Deck 19: Accounting for Income Taxes

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/59

العب

ملء الشاشة (f)

Deck 19: Accounting for Income Taxes

1

Taxable income is a tax accounting term and is also referred to as income before taxes.

False

2

Deductible amounts cause taxable income to be greater than pretax financial income in the future as a result of existing temporary differences.

False

3

Taxable amounts increase taxable income in future years.

True

4

A company should add a decrease in a deferred tax liability to income tax payable in computing income tax expense.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

5

Companies must consider presently enacted changes in the tax rate that become effective in future years when determining the tax rate to apply to existing temporary differences.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

6

Under the loss carryback approach, companies must apply a current year loss to the most recent year first and then to an earlier year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

7

Permanent differences do not give rise to future taxable or deductible amounts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

8

When a change in the tax rate is enacted, the effect is reported as an adjustment to income tax payable in the period of the change.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

9

The IASB believes that the deferred tax method is the most consistent method for accounting for income taxes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

10

An individual deferred tax asset or liability is classified as current or non-current based on the classification of the related asset/liability for financial reporting purposes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

11

Taxable temporary differences will result in taxable amounts in future years when the related assets are recovered.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

12

Companies should consider both positive and negative evidence to determine whether, based on the weight of available evidence, it needs adjust the deferred tax asset.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

13

A possible source of taxable income that may be available to realize a tax benefit for loss carryforwards is existing taxable temporary differences.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

14

A deferred tax asset represents the increase in taxes refundable in future years as a result of deductible temporary differences existing at the end of the current year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

15

Examples of taxable temporary differences are subscriptions received in advance and advance rental receipts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

16

Pretax financial income is the amount used to compute income tax payable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

17

The tax effect of a loss carryforward represents future tax savings and results in the recognition of a deferred tax asset.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

18

A company reduces a deferred tax asset if it is possible that it will not realize some portion of the deferred tax asset.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

19

Companies classify the balances in the deferred tax accounts on the statement of financial position as non-current assets or non-current liabilities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

20

A deferred tax liability represents the increase in taxes payable in future years as a result of taxable temporary differences existing at the end of the current year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

21

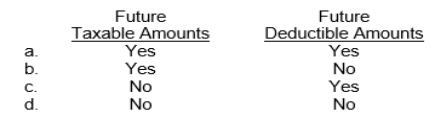

Machinery was acquired at the beginning of the year.Depreciation recorded during the life of the machinery could result in Future

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

22

Taxable income of a corporation

A)differs from accounting income due to differences in intraperiod allocation between the two methods of income determination.

B)differs from accounting income due to differences in interperiod allocation and permanent differences between the two methods of income determination.

C)is based on international financial reporting standards.

D)is reported on the corporation's income statement.

22 Taxable income of a corporation differs from pretax financial income because of

A)differs from accounting income due to differences in intraperiod allocation between the two methods of income determination.

B)differs from accounting income due to differences in interperiod allocation and permanent differences between the two methods of income determination.

C)is based on international financial reporting standards.

D)is reported on the corporation's income statement.

22 Taxable income of a corporation differs from pretax financial income because of

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

23

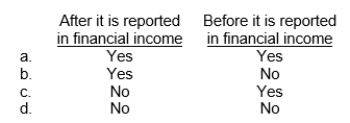

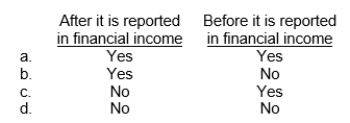

A temporary difference arises when a revenue item is reported for tax purposes in a period

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

24

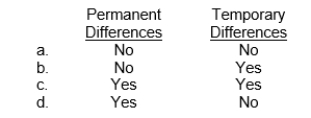

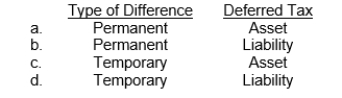

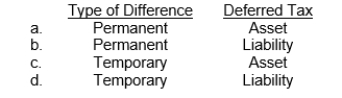

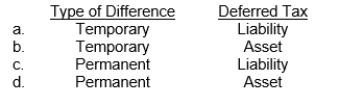

A company uses the equity method to account for an investment.This would result in what type of difference and in what type of deferred income tax?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

25

Which of the following differences would result in future taxable amounts?

A)Expenses or losses that are tax deductible after they are recognized in financial income.

B)Revenues or gains that are taxable before they are recognized in financial income.

C)Revenues or gains that are recognized in financial income but are never included in taxable income.

D)Expenses or losses that are tax deductible before they are recognized in financial income.

A)Expenses or losses that are tax deductible after they are recognized in financial income.

B)Revenues or gains that are taxable before they are recognized in financial income.

C)Revenues or gains that are recognized in financial income but are never included in taxable income.

D)Expenses or losses that are tax deductible before they are recognized in financial income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

26

Which of the following are temporary differences that are normally classified as expenses or losses that are deductible after they are recognized in financial income?

A)Advance rental receipts.

B)Product warranty liabilities.

C)Depreciable property.

D)Fines and expenses resulting from a violation of law.

A)Advance rental receipts.

B)Product warranty liabilities.

C)Depreciable property.

D)Fines and expenses resulting from a violation of law.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

27

The deferred tax expense is the

A)increase in balance of deferred tax asset minus the increase in balance of deferred tax liability.

B)increase in balance of deferred tax liability minus the increase in balance of deferred tax asset.

C)increase in balance of deferred tax asset plus the increase in balance of deferred tax liability.

D)decrease in balance of deferred tax asset minus the increase in balance of deferred tax liability.

A)increase in balance of deferred tax asset minus the increase in balance of deferred tax liability.

B)increase in balance of deferred tax liability minus the increase in balance of deferred tax asset.

C)increase in balance of deferred tax asset plus the increase in balance of deferred tax liability.

D)decrease in balance of deferred tax asset minus the increase in balance of deferred tax liability.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

28

Under IFRS

A)"probable" is defined as a level of likelihood of at least slightly more than 60%.

B)a company should reduce a deferred tax asset when it's likely that some or all of it will not be recognized.

C)a company considers only positive evidence when determining whether to recognize a deferred tax asset.

D)deferred tax assets must be evaluated at the end of each accounting period.

A)"probable" is defined as a level of likelihood of at least slightly more than 60%.

B)a company should reduce a deferred tax asset when it's likely that some or all of it will not be recognized.

C)a company considers only positive evidence when determining whether to recognize a deferred tax asset.

D)deferred tax assets must be evaluated at the end of each accounting period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

29

An assumption inherent in a company's IFRS statement of financial position is that companies recover and settle the assets and liabilities at

A)the amount that is probable where "probable" means a level of likelihood of at least more than 50%.

B)the present value of future cash flows.

C)their reported amounts.

D)their net realizable value.

A)the amount that is probable where "probable" means a level of likelihood of at least more than 50%.

B)the present value of future cash flows.

C)their reported amounts.

D)their net realizable value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

30

30.At the December 31, 2015 statement of financial position date, Unruh Corporation reports an accrued receivable for financial reporting purposes but not for tax purposes.When this asset is recovered in 2016, a future taxable amount will occur and

A)pretax financial income will exceed taxable income in 2016.

B)Unruh will record a decrease in a deferred tax liability in 2016.

C)total income tax expense for 2016 will exceed current tax expense for 2016.

D)Unruh will record an increase in a deferred tax asset in 2016.

A)pretax financial income will exceed taxable income in 2016.

B)Unruh will record a decrease in a deferred tax liability in 2016.

C)total income tax expense for 2016 will exceed current tax expense for 2016.

D)Unruh will record an increase in a deferred tax asset in 2016.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

31

Each of the following is determined according to IFRS except

A)income before taxes.

B)taxable income.

C)income for financial reporting purposes.

D)income for book purposes.

A)income before taxes.

B)taxable income.

C)income for financial reporting purposes.

D)income for book purposes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

32

A major distinction between temporary and permanent differences is

A)permanent differences are not representative of acceptable accounting practice.

B)temporary differences occur frequently, whereas permanent differences occur only once.

C)once an item is determined to be a temporary difference, it maintains that status; however, a permanent difference can change in status with the passage of time.

D)temporary differences reverse themselves in subsequent accounting periods, whereas permanent differences do not reverse.

A)permanent differences are not representative of acceptable accounting practice.

B)temporary differences occur frequently, whereas permanent differences occur only once.

C)once an item is determined to be a temporary difference, it maintains that status; however, a permanent difference can change in status with the passage of time.

D)temporary differences reverse themselves in subsequent accounting periods, whereas permanent differences do not reverse.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

33

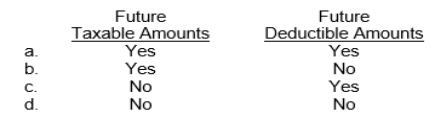

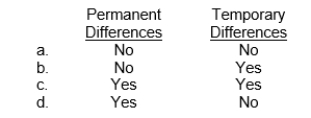

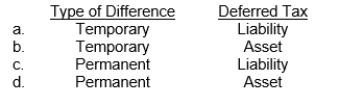

A company records an unrealized loss on short-term securities.This would result in what type of difference and in what type of deferred income tax?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

34

Assuming a 40% statutory tax rate applies to all years involved, which of the following situations will give rise to reporting a deferred tax liability on the balance sheet?

I)A revenue is deferred for financial reporting purposes but not for tax purposes.

II)A revenue is deferred for tax purposes but not for financial reporting purposes.

III)An expense is deferred for financial reporting purposes but not for tax purposes.

IV)An expense is deferred for tax purposes but not for financial reporting purposes.

A)item II only

B)items I and II only

C)items II and III only

D)items I and IV only

I)A revenue is deferred for financial reporting purposes but not for tax purposes.

II)A revenue is deferred for tax purposes but not for financial reporting purposes.

III)An expense is deferred for financial reporting purposes but not for tax purposes.

IV)An expense is deferred for tax purposes but not for financial reporting purposes.

A)item II only

B)items I and II only

C)items II and III only

D)items I and IV only

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

35

Which of the following statements is correct regarding deferred taxes under IFRS?

A)Income tax payable plus or minus the change in deferred income taxes equals income tax expense.

B)The current portion of income tax expense is the amount of change in deferred taxes related to the current period.

C)In computing income tax expense, a company deducts an increase in a deferred tax liability to income tax payable.

D)All of the choices are correct.

A)Income tax payable plus or minus the change in deferred income taxes equals income tax expense.

B)The current portion of income tax expense is the amount of change in deferred taxes related to the current period.

C)In computing income tax expense, a company deducts an increase in a deferred tax liability to income tax payable.

D)All of the choices are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

36

An example of a permanent difference is

A)fines resulting from a violation of law.

B)interest expense on money borrowed to invest in government bonds.

C)percentage depletion of natural resources.

D)All of these answer choices are correct.

A)fines resulting from a violation of law.

B)interest expense on money borrowed to invest in government bonds.

C)percentage depletion of natural resources.

D)All of these answer choices are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

37

Which of the following will not result in a temporary difference?

A)Product warranty liabilities

B)Advance rental receipts

C)Gain on involuntary conversion of non-monetary asset.

D)All of these answer choices will result in a temporary difference.

A)Product warranty liabilities

B)Advance rental receipts

C)Gain on involuntary conversion of non-monetary asset.

D)All of these answer choices will result in a temporary difference.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

38

Which of the following temporary differences results in a deferred tax asset in the year the temporary difference originates?

I)Accrual for product warranty liability.

II)Subscriptions received in advance.

III)Prepaid insurance expense.

A)I and II only.

B)II only.

C)III only.

D)I and III only.

I)Accrual for product warranty liability.

II)Subscriptions received in advance.

III)Prepaid insurance expense.

A)I and II only.

B)II only.

C)III only.

D)I and III only.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

39

Stuart Corporation's taxable income differed from its accounting income computed for this past year.An item that would create a permanent difference in accounting and taxable incomes for Stuart would be

A)a balance in the Unearned Rent account at year end.

B)using accelerated depreciation for tax purposes and straight-line depreciation for book purposes.

C)a fine resulting from violations of environmental regulations.

D)making installment sales during the year.

A)a balance in the Unearned Rent account at year end.

B)using accelerated depreciation for tax purposes and straight-line depreciation for book purposes.

C)a fine resulting from violations of environmental regulations.

D)making installment sales during the year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

40

Which of the following is a temporary difference classified as a revenue or gain that is taxable after it is recognized in financial income?

A)Subscriptions received in advance.

B)Prepaid royalty received in advance.

C)Sales accounted for on the accrual basis for financial reporting purposes and on the installment (cash) basis for tax purposes.

D)Interest received on government obligations.

A)Subscriptions received in advance.

B)Prepaid royalty received in advance.

C)Sales accounted for on the accrual basis for financial reporting purposes and on the installment (cash) basis for tax purposes.

D)Interest received on government obligations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

41

Tax rates other than the current tax rate may be used to calculate the deferred income tax amount on the statement of financial position if

A)it is probable that a future tax rate change will occur.

B)it appears likely that a future tax rate will be greater than the current tax rate.

C)the future tax rates have been enacted or substantially enacted.

D)it appears likely that a future tax rate will be less than the current tax rate.

A)it is probable that a future tax rate change will occur.

B)it appears likely that a future tax rate will be greater than the current tax rate.

C)the future tax rates have been enacted or substantially enacted.

D)it appears likely that a future tax rate will be less than the current tax rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

42

The IASB believes that the __________________ method is the most consistent method for accounting for income taxes.

A)Asset-liability.

B)Income statement.

C)Statement of financial position.

D)Revenue-expense.

A)Asset-liability.

B)Income statement.

C)Statement of financial position.

D)Revenue-expense.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

43

The IASB believes that the asset-liability method is the most consistent method for accounting for income taxes.Basic principles of this method include

I)A current tax liability or asset is recognized for the estimated taxes payable or refundable on the tax return for the current year.

II)A deferred tax liability or asset is recognized for the estimated future tax effects attributable to temporary differences and carryforwards.

III)The measurement of current and deferred tax liabilities and assets, is based on provisions of the enacted tax law.

IV)The measurement of deferred tax assets is reduced, if necessary, by the amount of any tax benefits that, based on available evidence, are not expected to be realized.

A)I, II and only.

B)II and III only.

C)I, II, and IV only.

D)I, II, III and IV.

I)A current tax liability or asset is recognized for the estimated taxes payable or refundable on the tax return for the current year.

II)A deferred tax liability or asset is recognized for the estimated future tax effects attributable to temporary differences and carryforwards.

III)The measurement of current and deferred tax liabilities and assets, is based on provisions of the enacted tax law.

IV)The measurement of deferred tax assets is reduced, if necessary, by the amount of any tax benefits that, based on available evidence, are not expected to be realized.

A)I, II and only.

B)II and III only.

C)I, II, and IV only.

D)I, II, III and IV.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

44

All of the following are procedures for the computation of deferred income taxes except to

A)identify the types and amounts of existing temporary differences and carryforwards.

B)measure the deferred tax liability for taxable temporary differences.

C)measure the deferred tax asset for deductible temporary differences and loss carrybacks.

D)All of these answer choices are procedures in computing deferred income taxes.

A)identify the types and amounts of existing temporary differences and carryforwards.

B)measure the deferred tax liability for taxable temporary differences.

C)measure the deferred tax asset for deductible temporary differences and loss carrybacks.

D)All of these answer choices are procedures in computing deferred income taxes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

45

Under IFRS deferred tax assets are recognized for

I)Deductible temporary differences.

II)Deductible permanent differences.

III)Operating loss carryforwards.

IV)Operating loss carrybacks.

A)I, II, and III.

B)I and III only.

C)I and IV only.

D)II and III only.

I)Deductible temporary differences.

II)Deductible permanent differences.

III)Operating loss carryforwards.

IV)Operating loss carrybacks.

A)I, II, and III.

B)I and III only.

C)I and IV only.

D)II and III only.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

46

Under IFRS when a change in the tax rates is enacted

I)Companies should record its effect on existing deferred tax accounts immediately.

II)Companies report the effect of changes in tax rates on deferred tax accounts in the period the new rate becomes effective.

III)Companies report the effect of changes in tax rates on deferred tax accounts that arise in future periods when the new tax rates are in effect.

A)I Only.

B)II Only.

C)III Only.

D)Either I, II, or III, depending on how frequently tax rates change in the company's tax jurisdiction.

I)Companies should record its effect on existing deferred tax accounts immediately.

II)Companies report the effect of changes in tax rates on deferred tax accounts in the period the new rate becomes effective.

III)Companies report the effect of changes in tax rates on deferred tax accounts that arise in future periods when the new tax rates are in effect.

A)I Only.

B)II Only.

C)III Only.

D)Either I, II, or III, depending on how frequently tax rates change in the company's tax jurisdiction.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

47

Major reason(s) for disclosure of deferred income tax information is (are)

A)better assessment of quality of earnings.

B)better predictions of future cash flows.

C)that it may be helpful in predicating future cash flows for operating loss carryforwards.

D)All of these answer choices are correct.

A)better assessment of quality of earnings.

B)better predictions of future cash flows.

C)that it may be helpful in predicating future cash flows for operating loss carryforwards.

D)All of these answer choices are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

48

Which of the following is not considered a permanent difference?

A)Interest received on government obligations.

B)Fines resulting from violating the law.

C)Percentage depletion of natural resources.

D)Stock-based compensation expense.

A)Interest received on government obligations.

B)Fines resulting from violating the law.

C)Percentage depletion of natural resources.

D)Stock-based compensation expense.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

49

Under IFRS companies are required to provide a reconciliation between actual tax expense and the applicable tax rate.The purpose(s) of this reconciliation include

I)Making better prediction of future cash flow.

II)Predicating future cash flows for operating loss carryforwards.

III)Assessing the composition of the net deferred income tax liability.

IV)Assessing quality of earnings.

A)I, III, and IV only.

B)I, II and IV only.

C)I and IV only.

D)I, II, III and IV.

I)Making better prediction of future cash flow.

II)Predicating future cash flows for operating loss carryforwards.

III)Assessing the composition of the net deferred income tax liability.

IV)Assessing quality of earnings.

A)I, III, and IV only.

B)I, II and IV only.

C)I and IV only.

D)I, II, III and IV.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

50

Which of the following statements is correct with regards to IFRS and U.S.GAAP?

A)Under U.S.GAAP, all potential liabilities related to uncertain tax positions must be recognized.

B)The tax effects related to certain items are reported under U.S.GAAP; under IFRS the tax effects are charged or credited to income.

C)IFRS uses an affirmative judgment approach for deferred tax assets, whereas U.S.GAAP uses an impairment approach for deferred tax assets.

D)IFRS classifies deferred taxes based on classification of the asset or liability to which it relates.

A)Under U.S.GAAP, all potential liabilities related to uncertain tax positions must be recognized.

B)The tax effects related to certain items are reported under U.S.GAAP; under IFRS the tax effects are charged or credited to income.

C)IFRS uses an affirmative judgment approach for deferred tax assets, whereas U.S.GAAP uses an impairment approach for deferred tax assets.

D)IFRS classifies deferred taxes based on classification of the asset or liability to which it relates.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

51

Recognition of tax benefits in the loss year due to a loss carryforward requires

A)the establishment of a deferred tax liability.

B)the establishment of a deferred tax asset.

C)the establishment of an income tax refund receivable.

D)only a note to the financial statements.

A)the establishment of a deferred tax liability.

B)the establishment of a deferred tax asset.

C)the establishment of an income tax refund receivable.

D)only a note to the financial statements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

52

Companies allocate income tax expense (or benefit) to all of the following except

A)discontinued operations.

B)prior period adjustments.

C)gross profit.

D)other comprehensive income.

A)discontinued operations.

B)prior period adjustments.

C)gross profit.

D)other comprehensive income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

53

Which of the following statements is correct regarding permanent differences under IFRS?

A)Permanent differences result from items that enter into pretax financial income but never into taxable income.

B)Permanent differences result from items that enter into taxable income but never into pretax financial income.

C)Permanent differences affect only the period in which they occur.

D)All of these answer choices are correct.

A)Permanent differences result from items that enter into pretax financial income but never into taxable income.

B)Permanent differences result from items that enter into taxable income but never into pretax financial income.

C)Permanent differences affect only the period in which they occur.

D)All of these answer choices are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

54

Accounting for income taxes can result in the reporting of deferred taxes as any of the following except

A)a current or non-current asset.

B)a current or non-current liability.

C)a contra-asset account.

D)All of these answer choices are acceptable methods of reporting deferred taxes.

A)a current or non-current asset.

B)a current or non-current liability.

C)a contra-asset account.

D)All of these answer choices are acceptable methods of reporting deferred taxes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

55

Which of the following statements is incorrect with regards to IFRS and U.S.GAAP?

A)With regard to uncertain tax positions, under IFRS, all potential liabilities must be recognized.

B)The tax effects related to certain items are reported in equity under U.S.GAAP, under IFRS the tax effects are charged or credited to income.

C)U.S.GAAP uses an impairment approach for deferred tax assets.The deferred tax asset is recognized in full and reduced by a valuation account if it is more likely than not all or a portion of the deferred tax asset will not be realized.

D)U.S.GAAP classifies deferred taxes based on the classification of the assets or liability to which it relates.

A)With regard to uncertain tax positions, under IFRS, all potential liabilities must be recognized.

B)The tax effects related to certain items are reported in equity under U.S.GAAP, under IFRS the tax effects are charged or credited to income.

C)U.S.GAAP uses an impairment approach for deferred tax assets.The deferred tax asset is recognized in full and reduced by a valuation account if it is more likely than not all or a portion of the deferred tax asset will not be realized.

D)U.S.GAAP classifies deferred taxes based on the classification of the assets or liability to which it relates.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

56

Tanner, Inc.incurred a financial and taxable loss for 2016.Tanner therefore decided to use the carryback provisions as it had been profitable up to this year.How should the amounts related to the carryback be reported in the 2016 financial statements?

A)The reduction of the loss should be reported as a prior period adjustment.

B)The refund claimed should be reported as a deferred charge and amortized over five years.

C)The refund claimed should be reported as revenue in the current year.

D)The refund claimed should be shown as a reduction of the loss in 2016.

A)The reduction of the loss should be reported as a prior period adjustment.

B)The refund claimed should be reported as a deferred charge and amortized over five years.

C)The refund claimed should be reported as revenue in the current year.

D)The refund claimed should be shown as a reduction of the loss in 2016.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

57

When a change in the tax rate is enacted into law, its effect on existing deferred income tax accounts should be

A)handled retroactively in accordance with the guidance related to changes in accounting standards.

B)considered, but it should only be recorded in the accounts if it reduces a deferred tax liability or increases a deferred tax asset.

C)reported as an adjustment to tax expense in the period of change.

D)applied to all temporary or permanent differences that arise prior to the date of the enactment of the tax rate change, but not subsequent to the date of the change.

A)handled retroactively in accordance with the guidance related to changes in accounting standards.

B)considered, but it should only be recorded in the accounts if it reduces a deferred tax liability or increases a deferred tax asset.

C)reported as an adjustment to tax expense in the period of change.

D)applied to all temporary or permanent differences that arise prior to the date of the enactment of the tax rate change, but not subsequent to the date of the change.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

58

Deferred taxes should be presented on the statement of financial position

A)as one net debit or credit amount.

B)as a net amount in the non-current section.

C)in two amounts: one for the net debit amount and one for the net credit amount.

D)as reductions of the related asset or liability accounts.

A)as one net debit or credit amount.

B)as a net amount in the non-current section.

C)in two amounts: one for the net debit amount and one for the net credit amount.

D)as reductions of the related asset or liability accounts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

59

In determining whether to adjust a deferred tax asset, a company should

A)consider all positive and negative information in determining the need for an adjustment.

B)consider only the positive information in determining the need for an adjustment.

C)take an aggressive approach in its tax planning.

D)pass a recognition threshold, after assuming that it will be audited by taxing authorities.

A)consider all positive and negative information in determining the need for an adjustment.

B)consider only the positive information in determining the need for an adjustment.

C)take an aggressive approach in its tax planning.

D)pass a recognition threshold, after assuming that it will be audited by taxing authorities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck