Deck 1: The Investment Environment

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

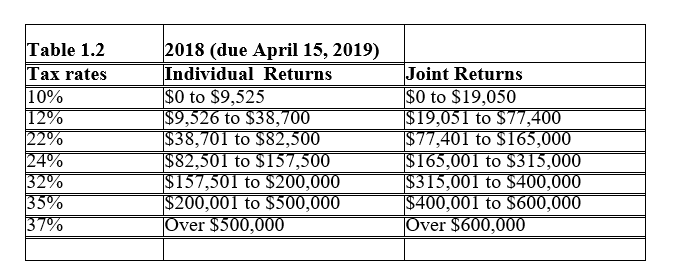

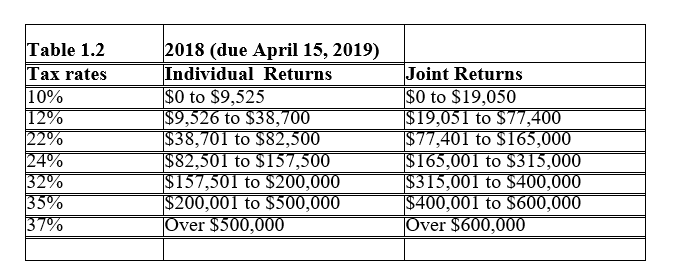

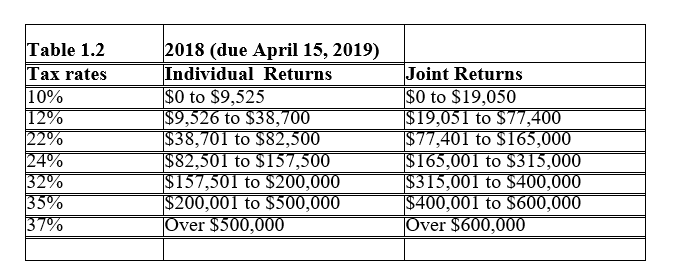

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/87

العب

ملء الشاشة (f)

Deck 1: The Investment Environment

1

Stocks of large publicly traded companies are

A) rarely traded.

B) illiquid.

C) rarely decline in value.

D) highly liquid.

A) rarely traded.

B) illiquid.

C) rarely decline in value.

D) highly liquid.

D

2

Since 1900, the average return on stocks has exceeded the average return on savings accounts by more than 6 percentage points.

True

3

Which of the following are true concerning institutional investors?

I) Institutional investors are professionals who manage money for other people.

II) Banks, insurance companies and mutual funds are all institutional investors.

III) Institutional investors are individuals who invest indirectly through financial institutions.

IV) Institutional investors invest large sums of money.

A) I and II only

B) I, II and IV only

C) II, III and IV only

D) I, II, III and IV

I) Institutional investors are professionals who manage money for other people.

II) Banks, insurance companies and mutual funds are all institutional investors.

III) Institutional investors are individuals who invest indirectly through financial institutions.

IV) Institutional investors invest large sums of money.

A) I and II only

B) I, II and IV only

C) II, III and IV only

D) I, II, III and IV

B

4

Which of the following is NOT traded in the securities markets?

A) stocks

B) bonds

C) derivatives

D) real estate

A) stocks

B) bonds

C) derivatives

D) real estate

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

5

A United States Savings Bond is an example of an investment as defined in the text.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

6

Stocks are a(n)_______ investment representing_____ of a business.

A) direct; ownership

B) direct; debt

C) indirect; ownership

D) indirect; debt

A) direct; ownership

B) direct; debt

C) indirect; ownership

D) indirect; debt

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

7

The government is generally

A) not involved in the financial markets.

B) the owner of the financial market.

C) a supplier of funds to the financial market.

D) a demander of funds in the financial market.

A) not involved in the financial markets.

B) the owner of the financial market.

C) a supplier of funds to the financial market.

D) a demander of funds in the financial market.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

8

An exchange traded fund that invests in the stocks of large corporations is an example of

A) direct investment.

B) indirect investment.

C) derivative investment.

D) tangible investment.

A) direct investment.

B) indirect investment.

C) derivative investment.

D) tangible investment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

9

Banks and insurance companies are examples of institutional investors.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

10

Most sources of investment information are in print format, expensive, and difficult to access.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

11

In the financial markets, individuals are net suppliers of funds.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

12

Institutional investors are individuals who invest indirectly through financial institutions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

13

Which of the following is NOT an investment as defined in the text?

A) a certificate of deposit issued by a bank

B) a new automobile

C) a United States Saving Bond

D) a mutual fund held in a retirement account

A) a certificate of deposit issued by a bank

B) a new automobile

C) a United States Saving Bond

D) a mutual fund held in a retirement account

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

14

Land and buildings are examples of real property investments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

15

On a net basis, funds in the financial markets are generally supplied by

A) individuals.

B) both individuals and business firms.

C) business firms.

D) the government.

A) individuals.

B) both individuals and business firms.

C) business firms.

D) the government.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

16

Which of the following has declined in recent years?

A) direct ownership of stock by individual investors

B) the percentage of foreign stocks held in typical portfolios

C) institutional ownership of common stocks

D) the timeliness of information available to investors

A) direct ownership of stock by individual investors

B) the percentage of foreign stocks held in typical portfolios

C) institutional ownership of common stocks

D) the timeliness of information available to investors

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

17

A non-interest bearing checking account is still considered an investment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

18

Which of the following has increased in recent years?

A) direct ownership of stock by individual investors

B) the percentage of domestic stocks held in typical portfolios

C) institutional ownership of common stocks

D) indirect ownership of stocks through mutual funds and ETFs.

A) direct ownership of stock by individual investors

B) the percentage of domestic stocks held in typical portfolios

C) institutional ownership of common stocks

D) indirect ownership of stocks through mutual funds and ETFs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

19

Institutional investors manage money for businesses and nonprofit organizations, but not for individuals.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

20

Debt represents funds loaned in exchange for

A) dividend income and the repayment of the loan principal.

B) dividend income and an ownership interest in the firm.

C) interest income and a partial ownership interest in the firm.

D) interest income and the repayment of the loan principal.

A) dividend income and the repayment of the loan principal.

B) dividend income and an ownership interest in the firm.

C) interest income and a partial ownership interest in the firm.

D) interest income and the repayment of the loan principal.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

21

Bond prices rise as interest rates decline.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

22

Bonds represent a lower level of risk than do stocks in the same company.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

23

Earning a high rate of return with little or no risk is a realistic investment goal.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

24

One reason that passively managed mutual funds have grown in popularity relative to actively managed mutual funds is that

A) passive fund expense ratios are lower.

B) passive fund returns are always higher.

C) active funds are too diverse.

D) none of these

A) passive fund expense ratios are lower.

B) passive fund returns are always higher.

C) active funds are too diverse.

D) none of these

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

25

Briefly describe three advantages of investing in mutual funds or exchange traded funds.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

26

Describe the major differences between individual and institutional investors.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

27

The major difference between mutual funds and exchange traded funds (ETFs) is

A) ETFs can be bought or sold at their current price at any time during normal trading hours.

B) mutual fund portfolios are always based on one of the major market indexes.

C) ETFs invest in broadly diversified portfolios of securities.

D) ETFs are actively managed.

A) ETFs can be bought or sold at their current price at any time during normal trading hours.

B) mutual fund portfolios are always based on one of the major market indexes.

C) ETFs invest in broadly diversified portfolios of securities.

D) ETFs are actively managed.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

28

Bond investors lend their money for a fixed period of time and receive interest.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

29

Over the past decade, passively managed index funds have

A) grown quite a lot.

B) declined in popularity.

C) attracted almost 100% of investment dollars.

D) almost disappeared as a fund type.

A) grown quite a lot.

B) declined in popularity.

C) attracted almost 100% of investment dollars.

D) almost disappeared as a fund type.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

30

Investors seeking a diversified, professionally managed portfolio of securities can purchase shares of

A) preferred stock.

B) convertible securities.

C) insurance policies.

D) mutual funds.

A) preferred stock.

B) convertible securities.

C) insurance policies.

D) mutual funds.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

31

Which one of the following would be the least liquid investment?

A) stock

B) put options

C) money market mutual fund

D) real estate

A) stock

B) put options

C) money market mutual fund

D) real estate

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

32

Bond interest and stock dividends are different ways of distributing a corporation's earnings to its owners.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

33

Call options on common stock are a form of equity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

34

Which of the following is an example of a tangible asset?

A) bonds

B) mutual funds

C) real estate

D) stocks

A) bonds

B) mutual funds

C) real estate

D) stocks

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

35

Exchange traded funds are similar to mutual funds, but are traded like stocks.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

36

An option to purchase common stock is a type of derivative security.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

37

Which of the following investments represents partial ownership of a corporation?

A) bonds

B) mutual funds

C) commercial paper

D) common stock

A) bonds

B) mutual funds

C) commercial paper

D) common stock

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

38

Mutual funds invest in diversified portfolios of securities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

39

Under current tax laws, most taxpayers will pay a lower tax rate on capital gains than on dividends.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

40

A collection of securities designed to meet an investment goal is called a portfolio.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

41

Under current laws, a couple filing jointly with a total income of $75,000 would pay a 15% tax on capital gains.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

42

Because Doug lost his job in 2018, his income was only $27,000. To make ends meet, he sold stock and realized capital gains of $5,000. Doug is single and files as an individual. The tax on his capital gains will be

A) $0.

B) $600.

C) $750.

D) $1,000.

A) $0.

B) $600.

C) $750.

D) $1,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

43

-In 2018, Jordan and Kailey earned a combined taxable income of $148,800 from employment plus $1,000 in long term capital gains and they file a joint tax return. What is their total federal income tax? Round to the nearest dollar.

A) $33,780

B) $29,063

C) $24,765

D) $24,659

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

44

Investors can postpone or avoid income taxes by investing through Individual Retirement Accounts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

45

Michelle and Patrick are in the 24% marginal tax bracket. They bought 100 shares of DJN stock at $45 per share and sold them 4 years later in 2018 at $22 per share? By how much did their loss reduce their taxes in the year when they sold the stock?

A) $0

B) $345

C) $552

D) $1,260

A) $0

B) $345

C) $552

D) $1,260

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

46

-For a taxpayer in the 22% marginal tax bracket, a long-term capital gain realized in 2018 will be taxed at

A) 5%.

B) 10%.

C) 15%.

D) 25%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

47

Investors seeking to increase their wealth as quickly as possible would invest in

A) corporate bonds and preferred stock.

B) large company stocks with high dividends.

C) smaller companies pursuing rapid growth.

D) government bonds and low-risk income stocks.

A) corporate bonds and preferred stock.

B) large company stocks with high dividends.

C) smaller companies pursuing rapid growth.

D) government bonds and low-risk income stocks.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

48

Andrew and Jennifer are in the 22% marginal tax bracket. Three years ago they purchased 100 shares of stock at $20 a share. In 2018, they sold the 100 shares for $29 a share. What is the amount of federal income tax they owe as a result of this sale?

A) $135

B) $165

C) $225

D) $435

A) $135

B) $165

C) $225

D) $435

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

49

Contributions to a Roth IRA are taxed up front, but subsequent earnings and withdrawals are tax free.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

50

In selecting investments consistent with your goals, you should consider

A) rates of return and taxes only.

B) the pre-tax rate of return only.

C) annual dividends and taxes only.

D) risks, returns, and taxes.

A) rates of return and taxes only.

B) the pre-tax rate of return only.

C) annual dividends and taxes only.

D) risks, returns, and taxes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

51

-Jon earned $82,500 in taxable income, all from wages and interest, and files an individual tax return. What is the amount of Josh's taxes for the year 2018? Round to the nearest dollar.

A) $13,750

B) $14,090

C) $18,150

D) $12,285

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

52

Retirement plans, such as a 401(k), allow employees to defer taxes on the plan contributions until such time as the funds are withdrawn from the retirement plan.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

53

Alexandra purchased a stock one year ago at a price of $64 a share. In the past year, she has received four quarterly dividends of $1.50 each. Today she sold the stock for $76 a share. Her capital gain per share is

A) $6.00.

B) $12.00.

C) $(6.00).

D) $18.00.

A) $6.00.

B) $12.00.

C) $(6.00).

D) $18.00.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

54

To qualify for long-term capital gains rates, a stock must be held for at least 12 months.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

55

Tax planning

A) guides investment activities to maximize after-tax returns over the long term for an acceptable level of risk.

B) ignores the source of income and concentrates solely on the amount of income.

C) is primarily done by individuals with incomes below $200,000.

D) is limited to reviewing income for the current year and determining how to minimize current taxes.

A) guides investment activities to maximize after-tax returns over the long term for an acceptable level of risk.

B) ignores the source of income and concentrates solely on the amount of income.

C) is primarily done by individuals with incomes below $200,000.

D) is limited to reviewing income for the current year and determining how to minimize current taxes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

56

Which of the following represent investment goals?

I) saving for major expenditures such as a house or education

II) sheltering income from taxes

III) increasing current income

IV) saving funds for retirement

A) I and IV only

B) III and IV only

C) I, III and IV only

D) I,,II, III and IV

I) saving for major expenditures such as a house or education

II) sheltering income from taxes

III) increasing current income

IV) saving funds for retirement

A) I and IV only

B) III and IV only

C) I, III and IV only

D) I,,II, III and IV

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

57

Beginning investors with small amounts to invest should

A) avoid stock investments completely.

B) invest all of their money in one high quality stock.

C) buy mutual funds or exchange traded funds (ETFs).

D) buy a portfolio of very low priced stocks (penny stocks).

A) avoid stock investments completely.

B) invest all of their money in one high quality stock.

C) buy mutual funds or exchange traded funds (ETFs).

D) buy a portfolio of very low priced stocks (penny stocks).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

58

Both the holding period to qualify and the tax rate on long-term capital gains

A) are subject to political pressure and occasionally change.

B) are very stable and have not changed since the 1960s.

C) are phased out on incomes over $388,351.

D) are adjusted for inflation every year.

A) are subject to political pressure and occasionally change.

B) are very stable and have not changed since the 1960s.

C) are phased out on incomes over $388,351.

D) are adjusted for inflation every year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

59

Research indicates that investors who monitor their portfolios less frequently

A) outperform those who hold investments for the long-term and trade infrequently.

B) tend to invest in riskier assets.

C) earn rates of return similar to those who hold investments for the long-term and trade infrequently.

D) are more highly educated and in higher income brackets than those who hold investments for the long term and trade infrequently.

A) outperform those who hold investments for the long-term and trade infrequently.

B) tend to invest in riskier assets.

C) earn rates of return similar to those who hold investments for the long-term and trade infrequently.

D) are more highly educated and in higher income brackets than those who hold investments for the long term and trade infrequently.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

60

A well-conceived investment policy statement will take into account

A) the investor's current age and economic situation.

B) the investor's preference for frequent or infrequent trading.

C) the types of investments the investor is willing to consider.

D) all of the above.

A) the investor's current age and economic situation.

B) the investor's preference for frequent or infrequent trading.

C) the types of investments the investor is willing to consider.

D) all of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

61

Short-term investments generally provide liquidity, safety, and a high rate of return.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

62

Discuss the relationship between stock prices and investors' beliefs about the business cycle.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

63

Short-term investments

I) provide liquidity.

II) fill an important part of most investment programs.

III) provide a high rate of return with low risk.

IV) provide resources for emergencies.

A) I and IV only

B) II and IV only

C) I, II and IV only

D) I, II, III and IV

I) provide liquidity.

II) fill an important part of most investment programs.

III) provide a high rate of return with low risk.

IV) provide resources for emergencies.

A) I and IV only

B) II and IV only

C) I, II and IV only

D) I, II, III and IV

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

64

Stringent regulations and vigorous enforcement have all but eliminated unethical behavior by financial professionals in recent years.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

65

What are some of the important prerequisites to investing?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

66

Federal insurance protects passbook savings accounts and money market deposit accounts (MMDAs) up to

A) $100,000.

B) $150,000.

C) $250,000.

D) $1,000,000.

A) $100,000.

B) $150,000.

C) $250,000.

D) $1,000,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

67

A major goal of corporate financial management is to increase the value of the firm to investors.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

68

Liquidity is the ability to convert an investment into cash quickly with little or no loss of value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

69

The average tax rate is the rate a person pays on their next dollar of income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

70

U.S. Treasury Bills mature in 1 year or less.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

71

A person's marginal tax rate is the rate they pay

A) on the next dollar of income.

B) on all income.

C) only on investment income.

D) only on earned income.

A) on the next dollar of income.

B) on all income.

C) only on investment income.

D) only on earned income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

72

Insurance companies invest the premiums and fees collected from customers in order to neutralize the risks assumed from their clients.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

73

Money market accounts, certificates of deposit, bonds and commercial paper are all forms of short-term investment vehicles.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

74

Discuss the general investment philosophy and the types of investments preferred by investors in each phase of the life cycle.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

75

The primary risk associated with a short-term investment is

A) purchasing power risk.

B) default risk.

C) interest rate risk.

D) economic risk.

A) purchasing power risk.

B) default risk.

C) interest rate risk.

D) economic risk.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

76

During which period are stock returns typically the lowest?

A) 6 months before a recession

B) during a recession

C) 12 months after a recession

D) there is no discernable pattern

A) 6 months before a recession

B) during a recession

C) 12 months after a recession

D) there is no discernable pattern

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

77

Certified Financial Planners typically manage institutional portfolios.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

78

Which one of the following has the lowest level of risk?

A) commercial paper

B) money market mutual fund account

C) banker's acceptance

D) U.S. Treasury bill

A) commercial paper

B) money market mutual fund account

C) banker's acceptance

D) U.S. Treasury bill

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

79

Since 2010, the interest rate on passbook accounts and certificates of deposit has

A) been less than the average rate of inflation.

B) closely tracked the average rate of inflation.

C) exceeded the average rate of inflation by 1.5%.

D) fluctuated widely.

A) been less than the average rate of inflation.

B) closely tracked the average rate of inflation.

C) exceeded the average rate of inflation by 1.5%.

D) fluctuated widely.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

80

The amount protected by the Federal Deposit Insurance Corporation in non-interest bearing checking accounts is

A) zero.

B) $100,000.

C) unlimited.

D) $250,000.

A) zero.

B) $100,000.

C) unlimited.

D) $250,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck