Deck 5: Merchandising Operations and the Accounting Cycle

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

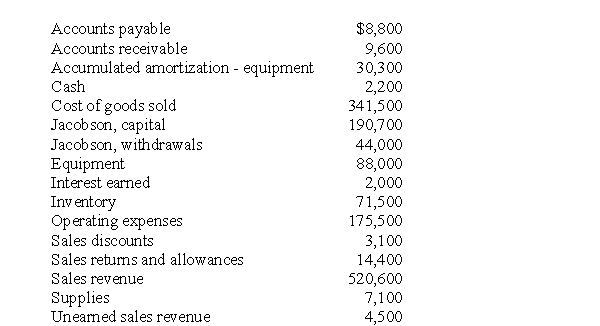

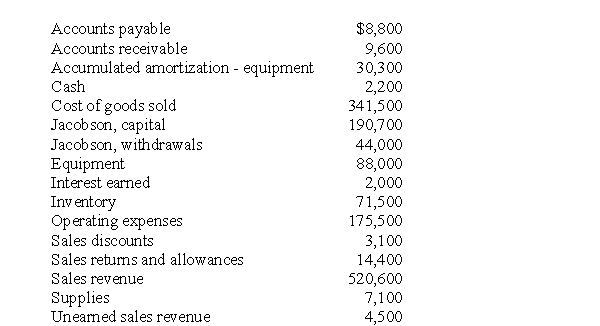

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/179

العب

ملء الشاشة (f)

Deck 5: Merchandising Operations and the Accounting Cycle

1

FOB shipping point means that the title to the goods passes to the purchaser upon receipt of the goods and the seller is responsible for the cost of the freight.

False

2

The entry to record the return of $250 of inventory to a supplier under the perpetual inventory system is recorded with a debit to:

A)Accounts Payable and a credit to Purchases Discounts.

B)Purchases Returns and Allowances and a credit to Accounts Payable.

C)Accounts Payable and a credit to Inventory.

D)Inventory and a credit to Accounts Payable.

A)Accounts Payable and a credit to Purchases Discounts.

B)Purchases Returns and Allowances and a credit to Accounts Payable.

C)Accounts Payable and a credit to Inventory.

D)Inventory and a credit to Accounts Payable.

C

3

Gross margin minus expenses equals gross profit.

False

4

Inventory includes all goods that the company owns and expects to use in normal operations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 179 في هذه المجموعة.

فتح الحزمة

k this deck

5

The entry to record the purchase of inventory on account in a perpetual inventory system includes a debit to the Purchases account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 179 في هذه المجموعة.

فتح الحزمة

k this deck

6

Purchase returns of merchandise decrease the liability to a creditor.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 179 في هذه المجموعة.

فتح الحزمة

k this deck

7

Net sales is equal to sales revenue plus sales returns and minus sales discounts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 179 في هذه المجموعة.

فتح الحزمة

k this deck

8

When the seller accepts a return of undamaged goods from the purchaser, the seller's journal entries would include two entries, if they are using a perpetual inventory system.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 179 في هذه المجموعة.

فتح الحزمة

k this deck

9

In a purchase discount, the larger the quantity of merchandise purchased, the lower the price per item.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 179 في هذه المجموعة.

فتح الحزمة

k this deck

10

What is the difference between a sales return and a sales allowance?

A)A sales return reduces the amount receivable from the customer, but an allowance does not.

B)A sales return involves an adjustment to Inventory, but a sales allowance does not.

C)A sales return requires a debit to Sales returns and allowances, but a sales allowance does not.

D)A sales allowance is deducted from Sales revenue to calculate net sales, but a sales return is not.

A)A sales return reduces the amount receivable from the customer, but an allowance does not.

B)A sales return involves an adjustment to Inventory, but a sales allowance does not.

C)A sales return requires a debit to Sales returns and allowances, but a sales allowance does not.

D)A sales allowance is deducted from Sales revenue to calculate net sales, but a sales return is not.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 179 في هذه المجموعة.

فتح الحزمة

k this deck

11

Inventory is a current liability on the balance sheet.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 179 في هذه المجموعة.

فتح الحزمة

k this deck

12

Gross margin is equal to net sales plus cost of goods sold.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 179 في هذه المجموعة.

فتح الحزمة

k this deck

13

Sales discounts is a contra account and has a normal credit balance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 179 في هذه المجموعة.

فتح الحزمة

k this deck

14

Credit terms of 1/15 n/30 means the purchaser can deduct 1% of the invoice price if paid within 15 days.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 179 في هذه المجموعة.

فتح الحزمة

k this deck

15

Cost of goods sold is an operating expense.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 179 في هذه المجموعة.

فتح الحزمة

k this deck

16

Define gross margin and operating income. Explain how they are used in evaluating a company.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 179 في هذه المجموعة.

فتح الحزمة

k this deck

17

A seller requesting payment will send the purchaser a purchase order.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 179 في هذه المجموعة.

فتح الحزمة

k this deck

18

Sales revenue minus sales returns and allowances and sales discounts equals:

A)gross margin.

B)income from operations.

C)cost of goods sold.

D)net sales.

A)gross margin.

B)income from operations.

C)cost of goods sold.

D)net sales.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 179 في هذه المجموعة.

فتح الحزمة

k this deck

19

Sales revenue and Net sales are synonymous terms.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 179 في هذه المجموعة.

فتح الحزمة

k this deck

20

Quantity discounts offered by suppliers for large shipments of inventory are always recorded separately.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 179 في هذه المجموعة.

فتح الحزمة

k this deck

21

Using a perpetual inventory system, the entry to record the purchase of merchandise on account involves a:

A)debit to Inventory.

B)debit to Accounts Payable.

C)credit to Inventory.

D)credit to Cash.

A)debit to Inventory.

B)debit to Accounts Payable.

C)credit to Inventory.

D)credit to Cash.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 179 في هذه المجموعة.

فتح الحزمة

k this deck

22

Credit terms of 1/10 n/30 indicates that the buyer is:

A)allowed a 10% discount if payment is made within 30 days.

B)allowed a 1% discount if payment is made within 10 days.

C)allowed a 1% discount if payment is made within 30 days.

D)allowed a 30% discount if payment is made within 10 days.

A)allowed a 10% discount if payment is made within 30 days.

B)allowed a 1% discount if payment is made within 10 days.

C)allowed a 1% discount if payment is made within 30 days.

D)allowed a 30% discount if payment is made within 10 days.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 179 في هذه المجموعة.

فتح الحزمة

k this deck

23

If the shipping terms are FOB shipping point and the freight bill is $200, the purchaser, using a perpetual inventory system would record payment of the freight with a debit to:

A)Inventory and credit to Cash for $200.

B)Accounts Payable and credit to Inventory for $200.

C)Inventory and credit to Purchases Discounts for $200.

D)Purchases Discounts and credit to Inventory for $200.

A)Inventory and credit to Cash for $200.

B)Accounts Payable and credit to Inventory for $200.

C)Inventory and credit to Purchases Discounts for $200.

D)Purchases Discounts and credit to Inventory for $200.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 179 في هذه المجموعة.

فتح الحزمة

k this deck

24

When a discount is taken for prompt payment under a perpetual inventory system, the purchaser would credit:

A)Accounts Payable.

B)Accounts Receivable.

C)Purchases Discounts.

D)Inventory.

A)Accounts Payable.

B)Accounts Receivable.

C)Purchases Discounts.

D)Inventory.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 179 في هذه المجموعة.

فتح الحزمة

k this deck

25

When the buyer pays the freight costs, the entry to record the payment under a perpetual inventory system would include a debit to:

A)Delivery Expense.

B)Purchases Discounts.

C)Inventory.

D)Freight In.

A)Delivery Expense.

B)Purchases Discounts.

C)Inventory.

D)Freight In.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 179 في هذه المجموعة.

فتح الحزمة

k this deck

26

Day Company purchased $3,000 of merchandise on credit, terms 3/15 n/30. The entry to record payment for the merchandise within the discount period under a perpetual inventory system would include a:

A)debit to Inventory of $1,940.

B)debit to Accounts Payable of $1,940.

C)credit to Purchase Discounts of $90.

D)credit to Inventory of $90.

A)debit to Inventory of $1,940.

B)debit to Accounts Payable of $1,940.

C)credit to Purchase Discounts of $90.

D)credit to Inventory of $90.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 179 في هذه المجموعة.

فتح الحزمة

k this deck

27

A company makes a purchase of $2,000 of inventory, subject to credit terms of 3/10 n/45 and returns $500 of inventory prior to payment. What is the amount of the payment assuming payment is made within the discount period?

A)$1,500

B)$1,455

C)$1,440

D)$1,560

A)$1,500

B)$1,455

C)$1,440

D)$1,560

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 179 في هذه المجموعة.

فتح الحزمة

k this deck

28

Which of the following credit terms allows for a cash discount?

A)n/30

B)n/eom

C)n/60

D)1/10 n/30

A)n/30

B)n/eom

C)n/60

D)1/10 n/30

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 179 في هذه المجموعة.

فتح الحزمة

k this deck

29

Mars Company purchased $2,500 of merchandise on account, terms 3/10 n/60. If payment was made within the discount period, the entry to record the payment under a perpetual inventory system would include a credit to:

A)Cash of $2,425.

B)Inventory of $2,352.

C)Accounts Payable of $2,400.

D)Cash for $2,400.

A)Cash of $2,425.

B)Inventory of $2,352.

C)Accounts Payable of $2,400.

D)Cash for $2,400.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 179 في هذه المجموعة.

فتح الحزمة

k this deck

30

The seller is responsible for the shipping costs when the shipping terms are:

A)FOB destination.

B)COD destination.

C)FOB shipping point.

D)COD shipping point.

A)FOB destination.

B)COD destination.

C)FOB shipping point.

D)COD shipping point.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 179 في هذه المجموعة.

فتح الحزمة

k this deck

31

When the seller accepts a return of goods from the purchaser originally sold on account, the seller's journal entry would include a debit to:

A)Sales Discounts and credit to Cash.

B)Sales Returns and Allowances and credit to Accounts Receivable.

C)Sales Returns and Allowances and credit to Sales Discounts.

D)Sales Revenue and credit to Cash.

A)Sales Discounts and credit to Cash.

B)Sales Returns and Allowances and credit to Accounts Receivable.

C)Sales Returns and Allowances and credit to Sales Discounts.

D)Sales Revenue and credit to Cash.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 179 في هذه المجموعة.

فتح الحزمة

k this deck

32

The buyer is responsible for the shipping costs when the shipping terms are:

A)FOB destination.

B)COD destination.

C)FOB shipping point.

D)COD shipping point.

A)FOB destination.

B)COD destination.

C)FOB shipping point.

D)COD shipping point.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 179 في هذه المجموعة.

فتح الحزمة

k this deck

33

The entry to record the sale of merchandise for cash includes a:

A)debit to Accounts Receivable.

B)credit to Sales Discounts.

C)debit to Sales Revenue.

D)credit to Sales Revenue.

A)debit to Accounts Receivable.

B)credit to Sales Discounts.

C)debit to Sales Revenue.

D)credit to Sales Revenue.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 179 في هذه المجموعة.

فتح الحزمة

k this deck

34

A merchandiser purchases inventory on account under a perpetual inventory system with terms of 2/10 n/30. The merchandiser would:

A)credit Inventory on date of payment if the discount is taken.

B)credit Inventory on date of payment if the discount is not taken.

C)credit Purchases Discounts on date of purchase if the discount is taken.

D)debit Purchases Discounts on date of purchase if the discount is not taken.

A)credit Inventory on date of payment if the discount is taken.

B)credit Inventory on date of payment if the discount is not taken.

C)credit Purchases Discounts on date of purchase if the discount is taken.

D)debit Purchases Discounts on date of purchase if the discount is not taken.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 179 في هذه المجموعة.

فتح الحزمة

k this deck

35

When the seller is liable for the shipping costs, the payment for the freight in the seller's accounts is recorded with a debit to:

A)Delivery Expense or Freight Out.

B)Freight In.

C)Inventory.

D)Cash.

A)Delivery Expense or Freight Out.

B)Freight In.

C)Inventory.

D)Cash.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 179 في هذه المجموعة.

فتح الحزمة

k this deck

36

Under a perpetual inventory system, the entry to record the cost of goods sold would include a debit to:

A)Cost of Goods Sold and a credit to Inventory for the retail price of the inventory.

B)Inventory and a credit to Sales Revenue for the retail price of the inventory.

C)Cost of Goods Sold and a credit to Inventory for the cost of the inventory.

D)Inventory and a credit to Cost of Goods Sold for the cost of the inventory.

A)Cost of Goods Sold and a credit to Inventory for the retail price of the inventory.

B)Inventory and a credit to Sales Revenue for the retail price of the inventory.

C)Cost of Goods Sold and a credit to Inventory for the cost of the inventory.

D)Inventory and a credit to Cost of Goods Sold for the cost of the inventory.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 179 في هذه المجموعة.

فتح الحزمة

k this deck

37

If a purchaser returns goods purchased on account to the supplier under a perpetual inventory system, the purchaser would debit:

A)Inventory and credit Accounts Payable.

B)Accounts Payable and credit Inventory.

C)Inventory and credit Accounts Receivable.

D)Accounts Receivable and credit Inventory.

A)Inventory and credit Accounts Payable.

B)Accounts Payable and credit Inventory.

C)Inventory and credit Accounts Receivable.

D)Accounts Receivable and credit Inventory.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 179 في هذه المجموعة.

فتح الحزمة

k this deck

38

A purchase return or allowance under a perpetual inventory system is credited to:

A)Accounts Payable.

B)Purchase Returns and Allowances.

C)Inventory.

D)Purchases.

A)Accounts Payable.

B)Purchase Returns and Allowances.

C)Inventory.

D)Purchases.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 179 في هذه المجموعة.

فتح الحزمة

k this deck

39

Under a perpetual inventory system, the entry to record a sale on account would include a debit to:

A)Accounts Receivable and a credit to Sales Revenue for the retail price of the inventory.

B)Inventory and a credit to Sales Revenue for the retail price of the inventory.

C)Cost of Goods Sold and a credit to Inventory for the retail price of the inventory.

D)Accounts Receivable and a credit to Sales Revenue for the cost of the inventory.

A)Accounts Receivable and a credit to Sales Revenue for the retail price of the inventory.

B)Inventory and a credit to Sales Revenue for the retail price of the inventory.

C)Cost of Goods Sold and a credit to Inventory for the retail price of the inventory.

D)Accounts Receivable and a credit to Sales Revenue for the cost of the inventory.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 179 في هذه المجموعة.

فتح الحزمة

k this deck

40

Green Company purchased $3,600 of merchandise on account, terms 2/10 n/30. If payment was made after the expiration of the discount period and a perpetual inventory system is used, the entry to record the payment would include a:

A)credit to Inventory of $3,600.

B)credit to Cash of $3,528.

C)credit to Cash of $3,600.

D)debit to Accounts Payable of $3,528.

A)credit to Inventory of $3,600.

B)credit to Cash of $3,528.

C)credit to Cash of $3,600.

D)debit to Accounts Payable of $3,528.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 179 في هذه المجموعة.

فتح الحزمة

k this deck

41

The entries to record a $5,000 cash sale under a perpetual inventory system, when the cost of the merchandise is $3,200, include a:

A)debit to Inventory for $5,000.

B)debit to Sales Revenue for $5,000.

C)credit to Cost of Goods Sold for $3,200.

D)debit to Cost of Goods Sold for $3,200.

A)debit to Inventory for $5,000.

B)debit to Sales Revenue for $5,000.

C)credit to Cost of Goods Sold for $3,200.

D)debit to Cost of Goods Sold for $3,200.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 179 في هذه المجموعة.

فتح الحزمة

k this deck

42

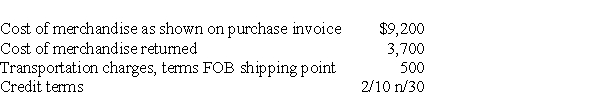

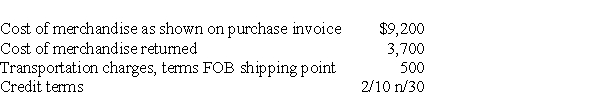

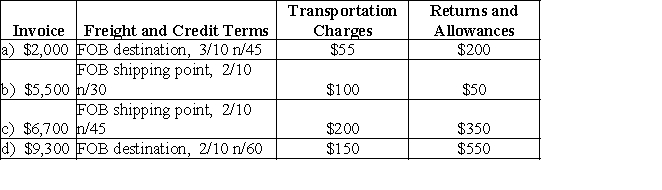

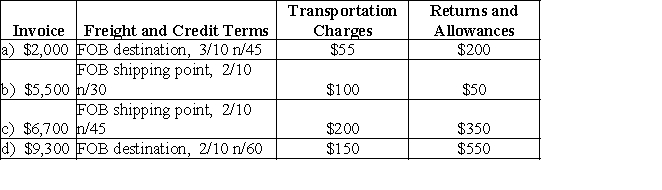

Details of a purchase invoice, credit terms, and a purchase return are shown below. Assume the credit memo was received and payment made within the discount period.  Compute the following:

Compute the following:

a)amount of discount

b)amount paid by purchaser, within the discount period, including freight, if applicable

c)amount paid by purchaser if paid after expiration of discount including freight, if applicable

Compute the following:

Compute the following:a)amount of discount

b)amount paid by purchaser, within the discount period, including freight, if applicable

c)amount paid by purchaser if paid after expiration of discount including freight, if applicable

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 179 في هذه المجموعة.

فتح الحزمة

k this deck

43

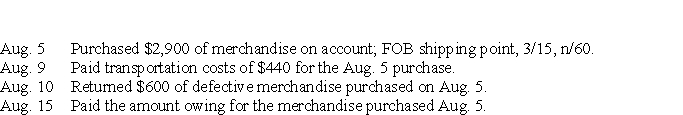

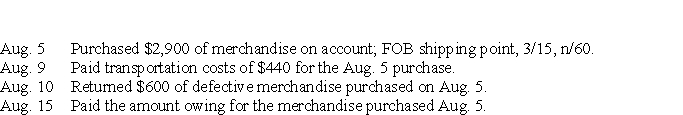

Table 5-9

Reid Art Supply Company uses a perpetual inventory system. The company had the following transactions during August, 2019:

Record the August journal entries for Reid Art Supply.

Reid Art Supply Company uses a perpetual inventory system. The company had the following transactions during August, 2019:

Record the August journal entries for Reid Art Supply.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 179 في هذه المجموعة.

فتح الحزمة

k this deck

44

The entries to record a $4,500 sale on account under a perpetual inventory system, when the cost of the merchandise is $3,000, include a:

A)debit to Inventory for $3,000.

B)credit to Sales Revenue for $3,000.

C)debit to Sales Revenue for $4,500.

D)credit to Inventory for $3,000.

A)debit to Inventory for $3,000.

B)credit to Sales Revenue for $3,000.

C)debit to Sales Revenue for $4,500.

D)credit to Inventory for $3,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 179 في هذه المجموعة.

فتح الحزمة

k this deck

45

Tobermory Merchandising had the following transactions during May:

May 5 Purchased $2,700 of merchandise on account, terms 3/15 n/60, FOB shipping point.

9 Paid transportation cost on the May 5 purchase, $250.

10 Returned $400 of defective merchandise purchased on May 5.

15 Paid for the May 5 purchase, less the return and the discount.

Required:

Assuming the perpetual inventory system is used, prepare the journal entries to record the above transactions.

May 5 Purchased $2,700 of merchandise on account, terms 3/15 n/60, FOB shipping point.

9 Paid transportation cost on the May 5 purchase, $250.

10 Returned $400 of defective merchandise purchased on May 5.

15 Paid for the May 5 purchase, less the return and the discount.

Required:

Assuming the perpetual inventory system is used, prepare the journal entries to record the above transactions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 179 في هذه المجموعة.

فتح الحزمة

k this deck

46

Under a perpetual inventory system, the entry to record the return of inventory sold on account for $360 with a cost of $210 would be recorded by the seller as a:

A)credit to Accounts Receivable for $210.

B)credit to Sales Returns and Allowances for $210.

C)debit to Sales Revenue for $360.

D)debit to Inventory for $210.

A)credit to Accounts Receivable for $210.

B)credit to Sales Returns and Allowances for $210.

C)debit to Sales Revenue for $360.

D)debit to Inventory for $210.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 179 في هذه المجموعة.

فتح الحزمة

k this deck

47

Details of purchase invoices including shipping terms, credit terms, and returns appear below. Compute the total amount to be paid in full settlement of each invoice, assuming that credit for returns is granted before the expiration of the discount period and payment is made within the discount period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 179 في هذه المجموعة.

فتح الحزمة

k this deck

48

To update the inventory records for the sale of merchandise under a perpetual inventory system, the entry would include a:

A)credit to Inventory.

B)debit to Accounts Payable.

C)debit to Sales Revenue.

D)credit to Cost of Goods Sold.

A)credit to Inventory.

B)debit to Accounts Payable.

C)debit to Sales Revenue.

D)credit to Cost of Goods Sold.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 179 في هذه المجموعة.

فتح الحزمة

k this deck

49

To update the inventory records for the sale of merchandise under a perpetual inventory system, the entry would include a:

A)debit to Inventory.

B)credit to Accounts Payable.

C)debit to Sales Revenue.

D)debit to Cost of Goods Sold.

A)debit to Inventory.

B)credit to Accounts Payable.

C)debit to Sales Revenue.

D)debit to Cost of Goods Sold.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 179 في هذه المجموعة.

فتح الحزمة

k this deck

50

Romeo Merchandising had the following transactions in June. Prepare journal entries for these transactions assuming Romeo uses a perpetual inventory system.

June 2 Romeo received an $18,000 invoice from one of its suppliers. Terms

were 2/10 n/30, FOB shipping point. Romeo paid the freight bill

amounting to $2,000.

4 Romeo returned $2,500 of the merchandise billed on June 2 because it

was defective.

5 Romeo sold $8,000 of merchandise on account, terms 3/15 n/30.

The cost of the merchandise sold was $5,100.

10 Romeo paid the invoice dated June 2, less the return and the discount.

15 A customer returned $2,500 of merchandise sold on June 5. The cost of

the returned merchandise that was placed back in inventory was $1,450.

19 Romeo received payment on the remaining amount due from the sale of

June 5, less the return and the discount.

June 2 Romeo received an $18,000 invoice from one of its suppliers. Terms

were 2/10 n/30, FOB shipping point. Romeo paid the freight bill

amounting to $2,000.

4 Romeo returned $2,500 of the merchandise billed on June 2 because it

was defective.

5 Romeo sold $8,000 of merchandise on account, terms 3/15 n/30.

The cost of the merchandise sold was $5,100.

10 Romeo paid the invoice dated June 2, less the return and the discount.

15 A customer returned $2,500 of merchandise sold on June 5. The cost of

the returned merchandise that was placed back in inventory was $1,450.

19 Romeo received payment on the remaining amount due from the sale of

June 5, less the return and the discount.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 179 في هذه المجموعة.

فتح الحزمة

k this deck

51

A merchandiser received payment in full within the discount period on a $5,000 sales invoice, terms 2/15 n/30. The journal entry would include a:

A)debit to Cash for $5,000.

B)credit to Accounts Receivable for $5,000.

C)credit to Accounts Receivable for $4,900.

D)credit to Sales Discounts for $100.

A)debit to Cash for $5,000.

B)credit to Accounts Receivable for $5,000.

C)credit to Accounts Receivable for $4,900.

D)credit to Sales Discounts for $100.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 179 في هذه المجموعة.

فتح الحزمة

k this deck

52

Under a perpetual inventory system, the entry to record the return of inventory sold on account for $250 with a cost of $185 would be recorded by the seller as a:

A)debit to Accounts Receivable for $250.

B)debit to Sales Returns and Allowances for $185.

C)credit to Sales Revenue for $250.

D)credit to Cost of Goods Sold for $185.

A)debit to Accounts Receivable for $250.

B)debit to Sales Returns and Allowances for $185.

C)credit to Sales Revenue for $250.

D)credit to Cost of Goods Sold for $185.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 179 في هذه المجموعة.

فتح الحزمة

k this deck

53

Under a perpetual inventory system, the entries to record a $3,400 sales return for undamaged goods on an original cash sale when the merchandise had a cost of $1,500 include a debit to:

A)Accounts Receivable of $3,400.

B)Cost of Goods Sold of $1,500.

C)Sales Returns and Allowances of $1,500.

D)Inventory of $1,500.

A)Accounts Receivable of $3,400.

B)Cost of Goods Sold of $1,500.

C)Sales Returns and Allowances of $1,500.

D)Inventory of $1,500.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 179 في هذه المجموعة.

فتح الحزمة

k this deck

54

The adjusting entry to record inventory shrinkage would include a debit to the cost of goods sold account in a perpetual inventory system.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 179 في هذه المجموعة.

فتح الحزمة

k this deck

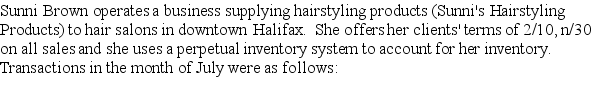

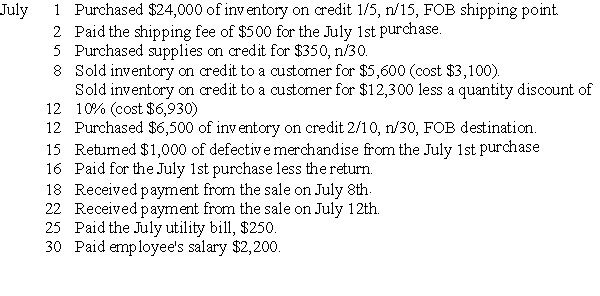

55

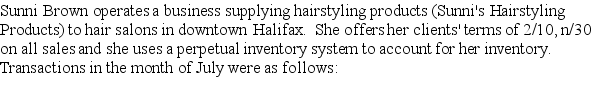

Table 5-10

Refer to Table 5-10. Record the July transactions in the general journal.

Refer to Table 5-10. Record the July transactions in the general journal.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 179 في هذه المجموعة.

فتح الحزمة

k this deck

56

Which of the following is true about freight in?

A)Freight in is added to the cost of merchandise inventory.

B)Freight in is a selling expense.

C)Freight in is an operating expense.

D)Freight in is deducted from Accounts payable.

A)Freight in is added to the cost of merchandise inventory.

B)Freight in is a selling expense.

C)Freight in is an operating expense.

D)Freight in is deducted from Accounts payable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 179 في هذه المجموعة.

فتح الحزمة

k this deck

57

Michelin Jewellers completed the following transactions. Michelin Jewellers uses the perpetual inventory system. On April 2, Michelin sold $9,000 of merchandise to a customer on account with terms of 3/15, n/30. Michelin's cost of the merchandise sold was $5,500. On April 4, the customer reported damaged goods and Michelin granted a $1,000 sales allowance. On April 10, Michelin received payment from the customer. Which of the following entries correctly records the cash receipt on Michelin's books?

A)

B)

C)

D)

A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 179 في هذه المجموعة.

فتح الحزمة

k this deck

58

A merchandiser received payment in full after the expiration of the discount period on a $3,000 sales invoice, terms 3/15 n/30. The journal entry would include a:

A)debit to Cash for $2,910.

B)credit to Accounts Receivable for $2,910.

C)debit to Sales Discount of $90.

D)debit to Cash for $3,000.

A)debit to Cash for $2,910.

B)credit to Accounts Receivable for $2,910.

C)debit to Sales Discount of $90.

D)debit to Cash for $3,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 179 في هذه المجموعة.

فتح الحزمة

k this deck

59

Under a perpetual inventory system, the entries to record a $2,600 sales return of undamaged goods for a sale originally made on account, when the merchandise had a cost of $1,200, include a:

A)debit to Inventory of $1,200.

B)debit to Sales Returns and Allowances of $1,200.

C)credit to Cost of Goods Sold of $2,600.

D)credit to Sales Returns and Allowances of $1,200.

A)debit to Inventory of $1,200.

B)debit to Sales Returns and Allowances of $1,200.

C)credit to Cost of Goods Sold of $2,600.

D)credit to Sales Returns and Allowances of $1,200.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 179 في هذه المجموعة.

فتح الحزمة

k this deck

60

Eastern Outfitters sold $2,500 of inventory to a customer on account, terms 3/15 n/40. Freight terms were FOB shipping point and freight charges totalled $150. The entry to record the sale would include a:

A)credit to Accounts Receivable for $2,350.

B)debit to Sales Revenue for $2,500.

C)credit to Sales Revenue for $2,500.

D)debit Accounts Receivable for $2,650.

A)credit to Accounts Receivable for $2,350.

B)debit to Sales Revenue for $2,500.

C)credit to Sales Revenue for $2,500.

D)debit Accounts Receivable for $2,650.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 179 في هذه المجموعة.

فتح الحزمة

k this deck

61

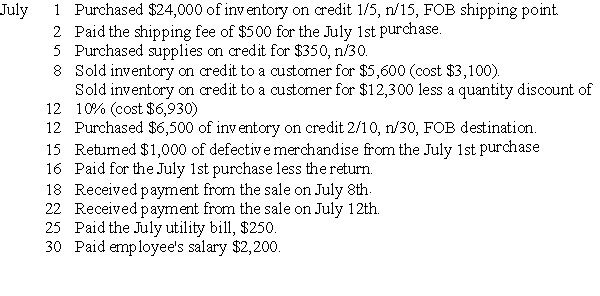

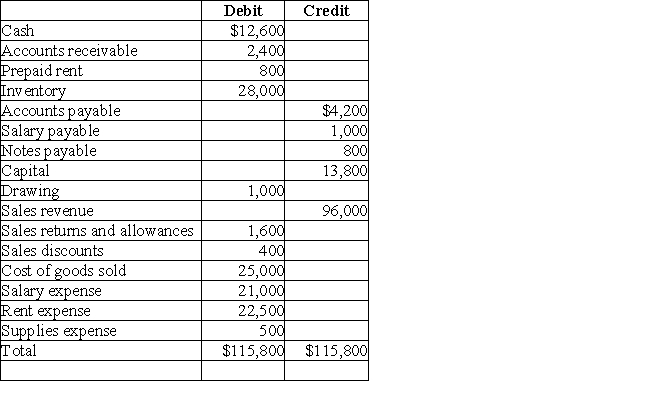

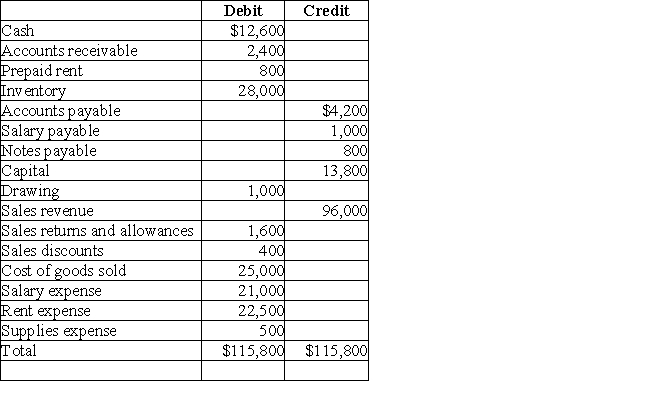

Table 5-10

The December 31, 2019 adjusted trial balance for Camptown Company is shown below.

Using the information from Table 5-10 prepare an income statement in single-step format and the closing entries for Camptown Company.

The December 31, 2019 adjusted trial balance for Camptown Company is shown below.

Using the information from Table 5-10 prepare an income statement in single-step format and the closing entries for Camptown Company.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 179 في هذه المجموعة.

فتح الحزمة

k this deck

62

Under a perpetual inventory system, which accounts would be closed to Income Summary with credits?

A)Sales Returns and Allowances, Sales Revenue, and Inventory

B)Sales Discounts, Sales Returns and Allowances, and Cost of Goods Sold

C)Sales Revenue and Cost of Goods Sold

D)Sales Returns and Allowances and Sales Revenue

A)Sales Returns and Allowances, Sales Revenue, and Inventory

B)Sales Discounts, Sales Returns and Allowances, and Cost of Goods Sold

C)Sales Revenue and Cost of Goods Sold

D)Sales Returns and Allowances and Sales Revenue

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 179 في هذه المجموعة.

فتح الحزمة

k this deck

63

A single-step format of the income statement will always have fewer sub-totals than the multi-step income statement format.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 179 في هذه المجموعة.

فتح الحزمة

k this deck

64

The adjusting entry required when the inventory counted is greater than the balance in the inventory account has a credit to Cost of Goods Sold.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 179 في هذه المجموعة.

فتح الحزمة

k this deck

65

An adjusted trial balance is shown below. What will the final balance in Capital be after the closing entries?

A)$37,800

B)$12,700

C)$24,000

D)$36,800

A)$37,800

B)$12,700

C)$24,000

D)$36,800

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 179 في هذه المجموعة.

فتح الحزمة

k this deck

66

Table 5-1

-Referring to Table 5-1, what is gross margin?

A)$145,000

B)$105,000

C)$140,000

D)$90,000

-Referring to Table 5-1, what is gross margin?

A)$145,000

B)$105,000

C)$140,000

D)$90,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 179 في هذه المجموعة.

فتح الحزمة

k this deck

67

In the closing entry process, the sales returns and allowances account is debited.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 179 في هذه المجموعة.

فتح الحزمة

k this deck

68

Inventory held by a business is a(n)________ and when sold becomes a(n)________.

A)liability; withdrawal

B)asset; expense

C)liability; asset

D)asset; contra asset

A)liability; withdrawal

B)asset; expense

C)liability; asset

D)asset; contra asset

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 179 في هذه المجموعة.

فتح الحزمة

k this deck

69

Operating expenses are divided into manufacturing expenses and selling expenses on the income statement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 179 في هذه المجموعة.

فتح الحزمة

k this deck

70

The income from operations is presented on both the multi-step and single-step income statements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 179 في هذه المجموعة.

فتح الحزمة

k this deck

71

Which accounts are affected in the closing process under a perpetual inventory system?

A)Gross Margin and Cost of Goods Sold

B)Cost of Goods Sold, Sales Returns and Allowances, and Sales Discounts

C)Gross Margin, Sales Returns and Allowances, and Sales Discounts

D)Operating Expenses, Sales Revenue, and Purchases

A)Gross Margin and Cost of Goods Sold

B)Cost of Goods Sold, Sales Returns and Allowances, and Sales Discounts

C)Gross Margin, Sales Returns and Allowances, and Sales Discounts

D)Operating Expenses, Sales Revenue, and Purchases

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 179 في هذه المجموعة.

فتح الحزمة

k this deck

72

In a perpetual inventory system, the closing entries include a credit to the Inventory account in an amount that equals the ending inventory, and a debit to the Inventory account in an amount that equals the beginning inventory.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 179 في هذه المجموعة.

فتح الحزمة

k this deck

73

A company's ledger shows an Inventory balance of $20,000 and a physical count of the inventory shows $19,000. Which of the following entries is needed to record the shrinkage?

A)

B)

C)

D)

A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 179 في هذه المجموعة.

فتح الحزمة

k this deck

74

The multi-step income statement format shows subtotals to highlight significant relationships.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 179 في هذه المجموعة.

فتح الحزمة

k this deck

75

Underwater Adventures has the following account balances on August 31, 2019:  The following information as at August 31, 2019 was also available:

The following information as at August 31, 2019 was also available:

a. A physical count of items showed $1,200 of supplies on hand.

b. An inventory count showed inventory on hand of $66,400.

c. The equipment has an estimated useful life of eight years and is expected to have no salvage value.

d. Unearned sales revenue of $1,000 was earned.

Required:

1. Prepare the necessary adjusting journal entries at August 31, 2019. For simplicity all operating expenses are combined into a single operating expense account for financial statement purposes. Use the normal account name for the adjusting journal entries.

2. Prepare a classified balance sheet based on adjusted account balances.

The following information as at August 31, 2019 was also available:

The following information as at August 31, 2019 was also available:a. A physical count of items showed $1,200 of supplies on hand.

b. An inventory count showed inventory on hand of $66,400.

c. The equipment has an estimated useful life of eight years and is expected to have no salvage value.

d. Unearned sales revenue of $1,000 was earned.

Required:

1. Prepare the necessary adjusting journal entries at August 31, 2019. For simplicity all operating expenses are combined into a single operating expense account for financial statement purposes. Use the normal account name for the adjusting journal entries.

2. Prepare a classified balance sheet based on adjusted account balances.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 179 في هذه المجموعة.

فتح الحزمة

k this deck

76

Table 5-1

-Referring to Table 5-1, what is net sales revenue?

A)$400,000

B)$445,000

C)$415,000

D)$455,000

-Referring to Table 5-1, what is net sales revenue?

A)$400,000

B)$445,000

C)$415,000

D)$455,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 179 في هذه المجموعة.

فتح الحزمة

k this deck

77

Under a perpetual inventory system, the adjusting entry to account for inventory shrinkage would include a:

A)credit to Miscellaneous Expense.

B)credit to Cost of Goods Sold.

C)credit to Inventory.

D)debit to Miscellaneous Expense.

A)credit to Miscellaneous Expense.

B)credit to Cost of Goods Sold.

C)credit to Inventory.

D)debit to Miscellaneous Expense.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 179 في هذه المجموعة.

فتح الحزمة

k this deck

78

Table 5-1

-Referring to Table 5-1, what is the income from operations?

A)$20,000

B)$55,000

C)$60,000

D)$190,000

-Referring to Table 5-1, what is the income from operations?

A)$20,000

B)$55,000

C)$60,000

D)$190,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 179 في هذه المجموعة.

فتح الحزمة

k this deck

79

The major revenue of a merchandiser is ________ while the major expense(s)is (are)________.

A)sales revenue; cost of goods sold

B)gross margin; operating expenses

C)income from operations; cost of goods sold

D)sales revenue; operating expenses

A)sales revenue; cost of goods sold

B)gross margin; operating expenses

C)income from operations; cost of goods sold

D)sales revenue; operating expenses

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 179 في هذه المجموعة.

فتح الحزمة

k this deck

80

Gross margin minus operating expenses equals income from operations on a multi-step income statement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 179 في هذه المجموعة.

فتح الحزمة

k this deck