Deck 8: Consolidated Tax Returns

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/154

العب

ملء الشاشة (f)

Deck 8: Consolidated Tax Returns

1

Campbell Corporation left the Crane consolidated tax return group after the calendar 2018 tax year. Generally, Crane can add Campbell back to the consolidated group but no earlier than for the 2024 tax year.

True

2

The consolidated return rules are designed to allow a tax-neutral means by which to elect to file on a consolidated basis.

True

3

A Federal consolidated group can claim a dividends received deduction for payments that the parent receives from other affiliates.

False

4

A joint venture subject to income tax laws like a partnership can join in a consolidated Federal income tax return.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

5

A subsidiary corporation must leave the consolidated group if it is restructured as an LLC.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

6

The calendar year Sterling Group files its Federal corporate income tax return on a consolidated basis. The group's

Form 1120 is due on April 15, or October 15 if an extended due date is approved by the IRS.

Form 1120 is due on April 15, or October 15 if an extended due date is approved by the IRS.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

7

A corporation organized in Germany and wholly owned by the U.S. parent can be included in a Federal consolidated return.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

8

Most of the Federal consolidated income tax return rules are found in detailed sections of the tax Regulations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

9

The right to file on a consolidated basis is available to a group of corporations when they constitute a "parent- subsidiary affiliated group."

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

10

All affiliates joining in a newly formed consolidated return must consent to the election on Form 1122, as attached to the Form 1120 for the group.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

11

A tax-exempt charitable trust created by a U.S. C corporation can join in a Federal consolidated return.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

12

Business reasons, and not tax incentives, constitute the primary motivation for most corporations to form a conglomerate and file tax and financial accounting reports on a consolidated basis.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

13

A consolidated Federal income tax return may be the product of a merger of the affiliates or another corporate combination.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

14

Giant Ltd. owns 100% of the stock of Middle Corporation. Bottom Corp is owned 60% by Giant and 40% by Middle.

Giant's Federal consolidated income tax return includes both Middle and Bottom.

Giant's Federal consolidated income tax return includes both Middle and Bottom.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

15

A calendar year parent corporation wants to file its tax returns on a consolidated basis with its affiliates. The group's election to file consolidated Federal corporate income tax returns must be made by the extended due date of the first return on which the consolidation is applied i.e., October 15).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

16

After a takeover, the parent's balance sheet shows a fair market value cost basis in the subsidiary for both book and tax purposes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

17

For consolidated tax return purposes, purchased goodwill is amortized as a deduction to taxable income over 15 years. Under financial accounting rules, 40-year amortization is allowed.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

18

A limited partnership can join the parent's consolidated group for book and for tax purposes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

19

The rules for computing Federal consolidated taxable income are some of the most complex in the tax law.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

20

When the parent acquires 51% of a subsidiary U.S. corporation, the subsidiary can join the consolidated financial statements and the consolidated tax return of the parent.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

21

Cooper Corporation joined the Duck consolidated Federal income tax return group when Cooper held a $1 million NOL carryforward. In its first year as a part of the Duck group, Cooper generated a $150,000 operating profit. For that year, Duck can deduct only $150,000 of Cooper's NOL in computing consolidated taxable income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

22

When a consolidated NOL is generated, each affiliate is allocated a share of the loss.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

23

In computing consolidated taxable income, compensation amounts are removed from the taxable incomes of the group members and determined on a group basis.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

24

The starting point in computing consolidated taxable income is the sum of the separate Federal taxable income amounts of the affiliated group members.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

25

In computing consolidated E & P, dividends paid to the parent by group members are subtracted.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

26

Keep Corporation joined an affiliated group by merger in 2010. The group generated a 2018 consolidated NOL, and Keep's share of the loss was $50,000. Keep's share of the loss is included in the group's NOL carryforward to 2019.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

27

Consolidated group members each are jointly and severally liable for the entire consolidated Federal income tax liability.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

28

If subsidiary stock is redeemed or sold outside the group when an excess loss account exists, the selling parent corporation recognizes ordinary income equal to the account balance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

29

Each member of a consolidated group must use the same tax year-end, and all of the members must use the same tax accounting methodse.g., LIFO or FIFO).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

30

In computing consolidated taxable income, capital gains and losses are removed from the taxable incomes of the group members and determined on a group basis.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

31

Cooper Corporation joined the Duck consolidated Federal income tax return group when Cooper held a $1 million NOL carryforward. In its first year as a part of the Duck group, Cooper generated a $150,000 taxable loss. For that year, Duck cannot deduct any of Cooper's NOL in computing consolidated taxable income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

32

When the net accumulated taxable losses of a subsidiary exceed the parent's acquisition price, the parent's basis in the subsidiary's stock becomes negative.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

33

When a member departs from a consolidated group, it leaves behind any NOLs that it generated while in the group.

The parent corporation and remaining affiliates apply those NOLs against future consolidated taxable income.

The parent corporation and remaining affiliates apply those NOLs against future consolidated taxable income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

34

A Federal consolidated filing group aggregates its separate charitable contributions for the tax year, deductions for which are then subject to an annual limitation of 10% of consolidated taxable income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

35

A Federal consolidated tax return group can apply the "relative taxable income" method as a means to apportion the tax liabilities of the members among the affiliates.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

36

In computing consolidated E & P, a negative adjustment is allowed for the group's disallowed entertainment expenditures.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

37

An example of an intercompany transaction is the use of the trademarks of the parent corporation by a subsidiary for an arm's length licensing fee.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

38

When a subsidiary sells to the parent some business-use property that has appreciated from its $20,000 basis to a

$50,000 fair market value, the subsidiary immediately recognizes $30,000 ordinary income on the consolidated return.

$50,000 fair market value, the subsidiary immediately recognizes $30,000 ordinary income on the consolidated return.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

39

In computing consolidated taxable income, capital gains and losses are removed from the taxable incomes of the group members and determined on a group basis.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

40

With the filing of its first consolidated return, the parent corporation of a Federal consolidated group makes an irrevocable election as to how the group will allocate a tax year's income tax liability among the group members.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

41

ParentCo owned 100% of SubCo for the entire year. ParentCo uses the accrual method of tax accounting whereas SubCo uses the cash method. During the year, SubCo sold raw materials to ParentCo for $35,000 under a contract that requires no payment to SubCo until the following year. Exclusive of this transaction, ParentCo had income for the year of $30,000, and SubCo had income of $50,000. The group's consolidated taxable income for the year was:

A) $165,000.

B) $150,000.

C) $115,000.

D) $80,000.

A) $165,000.

B) $150,000.

C) $115,000.

D) $80,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

42

The Rack, Spill, and Ton corporations file Federal income tax returns on a consolidated basis. The group's tax return currently is under audit. Under a valid tax-sharing agreement, each corporation is liable for one-third of the group's consolidated tax liability. The affiliates have agreed with the auditor that the group's unpaid tax liability for the year is $90,000. Because of an incorrect tax return position, another $3,000 in interest and an $18,000 penalty is attributable solely to Ton.

At present, only Rack is solvent and has the cash with which to make such a tax payment. What is the maximum amount for which the government could be successful in forcing Rack to satisfy the outstanding liabilities of the consolidated group?

A) $0

B) $90,000

C) $93,000

D) $108,000

E) $111,000

At present, only Rack is solvent and has the cash with which to make such a tax payment. What is the maximum amount for which the government could be successful in forcing Rack to satisfy the outstanding liabilities of the consolidated group?

A) $0

B) $90,000

C) $93,000

D) $108,000

E) $111,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

43

Azure Corporation joins the Colorful Corporation Federal consolidated return group. As a result:

A) Azure continues to file its own Form 1120.

B) The existing Colorful consolidation election is terminated.

C) Azure's tax results immediately are added to the Colorful group's consolidated Form 1120.

D) Azure's tax results first are added to the Colorful group's consolidated Form 1120 for the next tax year.

A) Azure continues to file its own Form 1120.

B) The existing Colorful consolidation election is terminated.

C) Azure's tax results immediately are added to the Colorful group's consolidated Form 1120.

D) Azure's tax results first are added to the Colorful group's consolidated Form 1120 for the next tax year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

44

Calendar year ParentCo acquired all of the stock of SubCo on January 1, year 1, for $1,000,000. The parties immediately elected to file consolidated income tax returns. SubCo generated taxable income of $250,000 for year 1 and paid a dividend of $100,000 to ParentCo. In year 2, SubCo generated an operating loss of $350,000, and in year 3, it produced taxable income of $750,000. As of the last day of year 3, what was ParentCo's basis in the stock of

SubCo?

A) $1,650,000

B) $1,550,000

C) $1,000,000

D) $0

SubCo?

A) $1,650,000

B) $1,550,000

C) $1,000,000

D) $0

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

45

ParentCo owned 100% of SubCo for the entire year, and both companies use the accrual method of tax accounting. During the year, SubCo purchased $20,000 of supplies from ParentCo. In addition, SubCo provided internal audit services to ParentCo, which were worth $40,000. Including these transactions, ParentCo's separate taxable income was $75,000, and SubCo's separate taxable income was $100,000. What is the group's consolidated taxable income for the year?

A) $215,000

B) $195,000

C) $175,000

D) $155,000

A) $215,000

B) $195,000

C) $175,000

D) $155,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

46

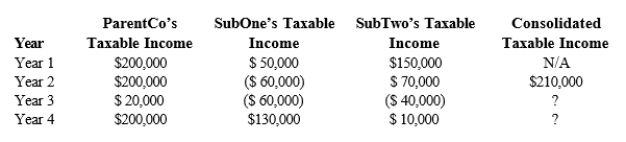

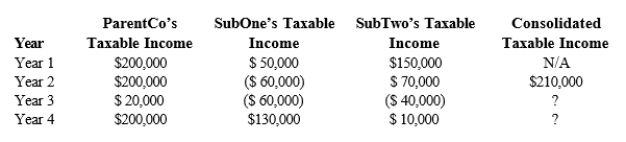

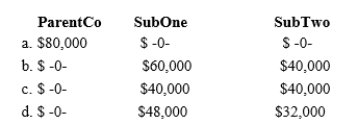

ParentCo and SubCo have filed consolidated returns since both entities were incorporated in year 1. Taxable income computations for the members include the following. Neither group member incurred any capital gain or loss transactions during these years, nor did they make any charitable contributions. The year 3 consolidated loss:

A) Is carried forward to year 4.

B) Is carried back to year 1 and produces a tax refund.

C) Can be used only to offset SubCo's future income.

D) Offsets ParentCo's year 1 income.

A) Is carried forward to year 4.

B) Is carried back to year 1 and produces a tax refund.

C) Can be used only to offset SubCo's future income.

D) Offsets ParentCo's year 1 income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

47

Which of the following entities is eligible to join in a Federal consolidated return?

A) A sole proprietor with annual sales of more than $50 million.

B) A U.S. corporation's § 401k) plan.

C) A partnership organized in Germany.

D) A corporation that operates in seven different U.S. states.

A) A sole proprietor with annual sales of more than $50 million.

B) A U.S. corporation's § 401k) plan.

C) A partnership organized in Germany.

D) A corporation that operates in seven different U.S. states.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

48

Which of the following entities is eligible to file Federal income tax returns on a consolidated basis?

A) A U.S. C corporation that files on a separate basis for its state income tax returns.

B) The charitable foundation of a U.S. C corporation.

C) The liquidating trust of a U.S. C corporation.

D) A wholly owned French subsidiary of a U.S. C corporation.

A) A U.S. C corporation that files on a separate basis for its state income tax returns.

B) The charitable foundation of a U.S. C corporation.

C) The liquidating trust of a U.S. C corporation.

D) A wholly owned French subsidiary of a U.S. C corporation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

49

Azure Corporation leaves the Colorful Corporation Federal consolidated return group on the last day of year 1. As a result:

A) Azure's tax results are included in the group's consolidated Form 1120 for the final time for year 2.

B) The existing Colorful consolidation election is terminated.

C) Azure's leaving the group is effective only when IRS permission to do so is granted.

D) Azure files its own Form 1120 beginning with year 2.

A) Azure's tax results are included in the group's consolidated Form 1120 for the final time for year 2.

B) The existing Colorful consolidation election is terminated.

C) Azure's leaving the group is effective only when IRS permission to do so is granted.

D) Azure files its own Form 1120 beginning with year 2.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

50

Which of the following potentially is a disadvantage of electing to file a Federal consolidated corporate income tax return?

A) The § 1231 loss of one member is not offset against the § 1231 gain of another member of the group.

B) Recognition of losses from certain intercompany transactions is deferred.

C) The tax basis of investments in the stock of subsidiaries is unaffected by members contributing to consolidated taxable income.

D) All of the above are disadvantages of a consolidation election.

A) The § 1231 loss of one member is not offset against the § 1231 gain of another member of the group.

B) Recognition of losses from certain intercompany transactions is deferred.

C) The tax basis of investments in the stock of subsidiaries is unaffected by members contributing to consolidated taxable income.

D) All of the above are disadvantages of a consolidation election.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

51

Under the consolidated return rules, the realized gain from an intercompany transaction is deferred. For most taxpayers, this produces:

A) An advantage in terms of the time value of money.

B) A disadvantage in terms of the time value of money.

C) A compliance issue that cannot be resolved.

D) A 20% penalty on the consolidated group.

A) An advantage in terms of the time value of money.

B) A disadvantage in terms of the time value of money.

C) A compliance issue that cannot be resolved.

D) A 20% penalty on the consolidated group.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

52

Which of the following is not generally a disadvantage of filing Federal corporate income tax returns on a consolidated basis?

A) Net capital losses from one affiliate can offset the capital gains from another. This can reduce the tax liabilities of the group as a whole.

B) Realized losses from transactions between affiliates are not recognized immediately.

C) Compliance costs usually are higher when a consolidation election is in effect.

D) The election generally is binding for future tax years.

A) Net capital losses from one affiliate can offset the capital gains from another. This can reduce the tax liabilities of the group as a whole.

B) Realized losses from transactions between affiliates are not recognized immediately.

C) Compliance costs usually are higher when a consolidation election is in effect.

D) The election generally is binding for future tax years.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

53

In computing a group's consolidated taxable income, the first step is to:

A) Compute the taxable income amounts for each affiliate on a standalone basis.

B) Obtain IRS permission to file on a consolidated basis for another tax year.

C) Eliminate the results of all intercompany transactions for the tax year.

D) Compute the allowable group NOL carryforward.

A) Compute the taxable income amounts for each affiliate on a standalone basis.

B) Obtain IRS permission to file on a consolidated basis for another tax year.

C) Eliminate the results of all intercompany transactions for the tax year.

D) Compute the allowable group NOL carryforward.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

54

Calendar year ParentCo purchased all of the stock of SubCo on January 1, year 1, for $500,000. In year 1, SubCo produced a loss of $150,000 and distributed cash of $25,000 to ParentCo. In year 2, SubCo generated a loss of $450,000; in year 3, it recognized net income of $90,000. What is ParentCo's capital gain or loss) if it sells all of its

SubCo stock to a nongroup member on year 4 for $150,000?

A) $185,000

B) $150,000

C) $35,000)

D) $535,000)

E) All gain/loss is ordinary when subsidiary stock is sold.

SubCo stock to a nongroup member on year 4 for $150,000?

A) $185,000

B) $150,000

C) $35,000)

D) $535,000)

E) All gain/loss is ordinary when subsidiary stock is sold.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

55

Which of the following potentially is a disadvantage of electing to file a Federal corporate income tax consolidated return?

A) Increased deduction amounts when computations are made on a group basis.

B) Deferral of gains realized in transactions between group members.

C) Increased basis in the stock of a subsidiary that generates annual taxable income.

D) Additional administrative costs in complying with the election.

A) Increased deduction amounts when computations are made on a group basis.

B) Deferral of gains realized in transactions between group members.

C) Increased basis in the stock of a subsidiary that generates annual taxable income.

D) Additional administrative costs in complying with the election.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

56

How are the members of a Federal consolidated group affected by computations related to E & P?

A) Each member keeps its own E & P account.

B) E & P is computed solely on a consolidated basis.

C) Members' E & P balances are frozen as long as the consolidation election is in place.

D) Consolidated E & P is computed as the sum of the E & P balances of each of the group members, computed on the last day of the tax year.

A) Each member keeps its own E & P account.

B) E & P is computed solely on a consolidated basis.

C) Members' E & P balances are frozen as long as the consolidation election is in place.

D) Consolidated E & P is computed as the sum of the E & P balances of each of the group members, computed on the last day of the tax year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

57

Conformity among the members of a consolidated group must be implemented for which of the following tax items?

A) Use of foreign tax payments i.e., as a credit or deduction).

B) Tax accounting method i.e., cash or accrual).

C) Inventory accounting method

D) Tax year-end.

E)g., FIFO or dollar-cost averaging).

A) Use of foreign tax payments i.e., as a credit or deduction).

B) Tax accounting method i.e., cash or accrual).

C) Inventory accounting method

D) Tax year-end.

E)g., FIFO or dollar-cost averaging).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

58

How must the IRS collect the liability for Federal taxes from among a consolidated group?

A) Against the parent of the group.

B) According to the members' current internal tax-sharing agreement.

C) Against the member of the group that generated the tax.

D) No particular order of collection is prescribed by IRS rules.

A) Against the parent of the group.

B) According to the members' current internal tax-sharing agreement.

C) Against the member of the group that generated the tax.

D) No particular order of collection is prescribed by IRS rules.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

59

Which of the following is not a requirement that must be met before a group files a consolidated return?

A) None of the corporations can be ineligible under the Code to file on a consolidated basis with the others.

B) All of the corporations must be members of an affiliated group.

C) The group members must share the same inventory accounting method,

D) The group members must share a common tax year end.

E)g., they all must use FIFO).

A) None of the corporations can be ineligible under the Code to file on a consolidated basis with the others.

B) All of the corporations must be members of an affiliated group.

C) The group members must share the same inventory accounting method,

D) The group members must share a common tax year end.

E)g., they all must use FIFO).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

60

Which of the following entities is eligible to file Federal income tax returns on a consolidated basis?

A) Professional sports team operating as a limited partnership.

B) Japanese corporation engaged in multinational operations, including two-thirds of its activities in the United States.

C) Japanese corporation engaged in multinational operations, including one-third of its activities in the United States.

D) U.S. corporation engaged in the marijuana industry.

A) Professional sports team operating as a limited partnership.

B) Japanese corporation engaged in multinational operations, including two-thirds of its activities in the United States.

C) Japanese corporation engaged in multinational operations, including one-third of its activities in the United States.

D) U.S. corporation engaged in the marijuana industry.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

61

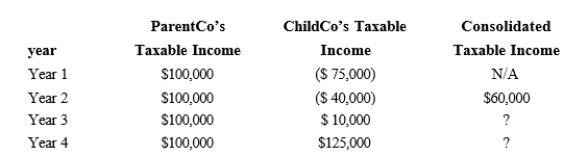

ParentCo purchased all of the stock of ChildCo on January 2, year 2, and the two companies filed consolidated returns for that year and thereafter. Both entities were incorporated in year 1. Taxable income computations for the members include the following. Neither group member incurred any capital gain or loss transactions during these years, nor did either member make any charitable contributions. No § 382 limit applies. To what extent are ChildCo's year 1 losses used by the group in year 2-year 4?

A) $100,000

B) $95,000

C) $75,000

D) $0

A) $100,000

B) $95,000

C) $75,000

D) $0

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

62

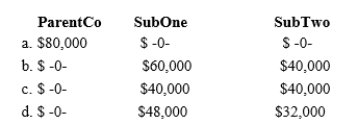

A Federal consolidated group reported the following taxable income amounts. Parent owns all of the stock of both Junior and Minor. Determine the net operating loss NOL) that is apportioned to Parent.

A) $360,000.

B) $400,000.

C) $500,000.

D) $900,000. All NOLs of a consolidated group are apportioned to the parent.

A) $360,000.

B) $400,000.

C) $500,000.

D) $900,000. All NOLs of a consolidated group are apportioned to the parent.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

63

The Nanie consolidated group reported the following taxable income amounts. Parent owns all of the stock of both Junior and Minor. Determine the net operating loss NOL) that is apportioned to Minor.

A) $100,000.

B) $300,000.

C) $0. Minor did not report an NOL of its own.

D) $0. All NOLs of a consolidated group are apportioned to the parent.

A) $100,000.

B) $300,000.

C) $0. Minor did not report an NOL of its own.

D) $0. All NOLs of a consolidated group are apportioned to the parent.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

64

Which of the following statements is true with regard to intercompany transactions?

A) An intercompany transaction is eliminated from consolidated taxable income.

B) All intercompany gains are recognized, but losses must be deferred.

C) A cash sale of a business asset by the purchasing member to an acquirer outside of the group triggers immediate recognition of the gain or loss.

D) The gain or loss on an intercompany transaction is deferred for up to 10 years after which it is recognized.

A) An intercompany transaction is eliminated from consolidated taxable income.

B) All intercompany gains are recognized, but losses must be deferred.

C) A cash sale of a business asset by the purchasing member to an acquirer outside of the group triggers immediate recognition of the gain or loss.

D) The gain or loss on an intercompany transaction is deferred for up to 10 years after which it is recognized.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

65

ParentCo's separate taxable income was $200,000, and JuniorCo's was $50,000. Consolidated taxable income before contributions was $200,000. Charitable contributions made by the affiliated group included $5,000 by ParentCo and $1,000 by JuniorCo. Compute the group's maximum charitable contribution deduction.

A) $0

B) $600

C) $6,000

D) $20,000

E) $25,000

A) $0

B) $600

C) $6,000

D) $20,000

E) $25,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

66

JuniorCo sells an asset to SeniorCo at a realized loss. That loss is not recognized by the group in the year of the sale, because of the:

A) Wash sale rule.

B) Transfer pricing rules.

C) Matching rule.

D) Acceleration rule.

E) None of these. The group deducts the loss.

A) Wash sale rule.

B) Transfer pricing rules.

C) Matching rule.

D) Acceleration rule.

E) None of these. The group deducts the loss.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

67

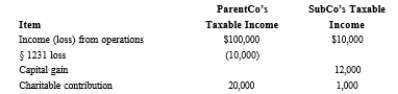

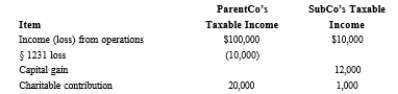

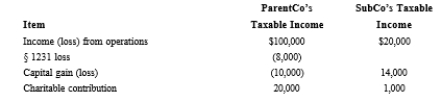

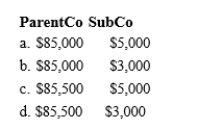

ParentCo and SubCo report the following items of income and deduction for the current year.  Compute ParentCo and SubCo's consolidated taxable income or loss.

Compute ParentCo and SubCo's consolidated taxable income or loss.

A) $91,000

B) $100,800

C) $112,000

D) $122,000

Compute ParentCo and SubCo's consolidated taxable income or loss.

Compute ParentCo and SubCo's consolidated taxable income or loss.A) $91,000

B) $100,800

C) $112,000

D) $122,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

68

The consolidated net operating loss of the Parent Group includes all of the following except the:

A) Parent's operating income/loss.

B) Parent's charitable contributions.

C) Parent's dividends received deduction.

D) Subsidiary's operating income/loss.

A) Parent's operating income/loss.

B) Parent's charitable contributions.

C) Parent's dividends received deduction.

D) Subsidiary's operating income/loss.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

69

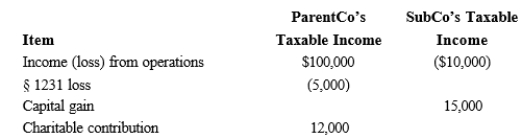

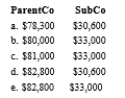

ParentCo and SubCo report the following items of income and deduction for the current year.  Compute ParentCo and SubCo's consolidated taxable income or loss.

Compute ParentCo and SubCo's consolidated taxable income or loss.

A) $81,000

B) $88,000

C) $90,000

D) $90,500

Compute ParentCo and SubCo's consolidated taxable income or loss.

Compute ParentCo and SubCo's consolidated taxable income or loss.A) $81,000

B) $88,000

C) $90,000

D) $90,500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

70

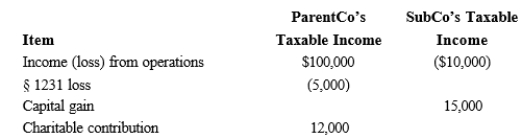

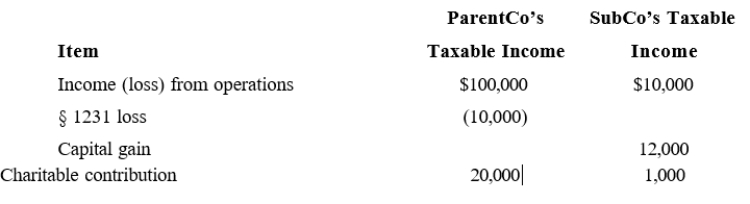

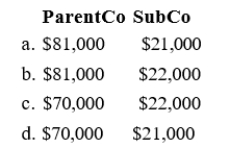

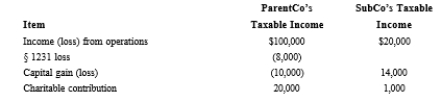

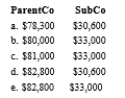

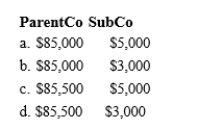

ParentCo and SubCo report the following items of income and deduction for the current year.  Compute ParentCo and SubCo's taxable income or loss computed on a separate basis.

Compute ParentCo and SubCo's taxable income or loss computed on a separate basis.

Compute ParentCo and SubCo's taxable income or loss computed on a separate basis.

Compute ParentCo and SubCo's taxable income or loss computed on a separate basis.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

71

One of the motivations for the consolidated return rules is to discourage conglomerates from trafficking in the deductible of other entities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

72

ParentCo and SubCo recorded the following items of income and deduction for the current tax year. Compute ParentCo and SubCo's consolidated taxable income or loss.

A) $95,000

B) $99,000

C) $104,400

D) $116,000

E) $120,000

A) $95,000

B) $99,000

C) $104,400

D) $116,000

E) $120,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

73

ParentCo, SubOne, and SubTwo have filed consolidated returns since year 2. All of the entities were incorporated in Taxable income computations for the members include the following. None of the group members incurred any capita transactions during these years, nor did they make any charitable contributions.  How should the Year 3 consolidated net operating loss be apportioned among the group members?

How should the Year 3 consolidated net operating loss be apportioned among the group members?

How should the Year 3 consolidated net operating loss be apportioned among the group members?

How should the Year 3 consolidated net operating loss be apportioned among the group members?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

74

ParentCo and SubCo recorded the following items of income and deduction for the current tax year.  Compute ParentCo and SubCo's taxable income or loss computed on a separate basis. Then compute the total of those amounts if appropriate.

Compute ParentCo and SubCo's taxable income or loss computed on a separate basis. Then compute the total of those amounts if appropriate.

Compute ParentCo and SubCo's taxable income or loss computed on a separate basis. Then compute the total of those amounts if appropriate.

Compute ParentCo and SubCo's taxable income or loss computed on a separate basis. Then compute the total of those amounts if appropriate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

75

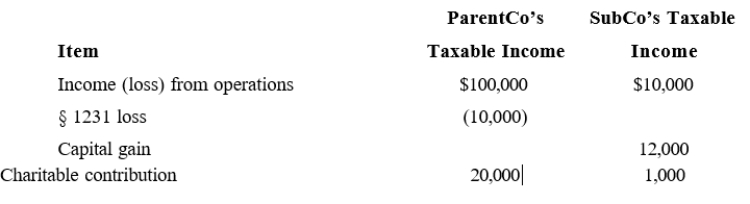

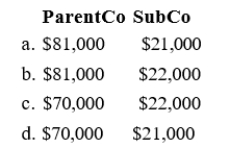

ParentCo and SubCo report the following items of income and deduction for the current year. ParentCo's SubCo's Taxable Item Taxable Income Income Income loss) from operations $100,000 $10,000)

§ 1231 loss 5,000)

Capital gain 15,000

Charitable contribution 12,000

Compute ParentCo and SubCo's taxable income or loss computed on a separate basis. Then compute the total of those amounts if appropriate.

§ 1231 loss 5,000)

Capital gain 15,000

Charitable contribution 12,000

Compute ParentCo and SubCo's taxable income or loss computed on a separate basis. Then compute the total of those amounts if appropriate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

76

SubCo sells an asset to ParentCo at a realized gain. While ParentCo still holds the asset, SubCo leaves the consolidated group. As a result:

A) The gain never is recognized.

B) SubCo recognizes the gain on its first tax return after leaving the group.

C) The group recognizes the gain under the related party rules.

D) The group recognizes the gain under the acceleration rule.

A) The gain never is recognized.

B) SubCo recognizes the gain on its first tax return after leaving the group.

C) The group recognizes the gain under the related party rules.

D) The group recognizes the gain under the acceleration rule.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

77

Which of the following items is not computed on a group basis for a Federal consolidated income tax return?

A) Dividends received deduction.

B) Cost recovery deduction.

C) Charitable contributions.

D) Net capital losses.

A) Dividends received deduction.

B) Cost recovery deduction.

C) Charitable contributions.

D) Net capital losses.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

78

ParentCo's separate taxable income was $200,000, and SubCo's was $50,000. Consolidated taxable income before contributions was $200,000. Charitable contributions made by the affiliated group included $60,000 by ParentCo and $10,000 by SubCo. Compute the group's maximum charitable contribution deduction.

A) $70,000

B) $60,000

C) $25,000

D) $20,000

A) $70,000

B) $60,000

C) $25,000

D) $20,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

79

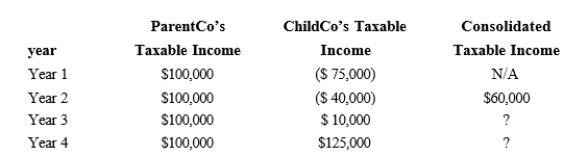

ParentCo purchased all of the stock of ChildCo on January 2, year 2, and the two companies filed consolidated returns for year 2 and thereafter. Both entities were incorporated in year 1. Taxable income computations for the members include the following. Neither group member incurred any capital gain or loss transactions during these years, nor did they make any charitable contributions. No § 382 limit applies.  To what extent can ChildCo's year 1 losses be used by the group in year 4?

To what extent can ChildCo's year 1 losses be used by the group in year 4?

A) $135,000

B) $125,000

C) $75,000

D) $10,000

E) $0

To what extent can ChildCo's year 1 losses be used by the group in year 4?

To what extent can ChildCo's year 1 losses be used by the group in year 4?A) $135,000

B) $125,000

C) $75,000

D) $10,000

E) $0

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

80

Subsidiary holds an allocated net operating loss NOL) when it leaves the Parent consolidated group. As a result:

A) The group keeps Subsidiary's allocated loss.

B) Subsidiary takes its allocated NOL and uses it on subsequent separate tax returns.

C) The loss is suspended for five years in case Subsidiary rejoins the group; then Parent can use it.

D) The loss is suspended for five years in case Subsidiary rejoins the group. At that time, Subsidiary uses the loss on its separate return.

A) The group keeps Subsidiary's allocated loss.

B) Subsidiary takes its allocated NOL and uses it on subsequent separate tax returns.

C) The loss is suspended for five years in case Subsidiary rejoins the group; then Parent can use it.

D) The loss is suspended for five years in case Subsidiary rejoins the group. At that time, Subsidiary uses the loss on its separate return.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck