Deck 30: Financial Crises, Panics, and Unconventional Monetary Policy

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/95

العب

ملء الشاشة (f)

Deck 30: Financial Crises, Panics, and Unconventional Monetary Policy

1

During the 2008/09 recession, the Fed bailed out 25 percent of banks to keep them solvent.

False

2

Having a pre-commitment strategy gives the Fed the ability to alter the Fed funds rate when needed.

False

3

The bursting of the stock market bubble was one of the contributing factors to the 2008 crisis.

True

4

A bank that is liquid:

A)has assets that can be readily converted into cash and money.

B)has sufficient assets to cover its long-term liabilities.

C)can sell short-term bonds to buy long-term bonds.

D)is diversified in its holdings of financial assets.

A)has assets that can be readily converted into cash and money.

B)has sufficient assets to cover its long-term liabilities.

C)can sell short-term bonds to buy long-term bonds.

D)is diversified in its holdings of financial assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 95 في هذه المجموعة.

فتح الحزمة

k this deck

5

The following is an example of the moral-hazard problem: Homebuyers do not properly evaluate the risks involved in buying a home because they are assuming government will bail them out of a bad mortgage as it has done before.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 95 في هذه المجموعة.

فتح الحزمة

k this deck

6

Government regulations that deal with financial crises tend to become less effective over time.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 95 في هذه المجموعة.

فتح الحزمة

k this deck

7

Why are financial-sector crises scarier than collapses in other sectors of the economy?

A)The financial sector is the biggest sector.

B)Financial-sector crises happen more often than collapses in other sectors.

C)Most people work in the financial sector.

D)If the financial sector fails, it can bring the whole economy down with it.

A)The financial sector is the biggest sector.

B)Financial-sector crises happen more often than collapses in other sectors.

C)Most people work in the financial sector.

D)If the financial sector fails, it can bring the whole economy down with it.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 95 في هذه المجموعة.

فتح الحزمة

k this deck

8

According to the efficient market hypothesis, rational people will not recognize that asset prices are rising too quickly.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 95 في هذه المجموعة.

فتح الحزمة

k this deck

9

An important role of central banks during a financial crisis is:

A)passing new bank regulations.

B)the lender of last resort.

C)closing banks.

D)eliminating bank reserves.

A)passing new bank regulations.

B)the lender of last resort.

C)closing banks.

D)eliminating bank reserves.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 95 في هذه المجموعة.

فتح الحزمة

k this deck

10

The Fed followed a pre-commitment policy when it promised to keep short-term interest rates low for a period of time after the 2008/09 U.S.recession.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 95 في هذه المجموعة.

فتح الحزمة

k this deck

11

According to structural stagnationists there is an argument to be made that the Fed should return to standard monetary policy.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 95 في هذه المجموعة.

فتح الحزمة

k this deck

12

Liquidity is:

A)having assets that can be readily converted into cash.

B)having liabilities that can be readily converted into cash.

C)sufficient assets to cover long-run liabilities.

D)sufficient liabilities to cover long-run assets.

A)having assets that can be readily converted into cash.

B)having liabilities that can be readily converted into cash.

C)sufficient assets to cover long-run liabilities.

D)sufficient liabilities to cover long-run assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 95 في هذه المجموعة.

فتح الحزمة

k this deck

13

When a central bank is acting as a lender of last resort it is:

A)buying long-term Treasury bonds and selling short-term Treasury notes.

B)buying Treasury bills directly from the public.

C)providing banks with Treasury bills for free.

D)providing banks with liquidity to meet their obligations.

A)buying long-term Treasury bonds and selling short-term Treasury notes.

B)buying Treasury bills directly from the public.

C)providing banks with Treasury bills for free.

D)providing banks with liquidity to meet their obligations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 95 في هذه المجموعة.

فتح الحزمة

k this deck

14

Structural stagnationists argue that unconventional monetary policy tools were necessary to restore order in the banking system.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 95 في هذه المجموعة.

فتح الحزمة

k this deck

15

Negative interest rates require that there be inflation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 95 في هذه المجموعة.

فتح الحزمة

k this deck

16

Extrapolative expectations work when prices are rising, but not when prices decline.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 95 في هذه المجموعة.

فتح الحزمة

k this deck

17

What role do almost all economists agree the central bank has in a financial crisis?

A)Contractionary fiscal policy to reduce leverage.

B)Lender of last resort.

C)Expansionary fiscal policy to reduce herding.

D)No role.

A)Contractionary fiscal policy to reduce leverage.

B)Lender of last resort.

C)Expansionary fiscal policy to reduce herding.

D)No role.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 95 في هذه المجموعة.

فتح الحزمة

k this deck

18

One of the roles of the Fed is to be the lender of last resort.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 95 في هذه المجموعة.

فتح الحزمة

k this deck

19

Leveraging can encourage herding behavior.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 95 في هذه المجموعة.

فتح الحزمة

k this deck

20

A financial bailout might make better sense on economic grounds than a bailout of the automotive industry because:

A)automobile companies are less deserving than financial companies.

B)the automobile industry is smaller than the financial industry.

C)the finance industry is necessary for other industries to function.

D)the automobile industry brings problems on itself.

A)automobile companies are less deserving than financial companies.

B)the automobile industry is smaller than the financial industry.

C)the finance industry is necessary for other industries to function.

D)the automobile industry brings problems on itself.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 95 في هذه المجموعة.

فتح الحزمة

k this deck

21

In which two markets did an asset bubble form that led to a financial crisis in 2008?

A)Housing and mortgage-backed securities.

B)Housing and automobiles.

C)Mortgage-backed securities and tulips.

D)South Sea Company and tulips.

A)Housing and mortgage-backed securities.

B)Housing and automobiles.

C)Mortgage-backed securities and tulips.

D)South Sea Company and tulips.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 95 في هذه المجموعة.

فتح الحزمة

k this deck

22

Leverage is best defined as:

A)the practice of buying an asset with borrowed money.

B)using friends inside the banking industry to secure loans.

C)the ability of people without income to secure mortgages.

D)low interest rates at the beginning of the term of a loan that later rise.

A)the practice of buying an asset with borrowed money.

B)using friends inside the banking industry to secure loans.

C)the ability of people without income to secure mortgages.

D)low interest rates at the beginning of the term of a loan that later rise.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 95 في هذه المجموعة.

فتح الحزمة

k this deck

23

The two main causes of an asset price bubble are:

A)herding and leverage.

B)herding and budget deficits.

C)budget surpluses and leverage.

D)herding and budget surpluses.

A)herding and leverage.

B)herding and budget deficits.

C)budget surpluses and leverage.

D)herding and budget surpluses.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 95 في هذه المجموعة.

فتح الحزمة

k this deck

24

Which type of expectations can lead to an asset price bubble?

A)Extrapolative

B)Efficient

C)Eeal

D)Inverted

A)Extrapolative

B)Efficient

C)Eeal

D)Inverted

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 95 في هذه المجموعة.

فتح الحزمة

k this deck

25

I invest $100 in stock, and borrow 90 percent of the $100 at 10 percent.The stock price rises by 20 percent.The rate of return on my investment is:

A)10 percent.

B)90 percent.

C)110 percent.

D)100 percent.

A)10 percent.

B)90 percent.

C)110 percent.

D)100 percent.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 95 في هذه المجموعة.

فتح الحزمة

k this deck

26

Which of the following was not a direct contributor to the booming housing market in the 2000s?

A)People were expecting housing prices to keep on rising.

B)People could get mortgages with little or no money down.

C)Lending standards became loose.

D)Contractionary policy was passed in2001.

A)People were expecting housing prices to keep on rising.

B)People could get mortgages with little or no money down.

C)Lending standards became loose.

D)Contractionary policy was passed in2001.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 95 في هذه المجموعة.

فتح الحزمة

k this deck

27

When there is unsustainable rapidly rising prices of some type of financial asset, such as stocks, we refer to this as a(n):

A)liquidity trap.

B)asset price bubble.

C)bad-precedent problem.

D)moral-hazard problem.

A)liquidity trap.

B)asset price bubble.

C)bad-precedent problem.

D)moral-hazard problem.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 95 في هذه المجموعة.

فتح الحزمة

k this deck

28

Suppose you work in investments for a financial institution, and other banks are making a fortune with Irish goldmines.The fact that you are more likely to move to invest in Irish goldmines just because you see other banks doing so is called:

A)the law of diminishing control.

B)leverage.

C)herding.

D)diversification.

A)the law of diminishing control.

B)leverage.

C)herding.

D)diversification.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 95 في هذه المجموعة.

فتح الحزمة

k this deck

29

Potential homebuyers expected house prices to continue to rise, which causes others to believe that they will rise even faster.This is an example of:

A)imperfect expectations.

B)heightened expectations.

C)extrapolative expectations.

D)irrational expectations.

A)imperfect expectations.

B)heightened expectations.

C)extrapolative expectations.

D)irrational expectations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 95 في هذه المجموعة.

فتح الحزمة

k this deck

30

If housing prices are rising by 20 percent per year, you can borrow money at 5 percent per year, and you are sure housing prices will continue to rise in the future, you would be wise to:

A)not buy a house because it will leave you in debt.

B)buy as many houses as you can.

C)buy a house if you need a house.

D)sell your house to get out of debt.

A)not buy a house because it will leave you in debt.

B)buy as many houses as you can.

C)buy a house if you need a house.

D)sell your house to get out of debt.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 95 في هذه المجموعة.

فتح الحزمة

k this deck

31

When the Fed loaned to banks using banks' long-run assets such as mortgages as collateral, it was:

A)loosening its regulations of bank.

B)providing banks with liquidity.

C)giving banks assets.

D)conducting standard monetary policy.

A)loosening its regulations of bank.

B)providing banks with liquidity.

C)giving banks assets.

D)conducting standard monetary policy.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 95 في هذه المجموعة.

فتح الحزمة

k this deck

32

Asset price bubbles are not sustainable because:

A)people realize that leverage really doesn't work mathematically.

B)invariably the government steps in to burst the asset price bubble.

C)investors eventually run out of assets with which to purchase the good.

D)they do not reflect an increase in the real productive value of the asset.

A)people realize that leverage really doesn't work mathematically.

B)invariably the government steps in to burst the asset price bubble.

C)investors eventually run out of assets with which to purchase the good.

D)they do not reflect an increase in the real productive value of the asset.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 95 في هذه المجموعة.

فتح الحزمة

k this deck

33

Suppose the people in my town hear a rumor that their local bank is in trouble and all rush to withdraw money from the bank.This is referred to as:

A)leverage.

B)a moral hazard problem.

C)a bad precedent problem.

D)a bank run.

A)leverage.

B)a moral hazard problem.

C)a bad precedent problem.

D)a bank run.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 95 في هذه المجموعة.

فتح الحزمة

k this deck

34

Which of the following was not a contributing factor to the housing market boom of the 2000s?

A)Low interest rates

B)Mortgages with no or little money down

C)The merging of large banks giving them more assets

D)Scant concern given to people's ability to meet the mortgage payment

A)Low interest rates

B)Mortgages with no or little money down

C)The merging of large banks giving them more assets

D)Scant concern given to people's ability to meet the mortgage payment

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 95 في هذه المجموعة.

فتح الحزمة

k this deck

35

Solvency is having:

A)assets that can be readily converted into cash.

B)liabilities that can be readily converted into cash.

C)sufficient assets to cover long-run liabilities.

D)sufficient liabilities to cover long-run assets.

A)assets that can be readily converted into cash.

B)liabilities that can be readily converted into cash.

C)sufficient assets to cover long-run liabilities.

D)sufficient liabilities to cover long-run assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 95 في هذه المجموعة.

فتح الحزمة

k this deck

36

The 2008 financial crisis was caused largely by:

A)a run on banks and other financial institutions.

B)a bursting of the automobile market bubble.

C)a bursting of the housing market bubble.

D)by the inability of the government to issue Treasury bonds.

A)a run on banks and other financial institutions.

B)a bursting of the automobile market bubble.

C)a bursting of the housing market bubble.

D)by the inability of the government to issue Treasury bonds.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 95 في هذه المجموعة.

فتح الحزمة

k this deck

37

Why could leverage lead to an asset price bubble?

A)It allows investors to take advantage of disinflation.

B)It takes advantage of insiders who help outsiders.

C)It increases the ability of people to purchase financial instruments.

D)It takes advantage of extrapolative expectations.

A)It allows investors to take advantage of disinflation.

B)It takes advantage of insiders who help outsiders.

C)It increases the ability of people to purchase financial instruments.

D)It takes advantage of extrapolative expectations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 95 في هذه المجموعة.

فتح الحزمة

k this deck

38

Mortgage -backed securities are financial instruments:

A)that are highly risky.

B)that are extremely safe.

C)whose value depends on the value of mortgages.

D)that are highly leveraged but which offer high returns.

A)that are highly risky.

B)that are extremely safe.

C)whose value depends on the value of mortgages.

D)that are highly leveraged but which offer high returns.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 95 في هذه المجموعة.

فتح الحزمة

k this deck

39

If a financial asset is liquid, it is:

A)considered to be a safe asset with no chance of being deleveraged.

B)an online asset and has no physical piece of paper associated with it.

C)a highly desirable asset.

D)an asset that can easily be converted into cash.

A)considered to be a safe asset with no chance of being deleveraged.

B)an online asset and has no physical piece of paper associated with it.

C)a highly desirable asset.

D)an asset that can easily be converted into cash.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 95 في هذه المجموعة.

فتح الحزمة

k this deck

40

Extrapolative expectations are expectations that:

A)are consistent with trending expectations.

B)a trend will reverse.

C)are consistent with economists' expectations.

D)a trend will continue.

A)are consistent with trending expectations.

B)a trend will reverse.

C)are consistent with economists' expectations.

D)a trend will continue.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 95 في هذه المجموعة.

فتح الحزمة

k this deck

41

Moral hazard is a problem that arises when:

A)people are required to bear the negative consequences of their actions.

B)people don't have to bear the negative consequences of their actions.

C)people benefit from the negative actions of others.

D)government discourages companies from taking risks.

A)people are required to bear the negative consequences of their actions.

B)people don't have to bear the negative consequences of their actions.

C)people benefit from the negative actions of others.

D)government discourages companies from taking risks.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 95 في هذه المجموعة.

فتح الحزمة

k this deck

42

The Glass-Steagall Act was set up to:

A)regulate financial institutions after the Savings and Loan Crisis the 1980s.

B)give the federal government the sole responsibility in carrying out fiscal policy to regulate the economy.

C)establish banking regulations and deposit insurance as a result of the 1930s crisis.

D)regulate the derivatives market as a result of the 2008 crisis.

A)regulate financial institutions after the Savings and Loan Crisis the 1980s.

B)give the federal government the sole responsibility in carrying out fiscal policy to regulate the economy.

C)establish banking regulations and deposit insurance as a result of the 1930s crisis.

D)regulate the derivatives market as a result of the 2008 crisis.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 95 في هذه المجموعة.

فتح الحزمة

k this deck

43

The efficient market hypothesis suggests that:

A)Congress is unable to pass effective laws.

B)the Fed will be unable to pop an asset price bubble.

C)asset price bubbles are a normal part of an economy.

D)asset price bubbles won't occur.

A)Congress is unable to pass effective laws.

B)the Fed will be unable to pop an asset price bubble.

C)asset price bubbles are a normal part of an economy.

D)asset price bubbles won't occur.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 95 في هذه المجموعة.

فتح الحزمة

k this deck

44

Whenever a regulatory system is set up, individuals or firms being regulated will figure out ways to get around these regulations.This is referred to as the law of:

A)diminishing returns.

B)unintended consequences.

C)diminishing control.

D)demand.

A)diminishing returns.

B)unintended consequences.

C)diminishing control.

D)demand.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 95 في هذه المجموعة.

فتح الحزمة

k this deck

45

Which of the following did not contribute to the law of diminishing control?

A)New financial institutions and instruments.

B)Political pressure to reduce regulations.

C)New monetary policy tools.

D)Regulations covered fewer financial instruments.

A)New financial institutions and instruments.

B)Political pressure to reduce regulations.

C)New monetary policy tools.

D)Regulations covered fewer financial instruments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 95 في هذه المجموعة.

فتح الحزمة

k this deck

46

Which is not a measure instituted to offset the moral hazard problem created by the FDIC?

A)Established strict regulations of banks.

B)The creation of the Federal Reserve Bank.

C)Separating banks from other financial institutions.

D)Require financial transactions essential to the economy to remain in banks.

A)Established strict regulations of banks.

B)The creation of the Federal Reserve Bank.

C)Separating banks from other financial institutions.

D)Require financial transactions essential to the economy to remain in banks.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 95 في هذه المجموعة.

فتح الحزمة

k this deck

47

Structural stagnationists believe expansionary monetary policy in the early 2000s:

A)was channeled into asset prices.

B)created far too much inflation.

C)required contractionary fiscal policy.

D)was entirely ineffective in affecting the economy.

A)was channeled into asset prices.

B)created far too much inflation.

C)required contractionary fiscal policy.

D)was entirely ineffective in affecting the economy.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 95 في هذه المجموعة.

فتح الحزمة

k this deck

48

The government has bailed out homeowners who are in danger of foreclosure.However, future homeowners may deduce that the government will again bail them out in the case of future economic turmoil.The government inadvertently has created what is known as:

A)deleveraging.

B)the law of diminishing control.

C)moral hazard.

D)herding.

A)deleveraging.

B)the law of diminishing control.

C)moral hazard.

D)herding.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 95 في هذه المجموعة.

فتح الحزمة

k this deck

49

The efficient market hypothesis suggests that:

A)while individuals can be irrational, collectively they will not.

B)because individuals are rational, collectively they are also rational.

C)irrationality must a part of every economic model.

D)asset price bubbles are efficient.

A)while individuals can be irrational, collectively they will not.

B)because individuals are rational, collectively they are also rational.

C)irrationality must a part of every economic model.

D)asset price bubbles are efficient.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 95 في هذه المجموعة.

فتح الحزمة

k this deck

50

Which of the following is not an example of moral hazard?

A)Investment banks use 40-1 leverage, knowing that if the market collapses, the government will come to the rescue.

B)Domestic automobile companies fail to design high-quality fuel-efficient cars, hoping that the government will save them if oil prices skyrocket.

C)A backcountry skier takes an excessively dangerous run, knowing that local rescue crews will come to his aid if he gets in an accident.

D)Insurance companies stopped offering insurance policies in New Orleans after a major hurricane, knowing the government will offer subsidies to draw people back.

A)Investment banks use 40-1 leverage, knowing that if the market collapses, the government will come to the rescue.

B)Domestic automobile companies fail to design high-quality fuel-efficient cars, hoping that the government will save them if oil prices skyrocket.

C)A backcountry skier takes an excessively dangerous run, knowing that local rescue crews will come to his aid if he gets in an accident.

D)Insurance companies stopped offering insurance policies in New Orleans after a major hurricane, knowing the government will offer subsidies to draw people back.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 95 في هذه المجموعة.

فتح الحزمة

k this deck

51

If a firm or an industry is considered too big to fail, it is

A)unwise to regulate it because the regulation will slow growth.

B)wise to regulate it because the regulation will make it smaller.

C)wise to regulate it because of the moral hazard problem.

D)unwise to regulate it because it is too big.

A)unwise to regulate it because the regulation will slow growth.

B)wise to regulate it because the regulation will make it smaller.

C)wise to regulate it because of the moral hazard problem.

D)unwise to regulate it because it is too big.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 95 في هذه المجموعة.

فتح الحزمة

k this deck

52

To offset the moral hazard problem created by the FDIC, government:

A)created securities to spread the risks.

B)created the Federal Reserve Bank.

C)separated banks from other financial institutions.

D)required individuals to pay a portion of the insurance costs.

A)created securities to spread the risks.

B)created the Federal Reserve Bank.

C)separated banks from other financial institutions.

D)required individuals to pay a portion of the insurance costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 95 في هذه المجموعة.

فتح الحزمة

k this deck

53

Deposit insurance is:

A)private insurance by depositors to guarantee against a bank run that would affect deposits.

B)government insurance that promised to reimburse individuals for loss in the value of deposits.

C)a regulation that limits how much an individual can deposit at a single bank to avoid bank runs.

D)a Federal Reserve Bank regulation that covered deposits by individuals against losses.

A)private insurance by depositors to guarantee against a bank run that would affect deposits.

B)government insurance that promised to reimburse individuals for loss in the value of deposits.

C)a regulation that limits how much an individual can deposit at a single bank to avoid bank runs.

D)a Federal Reserve Bank regulation that covered deposits by individuals against losses.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 95 في هذه المجموعة.

فتح الحزمة

k this deck

54

The FDIC is an example of:

A)the Glass-Steagall Act

B)a Federal Reserve Bank tool.

C)risk premium.

D)deposit insurance.

A)the Glass-Steagall Act

B)a Federal Reserve Bank tool.

C)risk premium.

D)deposit insurance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 95 في هذه المجموعة.

فتح الحزمة

k this deck

55

All of the following are examples of the law of diminishing control that followed banking regulations put in place after the Great Depression except:

A)Banks created new instruments to circumvent the law.

B)Financial business migrated to unregulated institutions.

C)Depositors demanded financial institutions be responsible for their financial decisions.

D)Politicians were pressured to dismantle the regulations.

A)Banks created new instruments to circumvent the law.

B)Financial business migrated to unregulated institutions.

C)Depositors demanded financial institutions be responsible for their financial decisions.

D)Politicians were pressured to dismantle the regulations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 95 في هذه المجموعة.

فتح الحزمة

k this deck

56

Which of the following does not explain why the Glass-Steagall regulations lost their effectiveness?

A)Over time, non-bank financial firms were able to borrow directly from the public, rather than having to borrow from commercial banks.

B)The Federal Reserve created regulations that ran counter to what the government was trying to do.

C)With the advent of new financial instruments, regulated banks lost business to unregulated institutions, and credit began to flow through unregulated systems.

D)As regulations became too successful, people wanted to eliminate these regulations in order to pursue the magic of the free market.

A)Over time, non-bank financial firms were able to borrow directly from the public, rather than having to borrow from commercial banks.

B)The Federal Reserve created regulations that ran counter to what the government was trying to do.

C)With the advent of new financial instruments, regulated banks lost business to unregulated institutions, and credit began to flow through unregulated systems.

D)As regulations became too successful, people wanted to eliminate these regulations in order to pursue the magic of the free market.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 95 في هذه المجموعة.

فتح الحزمة

k this deck

57

Structural stagnationists believe:

A)the efficient market hypothesis is operational at all times.

B)people can be irrational at times.

C)people are generally irrational.

D)the efficient market hypothesis is never operational.

A)the efficient market hypothesis is operational at all times.

B)people can be irrational at times.

C)people are generally irrational.

D)the efficient market hypothesis is never operational.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 95 في هذه المجموعة.

فتح الحزمة

k this deck

58

Which of the following describes the law of diminishing marginal control?

A)The Federal Reserve Bank cannot impact excess reserves and the money supply.

B)Financial institutions have few ways to assess the solvency of borrowers.

C)After regulations are enacted, institutions find ways around the regulations.

D)As people engage in leverage, they have less and less control over the price of the asset.

A)The Federal Reserve Bank cannot impact excess reserves and the money supply.

B)Financial institutions have few ways to assess the solvency of borrowers.

C)After regulations are enacted, institutions find ways around the regulations.

D)As people engage in leverage, they have less and less control over the price of the asset.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 95 في هذه المجموعة.

فتح الحزمة

k this deck

59

Initially, policy makers were not concerned about the financial crisis because:

A)conventional economic theory was telling them they did not have to worry about such an event occurring.

B)no other comparable crisis had happened before in history.

C)fiscal policy would kick in to stabilize the economy.

D)banks and other financial institutions had convinced policy makers that they would take care of any type of crisis.

A)conventional economic theory was telling them they did not have to worry about such an event occurring.

B)no other comparable crisis had happened before in history.

C)fiscal policy would kick in to stabilize the economy.

D)banks and other financial institutions had convinced policy makers that they would take care of any type of crisis.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 95 في هذه المجموعة.

فتح الحزمة

k this deck

60

In the 1970s and 1980s, savings banks invented NOW accounts to get around financial regulations.This is an example of:

A)a moral hazard problem.

B)deleveraging.

C)the law of diminishing control.

D)quantitative easing.

A)a moral hazard problem.

B)deleveraging.

C)the law of diminishing control.

D)quantitative easing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 95 في هذه المجموعة.

فتح الحزمة

k this deck

61

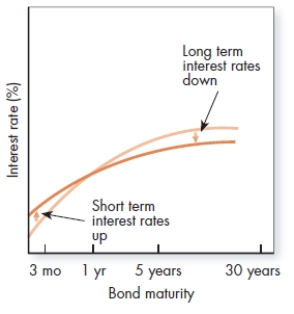

The graph shown shows what happens when the Fed implements:

A)operation twist.

B)credit easing.

C)quantitative easing.

D)precommitment policies.

A)operation twist.

B)credit easing.

C)quantitative easing.

D)precommitment policies.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 95 في هذه المجموعة.

فتح الحزمة

k this deck

62

The aim of unconventional monetary policy tools is to:

A)stimulate the economy in coordination with fiscal policy.

B)slow down liquidity and increase interest rates.

C)support the economy by boosting liquidity and reducing interest rates when credit channels are clogged.

D)increase the value of the dollar.

A)stimulate the economy in coordination with fiscal policy.

B)slow down liquidity and increase interest rates.

C)support the economy by boosting liquidity and reducing interest rates when credit channels are clogged.

D)increase the value of the dollar.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 95 في هذه المجموعة.

فتح الحزمة

k this deck

63

A policy of targeting a particular quantity of money by buying financial assets from banks and other financial institutions with newly created money is called:

A)precommitment policy.

B)operation twist.

C)credit easing.

D)quantitative easing.

A)precommitment policy.

B)operation twist.

C)credit easing.

D)quantitative easing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 95 في هذه المجموعة.

فتح الحزمة

k this deck

64

To avoid the law of diminishing control, the government could:

A)treat regulation as a one-time event that is not predictable.

B)leave the regulations the way they are.

C)let the Federal Reserve decide the regulations and implement the regulations.

D)change the regulations when it is appropriate to do so.

A)treat regulation as a one-time event that is not predictable.

B)leave the regulations the way they are.

C)let the Federal Reserve decide the regulations and implement the regulations.

D)change the regulations when it is appropriate to do so.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 95 في هذه المجموعة.

فتح الحزمة

k this deck

65

Purchasing long-term government bonds from private financial corporations for the purpose of changing the mix of securities held by the Fed toward less liquid and more risky assets is called:

A)credit easing.

B)Operation twist.

C)quantitative easing.

D)precommitment policy.

A)credit easing.

B)Operation twist.

C)quantitative easing.

D)precommitment policy.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 95 في هذه المجموعة.

فتح الحزمة

k this deck

66

The purpose of the Dodd-Frank Wall Street Reform Act was to:

A)encourage banks to engage in more risk-taking.

B)give banks the choice to report their holdings.

C)force banks to limit their risk-taking.

D)limit what stocks and mutual funds that investors could choose.

A)encourage banks to engage in more risk-taking.

B)give banks the choice to report their holdings.

C)force banks to limit their risk-taking.

D)limit what stocks and mutual funds that investors could choose.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 95 في هذه المجموعة.

فتح الحزمة

k this deck

67

Which of the following would not fall under the description of unconventional monetary policy by the Federal Reserve?

A)accepting lower quality assets as collateral for loans

B)opening lending facilities to non-commercial banks

C)directly purchasing short-term bonds from money market mutual funds

D)lowering the reserve requirement for banks

A)accepting lower quality assets as collateral for loans

B)opening lending facilities to non-commercial banks

C)directly purchasing short-term bonds from money market mutual funds

D)lowering the reserve requirement for banks

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 95 في هذه المجموعة.

فتح الحزمة

k this deck

68

When the Fed is changing the quality of the assets it holds, this is called:

A)quantitative easing.

B)operation twist.

C)credit easing.

D)precommitment policy.

A)quantitative easing.

B)operation twist.

C)credit easing.

D)precommitment policy.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 95 في هذه المجموعة.

فتح الحزمة

k this deck

69

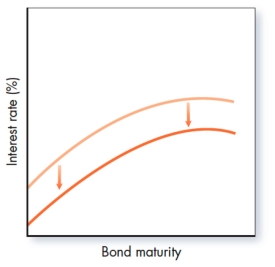

Which of the following would have the impact shown in the accompanying graph?

A)Operation twist.

B)Credit easing.

C)Quantitative easing.

D)Credit easing

A)Operation twist.

B)Credit easing.

C)Quantitative easing.

D)Credit easing

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 95 في هذه المجموعة.

فتح الحزمة

k this deck

70

Quantitative easing involves all of the following except:

A)higher long-term interest rates.

B)higher asset prices.

C)Lower long-term interest rates.

D)Purchasing longer-term bonds.

A)higher long-term interest rates.

B)higher asset prices.

C)Lower long-term interest rates.

D)Purchasing longer-term bonds.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 95 في هذه المجموعة.

فتح الحزمة

k this deck

71

Quantitative easing refers to:

A)a gradual reduction in interest rates by the Federal Reserve.

B)looser restrictions on banks' investments in derivatives.

C)a gradual reduction in marginal tax rates.

D)non-standard monetary policy designed to extend credit in the economy.

A)a gradual reduction in interest rates by the Federal Reserve.

B)looser restrictions on banks' investments in derivatives.

C)a gradual reduction in marginal tax rates.

D)non-standard monetary policy designed to extend credit in the economy.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 95 في هذه المجموعة.

فتح الحزمة

k this deck

72

The Fed sells short-term debt and uses the proceeds to buy long-term debt.This represents:

A)precommitment policies.

B)standard monetary policy

C)quantitative easing.

D)operation twist.

A)precommitment policies.

B)standard monetary policy

C)quantitative easing.

D)operation twist.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 95 في هذه المجموعة.

فتح الحزمة

k this deck

73

Selling short-term treasury bills and buying longer-term treasury bonds without creating more new money is called:

A)standard monetary policy.

B)operation twist.

C)quantitative easing.

D)precommitment policy.

A)standard monetary policy.

B)operation twist.

C)quantitative easing.

D)precommitment policy.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 95 في هذه المجموعة.

فتح الحزمة

k this deck

74

Which of the following is not one of the unconventional monetary policy tools used by the Fed?

A)Precommitment strategy

B)Credit easing

C)Operation twist

D)Dodd-Frank Act

A)Precommitment strategy

B)Credit easing

C)Operation twist

D)Dodd-Frank Act

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 95 في هذه المجموعة.

فتح الحزمة

k this deck

75

A problem with a precommitment policy is that it:

A)determines the Fed's response for a period of time.

B)binds the hands of the Fed from responding to unexpected events.

C)will cause the Fed to lose credibility.

D)locks the Fed into contractionary policy.

A)determines the Fed's response for a period of time.

B)binds the hands of the Fed from responding to unexpected events.

C)will cause the Fed to lose credibility.

D)locks the Fed into contractionary policy.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 95 في هذه المجموعة.

فتح الحزمة

k this deck

76

The recent regulation that was designed to limit risk-taking by banks by requiring them to report their holdings is called the:

A)The Glass-Steagall Act.

B)Dodd-Frank Wall Street Reform and Consumer Protection Act.

C)Troubled Asset Relief Program.

D)Federal Deposit Insurance Act.

A)The Glass-Steagall Act.

B)Dodd-Frank Wall Street Reform and Consumer Protection Act.

C)Troubled Asset Relief Program.

D)Federal Deposit Insurance Act.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 95 في هذه المجموعة.

فتح الحزمة

k this deck

77

Which of the following would not address the moral hazard problem?

A)Establish strict regulations of the banks

B)Design systems so that necessary financial transactions stayed within regulated banks

C)Allow the government to take over the policy-making decisions of the Federal Reserve

D)Separate banks from other financial institutions

A)Establish strict regulations of the banks

B)Design systems so that necessary financial transactions stayed within regulated banks

C)Allow the government to take over the policy-making decisions of the Federal Reserve

D)Separate banks from other financial institutions

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 95 في هذه المجموعة.

فتح الحزمة

k this deck

78

The main difference between quantitative easing and credit easing is that:

A)quantitative easing changes the mix of the Fed's holdings, credit easing does not.

B)credit easing changes the mix of the Fed's holdings, quantitative easing does not.

C)credit easing shifts long-term interest rates down while quantitative easing shifts them up.

D)There is no difference since both add credit to the economy.

A)quantitative easing changes the mix of the Fed's holdings, credit easing does not.

B)credit easing changes the mix of the Fed's holdings, quantitative easing does not.

C)credit easing shifts long-term interest rates down while quantitative easing shifts them up.

D)There is no difference since both add credit to the economy.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 95 في هذه المجموعة.

فتح الحزمة

k this deck

79

A general principle of regulation is:

A)do not offset the moral hazard problem.

B)set as few bad precedents as possible.

C)let banks fail regardless of the effect on the economy.

D)the need to reduce regulations over time.

A)do not offset the moral hazard problem.

B)set as few bad precedents as possible.

C)let banks fail regardless of the effect on the economy.

D)the need to reduce regulations over time.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 95 في هذه المجموعة.

فتح الحزمة

k this deck

80

Buying financial assets from banks and other financial institutions with newly created money is referred to as:

A)credit easing.

B)operation twist.

C)quantitative easing.

D)precommitment policy.

A)credit easing.

B)operation twist.

C)quantitative easing.

D)precommitment policy.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 95 في هذه المجموعة.

فتح الحزمة

k this deck