Deck 11: Current Liabilities and Payroll

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/70

العب

ملء الشاشة (f)

Deck 11: Current Liabilities and Payroll

1

The Federal Government collects all the PST and GST for the country and then passes on the collection of the PST to the individual provincial governments.

False

2

A $45,000, 10%, 90-day note payable comes to maturity. The amount to be paid at maturity including interest is $43,890.41.

False

3

Notes payable normally require the borrower to pay interest.

True

4

The failure to record an accrued liability causes a company to overstate its net income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

5

Sales tax payable is recorded as a debit when recording a sale of merchandise.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

6

The rate of provincial sales taxes is the same in every province.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

7

The methods of recording GST and HST are similar.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

8

The only way to reduce a current liability is to pay out cash.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

9

In some provinces individual consumers must pay both HST and PST.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

10

Interest must be accrued on all current notes payable. For long-term notes the interest is accrued at the maturity of the note.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

11

Most lines of credit are payable on demand.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

12

Current portion of long-term debt refers to the amount of principle on a note payable that must be paid within a year or an operating cycle.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

13

In provinces with PST, businesses must pay the tax when they are the final consumer of the goods.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

14

The province of Alberta has the lowest PST rate in Canada of 3%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

15

The entry to record unearned revenue received in advance includes a debit to unearned revenue and a credit to cash.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

16

Operating lines of credit are popular because they do not carry any interest charges.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

17

Accrued interest on a note payable should be credited to interest payable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

18

A $15,000, 8%, 9-month note payable requires an interest payment of $900 at maturity, if no interest was previously paid.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

19

An unearned revenue arises when a company receives cash from its customers in advance of earning the revenue.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

20

Interest payable is a contra liability account and is deducted from the note payable on the balance sheet.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

21

Amounts owed to suppliers for products or services purchased on open accounts are called:

A)notes payable.

B)unearned revenues.

C)accounts payable.

D)accrued expenses.

A)notes payable.

B)unearned revenues.

C)accounts payable.

D)accrued expenses.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

22

Goods and services taxes add an extra cost to the value of inventory.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

23

Sales revenue for Joe's Sporting Goods for the current period amounted to $215,000. Joe's Sporting Goods records GST when merchandise is sold. All sales are on account. The GST rate is 5%. The journal entry would include a debit to:

A)Accounts Receivable for $215,000.

B)Accounts Receivable for $225,750.

C)GST Payable for $10,750.

D)Sales Revenue for $215,000.

A)Accounts Receivable for $215,000.

B)Accounts Receivable for $225,750.

C)GST Payable for $10,750.

D)Sales Revenue for $215,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

24

A company borrows $5,000 on November 1, 2019, giving a 10%, 180-day note payable. The adjusting entry on December 31, 2019, would include a:

A)credit to Interest Payable for $82.19.

B)credit to Interest Payable for $123.29.

C)credit to Interest Expense for $82.19.

D)credit to Cash for $82.19.

A)credit to Interest Payable for $82.19.

B)credit to Interest Payable for $123.29.

C)credit to Interest Expense for $82.19.

D)credit to Cash for $82.19.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

25

When a company issues a short-term note payable:

A)the note payable account is credited.

B)the note payable is debited.

C)the interest expense is credited.

D)the interest expense account is debited.

A)the note payable account is credited.

B)the note payable is debited.

C)the interest expense is credited.

D)the interest expense account is debited.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

26

A company gives a $50,000, 60-day note at the bank at 7%. How much will the company pay the bank at maturity?

A)$50,287.67

B)$49,424.66

C)$49,712.33

D)$50,575.34

A)$50,287.67

B)$49,424.66

C)$49,712.33

D)$50,575.34

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

27

Stardust Company issued a five-year, interest-bearing note payable for $50,000 on January 1, 2019. Each January, Stardust is required to pay $10,000 principal on the note. What is the amount that will be reported on the current portion of long-term notes payable on the December 31, 2020 balance sheet?

A)$10,000

B)$0

C)$30,000

D)$20,000

A)$10,000

B)$0

C)$30,000

D)$20,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

28

A company gives a $100,000, 120-day note at the bank at 9%. How much will the company pay the bank at maturity?

A)$102,958.90

B)$97,041.10

C)$98,520.55

D)$101,479.45

A)$102,958.90

B)$97,041.10

C)$98,520.55

D)$101,479.45

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

29

A company gives a $40,000, six-month note at the bank at 8%. How much will the company pay the bank at maturity?

A)$40,000

B)$43,200

C)$41,600

D)$38,400

A)$40,000

B)$43,200

C)$41,600

D)$38,400

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

30

Secured operating lines of credit normally have lower rates of interest than unsecured operating lines of credit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

31

Long-term debt refers to obligations that have to be paid within a year of the balance sheet date.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

32

The entry to accrue sales tax expense includes a:

A)debit to Sales Tax Expense.

B)credit to Sales Tax Payable.

C)debit to Sales Tax Payable.

D)There is no accrual of sales tax expense.

A)debit to Sales Tax Expense.

B)credit to Sales Tax Payable.

C)debit to Sales Tax Payable.

D)There is no accrual of sales tax expense.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

33

Which of the following liabilities creates no expense on the part of the company?

A)Employment Insurance payable

B)Canada Pension Plan payable

C)GST payable

D)estimated warranty payable

A)Employment Insurance payable

B)Canada Pension Plan payable

C)GST payable

D)estimated warranty payable

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

34

A company borrows $15,000 on November 1, 2019, giving a 6%, 90-day note payable. The adjusting entry on December 31, 2019, would include a:

A)credit to Interest Payable for $73.97.

B)credit to Interest Payable for $147.95.

C)debit to Interest Expense for $221.92.

D)credit to Cash for $147.95.

A)credit to Interest Payable for $73.97.

B)credit to Interest Payable for $147.95.

C)debit to Interest Expense for $221.92.

D)credit to Cash for $147.95.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

35

Short-term notes payable:

A)are an unusual form of financing.

B)are generally due within one year.

C)are classified on the balance sheet as non-current.

D)are shown on the balance sheet as a reduction to notes receivable.

A)are an unusual form of financing.

B)are generally due within one year.

C)are classified on the balance sheet as non-current.

D)are shown on the balance sheet as a reduction to notes receivable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

36

Lippman Company Ltd. collects 5% GST on sales. If sales are $963,000, the proper accounting includes:

A)$101,115 credit to Sales.

B)$48,150 credit to GST Payable.

C)$48,150 debit to GST Recoverable.

D)$963,000 debit to Accounts Receivable.

A)$101,115 credit to Sales.

B)$48,150 credit to GST Payable.

C)$48,150 debit to GST Recoverable.

D)$963,000 debit to Accounts Receivable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

37

The journal entry to remit GST to the Receiver General includes:

A)credit to GST Payable.

B)debit to GST Recoverable.

C)credit to GST Recoverable and debit to GST Payable.

D)debit to GST Recoverable and credit to GST Payable.

A)credit to GST Payable.

B)debit to GST Recoverable.

C)credit to GST Recoverable and debit to GST Payable.

D)debit to GST Recoverable and credit to GST Payable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

38

Camrey Company issued a five-year, interest-bearing note payable for $50,000 on January 1, 2019. Each January Camrey is required to pay $10,000 principal on the note. What is the amount that will be reported on the long-term portion of long-term notes payable on the December 31, 2021 balance sheet?

A)$10,000

B)$40,000

C)$30,000

D)$20,000

A)$10,000

B)$40,000

C)$30,000

D)$20,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

39

Failure to record accrued interest on a note payable causes a company to:

A)overstate interest income.

B)understate interest expense.

C)understate retained earnings.

D)overstate interest expense and understate retained earnings.

A)overstate interest income.

B)understate interest expense.

C)understate retained earnings.

D)overstate interest expense and understate retained earnings.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

40

Unearned revenue represents revenue that has:

A)been earned and collected.

B)been earned but not yet collected.

C)been collected but not yet earned.

D)not been collected nor earned.

A)been earned and collected.

B)been earned but not yet collected.

C)been collected but not yet earned.

D)not been collected nor earned.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

41

Businesses do not accrue contingent gains but do report actual gains.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

42

Sales for the current year amount to $900,000. The company estimates warranty expense to be 5% of sales. The journal entry to accrue the estimated warranty expense includes a debit to estimated warranty payable for $45,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

43

A contingent liability is an actual liability that is estimated when things go wrong.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

44

All of the following are unearned revenues except:

A)deferred revenues.

B)accrued revenues.

C)revenues collected in advance.

D)customer prepayments.

A)deferred revenues.

B)accrued revenues.

C)revenues collected in advance.

D)customer prepayments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

45

The entry to accrue interest on a note payable would include a:

A)debit to Note Payable.

B)credit to Interest Receivable.

C)credit to Interest Revenue.

D)debit to Interest Expense.

A)debit to Note Payable.

B)credit to Interest Receivable.

C)credit to Interest Revenue.

D)debit to Interest Expense.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

46

Corporations and individuals both pay income tax.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

47

The law requires all employers to provide paid vacations to their employees.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

48

Liabilities that exist but whose exact amount is not known must be:

A)ignored.

B)estimated.

C)reported in the notes to the financial statements.

D)treated as a contingent liability.

A)ignored.

B)estimated.

C)reported in the notes to the financial statements.

D)treated as a contingent liability.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

49

Estimating a warranty expense in the same period as the sales revenue is recognized is an example of:

A)the recognition criteria for revenues.

B)the matching objective.

C)the full-disclosure principle.

D)conservatism.

A)the recognition criteria for revenues.

B)the matching objective.

C)the full-disclosure principle.

D)conservatism.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

50

A contingent liability is a potential liability that depends on a future event arising out of a past transaction.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

51

Warranty expense is debited:

A)in the period the product under warranty is repaired or replaced.

B)in the period the revenue from selling the product was earned.

C)the timing will depend on the length of the warranty period.

D)in the period when the payment for the sale is received.

A)in the period the product under warranty is repaired or replaced.

B)in the period the revenue from selling the product was earned.

C)the timing will depend on the length of the warranty period.

D)in the period when the payment for the sale is received.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

52

What entry is required when a business estimates warranty payable each period based on sales revenue?

A)

B)

C)

D)

A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

53

Bachman Merchandising has ten employees who each earn $180 per day. If they accumulate vacation time at the rate of 1.5 vacation days for each month worked, the amount of vacation benefits that should be accrued for the group at the end of the month is:

A)$1,800.

B)$180.

C)$270.

D)$2,700.

A)$1,800.

B)$180.

C)$270.

D)$2,700.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

54

Warranty expense is debited in the period that:

A)the product is repaired.

B)the product is sold.

C)the cash is collected from the customer.

D)either the product is sold or the cash is collected.

A)the product is repaired.

B)the product is sold.

C)the cash is collected from the customer.

D)either the product is sold or the cash is collected.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

55

The matching objective requires that companies record warranty expense at the time the repair is made.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

56

Sales revenue for Booker Company for 2019 amounted to $800,000. The products sold carry a six-month warranty. Management estimates the cost of the warranty to be 3% of sales revenue. Booker should:

A)debit Warranty Expense in 2019 for $24,000.

B)debit Estimated Warranty Payable in 2019 for $24,000.

C)debit Warranty Expense when the products are repaired or replaced in either 2019 or 2020.

D)credit Estimated Warranty Payable in either 2019 or 2020 when the products are repaired or replaced.

A)debit Warranty Expense in 2019 for $24,000.

B)debit Estimated Warranty Payable in 2019 for $24,000.

C)debit Warranty Expense when the products are repaired or replaced in either 2019 or 2020.

D)credit Estimated Warranty Payable in either 2019 or 2020 when the products are repaired or replaced.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

57

A corporation's journal entry to accrue income tax owed at year end includes a debit to income tax payable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

58

Because contingent liabilities are not real liabilities, they are easy to overlook.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

59

All of the following are estimated liabilities except:

A)corporate income tax payable.

B)vacation pay payable.

C)employee income tax payable.

D)warranty payable.

A)corporate income tax payable.

B)vacation pay payable.

C)employee income tax payable.

D)warranty payable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

60

The law requires most employers to provide a minimum number of weeks holiday per year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

61

Accruing warranty expense is prescribed by the:

A)recognition criteria for revenues.

B)matching objective.

C)full-disclosure principle.

D)going-concern assumption.

A)recognition criteria for revenues.

B)matching objective.

C)full-disclosure principle.

D)going-concern assumption.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

62

A contingent liability that is likely and can be reasonably estimated should be:

A)disclosed in a note to the financial statements.

B)accrued with a journal entry.

C)either disclosed in a note or accrued with a journal entry.

D)ignored until the liability materializes.

A)disclosed in a note to the financial statements.

B)accrued with a journal entry.

C)either disclosed in a note or accrued with a journal entry.

D)ignored until the liability materializes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

63

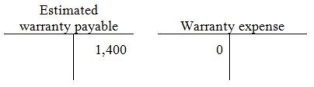

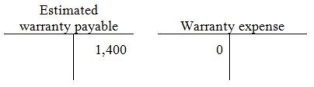

Table 11-13

Arc Digital starts the year with balances in its Estimated warranty payable account and Warranty expense account as shown below. During the year, there were $190,000 of sales and $3,200 of warranty repair payments. Arc Digital estimates warranty expense at 1.5% of sales.

Refer to Table 11-13. At the end of the year, what was the balance in the estimated warranty payable account?

A)$2,850 debit

B)$1,050 credit

C)$3,200 debit

D)$1,420 debit

Arc Digital starts the year with balances in its Estimated warranty payable account and Warranty expense account as shown below. During the year, there were $190,000 of sales and $3,200 of warranty repair payments. Arc Digital estimates warranty expense at 1.5% of sales.

Refer to Table 11-13. At the end of the year, what was the balance in the estimated warranty payable account?

A)$2,850 debit

B)$1,050 credit

C)$3,200 debit

D)$1,420 debit

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

64

Vacation pay expense should be debited:

A)when the employee takes vacation.

B)when the employee has performed a service to the company and earned the vacation.

C)is never debited.

D)when the employee returns from vacation.

A)when the employee takes vacation.

B)when the employee has performed a service to the company and earned the vacation.

C)is never debited.

D)when the employee returns from vacation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

65

A contingent liability that has a remote chance of occurrence and an uncertain amount should be:

A)disclosed in a note to the financial statements.

B)accrued with a journal entry.

C)either disclosed in a note or accrued with a journal entry.

D)ignored until the liability materializes.

A)disclosed in a note to the financial statements.

B)accrued with a journal entry.

C)either disclosed in a note or accrued with a journal entry.

D)ignored until the liability materializes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

66

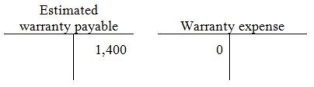

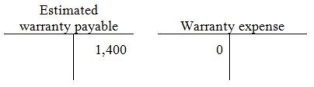

Table 11-13

Arc Digital starts the year with balances in its Estimated warranty payable account and Warranty expense account as shown below. During the year, there were $190,000 of sales and $3,200 of warranty repair payments. Arc Digital estimates warranty expense at 1.5% of sales.

Refer to Table 11-13. At the end of the year, what was the balance in the warranty expense account?

A)$2,850 debit

B)$1,250 credit

C)$3,200 debit

D)$1,420 debit

Arc Digital starts the year with balances in its Estimated warranty payable account and Warranty expense account as shown below. During the year, there were $190,000 of sales and $3,200 of warranty repair payments. Arc Digital estimates warranty expense at 1.5% of sales.

Refer to Table 11-13. At the end of the year, what was the balance in the warranty expense account?

A)$2,850 debit

B)$1,250 credit

C)$3,200 debit

D)$1,420 debit

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

67

BCB Corporation has made 11 monthly payments totaling $160,000 for its estimated annual income tax. At year end, income tax expense for BCB Corporation amounts to $185,000. The adjusting entry will involve a:

A)debit to Income Tax Payable for $25,000.

B)debit to Income Tax Expense for $185,000.

C)debit to Income Tax Expense for $25,000.

D)credit to Income Tax Payable for $185,000.

A)debit to Income Tax Payable for $25,000.

B)debit to Income Tax Expense for $185,000.

C)debit to Income Tax Expense for $25,000.

D)credit to Income Tax Payable for $185,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

68

Franconia Sales offers warranties on all their electronic goods. Warranty expense is estimated at 2% of sales revenue. In 2019, Franconia had $500,000 of sales. In the same year, Franconia paid out $7,500 of warranty payments. Which of the following is the entry needed to record the disbursement of warranty payments?

A)

B)

C)

D)

A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

69

A contingent gain that is likely and can be reasonably estimated should be:

A)disclosed in a note to the financial statements.

B)accrued with a journal entry.

C)either disclosed in a note or accrued with a journal entry.

D)ignored until the actual gain materializes.

A)disclosed in a note to the financial statements.

B)accrued with a journal entry.

C)either disclosed in a note or accrued with a journal entry.

D)ignored until the actual gain materializes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

70

Franconia Sales offers warranties on all their electronic goods. Warranty expense is estimated at 2% of sales revenue. In 2019, Franconia had $500,000 of sales. In the same year, Franconia paid out $7,500 of warranty payments. Which of the following is the entry needed to record the estimated warranty expense?

A)

B)

C)

D)

A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck