Deck 4: The Bookkeeping Process and Transaction Analysis

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/30

العب

ملء الشاشة (f)

Deck 4: The Bookkeeping Process and Transaction Analysis

1

A credit entry will:

A) increase an asset account.

B) increase a liability account.

C) decrease paid-in capital.

D) increase an expense account.

A) increase an asset account.

B) increase a liability account.

C) decrease paid-in capital.

D) increase an expense account.

B

2

Martin & Associates borrowed $5,000 on April 1, 2013 at 8% interest with both principal and interest due on March 31, 2014. Which of the following journal entries should the firm use to accrue interest at the end of each month?

A.

B.

C.

D.

A) Option A

B) Option B

C) Option C

D) Option D

A.

B.

C.

D.

A) Option A

B) Option B

C) Option C

D) Option D

Option C

3

In an advertiser's records, a newspaper ad submitted and published this week with the agreement to pay for it next week would:

A) decrease assets and decrease expenses.

B) increase liabilities and increase expenses.

C) decrease assets and increase revenue.

D) increase assets and decrease liabilities.

A) decrease assets and decrease expenses.

B) increase liabilities and increase expenses.

C) decrease assets and increase revenue.

D) increase assets and decrease liabilities.

B

4

The effect of an adjustment is:

A) to correct an entry that was not in balance.

B) to increase the accuracy of the financial statements.

C) to record transactions not previously recorded.

D) to close the books.

A) to correct an entry that was not in balance.

B) to increase the accuracy of the financial statements.

C) to record transactions not previously recorded.

D) to close the books.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 30 في هذه المجموعة.

فتح الحزمة

k this deck

5

The accountant at Abco, Inc. made an adjusting entry at the end of February to accrue interest on a note receivable from a customer. The effect of this entry is to:

A) decrease ROI for February.

B) increase ROI for February.

C) decrease working capital at February 28.

D) decrease the acid-test ratio at February 28.

A) decrease ROI for February.

B) increase ROI for February.

C) decrease working capital at February 28.

D) decrease the acid-test ratio at February 28.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 30 في هذه المجموعة.

فتح الحزمة

k this deck

6

In the buyer's records, the purchase of merchandise on account would:

A) increase assets and increase expenses.

B) increase assets and increase liabilities.

C) increase liabilities and increase paid-in capital.

D) have no effect on total assets.

A) increase assets and increase expenses.

B) increase assets and increase liabilities.

C) increase liabilities and increase paid-in capital.

D) have no effect on total assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 30 في هذه المجموعة.

فتح الحزمة

k this deck

7

A newspaper ad submitted and published this week, with the agreement to get paid for it next week would, in the newspaper's records:

A) increase assets and increase revenues.

B) increase assets and decrease liabilities.

C) increase assets and increase expenses.

D) have no effect on total assets.

A) increase assets and increase revenues.

B) increase assets and decrease liabilities.

C) increase assets and increase expenses.

D) have no effect on total assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 30 في هذه المجموعة.

فتح الحزمة

k this deck

8

Martin & Associates borrowed $5,000 on April 1, 2013 at 8% interest with both principal and interest due on March 31, 2014. How much should be in the firm's interest payable account at December 31, 2013?

A) $300

B) $400

C) $0

D) $333

A) $300

B) $400

C) $0

D) $333

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 30 في هذه المجموعة.

فتح الحزمة

k this deck

9

Wisdom Co. has a note payable to its bank. An adjustment is likely to be required on Wisdom's books at the end of every month that the loan is outstanding to record the:

A) amount of interest paid during the month.

B) amount of total interest to be paid when the note is paid off.

C) amount of principal payable at the maturity date of the note.

D) accrued interest expense for the month.

A) amount of interest paid during the month.

B) amount of total interest to be paid when the note is paid off.

C) amount of principal payable at the maturity date of the note.

D) accrued interest expense for the month.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 30 في هذه المجموعة.

فتح الحزمة

k this deck

10

Sage, Inc. has 20 employees who work Monday through Friday each week; each employee earns $100 per day and is paid every Friday. The end of the accounting period is on a Wednesday. How much wages expense should the firm accrue at the end of the period?

A) $2,000

B) $1,000

C) $0

D) $6,000

A) $2,000

B) $1,000

C) $0

D) $6,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 30 في هذه المجموعة.

فتح الحزمة

k this deck

11

In the seller's records, the sale of merchandise on account would:

A) increase assets and increase expenses.

B) increase assets and decrease liabilities.

C) increase assets and increase paid-in capital.

D) increase assets and decrease revenues.

A) increase assets and increase expenses.

B) increase assets and decrease liabilities.

C) increase assets and increase paid-in capital.

D) increase assets and decrease revenues.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 30 في هذه المجموعة.

فتح الحزمة

k this deck

12

Which of the following is not one of the 5 questions of transaction analysis?

A) What's going on?

B) Which accounts are affected?

C) Is this an accrual?

D) Does the balance sheet balance?

E) Does my analysis make sense?

A) What's going on?

B) Which accounts are affected?

C) Is this an accrual?

D) Does the balance sheet balance?

E) Does my analysis make sense?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 30 في هذه المجموعة.

فتح الحزمة

k this deck

13

A debit entry will:

A) decrease an asset account.

B) increase a liability account.

C) increase paid-in capital.

D) increase an expense account.

A) decrease an asset account.

B) increase a liability account.

C) increase paid-in capital.

D) increase an expense account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 30 في هذه المجموعة.

فتح الحزمة

k this deck

14

An engineering consultant provided $300 of services to a client; the client paid $50 when the bill was submitted and will pay the balance within a week. The consultant will record this transaction by:

A.

B.

C.

D.

A) Option A

B) Option B

C) Option C

D) Option D

A.

B.

C.

D.

A) Option A

B) Option B

C) Option C

D) Option D

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 30 في هذه المجموعة.

فتح الحزمة

k this deck

15

A journal entry recording an accrual:

A) results in a better matching of revenues and expenses.

B) will involve a debit or credit to cash.

C) will affect balance sheet accounts only.

D) will most likely include a debit to a liability account.

A) results in a better matching of revenues and expenses.

B) will involve a debit or credit to cash.

C) will affect balance sheet accounts only.

D) will most likely include a debit to a liability account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 30 في هذه المجموعة.

فتح الحزمة

k this deck

16

A credit entry will:

A) always decrease the account balance.

B) always increase the account balance.

C) increase the balance of a revenue account.

D) increase the balance of an expense account.

A) always decrease the account balance.

B) always increase the account balance.

C) increase the balance of a revenue account.

D) increase the balance of an expense account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 30 في هذه المجموعة.

فتح الحزمة

k this deck

17

Martin & Associates borrowed $5,000 on April 1, 2013 at 8% interest with both principal and interest due on March 31, 2014. Which of the following journal entries should the firm use to record the payment of interest on March 31, 2014?

A.

B.

C.

D.

A) Option A

B) Option B

C) Option C

D) Option D

A.

B.

C.

D.

A) Option A

B) Option B

C) Option C

D) Option D

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 30 في هذه المجموعة.

فتح الحزمة

k this deck

18

To accrue $3,200 of employee salaries for the last week of February, the employer's journal entry is:

A.

B.

C.

D.

A) Option A

B) Option B

C) Option C

D) Option D

A.

B.

C.

D.

A) Option A

B) Option B

C) Option C

D) Option D

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 30 في هذه المجموعة.

فتح الحزمة

k this deck

19

A debit entry will:

A) always decrease the account balance.

B) always increase the account balance.

C) increase the balance of a revenue account.

D) increase the balance of an expense account.

A) always decrease the account balance.

B) always increase the account balance.

C) increase the balance of a revenue account.

D) increase the balance of an expense account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 30 في هذه المجموعة.

فتح الحزمة

k this deck

20

An expanded version of the accounting equation could be:

A) Assets + Revenues = Liabilities + Stockholders' Equity - Expenses

B) Assets - Liabilities = Paid-in Capital - Revenues - Expenses

C) Assets = Liabilities + Paid-in Capital + Beginning Retained Earnings + Revenues - Expenses - Dividends

D) Assets = Liabilities + Paid-in Capital - Revenues + Expenses

A) Assets + Revenues = Liabilities + Stockholders' Equity - Expenses

B) Assets - Liabilities = Paid-in Capital - Revenues - Expenses

C) Assets = Liabilities + Paid-in Capital + Beginning Retained Earnings + Revenues - Expenses - Dividends

D) Assets = Liabilities + Paid-in Capital - Revenues + Expenses

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 30 في هذه المجموعة.

فتح الحزمة

k this deck

21

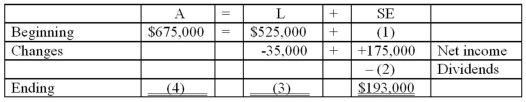

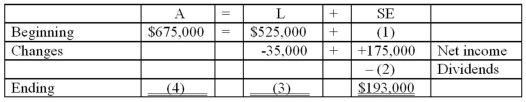

At the beginning of the current fiscal year, Surrey Corp.'s balance sheet showed assets of $675,000 and liabilities of $525,000. During the year, liabilities decreased by $35,000. Net Income for the year was $175,000, and net assets at the end of the year were $193,000. There were no changes in paid-in capital during the year.

Calculate the dividends, if any, declared during the year.

Calculate the total assets at the end of the year.

Calculate the dividends, if any, declared during the year.

Calculate the total assets at the end of the year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 30 في هذه المجموعة.

فتح الحزمة

k this deck

22

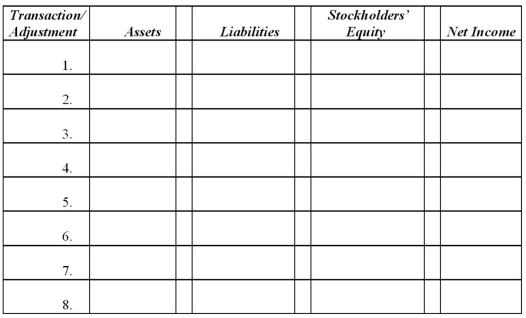

Using the column headings provided below, show the effect, if any, of the transaction entry or adjusting entry on the appropriate balance sheet category or on the income statement by entering the account name, amount, and indicating whether it is an addition (+) or subtraction (-). Column headings reflect the expanded balance sheet equation; items that affect net income should not be shown as affecting stockholders' equity.

(1.) The firm borrowed $2,000 from the bank; a short-term note was signed.

(2.) Merchandise inventory costing $750 was purchased; cash of $200 was paid and the balance is due in 30 days.

(3.) Employee wages of $1,000 were accrued at the end of the month.

(4.) Merchandise that cost $350 was sold for $450 in cash.

(5.) This month's rent of $700 was paid.

(6.) Revenues from services during month totaled $6,500. Of this amount, $2,000 was received in cash and the balance is expected to be received within 30 days.

(7.) During the month, supplies were purchased on account at a cost of $520, and debited into the Supplies (asset) account. A total of $400 of supplies were used during the month.

(8.) Interest of $240 has been earned on a note receivable, but has not yet been received.

(1.) The firm borrowed $2,000 from the bank; a short-term note was signed.

(2.) Merchandise inventory costing $750 was purchased; cash of $200 was paid and the balance is due in 30 days.

(3.) Employee wages of $1,000 were accrued at the end of the month.

(4.) Merchandise that cost $350 was sold for $450 in cash.

(5.) This month's rent of $700 was paid.

(6.) Revenues from services during month totaled $6,500. Of this amount, $2,000 was received in cash and the balance is expected to be received within 30 days.

(7.) During the month, supplies were purchased on account at a cost of $520, and debited into the Supplies (asset) account. A total of $400 of supplies were used during the month.

(8.) Interest of $240 has been earned on a note receivable, but has not yet been received.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 30 في هذه المجموعة.

فتح الحزمة

k this deck

23

The Interest Receivable account for February showed transactions totaling $8,500 and an adjustment of $11,200.

A) The transactions probably resulted from accruing interest income earned.

B) The transactions were probably entered on the credit side of the account.

C) The adjustment was probably for cash receipts of interest receivable accrued in prior months.

D) The balance in the interest receivable account decreased $2,700.

A) The transactions probably resulted from accruing interest income earned.

B) The transactions were probably entered on the credit side of the account.

C) The adjustment was probably for cash receipts of interest receivable accrued in prior months.

D) The balance in the interest receivable account decreased $2,700.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 30 في هذه المجموعة.

فتح الحزمة

k this deck

24

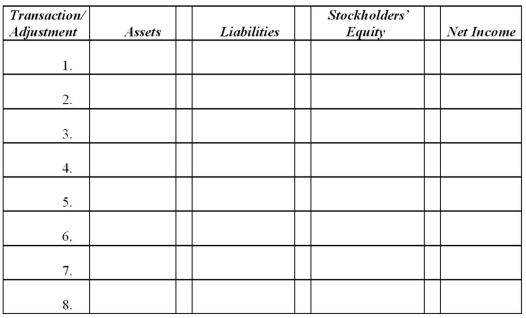

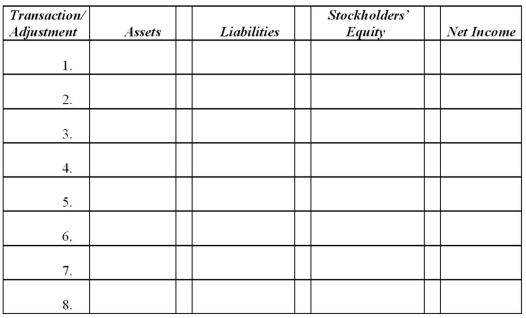

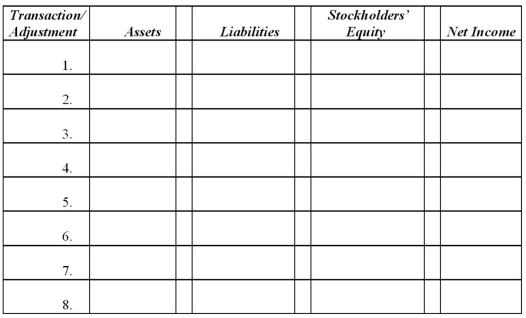

Using the column headings provided below, show the effect, if any, of the transaction entry or adjusting entry on the appropriate balance sheet category or on the income statement by entering the account name, amount, and indicating whether it is an addition (+) or subtraction (-). Column headings reflect the expanded balance sheet equation; items that affect net income should not be shown as affecting stockholders' equity.

(1.) During the month, the board of directors declared a cash dividend of $1,200, payable next month.

(2.) Employees were paid $1,900 in wages for their work during the first three weeks of the month.

(3.) Employee wages of $600 for the last week of the month have not been recorded.

(4.) Merchandise that cost $900 was sold for $1,350. Of this amount, $1,000 was received in cash and the balance is expected to be received within 30 days.

(5.) A contract was signed with a local radio station for a $100 advertisement; the ad was aired during this month but will not be paid for until next month.

(6.) Store equipment was purchased at a cash price of $300. The original list price of the equipment was $400, but a discount was received.

(7.) Received $180 of interest income for the current month.

(8.) Accrued $310 of interest expense at the end of the month.

(1.) During the month, the board of directors declared a cash dividend of $1,200, payable next month.

(2.) Employees were paid $1,900 in wages for their work during the first three weeks of the month.

(3.) Employee wages of $600 for the last week of the month have not been recorded.

(4.) Merchandise that cost $900 was sold for $1,350. Of this amount, $1,000 was received in cash and the balance is expected to be received within 30 days.

(5.) A contract was signed with a local radio station for a $100 advertisement; the ad was aired during this month but will not be paid for until next month.

(6.) Store equipment was purchased at a cash price of $300. The original list price of the equipment was $400, but a discount was received.

(7.) Received $180 of interest income for the current month.

(8.) Accrued $310 of interest expense at the end of the month.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 30 في هذه المجموعة.

فتح الحزمة

k this deck

25

When a firm purchases supplies for use in its business, and the cost of the supplies purchased is recorded as an asset, the following adjustment to recognize the cost of supplies used will probably be required:

A.

B.

C.

D.

A) Option A

B) Option B

C) Option C

D) Option D

A.

B.

C.

D.

A) Option A

B) Option B

C) Option C

D) Option D

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 30 في هذه المجموعة.

فتح الحزمة

k this deck

26

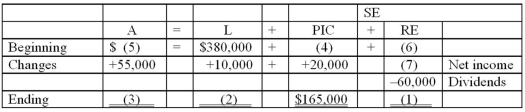

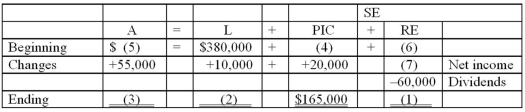

At the beginning of the current fiscal year, the balance sheet of Arches Co. showed liabilities of $380,000. During the year liabilities increased by $10,000, assets increased by $55,000, and paid-in capital increased by $20,000 to $165,000. Dividends declared and paid during the year were $60,000. At the end of the year, stockholders' equity totaled $402,000. Calculate net income or loss for the year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 30 في هذه المجموعة.

فتح الحزمة

k this deck

27

The effect of an adjustment on the financial statements is usually to:

A) make the balance sheet balance.

B) increase net income.

C) increase the accuracy of both the balance sheet and income statement.

D) match revenues and assets.

A) make the balance sheet balance.

B) increase net income.

C) increase the accuracy of both the balance sheet and income statement.

D) match revenues and assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 30 في هذه المجموعة.

فتح الحزمة

k this deck

28

When a firm purchases supplies for its business:

A) the supplies account should always be debited.

B) the supplies expense account should always be debited.

C) either the supplies account or the supplies expense account should be credited.

D) an adjustment will probably be required as supplies are used.

A) the supplies account should always be debited.

B) the supplies expense account should always be debited.

C) either the supplies account or the supplies expense account should be credited.

D) an adjustment will probably be required as supplies are used.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 30 في هذه المجموعة.

فتح الحزمة

k this deck

29

The accounting concept/principle being applied when an adjustment is made is usually:

A) matching revenue and expense.

B) consistency.

C) original cost.

D) materiality.

A) matching revenue and expense.

B) consistency.

C) original cost.

D) materiality.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 30 في هذه المجموعة.

فتح الحزمة

k this deck

30

The balance in the Wages Payable account increased from $12,200 at the beginning of the month to $15,000 at the end of the month. Wages accrued during the month totaled $61,000.

A) Wages paid during the month totaled $58,200.

B) Wages paid during the month totaled $64,800.

C) Wages expense for the month totaled $58,200.

D) Wages expense for the month totaled $76,000.

A) Wages paid during the month totaled $58,200.

B) Wages paid during the month totaled $64,800.

C) Wages expense for the month totaled $58,200.

D) Wages expense for the month totaled $76,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 30 في هذه المجموعة.

فتح الحزمة

k this deck