Deck 10: Capital Budgeting

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

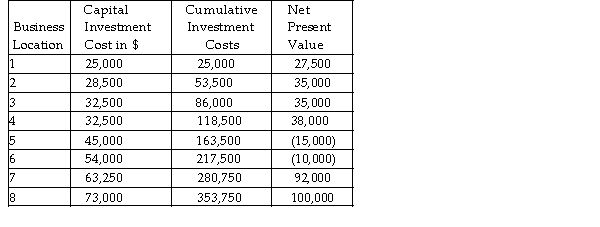

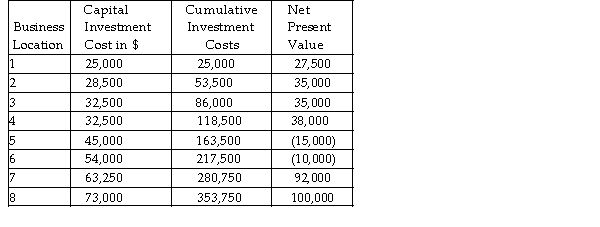

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/88

العب

ملء الشاشة (f)

Deck 10: Capital Budgeting

1

If the present value of the benefits received outweighs the present value of the costs incurred, then a company should make the decision to invest in the project.

True

2

Working capital consists of cash, marketable securities, accounts receivable, and inventory.

True

3

The first step involved in the capital budgeting decision is formulating the proposal.

True

4

Capital budgeting is the method we use to justify the acquisition of those items that have a useful life in excess of one year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

5

A benefit resulting from reducing taxable income is equal to the amount of taxes saved.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

6

Payback does not consider the time value of money.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

7

The cost of capital to the borrower consists of the opportunity cost on the amount of equity invested in the business.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

8

When making a capital budgeting decision, we must arrive at a forecast of future interest rates.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

9

The last step involved in capital budgeting is taking corrective action.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

10

Future moneys or benefits should be measured in before -tax dollars.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

11

A benefit resulting from reducing taxable income is equal to the amount of taxes paid.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

12

The weighted average cost of capital is the interest rate that is used in calculating the net present value for capital budgeting.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

13

The cost of capital to the lender consists of the opportunity cost on the amount of equity invested in the business.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

14

Future moneys or benefits should be measured in after -tax dollars.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

15

Capital budgeting investments are based on the assumption that rates of return on investments as well as current inflation rates will vary during the useful life of the investment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

16

Capital budgeting is the method we use to justify the acquisition of those items that have a useful life of less than one year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

17

If the present value of the benefits received is less than the present value of the costs incurred, then a company should make the decision to invest in the project.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

18

Capital budgeting investments are based on the assumption that rates of return on investments will vary, but current inflation rates will remain the same during the useful life of the investment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

19

Payback normally considers the time value of money.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

20

Capital budgeting investments are based on the assumption that rates of return on investments as well as current inflation rates will remain the same during the useful life of the investment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

21

The profitability index is the ratio of the present value of the cost to the present value of the benefits.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

22

Job shifts occurred in the early twenty -first century because of the decreased price of communication and transportation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

23

Capital rationing is a constraint placed on the amount of funds that can be invested in a given time period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

24

If the NPV is positive when using a specific interest rate, the IRR will be greater than that interest rate used.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

25

We can compute the IRR by using a calculator and the input of two variables.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

26

If you do not have a business or programmable calculator you can still find the IRR through the process of interpolation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

27

Which of the following assets is considered in capital budgeting?

A) purchase of stocks

B) purchase of inventory

C) purchase of trucks

D) purchase of bonds

A) purchase of stocks

B) purchase of inventory

C) purchase of trucks

D) purchase of bonds

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

28

The net present value is zero at the IRR.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

29

A mutually exclusive investment is one where several investments are chosen and one is ultimately sacrificed or excluded.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

30

The profitability index is the ratio of the present value of the benefits to the present value of the costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

31

The accounting rate of return uses cash flow.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

32

Setting up a communication center in India requires a capital budgeting decision.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

33

Capital Budgeting decisions pertain to domestic decisions only.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

34

In capital budgeting, the future moneys or benefits should be measured in

A) the sum of after -tax cash flows and accounting income.

