Deck 9: Mechanics of Options Markets

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/4

العب

ملء الشاشة (f)

Deck 9: Mechanics of Options Markets

1

A trader writes two naked put option contracts. The option price is $3, the strike price is $40 and the stock price is $42. What is the initial margin? _ _ _ _ _ _

$1880

2

Which of the following led to BHP issuing more shares? choose three)

A) Some executive stock options were exercised.

B) Some exchange-traded put options were exercised.

C) Some exchange-traded call options were exercised.

D) Some warrants on BHP were exercised.

E) Some of BHP's convertible debt was converted into equity.

A) Some executive stock options were exercised.

B) Some exchange-traded put options were exercised.

C) Some exchange-traded call options were exercised.

D) Some warrants on BHP were exercised.

E) Some of BHP's convertible debt was converted into equity.

Some executive stock options were exercised.

Some warrants on BHP were exercised.

Some of BHP's convertible debt was converted into equity.

Some warrants on BHP were exercised.

Some of BHP's convertible debt was converted into equity.

3

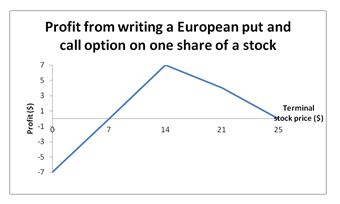

Supposed that the investor also writes a one-year European call option on the same stock with the same strike price as calculated above. The price of the call option is $5. Draw a diagram illustrating how the investor's profit or loss varies with the terminal stock price.

4

Consider an exchange traded put option to sell 100 shares for $20. Give

i) A 5 for 1 stock split a) _ _ _ _ _ _ b) _ _ _ _ _ _

ii) A 25% stock dividend a) _ _ _ _ _ _ b) _ _ _ _ _ _

iii) A $5 cash dividend a) _ _ _ _ _ _ b) _ _ _ _ _ _

i) A 5 for 1 stock split a) _ _ _ _ _ _ b) _ _ _ _ _ _

ii) A 25% stock dividend a) _ _ _ _ _ _ b) _ _ _ _ _ _

iii) A $5 cash dividend a) _ _ _ _ _ _ b) _ _ _ _ _ _

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 4 في هذه المجموعة.

فتح الحزمة

k this deck