8,000

B) $6,400

C) $16,000

D) $9,600

Jordan, Inc. produces 2 products from a joint process costing $24,000. The results from the most recent period follow:

If Jordan uses the physical output method, the joint costs allocated to Alpha-1 were

A) $8,000

B) $6,400

C) $16,000

D) $9,600

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

27

When joint production processes include a sales mix, the sales mix should be incorporated into the allocation method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

28

Use the following information for the next 3 questions.

Recyclers, Inc. reprocesses paper and obtains 2 main products, a by-product, and waste. By-product revenues are treated as a reduction in joint costs. During the period, 1,000 tons were processed at a cost of $12,000 for materials and processing, resulting in the following:

If the firm allocates joint costs to the main products using the physical output method, how much will be allocated to Main-1?

A) $2,000

B) $2,400

C) $2,222

D) $3,333

Recyclers, Inc. reprocesses paper and obtains 2 main products, a by-product, and waste. By-product revenues are treated as a reduction in joint costs. During the period, 1,000 tons were processed at a cost of $12,000 for materials and processing, resulting in the following:

If the firm allocates joint costs to the main products using the physical output method, how much will be allocated to Main-1?

A) $2,000

B) $2,400

C) $2,222

D) $3,333

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

29

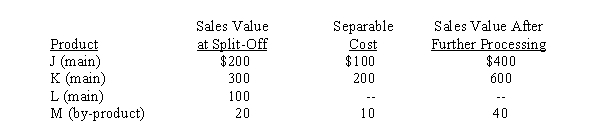

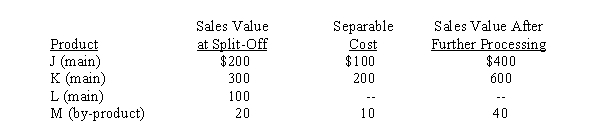

Use the following information for the next 2 questions.

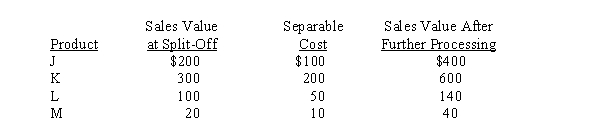

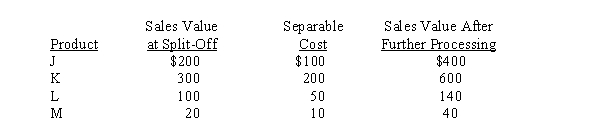

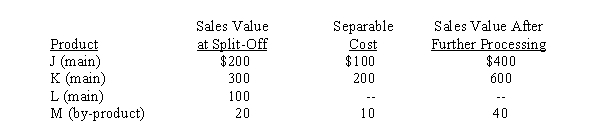

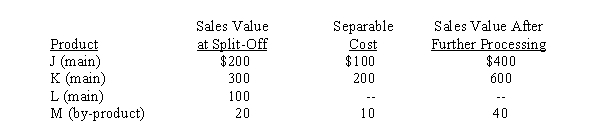

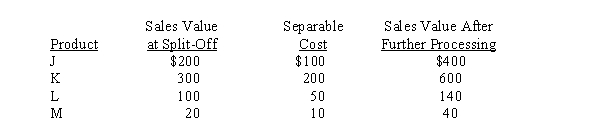

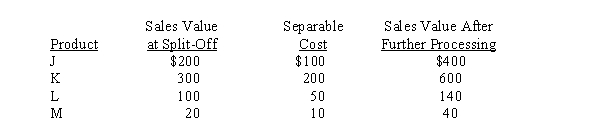

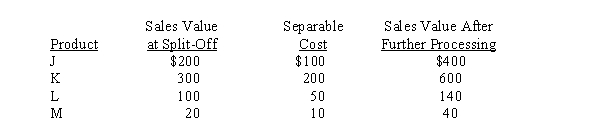

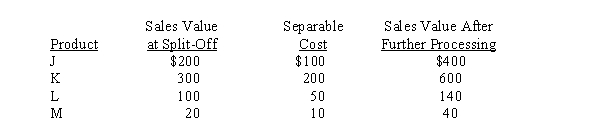

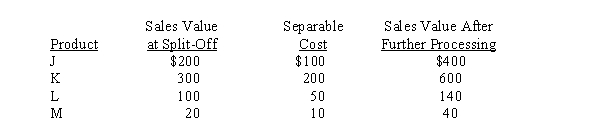

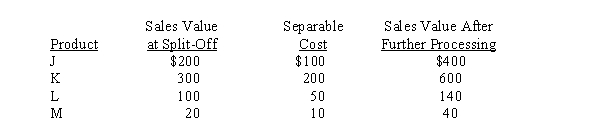

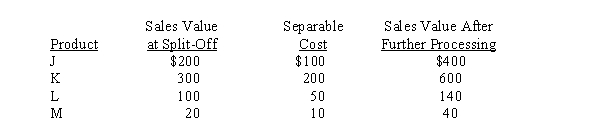

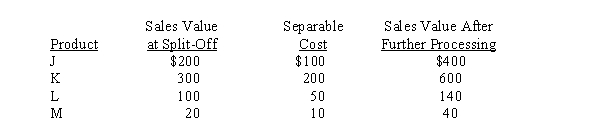

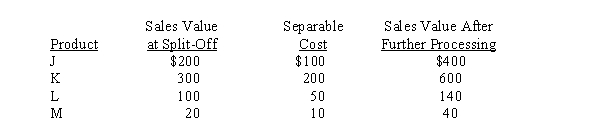

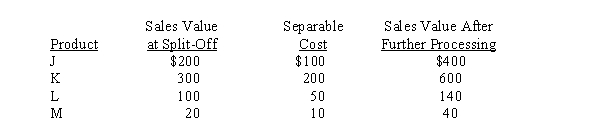

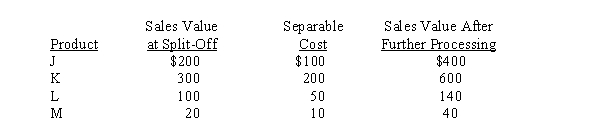

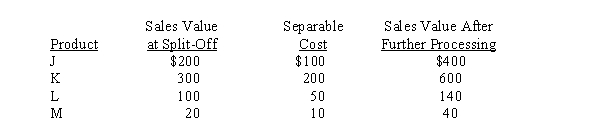

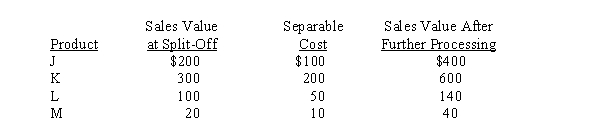

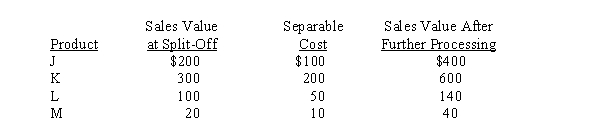

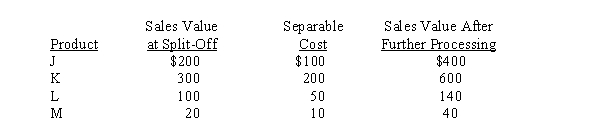

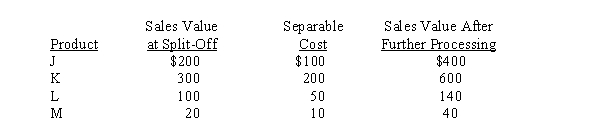

A joint input costing $500 results in four distinct products at the point of split-off. Products J, K and L are main products, and product M is a by-product. Relevant data follows:

If the revenue from Product M is recognized at time of sale, at what cost will it be inventoried before further processing?

A) $0

B) $10

C) $20

D) $30

A joint input costing $500 results in four distinct products at the point of split-off. Products J, K and L are main products, and product M is a by-product. Relevant data follows:

If the revenue from Product M is recognized at time of sale, at what cost will it be inventoried before further processing?

A) $0

B) $10

C) $20

D) $30

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

30

Use the following information for the next 3 questions.

Recyclers, Inc. reprocesses paper and obtains 2 main products, a by-product, and waste. By-product revenues are treated as a reduction in joint costs. During the period, 1,000 tons were processed at a cost of $12,000 for materials and processing, resulting in the following:

If the firm allocates joint costs to the main products using the net realizable value, how much will be allocated to Main-1?

A) $5,000

B) $5,714

C) $6,857

D) $6,000

Recyclers, Inc. reprocesses paper and obtains 2 main products, a by-product, and waste. By-product revenues are treated as a reduction in joint costs. During the period, 1,000 tons were processed at a cost of $12,000 for materials and processing, resulting in the following:

If the firm allocates joint costs to the main products using the net realizable value, how much will be allocated to Main-1?

A) $5,000

B) $5,714

C) $6,857

D) $6,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

31

Use the following information for the next 2 questions.

A joint input costing $500 results in four distinct products at the point of split-off. Relevant data follows:

Which of the four products should not be further processed?

A) J

B) K

C) L

D) M

A joint input costing $500 results in four distinct products at the point of split-off. Relevant data follows:

Which of the four products should not be further processed?

A) J

B) K

C) L

D) M

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

32

Use the following information for the next 5 questions.

Jordan, Inc. produces 2 products from a joint process costing $24,000. The results from the most recent period follow:

If Jordan uses the sales value at split-off point method, the joint costs allocated to Alpha-2 would be

A) $8,889

B) $10,667

C) $8,727

D) $13,333

Jordan, Inc. produces 2 products from a joint process costing $24,000. The results from the most recent period follow:

If Jordan uses the sales value at split-off point method, the joint costs allocated to Alpha-2 would be

A) $8,889

B) $10,667

C) $8,727

D) $13,333

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

33

Use the following information for the next 2 questions.

Major Foods, Inc. produces a cereal from oat grain. The company buys unprocessed oats for $400 per ton. It costs $60 per ton to send the oats through a processor, which produces 1,900 pounds of pure oats and 100 pounds of oat shells. The oat shells are ground and packaged at a cost of $100 per hundred pounds. They are sold to a poultry feed company for $3 per pound. The pure oats are cooked and packaged into 4-pound containers at a cost of $350. The packaged oats are sold for $2 per 4-pound container.

If Major uses the net realizable value method, the joint costs allocated to the oats is

A) $345

B) $110

C) $350

D) $115

Major Foods, Inc. produces a cereal from oat grain. The company buys unprocessed oats for $400 per ton. It costs $60 per ton to send the oats through a processor, which produces 1,900 pounds of pure oats and 100 pounds of oat shells. The oat shells are ground and packaged at a cost of $100 per hundred pounds. They are sold to a poultry feed company for $3 per pound. The pure oats are cooked and packaged into 4-pound containers at a cost of $350. The packaged oats are sold for $2 per 4-pound container.

If Major uses the net realizable value method, the joint costs allocated to the oats is

A) $345

B) $110

C) $350

D) $115

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

34

Use the following information for the next 5 questions.

Jordan, Inc. produces 2 products from a joint process costing $24,000. The results from the most recent period follow:

If Jordan uses the sales value at split-off point method to allocate joint costs, the cost per ton for Alpha-1 would be

A) $15

B) $32

C) $28

D) $29

Jordan, Inc. produces 2 products from a joint process costing $24,000. The results from the most recent period follow:

If Jordan uses the sales value at split-off point method to allocate joint costs, the cost per ton for Alpha-1 would be

A) $15

B) $32

C) $28

D) $29

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

35

Use the following information for the next 5 questions.

Jordan, Inc. produces 2 products from a joint process costing $24,000. The results from the most recent period follow:

If Jordan uses the physical output method to allocate joint costs, the cost per ton for Alpha-2 would be

A) $27

B) $22

C) $30

D) $20

Jordan, Inc. produces 2 products from a joint process costing $24,000. The results from the most recent period follow:

If Jordan uses the physical output method to allocate joint costs, the cost per ton for Alpha-2 would be

A) $27

B) $22

C) $30

D) $20

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

36

Use the following information for the next 2 questions.

Major Foods, Inc. produces a cereal from oat grain. The company buys unprocessed oats for $400 per ton. It costs $60 per ton to send the oats through a processor, which produces 1,900 pounds of pure oats and 100 pounds of oat shells. The oat shells are ground and packaged at a cost of $100 per hundred pounds. They are sold to a poultry feed company for $3 per pound. The pure oats are cooked and packaged into 4-pound containers at a cost of $350. The packaged oats are sold for $2 per 4-pound container.

If Major uses the net realizable value method, the gross profit from the oat shells is

A) $185

B) $200

C) $85

D) $215

Major Foods, Inc. produces a cereal from oat grain. The company buys unprocessed oats for $400 per ton. It costs $60 per ton to send the oats through a processor, which produces 1,900 pounds of pure oats and 100 pounds of oat shells. The oat shells are ground and packaged at a cost of $100 per hundred pounds. They are sold to a poultry feed company for $3 per pound. The pure oats are cooked and packaged into 4-pound containers at a cost of $350. The packaged oats are sold for $2 per 4-pound container.

If Major uses the net realizable value method, the gross profit from the oat shells is

A) $185

B) $200

C) $85

D) $215

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

37

Use the following information for the next 5 questions.

Jordan, Inc. produces 2 products from a joint process costing $24,000. The results from the most recent period follow:

If Jordan uses the net realizable value method, the joint costs allocated to Alpha-1 would be

A) $8,571

B) $,9000

C) $10,909

D) $10,286

Jordan, Inc. produces 2 products from a joint process costing $24,000. The results from the most recent period follow:

If Jordan uses the net realizable value method, the joint costs allocated to Alpha-1 would be

A) $8,571

B) $,9000

C) $10,909

D) $10,286

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

38

Use the following information for the next 2 questions.

A joint input costing $500 results in four distinct products at the point of split-off. Products J, K and L are main products, and product M is a by-product. Relevant data follows:

If the revenue from product M is recognized at the time of sale, what amount will be recorded as the cost of product M inventory at the time of split-off?

A) $0

B) $10

C) $20

D) $30

A joint input costing $500 results in four distinct products at the point of split-off. Products J, K and L are main products, and product M is a by-product. Relevant data follows:

If the revenue from product M is recognized at the time of sale, what amount will be recorded as the cost of product M inventory at the time of split-off?

A) $0

B) $10

C) $20

D) $30

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

39

Joint costs should be included in the calculation of product profitability for internal reporting purposes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

40

Use the following information for the next 3 questions.

Balley, Inc. produces three milk products (all are main products) from a joint process costing $200,000. Data from the current period's operation follow:

Which product(s) should be processed beyond the split-off point?

A) Regular and Fat-free only

B) Regular and 2% only

C) Fat-free only

D) 2% only

Balley, Inc. produces three milk products (all are main products) from a joint process costing $200,000. Data from the current period's operation follow:

Which product(s) should be processed beyond the split-off point?

A) Regular and Fat-free only

B) Regular and 2% only

C) Fat-free only

D) 2% only

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

41

Use the following information for the next 8 questions.

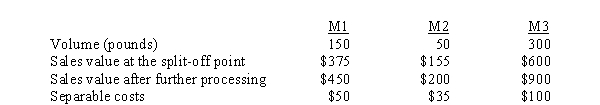

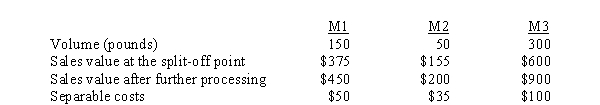

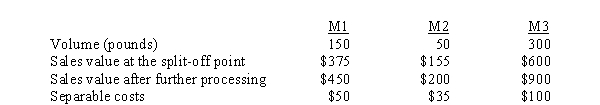

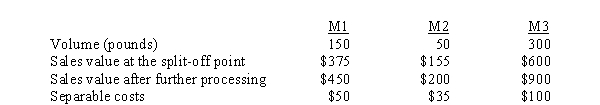

RKH Corporation produces three joint products. During a recent accounting period, joint costs totaled $365 and RKH had no beginning inventories. Additional data appear below:

Which of the following methods will result in the smallest joint cost allocation to M3?

A) Net realizable value

B) Sales value at split-off point

C) Physical output

D) Constant gross margin NRV

RKH Corporation produces three joint products. During a recent accounting period, joint costs totaled $365 and RKH had no beginning inventories. Additional data appear below:

Which of the following methods will result in the smallest joint cost allocation to M3?

A) Net realizable value

B) Sales value at split-off point

C) Physical output

D) Constant gross margin NRV

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

42

Use the following information for the next 8 questions.

RKH Corporation produces three joint products. During a recent accounting period, joint costs totaled $365 and RKH had no beginning inventories. Additional data appear below:

Using the constant gross margin NRV method, the joint costs allocated to M1 will be

A) $290

B) $160

C) $110

D) $50

RKH Corporation produces three joint products. During a recent accounting period, joint costs totaled $365 and RKH had no beginning inventories. Additional data appear below:

Using the constant gross margin NRV method, the joint costs allocated to M1 will be

A) $290

B) $160

C) $110

D) $50

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

43

A main product is typically differentiated from other joint products by its

A) Allocated joint costs

B) Size or weight

C) Sales value

D) Cost

A) Allocated joint costs

B) Size or weight

C) Sales value

D) Cost

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

44

Use the following information for the next 2 questions.

A joint input costing $500 results in four distinct products at the point of split-off. Relevant data follows:

When the products emerging from a joint process are similar in size and in relative value per unit, the most appealing joint cost allocation method is

A) Relative sales value

B) Net realizable value

C) Physical output method

D) Reciprocal method

A joint input costing $500 results in four distinct products at the point of split-off. Relevant data follows:

When the products emerging from a joint process are similar in size and in relative value per unit, the most appealing joint cost allocation method is

A) Relative sales value

B) Net realizable value

C) Physical output method

D) Reciprocal method

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

45

Use the following information for the next 2 questions.

A joint input costing $500 results in four distinct products at the point of split-off. Relevant data follows:

Joint costs are

A) Easily traceable to individual product lines

B) Common costs that result in two or more unique products

C) Incurred by a particular product

D) Fixed costs incurred after the split-off point

A joint input costing $500 results in four distinct products at the point of split-off. Relevant data follows:

Joint costs are

A) Easily traceable to individual product lines

B) Common costs that result in two or more unique products

C) Incurred by a particular product

D) Fixed costs incurred after the split-off point

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

46

Use the following information for the next 2 questions.

A joint input costing $500 results in four distinct products at the point of split-off. Relevant data follows:

Assume that K is processed further and that management is considering an alternative to the current process. The new separable cost of processing would be $250. If the firm is to be no worse off, the product must sell for at least

A) $550

B) $650

C) $750

D) $850

A joint input costing $500 results in four distinct products at the point of split-off. Relevant data follows:

Assume that K is processed further and that management is considering an alternative to the current process. The new separable cost of processing would be $250. If the firm is to be no worse off, the product must sell for at least

A) $550

B) $650

C) $750

D) $850

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

47

Use the following information for the next 2 questions.

A joint input costing $500 results in four distinct products at the point of split-off. Relevant data follows:

When separable costs are deducted from the selling price that can be achieved after further processing, the result is called the

A) Relative sales value

B) Net realizable value

C) Budgeted value

D) Inventory value

A joint input costing $500 results in four distinct products at the point of split-off. Relevant data follows:

When separable costs are deducted from the selling price that can be achieved after further processing, the result is called the

A) Relative sales value

B) Net realizable value

C) Budgeted value

D) Inventory value

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

48

Use the following information for the next 8 questions.

RKH Corporation produces three joint products. During a recent accounting period, joint costs totaled $365 and RKH had no beginning inventories. Additional data appear below:

Using the constant gross margin NRV method, the combined gross margin percentage (rounded to the nearest whole percent) is:

A) 65%

B) 88%

C) 76%

D) None of the above

RKH Corporation produces three joint products. During a recent accounting period, joint costs totaled $365 and RKH had no beginning inventories. Additional data appear below:

Using the constant gross margin NRV method, the combined gross margin percentage (rounded to the nearest whole percent) is:

A) 65%

B) 88%

C) 76%

D) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

49

Use the following information for the next 2 questions.

A joint input costing $500 results in four distinct products at the point of split-off. Relevant data follows:

By-products are products that

A) Are chosen to measure profitability

B) Are immaterial in value relative to main products

C) Are intentionally produced

D) Share in the allocation of joint product costs

A joint input costing $500 results in four distinct products at the point of split-off. Relevant data follows:

By-products are products that

A) Are chosen to measure profitability

B) Are immaterial in value relative to main products

C) Are intentionally produced

D) Share in the allocation of joint product costs

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

50

Use the following information for the next 2 questions.

A joint input costing $500 results in four distinct products at the point of split-off. Relevant data follows:

Joint product costs

A) Are irrelevant in deciding whether or not to produce beyond the split-off point

B) Cannot be allocated using the physical output method

C) Are not included in the costs of ending inventory

D) Require use of the alternative cost method

A joint input costing $500 results in four distinct products at the point of split-off. Relevant data follows:

Joint product costs

A) Are irrelevant in deciding whether or not to produce beyond the split-off point

B) Cannot be allocated using the physical output method

C) Are not included in the costs of ending inventory

D) Require use of the alternative cost method

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

51

Use the following information for the next 8 questions.

RKH Corporation produces three joint products. During a recent accounting period, joint costs totaled $365 and RKH had no beginning inventories. Additional data appear below:

Which of the following methods will result in the greatest joint cost allocation to M1?

A) Physical output

B) Sales value at split-off point

C) Net realizable value

D) Constant gross margin NRV

RKH Corporation produces three joint products. During a recent accounting period, joint costs totaled $365 and RKH had no beginning inventories. Additional data appear below:

Which of the following methods will result in the greatest joint cost allocation to M1?

A) Physical output

B) Sales value at split-off point

C) Net realizable value

D) Constant gross margin NRV

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

52

Use the following information for the next 8 questions.

RKH Corporation produces three joint products. During a recent accounting period, joint costs totaled $365 and RKH had no beginning inventories. Additional data appear below:

Which of the following methods will result in the greatest total joint cost allocation among the three products? I. Net realizable value

II) Sales value at split-off point

III) Physical output

IV) Constant gross margin NRV

A) I and II only

B) II and III only

C) I and IV only

D) All methods will result in the same total joint cost allocated

RKH Corporation produces three joint products. During a recent accounting period, joint costs totaled $365 and RKH had no beginning inventories. Additional data appear below:

Which of the following methods will result in the greatest total joint cost allocation among the three products? I. Net realizable value

II) Sales value at split-off point

III) Physical output

IV) Constant gross margin NRV

A) I and II only

B) II and III only

C) I and IV only

D) All methods will result in the same total joint cost allocated

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

53

Use the following information for the next 8 questions.

RKH Corporation produces three joint products. During a recent accounting period, joint costs totaled $365 and RKH had no beginning inventories. Additional data appear below:

Which of the following methods will result in the greatest joint cost allocation to M2?

A) Constant gross margin NRV

B) Net realizable value

C) Physical output

D) Sales value at split-off point

RKH Corporation produces three joint products. During a recent accounting period, joint costs totaled $365 and RKH had no beginning inventories. Additional data appear below:

Which of the following methods will result in the greatest joint cost allocation to M2?

A) Constant gross margin NRV

B) Net realizable value

C) Physical output

D) Sales value at split-off point

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

54

Joint processes can result in I. Products

II) Services

III) Intangible assets

A) I only

B) II only

C) I and III only

D) I and II only

II) Services

III) Intangible assets

A) I only

B) II only

C) I and III only

D) I and II only

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

55

Use the following information for the next 2 questions.

A joint input costing $500 results in four distinct products at the point of split-off. Relevant data follows:

If the incremental revenues for a joint product that has been processed further exceed the incremental costs, the general decision is to

A) Process beyond the split-off point

B) Sell at the split-off point

C) Be indifferent about whether to process further

D) Allocate the separable costs using the net realizable value method

A joint input costing $500 results in four distinct products at the point of split-off. Relevant data follows:

If the incremental revenues for a joint product that has been processed further exceed the incremental costs, the general decision is to

A) Process beyond the split-off point

B) Sell at the split-off point

C) Be indifferent about whether to process further

D) Allocate the separable costs using the net realizable value method

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

56

In which of the following industries would you be least likely to find a joint production process?

A) Oil and gas

B) Food

C) Chemicals

D) Textbook production

A) Oil and gas

B) Food

C) Chemicals

D) Textbook production

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

57

Which of the following are sub-categories of joint products?

A) Main products and by-products

B) Main products and split-off products

C) By-products and split-off products

D) Main products, by-products and split-off products

A) Main products and by-products

B) Main products and split-off products

C) By-products and split-off products

D) Main products, by-products and split-off products

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

58

Use the following information for the next 8 questions.

RKH Corporation produces three joint products. During a recent accounting period, joint costs totaled $365 and RKH had no beginning inventories. Additional data appear below:

Using the constant gross margin NRV method, the total separable costs allocated to the three products will be

A) $0

B) $185

C) $365

D) $550

RKH Corporation produces three joint products. During a recent accounting period, joint costs totaled $365 and RKH had no beginning inventories. Additional data appear below:

Using the constant gross margin NRV method, the total separable costs allocated to the three products will be

A) $0

B) $185

C) $365

D) $550

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

59

Use the following information for the next 2 questions.

A joint input costing $500 results in four distinct products at the point of split-off. Relevant data follows:

When individual products/services become separately identifiable, this is called the

A) Break point

B) Split-off point

C) Breakeven point

D) Point of no return

A joint input costing $500 results in four distinct products at the point of split-off. Relevant data follows:

When individual products/services become separately identifiable, this is called the

A) Break point

B) Split-off point

C) Breakeven point

D) Point of no return

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

60

Use the following information for the next 2 questions.

A joint input costing $500 results in four distinct products at the point of split-off. Relevant data follows:

Costs incurred beyond the split-off point that are traceable to individual products are

A) Joint costs

B) Common costs

C) Net realizable costs

D) Separable costs

A joint input costing $500 results in four distinct products at the point of split-off. Relevant data follows:

Costs incurred beyond the split-off point that are traceable to individual products are

A) Joint costs

B) Common costs

C) Net realizable costs

D) Separable costs

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

61

Use the following information for the next 8 questions.

HGT Corporation produces four products from a common production process. Selected data from HGT's accounting system for the four products appears below: Joint costs for the accounting period totaled $5,000. Each product line has a different product manager, who is evaluated based on product line profitability. Therefore, each manager is motivated to reduce his / her total product line costs as much as possible. The managers have been given information about potential joint cost allocations using the following three methods: physical output, sales at split-off point, and net realizable value. The managers are comparing the joint cost allocations under each method so that they can give the accountant input about their preferred method(s).

Joint costs for the accounting period totaled $5,000. Each product line has a different product manager, who is evaluated based on product line profitability. Therefore, each manager is motivated to reduce his / her total product line costs as much as possible. The managers have been given information about potential joint cost allocations using the following three methods: physical output, sales at split-off point, and net realizable value. The managers are comparing the joint cost allocations under each method so that they can give the accountant input about their preferred method(s).

Which product line would receive the least amount of joint cost under the sales value at the split-off point method?

A) Floor cushions

B) Full-body pillows

C) Sofa cushions and standard pillows

D) None of the above

HGT Corporation produces four products from a common production process. Selected data from HGT's accounting system for the four products appears below:

Joint costs for the accounting period totaled $5,000. Each product line has a different product manager, who is evaluated based on product line profitability. Therefore, each manager is motivated to reduce his / her total product line costs as much as possible. The managers have been given information about potential joint cost allocations using the following three methods: physical output, sales at split-off point, and net realizable value. The managers are comparing the joint cost allocations under each method so that they can give the accountant input about their preferred method(s).

Joint costs for the accounting period totaled $5,000. Each product line has a different product manager, who is evaluated based on product line profitability. Therefore, each manager is motivated to reduce his / her total product line costs as much as possible. The managers have been given information about potential joint cost allocations using the following three methods: physical output, sales at split-off point, and net realizable value. The managers are comparing the joint cost allocations under each method so that they can give the accountant input about their preferred method(s).Which product line would receive the least amount of joint cost under the sales value at the split-off point method?

A) Floor cushions

B) Full-body pillows

C) Sofa cushions and standard pillows

D) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

62

A by-product can become a main product when

A) Changes in technologies give it greater sales value

B) Markets contract, lessening demand

C) Its net costs increase

D) Its value decreases

A) Changes in technologies give it greater sales value

B) Markets contract, lessening demand

C) Its net costs increase

D) Its value decreases

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

63

Compared to other products, by-products have

A) Low sales values

B) High joint cost allocations

C) Low sales volumes

D) Low physical outputs

A) Low sales values

B) High joint cost allocations

C) Low sales volumes

D) Low physical outputs

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

64

DRY Corporation recently disposed of a by-product at a net cost of $500. Provided that amount is considered material, the $500 should be accounted for as

A) Part of the separable cost of the by-product.

B) A decrease in by-product inventory on the balance sheet.

C) An increase in by-product inventory on the balance sheet.

D) Part of the joint costs of production.

A) Part of the separable cost of the by-product.

B) A decrease in by-product inventory on the balance sheet.

C) An increase in by-product inventory on the balance sheet.

D) Part of the joint costs of production.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

65

Use the following information for the next 8 questions.

RKH Corporation produces three joint products. During a recent accounting period, joint costs totaled $365 and RKH had no beginning inventories. Additional data appear below:

Using the constant gross margin NRV method, the total joint costs allocated to the three products will be

A) $0

B) $185

C) $365

D) $550

RKH Corporation produces three joint products. During a recent accounting period, joint costs totaled $365 and RKH had no beginning inventories. Additional data appear below:

Using the constant gross margin NRV method, the total joint costs allocated to the three products will be

A) $0

B) $185

C) $365

D) $550

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

66

Cost distortions are likely when products have differential incremental contributions under which of the following methods?

A) Sales value at split-off point

B) Constant gross margin NRV

C) Physical output

D) Net realizable value

A) Sales value at split-off point

B) Constant gross margin NRV

C) Physical output

D) Net realizable value

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

67

Which joint cost allocation method best reflects the idea that joint costs cannot be separated?

A) Net realizable value

B) Constant gross margin NRV

C) Physical output

D) Sales value at split-off

A) Net realizable value

B) Constant gross margin NRV

C) Physical output

D) Sales value at split-off

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

68

The joint cost allocation method affects the

A) Apparent profitability of different products

B) Total profit of an organization

C) Revenue generated by an individual product

D) Total revenue of an organization

A) Apparent profitability of different products

B) Total profit of an organization

C) Revenue generated by an individual product

D) Total revenue of an organization

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

69

The sales value at split-off point method of joint cost allocation is most appropriate when

A) Products have roughly equal sales values

B) Products have roughly equal separable costs

C) Most products are sold at the split-off point

D) Few products are sold at the split-off point

A) Products have roughly equal sales values

B) Products have roughly equal separable costs

C) Most products are sold at the split-off point

D) Few products are sold at the split-off point

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

70

Which method of allocating joint costs is most likely to develop a true cost per unit of product?

A) Physical output

B) Sales value at split-off point

C) Net realizable value

D) None of the above; all methods result in arbitrary allocations

A) Physical output

B) Sales value at split-off point

C) Net realizable value

D) None of the above; all methods result in arbitrary allocations

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

71

Use the following information for the next 8 questions.

HGT Corporation produces four products from a common production process. Selected data from HGT's accounting system for the four products appears below: Joint costs for the accounting period totaled $5,000. Each product line has a different product manager, who is evaluated based on product line profitability. Therefore, each manager is motivated to reduce his / her total product line costs as much as possible. The managers have been given information about potential joint cost allocations using the following three methods: physical output, sales at split-off point, and net realizable value. The managers are comparing the joint cost allocations under each method so that they can give the accountant input about their preferred method(s).

Joint costs for the accounting period totaled $5,000. Each product line has a different product manager, who is evaluated based on product line profitability. Therefore, each manager is motivated to reduce his / her total product line costs as much as possible. The managers have been given information about potential joint cost allocations using the following three methods: physical output, sales at split-off point, and net realizable value. The managers are comparing the joint cost allocations under each method so that they can give the accountant input about their preferred method(s).

Which product line would receive the least amount of joint cost under the physical output method?

A) Floor cushions and sofa cushions

B) Floor cushions and full-body pillows

C) Standard pillows and full-body pillows

D) None of the above

HGT Corporation produces four products from a common production process. Selected data from HGT's accounting system for the four products appears below:

Joint costs for the accounting period totaled $5,000. Each product line has a different product manager, who is evaluated based on product line profitability. Therefore, each manager is motivated to reduce his / her total product line costs as much as possible. The managers have been given information about potential joint cost allocations using the following three methods: physical output, sales at split-off point, and net realizable value. The managers are comparing the joint cost allocations under each method so that they can give the accountant input about their preferred method(s).

Joint costs for the accounting period totaled $5,000. Each product line has a different product manager, who is evaluated based on product line profitability. Therefore, each manager is motivated to reduce his / her total product line costs as much as possible. The managers have been given information about potential joint cost allocations using the following three methods: physical output, sales at split-off point, and net realizable value. The managers are comparing the joint cost allocations under each method so that they can give the accountant input about their preferred method(s).Which product line would receive the least amount of joint cost under the physical output method?

A) Floor cushions and sofa cushions

B) Floor cushions and full-body pillows

C) Standard pillows and full-body pillows

D) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

72

The value of a by-product can be recognized at the time I. Of production

II) Of its sale

III) Joint products are sold

A) I and II only

B) I and III only

C) II and III only

D) I, II, and III

II) Of its sale

III) Joint products are sold

A) I and II only

B) I and III only

C) II and III only

D) I, II, and III

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

73

When deciding whether to process a product beyond the split-off point

A) Joint costs are relevant

B) Joint costs are irrelevant

C) Separable costs are irrelevant

D) Revenue is irrelevant

A) Joint costs are relevant

B) Joint costs are irrelevant

C) Separable costs are irrelevant

D) Revenue is irrelevant

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

74

Managers should choose a joint cost allocation method to

A) Justify dropping an unprofitable product

B) Minimize the total joint cost allocated to all products

C) Maximize the organization's overall profitability

D) Avoid giving the mistaken impression that one or more products are sold at a loss

A) Justify dropping an unprofitable product

B) Minimize the total joint cost allocated to all products

C) Maximize the organization's overall profitability

D) Avoid giving the mistaken impression that one or more products are sold at a loss

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

75

Which of the following joint cost allocation methods is used in many industries because they have units of similar size with similar net realizable values?

A) Physical output

B) Constant gross margin NRV

C) Net realizable value

D) Sales value at split-off

A) Physical output

B) Constant gross margin NRV

C) Net realizable value

D) Sales value at split-off

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

76

Managers are most likely to select a method of by-product accounting depending upon

A) The effect of the method on overall profitability

B) The degree of desired control over the by-product

C) The physical quantity of the by-product

D) Their incentive compensation package

A) The effect of the method on overall profitability

B) The degree of desired control over the by-product

C) The physical quantity of the by-product

D) Their incentive compensation package

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

77

Use the following information for the next 8 questions.

HGT Corporation produces four products from a common production process. Selected data from HGT's accounting system for the four products appears below: Joint costs for the accounting period totaled $5,000. Each product line has a different product manager, who is evaluated based on product line profitability. Therefore, each manager is motivated to reduce his / her total product line costs as much as possible. The managers have been given information about potential joint cost allocations using the following three methods: physical output, sales at split-off point, and net realizable value. The managers are comparing the joint cost allocations under each method so that they can give the accountant input about their preferred method(s).

Joint costs for the accounting period totaled $5,000. Each product line has a different product manager, who is evaluated based on product line profitability. Therefore, each manager is motivated to reduce his / her total product line costs as much as possible. The managers have been given information about potential joint cost allocations using the following three methods: physical output, sales at split-off point, and net realizable value. The managers are comparing the joint cost allocations under each method so that they can give the accountant input about their preferred method(s).

Which product line would receive the least amount of joint cost under the net realizable value method?

A) Floor cushions and full-body pillows

B) Full-body pillows

C) Sofa cushions

D) None of the above

HGT Corporation produces four products from a common production process. Selected data from HGT's accounting system for the four products appears below:

Joint costs for the accounting period totaled $5,000. Each product line has a different product manager, who is evaluated based on product line profitability. Therefore, each manager is motivated to reduce his / her total product line costs as much as possible. The managers have been given information about potential joint cost allocations using the following three methods: physical output, sales at split-off point, and net realizable value. The managers are comparing the joint cost allocations under each method so that they can give the accountant input about their preferred method(s).

Joint costs for the accounting period totaled $5,000. Each product line has a different product manager, who is evaluated based on product line profitability. Therefore, each manager is motivated to reduce his / her total product line costs as much as possible. The managers have been given information about potential joint cost allocations using the following three methods: physical output, sales at split-off point, and net realizable value. The managers are comparing the joint cost allocations under each method so that they can give the accountant input about their preferred method(s).Which product line would receive the least amount of joint cost under the net realizable value method?

A) Floor cushions and full-body pillows

B) Full-body pillows

C) Sofa cushions

D) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

78

When by-product value is recognized at the time of sale, the journal entry can include a credit to I. Sales revenue

II) Other income

III) Cost of goods sold

IV) Work in process

A) I, II, or IV only

B) II, III, or IV only

C) I, II, or III only

D) I, III, or IV only

II) Other income

III) Cost of goods sold

IV) Work in process

A) I, II, or IV only

B) II, III, or IV only

C) I, II, or III only

D) I, III, or IV only

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

79

Which joint cost allocation methods are preferred because they are based on a product's ability to pay for its allocated cost? I. Constant gross margin NRV

II) Physical output

III) Net realizable value

A) I and II only

B) I and III only

C) II and III only

D) III only

II) Physical output

III) Net realizable value

A) I and II only

B) I and III only

C) II and III only

D) III only

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

80

Use the following information for the next 8 questions.

HGT Corporation produces four products from a common production process. Selected data from HGT's accounting system for the four products appears below: Joint costs for the accounting period totaled $5,000. Each product line has a different product manager, who is evaluated based on product line profitability. Therefore, each manager is motivated to reduce his / her total product line costs as much as possible. The managers have been given information about potential joint cost allocations using the following three methods: physical output, sales at split-off point, and net realizable value. The managers are comparing the joint cost allocations under each method so that they can give the accountant input about their preferred method(s).

Joint costs for the accounting period totaled $5,000. Each product line has a different product manager, who is evaluated based on product line profitability. Therefore, each manager is motivated to reduce his / her total product line costs as much as possible. The managers have been given information about potential joint cost allocations using the following three methods: physical output, sales at split-off point, and net realizable value. The managers are comparing the joint cost allocations under each method so that they can give the accountant input about their preferred method(s).

If HGT allocates joint costs using the physical output method, the total joint cost allocated to standard pillows will be

A) $1,500

B) $1,650

C) $1,250

D) None of the above

HGT Corporation produces four products from a common production process. Selected data from HGT's accounting system for the four products appears below:

Joint costs for the accounting period totaled $5,000. Each product line has a different product manager, who is evaluated based on product line profitability. Therefore, each manager is motivated to reduce his / her total product line costs as much as possible. The managers have been given information about potential joint cost allocations using the following three methods: physical output, sales at split-off point, and net realizable value. The managers are comparing the joint cost allocations under each method so that they can give the accountant input about their preferred method(s).

Joint costs for the accounting period totaled $5,000. Each product line has a different product manager, who is evaluated based on product line profitability. Therefore, each manager is motivated to reduce his / her total product line costs as much as possible. The managers have been given information about potential joint cost allocations using the following three methods: physical output, sales at split-off point, and net realizable value. The managers are comparing the joint cost allocations under each method so that they can give the accountant input about their preferred method(s).If HGT allocates joint costs using the physical output method, the total joint cost allocated to standard pillows will be

A) $1,500

B) $1,650

C) $1,250

D) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck