Deck 12: Advanced Micro-Level Valuation

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/18

العب

ملء الشاشة (f)

Deck 12: Advanced Micro-Level Valuation

1

Please use the following template to help you organize and present your answer. You may use the back of the page for computations.)

Answer:

Part V. Required Problem 20 points)

Part V. Required Problem 20 points)

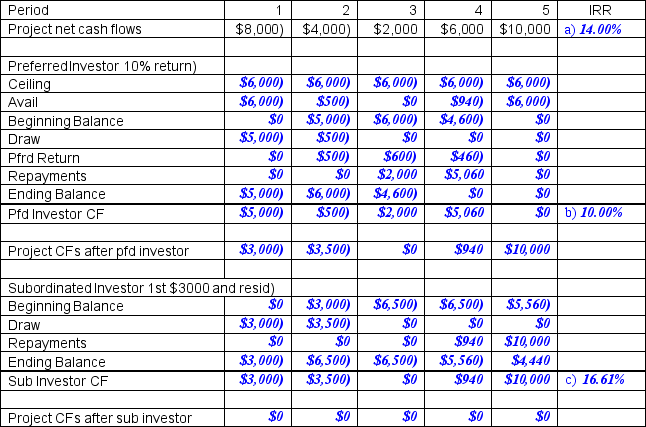

Based on the information below, analyze whether the development project should be undertaken, and state what is the maximum land value that could support economic development. Also compute the "canonical" OCC of investment in this development project, and compare that to the project's going-in IRR at the given land price. State clearly any assumptions you feel you must make beyond the information provided. You must clearly show your work and steps for full credit and you may ignore the potential value of waiting to invest later).

• Time zero price of the site is $1,000,000.

• Total construction cost is projected to be $3,000,000, and construction is expected to take 1 year T =1), with payment for work done owed to the contractor projected to occur in a single payment of $3,000,000 at the end of the 1-year construction phase.

• Construction completion is expected to be followed by 1 year of absorption lease-up), that can be represented by a single projected net operating cash flow at the end of year 2 of negative $200,000.

• Stabilized operation beginning at the end of Year 2 includes projected NOI = $400,000/yr with projected growth of 1% per year thereafter based on rental market projections.

• OCC going-in IRR) for investments in stabilized property projected to be 8% per annum.

• OCC for lease-up asset investments is 200 basis-points greater than the OCC for stabilized investment.

• OCC of construction cost cash flows is 3.50%.

Answer:

Part V. Required Problem 20 points)

Part V. Required Problem 20 points)Based on the information below, analyze whether the development project should be undertaken, and state what is the maximum land value that could support economic development. Also compute the "canonical" OCC of investment in this development project, and compare that to the project's going-in IRR at the given land price. State clearly any assumptions you feel you must make beyond the information provided. You must clearly show your work and steps for full credit and you may ignore the potential value of waiting to invest later).

• Time zero price of the site is $1,000,000.

• Total construction cost is projected to be $3,000,000, and construction is expected to take 1 year T =1), with payment for work done owed to the contractor projected to occur in a single payment of $3,000,000 at the end of the 1-year construction phase.

• Construction completion is expected to be followed by 1 year of absorption lease-up), that can be represented by a single projected net operating cash flow at the end of year 2 of negative $200,000.

• Stabilized operation beginning at the end of Year 2 includes projected NOI = $400,000/yr with projected growth of 1% per year thereafter based on rental market projections.

• OCC going-in IRR) for investments in stabilized property projected to be 8% per annum.

• OCC for lease-up asset investments is 200 basis-points greater than the OCC for stabilized investment.

• OCC of construction cost cash flows is 3.50%.

Part VI: Extra-credit question. Earn up to 5 points extra credit. It can help you but not hurt you.

Part VI: Extra-credit question. Earn up to 5 points extra credit. It can help you but not hurt you. 2

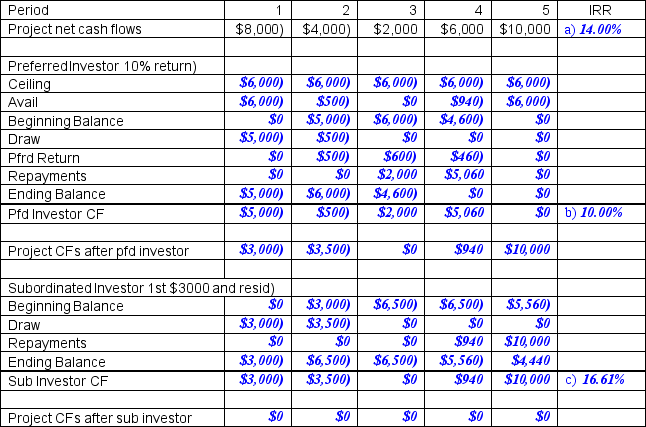

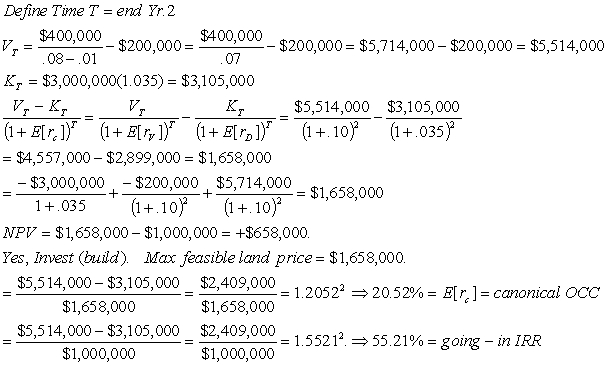

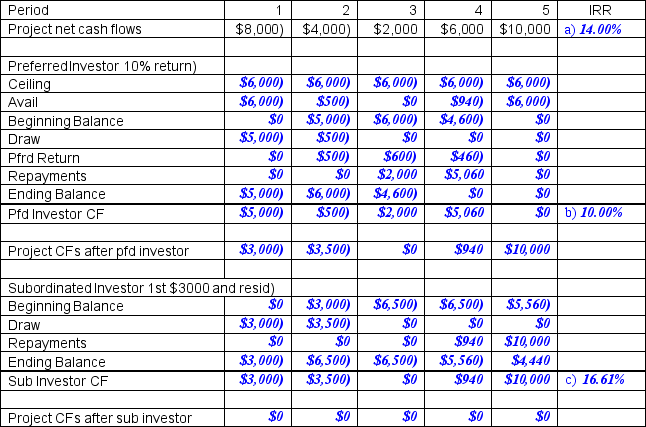

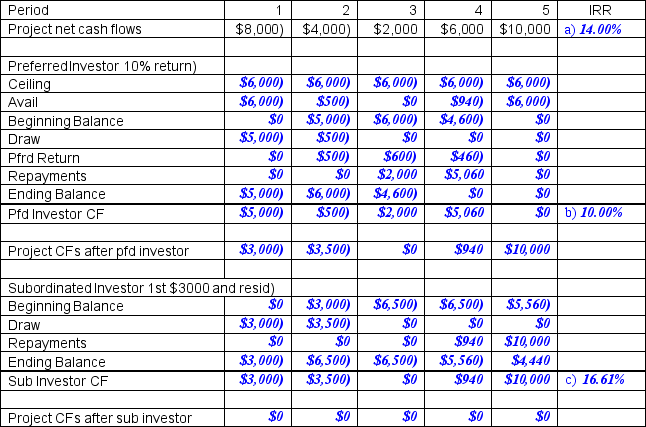

A certain housing development has the following projected equity net cash flows per year in thousands):

a) The underlying project equity as a whole;

b) The preferred equity investor; and

c) The subordinated equity investor.

a) The underlying project equity as a whole;

b) The preferred equity investor; and

c) The subordinated equity investor.

There are to be two classes of investors providing the equity capital. A preferred investor is committed to provide $6 million with a 10% preferred return computed on a current basis, accumulated with compounding). The subordinated or residual) equity partner will put in the first $3 million, and then whatever is required after the preferred investor puts in their $6 million.

There are to be two classes of investors providing the equity capital. A preferred investor is committed to provide $6 million with a 10% preferred return computed on a current basis, accumulated with compounding). The subordinated or residual) equity partner will put in the first $3 million, and then whatever is required after the preferred investor puts in their $6 million.Set up the projected capital accounts of these two classes of investors with their projected cash flows each year, and compute the projected IRR for: a) The underlying project equity as a whole; b) The preferred equity investor; and c) The subordinated equity investor.

3

The NPV investment decision rule is applicable even in the case of a real option, such as a real estate development investment decision, because:

A) The NPV rule states that any investment with a positive NPV should be undertaken.

B) The real options nature of development enables a negative NPV investment to be rational.

C) The NPV rule will insure that a development project that presents a higher IRR will be chosen over one that presents a lower IRR.

D) The NPV rule requires making the decision that maximizes the NPV over all mutually exclusive alternatives, and building today versus waiting are mutually exclusive alternatives on a given piece of land.

A) The NPV rule states that any investment with a positive NPV should be undertaken.

B) The real options nature of development enables a negative NPV investment to be rational.

C) The NPV rule will insure that a development project that presents a higher IRR will be chosen over one that presents a lower IRR.

D) The NPV rule requires making the decision that maximizes the NPV over all mutually exclusive alternatives, and building today versus waiting are mutually exclusive alternatives on a given piece of land.

D

4

According to real option theory, even if construction were instantaneous and the property market were perfectly liquid, it might be optimal not to immediately build a project whose value currently exceeds its construction cost, because:

A) There is sufficient probability that the value of the project will rise sufficiently in the future, and building today is mutually exclusive with building in the future.

B) There is sufficient probability that the value of the project will fall sufficiently far in the future such that you would lose money if you built it today.

C) There is never any reason to exercise a call option before its expiration date.

D) The cost of construction can be invested at a rate less than the cap rate or current cash yield) of the completed project.

A) There is sufficient probability that the value of the project will rise sufficiently in the future, and building today is mutually exclusive with building in the future.

B) There is sufficient probability that the value of the project will fall sufficiently far in the future such that you would lose money if you built it today.

C) There is never any reason to exercise a call option before its expiration date.

D) The cost of construction can be invested at a rate less than the cap rate or current cash yield) of the completed project.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 18 في هذه المجموعة.

فتح الحزمة

k this deck

5

Why is it important to apply separate DCF analyses to the development construction) phase and to the stabilized operational phase of an investment in a development investment?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 18 في هذه المجموعة.

فتح الحزمة

k this deck

6

Discuss the statement: "Developers don't really use the NPV Rule in making development decisions."

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 18 في هذه المجموعة.

فتح الحزمة

k this deck

7

What we have called in class the "canonical" formula for determining the OCC of a development project investment is based on all of the following except:

A) Equilibrium exists within the market for developable land.

B) Equilibrium exists across the markets for developable land, stabilized built) properties, and bonds or instruments with low-risk debtlike cash flows).

C) The investor will be irreversibly committed to completing the subject development project.

D) Development is a "real option" in which the developer/landowner has the flexibility to postpone development.

A) Equilibrium exists within the market for developable land.

B) Equilibrium exists across the markets for developable land, stabilized built) properties, and bonds or instruments with low-risk debtlike cash flows).

C) The investor will be irreversibly committed to completing the subject development project.

D) Development is a "real option" in which the developer/landowner has the flexibility to postpone development.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 18 في هذه المجموعة.

فتح الحزمة

k this deck

8

For the same property as above, suppose the underwriting criteria is a maximum loan/value ratio LTV) of 80%, and we estimate property value by direct capitalization using a rate of 7% on the stated NOI. By this criterion what is the maximum loan amount?

A) $80,000

B) $8,000,000

C) $11,177,084

D) $11,428,571

E) $14,285,714

A) $80,000

B) $8,000,000

C) $11,177,084

D) $11,428,571

E) $14,285,714

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 18 في هذه المجموعة.

فتح الحزمة

k this deck

9

The NOI is $1,000,000, the debt service is $800,000 of which $700,000 is interest, the depreciation expense is $250,000. What is the Before-tax Cash Flow to the equity investor EBTCF) if there are no capital improvement expenditures or reversion items this period?

A) $50,000

B) $182,500

C) $200,000

D) $300,000

E) $750,000

A) $50,000

B) $182,500

C) $200,000

D) $300,000

E) $750,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 18 في هذه المجموعة.

فتح الحزمة

k this deck

10

A REIT has expected total return on equity of 15%, interest on their debt is 9%, and their debt-to-total-value ratio is 40%. What is the REIT's average cost of capital?

A) 9.0%

B) 10.4%

C) 12.6%

D) 15.0%

E) Insufficient information to answer this question.

A) 9.0%

B) 10.4%

C) 12.6%

D) 15.0%

E) Insufficient information to answer this question.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 18 في هذه المجموعة.

فتح الحزمة

k this deck

11

All of the following are characteristics of the classical "Simple Financial Feasibility Analysis" SFFA) procedure for real estate development projects, except:

A) The procedure is easy to understand and apply without advanced or specialized financial knowledge or knowledge of the capital markets other than the local mortgage market).

B) The procedure can be applied from either a "front door" or "back door" perspective.

C) It generally assumes the developer will take out the largest mortgage possible upon completion of the project, and that the project cost will equal its value for applying lender's loan/value criteria.

D) It is based fundamentally on the NPV investment evaluation principle and therefore is consistent with wealth maximization.

A) The procedure is easy to understand and apply without advanced or specialized financial knowledge or knowledge of the capital markets other than the local mortgage market).

B) The procedure can be applied from either a "front door" or "back door" perspective.

C) It generally assumes the developer will take out the largest mortgage possible upon completion of the project, and that the project cost will equal its value for applying lender's loan/value criteria.

D) It is based fundamentally on the NPV investment evaluation principle and therefore is consistent with wealth maximization.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 18 في هذه المجموعة.

فتح الحزمة

k this deck

12

Two loans have the same interest rate and maturity. Loan A has a 15-year amortization rate. Loan B has a 30-year amortization rate. In comparing these two loans from a borrower's perspective:

A) The advantage of Loan A is lower monthly payments and lower balloon payment at maturity.

B) The advantage of Loan B is lower monthly payments and lower balloon payment at maturity.

C) The advantage of Loan A is lower monthly payments but its disadvantage is a higher balloon at maturity.

D) The advantage of Loan B is lower monthly payments but its disadvantage is a higher balloon at maturity.

A) The advantage of Loan A is lower monthly payments and lower balloon payment at maturity.

B) The advantage of Loan B is lower monthly payments and lower balloon payment at maturity.

C) The advantage of Loan A is lower monthly payments but its disadvantage is a higher balloon at maturity.

D) The advantage of Loan B is lower monthly payments but its disadvantage is a higher balloon at maturity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 18 في هذه المجموعة.

فتح الحزمة

k this deck

13

Consider a 20-year monthly-payment), 8%, $80,000 mortgage with 2 points prepaid interest up front. What is the yield to maturity?

A) 8.00%

B) 8.12%

C) 8.20%

D) 8.27%

A) 8.00%

B) 8.12%

C) 8.20%

D) 8.27%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 18 في هذه المجموعة.

فتح الحزمة

k this deck

14

In translating construction cost cash flows across time to arrive at the present certainty-equivalent value of the construction cost as of time zero, the opportunity cost of capital OCC) that should be used as the discount rate is best described as follows:

A) Use the contract interest rate on the construction loan.

B) Use a rate equal to or only slightly above the riskfree interest rate.

C) Use the development phase OCC reflecting the leverage in the construction project.

D) Use the yield on long-term Government bonds.

A) Use the contract interest rate on the construction loan.

B) Use a rate equal to or only slightly above the riskfree interest rate.

C) Use the development phase OCC reflecting the leverage in the construction project.

D) Use the yield on long-term Government bonds.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 18 في هذه المجموعة.

فتح الحزمة

k this deck

15

What does each partner bring to the deal in a typical real estate development joint venture arrangement between a local entrepreneur and national capital source? What does each partner expect to get out of the deal?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 18 في هذه المجموعة.

فتح الحزمة

k this deck

16

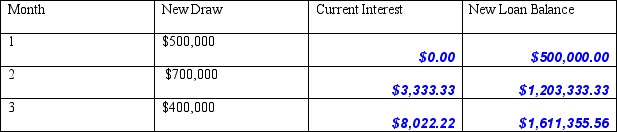

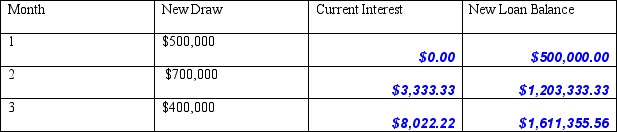

Please use the following template to help you organize and present your answer. You may use the back of the page for computations.)

Answer:

Part V. Required Problem 20 points)

Part V. Required Problem 20 points)

Fill in the table below assuming end-of-month draws, 8% interest per annum compounded monthly, and no payments owed for either interest or principal during the construction.

Answer:

Part V. Required Problem 20 points)

Part V. Required Problem 20 points)Fill in the table below assuming end-of-month draws, 8% interest per annum compounded monthly, and no payments owed for either interest or principal during the construction.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 18 في هذه المجموعة.

فتح الحزمة

k this deck

17

Consider a 6.5% loan amortizing at a 20-year rate with monthly payments. What is the maximum amount that can be loaned on a property whose net operating income NOI) is $1,000,000 per year, if the underwriting criteria specify a debt service coverage ratio DCR) no less than 120%?

A) $69,444

B) $8,000,000

C) $9,314,236

D) $11,177,084

E) $13,412,500

A) $69,444

B) $8,000,000

C) $9,314,236

D) $11,177,084

E) $13,412,500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 18 في هذه المجموعة.

فتح الحزمة

k this deck

18

Consider a 30-year monthly-payment), 6%, $300,000 mortgage with 3 points prepaid interest up front. What is the yield to maturity?

A) 5.87%

B) 6.00%

C) 6.29%

D) 6.50%

E) Insufficient information to answer the question.

A) 5.87%

B) 6.00%

C) 6.29%

D) 6.50%

E) Insufficient information to answer the question.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 18 في هذه المجموعة.

فتح الحزمة

k this deck