B) after -tax cash flows.

C) before -tax cash flows.

D) the cash balance in our checking account before taxes.

A) the sum of after -tax cash flows and accounting income.

B) after -tax cash flows.

C) before -tax cash flows.

D) the cash balance in our checking account before taxes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

35

Capital budgeting investments are feasible if after capital budgeting analysis the

A) present value of the benefits > the present value of the costs.

B) present value of the costs > the present value of the benefits.

C) present value of the costs < the present value of the benefits.

D) Both A and C above.

E) Both A and B above.

A) present value of the benefits > the present value of the costs.

B) present value of the costs > the present value of the benefits.

C) present value of the costs < the present value of the benefits.

D) Both A and C above.

E) Both A and B above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

36

Which of the following government actions would require a capital budgeting decision?

A) an increase in factoring requirements imposed by our bank

B) an increase in collection service fees imposed by our collection agency

C) an increase in sales taxes on all items sold after the first of next year

D) an increase in the number of wheelchair ramps available for customers entering our business

A) an increase in factoring requirements imposed by our bank

B) an increase in collection service fees imposed by our collection agency

C) an increase in sales taxes on all items sold after the first of next year

D) an increase in the number of wheelchair ramps available for customers entering our business

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

37

The IRR is the actual rate of return on an investment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

38

A mutually exclusive investment is one where one investment is chosen and the others are ultimately sacrificed or excluded.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

39

The IRR is the rate that allows the present value of the benefits to exactly equal the present value of the costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

40

Capital rationing is a constraint placed on the number of investments that can be made in a given time period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

41

The local printing company purchases a new copy machine that reduces the cost of making a color copy by ten cents a copy. It normally makes 50,000 color copies a year and is in the 28 percent income tax bracket. The tax consequence of this investment will be

A) no difference in income tax paid.

B) an increase in income tax paid.

C) a decrease in income tax paid.

D) cannot tell with the information provided.

A) no difference in income tax paid.

B) an increase in income tax paid.

C) a decrease in income tax paid.

D) cannot tell with the information provided.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

42

The local printing company purchases a new copy machine for $150,000 that reduces the cost of making a color copy by ten cents a copy. The copy machine can be depreciated straight line for seven years and the company is in the 28 percent income tax bracket. The owner believes the machine can be sold for $10,000 at the end of seven years. What is this company's total tax savings due to depreciation?

A) $2,800

B) $39,200

C) $42,000

D) $5,600

A) $2,800

B) $39,200

C) $42,000

D) $5,600

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

43

George William buys a machine for his business. The machine costs $150,000. George estimates that the machine can produce $40,000 cash inflow per year for the next five years. George's cost of capital is 10 percent. What is the approximate internal rate of return?

A) 8.95%

B) 9.43%

C) 11.59%

D) 10.43%

A) 8.95%

B) 9.43%

C) 11.59%

D) 10.43%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

44

Anna Taylor buys a machine for her business. The machine costs $150,000. Anna estimates that the machine can produce $40,000 cash inflow per year for the next five years. Her cost of capital is 12 percent. What is the approximate net present value?

A) $(5,808)

B) $34,192

C) $14,456

D) $11,492

A) $(5,808)

B) $34,192

C) $14,456

D) $11,492

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

45

George William buys a machine for his business. The machine costs $150,000. George estimates that the machine can produce $40,000 cash inflow per year for the next five years. George's cost of capital is 10 percent. What is the approximate profitability index for this investment?

A) 1.11

B) 1.01

C) 0.91

D) 1.16

A) 1.11

B) 1.01

C) 0.91

D) 1.16

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

46

Anna Taylor buys a machine for her business. The machine costs $150,000. Anna estimates that the machine can produce $40,000 cash inflow per year for the next five years. Her cost of capital is 12 percent. Based upon the net present value of this investment, Anna should

A) invest in the machine if she can get a higher cost of capital.

B) not invest in the machine.

C) invest in the machine.

D) Cannot tell without additional information.

A) invest in the machine if she can get a higher cost of capital.

B) not invest in the machine.

C) invest in the machine.

D) Cannot tell without additional information.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

47

The local printing company purchases a new copy machine that reduces the cost of making a color copy by ten cents a copy. It normally makes 50,000 color copies a year and is in the 28 percent income tax bracket. The total benefits that this company will expect to realize is

A) $1,400.

B) $6,400.

C) $5,000.

D) $3,600.

A) $1,400.

B) $6,400.

C) $5,000.

D) $3,600.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

48

George William buys a machine for his business. The machine costs $150,000. George estimates that the machine can produce $40,000 cash inflow per year for the next five years. George's cost of capital is 12 percent. What is the approximate internal rate of return?

A) 11.59%

B) 10.43%

C) 9.43%

D) 8.95%

A) 11.59%

B) 10.43%

C) 9.43%

D) 8.95%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

49

Anna Taylor buys a machine for her business. The machine costs $150,000. Anna estimates that the machine can produce $40,000 cash inflow per year for the next five years. Her cost of capital is 12 percent. What is the approximate present value of the future cash flow for Anna?

A) $164,456

B) $144,192

C) $184,192

D) $161,492

A) $164,456

B) $144,192

C) $184,192

D) $161,492

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

50

George William buys a machine for his business. The machine costs $150,000. George estimates that the machine can produce $40,000 cash inflow per year for the next five years. George's cost of capital is 10 percent. What is the approximate present value of the future cash flow for George?

A) $166,796

B) $174,212

C) $191,632

D) $151,632

A) $166,796

B) $174,212

C) $191,632

D) $151,632

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

51

You own a restaurant and just negotiated a decrease in the cost of steaks by 25 cents a steak. You normally sell 300,000 steak dinners a year. Your business pays an average of 30 percent in income taxes. What is the annual benefit of this increased efficiency?

A) $52,500

B) $210,000

C) $22,500

D) $75,000

A) $52,500

B) $210,000

C) $22,500

D) $75,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

52

Start -up costs include all of the following EXCEPT

A) training costs of employees.

B) investment costs in accounts receivable.

C) service agreement costs.

D) changes in inventory storage space.

A) training costs of employees.

B) investment costs in accounts receivable.

C) service agreement costs.

D) changes in inventory storage space.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

53

Which of the following costs must be considered in evaluating a capital budgeting decision?

A) tax factor costs

B) working capital commitment costs

C) start -up costs

D) all of the above

A) tax factor costs

B) working capital commitment costs

C) start -up costs

D) all of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

54

The local printing company purchases a new copy machine that reduces the cost of making a color copy by ten cents a copy. It normally makes 50,000 color copies a year and is in the 28 percent income tax bracket. The annual taxes on this purchase will be

A) $3,600.

B) $5,000.

C) $6,400.

D) $1,400.

A) $3,600.

B) $5,000.

C) $6,400.

D) $1,400.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

55

Anna Taylor buys a machine for her business. The machine costs $150,000. Anna estimates that the machine can produce $40,000 cash inflow per year for the next five years. Her cost of capital is 12 percent. What is the approximate profitability index of this investment?

A) 1.08

B) 0.96

C) 1.10

D) 1.22

A) 1.08

B) 0.96

C) 1.10

D) 1.22

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

56

The local printing company purchases a new copy machine for $150,000 that reduces the cost of making a color copy by ten cents a copy. The copy machine can be depreciated straight line for seven years and the company is in the 28 percent income tax bracket. The owner believes the machine can be sold for $10,000 at the end of seven years. Approximately how much will this company save on an annual basis in income taxes?

A) $5,600

B) $42,000

C) $39,200

D) $2,800

A) $5,600

B) $42,000

C) $39,200

D) $2,800

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

57

Which of the following is a start -up cost?

A) utility costs

B) recruiting employees

C) sales taxes

D) tax factor costs

A) utility costs

B) recruiting employees

C) sales taxes

D) tax factor costs

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

58

Which of the following is NOT a step in the capital budgeting decision?

A) corrective action

B) making a decision to minimize the greatest future benefit

C) post audit

D) evaluating the data

E) formulating a proposal

A) corrective action

B) making a decision to minimize the greatest future benefit

C) post audit

D) evaluating the data

E) formulating a proposal

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

59

George William buys a machine for his business. The machine costs $150,000. George estimates that the machine can produce $40,000 cash inflow per year for the next five years. George's cost of capital is 10 percent. What is the approximate net present value?

A) $31,632

B) $16,796

C) $1,632

D) $24,212

A) $31,632

B) $16,796

C) $1,632

D) $24,212

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

60

You own a restaurant and just negotiated a decrease in the cost of steaks by 25 cents a steak. You normally sell 300,000 steak dinners a year. Your business pays an average of 30 percent in income taxes. What is the annual tax cost of this increased efficiency?

A) $52,500

B) $75,000

C) $210,000

D) $22,500

A) $52,500

B) $75,000

C) $210,000

D) $22,500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

61

George William buys a machine for his business. The machine costs $150,000. George estimates that the machine can produce $40,000 cash inflow per year for the next five years. George's cost of capital is 10 percent. What is the accounting rate of return?

A) 133%

B) 75%

C) 26.67%

D) 375%

A) 133%

B) 75%

C) 26.67%

D) 375%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

62

Sam Jones has an engineering firm. He wants to build a new headquarters building. The building will cost $1,500,000. He will put down $1,050,000 and have a bank finance the remainder at prime plus 2 percent. The prime lending rate is currently 8.5 percent. Sam will withdraw the money for the down payment from his mutual fund account where he has earned 13 percent for the last ten years. What is Sam's weighted average cost of capital?

A) 10.5%

B) 11.25%

C) 8.5%

D) 12.25%

A) 10.5%

B) 11.25%

C) 8.5%

D) 12.25%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

63

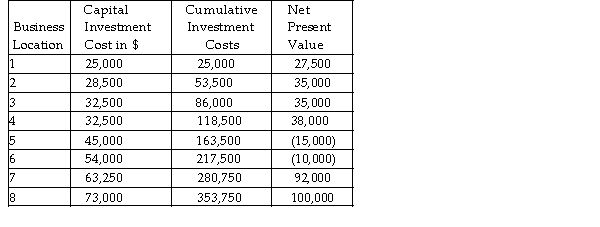

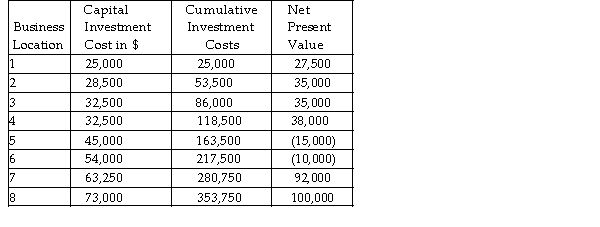

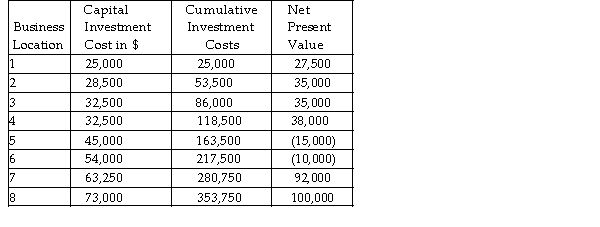

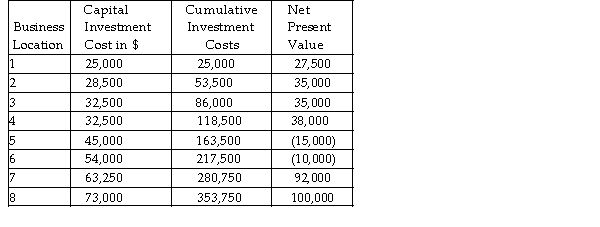

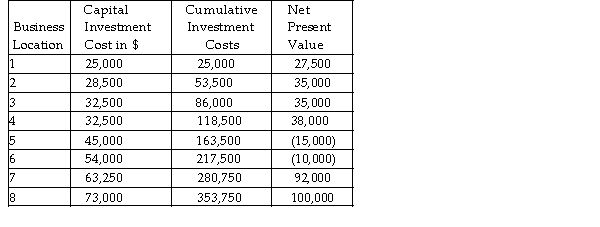

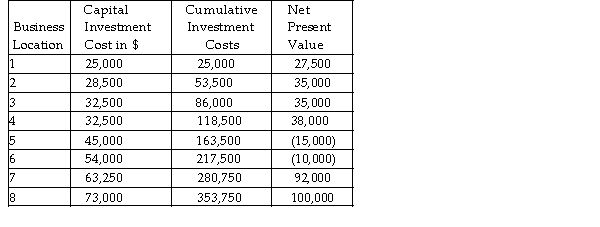

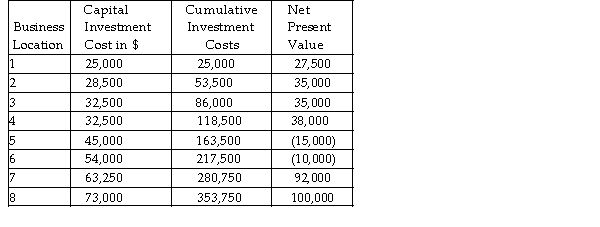

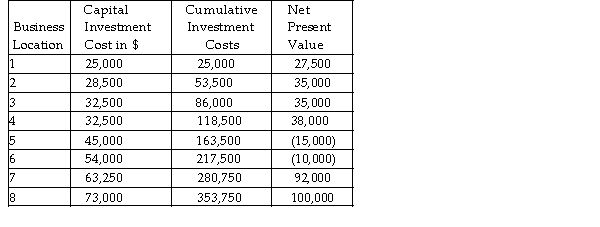

Table 10 -1. Capital Budgeting Choices

Refer to Table 10 -1. Glen Write owns an engineering firm. He asked his employees for suggestions regarding equipment they thought the firm would need during the next year. They suggested the purchase of eight pieces of equipment. Glen calculated the net present value of each recommendation. Glen estimates that he will have no more than $150,000 to invest next year. Based on the projects chosen, how much will he actually invest?

A) $290,500

B) $136,250

C) $299,750

D) $145,000

Refer to Table 10 -1. Glen Write owns an engineering firm. He asked his employees for suggestions regarding equipment they thought the firm would need during the next year. They suggested the purchase of eight pieces of equipment. Glen calculated the net present value of each recommendation. Glen estimates that he will have no more than $150,000 to invest next year. Based on the projects chosen, how much will he actually invest?

A) $290,500

B) $136,250

C) $299,750

D) $145,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

64

Cheryl Peck purchased a computer network for her classroom. The computer network cost $100,000. She estimates that she can charge $500 for one session in the classroom. Cheryl knows that enrollment will increase over time. She estimates 50 students the first year, 75 students the second year, 100 students the third year, and 150 students the fourth year. If her cost of capital is 12 percent, what is the approximate profitability index?

A) 1.19

B) 1.88

C) 1.35

D) 1.05

A) 1.19

B) 1.88

C) 1.35

D) 1.05

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

65

Cheryl Peck purchased a computer network for her classroom. The computer network cost $100,000. She estimates that she can charge $500 for one session in the classroom. Cheryl knows that enrollment will increase over time. She estimates 50 students the first year, 75 students the second year, 100 students the third year, and 150 students the fourth year. If her cost of capital is 12 percent, what is her accounting rate of return?

A) 33.87%

B) 78.33%

C) 64.87%

D) 46.88%

A) 33.87%

B) 78.33%

C) 64.87%

D) 46.88%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

66

Cheryl Peck purchased a computer network for her classroom. The computer network cost $100,000. She estimates that she can charge $500 for one session in the classroom. Cheryl knows that enrollment will increase over time. She estimates 50 students the first year, 75 students the second year, 100 students the third year, and 150 students the fourth year. If her cost of capital is 12 percent, what is the approximate net present value of her investment?

A) $35,471

B) $19,156

C) $87,500

D) Cannot tell without more information.

A) $35,471

B) $19,156

C) $87,500

D) Cannot tell without more information.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

67

Sam Jones has an engineering firm. He wants to build a new headquarters building. The building will cost $1,500,000. He will put down $450,000 and have a bank finance the remainder at prime plus 2 percent. The prime lending rate is currently 8.5 percent. Sam will withdraw the money for the down payment from his mutual fund account where he has earned 13 percent for the last ten years. What percentage of the building is being financed by the bank?

A) 30%

B) 10.5%

C) 13%

D) 70%

A) 30%

B) 10.5%

C) 13%

D) 70%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

68

Cheryl Peck purchased a computer network for her classroom. The computer network cost $100,000. She estimates that she can charge $500 for one session in the classroom. Cheryl knows that enrollment will increase over time. She estimates 50 students the first year, 75 students the second year, 100 students the third year, and 150 students the fourth year. If her cost of capital is 16 percent, what is the approximate net present value?

A) $19,156

B) $22,881

C) $35,471

D) $87,500

A) $19,156

B) $22,881

C) $35,471

D) $87,500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

69

Table 10 -1. Capital Budgeting Choices

Refer to Table 10 -1. Glen Write owns an engineering firm. He asked his employees for suggestions regarding equipment they thought the firm would need during the next year. They suggested the purchase of eight pieces of equipment. Glen calculated the net present value of each recommendation. Glen estimates that he will have no more than $150,000 to invest next year. Based on NPV, which of the following items should he purchase?

A) 2, 3, & 7

B) 1, 2, 3, & 4

C) 1, 2, & 8

D) 7 & 8

Refer to Table 10 -1. Glen Write owns an engineering firm. He asked his employees for suggestions regarding equipment they thought the firm would need during the next year. They suggested the purchase of eight pieces of equipment. Glen calculated the net present value of each recommendation. Glen estimates that he will have no more than $150,000 to invest next year. Based on NPV, which of the following items should he purchase?

A) 2, 3, & 7

B) 1, 2, 3, & 4

C) 1, 2, & 8

D) 7 & 8

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

70

Cheryl Peck purchased a computer network for her classroom. The computer network cost $100,000. She estimates that she can charge $500 for one session in the classroom. Cheryl knows that enrollment will increase over time. She estimates 50 students the first year, 75 students the second year, 100 students the third year, and 150 students the fourth year. If her cost of capital is 16 percent, what is the approximate present value of the benefits?

A) $122,881

B) $135,471

C) $187,500

D) $119,156

A) $122,881

B) $135,471

C) $187,500

D) $119,156

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

71

Table 10 -1. Capital Budgeting Choices

Refer to Table 10 -1. Glen Write owns an engineering firm. He asked his employees for suggestions regarding equipment they thought the firm would need during the next year. They suggested the purchase of eight pieces of equipment. Glen calculated the net present value of each recommendation. Glenn has a policy of purchasing only one item per year. Which alternative to capital budgeting is Glen using?

A) positive NPV

B) capital rationing

C) mutually exclusive

D) non -mutually exclusive

Refer to Table 10 -1. Glen Write owns an engineering firm. He asked his employees for suggestions regarding equipment they thought the firm would need during the next year. They suggested the purchase of eight pieces of equipment. Glen calculated the net present value of each recommendation. Glenn has a policy of purchasing only one item per year. Which alternative to capital budgeting is Glen using?

A) positive NPV

B) capital rationing

C) mutually exclusive

D) non -mutually exclusive

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

72

George William buys a machine for his business. The machine costs $150,000. George estimates that the machine can produce $40,000 cash inflow per year for the next five years. George's cost of capital is 10 percent. What is the payback for this investment?

A) 5 years

B) 1.25 years

C) 3.75 years

D) 9.43 years

A) 5 years

B) 1.25 years

C) 3.75 years

D) 9.43 years

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

73

Sam Jones has an engineering firm. He wants to build a new headquarters building. The building will cost $1,500,000. He will finance the entire building himself, even though bank financing is at prime plus 2 percent. The prime lending rate is currently 8.5 percent. Sam will withdraw the money for the building from his mutual fund account where he has earned 13 percent for the last ten years. What is Sam's weighted average cost of capital?

A) 10.5%

B) 13.00%

C) 11.25%

D) 8.5%

A) 10.5%

B) 13.00%

C) 11.25%

D) 8.5%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

74

Sam Jones has an engineering firm. He wants to build a new headquarters building. The building will cost $1,500,000. He will put down $450,000 and have a bank finance the remainder at prime plus 2 percent. The prime lending rate is currently 8.5 percent. Sam will withdraw the money for the down payment from his mutual fund account where he has earned 13 percent for the last ten years. What percentage of the building is being equity financed?

A) 10.5%

B) 70%

C) 13%

D) 30%

A) 10.5%

B) 70%

C) 13%

D) 30%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

75

Cheryl Peck purchased a computer network for her classroom. The computer network cost $100,000. She estimates that she can charge $500 for one session in the classroom. Cheryl knows that enrollment will increase over time. She estimates 50 students the first year, 75 students the second year, 100 students the third year, and 150 students the fourth year. If her cost of capital is 12 percent, what is the approximate present value of the benefits?

A) $119,156

B) $187,500

C) $135,471

D) Cannot tell without more information.

A) $119,156

B) $187,500

C) $135,471

D) Cannot tell without more information.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

76

Table 10 -1. Capital Budgeting Choices

Refer to Table 10 -1. Glen Write owns an engineering firm. He asked his employees for suggestions regarding equipment they thought the firm would need during the next year. They suggested the purchase of eight pieces of equipment. Glen calculated the net present value of each recommendation. Glenn has a policy of purchasing only one item per year. Based on NPV, which should he purchase?

A) 8

B) 6

C) 1

D) 5

Refer to Table 10 -1. Glen Write owns an engineering firm. He asked his employees for suggestions regarding equipment they thought the firm would need during the next year. They suggested the purchase of eight pieces of equipment. Glen calculated the net present value of each recommendation. Glenn has a policy of purchasing only one item per year. Based on NPV, which should he purchase?

A) 8

B) 6

C) 1

D) 5

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

77

Table 10 -1. Capital Budgeting Choices

Refer to Table 10 -1. Glen Write owns an engineering firm. He asked his employees for suggestions regarding equipment they thought the firm would need during the next year. They suggested the purchase of eight pieces of equipment. Glen calculated the net present value of each recommendation. Glen estimates that he will have no more than $300,000 to invest next year. Based on NPV, which of the following items should he purchase?

A) 1, 2, 3, 4, 5, 6, & 8

B) 1, 2, 3, 4, 7, & 8

C) 1, 2, 3, 4, 5, 7, & 8

D) 1, 2, 4, 5, 6, & 7

Refer to Table 10 -1. Glen Write owns an engineering firm. He asked his employees for suggestions regarding equipment they thought the firm would need during the next year. They suggested the purchase of eight pieces of equipment. Glen calculated the net present value of each recommendation. Glen estimates that he will have no more than $300,000 to invest next year. Based on NPV, which of the following items should he purchase?

A) 1, 2, 3, 4, 5, 6, & 8

B) 1, 2, 3, 4, 7, & 8

C) 1, 2, 3, 4, 5, 7, & 8

D) 1, 2, 4, 5, 6, & 7

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

78

Sam Jones has an engineering firm. He wants to build a new headquarters building. The building will cost $1,500,000. He will put down $450,000 and have a bank finance the remainder at prime plus 2 percent. The prime lending rate is currently 8.5 percent. Sam will withdraw the money for the down payment from his mutual fund account where he has earned 13 percent for the last ten years. What is Sam's weighted average cost of capital?

A) 11.25%

B) 13.00%

C) 10.5%

D) 8.5%

A) 11.25%

B) 13.00%

C) 10.5%

D) 8.5%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

79

Cheryl Peck purchased a computer network for her classroom. The computer network cost $100,000. She estimates that she can charge $500 for one session in the classroom. Cheryl knows that enrollment will increase over time. She estimates 50 students the first year, 75 students the second year, 100 students the third year, and 150 students the fourth year. If her cost of capital is 12 percent, what is the approximate payback period for this investment?

A) 1.87 years

B) 2.75 years

C) 4.00 years

D) 1.19 years

A) 1.87 years

B) 2.75 years

C) 4.00 years

D) 1.19 years

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

80

Cheryl Peck purchased a computer network for her classroom. The computer network cost $100,000. She estimates that she can charge $500 for one session in the classroom. Cheryl knows that enrollment will increase over time. She estimates 50 students the first year, 75 students the second year, 100 students the third year, and 150 students the fourth year. If her cost of capital is 16 percent, what is the approximate profitability index?

A) 1.88

B) 1.08

C) 1.23

D) 1.19

A) 1.88

B) 1.08

C) 1.23

D) 1.19

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck