Deck 4: Completion of the Accounting Cycle

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/151

العب

ملء الشاشة (f)

Deck 4: Completion of the Accounting Cycle

1

After closing entries have been journalized and posted, all temporary accounts in the ledger should have zero balances.

True

2

Correcting entries will only be done at the same time as the adjusting entries are being prepared.

False

3

The owner's drawings account is a permanent account whose balance is carried forward to the next accounting period.

False

4

Reversing Entries are an optional part of the accounting cycle.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 151 في هذه المجموعة.

فتح الحزمة

k this deck

5

An incorrect debit to Accounts Receivable instead of the correct account Notes Receivable does not require a correcting entry because total assets will not be misstated.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 151 في هذه المجموعة.

فتح الحزمة

k this deck

6

The amounts appearing on an income statement should agree with the amounts appearing on the post-closing trial balance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 151 في هذه المجموعة.

فتح الحزمة

k this deck

7

Cash is a temporary account and it should be zero after all closing entries have been posted.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 151 في هذه المجموعة.

فتح الحزمة

k this deck

8

Closing entries are an optional part of the accounting cycle.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 151 في هذه المجموعة.

فتح الحزمة

k this deck

9

A company has only one accounting cycle over its economic existence.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 151 في هذه المجموعة.

فتح الحزمة

k this deck

10

Correcting entries are made any time an error is discovered even though it may not be at the end of an accounting period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 151 في هذه المجموعة.

فتح الحزمة

k this deck

11

Closing revenue and expense accounts to the Income Summary account is an optional bookkeeping procedure.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 151 في هذه المجموعة.

فتح الحزمة

k this deck

12

The owner's drawings account is closed to the Income Summary account in order to properly determine Profit (or loss) for the period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 151 في هذه المجموعة.

فتح الحزمة

k this deck

13

Both correcting entries and adjusting entries always affect at least one balance sheet account and one income statement account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 151 في هذه المجموعة.

فتح الحزمة

k this deck

14

The accounting cycle begins at the start of a new accounting period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 151 في هذه المجموعة.

فتح الحزمة

k this deck

15

The final step in the accounting cycle is the pre-closing trial balance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 151 في هذه المجموعة.

فتح الحزمة

k this deck

16

After the closing entries are posted to the accounts, a trial balance will show balances only in the Balance Sheet Accounts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 151 في هذه المجموعة.

فتح الحزمة

k this deck

17

Closing entries are journalized after adjusting entries have been journalized.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 151 في هذه المجموعة.

فتح الحزمة

k this deck

18

Closing the drawings account to Capital is not necessary if profit is greater than owner's drawings during the period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 151 في هذه المجموعة.

فتح الحزمة

k this deck

19

Closing entries are necessary if the business plans to continue operating in the future and issue financial statements each year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 151 في هذه المجموعة.

فتح الحزمة

k this deck

20

In a post closing trial balance the profit of the business will be one of the temporary accounts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 151 في هذه المجموعة.

فتح الحزمة

k this deck

21

If a company has a loss in the period, the amount of the loss will appear in the income statement credit column and the balance sheet debit column of the work sheet.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 151 في هذه المجموعة.

فتح الحزمة

k this deck

22

A liability is classified as a current liability if it is to be settled within one year from the balance sheet date or in the company's normal operating cycle.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 151 في هذه المجموعة.

فتح الحزمة

k this deck

23

The difference between current assets and current liabilities is called working capital.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 151 في هذه المجموعة.

فتح الحزمة

k this deck

24

Long-term investments would appear in the property, plant, and equipment section of the balance sheet.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 151 في هذه المجموعة.

فتح الحزمة

k this deck

25

Abbott Manufacturing Company's current ratio is 2:1. The company has $50,000 in current liabilities; current assets must be $25,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 151 في هذه المجموعة.

فتح الحزمة

k this deck

26

It is not necessary to prepare formal financial statements if a work sheet has been prepared because financial position and profit are shown on the work sheet.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 151 في هذه المجموعة.

فتح الحزمة

k this deck

27

Under International Financial Reporting Standards, current assets may be shown after non current assets on the Balance Sheet.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 151 في هذه المجموعة.

فتح الحزمة

k this deck

28

Cash and office supplies are both classified as current assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 151 في هذه المجموعة.

فتح الحزمة

k this deck

29

A reversing entry is made at the beginning of the next accounting period and is the exact opposite of the adjusting entry that was made in the previous period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 151 في هذه المجموعة.

فتح الحزمة

k this deck

30

All Canadian public companies must follow International Financial Reporting Standards.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 151 في هذه المجموعة.

فتح الحزمة

k this deck

31

Drawings will appear in the balance sheet debit column of a work sheet.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 151 في هذه المجموعة.

فتح الحزمة

k this deck

32

Another name for Balance Sheet is the Statement of Financial Position.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 151 في هذه المجموعة.

فتح الحزمة

k this deck

33

The balance of the Depreciation Expense account will appear in the income statement debit column of a work sheet.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 151 في هذه المجموعة.

فتح الحزمة

k this deck

34

Common Canadian practice shows current assets as the first items listed on a classified balance sheet.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 151 في هذه المجموعة.

فتح الحزمة

k this deck

35

The current ratio is the ratio of current liabilities divided by current assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 151 في هذه المجموعة.

فتح الحزمة

k this deck

36

If a work sheet is used, financial statements can be prepared before adjusting entries are journalized.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 151 في هذه المجموعة.

فتح الحزمة

k this deck

37

Current assets are normally listed in the balance sheet in order of permanency.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 151 في هذه المجموعة.

فتح الحزمة

k this deck

38

The acid-test ratio is a measure of a company's long term liquidity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 151 في هذه المجموعة.

فتح الحزمة

k this deck

39

The adjustments on a work sheet can be posted directly to the accounts in the ledger from the work sheet.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 151 في هذه المجموعة.

فتح الحزمة

k this deck

40

If total credits in the income statement columns of a work sheet exceed total debits, the company has profit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 151 في هذه المجموعة.

فتح الحزمة

k this deck

41

Which of the following is a true statement about closing the books of a proprietorship?

A) Expenses are closed to the owner's drawings account.

B) Only revenues are closed to the Income Summary account.

C) Only revenues and expenses are closed to the Income Summary account.

D) Revenues, expenses, and the owner's drawings account are closed to the Income Summary account.

A) Expenses are closed to the owner's drawings account.

B) Only revenues are closed to the Income Summary account.

C) Only revenues and expenses are closed to the Income Summary account.

D) Revenues, expenses, and the owner's drawings account are closed to the Income Summary account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 151 في هذه المجموعة.

فتح الحزمة

k this deck

42

Closing entries are journalized in the

A) trial balance.

B) general journal.

C) general ledger.

D) chart of accounts.

A) trial balance.

B) general journal.

C) general ledger.

D) chart of accounts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 151 في هذه المجموعة.

فتح الحزمة

k this deck

43

An error has occurred in the closing entry process if

A) the revenue and expense accounts have zero balances.

B) the owner's capital account is credited for the amount of profit.

C) the owner's drawings account is closed to the owner's capital account.

D) the balance sheet accounts have zero balances.

A) the revenue and expense accounts have zero balances.

B) the owner's capital account is credited for the amount of profit.

C) the owner's drawings account is closed to the owner's capital account.

D) the balance sheet accounts have zero balances.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 151 في هذه المجموعة.

فتح الحزمة

k this deck

44

In order to close a revenue account, the

A) income summary account should be credited.

B) income summary account should be debited.

C) owner's drawings account should be credited.

D) owner's drawings account should be debited.

A) income summary account should be credited.

B) income summary account should be debited.

C) owner's drawings account should be credited.

D) owner's drawings account should be debited.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 151 في هذه المجموعة.

فتح الحزمة

k this deck

45

Closing entries

A) are prepared before the financial statements.

B) reduce the number of permanent accounts.

C) cause the revenue and expense accounts to have zero balances.

D) close all of the permanent accounts.

A) are prepared before the financial statements.

B) reduce the number of permanent accounts.

C) cause the revenue and expense accounts to have zero balances.

D) close all of the permanent accounts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 151 في هذه المجموعة.

فتح الحزمة

k this deck

46

The owner's capital account is

A) a permanent account.

B) closed to the owner's drawings account at the end of the accounting period.

C) closed to the Income Summary account at the end of the accounting period.

D) a temporary account.

A) a permanent account.

B) closed to the owner's drawings account at the end of the accounting period.

C) closed to the Income Summary account at the end of the accounting period.

D) a temporary account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 151 في هذه المجموعة.

فتح الحزمة

k this deck

47

In order to close the owner's drawings account, the

A) income summary account should be debited.

B) income summary account should be credited.

C) owner's capital account should be credited.

D) owner's capital account should be debited.

A) income summary account should be debited.

B) income summary account should be credited.

C) owner's capital account should be credited.

D) owner's capital account should be debited.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 151 في هذه المجموعة.

فتح الحزمة

k this deck

48

A post-closing trial balance will show

A) only permanent account balances.

B) only temporary account balances.

C) zero balances for all accounts.

D) the amount of profit (or loss) for the period.

A) only permanent account balances.

B) only temporary account balances.

C) zero balances for all accounts.

D) the amount of profit (or loss) for the period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 151 في هذه المجموعة.

فتح الحزمة

k this deck

49

Closing entries are made

A) in order to terminate the business as an operating entity.

B) so that all assets, liabilities, and owner's capital accounts will have zero balances when the next accounting period starts.

C) in order to transfer Profit (or loss) and owner's drawings to the owner's capital account.

D) so that financial statements can be prepared.

A) in order to terminate the business as an operating entity.

B) so that all assets, liabilities, and owner's capital accounts will have zero balances when the next accounting period starts.

C) in order to transfer Profit (or loss) and owner's drawings to the owner's capital account.

D) so that financial statements can be prepared.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 151 في هذه المجموعة.

فتح الحزمة

k this deck

50

In preparing closing entries

A) every revenue account will be credited.

B) every expense account will be credited.

C) the owner's capital account will be debited if there is profit for the period.

D) the owner's drawings account will be debited.

A) every revenue account will be credited.

B) every expense account will be credited.

C) the owner's capital account will be debited if there is profit for the period.

D) the owner's drawings account will be debited.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 151 في هذه المجموعة.

فتح الحزمة

k this deck

51

A post-closing trial balance should be prepared

A) before closing entries are posted to the ledger accounts.

B) after closing entries are posted to the ledger accounts.

C) before adjusting entries are posted to the ledger accounts.

D) after adjusting entries are posted to the ledger accounts.

A) before closing entries are posted to the ledger accounts.

B) after closing entries are posted to the ledger accounts.

C) before adjusting entries are posted to the ledger accounts.

D) after adjusting entries are posted to the ledger accounts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 151 في هذه المجموعة.

فتح الحزمة

k this deck

52

When is a post-closing trial balance prepared?

A) when reversing entries are required

B) after adjusting entries but before closing entries

C) after both adjusting and closing entries have been posted

D) after the balance sheet has been prepared

A) when reversing entries are required

B) after adjusting entries but before closing entries

C) after both adjusting and closing entries have been posted

D) after the balance sheet has been prepared

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 151 في هذه المجموعة.

فتح الحزمة

k this deck

53

After closing entries are posted, the balance in the owner's capital account in the ledger will be equal to

A) the beginning owner's capital reported on the statement of owner's equity.

B) the amount of the owner's capital reported on the balance sheet.

C) zero.

D) the profit (or loss) for the period.

A) the beginning owner's capital reported on the statement of owner's equity.

B) the amount of the owner's capital reported on the balance sheet.

C) zero.

D) the profit (or loss) for the period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 151 في هذه المجموعة.

فتح الحزمة

k this deck

54

Closing entries are journalized and posted

A) before the financial statements are prepared.

B) after the financial statements are prepared.

C) when the business is closing its doors.

D) at the end of each interim accounting period.

A) before the financial statements are prepared.

B) after the financial statements are prepared.

C) when the business is closing its doors.

D) at the end of each interim accounting period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 151 في هذه المجموعة.

فتح الحزمة

k this deck

55

The closing entry process consists of closing

A) all asset and liability accounts.

B) out the owner's capital account.

C) all permanent accounts.

D) all temporary accounts.

A) all asset and liability accounts.

B) out the owner's capital account.

C) all permanent accounts.

D) all temporary accounts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 151 في هذه المجموعة.

فتح الحزمة

k this deck

56

Closing entries are

A) an optional step in the accounting cycle.

B) posted to the ledger accounts from the work sheet.

C) made to close permanent or real accounts.

D) journalized in the general journal.

A) an optional step in the accounting cycle.

B) posted to the ledger accounts from the work sheet.

C) made to close permanent or real accounts.

D) journalized in the general journal.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 151 في هذه المجموعة.

فتح الحزمة

k this deck

57

Reversing Entries are more relevant in corporations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 151 في هذه المجموعة.

فتح الحزمة

k this deck

58

To close the depreciation expense account

A) income summary is debited and owner's capital is credited.

B) income summary is debited and the depreciation expense is credited.

C) income summary is credited and the owner's capital is debited.

D) income summary is credited and the depreciation expense is debited.

A) income summary is debited and owner's capital is credited.

B) income summary is debited and the depreciation expense is credited.

C) income summary is credited and the owner's capital is debited.

D) income summary is credited and the depreciation expense is debited.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 151 في هذه المجموعة.

فتح الحزمة

k this deck

59

Which of the following is an example of a temporary account that will be closed to Income Summary at the end of the accounting period?

A) Accumulated Depreciation

B) Land

C) Accounts Payable

D) Service Revenue

A) Accumulated Depreciation

B) Land

C) Accounts Payable

D) Service Revenue

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 151 في هذه المجموعة.

فتح الحزمة

k this deck

60

The balance in the owner's drawings account after all closing entries have been posted will be equal to

A) zero.

B) the profit (or loss) for the period.

C) the cash withdrawn by the owner during the period.

D) the balance in the Owner's Capital account.

A) zero.

B) the profit (or loss) for the period.

C) the cash withdrawn by the owner during the period.

D) the balance in the Owner's Capital account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 151 في هذه المجموعة.

فتح الحزمة

k this deck

61

The first required step in the accounting cycle is

A) reversing entries.

B) journalizing transactions in the book of original entry.

C) analyzing transactions.

D) posting transactions.

A) reversing entries.

B) journalizing transactions in the book of original entry.

C) analyzing transactions.

D) posting transactions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 151 في هذه المجموعة.

فتح الحزمة

k this deck

62

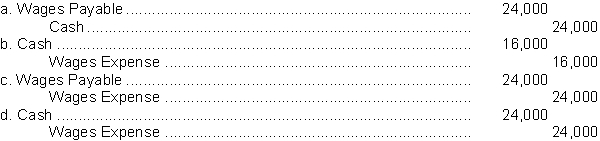

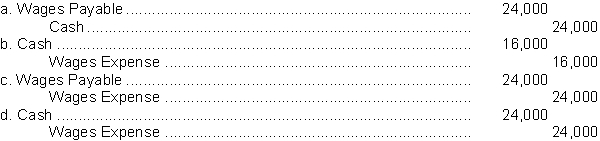

Carr Company paid the weekly payroll on January 2 by debiting Wages Expense for $40,000. The accountant preparing the payroll entry overlooked the fact that Wages Expense of $24,000 had been accrued at year end on December 31. The correcting entry is

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 151 في هذه المجموعة.

فتح الحزمة

k this deck

63

Crimmins Boats paid a $350 cheque to a supplier for the balance due on an account payable. The transaction was erroneously recorded as a credit to cash of $530 and a debit to Repairs Expense of $530. The correcting entry is

A) debit Accounts Payable $350; credit Cash $350

B) debit Accounts Payable $180; credit Cash $180

C) debit Cash $180; debit Accounts Payable $350, credit Repairs Expense $530

D) debit Cash $350; debit Accounts Payable $180 credit Repairs Expense $530

A) debit Accounts Payable $350; credit Cash $350

B) debit Accounts Payable $180; credit Cash $180

C) debit Cash $180; debit Accounts Payable $350, credit Repairs Expense $530

D) debit Cash $350; debit Accounts Payable $180 credit Repairs Expense $530

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 151 في هذه المجموعة.

فتح الحزمة

k this deck

64

On January 1, Robert Auto Repair Shop purchased parts on account for $800. Robert paid the entire balance on January 31 and recorded the payment by debiting Supplies for $800 and crediting Cash for $800. On the January 31 financial statements

A) assets and expenses will be understated.

B) assets and liabilities will be overstated.

C) expenses and liabilities will be overstated.

D) assets and liabilities will be understated.

A) assets and expenses will be understated.

B) assets and liabilities will be overstated.

C) expenses and liabilities will be overstated.

D) assets and liabilities will be understated.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 151 في هذه المجموعة.

فتح الحزمة

k this deck

65

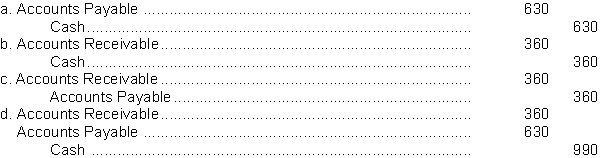

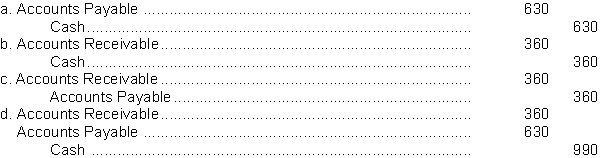

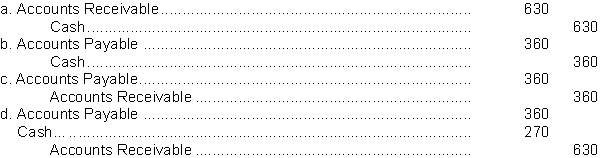

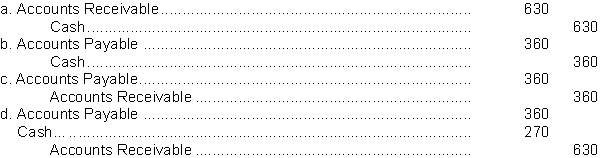

The Singh Company paid $630 on account to a creditor. The transaction was erroneously recorded as a debit to Cash of $360 and a credit to Accounts Receivable, $360. The correcting entry is

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 151 في هذه المجموعة.

فتح الحزمة

k this deck

66

The Saint John River Company received $630 on account from a customer. The transaction was erroneously recorded as a debit to Cash of $360 and a credit to Accounts Payable, $360. The correcting entry is

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 151 في هذه المجموعة.

فتح الحزمة

k this deck

67

If errors occur in the recording process, they

A) should be corrected as adjustments at the end of the period.

B) should be corrected as soon as they are discovered.

C) should be corrected when preparing annual financial statements.

D) cannot be corrected until the next accounting period.

A) should be corrected as adjustments at the end of the period.

B) should be corrected as soon as they are discovered.

C) should be corrected when preparing annual financial statements.

D) cannot be corrected until the next accounting period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 151 في هذه المجموعة.

فتح الحزمة

k this deck

68

On August 1, Rothesay Boat Club provided services on account for $800. Rothesay received the entire balance on August 31 and recorded the payment by debiting Cash for $800 and crediting Service Revenue for $800. On the August 31 financial statements

A) assets and revenues will be understated.

B) assets and liabilities will be overstated.

C) assets and revenue will be overstated.

D) assets and liabilities will be understated.

A) assets and revenues will be understated.

B) assets and liabilities will be overstated.

C) assets and revenue will be overstated.

D) assets and liabilities will be understated.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 151 في هذه المجموعة.

فتح الحزمة

k this deck

69

The balances that appear on the post-closing trial balance will match the

A) income statement account balances after adjustments.

B) balance sheet account balances after closing entries.

C) income statement account balances after closing entries.

D) balance sheet account balances after adjustments.

A) income statement account balances after adjustments.

B) balance sheet account balances after closing entries.

C) income statement account balances after closing entries.

D) balance sheet account balances after adjustments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 151 في هذه المجموعة.

فتح الحزمة

k this deck

70

Which of the following depicts the proper sequence of steps in the accounting cycle?

A) Journalize the transactions, analyze business transactions, prepare a trial balance

B) Prepare a trial balance, prepare financial statements, prepare adjusting entries

C) Prepare a trial balance, prepare adjusting entries, prepare financial statements

D) Prepare a trial balance, post to ledger accounts, post adjusting entries

A) Journalize the transactions, analyze business transactions, prepare a trial balance

B) Prepare a trial balance, prepare financial statements, prepare adjusting entries

C) Prepare a trial balance, prepare adjusting entries, prepare financial statements

D) Prepare a trial balance, post to ledger accounts, post adjusting entries

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 151 في هذه المجموعة.

فتح الحزمة

k this deck

71

Which one of the following is an optional step in the accounting cycle of a business enterprise?

A) Analyze business transactions.

B) Prepare a work sheet.

C) Prepare a trial balance.

D) Post to the ledger accounts.

A) Analyze business transactions.

B) Prepare a work sheet.

C) Prepare a trial balance.

D) Post to the ledger accounts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 151 في هذه المجموعة.

فتح الحزمة

k this deck

72

Jasmine Company received a $350 cheque from a customer for the balance due on an accounts receivable. The transaction was erroneously recorded as a debit to cash of $530 and a credit to service revenue of $530. The correcting entry is

A) debit Accounts Receivable $350; credit Cash $350

B) debit Accounts Receivable $180; credit Cash $180

C) debit Service Revenue $530; credit Cash $180; credit Accounts Receivable $350

D) debit Service Revenue $530; credit Cash $350; credit Accounts Receivable $180

A) debit Accounts Receivable $350; credit Cash $350

B) debit Accounts Receivable $180; credit Cash $180

C) debit Service Revenue $530; credit Cash $180; credit Accounts Receivable $350

D) debit Service Revenue $530; credit Cash $350; credit Accounts Receivable $180

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 151 في هذه المجموعة.

فتح الحزمة

k this deck

73

Which of the following steps in the accounting cycle may be performed more frequently than annually?

A) Prepare a post-closing trial balance.

B) Journalize closing entries.

C) Post closing entries.

D) Prepare a trial balance.

A) Prepare a post-closing trial balance.

B) Journalize closing entries.

C) Post closing entries.

D) Prepare a trial balance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 151 في هذه المجموعة.

فتح الحزمة

k this deck

74

A post-closing trial balance will show

A) zero balances for all accounts.

B) zero balances for balance sheet accounts.

C) only balance sheet accounts.

D) only income statement accounts.

A) zero balances for all accounts.

B) zero balances for balance sheet accounts.

C) only balance sheet accounts.

D) only income statement accounts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 151 في هذه المجموعة.

فتح الحزمة

k this deck

75

A correcting entry

A) must involve one balance sheet account and one income statement account.

B) is another name for a closing entry.

C) may involve any combination of accounts.

D) is a required step in the accounting cycle.

A) must involve one balance sheet account and one income statement account.

B) is another name for a closing entry.

C) may involve any combination of accounts.

D) is a required step in the accounting cycle.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 151 في هذه المجموعة.

فتح الحزمة

k this deck

76

Which of the following steps in the accounting cycle would NOT generally be performed daily?

A) Journalize transactions.

B) Post to ledger accounts.

C) Prepare adjusting entries.

D) Analyze business transactions.

A) Journalize transactions.

B) Post to ledger accounts.

C) Prepare adjusting entries.

D) Analyze business transactions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 151 في هذه المجموعة.

فتح الحزمة

k this deck

77

The purpose of the post-closing trial balance is to

A) ensure that all adjusting entries were made.

B) prove the equality of the balance sheet account balances that are carried forward into the next accounting period.

C) prove the equality of the income statement account balances that are carried forward into the next accounting period.

D) list all the balance sheet accounts in alphabetical order for easy reference.

A) ensure that all adjusting entries were made.

B) prove the equality of the balance sheet account balances that are carried forward into the next accounting period.

C) prove the equality of the income statement account balances that are carried forward into the next accounting period.

D) list all the balance sheet accounts in alphabetical order for easy reference.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 151 في هذه المجموعة.

فتح الحزمة

k this deck

78

The heading for a post-closing trial balance has a date line that is similar to the one found on

A) a balance sheet.

B) an income statement.

C) a statement of owner's equity.

D) the work sheet.

A) a balance sheet.

B) an income statement.

C) a statement of owner's equity.

D) the work sheet.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 151 في هذه المجموعة.

فتح الحزمة

k this deck

79

The final step in the accounting cycle is to prepare

A) closing entries.

B) financial statements.

C) a post-closing trial balance.

D) adjusting entries.

A) closing entries.

B) financial statements.

C) a post-closing trial balance.

D) adjusting entries.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 151 في هذه المجموعة.

فتح الحزمة

k this deck

80

The two optional steps in the accounting cycle are preparing

A) a post-closing trial balance and reversing entries.

B) a work sheet and post-closing trial balances.

C) reversing entries and a work sheet.

D) an adjusted trial balance and a post-closing trial balance.

A) a post-closing trial balance and reversing entries.

B) a work sheet and post-closing trial balances.

C) reversing entries and a work sheet.

D) an adjusted trial balance and a post-closing trial balance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 151 في هذه المجموعة.

فتح الحزمة

k this deck