Deck 7: Plant Assets and Intangibles

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/118

العب

ملء الشاشة (f)

Deck 7: Plant Assets and Intangibles

1

Skyline Mine, Inc., acquired a mineral deposit for $12,000,000 in 2008. Geologists estimate the deposit contains 2,000,000 tons of ore. During 2008 and 2009, Skyline Mine, Inc. removed 610,000 tons and 480,000 tons of ore, respectively. The balance in the Accumulated Depletion account for the mineral deposit on December 31, 2009, will be:

A)unknown; the balance cannot be determined without knowing the residual value of the resource.

B)$5,490,000.

C)$2,880,000.

D)$6,540,000.

A)unknown; the balance cannot be determined without knowing the residual value of the resource.

B)$5,490,000.

C)$2,880,000.

D)$6,540,000.

D

2

The portion of the cost of natural resources that is consumed in a particular period is called:

A)depletion expense.

B)depreciation expense.

C)amortization expense.

D)resource expense.

A)depletion expense.

B)depreciation expense.

C)amortization expense.

D)resource expense.

A

3

Amortization is most closely associated with which asset?

A)Natural gas lease

B)Copyright

C)Building

D)All of the above

A)Natural gas lease

B)Copyright

C)Building

D)All of the above

B

4

Which of the following depreciation methods best applies to those assets that generate greater revenue earlier in their useful lives?

A)Units- of- production method

B)Depletion method

C)Double- declining- balance method

D)Straight- line method

A)Units- of- production method

B)Depletion method

C)Double- declining- balance method

D)Straight- line method

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

5

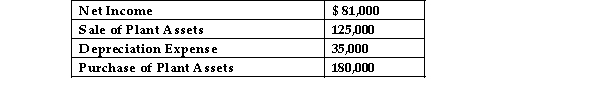

Given the following partial statement of cash flows, what is the amount of Equipment purchased, if Depreciation expense amounted to 1,548?

A)$2,390

B)$2,518

C)$1,484

A)$2,390

B)$2,518

C)$1,484

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

6

The expected cash value of a plant asset at the end of its useful life is known as:

A)salvage value.

B)residual value.

C)scrap value.

D)all of the above answers.

A)salvage value.

B)residual value.

C)scrap value.

D)all of the above answers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

7

Which accounting principle directs the depreciation process?

A)Matching

B)Going concern

C)Historical cost

D)Full disclosure

A)Matching

B)Going concern

C)Historical cost

D)Full disclosure

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

8

Research and development costs incurred by a company should be:

A)either capitalized and depreciated or expensed immediately at the option of the accountant.

B)expensed on the current year's income statement.

C)capitalized and depreciated over a period not to exceed 20 years.

D)capitalized and amortized over the useful life of the asset.

A)either capitalized and depreciated or expensed immediately at the option of the accountant.

B)expensed on the current year's income statement.

C)capitalized and depreciated over a period not to exceed 20 years.

D)capitalized and amortized over the useful life of the asset.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

9

The depreciation process attempts to match the:

A)book value and the current market value of the asset.

B)cost of the asset and the cash required to replace the asset.

C)salvage value of the asset and the future market value of the asset.

D)revenues earned by the asset and the cost of the asset.

A)book value and the current market value of the asset.

B)cost of the asset and the cash required to replace the asset.

C)salvage value of the asset and the future market value of the asset.

D)revenues earned by the asset and the cost of the asset.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

10

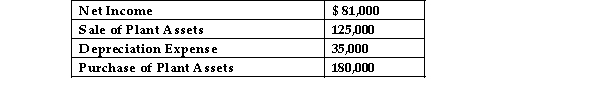

Farmer's Corp. has the following items that the controller is uncertain of where to place on the statement of cash flows:

A total of $ would appear in the Investing Activities section.

A total of $ would appear in the Investing Activities section.

A)$305,000

B)$46,000)

C)$116,000

D)$55,000)

A total of $ would appear in the Investing Activities section.

A total of $ would appear in the Investing Activities section.A)$305,000

B)$46,000)

C)$116,000

D)$55,000)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

11

Pat's Pets recently paid to have the engine in its delivery van overhauled. The estimated useful life of the van was originally estimated to be 7 years. The overhaul is expected to extend the useful life of the van to 9 years. The overhaul is regarded as an):

A)revenue expenditure.

B)matching expenditure.

C)equity expenditure.

D)capital expenditure.

A)revenue expenditure.

B)matching expenditure.

C)equity expenditure.

D)capital expenditure.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

12

The correct journal entry to record depletion for an oil well would include:

A)a credit to Depletion Expense, Oil Well.

B)a debit to Accumulated Depletion, Oil Well.

C)a debit to Depletion Expense, Oil Well.

D)none of the above.

A)a credit to Depletion Expense, Oil Well.

B)a debit to Accumulated Depletion, Oil Well.

C)a debit to Depletion Expense, Oil Well.

D)none of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

13

The cost of installing shrubbery should be recorded as:

A)land improvements.

B)land improvement expense.

C)land maintenance expense.

D)land.

A)land improvements.

B)land improvement expense.

C)land maintenance expense.

D)land.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

14

Equipment acquired on January 1, 2006, is sold on June 30, 2009, for $11,200. The equipment cost $26,800, had an estimated residual value of $6,800, and an estimated useful life of 5 years. The company prepared financial statements on December 31, and the equipment has been depreciated using the straight- line method. Prior to determining the gain or loss on the sale of this equipment, the company should record depreciation of:

A)$5,000.

B)$31,700.

C)$2,000.

D)nothing, because no entry is required.

A)$5,000.

B)$31,700.

C)$2,000.

D)nothing, because no entry is required.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

15

Equipment costing $47,500 with a book value of $22,500 is sold for $26,000. The journal entry will involve a to Accumulated Depreciation.

A)debit of $25,000

B)credit of $22,500

C)debit of $22,500

D)credit of $25,000

A)debit of $25,000

B)credit of $22,500

C)debit of $22,500

D)credit of $25,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

16

Bixby Corporation purchased land and a building for $800,000. An appraisal indicates that the land's value is $400,000 and the building's value is $500,000. When recording this transaction Galaxy should debit:

A)Land for $800,000.

B)Building for $444,444.

C)Land Improvement- Building for $500,000.

D)Building for $355,555.

A)Land for $800,000.

B)Building for $444,444.

C)Land Improvement- Building for $500,000.

D)Building for $355,555.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

17

Needles Company purchased Boston Company on August 31, 2004. Needles recorded goodwill in the purchase of Boston and has determined that the Boston goodwill will have an indefinite life. How will Needles account for the Boston goodwill in future accounting periods?

A)Needles will amortize the Boston goodwill over a 50- year life.

B)If the value of the Boston goodwill decreases in subsequent years, Needles will decrease the value in the Boston Goodwill account.

C)Needles is not allowed to change the value of the Boston Goodwill account regardless of any future increase or decrease in the value of Boston goodwill.

D)If the value of the Boston goodwill increases in subsequent years, Needles will increase the value in the Boston Goodwill account.

A)Needles will amortize the Boston goodwill over a 50- year life.

B)If the value of the Boston goodwill decreases in subsequent years, Needles will decrease the value in the Boston Goodwill account.

C)Needles is not allowed to change the value of the Boston Goodwill account regardless of any future increase or decrease in the value of Boston goodwill.

D)If the value of the Boston goodwill increases in subsequent years, Needles will increase the value in the Boston Goodwill account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

18

All of the following are intangible assets EXCEPT:

A)natural gas.

B)copyrights.

C)goodwill.

D)trademarks.

A)natural gas.

B)copyrights.

C)goodwill.

D)trademarks.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

19

When an asset is fully depreciated:

A)the book value is zero, and the asset has no market value.

B)the book value is equal to the salvage value, and the asset has reached the end of its estimated useful life.

C)the depreciable cost is equal to the salvage value, and the asset is of no further use to the company.

D)the total depreciation is equal to the accumulated depreciation, and the asset has reached the end of its actual useful life.

A)the book value is zero, and the asset has no market value.

B)the book value is equal to the salvage value, and the asset has reached the end of its estimated useful life.

C)the depreciable cost is equal to the salvage value, and the asset is of no further use to the company.

D)the total depreciation is equal to the accumulated depreciation, and the asset has reached the end of its actual useful life.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

20

Which of the following should be included in the cost of land?

A)Lighting

B)Landscaping

C)Construction cost of a parking lot

D)Real estate brokerage commission

A)Lighting

B)Landscaping

C)Construction cost of a parking lot

D)Real estate brokerage commission

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

21

The depreciable cost of an asset is defined as:

A)cost minus annual maintenance expense.

B)cost minus accumulated depreciation.

C)current sales value minus historical cost.

D)cost minus salvage value.

A)cost minus annual maintenance expense.

B)cost minus accumulated depreciation.

C)current sales value minus historical cost.

D)cost minus salvage value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

22

On January 2, 2006, KJ Corporation acquired equipment for $260,000. The estimated life of the equipment is 5 years or 40,000 hours. The estimated residual value is $20,000. What is the balance in Accumulated Depreciation on December 31, 2007, if KJ Corporation uses the straight- line method of depreciation?

A)$49,500

B)$53,625

C)$96,000

D)$51,500

A)$49,500

B)$53,625

C)$96,000

D)$51,500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

23

Patents are amortized over a period:

A)of 20 years or less.

B)greater than 40 years.

C)of 1 year-that is, patents are expensed immediately.

D)of 40 years or less.

A)of 20 years or less.

B)greater than 40 years.

C)of 1 year-that is, patents are expensed immediately.

D)of 40 years or less.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

24

A loss is recorded on the sale of a plant asset when the:

A)cash received exceeds the cash paid for the replacement asset.

B)asset's book value is less than its historical cost.

C)cash received exceeds the asset's book value.

D)asset's book value is greater than the amount of cash received from the sale.

A)cash received exceeds the cash paid for the replacement asset.

B)asset's book value is less than its historical cost.

C)cash received exceeds the asset's book value.

D)asset's book value is greater than the amount of cash received from the sale.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

25

On January 2, 2007, Mosby Corporation acquired equipment for $200,000. The estimated life of the equipment is 8 years or 35,000 hours. The estimated residual value is $40,000. What is the amount of depreciation expense for 2007, if the company uses the double- declining- balance method of depreciation?

A)$112,500

B)$30,000

C)$50,000

D)$87,500

A)$112,500

B)$30,000

C)$50,000

D)$87,500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

26

Which of the following is NOT an intangible asset?

A)Mineral rights

B)Patent

C)Copyright

D)Goodwill

A)Mineral rights

B)Patent

C)Copyright

D)Goodwill

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

27

Carl's Cigar Corporation's net income before depreciation and taxes is $310,000. Using straight- line depreciation, the current year's depreciation expense would be $24,000. Using double- declining- balance depreciation, the current year's depreciation expense would be $36,000.

Assuming a tax rate of 35%, what is Carl's Cigar Corporation's net income if the double- declining- balance depreciation method is

Used?

A)$178,100

B)$166,400

C)$185,900

D)$171,600

Assuming a tax rate of 35%, what is Carl's Cigar Corporation's net income if the double- declining- balance depreciation method is

Used?

A)$178,100

B)$166,400

C)$185,900

D)$171,600

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

28

Capital expenditures are not immediately expensed because these items:

A)return an asset to its prior condition.

B)do not extend the life of an asset.

C)increase the asset's capacity.

D)do all of the above.

A)return an asset to its prior condition.

B)do not extend the life of an asset.

C)increase the asset's capacity.

D)do all of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

29

Bay Back Company acquired equipment on June 30, 2007, for $210,000. The residual value is $35,000 and the estimated life is 5 years or 40,000 hours. Compute the balance in Accumulated Depreciation as of December 31, 2009, if Bay Back Company uses the double- declining- balance method of depreciation.

A)$134,400

B)$141,960

C)$149,520

D)$68,040

A)$134,400

B)$141,960

C)$149,520

D)$68,040

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

30

Valtrex Inc. sells a major plant asset.

A)Depreciation expense should be recorded through the date of sale.

B)The book value of the asset should be credited to the asset account.

C)A loss should be recognized, but not a gain, if depreciation expense was taken on the asset before the asset was sold.

D)No gain should be recognized if depreciation expense was taken on the asset before the asset was sold.

A)Depreciation expense should be recorded through the date of sale.

B)The book value of the asset should be credited to the asset account.

C)A loss should be recognized, but not a gain, if depreciation expense was taken on the asset before the asset was sold.

D)No gain should be recognized if depreciation expense was taken on the asset before the asset was sold.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

31

Patch Company sold some office furniture for $4,800 cash. The furniture cost $31,500 and had accumulated depreciation through the date of sale totaling $29,300. The journal entry to record the sale of the furniture will include a:

A)debit to Loss on Sale of Furniture for $26,700.

B)credit to Gain on Sale of Furniture for $2,600.

C)debit to Gain on Sale of Furniture for $2,600.

D)credit to Loss on Sale of Furniture for $26,700.

A)debit to Loss on Sale of Furniture for $26,700.

B)credit to Gain on Sale of Furniture for $2,600.

C)debit to Gain on Sale of Furniture for $2,600.

D)credit to Loss on Sale of Furniture for $26,700.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

32

Jackson Corporation acquired equipment on January 1, 2007, for $320,000. The equipment had an estimated useful life of 10 years and an estimated salvage value of $25,000. On January 1, 2010, Jackson Corporation revised the total useful life of the equipment to 8 years and the estimated salvage value to be $20,000. Compute depreciation expense for the year ending December 31, 2010, if Jackson Corporation uses straight- line depreciation.

A)$26,477

B)$46,300

C)$39,300

D)$42,300

A)$26,477

B)$46,300

C)$39,300

D)$42,300

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

33

The computation of depletion expense is most closely related to which method for computing depreciation?

A)Units- of- production

B)Straight- line

C)Double- declining balance

D)The method selected depends upon the specific natural resource.

A)Units- of- production

B)Straight- line

C)Double- declining balance

D)The method selected depends upon the specific natural resource.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

34

The Fall River Corporation bought a plant asset on January 1, 2006, at a cost of $45,000. Estimated residual value is $5,000 and the estimated useful life is 8 years. The company uses straight- line depreciation. On January 1, 2009, Fall River's management revises the total estimated life to be 10 years, with estimated residual value of $2,000. The balance in Accumulated Depreciation on December 31, 2009, is:

A)$16,358.

B)$19,000.

C)$21,429.

D)$10,000.

A)$16,358.

B)$19,000.

C)$21,429.

D)$10,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

35

Deland Company purchased equipment on March 1, 2009, for $130,000. The residual value is $40,000 and the estimated life is 10 years or 60,000 hours. Compute depreciation expense for the year ending December 31, 2010, if the company uses the double- declining- balance method of depreciation.

A)$24,666

B)$20,800

C)$21,666

D)$26,333

A)$24,666

B)$20,800

C)$21,666

D)$26,333

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

36

Which of the following statements is FALSE?

A)Depreciation is a non- cash expense.

B)Depreciation is a process of subjective valuation.

C)Accumulated depreciation represents a growing amount of cash to be used to replace the existing asset.

D)Accumulated depreciation is that portion of a plant asset's cost that has been recorded previously as an expense.

A)Depreciation is a non- cash expense.

B)Depreciation is a process of subjective valuation.

C)Accumulated depreciation represents a growing amount of cash to be used to replace the existing asset.

D)Accumulated depreciation is that portion of a plant asset's cost that has been recorded previously as an expense.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

37

Using an accelerated depreciation method will cause a company to incur:

A)less taxes in early years of the asset's use as compared to later years.

B)none of these answers are correct.

C)more taxes in early years of the asset's use as compared to later years.

D)the same amount of taxes in early years of the asset's use as in the later years.

A)less taxes in early years of the asset's use as compared to later years.

B)none of these answers are correct.

C)more taxes in early years of the asset's use as compared to later years.

D)the same amount of taxes in early years of the asset's use as in the later years.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

38

Jackson Corporation acquired equipment on January 1, 2007, for $320,000. The equipment had an estimated useful life of 10 years and an estimated salvage value of $25,000. On January 1, 2010, Jackson Corporation revised the total useful life of the equipment to 8 years and the estimated salvage value to be $20,000. Compute depreciation expense for the year ending December 31, 2010, if Jackson Corporation uses straight- line depreciation.

A)$26,477

B)$46,300

C)$42,300

D)$39,300

A)$26,477

B)$46,300

C)$42,300

D)$39,300

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

39

At the end of an asset's useful life, the balance in Accumulated Depreciation will be the same as:

A)depreciable cost.

B)original cost.

C)book value.

D)salvage value.

A)depreciable cost.

B)original cost.

C)book value.

D)salvage value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

40

The cost of assets acquired in a lump- sum purchase must be allocated using which method?

A)Cost method

B)Relative- sales- value- method

C)Book- value method

D)Per capita method

A)Cost method

B)Relative- sales- value- method

C)Book- value method

D)Per capita method

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

41

On January 2, 2006, KJ Corporation acquired equipment for $260,000. The estimated life of the equipment is 5 years or 40,000 hours. The estimated residual value is $20,000. What is the balance in Accumulated Depreciation on December 31, 2006, if KJ Corporation uses the double- declining- balance method of depreciation?

A)$96,000

B)$88,000

C)$62,400

D)$104,000

A)$96,000

B)$88,000

C)$62,400

D)$104,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

42

Land is purchased for $62,500. Back taxes paid by the purchaser were $7,500; total costs to demolish an existing building were $11,000; fencing costs were $12,500; and lighting costs were $1,500. What is the cost of the land?

A)$81,000

B)$93,500

C)$95,000

D)$62,500

A)$81,000

B)$93,500

C)$95,000

D)$62,500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

43

Which of the following depreciation methods best fits those assets that tend to wear out before they become obsolete?

A)Depletion method

B)Double- declining- balance method

C)Units- of- production method

D)Straight- line method

A)Depletion method

B)Double- declining- balance method

C)Units- of- production method

D)Straight- line method

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

44

The book value of an asset is defined as:

A)cost minus salvage value.

B)current sales value minus historical cost.

C)cost minus accumulated depreciation.

D)cost minus annual maintenance expense.

A)cost minus salvage value.

B)current sales value minus historical cost.

C)cost minus accumulated depreciation.

D)cost minus annual maintenance expense.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

45

Equipment is sold for $20,000 cash that had a book value of $6,000 The statement of cash flows will report a:

A)$20,000 cash inflow in the financing activities section.

B)$14,000 inflow in the operating activities section.

C)$20,000 cash outflow in the investing activities section.

D)$20,000 inflow in the investing activities section.

A)$20,000 cash inflow in the financing activities section.

B)$14,000 inflow in the operating activities section.

C)$20,000 cash outflow in the investing activities section.

D)$20,000 inflow in the investing activities section.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

46

Tomas Company trades in a printing press for a newer model. The cost of the old printing press was $61,500, and accumulated depreciation up to the date of the trade- in amounts to $38,000. The company also pays $41,200 cash for the newer printing press. The journal entry to acquire the new printing press will require a debit to Equipment for:

A)$61,500.

B)$64,700.

C)$102,700.

D)$41,200.

A)$61,500.

B)$64,700.

C)$102,700.

D)$41,200.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

47

Deland Company purchased equipment on March 1, 2009, for $130,000. The residual value is $40,000 and the estimated life is 10 years or 60,000 hours. Compute depreciation expense for the year ending December 31, 2009, if the company uses the straight- line method of depreciation.

A)$9,000

B)$14,444

C)$21,666

D)$7,500

A)$9,000

B)$14,444

C)$21,666

D)$7,500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

48

Equipment purchased for $85,000 on January 1, 2006, was sold on July 1, 2009. The company uses the straight- line method of computing depreciation and recognizes $17,000 of depreciation expense annually. When recording the sale, the company should record a debit to Accumulated Depreciation for:

A)$59,500.

B)$68,000.

C)$51,000.

D)none of the above answers; Accumulated Depreciation is not debited.

A)$59,500.

B)$68,000.

C)$51,000.

D)none of the above answers; Accumulated Depreciation is not debited.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

49

Great Farms Company sold some fully depreciated equipment for $4,100 cash. The equipment had been purchased for $49,600, and the company had estimated the useful life at 8 years and a residual value at $5,600. How will this sale affect Retained Earnings?

A)It will increase Retained Earnings by $4,100.

B)It will decrease Retained Earnings by $44,000.

C)It will decrease Retained Earnings by $1,500.

D)It will have no effect on Retained Earnings.

A)It will increase Retained Earnings by $4,100.

B)It will decrease Retained Earnings by $44,000.

C)It will decrease Retained Earnings by $1,500.

D)It will have no effect on Retained Earnings.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

50

The main types of plant asset transactions that appear on the Statement of Cash Flows are:

A)sales and depreciation.

B)acquisitions and depreciation.

C)acquisitions and sales.

D)acquisitions, sales and depreciation.

A)sales and depreciation.

B)acquisitions and depreciation.

C)acquisitions and sales.

D)acquisitions, sales and depreciation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

51

Deland Company purchased equipment on March 1, 2009, for $130,000. The residual value is $40,000 and the estimated life is 10 years or 60,000 hours. Compute depreciation expense for the year ending December 31, 2009, if the company uses the units- of- production method of depreciation and uses the equipment for 9,000 hours.

A)$9,000

B)$13,500

C)$10,500

D)$29,500

A)$9,000

B)$13,500

C)$10,500

D)$29,500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

52

Under the MACRS depreciation method, automobiles and equipment are depreciated using the:

A)IRS units- of- production method.

B)straight- line method.

C)double- declining- balance method.

D)150%- declining- balance method.

A)IRS units- of- production method.

B)straight- line method.

C)double- declining- balance method.

D)150%- declining- balance method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

53

The Augusta Health Company purchased land, buildings and equipment for $2,400,000. The land has been appraised at $915,000, the buildings at $1,125,000 and the equipment at $510,000. The equipment account will be debited for:

A)$480,000.

B)$500,000.

C)$410,156.

D)$541,875.

A)$480,000.

B)$500,000.

C)$410,156.

D)$541,875.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

54

Morton Corporation purchased equipment for $46,000. Morton also paid $1,200 for freight and insurance while the equipment was in transit. Sales tax amounted to $850. Insurance, taxes and maintenance for the first year of use was $1,000. How much should Morton Corporation capitalize as the cost of the equipment?

A)$46,000

B)$46,850

C)$49,050

D)$48,050

A)$46,000

B)$46,850

C)$49,050

D)$48,050

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

55

Smucker's Company sold equipment costing $65,000 with $60,000 of accumulated depreciation for $10,000 cash. The company's journal entry to record this sale will NOT include a:

A)debit to Gain on Sale of Equipment for $5,000.

B)debit to Accumulated Depreciation for $60,000.

C)credit to Equipment for $65,000.

D)credit to Gain on Sale of Equipment for $5,000.

A)debit to Gain on Sale of Equipment for $5,000.

B)debit to Accumulated Depreciation for $60,000.

C)credit to Equipment for $65,000.

D)credit to Gain on Sale of Equipment for $5,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

56

On January 2, 2007, Mosby Corporation acquired equipment for $200,000. The estimated life of the equipment is 8 years or 35,000 hours. The estimated residual value is $40,000. What is the book value of the equipment on December 31, 2007, if Mosby Corporation uses the double- declining- balance method of depreciation?

A)$150,000

B)$72,000

C)$128,000

D)$87,500

A)$150,000

B)$72,000

C)$128,000

D)$87,500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

57

All amounts paid to acquire a plant asset and to get it ready for its intended use are referred to as: set up costs.

A)the cost of an asset.

B)capital expenditures.

C)set up costs.

D)maintenance expense.

A)the cost of an asset.

B)capital expenditures.

C)set up costs.

D)maintenance expense.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

58

Paul's Lodging Corporation purchased equipment on January 1, 2006 for $180,000. The equipment had an estimated useful life of 10 years and an estimated salvage value of $30,000. After using the equipment for 3 years, the company determined that the equipment could be used for an additional 9 years and still have a salvage value. Assuming Paul's Lodging Corporation uses straight- line depreciation, compute depreciation expense for the year ending December 31, 2009.

A)$15,000

B)$13,500

C)$11,250

D)$20,000

A)$15,000

B)$13,500

C)$11,250

D)$20,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

59

On January 2, 2008, Bantam Oil Company purchased an oil well for $625,000. The well contains an estimated 150,000 barrels of oil, with an estimated residual value of $25,000. During 2008, 15,000 barrels of oil were removed from the well. To record depletion for 2008, Bantam Oil Company will debit Depletion Expense for:

A)$60,000.

B)$64,500.

C)$62,500.

D)$69,444.

A)$60,000.

B)$64,500.

C)$62,500.

D)$69,444.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

60

Repairs made to equipment as part of a yearly maintenance project would be recorded in the journal by debiting:

A)Accumulated Depreciation.

B)Equipment.

C)Depreciation Expense.

D)Repair Expense.

A)Accumulated Depreciation.

B)Equipment.

C)Depreciation Expense.

D)Repair Expense.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

61

All of the following are classified as natural resources and are depleted EXCEPT for:

A)minerals.

B)land.

C)timber.

D)gasoline.

A)minerals.

B)land.

C)timber.

D)gasoline.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

62

A revision of an estimate which will extend the asset's useful life is called a change in accounting:

A)theory.

B)procedure.

C)estimate.

D)policy.

A)theory.

B)procedure.

C)estimate.

D)policy.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

63

On January 10, 2007, Maxim Corporation acquired equipment for $124,000. The estimated life of the equipment is 3 years or 24,000 hours. The estimated residual value is $10,000. What is the depreciation for 2007, if Baldwin Corporation uses the asset 9,100 hours and uses the units- of- production method of depreciation?

A)$38,000

B)$41,333

C)$43,225

D)$47,017

A)$38,000

B)$41,333

C)$43,225

D)$47,017

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

64

Accumulated Depletion is an):

A)contra- liability account.

B)expense account.

C)contra- asset account.

D)contra- revenue account.

A)contra- liability account.

B)expense account.

C)contra- asset account.

D)contra- revenue account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

65

In a lump- sum purchase of assets, the relative sales value is defined as the:

A)ratio of each asset's market value to the total book value.

B)ratio of each asset's market value to the total market value.

C)total price paid less the value of the most valuable asset.

D)total price paid compared to the total market value.

A)ratio of each asset's market value to the total book value.

B)ratio of each asset's market value to the total market value.

C)total price paid less the value of the most valuable asset.

D)total price paid compared to the total market value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

66

Which of the following costs associated with a delivery van should be capitalized? I. The van is repainted.

II. The van's transmission is completely overhauled.

III. The van is modified for a specific use.

A)I and III

B)I and II

C)II and III

D)All of these answers are correct.

II. The van's transmission is completely overhauled.

III. The van is modified for a specific use.

A)I and III

B)I and II

C)II and III

D)All of these answers are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

67

In 2007, First Company purchased Second Company for $15,000,000 cash. At the time of purchase Second Company had $18,500,000 in assets and liabilities of $11,000,000. After two years, the value of the assets purchased from Second Company has increased in value to $9,500,000. The 2009 balance sheet for First Company should show goodwill of:

A)$2,500,000.

B)$0.

C)$7,500,000.

D)$9,500,000.

A)$2,500,000.

B)$0.

C)$7,500,000.

D)$9,500,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

68

Depreciation expense is:

A)added to the investing activities on a statement of cash flows.

B)subtracted from the investing activities on a statement of cash flows.

C)added to net income on a statement of cash flows, since it decreases net income but does not involve an outflow of cash.

D)subtracted from net income on a statement of cash flows, since it decreases net income but does not involve an outflow of cash.

A)added to the investing activities on a statement of cash flows.

B)subtracted from the investing activities on a statement of cash flows.

C)added to net income on a statement of cash flows, since it decreases net income but does not involve an outflow of cash.

D)subtracted from net income on a statement of cash flows, since it decreases net income but does not involve an outflow of cash.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

69

Which of the following should be included in the Machinery account?

A)The cost of a maintenance insurance plan after the machinery is up and running.

B)The cost of calibrating the machinery before it is shipped.

C)The cost of transporting the machinery to its setup location.

D)The cost of insurance while the machinery is being overhauled.

A)The cost of a maintenance insurance plan after the machinery is up and running.

B)The cost of calibrating the machinery before it is shipped.

C)The cost of transporting the machinery to its setup location.

D)The cost of insurance while the machinery is being overhauled.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

70

On January 10, 2006, Maxim Corporation acquired equipment for $124,000. The estimated life of the equipment is 3 years or 24,000 hours. The estimated residual value is $10,000. What is the balance of Accumulated Depreciation on December 31, 2007, if Baldwin Corporation uses the asset 5,500 hours in 2006 and 4,500 hours in 2007?

A)$47,500

B)$61,218

C)$52,083

D)$76,000

A)$47,500

B)$61,218

C)$52,083

D)$76,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

71

The entry to amortize a patent includes a credit to:

A)Amortization Expense - Patent.

B)Patent.

C)Accumulated Amortization - Patent.

D)none of these, as a patent is not amortized.

A)Amortization Expense - Patent.

B)Patent.

C)Accumulated Amortization - Patent.

D)none of these, as a patent is not amortized.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

72

A plant asset is acquired by a business on January 1, 2005, for $30,000. The asset's estimated residual value is $8,000 and its estimated life is 5 years. Management chooses to use straight- line depreciation. On January 1, 2007, management revises the total useful life to 6 years and the residual value to be zero. Compute the balance in Accumulated Depreciation on December 31, 2007.

A)$4,400

B)$14,100

C)$5,300

D)$8,800

A)$4,400

B)$14,100

C)$5,300

D)$8,800

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

73

The process of allocating a plant asset's cost to expense over the period in which the asset is used is called:

A)depreciation.

B)depletion.

C)allocation.

D)amortization.

A)depreciation.

B)depletion.

C)allocation.

D)amortization.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

74

The journal entry to record a major expenditure to upgrade equipment that extends its useful life beyond the original estimate would include a:

A)debit to Equipment.

B)debit to Depreciation Expense.

C)credit to Depreciation Expense.

D)debit to Repair Expense.

A)debit to Equipment.

B)debit to Depreciation Expense.

C)credit to Depreciation Expense.

D)debit to Repair Expense.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

75

An example of a long- term asset would be:

A)office supplies.

B)patents.

C)furniture.

D)investment in LQH company.

A)office supplies.

B)patents.

C)furniture.

D)investment in LQH company.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

76

When compared to the other methods of depreciation, the double- declining- balance method of depreciation gives depreciation expense for a period that is:

A)more in the earlier periods.

B)approximately the same in earlier periods as with other methods.

C)an accelerated method; therefore, companies cannot use this method.

D)less in the earlier periods.

A)more in the earlier periods.

B)approximately the same in earlier periods as with other methods.

C)an accelerated method; therefore, companies cannot use this method.

D)less in the earlier periods.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

77

Equipment is acquired by issuing a note payable for $57,000 and a down payment of $30,000. The statement of cash flows will report a:

A)$57,000 inflow in the investing activities section.

B)$57,000 cash inflow in the financing activities section.

C)$30,000 cash outflow in the investing activities section.

D)$30,000 inflow in the operating activities section.

A)$57,000 inflow in the investing activities section.

B)$57,000 cash inflow in the financing activities section.

C)$30,000 cash outflow in the investing activities section.

D)$30,000 inflow in the operating activities section.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

78

All of the following assets should be amortized EXCEPT:

A)patent.

B)franchises.

C)goodwill.

D)all of the above.

A)patent.

B)franchises.

C)goodwill.

D)all of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

79

Treating a capital expenditure as an immediate expense:

A)understates expenses and understates assets.

B)understates expenses and overstates owners' equity.

C)overstates expenses and understates net income.

D)overstates assets and overstates owners' equity.

A)understates expenses and understates assets.

B)understates expenses and overstates owners' equity.

C)overstates expenses and understates net income.

D)overstates assets and overstates owners' equity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

80

On January 2, 2006, KJ Corporation acquired equipment for $260,000. The estimated life of the equipment is 5 years or 40,000 hours. The estimated residual value is $20,000. What is the book value of the asset on December 31, 2007, if KJ Corporation uses the straight- line method of depreciation?

A)$104,000

B)$96,000

C)$80,000

D)$164,000

A)$104,000

B)$96,000

C)$80,000

D)$164,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck