Deck 11: Standard Costs and Variance Analysis

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

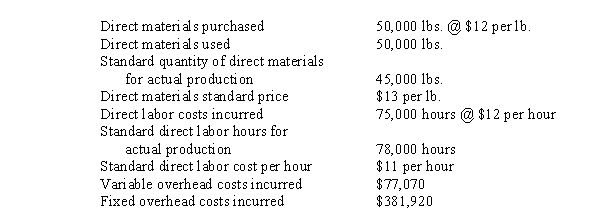

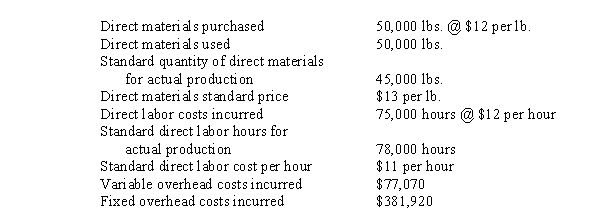

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

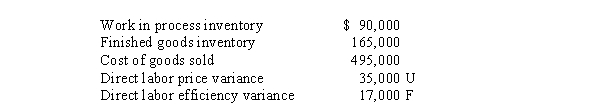

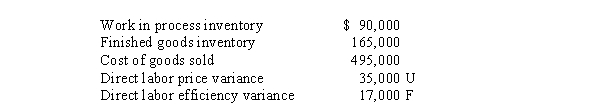

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

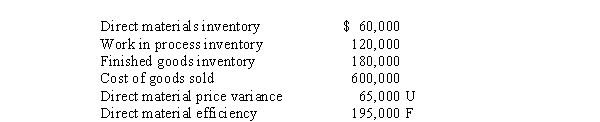

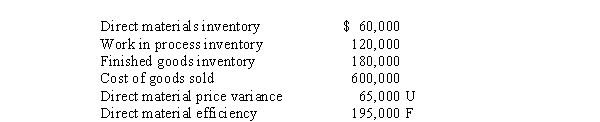

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/126

العب

ملء الشاشة (f)

Deck 11: Standard Costs and Variance Analysis

1

If the total variances in the accounting information system are favorable, accountants must adjust some accounts by decreasing costs during the closing process.

True

2

The direct materials price variance is often based on materials purchased, rather than on materials used.

True

3

Identifying the reasons for variances is usually a quick and easy process.

False

4

The cost categories that are measured and monitored in a given organization depend, in part, on the costs that managers consider important.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

5

Normal fluctuations in labor hours may cause a favorable direct labor efficiency variance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

6

If a variance is considered material, it should be allocated to work in process inventory, finished goods inventory, and cost of goods sold.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

7

The fixed overhead spending variance is normally zero because fixed costs are constant within a relevant range of activity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

8

If a variance is unfavorable, it should be closed directly to cost of goods sold.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

9

The total direct labor variance can be broken down into two components: the efficiency variance and the price variance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

10

Calculating variances is a necessary, but not sufficient, step for completing a variance analysis.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

11

Unreasonable standards may be the cause of direct materials variances, but not of direct labor variances.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

12

A standard cost variance is a difference between a standard cost and an actual cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

13

The standard cost of direct materials is computed as the standard price per unit of input times the standard quantity per unit of input.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

14

The total standard cost for a unit of output is the sum of the standard costs for the resources used in production.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

15

The direct materials efficiency variance tells managers about the efficiency of the purchasing process.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

16

Variance analysis is used for monitoring and performance evaluation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

17

A contract with a new supplier may cause an unfavorable materials price variance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

18

Errors in the accounting records related to actual production output could lead to a fixed overhead production volume variance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

19

The fixed overhead budget variance can be broken down into two parts: the spending variance and the production volume variance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

20

The variable overhead budget variance is the difference between allocated variable overhead cost and actual variable overhead cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

21

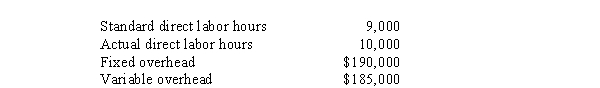

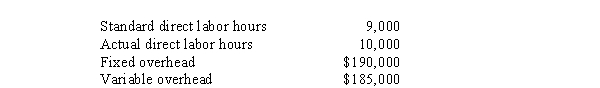

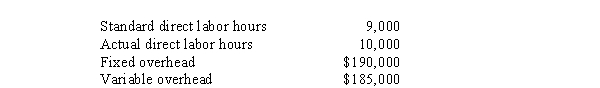

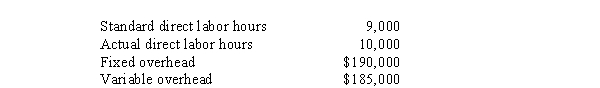

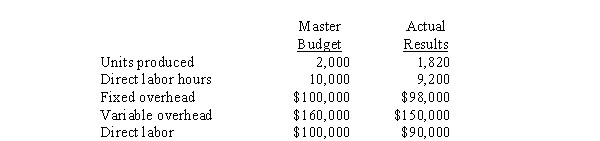

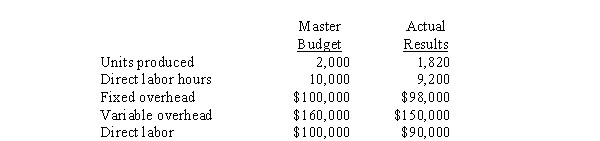

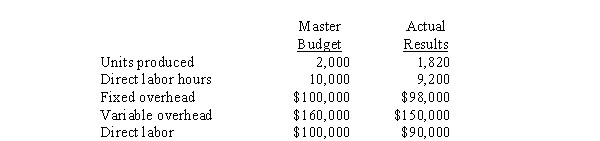

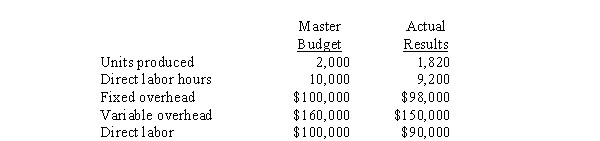

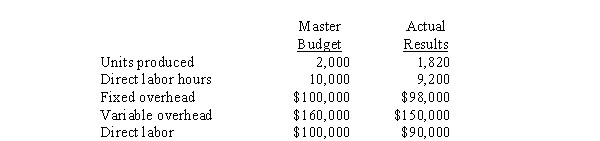

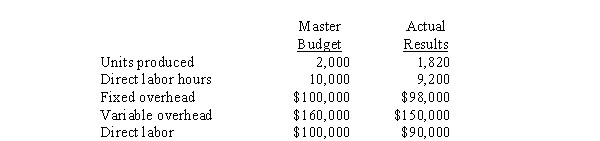

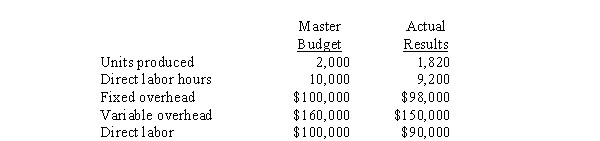

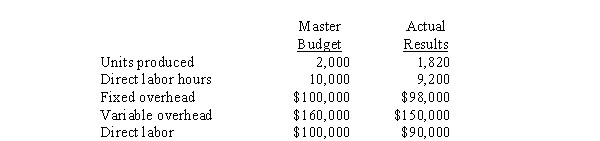

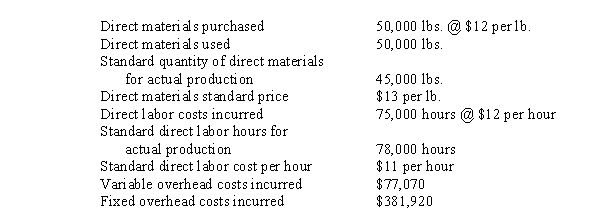

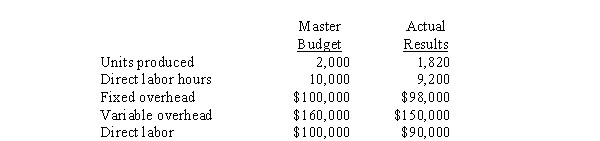

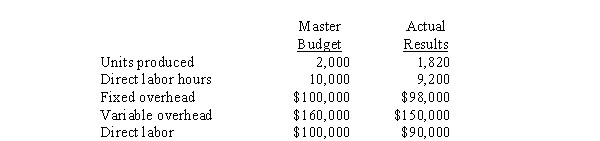

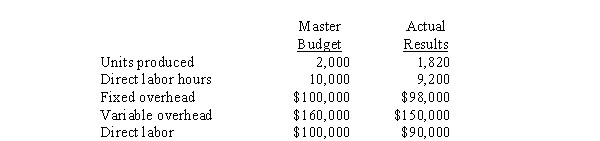

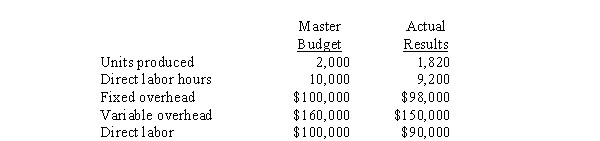

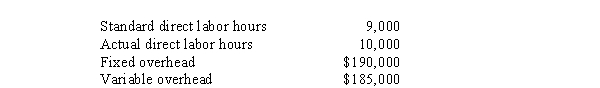

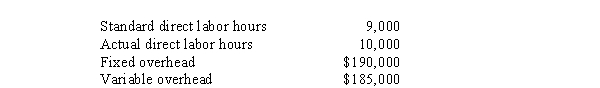

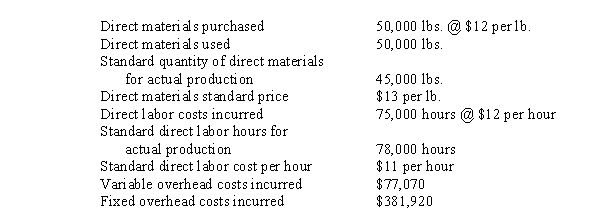

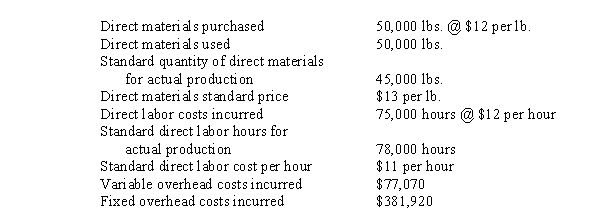

Use the following information for the next 4 questions.

Burkett Company uses a standard cost system. Indirect costs were budgeted at $200,000 plus $15 per direct labor hour. The overhead rate is based on 10,000 hours. Actual results were:

The over- or underapplied overhead was

A) $50,000 under

B) $10,000 over

C) $60,000 under

D) $20,000 over

Burkett Company uses a standard cost system. Indirect costs were budgeted at $200,000 plus $15 per direct labor hour. The overhead rate is based on 10,000 hours. Actual results were:

The over- or underapplied overhead was

A) $50,000 under

B) $10,000 over

C) $60,000 under

D) $20,000 over

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

22

Use the following information for the next 4 questions.

Burkett Company uses a standard cost system. Indirect costs were budgeted at $200,000 plus $15 per direct labor hour. The overhead rate is based on 10,000 hours. Actual results were:

The variable overhead spending variance was

A) $10,000 F

B) $50,000 U

C) $35,000 U

D) $15,000 U

Burkett Company uses a standard cost system. Indirect costs were budgeted at $200,000 plus $15 per direct labor hour. The overhead rate is based on 10,000 hours. Actual results were:

The variable overhead spending variance was

A) $10,000 F

B) $50,000 U

C) $35,000 U

D) $15,000 U

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

23

(Appendix 11A) For organizations that sell multiple products, contribution margin and sales mix variances are often useful for decision making.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

24

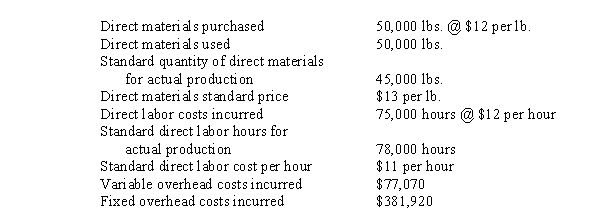

Use the following information for the next 4 questions.

Hogle Mfg. Co. uses a standard costing system. The standard time to produce one unit is 4 hours, and normal production is 3,000 units monthly. Overhead costs were estimated to be $135,000. The standard variable overhead rate is $5 per machine hour. During April the following results were recorded:

The fixed overhead production volume variance was

A) $1,000 U

B) $2,500 F

C) $1,500 F

D) $5,000 U

Hogle Mfg. Co. uses a standard costing system. The standard time to produce one unit is 4 hours, and normal production is 3,000 units monthly. Overhead costs were estimated to be $135,000. The standard variable overhead rate is $5 per machine hour. During April the following results were recorded:

The fixed overhead production volume variance was

A) $1,000 U

B) $2,500 F

C) $1,500 F

D) $5,000 U

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

25

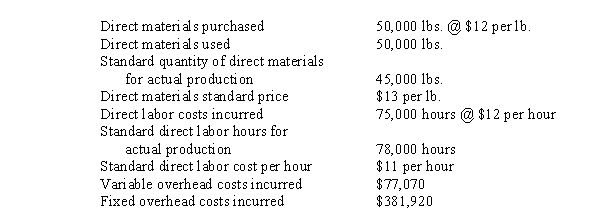

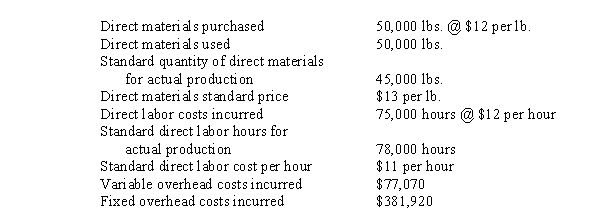

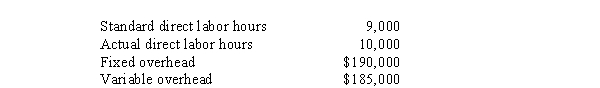

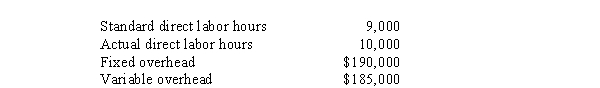

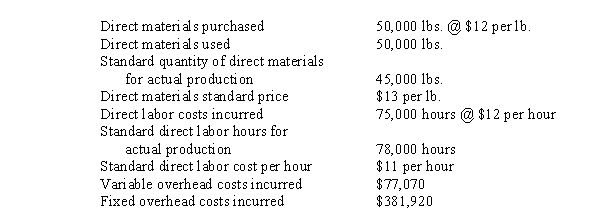

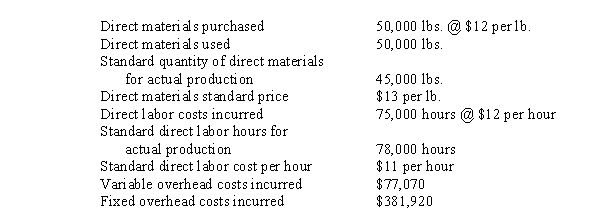

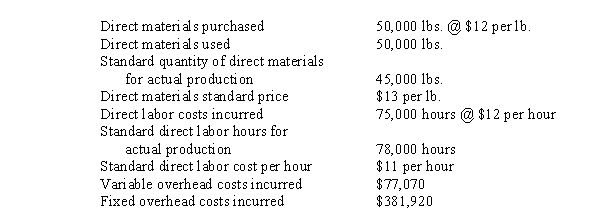

Use the following information for the next 6 questions.

Hyteck, Inc. is a capital intensive firm. Indirect costs make up nearly 70% of the product costs. The company has no direct material costs because customers provide the direct materials used for each job. To plan and control such costs, the firm employs flexible budgets and standard costs. Overhead rates, based on direct labor hours, are derived from the master budget.

The fixed overhead production volume variance was

A) $9,000 U

B) $2,000 F

C) $7,000 U

D) $2,800 U

Hyteck, Inc. is a capital intensive firm. Indirect costs make up nearly 70% of the product costs. The company has no direct material costs because customers provide the direct materials used for each job. To plan and control such costs, the firm employs flexible budgets and standard costs. Overhead rates, based on direct labor hours, are derived from the master budget.

The fixed overhead production volume variance was

A) $9,000 U

B) $2,000 F

C) $7,000 U

D) $2,800 U

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

26

Use the following information for the next 5 questions.

Mason, Inc. uses a standard costing system. Overhead costs are allocated based on direct labor hours. The standard variable overhead and fixed overhead rates are $1 and $5 per direct labor hour, respectively. Data relevant for the current period include:

The purchase of direct materials would be recorded in direct materials inventory at

A) $540,000

B) $585,000

C) $600,000

D) $650,000

Mason, Inc. uses a standard costing system. Overhead costs are allocated based on direct labor hours. The standard variable overhead and fixed overhead rates are $1 and $5 per direct labor hour, respectively. Data relevant for the current period include:

The purchase of direct materials would be recorded in direct materials inventory at

A) $540,000

B) $585,000

C) $600,000

D) $650,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

27

Use the following information for the next 6 questions.

Hyteck, Inc. is a capital intensive firm. Indirect costs make up nearly 70% of the product costs. The company has no direct material costs because customers provide the direct materials used for each job. To plan and control such costs, the firm employs flexible budgets and standard costs. Overhead rates, based on direct labor hours, are derived from the master budget.

The variable overhead spending variance was

A) $1,200 F

B) $2,000 F

C) $2,800 U

D) $1,600 U

Hyteck, Inc. is a capital intensive firm. Indirect costs make up nearly 70% of the product costs. The company has no direct material costs because customers provide the direct materials used for each job. To plan and control such costs, the firm employs flexible budgets and standard costs. Overhead rates, based on direct labor hours, are derived from the master budget.

The variable overhead spending variance was

A) $1,200 F

B) $2,000 F

C) $2,800 U

D) $1,600 U

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

28

Use the following information for the next 4 questions.

Hogle Mfg. Co. uses a standard costing system. The standard time to produce one unit is 4 hours, and normal production is 3,000 units monthly. Overhead costs were estimated to be $135,000. The standard variable overhead rate is $5 per machine hour. During April the following results were recorded:

The total overhead allocated was

A) $135,000

B) $139,500

C) $141,500

D) $137,000

Hogle Mfg. Co. uses a standard costing system. The standard time to produce one unit is 4 hours, and normal production is 3,000 units monthly. Overhead costs were estimated to be $135,000. The standard variable overhead rate is $5 per machine hour. During April the following results were recorded:

The total overhead allocated was

A) $135,000

B) $139,500

C) $141,500

D) $137,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

29

Use the following information for the next 6 questions.

Hyteck, Inc. is a capital intensive firm. Indirect costs make up nearly 70% of the product costs. The company has no direct material costs because customers provide the direct materials used for each job. To plan and control such costs, the firm employs flexible budgets and standard costs. Overhead rates, based on direct labor hours, are derived from the master budget.

The direct labor price variance was

A) $2,000 F

B) $2,800 U

C) $1,000 U

D) $1,000 F

Hyteck, Inc. is a capital intensive firm. Indirect costs make up nearly 70% of the product costs. The company has no direct material costs because customers provide the direct materials used for each job. To plan and control such costs, the firm employs flexible budgets and standard costs. Overhead rates, based on direct labor hours, are derived from the master budget.

The direct labor price variance was

A) $2,000 F

B) $2,800 U

C) $1,000 U

D) $1,000 F

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

30

Use the following information for the next 6 questions.

Hyteck, Inc. is a capital intensive firm. Indirect costs make up nearly 70% of the product costs. The company has no direct material costs because customers provide the direct materials used for each job. To plan and control such costs, the firm employs flexible budgets and standard costs. Overhead rates, based on direct labor hours, are derived from the master budget.

The budget variance for variable overhead was

A) $2,800 U

B) $7,000 U

C) $4,400 U

D) $9,000 U

Hyteck, Inc. is a capital intensive firm. Indirect costs make up nearly 70% of the product costs. The company has no direct material costs because customers provide the direct materials used for each job. To plan and control such costs, the firm employs flexible budgets and standard costs. Overhead rates, based on direct labor hours, are derived from the master budget.

The budget variance for variable overhead was

A) $2,800 U

B) $7,000 U

C) $4,400 U

D) $9,000 U

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

31

Use the following information for the next 4 questions.

Hogle Mfg. Co. uses a standard costing system. The standard time to produce one unit is 4 hours, and normal production is 3,000 units monthly. Overhead costs were estimated to be $135,000. The standard variable overhead rate is $5 per machine hour. During April the following results were recorded:

The combined fixed and variable overhead spending variance was

A) $1,000 U

B) $2,000 F

C) $7,000 U

D) $3,000 F

Hogle Mfg. Co. uses a standard costing system. The standard time to produce one unit is 4 hours, and normal production is 3,000 units monthly. Overhead costs were estimated to be $135,000. The standard variable overhead rate is $5 per machine hour. During April the following results were recorded:

The combined fixed and variable overhead spending variance was

A) $1,000 U

B) $2,000 F

C) $7,000 U

D) $3,000 F

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

32

Use the following information for the next 4 questions.

Burkett Company uses a standard cost system. Indirect costs were budgeted at $200,000 plus $15 per direct labor hour. The overhead rate is based on 10,000 hours. Actual results were:

The fixed overhead production volume variance was

A) $15,000 F

B) $20,000 U

C) $10,000 F

D) $10,000 U

Burkett Company uses a standard cost system. Indirect costs were budgeted at $200,000 plus $15 per direct labor hour. The overhead rate is based on 10,000 hours. Actual results were:

The fixed overhead production volume variance was

A) $15,000 F

B) $20,000 U

C) $10,000 F

D) $10,000 U

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

33

Use the following information for the next 4 questions.

Hogle Mfg. Co. uses a standard costing system. The standard time to produce one unit is 4 hours, and normal production is 3,000 units monthly. Overhead costs were estimated to be $135,000. The standard variable overhead rate is $5 per machine hour. During April the following results were recorded:

The variable overhead efficiency variance was

A) $8,000 U

B) $4,000U

C) $2,000 U

D) $4,000 F

Hogle Mfg. Co. uses a standard costing system. The standard time to produce one unit is 4 hours, and normal production is 3,000 units monthly. Overhead costs were estimated to be $135,000. The standard variable overhead rate is $5 per machine hour. During April the following results were recorded:

The variable overhead efficiency variance was

A) $8,000 U

B) $4,000U

C) $2,000 U

D) $4,000 F

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

34

Use the following information for the next 5 questions.

Mason, Inc. uses a standard costing system. Overhead costs are allocated based on direct labor hours. The standard variable overhead and fixed overhead rates are $1 and $5 per direct labor hour, respectively. Data relevant for the current period include:

The cost of direct materials added to work in process would be

A) $540,000

B) $585,000

C) $600,000

D) $650,000

Mason, Inc. uses a standard costing system. Overhead costs are allocated based on direct labor hours. The standard variable overhead and fixed overhead rates are $1 and $5 per direct labor hour, respectively. Data relevant for the current period include:

The cost of direct materials added to work in process would be

A) $540,000

B) $585,000

C) $600,000

D) $650,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

35

Use the following information for the next 5 questions.

Mason, Inc. uses a standard costing system. Overhead costs are allocated based on direct labor hours. The standard variable overhead and fixed overhead rates are $1 and $5 per direct labor hour, respectively. Data relevant for the current period include:

The direct materials efficiency variance is

A) $60,000 Favorable

B) $60,000 Unfavorable

C) $65,000 Favorable

D) $65,000 Unfavorable

Mason, Inc. uses a standard costing system. Overhead costs are allocated based on direct labor hours. The standard variable overhead and fixed overhead rates are $1 and $5 per direct labor hour, respectively. Data relevant for the current period include:

The direct materials efficiency variance is

A) $60,000 Favorable

B) $60,000 Unfavorable

C) $65,000 Favorable

D) $65,000 Unfavorable

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

36

Use the following information for the next 6 questions.

Hyteck, Inc. is a capital intensive firm. Indirect costs make up nearly 70% of the product costs. The company has no direct material costs because customers provide the direct materials used for each job. To plan and control such costs, the firm employs flexible budgets and standard costs. Overhead rates, based on direct labor hours, are derived from the master budget.

The fixed overhead spending variance was

A) $9,000 U

B) $2,000 F

C) $7,000 U

D) $2,800 U

Hyteck, Inc. is a capital intensive firm. Indirect costs make up nearly 70% of the product costs. The company has no direct material costs because customers provide the direct materials used for each job. To plan and control such costs, the firm employs flexible budgets and standard costs. Overhead rates, based on direct labor hours, are derived from the master budget.

The fixed overhead spending variance was

A) $9,000 U

B) $2,000 F

C) $7,000 U

D) $2,800 U

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

37

Use the following information for the next 6 questions.

Hyteck, Inc. is a capital intensive firm. Indirect costs make up nearly 70% of the product costs. The company has no direct material costs because customers provide the direct materials used for each job. To plan and control such costs, the firm employs flexible budgets and standard costs. Overhead rates, based on direct labor hours, are derived from the master budget.

The direct labor efficiency variance was

A) $2,000 F

B) $2,800 U

C) $1,000 U

D) $1,000 F

Hyteck, Inc. is a capital intensive firm. Indirect costs make up nearly 70% of the product costs. The company has no direct material costs because customers provide the direct materials used for each job. To plan and control such costs, the firm employs flexible budgets and standard costs. Overhead rates, based on direct labor hours, are derived from the master budget.

The direct labor efficiency variance was

A) $2,000 F

B) $2,800 U

C) $1,000 U

D) $1,000 F

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

38

Variance analysis can be used for both costs and revenues.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

39

Use the following information for the next 4 questions.

Burkett Company uses a standard cost system. Indirect costs were budgeted at $200,000 plus $15 per direct labor hour. The overhead rate is based on 10,000 hours. Actual results were:

The variable overhead efficiency variance was

A) $10,000 F

B) $50,000 U

C) $35,000 U

D) $15,000 U

Burkett Company uses a standard cost system. Indirect costs were budgeted at $200,000 plus $15 per direct labor hour. The overhead rate is based on 10,000 hours. Actual results were:

The variable overhead efficiency variance was

A) $10,000 F

B) $50,000 U

C) $35,000 U

D) $15,000 U

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

40

(Appendix 11A) The sales price variance is calculated as (actual price - standard price) X actual volume sold.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

41

How do managers decide which variances are important enough to investigate? I. By considering whether they are favorable or unfavorable

II) By calculating and investigating all possible variances

III) By considering whether it is large enough to justify investigation

A) I only

B) II only

C) III only

D) I and III only

II) By calculating and investigating all possible variances

III) By considering whether it is large enough to justify investigation

A) I only

B) II only

C) III only

D) I and III only

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

42

Variance analysis includes which of the following processes? I. Calculating variances

II) Analyzing the reasons variances occurred

III) Predicting variances in future periods

A) I and II only

B) I and III only

C) II and III only

D) I, II, and III

II) Analyzing the reasons variances occurred

III) Predicting variances in future periods

A) I and II only

B) I and III only

C) II and III only

D) I, II, and III

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

43

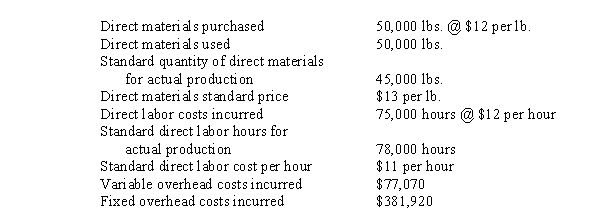

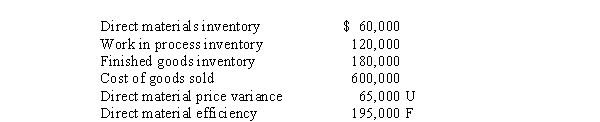

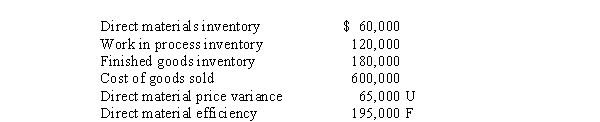

Use the following information for the next 5 questions.

Mason, Inc. uses a standard costing system. Overhead costs are allocated based on direct labor hours. The standard variable overhead and fixed overhead rates are $1 and $5 per direct labor hour, respectively. Data relevant for the current period include:

The direct labor price variance is

A) $30,000 Favorable

B) $30,000 Unfavorable

C) $75,000 Unfavorable

D) $78,000 Unfavorable

Mason, Inc. uses a standard costing system. Overhead costs are allocated based on direct labor hours. The standard variable overhead and fixed overhead rates are $1 and $5 per direct labor hour, respectively. Data relevant for the current period include:

The direct labor price variance is

A) $30,000 Favorable

B) $30,000 Unfavorable

C) $75,000 Unfavorable

D) $78,000 Unfavorable

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

44

The budget that reflects the level of activity management expects to attain is the

A) Flexible budget

B) Standard budget

C) Master budget

D) Expected budget

A) Flexible budget

B) Standard budget

C) Master budget

D) Expected budget

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

45

Standard costs should be reviewed

A) Daily

B) Monthly

C) Annually

D) As often as managers and accountants deem necessary

A) Daily

B) Monthly

C) Annually

D) As often as managers and accountants deem necessary

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

46

Use the following information for the next 5 questions.

Mason, Inc. uses a standard costing system. Overhead costs are allocated based on direct labor hours. The standard variable overhead and fixed overhead rates are $1 and $5 per direct labor hour, respectively. Data relevant for the current period include:

Given the following account balances at the end of the first year of operations: Assuming that variances are considered material, the entry and amount of direct labor variances allocated to the Finished Goods Inventory is

Assuming that variances are considered material, the entry and amount of direct labor variances allocated to the Finished Goods Inventory is

A) Credit $3,740

B) Debit $2,160

C) Credit $770

D) Debit $3,960

Mason, Inc. uses a standard costing system. Overhead costs are allocated based on direct labor hours. The standard variable overhead and fixed overhead rates are $1 and $5 per direct labor hour, respectively. Data relevant for the current period include:

Given the following account balances at the end of the first year of operations:

Assuming that variances are considered material, the entry and amount of direct labor variances allocated to the Finished Goods Inventory is

Assuming that variances are considered material, the entry and amount of direct labor variances allocated to the Finished Goods Inventory isA) Credit $3,740

B) Debit $2,160

C) Credit $770

D) Debit $3,960

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

47

Which of the following is not a typical step in variance analysis?

A) Calculate variances

B) Identify reasons for variances

C) Report variances in financial statements

D) Draw conclusions and take action

A) Calculate variances

B) Identify reasons for variances

C) Report variances in financial statements

D) Draw conclusions and take action

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

48

In a traditional manufacturing accounting system, the standard cost of a unit of output is the sum of the standard costs of

A) Direct material, direct labor, and variable overhead

B) Direct material, direct labor ,and fixed overhead

C) Direct material, direct labor, and period costs

D) Direct material, direct labor, variable overhead, and fixed overhead

A) Direct material, direct labor, and variable overhead

B) Direct material, direct labor ,and fixed overhead

C) Direct material, direct labor, and period costs

D) Direct material, direct labor, variable overhead, and fixed overhead

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

49

The production manager of CLR Corporation calculated a material and unfavorable variance of $4,000 with respect to the cost of direct materials. Which of the following is a likely next step for the production manager?

A) Identify and discipline the responsible employee

B) Take actions to prevent the variance from recurring

C) Ascertain the cause of the variance

D) Switch suppliers for direct materials

A) Identify and discipline the responsible employee

B) Take actions to prevent the variance from recurring

C) Ascertain the cause of the variance

D) Switch suppliers for direct materials

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

50

Standard costing allows management to I. Measure performance

II) Identify inefficiencies

III) Control costs

A) I and II only

B) I and III only

C) II and III only

D) I, II, and III

II) Identify inefficiencies

III) Control costs

A) I and II only

B) I and III only

C) II and III only

D) I, II, and III

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

51

Favorable price variances occur because of

A) Rising prices of finished goods

B) Increases in raw materials efficiency

C) Price decreases in raw materials

D) Efficiency in the production department

A) Rising prices of finished goods

B) Increases in raw materials efficiency

C) Price decreases in raw materials

D) Efficiency in the production department

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

52

For overhead variances, the difference between the flexible budget amounts and actual costs incurred is called the

A) Efficiency variance

B) Budget variance

C) Favorable variance

D) Quantity variance

A) Efficiency variance

B) Budget variance

C) Favorable variance

D) Quantity variance

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

53

Which department is customarily responsible for an unfavorable material price variance?

A) Sales

B) Purchasing

C) Engineering

D) Production

A) Sales

B) Purchasing

C) Engineering

D) Production

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

54

The process of calculating variances and analyzing the reasons they occurred is called

A) Variance analysis

B) Budget analysis

C) Historical analysis

D) Activity-based analysis

A) Variance analysis

B) Budget analysis

C) Historical analysis

D) Activity-based analysis

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

55

Use the following information for the next 5 questions.

Mason, Inc. uses a standard costing system. Overhead costs are allocated based on direct labor hours. The standard variable overhead and fixed overhead rates are $1 and $5 per direct labor hour, respectively. Data relevant for the current period include:

The variable overhead spending variance is

A) $930 Favorable

B) $2,070 Unfavorable

C) $33,000 Unfavorable

D) $33,000 Unfavorable

Mason, Inc. uses a standard costing system. Overhead costs are allocated based on direct labor hours. The standard variable overhead and fixed overhead rates are $1 and $5 per direct labor hour, respectively. Data relevant for the current period include:

The variable overhead spending variance is

A) $930 Favorable

B) $2,070 Unfavorable

C) $33,000 Unfavorable

D) $33,000 Unfavorable

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

56

Expected costs per unit of input are called

A) Standard prices

B) Standard costs

C) Standard quantities

D) Standard ideals

A) Standard prices

B) Standard costs

C) Standard quantities

D) Standard ideals

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

57

Use the following information for the next 2 questions.

Given the following account balances at the end of the first year of operations:

Assuming that variances are considered material, the entry and amount of the direct material price variance allocated to Cost of Goods Sold is

A) Debit $40,625

B) Debit $41,082

C) Credit $43,333

D) Debit $39,935

Given the following account balances at the end of the first year of operations:

Assuming that variances are considered material, the entry and amount of the direct material price variance allocated to Cost of Goods Sold is

A) Debit $40,625

B) Debit $41,082

C) Credit $43,333

D) Debit $39,935

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

58

Use the following information for the next 2 questions.

Given the following account balances at the end of the first year of operations:

Assuming that variances are considered material, the entry and amount of the direct material efficiency variance allocated to work in process inventory is

A) Credit $26,000

B) Credit $24,375

C) Debit $17,333

D) Debit $8,125

Given the following account balances at the end of the first year of operations:

Assuming that variances are considered material, the entry and amount of the direct material efficiency variance allocated to work in process inventory is

A) Credit $26,000

B) Credit $24,375

C) Debit $17,333

D) Debit $8,125

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

59

Managers investigate

A) All variances

B) All unfavorable variances

C) Variances they consider important

D) Variances that are reported in the financial statements

A) All variances

B) All unfavorable variances

C) Variances they consider important

D) Variances that are reported in the financial statements

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

60

Which of the following is a possible cause of an unfavorable materials efficiency variance?

A) Using materials that do not meet specifications

B) Using a higher class of labor than called for

C) Using a higher quality of material than called for

D) Using fewer hours of labor than labor specifications call for

A) Using materials that do not meet specifications

B) Using a higher class of labor than called for

C) Using a higher quality of material than called for

D) Using fewer hours of labor than labor specifications call for

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

61

A favorable variance in one area might be offset by

A) Favorable variance in another area

B) Unfavorable variance in another area

C) Increase in period costs

D) Decrease in period costs

A) Favorable variance in another area

B) Unfavorable variance in another area

C) Increase in period costs

D) Decrease in period costs

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

62

At the end of 20x1, ELM Corporation's production manager estimated direct labor overtime hours at 200 for the first quarter of 20x2. At the end of the first quarter, actual overtime hours totaled 180. This difference is most likely to lead to

A) Favorable variable overhead spending variance

B) Unfavorable production volume variance

C) Favorable labor efficiency variance

D) Unfavorable labor efficiency variance

A) Favorable variable overhead spending variance

B) Unfavorable production volume variance

C) Favorable labor efficiency variance

D) Unfavorable labor efficiency variance

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

63

The production volume variance provides information about

A) Capacity utilization

B) Variable overhead costs which vary with volume

C) Fixed overhead costs which vary with volume

D) Sales levels

A) Capacity utilization

B) Variable overhead costs which vary with volume

C) Fixed overhead costs which vary with volume

D) Sales levels

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

64

If a variance is investigated and determined to be random, managers should

A) Write off the variance against cost of goods sold

B) Do nothing

C) Identify and discipline the employee(s) responsible

D) Write off the variance against work in process

A) Write off the variance against cost of goods sold

B) Do nothing

C) Identify and discipline the employee(s) responsible

D) Write off the variance against work in process

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

65

Because managers use estimates in calculating overhead allocation rates, they are likely to experience

A) Fixed overhead production volume variances

B) No fixed or variable overhead variances

C) Direct labor price variances

D) Lower than expected profits

A) Fixed overhead production volume variances

B) No fixed or variable overhead variances

C) Direct labor price variances

D) Lower than expected profits

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

66

Variances can be caused by I. Out-of-control operations

II) Better-than-expected operations

III) Inappropriate benchmarks

A) I and III only

B) II and III only

C) I and II only

D) I, II, and III

II) Better-than-expected operations

III) Inappropriate benchmarks

A) I and III only

B) II and III only

C) I and II only

D) I, II, and III

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

67

During the middle of the fiscal year, AWR Corporation unexpectedly revised its estimate of a plant asset's life from 5 years to 7 years. That revision is most likely to lead to

A) No variance, since the plant asset's cost is sunk

B) Fixed overhead spending variance

C) Fixed overhead production volume variance

D) Variable overhead spending variance

A) No variance, since the plant asset's cost is sunk

B) Fixed overhead spending variance

C) Fixed overhead production volume variance

D) Variable overhead spending variance

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

68

LST Corporation entered into a new contract with one of its raw material suppliers. The new contract required the supplier to deliver raw materials with a 24-hour notice from LST. This reduces LST's material handling costs, but has increased the cost of the raw materials delivered. Which of the following variances is most likely to result?

A) Unfavorable direct material price variance

B) Favorable direct price variance

C) Unfavorable variable overhead spending variance

D) Unfavorable fixed overhead spending variance

A) Unfavorable direct material price variance

B) Favorable direct price variance

C) Unfavorable variable overhead spending variance

D) Unfavorable fixed overhead spending variance

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

69

Overhead efficiency variances

A) Provide managers with useful information for cost management

B) Do not provide marginal information for cost management because they involve estimates

C) Do not provide new cost management information because direct cost efficiency variances provide the same information

D) Provide useful information for financial reporting purposes

A) Provide managers with useful information for cost management

B) Do not provide marginal information for cost management because they involve estimates

C) Do not provide new cost management information because direct cost efficiency variances provide the same information

D) Provide useful information for financial reporting purposes

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

70

Variable overhead spending variances can result from unattainable variable allocation rates. In turn, those rates may be caused by I. Inappropriate allocation bases

II) Poor estimates of total overhead costs

III) Change in estimated life of depreciable assets

A) I only

B) I and II only

C) I and III only

D) I, II, and III

II) Poor estimates of total overhead costs

III) Change in estimated life of depreciable assets

A) I only

B) I and II only

C) I and III only

D) I, II, and III

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

71

Intentional worker damage is most likely to result in which type of variance?

A) Direct materials price variance

B) Direct materials efficiency variance

C) Direct labor price variance

D) Variable overhead spending variance

A) Direct materials price variance

B) Direct materials efficiency variance

C) Direct labor price variance

D) Variable overhead spending variance

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

72

Rewarding employees in one production department for meeting or exceeding standard cost benchmarks can create new sets of problems for organizations. Which of the following is not one of them?

A) An unfavorable efficiency variance because of rework needed on work from another department

B) Variances in another production department

C) Unmotivated employees in that production department

D) Poor quality finished goods

A) An unfavorable efficiency variance because of rework needed on work from another department

B) Variances in another production department

C) Unmotivated employees in that production department

D) Poor quality finished goods

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

73

Fixed overhead costs are not expected to vary with production volumes. Therefore, production volume variances

A) Do not exist in most organizations

B) Exist only if production volume is higher than anticipated

C) Exist only if production volume is lower than expected

D) Exist because of estimates in the calculation of the overhead allocation rate

A) Do not exist in most organizations

B) Exist only if production volume is higher than anticipated

C) Exist only if production volume is lower than expected

D) Exist because of estimates in the calculation of the overhead allocation rate

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

74

Unattainable standards are likely to lead to I. Errors in the accounting information system

II) Favorable variances

III) Unfavorable variances

A) I only

B) II only

C) III only

D) I and III only

II) Favorable variances

III) Unfavorable variances

A) I only

B) II only

C) III only

D) I and III only

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

75

Which of the following statements regarding tradeoffs among variances is true?

A) Managers generally do not need to consider tradeoffs in variance analysis

B) Managers may sometimes make tradeoffs between favorable and unfavorable variances

C) Unfavorable direct material price variances often lead to unfavorable direct labor efficiency variances

D) Favorable direct material price variances often lead to favorable direct material efficiency variances

A) Managers generally do not need to consider tradeoffs in variance analysis

B) Managers may sometimes make tradeoffs between favorable and unfavorable variances

C) Unfavorable direct material price variances often lead to unfavorable direct labor efficiency variances

D) Favorable direct material price variances often lead to favorable direct material efficiency variances

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

76

If a variance analysis shows that operations are better than expected, managers should

A) Do nothing

B) Revise standard costs to make them harder to achieve

C) Distribute extra dividends to shareholders

D) Monitor quality to ensure it was maintained

A) Do nothing

B) Revise standard costs to make them harder to achieve

C) Distribute extra dividends to shareholders

D) Monitor quality to ensure it was maintained

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

77

Theft of raw materials is most likely to lead to

A) Direct materials price variance

B) Favorable direct materials price variance

C) Unfavorable direct materials efficiency variance

D) Favorable direct materials efficiency variance

A) Direct materials price variance

B) Favorable direct materials price variance

C) Unfavorable direct materials efficiency variance

D) Favorable direct materials efficiency variance

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

78

ELM Corporation introduced a new automated production process that has reduced the amount of labor needed, but not affected the use of materials. The standard cost system has not been changed yet to reflect this new process. Assuming the machinery is functioning properly and that workers were properly trained in its use, which of the following variances is most likely to result?

A) Favorable variable overhead spending variance

B) Favorable direct labor efficiency variance

C) Unfavorable direct labor efficiency variance

D) Favorable direct materials price variance

A) Favorable variable overhead spending variance

B) Favorable direct labor efficiency variance

C) Unfavorable direct labor efficiency variance

D) Favorable direct materials price variance

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

79

Which of the following variances is least likely to provide useful information for making decisions, if calculated as part of a comprehensive set of variances?

A) Variable overhead spending

B) Production volume variance

C) Direct material price

D) Direct labor efficiency

A) Variable overhead spending

B) Production volume variance

C) Direct material price

D) Direct labor efficiency

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

80

Accountants investigate manufacturing overhead spending variances to determine

A) Which specific overhead costs differ from expectations, and whether corrections are needed

B) Which specific direct costs differ from expectations, and whether corrections are needed

C) Which specific marketing costs differ from expectations, and whether corrections are needed

D) Whether the variance is material

A) Which specific overhead costs differ from expectations, and whether corrections are needed

B) Which specific direct costs differ from expectations, and whether corrections are needed

C) Which specific marketing costs differ from expectations, and whether corrections are needed

D) Whether the variance is material

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck