Deck 14: Process-Costing Systems

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/166

العب

ملء الشاشة (f)

Deck 14: Process-Costing Systems

1

In a job- cost system all costs for a particular product service or batch of product are recorded on the:

A) job- cost record

B) labor time ticket

C) materials requisition form

D) budgeted overhead rate

A) job- cost record

B) labor time ticket

C) materials requisition form

D) budgeted overhead rate

A

2

Nicholson Company produces plastic cups in a one- department process. The following information is available: The units still in process are 100% complete with respect to direct materials and 60% complete with respect to conversion costs. The equivalent units for conversion costs are:

A) 12,000

B) 36,000

C) 55,200

D) 60,000

A) 12,000

B) 36,000

C) 55,200

D) 60,000

55,200

3

A debit to Direct- Materials Inventory is used to record:

A) cost of goods completed

B) a requisition of direct materials

C) purchase of direct materials

D) a sale of merchandise

A) cost of goods completed

B) a requisition of direct materials

C) purchase of direct materials

D) a sale of merchandise

C

4

A debit to Finished- Goods Inventory is used to record:

A) purchase of direct materials

B) requisition of direct materials

C) cost of goods completed

D) a sale of merchandise

A) purchase of direct materials

B) requisition of direct materials

C) cost of goods completed

D) a sale of merchandise

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 166 في هذه المجموعة.

فتح الحزمة

k this deck

5

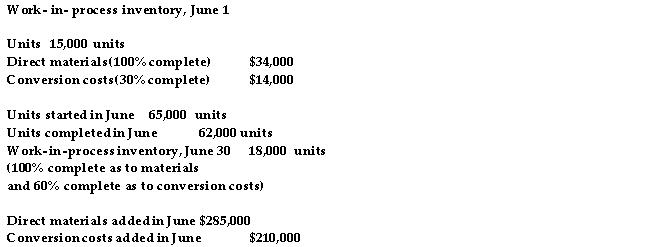

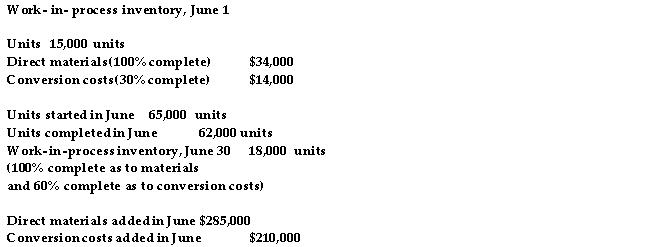

Paste 'em Company manufactures generic notebooks. Material is introduced at the beginning of the process in the Printing department. Conversion costs are applied uniformly throughout the process. The weighted- average method of product costing is used. Data for the Printing department for the month of June follow:  The unit cost for conversion costs is:

The unit cost for conversion costs is:

A) $3.08

B) $2.80

C) $2.88

D) $2.62

The unit cost for conversion costs is:

The unit cost for conversion costs is:A) $3.08

B) $2.80

C) $2.88

D) $2.62

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 166 في هذه المجموعة.

فتح الحزمة

k this deck

6

Hit or Miss Hospital uses a job- cost system for all patients who have surgery. In January, the pre- operating room (PRE- OP) and operating room (OR) had budgeted allocation bases of 2,000 nursing hours and 1,000 nursing hours, respectively. The budgeted nursing overhead charges for each department for the month were $84,000 and $66,000, respectively. The hospital floor for surgery patients had budgeted overhead costs of $600,000 and 7,500 nursing hours for the month. For patient Sid Caesar, actual hours incurred were eight and four hours, respectively, in the

PRE- OP and OR rooms. Sid Caesar was in the hospital for 4 days (96 hours). Other costs related to Sid Caesar were: The hospital uses a budgeted overhead rate for applying overhead to patient stays. The total cost of the stay of patient Sid Caesar is:

A) $1,550

B) $8,280

C) $11,300

D) $21,130

PRE- OP and OR rooms. Sid Caesar was in the hospital for 4 days (96 hours). Other costs related to Sid Caesar were: The hospital uses a budgeted overhead rate for applying overhead to patient stays. The total cost of the stay of patient Sid Caesar is:

A) $1,550

B) $8,280

C) $11,300

D) $21,130

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 166 في هذه المجموعة.

فتح الحزمة

k this deck

7

Savage Clothing had 40,000 shirts in process at May 31 (50% converted). All direct materials are added at the beginning of the production process. During the month, 140,000 shirts were transferred to Finished Goods Inventory. There was no beginning inventory. were started during May.

A) 90,000 shirts

B) 140,000 shirts

C) 100,000 shirts

D) 180,000 shirts

A) 90,000 shirts

B) 140,000 shirts

C) 100,000 shirts

D) 180,000 shirts

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 166 في هذه المجموعة.

فتح الحزمة

k this deck

8

is the system which applies costs to like products that are usually mass produced in continuous fashion through a series of production processes.

A) Job- order costing

B) Process costing

C) Variable costing

D) JIT costing

A) Job- order costing

B) Process costing

C) Variable costing

D) JIT costing

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 166 في هذه المجموعة.

فتح الحزمة

k this deck

9

Tearjerkers Company manufactures generic greeting cards. Material is introduced at the beginning of the process in the Printing department. Conversion costs are applied uniformly throughout the process. The weighted- average method of product costing is used. Data for the Printing department for the month of September follow:

Units 22,500 units

Directmaterials(100\% complete)

Conversion costs ( complete)

Units started inSeptember 127,500 units

Units completed in September 123,000 units

Work-in-process inventory September 30 27,000 units

( complete as to materials

and complete as to conversion costs)

Directmaterialsadded in September

Conversioncosts added in September The total cost of goods transferred out of the Printing department is:

A) $742,500

B) $688,800

C) $714,000

D) $813,972

Units 22,500 units

Directmaterials(100\% complete)

Conversion costs ( complete)

Units started inSeptember 127,500 units

Units completed in September 123,000 units

Work-in-process inventory September 30 27,000 units

( complete as to materials

and complete as to conversion costs)

Directmaterialsadded in September

Conversioncosts added in September The total cost of goods transferred out of the Printing department is:

A) $742,500

B) $688,800

C) $714,000

D) $813,972

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 166 في هذه المجموعة.

فتح الحزمة

k this deck

10

Spiral Company manufactures generic notebooks. Material is introduced at the beginning of the process in the Printing department. Conversion costs are applied uniformly throughout the process. The weighted- average method of product costing is used. Data for the Printing department for the month of June follow: The total cost of the ending work- in- process inventory is:

A) $127,260

B) $111,996

C) $122,175

D) $105,084

A) $127,260

B) $111,996

C) $122,175

D) $105,084

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 166 في هذه المجموعة.

فتح الحزمة

k this deck

11

Speedwagon Company produces calendars in a one- department process. The following information is available: The units still in process are 100% complete with respect to direct materials and 60% complete with respect to conversion costs. The cost of one completed unit is:

A) $5.08

B) $4.07

C) $4.42

D) $4.25

A) $5.08

B) $4.07

C) $4.42

D) $4.25

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 166 في هذه المجموعة.

فتح الحزمة

k this deck

12

Dusty Company manufactures phones in a two- department process: Assembly and Finishing. Information on the Assembly department follows: There was no beginning inventory, and of the 80,000 units started in production, 67,200 were completed and transferred to the Finishing department, while 12,800 units were still in process. These units had all materials added but were only 75% complete as far as conversion costs.The entry to record the units completed and transferred to Finishing includes a:

A) debit to Work- in- Process Inventory, Assembly for $887,040

B) credit to Work- in- Process Inventory, Finishing for $862,848

C) credit to Work- in- Process Inventory, Assembly for $887,040

D) debit to Work- in- Process Inventory, Finishing for $862,848

A) debit to Work- in- Process Inventory, Assembly for $887,040

B) credit to Work- in- Process Inventory, Finishing for $862,848

C) credit to Work- in- Process Inventory, Assembly for $887,040

D) debit to Work- in- Process Inventory, Finishing for $862,848

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 166 في هذه المجموعة.

فتح الحزمة

k this deck

13

Choosing direct labor cost rather than direct labor hours as a cost driver for overhead implies that:

A) direct labor cost data is easier to obtain

B) higher paid employees use proportionally more support cost

C) lower paid employees use proportionally less support cost

D) direct labor hour data is easier to obtain

A) direct labor cost data is easier to obtain

B) higher paid employees use proportionally more support cost

C) lower paid employees use proportionally less support cost

D) direct labor hour data is easier to obtain

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 166 في هذه المجموعة.

فتح الحزمة

k this deck

14

Betty Company uses a job- order- cost system and had the following data available: (as a percent of direct- labor cost) The journal entry to record the sale of all jobs would include a:

A) debit to Finished- Goods Inventory for $292,000

B) credit to Cost of Goods Sold for $292,000

C) credit to WIP Inventory for $256,000

D) credit to Finished- Goods Inventory for $256,000

A) debit to Finished- Goods Inventory for $292,000

B) credit to Cost of Goods Sold for $292,000

C) credit to WIP Inventory for $256,000

D) credit to Finished- Goods Inventory for $256,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 166 في هذه المجموعة.

فتح الحزمة

k this deck

15

Sabbath Company produces plastic cups in a one- department process. The following information is available:

The units still in process are 100% complete with respect to direct materials and 60% complete with respect to conversion costs. The total cost of units completed and transferred is:

A) $456,000

B) $408,000

C) $488,400

D) $90,240

The units still in process are 100% complete with respect to direct materials and 60% complete with respect to conversion costs. The total cost of units completed and transferred is:

A) $456,000

B) $408,000

C) $488,400

D) $90,240

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 166 في هذه المجموعة.

فتح الحزمة

k this deck

16

Identify which one of the following statements regarding process costing is true.

A) The unit cost for inventory purposes is calculated by accumulating the costs of all processing departments and dividing the total costs by the number of units produced.

B) Individual jobs exist in process costing.

C) Process- costing systems are usually simpler than job- order costing systems.

D) The process- costing approach does not distinguish among individual units of product.

A) The unit cost for inventory purposes is calculated by accumulating the costs of all processing departments and dividing the total costs by the number of units produced.

B) Individual jobs exist in process costing.

C) Process- costing systems are usually simpler than job- order costing systems.

D) The process- costing approach does not distinguish among individual units of product.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 166 في هذه المجموعة.

فتح الحزمة

k this deck

17

would be part of the entry to record the sale of goods.

A) A debit to WIP Inventory

B) A credit to Cost of Goods Sold

C) A debit to Sales

D) A credit to Finished- Goods Inventory

A) A debit to WIP Inventory

B) A credit to Cost of Goods Sold

C) A debit to Sales

D) A credit to Finished- Goods Inventory

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 166 في هذه المجموعة.

فتح الحزمة

k this deck

18

is supported by a file of job- cost records for partially completed jobs.

A) The WIP Inventory account

B) The Finished- Goods Inventory account

C) The Direct- Materials Inventory account

D) The Cost of Goods Sold account

A) The WIP Inventory account

B) The Finished- Goods Inventory account

C) The Direct- Materials Inventory account

D) The Cost of Goods Sold account

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 166 في هذه المجموعة.

فتح الحزمة

k this deck

19

would be part of the entry to record the incurrence of direct labor costs.

A) A credit to Cost of Goods Sold

B) A credit to WIP Inventory

C) A credit to Finished- Goods Inventory

D) A credit to Accrued Payroll

A) A credit to Cost of Goods Sold

B) A credit to WIP Inventory

C) A credit to Finished- Goods Inventory

D) A credit to Accrued Payroll

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 166 في هذه المجموعة.

فتح الحزمة

k this deck

20

For external reporting purposes, the costs incurred in the production and distribution phases of the value chain are:

A) period costs

B) product costs

C) period cost and product cost, respectively

D) product cost and period cost, respectively

A) period costs

B) product costs

C) period cost and product cost, respectively

D) product cost and period cost, respectively

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 166 في هذه المجموعة.

فتح الحزمة

k this deck

21

In a production- cost report, the total costs accounted for is equal to the cost of units completed and transferred plus the cost of:

A) ending work- in- process inventory

B) beginning work- in- process inventory

C) the units started and finished

D) the units completed but still on hand

A) ending work- in- process inventory

B) beginning work- in- process inventory

C) the units started and finished

D) the units completed but still on hand

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 166 في هذه المجموعة.

فتح الحزمة

k this deck

22

is better suited for a single physical unit or a few like units.

A) The product- costing system

B) The job- order- costing system

C) The period- costing system

D) The process- costing system

A) The product- costing system

B) The job- order- costing system

C) The period- costing system

D) The process- costing system

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 166 في هذه المجموعة.

فتح الحزمة

k this deck

23

would be part of the entry to record application of factory costs.

A) A debit to Factory Department Overhead Control

B) A debit to Factory Overhead Applied

C) A debit to WIP Inventory

D) A credit to Cost of Goods Sold

A) A debit to Factory Department Overhead Control

B) A debit to Factory Overhead Applied

C) A debit to WIP Inventory

D) A credit to Cost of Goods Sold

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 166 في هذه المجموعة.

فتح الحزمة

k this deck

24

In process costing, the journal entry to record direct labor would include a:

A) credit to Finished Goods

B) debit to Accrued Payroll

C) credit to Factory Overhead

D) debit to Work- in- Process Inventory, Department Name

A) credit to Finished Goods

B) debit to Accrued Payroll

C) credit to Factory Overhead

D) debit to Work- in- Process Inventory, Department Name

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 166 في هذه المجموعة.

فتح الحزمة

k this deck

25

The overhead application rate is lower when an activity- based- costing approach is used than when a traditional approach is used because:

A) more costs are directly traced

B) costs are spread over more value- chain activities

C) nonvalue- added costs are eliminated

D) less costs are incurred

A) more costs are directly traced

B) costs are spread over more value- chain activities

C) nonvalue- added costs are eliminated

D) less costs are incurred

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 166 في هذه المجموعة.

فتح الحزمة

k this deck

26

Booker Company manufactures phones in a two- department process: Assembly and Finishing. Information on the Assembly department follows:

There was no beginning inventory, and of the 80,000 units started in production, 67,200 were completed and transferred to the Finishing department, while 12,800 units were still in process. These units had all materials added but were only 75% complete as far as conversion costs. The equivalent units for materials are:

A) 67,800

B) 12,800

C) 76,800

D) 80,000

There was no beginning inventory, and of the 80,000 units started in production, 67,200 were completed and transferred to the Finishing department, while 12,800 units were still in process. These units had all materials added but were only 75% complete as far as conversion costs. The equivalent units for materials are:

A) 67,800

B) 12,800

C) 76,800

D) 80,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 166 في هذه المجموعة.

فتح الحزمة

k this deck

27

Big Show Clothing had 40,000 shirts in process at May 31 (50% converted). All direct materials are added at the beginning of the production process. During the month 140,000 shirts were transferred to Finished Goods Inventory. There was no beginning inventory. The equivalent units for conversion costs for May are:

A) 160,000 shirts

B) 118,000 shirts

C) 180,000 shirts

D) 140,000 shirts

A) 160,000 shirts

B) 118,000 shirts

C) 180,000 shirts

D) 140,000 shirts

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 166 في هذه المجموعة.

فتح الحزمة

k this deck

28

Tear Company manufactures generic notebooks. Material is introduced at the beginning of the process in the Printing department. Conversion costs are applied uniformly throughout the process. The weighted- average method of product costing is used. Data for the Printing department for the month of June follow: The total cost of goods transferred out of the Printing department is:

A) $420,825

B) $543,000

C) $438,340

D) $495,000

A) $420,825

B) $543,000

C) $438,340

D) $495,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 166 في هذه المجموعة.

فتح الحزمة

k this deck

29

would be part of the entry to record the requisition of direct materials.

A) A credit to Accounts Payable

B) A credit to WIP Inventory

C) A debit to Finished- Goods Inventory

D) A credit to Direct- Materials Inventory

A) A credit to Accounts Payable

B) A credit to WIP Inventory

C) A debit to Finished- Goods Inventory

D) A credit to Direct- Materials Inventory

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 166 في هذه المجموعة.

فتح الحزمة

k this deck

30

Identify which of the following statements regarding job- order costing is true.

A) In job- order costing the measure of production is small, whereas in process costing the measure of production is large.

B) Job- order costing deals with great masses of like units.

C) Job- order costing is an averaging process.

D) Job- order costing is one of the two common systems of product costing.

A) In job- order costing the measure of production is small, whereas in process costing the measure of production is large.

B) Job- order costing deals with great masses of like units.

C) Job- order costing is an averaging process.

D) Job- order costing is one of the two common systems of product costing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 166 في هذه المجموعة.

فتح الحزمة

k this deck

31

Tearjerkers Company manufactures generic greeting cards. Material is introduced at the beginning of the process in the Printing department. Conversion costs are applied uniformly throughout the process. The weighted- average method of product costing is used. Data for the Printing department for the month of September follow:

Units 22,500 units

Directmaterials(100\% complete)

Conversion costs ( complete)

Units started inSeptember 127,500 units

Units completed in September 123,000 units

Work-in-process inventory September 30 27,000 units

( complete as to materials

and complete as to conversion costs)

Directmaterialsadded in September

Conversioncosts added in September The unit cost for conversion is:

A) $2.41

B) $2.73

C) $2.26

D) $2.24

Units 22,500 units

Directmaterials(100\% complete)

Conversion costs ( complete)

Units started inSeptember 127,500 units

Units completed in September 123,000 units

Work-in-process inventory September 30 27,000 units

( complete as to materials

and complete as to conversion costs)

Directmaterialsadded in September

Conversioncosts added in September The unit cost for conversion is:

A) $2.41

B) $2.73

C) $2.26

D) $2.24

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 166 في هذه المجموعة.

فتح الحزمة

k this deck

32

Hulkster Clothing had 40,000 shirts in process at May 31 (50% converted). All materials are added at the beginning of the production process. During the month, 140,000 shirts were transferred to Finished Goods Inventory. There was no beginning inventory. The equivalent units for materials costs for May using the weighted- average method are:

A) 90,000 shirts

B) 140,000 shirts

C) 160,000 shirts

D) 180,000 shirts

A) 90,000 shirts

B) 140,000 shirts

C) 160,000 shirts

D) 180,000 shirts

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 166 في هذه المجموعة.

فتح الحزمة

k this deck

33

Heartbreak Kid Company manufactures potato chips in a two- department process: Cutting and Frying. In the Cutting department 10,000 pounds were started in production and 8,400 pounds were completed and transferred to the Frying department, while 1,600 pounds were still in process. These pounds were only 75% complete as far as conversion costs. The equivalent units for conversion costs are:

A) 8,400

B) 9,600

C) 10,000

D) 1,600

A) 8,400

B) 9,600

C) 10,000

D) 1,600

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 166 في هذه المجموعة.

فتح الحزمة

k this deck

34

Wheels Company uses a backflush- costing system to produce bicycles. Bicycles are scheduled for production only after orders are recorded and products are shipped to customers immediately upon completion. No finished goods inventory is maintained and product costs are applied directly to cost of goods sold. Standard cost for materials and conversion is $150 and $75, respectively. During the current month, Wheels purchased $6,000 of direct materials and incurred $3,300 in conversion cost to produce 40 units. The entry to record the purchase of materials includes a debit to:

A) Finished- Goods Inventory

B) Materials Inventory

C) Work- in- Process Inventory

D) Cost of Goods Sold

A) Finished- Goods Inventory

B) Materials Inventory

C) Work- in- Process Inventory

D) Cost of Goods Sold

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 166 في هذه المجموعة.

فتح الحزمة

k this deck

35

Vicious Company produces plastic cups in a one- department process. The following information is available:

The units still in process are 100% complete with respect to direct materials and 60% complete with respect to conversion costs. The cost of one completed unit is:

A) $8.84

B) $10.18

C) $8.50

D) $8.14

The units still in process are 100% complete with respect to direct materials and 60% complete with respect to conversion costs. The cost of one completed unit is:

A) $8.84

B) $10.18

C) $8.50

D) $8.14

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 166 في هذه المجموعة.

فتح الحزمة

k this deck

36

Rippem Company manufactures generic notebooks. Material is introduced at the beginning of the process in the Printing department. Conversion costs are applied uniformly throughout the process. The weighted- average method of product costing is used. Data for the Printing department for the month of June follow: The equivalent units for materials are:

A) 80,000

B) 77,000

C) 83,000

D) 62,000

A) 80,000

B) 77,000

C) 83,000

D) 62,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 166 في هذه المجموعة.

فتح الحزمة

k this deck

37

Spokes Company uses a backflush- costing system to produce bicycles. Bicycles are scheduled for production only after orders are recorded and products are shipped to customers immediately upon completion. No finished goods inventory is maintained and product costs are applied directly to cost of goods sold. Standard cost for materials and conversion is $150 and $75, respectively. During the current month, Spokes Company purchased $6,000 of direct materials and incurred

$3,300 in conversion cost to produce 40 units. The entry to apply cost to completed goods includes a debit to:

A) Cost of Goods Sold for $9,300

B) Finished- Goods Inventory for $9,300

C) Cost of Goods Sold for $9,000

D) Work- in- Process Inventory for $9,000

$3,300 in conversion cost to produce 40 units. The entry to apply cost to completed goods includes a debit to:

A) Cost of Goods Sold for $9,300

B) Finished- Goods Inventory for $9,300

C) Cost of Goods Sold for $9,000

D) Work- in- Process Inventory for $9,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 166 في هذه المجموعة.

فتح الحزمة

k this deck

38

In process costing, the journal entry to record factory overhead applied would include a:

A) debit to Work- in- Process Inventory, Department Name

B) debit to Factory Overhead

C) credit to Finished Goods

D) credit to Cost of Goods Sold

A) debit to Work- in- Process Inventory, Department Name

B) debit to Factory Overhead

C) credit to Finished Goods

D) credit to Cost of Goods Sold

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 166 في هذه المجموعة.

فتح الحزمة

k this deck

39

Journey Company produces plastic cups in a one- department process. The following information is available:

The units still in process are 100% complete with respect to direct materials and 60% complete with respect to conversion costs. The cost of the ending work- in- process inventory is:

A) $122,100

B) $102,000

C) $61,200

D) $80,400

The units still in process are 100% complete with respect to direct materials and 60% complete with respect to conversion costs. The cost of the ending work- in- process inventory is:

A) $122,100

B) $102,000

C) $61,200

D) $80,400

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 166 في هذه المجموعة.

فتح الحزمة

k this deck

40

A debit to Cost of Goods Sold is used to record:

A) cost of goods completed

B) a sale of merchandise

C) a requisition of direct materials

D) purchase of direct materials

A) cost of goods completed

B) a sale of merchandise

C) a requisition of direct materials

D) purchase of direct materials

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 166 في هذه المجموعة.

فتح الحزمة

k this deck

41

Hallelujah Company uses a job- order- cost system and had the following data available:

(as a percent of direct- labor cost)

The journal entry to record the purchase of direct materials would include a:

A) credit to WIP Inventory for $148,000

B) credit to Direct- Materials Inventory for $148,000

C) debit to WIP Inventory for $148,000

D) debit to Direct- Materials Inventory for $148,000

(as a percent of direct- labor cost)

The journal entry to record the purchase of direct materials would include a:

A) credit to WIP Inventory for $148,000

B) credit to Direct- Materials Inventory for $148,000

C) debit to WIP Inventory for $148,000

D) debit to Direct- Materials Inventory for $148,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 166 في هذه المجموعة.

فتح الحزمة

k this deck

42

Banana Seat Company uses a backflush- costing system to produce bicycles. Bicycles are scheduled for production only after orders are recorded and products are shipped to customers immediately upon completion. No finished goods inventory is maintained and product costs are applied directly to cost of goods sold. Standard cost for materials and conversion is $150 and $75, respectively. During the current month, Banana Seat Company purchased $6,000 of direct materials and incurred $3,300 in conversion cost to produce 40 units. The entry to eliminate the conversion cost variance includes a debit to:

A) Costs of Goods Sold for $300

B) Finished- Goods Inventory for $300

C) Conversion Costs for $300

D) None of these answers is correct.

A) Costs of Goods Sold for $300

B) Finished- Goods Inventory for $300

C) Conversion Costs for $300

D) None of these answers is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 166 في هذه المجموعة.

فتح الحزمة

k this deck

43

Hybrid- costing systems use a combination of:

A) job- order costing and process costing ideas

B) fixed and variable costs

C) value- added and nonvalue- added costs

D) direct and indirect costs

A) job- order costing and process costing ideas

B) fixed and variable costs

C) value- added and nonvalue- added costs

D) direct and indirect costs

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 166 في هذه المجموعة.

فتح الحزمة

k this deck

44

Broderick Company manufactures phones in a two- department process: Assembly and Finishing. Information on the first department, Assembly, follows: There was no beginning inventory, and of the 80,000 units started in production, 67,200 were completed and transferred to the Finishing department, while 12,800 units were still in process. These units had all materials added but were only 75% complete as far as conversion costs. The entry to record the requisition of direct materials includes a debit to:

A) Finished- Goods Inventory for $336,000

B) Work- in- Process Inventory, Assembly for $336,000

C) Work- in- Process Inventory, Finishing for $336,000

D) Direct- Materials Inventory for $336,000

A) Finished- Goods Inventory for $336,000

B) Work- in- Process Inventory, Assembly for $336,000

C) Work- in- Process Inventory, Finishing for $336,000

D) Direct- Materials Inventory for $336,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 166 في هذه المجموعة.

فتح الحزمة

k this deck

45

Costs incurred in a previous department for items that have been received by a subsequent department are called:

A) prior period

B) transferred- in- costs

C) accumulated

D) variable costs

A) prior period

B) transferred- in- costs

C) accumulated

D) variable costs

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 166 في هذه المجموعة.

فتح الحزمة

k this deck

46

Ultimate Warrior Company produces plastic cups in a one- department process. The following information is available: The units still in process are 100% complete with respect to direct materials and 60% complete with respect to conversion costs. The unit cost of conversion costs is:

A) $0.88

B) $4.50

C) $4.14

D) $5.18

A) $0.88

B) $4.50

C) $4.14

D) $5.18

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 166 في هذه المجموعة.

فتح الحزمة

k this deck

47

Brutus Beefcake Company manufactures tape dispensers. Its Assembly department had the following output and costs: These units had all materials added but were only 60% completed for conversion costs. Direct materials costs were $480,000; conversion costs were $240,000. The total cost of units completed and transferred to Finishing is:

A) $630,000

B) $720,000

C) $641,200

D) $690,000

A) $630,000

B) $720,000

C) $641,200

D) $690,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 166 في هذه المجموعة.

فتح الحزمة

k this deck

48

Process costing can be used for:

A) manufacturing activities only

B) nonmanufacturing activities only

C) both manufacturing and nonmanufacturing activities

D) neither manufacturing nor nonmanufacturing activities

A) manufacturing activities only

B) nonmanufacturing activities only

C) both manufacturing and nonmanufacturing activities

D) neither manufacturing nor nonmanufacturing activities

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 166 في هذه المجموعة.

فتح الحزمة

k this deck

49

Golddust Company manufactures phones in a two- department process: Assembly and Finishing. Information on the Assembly department follows: There was no beginning inventory, and of the 80,000 units started in production, 67,200 were completed and transferred to the Finishing department, whole 12,800 units were still in process. These units had all materials added but were only 75% complete as far as conversion costs. The ending balance in Work- in- Process Inventory, Assembly is:

A) $862,848

B) $168,960

C) $140,160

D) $887,040

A) $862,848

B) $168,960

C) $140,160

D) $887,040

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 166 في هذه المجموعة.

فتح الحزمة

k this deck

50

The central product costing problem is how each department computes the cost of:

A) uncompleted goods remaining in the department and completed goods transferred

B) uncompleted goods sold and completed goods sold

C) uncompleted goods transferred and completed goods sold

D) All of these answers are correct.

A) uncompleted goods remaining in the department and completed goods transferred

B) uncompleted goods sold and completed goods sold

C) uncompleted goods transferred and completed goods sold

D) All of these answers are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 166 في هذه المجموعة.

فتح الحزمة

k this deck

51

Muhammad Company produces calendars in a one- department process. The following information is available: The units still in process are 100% complete with respect to direct materials and 60% complete with respect to conversion costs. The total of costs to account for is:

A) $20,700

B) $50,700

C) $30,000

D) $61,050

A) $20,700

B) $50,700

C) $30,000

D) $61,050

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 166 في هذه المجموعة.

فتح الحزمة

k this deck

52

Tearjerkers Company manufactures generic greeting cards. Material is introduced at the beginning of the process in the Printing department. Conversion costs are applied uniformly throughout the process. The weighted- average method of product costing is used. Data for the Printing department for the month of September follow:

Units 22,500 units

Directmaterials(100\% complete)

Conversion costs ( complete)

Units started inSeptember 127,500 units

Units completed in September 123,000 units

Work-in-process inventory September 30 27,000 units

( complete as to materials

and complete as to conversion costs)

Directmaterialsadded in September

Conversioncosts added in September The equivalent units for conversion costs are:

A) 123,000

B) 139,200

C) 132,450

D) 150,000

Units 22,500 units

Directmaterials(100\% complete)

Conversion costs ( complete)

Units started inSeptember 127,500 units

Units completed in September 123,000 units

Work-in-process inventory September 30 27,000 units

( complete as to materials

and complete as to conversion costs)

Directmaterialsadded in September

Conversioncosts added in September The equivalent units for conversion costs are:

A) 123,000

B) 139,200

C) 132,450

D) 150,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 166 في هذه المجموعة.

فتح الحزمة

k this deck

53

is a job- cost source document.

A) A labor time ticket

B) An inventory summary record

C) A budgeted overhead rate

D) A job- cost record

A) A labor time ticket

B) An inventory summary record

C) A budgeted overhead rate

D) A job- cost record

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 166 في هذه المجموعة.

فتح الحزمة

k this deck

54

Jake the Snake Company manufactures tape dispensers. Its Assembly department had the following output and costs: Units started and completed 70,000

Started and in process 10,000

These units had all materials added but were only 60% complete as far as conversion costs. Direct materials costs were $480,000; conversion costs were $240,000. The cost of one completed unit in the Assembly department is:

A) $ 9.16

B) $10.29

C) $ 9.00

D) $ 9.47

Started and in process 10,000

These units had all materials added but were only 60% complete as far as conversion costs. Direct materials costs were $480,000; conversion costs were $240,000. The cost of one completed unit in the Assembly department is:

A) $ 9.16

B) $10.29

C) $ 9.00

D) $ 9.47

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 166 في هذه المجموعة.

فتح الحزمة

k this deck

55

Cuckoo Company produces plastic cups in a one- department process. The following information is available: The units still in process are 100% complete with respect to direct materials and 60% complete with respect to conversion costs. The equivalent units for materials are:

A) 36,000

B) 38,400

C) 60,000

D) 12,000

A) 36,000

B) 38,400

C) 60,000

D) 12,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 166 في هذه المجموعة.

فتح الحزمة

k this deck

56

are the number of completed units that could have been produced from the inputs applied.

A) Physical units

B) Partial units

C) Conversion units

D) Equivalent units

A) Physical units

B) Partial units

C) Conversion units

D) Equivalent units

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 166 في هذه المجموعة.

فتح الحزمة

k this deck

57

Tearjerkers Company manufactures generic greeting cards. Material is introduced at the beginning of the process in the Printing department. Conversion costs are applied uniformly throughout the process. The weighted- average method of product costing is used. Data for the Printing department for the month of September follow:

Units 22,500 units

Directmaterials(100\% complete)

Conversion costs ( complete)

Units started inSeptember 127,500 units

Units completed in September 123,000 units

Work-in-process inventory September 30 27,000 units

( complete as to materials

and complete as to conversion costs)

Directmaterialsadded in September

Conversioncosts added in September The unit cost for materials is:

A) $2.85

B) $3.19

C) $3.48

D) $3.89

Units 22,500 units

Directmaterials(100\% complete)

Conversion costs ( complete)

Units started inSeptember 127,500 units

Units completed in September 123,000 units

Work-in-process inventory September 30 27,000 units

( complete as to materials

and complete as to conversion costs)

Directmaterialsadded in September

Conversioncosts added in September The unit cost for materials is:

A) $2.85

B) $3.19

C) $3.48

D) $3.89

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 166 في هذه المجموعة.

فتح الحزمة

k this deck

58

would be part of the entry to record the cost of goods completed.

A) A debit to Cost of Goods Sold

B) A credit to WIP Inventory

C) A debit to Factory Department Overhead Control

D) A credit to Finished- Goods Inventory

A) A debit to Cost of Goods Sold

B) A credit to WIP Inventory

C) A debit to Factory Department Overhead Control

D) A credit to Finished- Goods Inventory

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 166 في هذه المجموعة.

فتح الحزمة

k this deck

59

Tearjerkers Company manufactures generic greeting cards. Material is introduced at the beginning of the process in the Printing department. Conversion costs are applied uniformly throughout the process. The weighted- average method of product costing is used. Data for the Printing department for the month of September follow:

Units 22,500 units

Directmaterials(100\% complete)

Conversion costs ( complete)

Units started inSeptember 127,500 units

Units completed in September 123,000 units

Work-in-process inventory September 30 27,000 units

( complete as to materials

and complete as to conversion costs)

Directmaterialsadded in September

Conversioncosts added in September The equivalent units for materials are:

A) 150,000

B) 154,500

C) 123,000

D) 145,500

Units 22,500 units

Directmaterials(100\% complete)

Conversion costs ( complete)

Units started inSeptember 127,500 units

Units completed in September 123,000 units

Work-in-process inventory September 30 27,000 units

( complete as to materials

and complete as to conversion costs)

Directmaterialsadded in September

Conversioncosts added in September The equivalent units for materials are:

A) 150,000

B) 154,500

C) 123,000

D) 145,500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 166 في هذه المجموعة.

فتح الحزمة

k this deck

60

Jimbo Company uses a job- order- cost system and had the following data available: (as a percent of direct- labor cost) The journal entry to record the factory overhead costs incurred would include a:

A) credit to Factory Department Overhead Control for $162,500

B) credit to WIP Inventory for $162,500

C) debit to WIP Inventory for $146,000

D) debit to Factory Department Overhead Control for $146,000

A) credit to Factory Department Overhead Control for $162,500

B) credit to WIP Inventory for $162,500

C) debit to WIP Inventory for $146,000

D) debit to Factory Department Overhead Control for $146,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 166 في هذه المجموعة.

فتح الحزمة

k this deck

61

Wolverine Company manufactures tape dispensers. Its Assembly department had the following output and costs: These units had all materials added but were only 60% complete as far as conversion costs. Direct materials costs were $480,000; conversion costs were $240,000. The unit cost of direct materials is:

A) $6.00

B) $1.67

C) $6.86

D) $3.32

A) $6.00

B) $1.67

C) $6.86

D) $3.32

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 166 في هذه المجموعة.

فتح الحزمة

k this deck

62

Matthew Company manufactures phones in a two- department process: Assembly and Finishing. Information on the Assembly department follows: There was no beginning inventory, and of the 80,000 units started in production, 67,200 were completed and transferred to the Finishing department, while 12,800 units were still in process. These units had all materials added but were only 75% complete as far as conversion costs. The unit cost of conversion costs is:

A) $3.00

B) $9.00

C) $6.00

D) $8.64

A) $3.00

B) $9.00

C) $6.00

D) $8.64

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 166 في هذه المجموعة.

فتح الحزمة

k this deck

63

Road Warriors Company manufactures tape dispensers. Its Assembly department had the following output and costs: These units had all materials added but were only 60% completed for conversion costs. Direct materials costs were $480,000; conversion costs were $240,000. The total cost of ending

Work- in- process inventory is:

A) $60,000

B) $90,000

C) $91,600

D) $78,960

Work- in- process inventory is:

A) $60,000

B) $90,000

C) $91,600

D) $78,960

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 166 في هذه المجموعة.

فتح الحزمة

k this deck

64

Mercy Hospital uses a job- cost system for all patients who have surgery. In January, the pre- operating room (PRE- OP) and operating room (OR) had budgeted allocation bases of 2,000 nursing hours and 1,000 nursing hours, respectively. The budgeted nursing overhead charges for each department for the month were $84,000 and $66,000, respectively. The hospital floor for surgery patients had budgeted overhead costs of $600,000 and 7,500 nursing hours for the month. For patient Jesse Johnson, actual hours incurred were eight and four hours, respectively, in the PRE- OP and OR rooms. Jesse Johnson was in the hospital for 4 days (96 hours). Other costs related to Jesse Johnson were:

The hospital uses a budgeted overhead rate for applying overhead to patient stays. The budgeted nursing overhead rate for PRE- OP cost is:

A) $43.25

B) $66.00

C) $80.00

D) $42.00

The hospital uses a budgeted overhead rate for applying overhead to patient stays. The budgeted nursing overhead rate for PRE- OP cost is:

A) $43.25

B) $66.00

C) $80.00

D) $42.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 166 في هذه المجموعة.

فتح الحزمة

k this deck

65

Foreman Company produces calendars in a one- department process. The following information is available: The units still in process are 100% complete with respect to direct materials and 60% complete with respect to conversion costs. The equivalent units for materials are:

A) 15,000

B) 13,800

C) 3,000

D) 12,000

A) 15,000

B) 13,800

C) 3,000

D) 12,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 166 في هذه المجموعة.

فتح الحزمة

k this deck

66

is an example of a product that would not be manufactured using process costing.

A) Glass

B) A building

C) Flour

D) Toothpaste

A) Glass

B) A building

C) Flour

D) Toothpaste

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 166 في هذه المجموعة.

فتح الحزمة

k this deck

67

Identify which one of the following statements regarding backflush costing is false.

A) Backflush costing does not have a Work- in- Process Inventory account.

B) Backflush costing has only one category of costs: conversion costs.

C) Costs are transferred out almost immediately after being initially recorded.

D) Some backflush- costing systems eliminate the Finished- Goods Inventory account and transfer costs directly to Cost of Goods Sold.

A) Backflush costing does not have a Work- in- Process Inventory account.

B) Backflush costing has only one category of costs: conversion costs.

C) Costs are transferred out almost immediately after being initially recorded.

D) Some backflush- costing systems eliminate the Finished- Goods Inventory account and transfer costs directly to Cost of Goods Sold.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 166 في هذه المجموعة.

فتح الحزمة

k this deck

68

is supported by a file of completed job- cost records.

A) The Cost of Goods Sold account

B) The Finished- Goods Inventory account

C) The WIP Inventory account

D) The Direct- Materials Inventory account

A) The Cost of Goods Sold account

B) The Finished- Goods Inventory account

C) The WIP Inventory account

D) The Direct- Materials Inventory account

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 166 في هذه المجموعة.

فتح الحزمة

k this deck

69

A debit to WIP Inventory is used to record:

A) a requisition of direct materials

B) purchase of direct materials

C) a sale of merchandise

D) cost of goods completed

A) a requisition of direct materials

B) purchase of direct materials

C) a sale of merchandise

D) cost of goods completed

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 166 في هذه المجموعة.

فتح الحزمة

k this deck

70

Identify which of the following industries is most likely not to use a job- order costing system.

A) construction

B) printing

C) lumber

D) aircraft

A) construction

B) printing

C) lumber

D) aircraft

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 166 في هذه المجموعة.

فتح الحزمة

k this deck

71

is a product cost.

A) Selling cost

B) Direct material cost

C) Distribution cost

D) Administrative cost

A) Selling cost

B) Direct material cost

C) Distribution cost

D) Administrative cost

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 166 في هذه المجموعة.

فتح الحزمة

k this deck

72

Stone Cold Company manufactures potato chips in a two- department process: Cutting and Frying. In the Cutting department 10,000 pounds were started in production and 8,400 pounds were completed and transferred to the Frying department, while 1,600 pounds were still in process. These pounds were only 75% complete as far as conversion costs. The equivalent units for materials are:

A) 8,400

B) 9,600

C) 1,600

D) 10,000

A) 8,400

B) 9,600

C) 1,600

D) 10,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 166 في هذه المجموعة.

فتح الحزمة

k this deck

73

Cable Company manufactures phones in a two- department process: Assembly and Finishing. Information on the Assembly department follows: There was no beginning inventory, and of the 80,000 units started in production, 67,200 were completed and transferred to the Finishing department, while 12,800 units were still in process. These units had all materials added but were only 75% complete as far as conversion costs. The cost of a finished unit is:

A) $12.84

B) $13.20

C) $15.29

D) $17.20

A) $12.84

B) $13.20

C) $15.29

D) $17.20

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 166 في هذه المجموعة.

فتح الحزمة

k this deck

74

is not a step in process costing.

A) Calculating output in terms of equivalent units

B) Calculating unit costs

C) Summarizing the total costs by job

D) Summarizing the total costs to account for

A) Calculating output in terms of equivalent units

B) Calculating unit costs

C) Summarizing the total costs by job

D) Summarizing the total costs to account for

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 166 في هذه المجموعة.

فتح الحزمة

k this deck

75

Barney Company uses a job- order- cost system and had the following data available:

(as a percent of direct- labor cost) The ending inventory of direct materials is:

A) $108,000

B) $174,000

C) $92,000

D) $82,000

(as a percent of direct- labor cost) The ending inventory of direct materials is:

A) $108,000

B) $174,000

C) $92,000

D) $82,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 166 في هذه المجموعة.

فتح الحزمة

k this deck

76

Bueller Company manufactures phones in a two- department process: Assembly and Finishing. Information on the Assembly department follows: There was no beginning inventory, and of the 80,000 units started in production 67,200 were completed and transferred to the Finishing department, while 12,800 units were still in process. These units had all materials added but were only 75% complete as far as conversion costs. The equivalent units for conversion costs are:

A) 12,800

B) 67,200

C) 80,000

D) 76,800

A) 12,800

B) 67,200

C) 80,000

D) 76,800

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 166 في هذه المجموعة.

فتح الحزمة

k this deck

77

Tearjerkers Company manufactures generic greeting cards. Material is introduced at the beginning of the process in the Printing department. Conversion costs are applied uniformly throughout the process. The weighted- average method of product costing is used. Data for the Printing department for the month of September follow:

Units 22,500 units

Directmaterials(100\% complete)

Conversion costs ( complete)

Units started inSeptember 127,500 units

Units completed in September 123,000 units

Work-in-process inventory September 30 27,000 units

( complete as to materials

and complete as to conversion costs)

Directmaterialsadded in September

Conversioncosts added in September The total cost of the ending work- in- process inventory is:

A) $128,520

B) $151,200

C) $125,172

D) $90,720

Units 22,500 units

Directmaterials(100\% complete)

Conversion costs ( complete)

Units started inSeptember 127,500 units

Units completed in September 123,000 units

Work-in-process inventory September 30 27,000 units

( complete as to materials

and complete as to conversion costs)

Directmaterialsadded in September

Conversioncosts added in September The total cost of the ending work- in- process inventory is:

A) $128,520

B) $151,200

C) $125,172

D) $90,720

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 166 في هذه المجموعة.

فتح الحزمة

k this deck

78

Notes Company manufactures generic notebooks. Material is introduced at the beginning of the process in the Printing department. Conversion costs are applied uniformly throughout the process. The weighted- average method of product costing is used. Data for the Printing department for the month of June follow: The equivalent units for conversion costs are:

A) 62,000

B) 72,800

C) 80,000

D) 68,300

A) 62,000

B) 72,800

C) 80,000

D) 68,300

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 166 في هذه المجموعة.

فتح الحزمة

k this deck

79

In process costing, the journal entry to transfer completed units from Department A to Department B would include a:

A) credit to Direct Materials Inventory

B) debit to Department B

C) debit to Department A

D) credit to Department B

A) credit to Direct Materials Inventory

B) debit to Department B

C) debit to Department A

D) credit to Department B

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 166 في هذه المجموعة.

فتح الحزمة

k this deck

80

Identify which of the following industries is most likely to use a job- order costing system.

A) chemicals

B) meat packing

C) plastics

D) printing

A) chemicals

B) meat packing

C) plastics

D) printing

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 166 في هذه المجموعة.

فتح الحزمة

k this deck