Deck 20: Risk Management in Financial Institutions

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/75

العب

ملء الشاشة (f)

Deck 20: Risk Management in Financial Institutions

1

The simplest form of hedging interest rate risk is matched funding of loans..

True

2

Swaps are usually the best hedging tool to use to hedge short term risks occurring in a half year or less.

False

3

If a bank specializes in mortgage lending it will tend to have a negative $ GAP and a positive duration GAP.

True

4

A rate sensitive asset is one that either matures within the maturity bucket or one that will have a payment change within the maturity bucket if interest rates change.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

5

A firm informs the bank they will immediately draw down the maximum amount on their credit line. This is an example of liquidity risk.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

6

Microhedging is hedging the interest rate risk of a specific transaction.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

7

For a given time period, assets that mature within the period or reprice within the period are considered rate sensitive.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

8

Basis risk is the risk that the prices or value of the underlying spot and the derivatives instrument used to hedge do not move predictably relative to one another.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

9

A U.S. company has a euro denominated liability it must repay in 6 months. A short position in euro futures could help offset the corporation's foreign exchange risk.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

10

Banks must balance liquidity risk, interest rate risk, credit risk and currency risk while still generating sufficient profitability to satisfy its owners.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

11

To hedge a positive duration gap a bank could sell interest rate futures.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

12

The VaR is typically used to measure a bank's credit risk.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

13

As interest rates increase, a long call option position on a bond decreases in value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

14

If the asset duration is less than the weighted duration of the liabilities, then falling interest rates will cause the market value of equity to rise.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

15

The sensitivity of the market price of a financial futures contract to interest rates depends upon the duration of the security to be delivered under the futures contract.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

16

Large banks tend to rely more on assets for liquidity and small banks tend to rely more on purchased liquidity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

17

Insolvency occurs when an institution's duration gap becomes negative.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

18

If a bank has a positive repricing gap, falling interest rates increase profitability.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

19

Value at risk (VaR) is to measure price or market risk of a portfolio of assets and attempt to maximum likely loss at a given probability that they might sustain over a designated determine the period of time.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

20

Writing a call option on a bond pays off if interest rates decrease.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

21

Bank A has a loan to deposit ratio of 75%, core deposits equal 62% of total assets and borrowed funds are 5% of assets. Bank B has a loan to deposit ratio of 82%. Core deposits are 55% of assets and borrowed funds are 20% of assets. Which bank has more liquidity risk? Ceteris paribus, which bank will probably be more profitable when interest rates are low and the economy is growing?

A) Bank A; Bank A

B) Bank A; Bank B

C) Bank B; Bank A

D) Bank B; Bank B

A) Bank A; Bank A

B) Bank A; Bank B

C) Bank B; Bank A

D) Bank B; Bank B

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

22

ABC Bank has $39 million invested in T-Bonds with a 16-year duration, $39 million in 6 month maturity T-Bills, and $75 million invested in consumer loans with a 3 year duration. Based only on this data, what is the duration of the bank's asset portfolio in years?

A) 5.95 years

B) 5.68 years

C) 7.23 years

D) 8.78 years

E) 9.51 years

A) 5.95 years

B) 5.68 years

C) 7.23 years

D) 8.78 years

E) 9.51 years

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

23

A ______ eliminates the effects of extreme movements in interest rates, allowing the bank's cash flows to fluctuate within a specified range.

A) Cap

B) Floor

C) Sleeve

D) Collar

E) Straddle

A) Cap

B) Floor

C) Sleeve

D) Collar

E) Straddle

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

24

A bank has a negative $GAP. If interest rates fall the bank's overall NII will

A) fall.

B) rise.

C) not change.

D) not change unless the duration gap is also negative.

A) fall.

B) rise.

C) not change.

D) not change unless the duration gap is also negative.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

25

Which of the following results in a net liquidity drain?

A) Demand deposits increase $120; loans increase $80

B) Reverse repurchase agreements increase $50; demand deposit decrease $50

C) Repurchase agreements increase $100; Demand deposit decrease $50

D) Demand deposits decrease $120; loan repayments are $250

E) Demand deposits increase $10; loans decrease $10

A) Demand deposits increase $120; loans increase $80

B) Reverse repurchase agreements increase $50; demand deposit decrease $50

C) Repurchase agreements increase $100; Demand deposit decrease $50

D) Demand deposits decrease $120; loan repayments are $250

E) Demand deposits increase $10; loans decrease $10

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

26

Refer to the information below for questions

Formosa International Bank (FIB) (mill$)

-What are Formosa International Bank's total sources of future liquidity?

A) $16,520

B) $13,400

C) $14,200

D) $12,280

E) $15,760

Formosa International Bank (FIB) (mill$)

-What are Formosa International Bank's total sources of future liquidity?

A) $16,520

B) $13,400

C) $14,200

D) $12,280

E) $15,760

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

27

Refer to the information below for questions

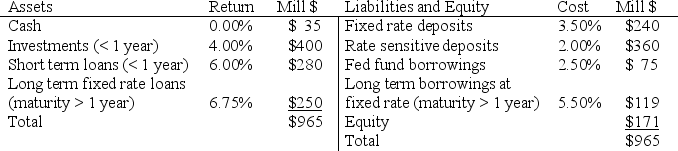

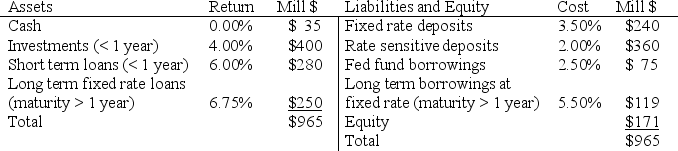

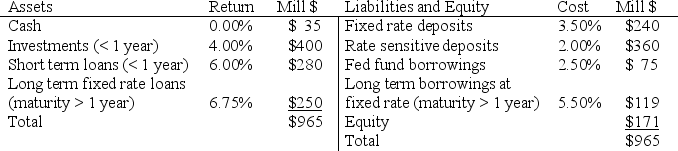

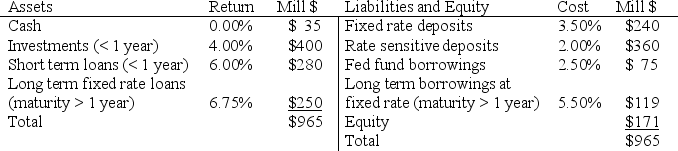

Formosa Independence Bank has the following balance sheet:

If all interest rates on the two sides of balance sheet decline by 65 basis points, when other things are equal, what is the change in net interest income for Formosa Independence Bank over the year?

A) $0

B) $1,400,000

C) -$1,400,000

D) $1,592,500

E) -$1,592,500

Formosa Independence Bank has the following balance sheet:

If all interest rates on the two sides of balance sheet decline by 65 basis points, when other things are equal, what is the change in net interest income for Formosa Independence Bank over the year?

A) $0

B) $1,400,000

C) -$1,400,000

D) $1,592,500

E) -$1,592,500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

28

Refer to the information below for questions

Formosa International Bank (FIB) (mill$)

-What are Formosa International Bank's total current uses of liquidity?

A) $ 6,500

B) $14,500

C) $14,900

D) $16,280

E) $15,760

Formosa International Bank (FIB) (mill$)

-What are Formosa International Bank's total current uses of liquidity?

A) $ 6,500

B) $14,500

C) $14,900

D) $16,280

E) $15,760

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

29

A difference payment refers to

A) the different notional principal amounts on the two sides of a swap.

B) the change in margin account due to daily marking to market on a futures position.

C) the amount an option is in the money.

D) the net payment amount on a collar.

E) the net amount owed on a swap payment date between the swap parties.

A) the different notional principal amounts on the two sides of a swap.

B) the change in margin account due to daily marking to market on a futures position.

C) the amount an option is in the money.

D) the net payment amount on a collar.

E) the net amount owed on a swap payment date between the swap parties.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

30

Macrohedging is the use of risk-management instruments such as futures and options to reduce the interest rate risk of the overall bank portfolio.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

31

The number of futures contracts that a bank will need in order to fully hedge the bank's overall interest rate risk exposure and protect the bank's net worth depends upon (among other factors): I. The relative duration of bank assets and liabilities.

II) The duration of the underlying security named in the futures contract.

III) The price of the futures contract.

IV) The debt to asset ratio.

A) I and II

B) II and III

C) III and IV

D) I, II and III

E) I, II, III and IV

II) The duration of the underlying security named in the futures contract.

III) The price of the futures contract.

IV) The debt to asset ratio.

A) I and II

B) II and III

C) III and IV

D) I, II and III

E) I, II, III and IV

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

32

Interest rate collars do which one of the following?

A) eliminate the variation in a bank's liability costs.

B) place a floor on the bank's liability costs, but not a ceiling.

C) place a ceiling on a bank's liability costs, but not a floor.

D) limit the movement of a bank's liability costs to remain within a specified range.

A) eliminate the variation in a bank's liability costs.

B) place a floor on the bank's liability costs, but not a ceiling.

C) place a ceiling on a bank's liability costs, but not a floor.

D) limit the movement of a bank's liability costs to remain within a specified range.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

33

Which one of the following is a source of liquidity risk for a bank?

A) Predicted increase in net deposit withdraws before holidays

B) Small town local high school football team unexpectedly wins divisional and must travel to state championship

C) Corporation calls in a bond the bank is holding

D) Maturation of notes payable due to the bank

A) Predicted increase in net deposit withdraws before holidays

B) Small town local high school football team unexpectedly wins divisional and must travel to state championship

C) Corporation calls in a bond the bank is holding

D) Maturation of notes payable due to the bank

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

34

Refer to the information below for questions

Formosa Independence Bank has the following balance sheet:

The bank's one-year gap between assets and liabilities is (Mill $)

A) $425

B) $245

C) $174

D) $140

E) $126

Formosa Independence Bank has the following balance sheet:

The bank's one-year gap between assets and liabilities is (Mill $)

A) $425

B) $245

C) $174

D) $140

E) $126

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

35

Duration GAP is a conceptually superior method to assess the interest rate risk of a financial institution than $GAP.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

36

Which one of the following situations creates the most liquidity risk?

A) Long term assets funded by short term liabilities

B) Short term assets funded by short term liabilities

C) Long term assets funded by long term liabilities

D) Short term assets funded by long term liabilities

E) Long term liabilities funded by short term assets

A) Long term assets funded by short term liabilities

B) Short term assets funded by short term liabilities

C) Long term assets funded by long term liabilities

D) Short term assets funded by long term liabilities

E) Long term liabilities funded by short term assets

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

37

A bank that has made 30 year adjustable rate mortgages that reprice in 6 months that are funded with one year CDs will have a positive $GAP over a 1 year period and a negative Duration Gap all else equal.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

38

Refer to the information below for questions

Formosa International Bank (FIB) (mill$)

-What is Formosa International Bank's total net liquidity?

A) $4,520

B) $6,500

C) $5,200

D) $7,280

E) $6,900

Formosa International Bank (FIB) (mill$)

-What is Formosa International Bank's total net liquidity?

A) $4,520

B) $6,500

C) $5,200

D) $7,280

E) $6,900

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

39

Which one of the following alternatives is an appropriate way to deal with deposit withdrawals that utilizes asset management of liquidity?

A) Purchasing T-bonds

B) Contacting an investment banker to find new corporate deposits

C) Increasing Fed funds borrowed

D) Issuance of a negotiable CD

E) Selling the bank's holdings of T-bills

A) Purchasing T-bonds

B) Contacting an investment banker to find new corporate deposits

C) Increasing Fed funds borrowed

D) Issuance of a negotiable CD

E) Selling the bank's holdings of T-bills

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

40

Although caps, floors, and collars can be created by buying and selling options on financial futures, this strategy is difficult because

A) exchange-traded options with sufficiently long maturities may not exist, or are illiquid, or are too expensive.

B) these strategies limit the options of banks who use them.

C) regulators prefer swaps to options.

D) they can be used to hedge the $GAP, but not the duration gap.

A) exchange-traded options with sufficiently long maturities may not exist, or are illiquid, or are too expensive.

B) these strategies limit the options of banks who use them.

C) regulators prefer swaps to options.

D) they can be used to hedge the $GAP, but not the duration gap.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

41

A bond portfolio manager has a $25 million market value bond portfolio with a 6 year duration. The manager believes interest rates may increase 50 basis points. Which of the following could be used to help limit his risk?

I. Sell the bonds forward.

II. Buy bond futures contracts.

III. Buy call options on the bonds.

IV. Buy put options on the bonds.

A) I only

B) II only

C) I and III only

D) II and III only

E) I and IV only

I. Sell the bonds forward.

II. Buy bond futures contracts.

III. Buy call options on the bonds.

IV. Buy put options on the bonds.

A) I only

B) II only

C) I and III only

D) II and III only

E) I and IV only

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

42

A bank wishing to avoid higher borrowing costs would be most likely to:

A) short sell futures.

B) buy futures.

C) buy call options on bonds.

D) use a floor.

A) short sell futures.

B) buy futures.

C) buy call options on bonds.

D) use a floor.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

43

Which of the following could be used to reduce a bank's credit risk exposure?

I. Increase its loan to deposit ratio

II. Increase its allowable concentration ratio

III. Increase its required minimum credit score

IV. Participate in loans in other geographic areas

A) I and II

B) I, II and III

C) I, II and IV

D) III and IV

E) I, II, III and IV

I. Increase its loan to deposit ratio

II. Increase its allowable concentration ratio

III. Increase its required minimum credit score

IV. Participate in loans in other geographic areas

A) I and II

B) I, II and III

C) I, II and IV

D) III and IV

E) I, II, III and IV

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

44

A bank has an average asset duration of 5 years and an average liability duration of 3 years. This bank has total assets of $500 million and total liabilities of $250 million. Currently, market interest rates are 10 percent. If interest rates fall to 8 percent, what is this bank's change in net worth?

A) Net worth will decrease by $31.82 million

B) Net worth will increase by $31.82 million

C) Net worth will increase by $27.27 million

D) Net worth will decrease by $27.27 million

E) Net worth will not change at all

A) Net worth will decrease by $31.82 million

B) Net worth will increase by $31.82 million

C) Net worth will increase by $27.27 million

D) Net worth will decrease by $27.27 million

E) Net worth will not change at all

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

45

Limitation to VaR include I. Basic VaR calculations assume returns on portfolios are normally distributed

II) VaR is sensitive to the time period chosen

III) VaR does not specify the maximum possible loss

IV) VaR is not easy to understand

A) I and II

B) I, II and III

C) I, II and IV

D) II, III and IV

E) I, II, III and IV

II) VaR is sensitive to the time period chosen

III) VaR does not specify the maximum possible loss

IV) VaR is not easy to understand

A) I and II

B) I, II and III

C) I, II and IV

D) II, III and IV

E) I, II, III and IV

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

46

Suppose a bank has an asset duration of 5 years and a liability duration of 2.5 years. This bank has $1,000 million in assets and $750 million in liabilities. They plan on hedging with a Treasury bond futures contract which has an underlying duration of 8.5 years and which is selling right now for $99,000 for a $100,000 contract. How many futures contracts does this bank need to fully hedge itself against interest rate risk?

A) 3,714 contracts

B) 3,125 contracts

C) 2,971 contracts

D) 371 contracts

E) 37 contacts

A) 3,714 contracts

B) 3,125 contracts

C) 2,971 contracts

D) 371 contracts

E) 37 contacts

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

47

A bank has a negative duration gap and wishes to hedge to use an interest rate swap to hedge its interest rate risk. The bank should

A) pay a variable rate of interest and receive a fixed rate of interest.

B) pay a fixed rate of interest and receive a variable rate of interest.

C) pay a fixed rate of interest and receive a fixed rate of interest.

D) pay a variable rate of interest and receive a variable rate of interest.

A) pay a variable rate of interest and receive a fixed rate of interest.

B) pay a fixed rate of interest and receive a variable rate of interest.

C) pay a fixed rate of interest and receive a fixed rate of interest.

D) pay a variable rate of interest and receive a variable rate of interest.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

48

A bank with a positive dollar gap will have a decrease in net interest income when ______.

A) interest rates increase

B) interest rates decrease

C) the duration gap also changes

D) the incremental gap is negative

A) interest rates increase

B) interest rates decrease

C) the duration gap also changes

D) the incremental gap is negative

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

49

FICO credit scores typically range from ______ with ______ and higher generally considered to be a good score.

A) 400 to 800; 650

B) 200 to 700; 600

C) 300 to 850; 700

D) 250 to 750; 625

A) 400 to 800; 650

B) 200 to 700; 600

C) 300 to 850; 700

D) 250 to 750; 625

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

50

A bank has an average asset duration of 1.15 years and an average liability duration of 2.70 years. This bank has $250 million in total assets and $225 million in total liabilities. This bank has:

A) A negative duration gap of 1.55 years.

B) A positive duration gap of 1.28 years.

C) A negative duration gap of 3.85 years.

D) A negative duration gap of 1.28 years.

A) A negative duration gap of 1.55 years.

B) A positive duration gap of 1.28 years.

C) A negative duration gap of 3.85 years.

D) A negative duration gap of 1.28 years.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

51

A microhedge is a

A) Hedge against a change in a particular macro variable

B) Hedge of a particular asset or liability

C) Hedge of an entire balance sheet

D) Hedge using options

E) Hedge without basis risk

A) Hedge against a change in a particular macro variable

B) Hedge of a particular asset or liability

C) Hedge of an entire balance sheet

D) Hedge using options

E) Hedge without basis risk

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

52

Refer to the information below for questions

XYZ Bank has DA = 2.4 years and DL = 0.9 years. The bank has total equity of $82 million and total assets of $850 million. Currently, interest rates are at 6%.

If interest rates increase 100 basis points the predicted dollar change in equity value will equal

A) $10,171,698

B) -$10,171,698

C) $12,724,528

D) -$12,724,528

E) $4,928,756

XYZ Bank has DA = 2.4 years and DL = 0.9 years. The bank has total equity of $82 million and total assets of $850 million. Currently, interest rates are at 6%.

If interest rates increase 100 basis points the predicted dollar change in equity value will equal

A) $10,171,698

B) -$10,171,698

C) $12,724,528

D) -$12,724,528

E) $4,928,756

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

53

A macro hedge is a

A) Hedge of a particular asset or liability

B) Hedge on macroeconomic variables

C) Hedge using options on particular liabilities

D) Hedge without basis risk

E) Hedge of an entire balance sheet

A) Hedge of a particular asset or liability

B) Hedge on macroeconomic variables

C) Hedge using options on particular liabilities

D) Hedge without basis risk

E) Hedge of an entire balance sheet

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

54

Refer to the information below for questions

XYZ Bank has DA = 2.4 years and DL = 0.9 years. The bank has total equity of $82 million and total assets of $850 million. Currently, interest rates are at 6%.

What is the bank's duration gap in years?

A) 1.432

B) 1.488

C) 1.587

D) 1.656

E) 1.722

XYZ Bank has DA = 2.4 years and DL = 0.9 years. The bank has total equity of $82 million and total assets of $850 million. Currently, interest rates are at 6%.

What is the bank's duration gap in years?

A) 1.432

B) 1.488

C) 1.587

D) 1.656

E) 1.722

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

55

Refer to the information below for questions

XYZ Bank has DA = 2.4 years and DL = 0.9 years. The bank has total equity of $82 million and total assets of $850 million. Currently, interest rates are at 6%.

To set the bank's duration gap to zero the bank could

A) Reduce DA to 1.2 years

B) Increase DL to 2.656 years

C) Increase DL to 2.77 years

D) Reduce DA to zero

E) Increase DL to 3.10 years

XYZ Bank has DA = 2.4 years and DL = 0.9 years. The bank has total equity of $82 million and total assets of $850 million. Currently, interest rates are at 6%.

To set the bank's duration gap to zero the bank could

A) Reduce DA to 1.2 years

B) Increase DL to 2.656 years

C) Increase DL to 2.77 years

D) Reduce DA to zero

E) Increase DL to 3.10 years

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

56

Maximum loan concentration ratios are usually applied to which of the following?

I. geographic location

II. type of loan

III. loans to an individual borrower

IV. industry

A) I and II

B) I, II and III

C) I, II and IV

D) II, III and IV

E) I, II, III and IV

I. geographic location

II. type of loan

III. loans to an individual borrower

IV. industry

A) I and II

B) I, II and III

C) I, II and IV

D) II, III and IV

E) I, II, III and IV

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

57

Which of the following could be appropriately used to reduce the $Gap for a bank that specializes in mortgage lending?

I. Issue more ARMs

II. Securitize and sell mortgages

III. Buy futures on long term Treasury bonds

IV. Enter into a swap to pay fixed and receive a variable rate of interest

A) I and II

B) I, II and III

C) I, II and IV

D) II, III and IV

E) I, II, III and IV

I. Issue more ARMs

II. Securitize and sell mortgages

III. Buy futures on long term Treasury bonds

IV. Enter into a swap to pay fixed and receive a variable rate of interest

A) I and II

B) I, II and III

C) I, II and IV

D) II, III and IV

E) I, II, III and IV

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

58

A certain loan category has a 2.1% default rate and defaulted loans have a -10% return. Loans that don't default earn whatever rate the bank charges. If the lending bank wishes to earn a 4.5% average return on this loan category, including defaulted loans, what rate must the bank charge each borrower?

A) 4.752%

B) 4.811%

C) 4.925%

D) 4.756%

A) 4.752%

B) 4.811%

C) 4.925%

D) 4.756%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

59

A bond has a duration of 7.5 years. Its current market price is $1,125. Interest rates in the market are 7% today. It has been forecasted that interest rates will rise to 9% over the next couple of weeks. How will this bond's price change in percentage terms?

A) This bond's price will rise by 2 percent.

B) This bond's price will fall by 2 percent.

C) This bond's price will not change

D) This bond's price will rise by 14.02 percent

E) This bond's price will fall by 14 .02 percent

A) This bond's price will rise by 2 percent.

B) This bond's price will fall by 2 percent.

C) This bond's price will not change

D) This bond's price will rise by 14.02 percent

E) This bond's price will fall by 14 .02 percent

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

60

In a credit default swap, the most a seller of the swap may have to pay is

A) the monthly payment due to the swap buyer.

B) the difference payment based on the fixed and variable interest rates on the swap.

C) the par value of the insured security.

D) the marking to market value of the underlying.

A) the monthly payment due to the swap buyer.

B) the difference payment based on the fixed and variable interest rates on the swap.

C) the par value of the insured security.

D) the marking to market value of the underlying.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

61

Relying on liquid assets to meet liquidity requirements is ______ than relying on liability management, but the former is ______.

A) safer; less profitable

B) riskier; more profitable

C) easier; more volatile

D) more volatile; preferred by regulators

A) safer; less profitable

B) riskier; more profitable

C) easier; more volatile

D) more volatile; preferred by regulators

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

62

Suppose that the mean change in the Treasury bill yield over the next month is 0 basis points with a standard deviation of 0.50. The duration for the Treasury bills is 6 months or 0.50 years and the bank holds $10,000,000 in Treasury bills The Treasury bills have an APR of 7.0 (3.5% for six months) . Based on this information, what is the VaR with a 99% confidence level?

A) $ 39,731

B) $ 56,192

C) $ 79,462

D) $112,384

A) $ 39,731

B) $ 56,192

C) $ 79,462

D) $112,384

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

63

Savings accounts and demand deposits are called

A) noncore deposits

B) hot money

C) primary reserves

D) secondary reserves

E) core deposits

A) noncore deposits

B) hot money

C) primary reserves

D) secondary reserves

E) core deposits

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

64

Why might a bank that has purchased a cap also wish to also sell a floor?

A) By themselves, caps are ineffective at limiting changes in a bank's cost of funds in a desirable way.

B) Regulators require one to be used with the other.

C) Selling a floor reduces the cost of buying the cap.

D) Dealers won't sell a cap without also dealing with the floor to limit their own risk.

E) It is not a complete hedge without both positions.

A) By themselves, caps are ineffective at limiting changes in a bank's cost of funds in a desirable way.

B) Regulators require one to be used with the other.

C) Selling a floor reduces the cost of buying the cap.

D) Dealers won't sell a cap without also dealing with the floor to limit their own risk.

E) It is not a complete hedge without both positions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

65

A major problem with VaR analysis is that

A) it does not indicate the maximum possible loss.

B) it only works for individual assets rather than portfolios.

C) regulators do not understand VaR and so they don't allow its use.

D) it encourages excessive risk taking since it does not correctly account for asset correlations.

A) it does not indicate the maximum possible loss.

B) it only works for individual assets rather than portfolios.

C) regulators do not understand VaR and so they don't allow its use.

D) it encourages excessive risk taking since it does not correctly account for asset correlations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

66

If a bank encounters a loan default the bank will typically

A) write off the loan and reduce the amount of loans in that category.

B) immediately foreclose and sue the customer.

C) negotiate with the customer to recover at least some of its capital.

D) reduce its loan loss reserve.

A) write off the loan and reduce the amount of loans in that category.

B) immediately foreclose and sue the customer.

C) negotiate with the customer to recover at least some of its capital.

D) reduce its loan loss reserve.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

67

What can a bank do to reduce its credit risk?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

68

A bank can purchase a cap on interest rates by

A) purchasing a put option on a financial futures contract.

B) purchasing a call option on a financial futures contract

C) writing a put option on a financial futures contract.

D) selling T-Bond futures.

A) purchasing a put option on a financial futures contract.

B) purchasing a call option on a financial futures contract

C) writing a put option on a financial futures contract.

D) selling T-Bond futures.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

69

Explain the dilemma between liquidity, solvency and profitability. How can liquidity risk can lead to insolvency risk?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

70

Earnings simulations that estimate proforma income statements and balance sheets for different detailed economic and interest rate scenarios for 1‐ or 2‐year periods are called ______ analysis.

A) rate sensitivity gap

B) duration gap

C) EVA

D) VaR

A) rate sensitivity gap

B) duration gap

C) EVA

D) VaR

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

71

Negotiable certificates of deposit (CDs), federal funds, repurchase agreements, commercial paper, and Eurodollar borrowings are called

A) noninterest bearing liabilities

B) hot money

C) primary reserves

D) secondary reserves

E) core deposits

A) noninterest bearing liabilities

B) hot money

C) primary reserves

D) secondary reserves

E) core deposits

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

72

The risk of direct or indirect loss resulting from inadequate or failed internal processes, people, and systems, or from external events is called

A) solvency risk.

B) interest rate risk.

C) credit risk.

D) operational risk.

E) systemic risk.

A) solvency risk.

B) interest rate risk.

C) credit risk.

D) operational risk.

E) systemic risk.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

73

The most liquid asset on the bank balance sheet are ______ and the highest earning category of assets are ______.

A) investments; secondary reserves

B) primary reserves; secondary reserves

C) loans; deposits

D) deposits; loans

E) primary reserves; loans

A) investments; secondary reserves

B) primary reserves; secondary reserves

C) loans; deposits

D) deposits; loans

E) primary reserves; loans

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

74

A bank's primary reserves include

A) vault cash, reverse repurchase agreements and Fed Funds sold

B) Fed funds purchased, reverse repurchase agreements, checkable deposits

C) cash on hand, discount window loans and repurchase agreements

D) vault cash, deposits at correspondent banks, and deposits held at Federal Reserve banks

E) core deposits, brokered CDs and perpetual preferred stock.

A) vault cash, reverse repurchase agreements and Fed Funds sold

B) Fed funds purchased, reverse repurchase agreements, checkable deposits

C) cash on hand, discount window loans and repurchase agreements

D) vault cash, deposits at correspondent banks, and deposits held at Federal Reserve banks

E) core deposits, brokered CDs and perpetual preferred stock.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

75

Short‐term assets that can be converted quickly into cash at a price near their purchase price that are held to provide both liquidity and a safe return are called

A) primary reserves.

B) secondary reserves.

C) tertiary reserves

D) Federal reserves

A) primary reserves.

B) secondary reserves.

C) tertiary reserves

D) Federal reserves

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck