Deck 14: Measuring and Assigning Costs for Income Statements

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

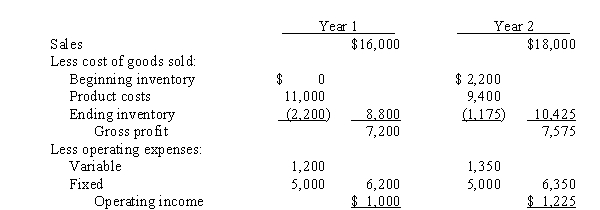

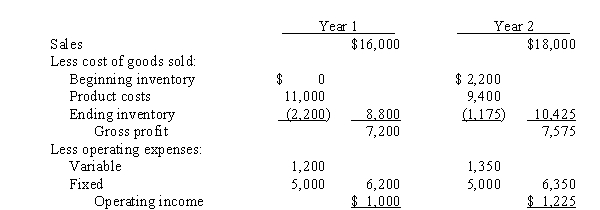

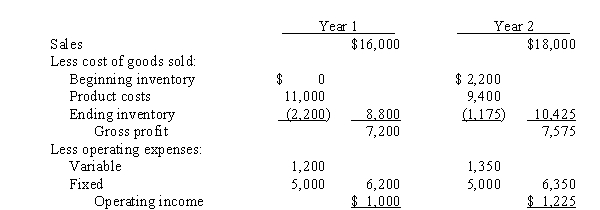

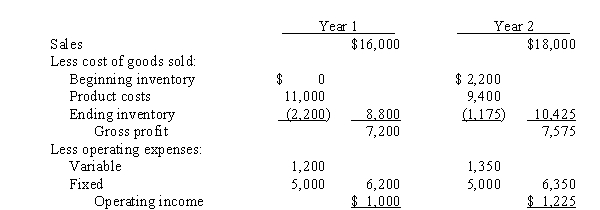

سؤال

سؤال

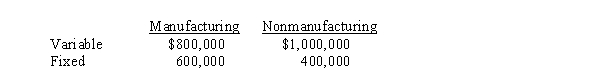

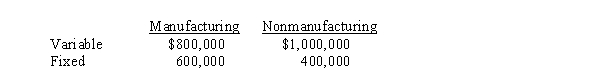

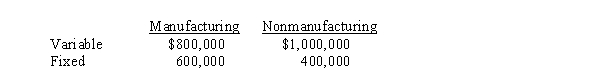

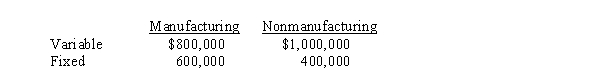

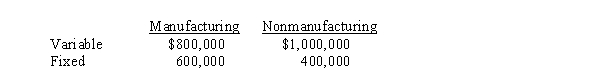

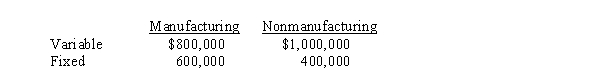

سؤال

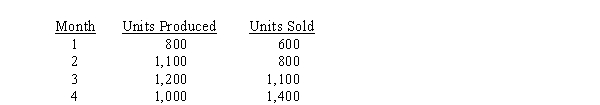

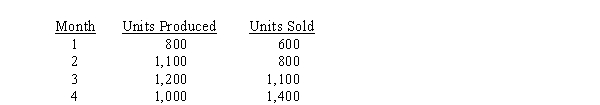

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

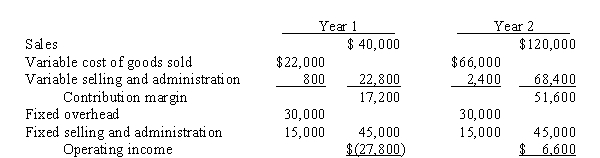

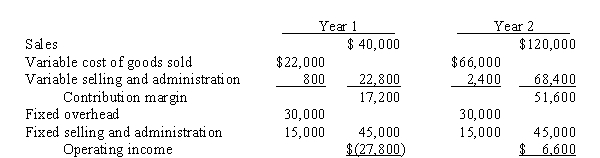

سؤال

سؤال

سؤال

سؤال

سؤال

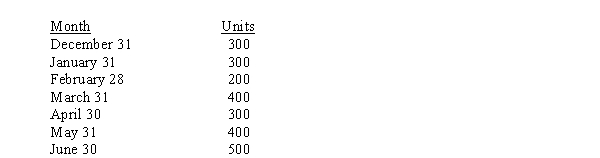

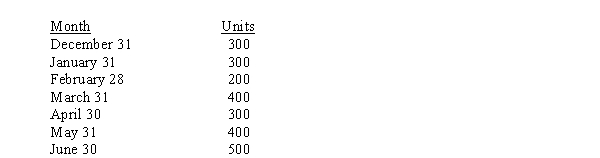

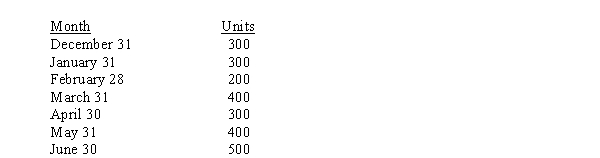

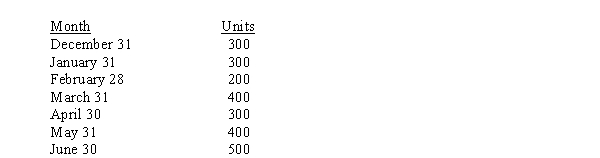

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

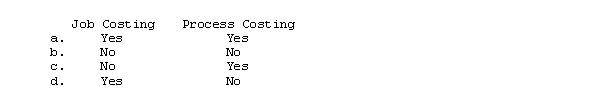

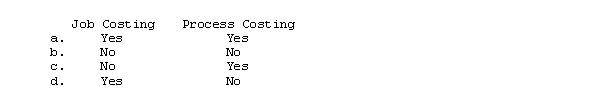

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/141

العب

ملء الشاشة (f)

Deck 14: Measuring and Assigning Costs for Income Statements

1

Absorption costing systems subtract inventoried costs from revenues at the time of production.

False

2

Theoretical capacity is a supply-based capacity measurement.

True

3

When units produced are equal to units sold, operating income under absorption costing will equal operating income under variable costing.

True

4

Absorption costing statements conform to generally accepted accounting principles.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

5

"Cost" and "expense" are two terms for describing the same concept.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

6

Variable costing data can often be used for making nonroutine operating decisions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

7

Theoretical capacity and practical capacity are demand-based capacity measurements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

8

Throughput costing is a modified form of absorption costing that treats direct labor and variable overhead as period expenses.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

9

In a throughput costing income statement, the throughput contribution is calculated as revenues - direct materials costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

10

Variable costing income statements include fixed manufacturing overhead as part of the costs of ending inventory.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

11

Throughput costing was an outgrowth of the Theory of Constraints.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

12

In absorption costing systems, costs on the income statement are classified by their behavior.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

13

Budgeted capacity is always greater than normal capacity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

14

On a variable costing income statement, costs are grouped according to their behavior.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

15

Synonyms for variable costing include direct costing and marginal costing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

16

The Internal Revenue Service requires managers to use practical capacity for tax reporting because it is more stable over time and therefore less easy to manipulate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

17

Normal capacity and budgeted capacity are demand-based capacity measurements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

18

Practical capacity is always less than theoretical capacity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

19

Variable costing does not conform to GAAP because it does not match manufacturing costs with revenues.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

20

Absorption costing income statements typically include "gross margin" as a line item.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

21

Improved information technology has increased the availability of variable costing and throughput costing income statements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

22

Throughput costing income statements help managers determine the most efficient uses of resources in the short term.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

23

Throughput costing assumes that product costs other than materials tend to be fixed in the short run.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

24

Fixed overhead costs are treated differently under variable costing and throughput costing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

25

Operating income for year 2 using variable costing would be

A) $1,000

B) $1,600

C) $4,000

D) $1,450

A) $1,000

B) $1,600

C) $4,000

D) $1,450

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

26

JIT systems are incompatible with absorption costing systems.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

27

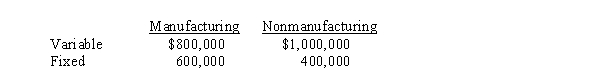

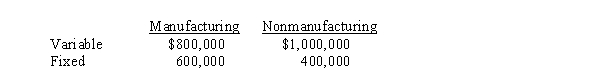

Use the following information for the next 4 questions.

Shipp, Inc. budgets the following costs for a normal monthly volume of 500 units selling for $4,000 each.

The product cost per unit using absorption costing is

A) $1,600

B) $2,800

C) $2,000

D) $2,400

Shipp, Inc. budgets the following costs for a normal monthly volume of 500 units selling for $4,000 each.

The product cost per unit using absorption costing is

A) $1,600

B) $2,800

C) $2,000

D) $2,400

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

28

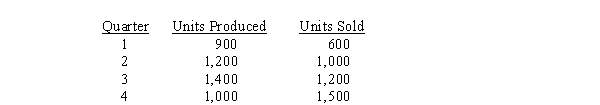

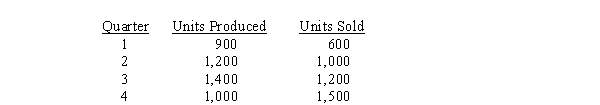

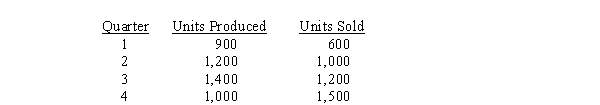

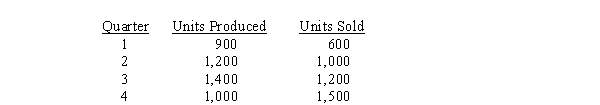

Use the following information for the next 3 questions.

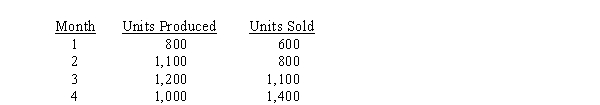

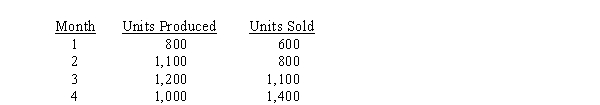

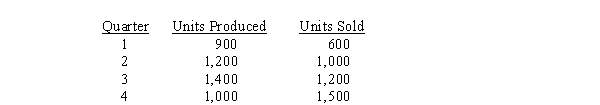

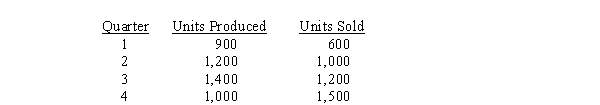

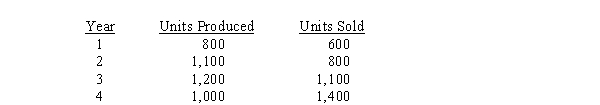

Exeter Mfg. Co. introduced a new mass-produced specialty product early in the year. Production and sales of this product for the first four months are as follows: The firm's budgeted fixed overhead is $200,000, and budgeted output is 1,000 units per month. The volume variance, if any, is carried forward month-by-month and closed at the end of the year. When 1,000 units are produced and sold, expected monthly operating income is $40,000.

The firm's budgeted fixed overhead is $200,000, and budgeted output is 1,000 units per month. The volume variance, if any, is carried forward month-by-month and closed at the end of the year. When 1,000 units are produced and sold, expected monthly operating income is $40,000.

In which month(s) was variable costing income higher than absorption costing income?

A) 4

B) l, 2, and 3

C) 2 and 3

D) 3 and 4

Exeter Mfg. Co. introduced a new mass-produced specialty product early in the year. Production and sales of this product for the first four months are as follows:

The firm's budgeted fixed overhead is $200,000, and budgeted output is 1,000 units per month. The volume variance, if any, is carried forward month-by-month and closed at the end of the year. When 1,000 units are produced and sold, expected monthly operating income is $40,000.

The firm's budgeted fixed overhead is $200,000, and budgeted output is 1,000 units per month. The volume variance, if any, is carried forward month-by-month and closed at the end of the year. When 1,000 units are produced and sold, expected monthly operating income is $40,000.In which month(s) was variable costing income higher than absorption costing income?

A) 4

B) l, 2, and 3

C) 2 and 3

D) 3 and 4

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

29

Use the following information for the next 4 questions.

Shipp, Inc. budgets the following costs for a normal monthly volume of 500 units selling for $4,000 each.

The income (loss) using absorption costing when 500 units are produced and 400 units are sold is

A) $840,000 loss

B) $160,000 income

C) $480,000 income

D) $720,000 loss

Shipp, Inc. budgets the following costs for a normal monthly volume of 500 units selling for $4,000 each.

The income (loss) using absorption costing when 500 units are produced and 400 units are sold is

A) $840,000 loss

B) $160,000 income

C) $480,000 income

D) $720,000 loss

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

30

Use the following information for the next 4 questions.

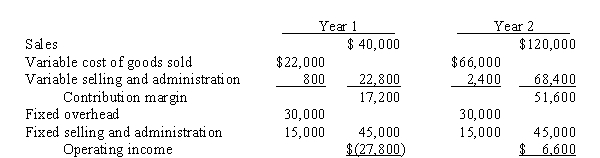

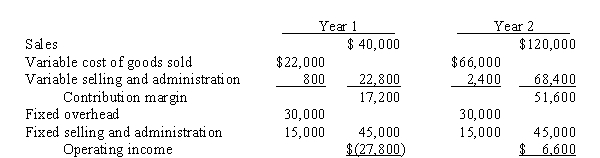

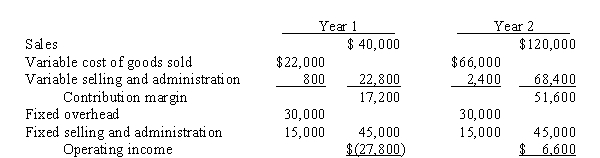

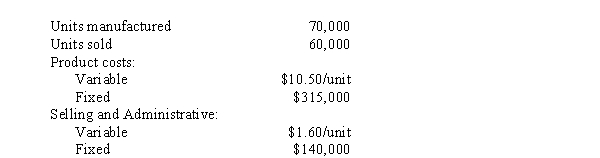

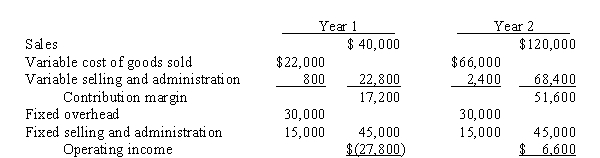

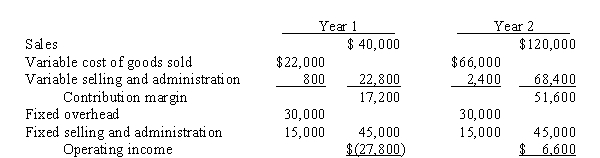

Bella, Inc. has operated for 2 years. During that time it produced 1,000 units in year 1 and 800 in year 2, while sales were 800 units in year 1 and 900 in year 2. Variable production costs were $8 per unit during both years. The company uses last-in, first-out (LIFO) for inventory costing. The absorption costing income statements for these 2 years were:

Cost of goods sold for year 1 using variable costing would be

A) $6,400

B) $8,800

C) $8,000

D) $7,600

Bella, Inc. has operated for 2 years. During that time it produced 1,000 units in year 1 and 800 in year 2, while sales were 800 units in year 1 and 900 in year 2. Variable production costs were $8 per unit during both years. The company uses last-in, first-out (LIFO) for inventory costing. The absorption costing income statements for these 2 years were:

Cost of goods sold for year 1 using variable costing would be

A) $6,400

B) $8,800

C) $8,000

D) $7,600

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

31

Because absorption costing capitalizes fixed manufacturing overhead costs to inventory, managers using it may build up inventories unnecessarily.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

32

Throughput costing income statements cannot be used to evaluate management performance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

33

Direct materials costs are treated similarly under variable costing and throughput costing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

34

Use the following information for the next 4 questions.

Shipp, Inc. budgets the following costs for a normal monthly volume of 500 units selling for $4,000 each.

The income (loss) using variable costing when 500 units are produced and 400 units are sold is

A) $840,000 loss

B) $160,000 income

C) $480,000 income

D) $720,000 loss

Shipp, Inc. budgets the following costs for a normal monthly volume of 500 units selling for $4,000 each.

The income (loss) using variable costing when 500 units are produced and 400 units are sold is

A) $840,000 loss

B) $160,000 income

C) $480,000 income

D) $720,000 loss

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

35

Compared to using absorption costing, using variable costing will result in operating income for the 4-month period to be

A) Higher

B) Lower

C) Same

D) Cannot be determined

A) Higher

B) Lower

C) Same

D) Cannot be determined

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

36

Use the following information for the next 4 questions.

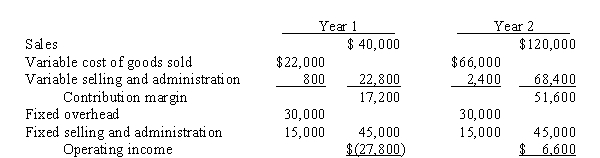

Baylor, Inc. just finished its second year of operations. In the first year it produced 1,000 units and sold 400. The second year resulted in the same production level, but sales were 1,200 units. The variable costing income statements for both years are shown below:

The product cost per unit during year 1 using absorption would be

A) $67,000

B) $73,000

C) $82,000

D) $85,000

Baylor, Inc. just finished its second year of operations. In the first year it produced 1,000 units and sold 400. The second year resulted in the same production level, but sales were 1,200 units. The variable costing income statements for both years are shown below:

The product cost per unit during year 1 using absorption would be

A) $67,000

B) $73,000

C) $82,000

D) $85,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

37

Use the following information for the next 4 questions.

Shipp, Inc. budgets the following costs for a normal monthly volume of 500 units selling for $4,000 each.

The product cost per unit using variable costing is

A) $1,600

B) $2,800

C) $2,000

D) $2,400

Shipp, Inc. budgets the following costs for a normal monthly volume of 500 units selling for $4,000 each.

The product cost per unit using variable costing is

A) $1,600

B) $2,800

C) $2,000

D) $2,400

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

38

Use the following information for the next 4 questions.

Bella, Inc. has operated for 2 years. During that time it produced 1,000 units in year 1 and 800 in year 2, while sales were 800 units in year 1 and 900 in year 2. Variable production costs were $8 per unit during both years. The company uses last-in, first-out (LIFO) for inventory costing. The absorption costing income statements for these 2 years were:

Operating income for year 1 using variable costing would be

A) $1,600

B) $(2,800)

C) $2,200

D) $400

Bella, Inc. has operated for 2 years. During that time it produced 1,000 units in year 1 and 800 in year 2, while sales were 800 units in year 1 and 900 in year 2. Variable production costs were $8 per unit during both years. The company uses last-in, first-out (LIFO) for inventory costing. The absorption costing income statements for these 2 years were:

Operating income for year 1 using variable costing would be

A) $1,600

B) $(2,800)

C) $2,200

D) $400

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

39

Ending inventory for year 2 using variable costing would be

A) $2,200

B) $1,100

C) $1,175

D) $800

A) $2,200

B) $1,100

C) $1,175

D) $800

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

40

Use the following information for the next 3 questions.

Exeter Mfg. Co. introduced a new mass-produced specialty product early in the year. Production and sales of this product for the first four months are as follows: The firm's budgeted fixed overhead is $200,000, and budgeted output is 1,000 units per month. The volume variance, if any, is carried forward month-by-month and closed at the end of the year. When 1,000 units are produced and sold, expected monthly operating income is $40,000.

The firm's budgeted fixed overhead is $200,000, and budgeted output is 1,000 units per month. The volume variance, if any, is carried forward month-by-month and closed at the end of the year. When 1,000 units are produced and sold, expected monthly operating income is $40,000.

In which month(s) was variable costing income lower than absorption costing income?

A) 4

B) 1, 2, and 3

C) 2 and 3

D) 3 and 4

Exeter Mfg. Co. introduced a new mass-produced specialty product early in the year. Production and sales of this product for the first four months are as follows:

The firm's budgeted fixed overhead is $200,000, and budgeted output is 1,000 units per month. The volume variance, if any, is carried forward month-by-month and closed at the end of the year. When 1,000 units are produced and sold, expected monthly operating income is $40,000.

The firm's budgeted fixed overhead is $200,000, and budgeted output is 1,000 units per month. The volume variance, if any, is carried forward month-by-month and closed at the end of the year. When 1,000 units are produced and sold, expected monthly operating income is $40,000.In which month(s) was variable costing income lower than absorption costing income?

A) 4

B) 1, 2, and 3

C) 2 and 3

D) 3 and 4

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

41

Use the following information for the next 4 questions.

Baylor, Inc. just finished its second year of operations. In the first year it produced 1,000 units and sold 400. The second year resulted in the same production level, but sales were 1,200 units. The variable costing income statements for both years are shown below:

The ending inventory for year 2 using absorption costing would be

A) $51,000

B) $34,000

C) $22,000

D) $17,000

Baylor, Inc. just finished its second year of operations. In the first year it produced 1,000 units and sold 400. The second year resulted in the same production level, but sales were 1,200 units. The variable costing income statements for both years are shown below:

The ending inventory for year 2 using absorption costing would be

A) $51,000

B) $34,000

C) $22,000

D) $17,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

42

In how many months would variable costing income be equal to absorption costing income?

A) 0

B) 1

C) 2

D) 3

A) 0

B) 1

C) 2

D) 3

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

43

Use the following information for the next 3 questions.

Rubble Enterprises develops an annual overhead budget at the start of each year (which has remained unchanged for the last 2 years), and closes any over- or underapplied overhead at year-end. For the firm's single product the following ending inventory levels have been experienced during the last 7 months:

For how many months would variable costing income be higher than absorption?

A) 1

B) 2

C) 3

D) 4

Rubble Enterprises develops an annual overhead budget at the start of each year (which has remained unchanged for the last 2 years), and closes any over- or underapplied overhead at year-end. For the firm's single product the following ending inventory levels have been experienced during the last 7 months:

For how many months would variable costing income be higher than absorption?

A) 1

B) 2

C) 3

D) 4

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

44

Use the following information for the next 3 questions.

Rubble Enterprises develops an annual overhead budget at the start of each year (which has remained unchanged for the last 2 years), and closes any over- or underapplied overhead at year-end. For the firm's single product the following ending inventory levels have been experienced during the last 7 months:

In how many months would variable costing income be lower than absorption costing income?

A) 1

B) 2

C) 3

D) 4

Rubble Enterprises develops an annual overhead budget at the start of each year (which has remained unchanged for the last 2 years), and closes any over- or underapplied overhead at year-end. For the firm's single product the following ending inventory levels have been experienced during the last 7 months:

In how many months would variable costing income be lower than absorption costing income?

A) 1

B) 2

C) 3

D) 4

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

45

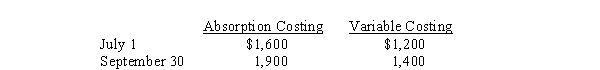

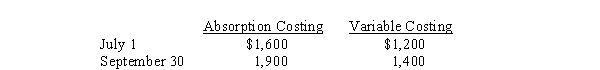

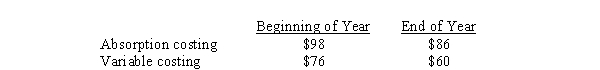

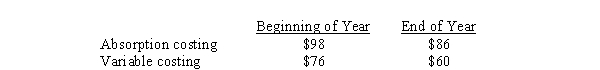

Variable costing income for the period July 1 through September 30 was $400. Inventory data are as follows:  What is the income if absorption costing is used?

What is the income if absorption costing is used?

A) $300

B) $500

C) $400

D) $600

What is the income if absorption costing is used?

What is the income if absorption costing is used?A) $300

B) $500

C) $400

D) $600

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

46

Any costs traced or allocated to inventory are expensed when units are sold in which of the following costing method(s)? I. Absorption

II) Throughput

III) Variable

A) I and II only

B) II and III only

C) I and III only

D) I, II, and III

II) Throughput

III) Variable

A) I and II only

B) II and III only

C) I and III only

D) I, II, and III

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

47

Variable production overhead is allocated to inventory when using

A) Absorption costing and variable costing

B) Absorption costing and throughput costing

C) Variable costing and throughput costing

D) Absorption costing, variable costing, and throughput costing

A) Absorption costing and variable costing

B) Absorption costing and throughput costing

C) Variable costing and throughput costing

D) Absorption costing, variable costing, and throughput costing

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

48

Which costing method matches costs and revenues most appropriately for generally accepted accounting principles?

A) Throughput costing

B) Absorption costing

C) Variable costing

D) Activity-based costing

A) Throughput costing

B) Absorption costing

C) Variable costing

D) Activity-based costing

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

49

Use the following information for the next 4 questions.

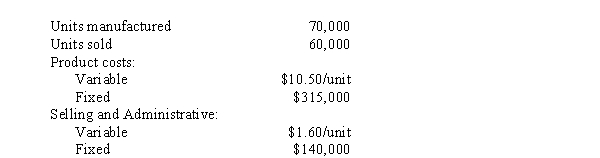

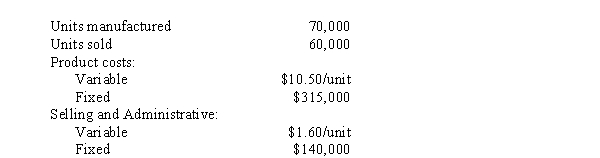

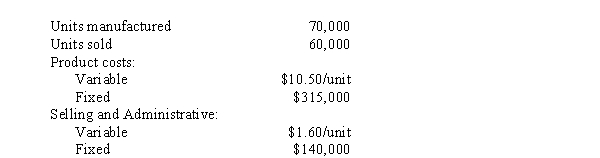

During its first year of operations, Kima Corp. experienced the following:

The amount of variable costs deducted from revenues under the variable costing approach would be

A) $847,000

B) $831,000

C) $726,000

D) $742,000

During its first year of operations, Kima Corp. experienced the following:

The amount of variable costs deducted from revenues under the variable costing approach would be

A) $847,000

B) $831,000

C) $726,000

D) $742,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

50

The chief executive officer told Nick, the production manager at BRS Corporation, to reduce costs and increase profits. In response, Nick decided to produce more units for inventory. BRS is most likely using

A) Variable costing.

B) Throughput costing.

C) Absorption costing.

D) Capacity-based costing.

A) Variable costing.

B) Throughput costing.

C) Absorption costing.

D) Capacity-based costing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

51

Philpott's operating income using absorption costing is $100. Its inventories using both absorption and variable costing are as follows:  Under variable costing, operating income would be:

Under variable costing, operating income would be:

A) $102

B) $94

C) $100

D) $96

Under variable costing, operating income would be:

Under variable costing, operating income would be:A) $102

B) $94

C) $100

D) $96

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

52

Direct materials costs are deducted from revenues when units are sold under which of the following costing method(s)? I. Absorption

II) Throughput

III) Variable

A) I and II only

B) II and III only

C) I and III only

D) I, II, and III

II) Throughput

III) Variable

A) I and II only

B) II and III only

C) I and III only

D) I, II, and III

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

53

Use the following information for the next 3 questions.

General Mtg. Co. budgeted fixed overhead costs of $25,000 per quarter and 1,000 units per quarter in its normal absorption costing system. Any volume variance is carried forward and closed at year end. The company experienced the following activity:

The volume variance was favorable in quarter(s)?

A) 2, 3, and 4

B) 2 and 3

C) 3 and 4

D) 3

General Mtg. Co. budgeted fixed overhead costs of $25,000 per quarter and 1,000 units per quarter in its normal absorption costing system. Any volume variance is carried forward and closed at year end. The company experienced the following activity:

The volume variance was favorable in quarter(s)?

A) 2, 3, and 4

B) 2 and 3

C) 3 and 4

D) 3

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

54

Use the following information for the next 4 questions.

Baylor, Inc. just finished its second year of operations. In the first year it produced 1,000 units and sold 400. The second year resulted in the same production level, but sales were 1,200 units. The variable costing income statements for both years are shown below:

The operating income for year 1 using absorption costing would be

A) $6,000

B) $(9,000)

C) $(9,800)

D) $600

Baylor, Inc. just finished its second year of operations. In the first year it produced 1,000 units and sold 400. The second year resulted in the same production level, but sales were 1,200 units. The variable costing income statements for both years are shown below:

The operating income for year 1 using absorption costing would be

A) $6,000

B) $(9,000)

C) $(9,800)

D) $600

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

55

Total production overhead is treated as a product cost when using

A) Absorption costing

B) Throughput costing

C) Variable costing

D) Throughput costing and absorption costing

A) Absorption costing

B) Throughput costing

C) Variable costing

D) Throughput costing and absorption costing

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

56

The cost of goods sold under absorption costing would be

A) $585,000

B) $735,000

C) $945,000

D) $900,000

A) $585,000

B) $735,000

C) $945,000

D) $900,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

57

If Kima calculates operating income under the variable costing method as opposed to the absorption costing method, operating income will be

A) $45,000 lower

B) $270,000 lower

C) $315,000 higher

D) $270,000 higher

A) $45,000 lower

B) $270,000 lower

C) $315,000 higher

D) $270,000 higher

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

58

Use the following information for the next 4 questions.

During its first year of operations, Kima Corp. experienced the following:

The amount of fixed costs deducted from revenues under the absorption costing approach would be

A) $410,000

B) $455,000

C) $390,000

D) $435,000

During its first year of operations, Kima Corp. experienced the following:

The amount of fixed costs deducted from revenues under the absorption costing approach would be

A) $410,000

B) $455,000

C) $390,000

D) $435,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

59

Use the following information for the next 4 questions.

Baylor, Inc. just finished its second year of operations. In the first year it produced 1,000 units and sold 400. The second year resulted in the same production level, but sales were 1,200 units. The variable costing income statements for both years are shown below:

The operating income for year 2 using absorption costing would be

A) $(9,800)

B) $600

C) $(9,000)

D) $6,000

Baylor, Inc. just finished its second year of operations. In the first year it produced 1,000 units and sold 400. The second year resulted in the same production level, but sales were 1,200 units. The variable costing income statements for both years are shown below:

The operating income for year 2 using absorption costing would be

A) $(9,800)

B) $600

C) $(9,000)

D) $6,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

60

Under which costing method(s) are administrative and selling costs considered period expenses? I. Absorption costing

II) Throughput costing

III) Variable costing

A) I and II only

B) II and III only

C) I and III only

D) I, II, and III

II) Throughput costing

III) Variable costing

A) I and II only

B) II and III only

C) I and III only

D) I, II, and III

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

61

Use the following information for the next 3 questions.

General Mtg. Co. budgeted fixed overhead costs of $25,000 per quarter and 1,000 units per quarter in its normal absorption costing system. Any volume variance is carried forward and closed at year end. The company experienced the following activity:

The volume variance in quarter 1 was

A) $2,500 Unfavorable

B) $10,000 Unfavorable

C) $7,500 Favorable

D) $5,000 Favorable

General Mtg. Co. budgeted fixed overhead costs of $25,000 per quarter and 1,000 units per quarter in its normal absorption costing system. Any volume variance is carried forward and closed at year end. The company experienced the following activity:

The volume variance in quarter 1 was

A) $2,500 Unfavorable

B) $10,000 Unfavorable

C) $7,500 Favorable

D) $5,000 Favorable

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

62

For income tax accounting, the Internal Revenue Service requires the use of

A) Normal capacity

B) Budgeted capacity

C) Theoretical capacity

D) Practical capacity

A) Normal capacity

B) Budgeted capacity

C) Theoretical capacity

D) Practical capacity

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

63

Practical capacity is estimated based on

A) Engineering studies and labor use patterns

B) The behavior of fixed costs

C) The behavior of variable costs

D) Demand patterns

A) Engineering studies and labor use patterns

B) The behavior of fixed costs

C) The behavior of variable costs

D) Demand patterns

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

64

Volume variances are calculated for which of the following reasons? I. GAAP requires that actual costs be recorded in the income statement and balance sheet.

II) Estimates are used for allocation rates so that costs can be allocated when actual costs are not yet known.

III) Only the IRS requires volume variances in the calculation of income taxes.

A) I only

B) II only

C) I and II only

D) I, II, and III

II) Estimates are used for allocation rates so that costs can be allocated when actual costs are not yet known.

III) Only the IRS requires volume variances in the calculation of income taxes.

A) I only

B) II only

C) I and II only

D) I, II, and III

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

65

Supply-based capacity levels include I. Normal capacity

II) Practical capacity

III) Theoretical capacity

A) I and II only

B) I and III only

C) II and III only

D) I, II, and III

II) Practical capacity

III) Theoretical capacity

A) I and II only

B) I and III only

C) II and III only

D) I, II, and III

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

66

Under the variable costing method, fixed production overhead is

A) Included in inventory

B) Expensed in the period incurred

C) Expensed as a product cost

D) Expensed when the inventory is sold

A) Included in inventory

B) Expensed in the period incurred

C) Expensed as a product cost

D) Expensed when the inventory is sold

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

67

An estimated fixed overhead allocation rate

A) Is unrealistically large if determined using theoretical capacity

B) Can be considered an estimated cost of capacity per unit

C) Is usually based on theoretical capacity

D) Does not provide information about opportunity costs of unused capacity

A) Is unrealistically large if determined using theoretical capacity

B) Can be considered an estimated cost of capacity per unit

C) Is usually based on theoretical capacity

D) Does not provide information about opportunity costs of unused capacity

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

68

The capacity level which assumes continuous, uninterrupted production 365 days per year is called

A) Budgeted capacity

B) Normal capacity

C) Practical capacity

D) Theoretical capacity

A) Budgeted capacity

B) Normal capacity

C) Practical capacity

D) Theoretical capacity

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

69

When calculating an estimated fixed production cost overhead allocation rate, accountants choose the

A) Allocation base to use as the denominator

B) Allocation base to use as the numerator

C) Allocation base to use as the rate

D) Allocation base that minimizes total fixed production overhead

A) Allocation base to use as the denominator

B) Allocation base to use as the numerator

C) Allocation base to use as the rate

D) Allocation base that minimizes total fixed production overhead

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

70

Which of the following types of capacity can result in an unrealistically small fixed overhead allocation rate if used as an allocation base?

A) Normal capacity

B) Theoretical capacity

C) Budgeted capacity

D) Practical capacity

A) Normal capacity

B) Theoretical capacity

C) Budgeted capacity

D) Practical capacity

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

71

Absorption costing will produce a larger operating income than variable costing if

A) Fixed production overhead increases

B) Fixed production overhead decreases

C) Units produced exceed units sold

D) Units sold exceed units produced

A) Fixed production overhead increases

B) Fixed production overhead decreases

C) Units produced exceed units sold

D) Units sold exceed units produced

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

72

The difference between practical capacity and theoretical capacity is

A) Budgeted fixed costs

B) Expected downtimes

C) Excess capacity

D) Nothing, because the two terms have the same meaning

A) Budgeted fixed costs

B) Expected downtimes

C) Excess capacity

D) Nothing, because the two terms have the same meaning

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

73

Absorption costing

A) Is used for external reporting purposes

B) Includes variable and fixed period costs in inventory

C) Is the method in which the fixed overhead cost is not included in inventory

D) Treats production costs as expenses in the period in which they are incurred

A) Is used for external reporting purposes

B) Includes variable and fixed period costs in inventory

C) Is the method in which the fixed overhead cost is not included in inventory

D) Treats production costs as expenses in the period in which they are incurred

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

74

Use the following information for the next 3 questions.

General Mtg. Co. budgeted fixed overhead costs of $25,000 per quarter and 1,000 units per quarter in its normal absorption costing system. Any volume variance is carried forward and closed at year end. The company experienced the following activity:

The volume variance for the year was

A) -0-

B) Favorable

C) Unfavorable

D) Cannot be determined

General Mtg. Co. budgeted fixed overhead costs of $25,000 per quarter and 1,000 units per quarter in its normal absorption costing system. Any volume variance is carried forward and closed at year end. The company experienced the following activity:

The volume variance for the year was

A) -0-

B) Favorable

C) Unfavorable

D) Cannot be determined

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

75

Under generally accepted accounting principles, absorption costing is used for

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

76

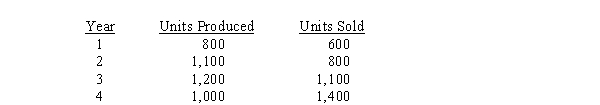

Exter Manufacturing experienced the following activity over the last four years.  The firm's estimated fixed overhead allocation rate was unchanged over the 4 years at $200 per unit, based on budgeted fixed overhead of $200,000 and 1,000 units of output. The volume variance is closed to the cost of goods sold each year. Exter maintains an absorption costing system. The volume variance for Year 2 is

The firm's estimated fixed overhead allocation rate was unchanged over the 4 years at $200 per unit, based on budgeted fixed overhead of $200,000 and 1,000 units of output. The volume variance is closed to the cost of goods sold each year. Exter maintains an absorption costing system. The volume variance for Year 2 is

A) $40,000 Unfavorable

B) $60,000 Favorable

C) $100,000 Unfavorable

D) $20,000 Favorable

The firm's estimated fixed overhead allocation rate was unchanged over the 4 years at $200 per unit, based on budgeted fixed overhead of $200,000 and 1,000 units of output. The volume variance is closed to the cost of goods sold each year. Exter maintains an absorption costing system. The volume variance for Year 2 is

The firm's estimated fixed overhead allocation rate was unchanged over the 4 years at $200 per unit, based on budgeted fixed overhead of $200,000 and 1,000 units of output. The volume variance is closed to the cost of goods sold each year. Exter maintains an absorption costing system. The volume variance for Year 2 isA) $40,000 Unfavorable

B) $60,000 Favorable

C) $100,000 Unfavorable

D) $20,000 Favorable

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

77

Which of the following are demand-based capacity levels? I. Normal capacity

II) Budgeted capacity

III) Practical capacity

A) I and II only

B) II and III only

C) I and III only

D) I, II, and III

II) Budgeted capacity

III) Practical capacity

A) I and II only

B) II and III only

C) I and III only

D) I, II, and III

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

78

In variable costing

A) Only variable production costs are considered product costs

B) All non-variable production costs are treated as product costs

C) Direct costs are considered to be period costs

D) All variable costs are considered product costs

A) Only variable production costs are considered product costs

B) All non-variable production costs are treated as product costs

C) Direct costs are considered to be period costs

D) All variable costs are considered product costs

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

79

The volume variance is calculated as

A) Difference between estimated fixed overhead costs and allocated fixed overhead costs

B) Sum of estimated fixed overhead costs and allocated fixed overhead costs

C) Difference between estimated fixed overhead costs and actual fixed overhead costs

D) Difference between actual fixed overhead costs and allocated fixed overhead costs

A) Difference between estimated fixed overhead costs and allocated fixed overhead costs

B) Sum of estimated fixed overhead costs and allocated fixed overhead costs

C) Difference between estimated fixed overhead costs and actual fixed overhead costs

D) Difference between actual fixed overhead costs and allocated fixed overhead costs

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

80

What type of capacity is the upper capacity limit that takes into account the organization's regularly scheduled times for production?

A) Tax capacity

B) Practical capacity

C) Scheduled capacity

D) Normal capacity

A) Tax capacity

B) Practical capacity

C) Scheduled capacity

D) Normal capacity

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck