Deck 4: Inside the City I: Some Basic Urban Economics

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/20

العب

ملء الشاشة (f)

Deck 4: Inside the City I: Some Basic Urban Economics

1

If the market value cap rate based on NOI) on a certain type of property is 11%, capital improvement expenditures are typically 1% of property value per year, and you expect the property to appreciate at 3% per year, what discount rate total return) should be applied to determine the market value in a multi-year DCF analysis?

A) 3%

B) 10%

C) 11.5%

D) 13%

E) 11%

A) 3%

B) 10%

C) 11.5%

D) 13%

E) 11%

D

2

All of the following are components of the operating expenses of a property except:

A) Property taxes

B) Management expenses

C) Electricity bill

D) Income taxes

E) Hazard insurance expense

A) Property taxes

B) Management expenses

C) Electricity bill

D) Income taxes

E) Hazard insurance expense

D

3

Suppose the Net Operating Income NOI) in a property is $6,500,000 and the market value cap rate is 9.50%. What is the market value of the property using direct capitalization?

A) $2,622,842

B) $5,936,073

C) $61,750,000

D) $65,000,000

E) $68,421,000

A) $2,622,842

B) $5,936,073

C) $61,750,000

D) $65,000,000

E) $68,421,000

E

4

What is the ex ante IRR of the investment if you pay $500,000 today for the property?

A) 1.13%

B) 10.00%

C) 12.00%

D) 13.51%

E) 54.00%

A) 1.13%

B) 10.00%

C) 12.00%

D) 13.51%

E) 54.00%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 20 في هذه المجموعة.

فتح الحزمة

k this deck

5

An apartment complex has 100 units of which on average 5 are vacant at any given time. Per unit, the rent is $1000 per month, and the operating expenses paid by the landlord including realistic capital reserve) average $5000 per occupied unit) per year. Both rents and expenses are expected to grow at 1 percent per year in perpetuity, and the building value is expected to remain a constant multiple of its net income.

a) What is the projected potential gross income PGI) for the property in the first year?

b) What is the projected effective gross income EGI) for the property in the first year?

c) What is the projected net operating income NOI) for the property in the first year?

d) Suppose historically properties like this have averaged total returns of 10% per year when T-bills have averaged returns of 7%. If T-bills are currently yielding 5%, what is the NPV of a deal to purchase this property for $7,000,000?

a) What is the projected potential gross income PGI) for the property in the first year?

b) What is the projected effective gross income EGI) for the property in the first year?

c) What is the projected net operating income NOI) for the property in the first year?

d) Suppose historically properties like this have averaged total returns of 10% per year when T-bills have averaged returns of 7%. If T-bills are currently yielding 5%, what is the NPV of a deal to purchase this property for $7,000,000?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 20 في هذه المجموعة.

فتح الحزمة

k this deck

6

What is the value of the property if the required initial return is 12 percent per year?

A) $44,643

B) $416,667

C) $548,801

D) $583,333

E) $770,000

A) $44,643

B) $416,667

C) $548,801

D) $583,333

E) $770,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 20 في هذه المجموعة.

فتح الحزمة

k this deck

7

If the market value cap rate yield) on a certain type of property is 10%, and you expect the property to appreciate at 3% per year, what discount rate total return) should be applied to determine the market value in a multi-year DCF analysis?

A) 3%

B) 10%

C) 11.5%

D) 13%

E) 7%

A) 3%

B) 10%

C) 11.5%

D) 13%

E) 7%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 20 في هذه المجموعة.

فتح الحزمة

k this deck

8

The Corporez Development Co. recently acquired a developable land parcel for $3,000,000. Corporez has decided that the most lucrative development for this site would be a building that, upon completion, would be worth $10,000,000 including the land). It will cost Corporez $6,000,000 of construction cost excluding land), to build this project. Construction is instantaneous. What is the NPV to Corporez of building this project today:

a) If the best that the "typical" or "second-best") developer of this site could do is to build a building worth $9,000,000 on completion including land), at a construction cost excluding land) of $7,000,000?

b) If the best that the "typical" or "second-best") developer of this site could do is to build a building worth $11,000,000 on completion including land), at a construction cost excluding land) of $5,000,000?

b), what should Corporez do?

c) In the situation described in

a) If the best that the "typical" or "second-best") developer of this site could do is to build a building worth $9,000,000 on completion including land), at a construction cost excluding land) of $7,000,000?

b) If the best that the "typical" or "second-best") developer of this site could do is to build a building worth $11,000,000 on completion including land), at a construction cost excluding land) of $5,000,000?

b), what should Corporez do?

c) In the situation described in

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 20 في هذه المجموعة.

فتح الحزمة

k this deck

9

Suppose you analyze a particular deal and it appears that for an investment of $1,000,000 your client can obtain a positive NPV of over $500,000. Your client is typical of the type of high tax bracket individual investors who commonly purchase and sell this type of property, and indeed typically determine equilibrium prices in the asset market in which these properties are sold. What should you do?

A) Reject the deal out of hand because it costs twice as much as its NPV.

B) Phone your client right away on your cell phone and urge her to pounce on this deal before it "gets away" - the seller must have made a mistake in their offering price!

C) Buy the property with cash, take out an 80% loan-to-value ratio mortgage, and laugh all the way to the bank with $200,000 of arbitrage profits!

D) Sharpen your pencil, double-check your assumptions and analysis, try to find what's unique about client.

A) Reject the deal out of hand because it costs twice as much as its NPV.

B) Phone your client right away on your cell phone and urge her to pounce on this deal before it "gets away" - the seller must have made a mistake in their offering price!

C) Buy the property with cash, take out an 80% loan-to-value ratio mortgage, and laugh all the way to the bank with $200,000 of arbitrage profits!

D) Sharpen your pencil, double-check your assumptions and analysis, try to find what's unique about client.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 20 في هذه المجموعة.

فتح الحزمة

k this deck

10

Suppose the Net Operating Income NOI) in a property is $5,000,000 and the market value cap rate is 9.00%. What is the market value of the property using direct capitalization?

A) $450,000

B) $4,500,000

C) $5,450,000

D) $45,000,000

E) $55,555,556

A) $450,000

B) $4,500,000

C) $5,450,000

D) $45,000,000

E) $55,555,556

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 20 في هذه المجموعة.

فتح الحزمة

k this deck

11

You are the Landlord of a building with two tenants A and B). Use the following information to calculate the projected) Year 3 building operating expenses, assuming 100% gross leases for all tenants: Each tenant occupies 50% of net rentable space. Tenant A has a fixed lease for the next ten years, and Tenant B has a lease which expires at the end of year 2 beginning of year 3). First year Operating Expenses are $1000, and are projected to increase 5% per year. Building expenses are 60% fixed, 40% variable. Assume that Tenant B has a 70% probability of exercising an extension option for year 3. If they do not renew, assume the space will be vacant for 3 months, and then occupied by a similar tenant in terms of operating expenses). Show your work.

1,000 x 1.05)^3 = 1,157.6

In case of renewal,

1,157.6 x 70% = 810.3

In case of non-renewal

1,157.6 - 1,157.6 x 40% x ½ x ¼)) x 30% = 329.9

810.3 + 329.9 = 1,140.2

1,000 x 1.05)^3 = 1,157.6

In case of renewal,

1,157.6 x 70% = 810.3

In case of non-renewal

1,157.6 - 1,157.6 x 40% x ½ x ¼)) x 30% = 329.9

810.3 + 329.9 = 1,140.2

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 20 في هذه المجموعة.

فتح الحزمة

k this deck

12

Consider two adjacent properties near the airport in the suburbs of a growing metropolis. Property A is a warehouse with a long-term tenant. Property B is a cornfield. The corn harvest just pays the property taxes, but the land is zoned for industrial warehouse) development. Warehouses are currently selling at cap rates cash yields) of around 10% in this market, and warehouse rents typically grow at 2% per year. You expect that the cornfield will grow in value at a rate of 10% per year for the next few years. Suppose you own the cornfield. Use what you know and can reasonably assume about risk and return, to tell me whether you should:

a) hold the corn field undeveloped as a speculative investment for the time being, or

b) immediately either sell or develop the corn field. Support your answer with a tight quantitative argument.

a) hold the corn field undeveloped as a speculative investment for the time being, or

b) immediately either sell or develop the corn field. Support your answer with a tight quantitative argument.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 20 في هذه المجموعة.

فتح الحزمة

k this deck

13

Suppose apartment rents are currently Year 1) $300 per month per unit, all signed at various times. Rents are expected to grow at 2 percent per year. On average, tenants remain five years, and units are vacant 3 months between tenants. Operating expenses are $1500 per unit per year 100% fixed), also expected to increase 2 percent per year. What is the approximate forecasted Net Operating Income per unit for next year after vacancy allowance)?

A) $1,920

B) $1,929

C) $2,034

D) $2,047

E) $2,100

A) $1,920

B) $1,929

C) $2,034

D) $2,047

E) $2,100

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 20 في هذه المجموعة.

فتح الحزمة

k this deck

14

A property has a McDonald's restaurant on it, which can earn $50,000 per year. In any other use including another brand of restaurant), the most it can earn is $40,000 per year. Assuming a discount rate of 10% and constant cash flow in perpetuity, what is the "investment value" of this property to McDonald's, and what is its "market value"?

A) Both investment value and market value are $400,000.

B) Both investment value and market value are $500,000.

C) Investment value is $400,000 and market value is $500,000.

D) Investment value is $500,000 and market value is $400,000.

A) Both investment value and market value are $400,000.

B) Both investment value and market value are $500,000.

C) Investment value is $400,000 and market value is $500,000.

D) Investment value is $500,000 and market value is $400,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 20 في هذه المجموعة.

فتح الحزمة

k this deck

15

Suppose the lease on a certain space will expire at the beginning of this year. You believe that the probability of the existing tenant renewing is 50 percent. If he renews, you will need to spend only an estimated $5.00/SF to upgrade his space. If he does not renew, it will take $25.00/SF to modernize the space, even then you expect 6 months of vacancy. What expected cash flow forecast should you put in your pro forma for this space, if you expect triple-net market rents on new leases to be $20/SF?

A) $17.50/SF

B) $15.00/SF

C) Zero

D) - $10.00/SF

E) -$5.00

A) $17.50/SF

B) $15.00/SF

C) Zero

D) - $10.00/SF

E) -$5.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 20 في هذه المجموعة.

فتح الحزمة

k this deck

16

The difference between the net operating income NOI) and the property before-tax cash flow PBTCF) is:

A) Property Tax Expense

B) The debt service

C) Income taxes

D) Capital Improvement Expenditures

A) Property Tax Expense

B) The debt service

C) Income taxes

D) Capital Improvement Expenditures

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 20 في هذه المجموعة.

فتح الحزمة

k this deck

17

Normally, in a healthy rental market, one would expect what relationship between the "going-in" and "going-out" cap rate?

A) The going-in cap rate should be higher than the going out.

B) The going-out cap rate should be at least as high as the going-in rate.

C) There is no particular relation between the two.

D) The going-out cap rate is too far in the future, and should not be estimated.

A) The going-in cap rate should be higher than the going out.

B) The going-out cap rate should be at least as high as the going-in rate.

C) There is no particular relation between the two.

D) The going-out cap rate is too far in the future, and should not be estimated.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 20 في هذه المجموعة.

فتح الحزمة

k this deck

18

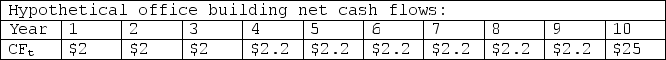

A single-tenant building has the following expected future cash flows, all occurring at the ends of the years. The first three years reflect an existing in-place lease. The next six years are the expected rents under a subsequent 6-year lease, that is expected to be signed at the end of Year 3, but the amount of the rent in that subsequent lease is not certain in advance of the signing of that lease. The Year 10 cash flow includes reversion as well as subsequent operating cash flow beyond the second lease. The current T-bill yield is 6%. The risk premium appropriate for discounting contractual cash flows is 200 basis-points. The risk premium appropriate for discounting non-contractual cash flows is 600 basis-points. What is the value of this building? Please show your work for possible partial credit.)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 20 في هذه المجموعة.

فتح الحزمة

k this deck

19

In the Discounted Cash Flow DCF) valuation procedure:

A) The cash flows should represent a conservative or pessimistic forecast, so as to make sure you don't encounter unexpected problems later on.

B) The cash flows should represent an aggressive or optimistic forecast, to help sell the property as quickly as possible.

C) The cash flows should be realistic best-guess forecasts, as risk always has both an "upside" and "downside".

D) The cash flow forecast should obey the "G.I.G.O" rule: "Get In and Get Out" before the market crashes.

A) The cash flows should represent a conservative or pessimistic forecast, so as to make sure you don't encounter unexpected problems later on.

B) The cash flows should represent an aggressive or optimistic forecast, to help sell the property as quickly as possible.

C) The cash flows should be realistic best-guess forecasts, as risk always has both an "upside" and "downside".

D) The cash flow forecast should obey the "G.I.G.O" rule: "Get In and Get Out" before the market crashes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 20 في هذه المجموعة.

فتح الحزمة

k this deck

20

Suppose the lease on a certain space will expire in one year The end of Year 1). You believe that the probability of the existing tenant renewing is 50 percent. If he renews, you will need to spend only an estimated $5.00/SF to upgrade his space. If he does not renew, it will take $25.00/SF to modernize the space, plus $5.00/SF in leasing broker commissions to attract a new tenant, and even then you expect 6 months of vacancy. What expected cash flow forecast should you put in year 2 of your pro forma for this space, if you expect triple-net market rents on new leases in year 2 to be $20/SF?

A) $22.50/SF

B) $15.00/SF

C) - $2.50/SF

D) - $7.50/SF

E) - $20.00/SF

A) $22.50/SF

B) $15.00/SF

C) - $2.50/SF

D) - $7.50/SF

E) - $20.00/SF

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 20 في هذه المجموعة.

فتح الحزمة

k this deck