Deck 10: Reporting and Analyzing Liabilities

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

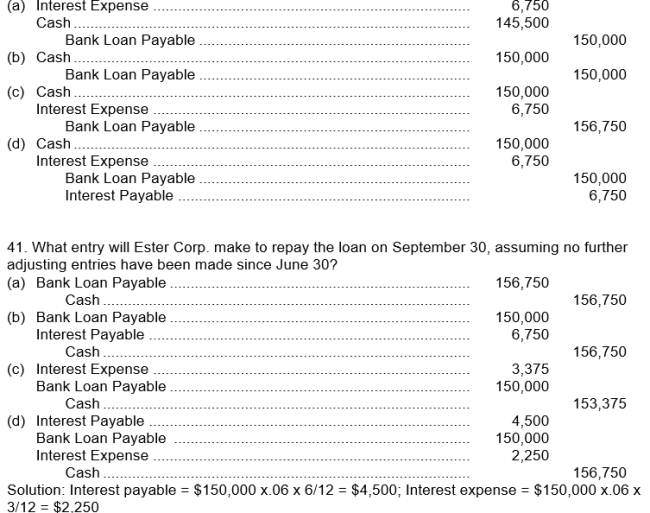

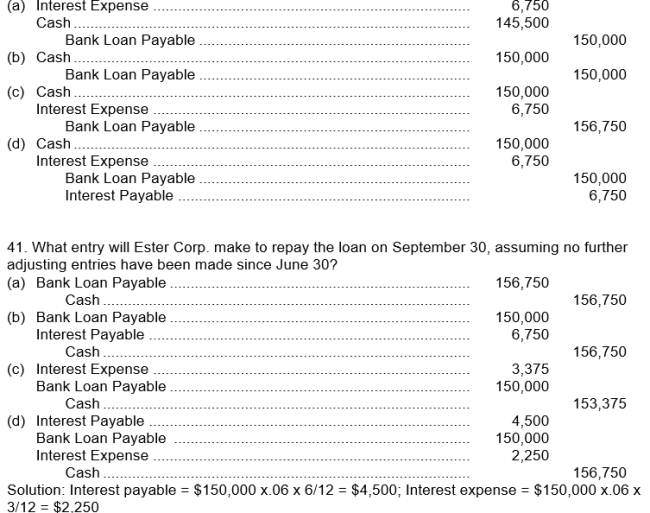

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

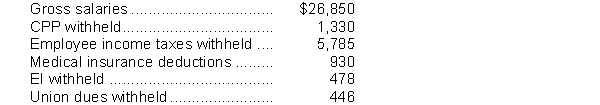

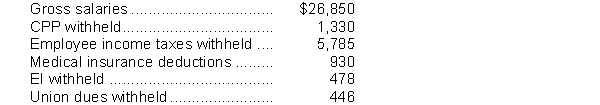

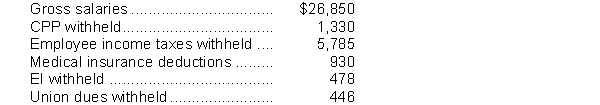

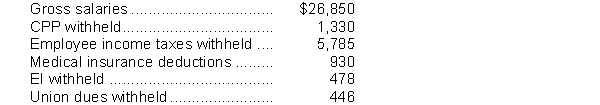

سؤال

سؤال

سؤال

سؤال

سؤال

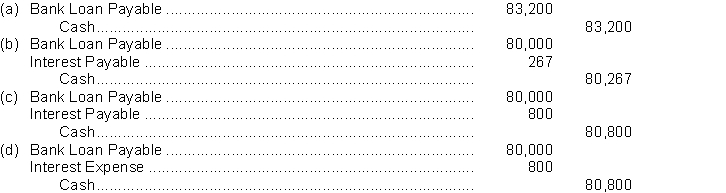

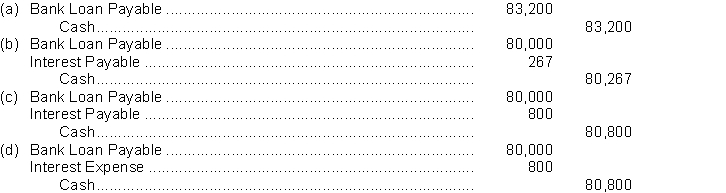

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/98

العب

ملء الشاشة (f)

Deck 10: Reporting and Analyzing Liabilities

1

Unearned revenue is a financial liability.

False

2

If a company's fiscal year is the same as the calendar year used for property tax purposes, there should be no prepaid property tax on its year-end financial statements but there may be a property tax liability.

True

3

Property tax payable is classified as a non-current liability because it is related to property, which is a non-current asset.

False

4

A contingent liability may materialize in the future because of something that happened in the past.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

5

Long-term notes payable can only have floating interest rates.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

6

When a business sells an item and collects Harmonized Sales Tax (HST) on it, a current liability arises.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

7

Provisions are liabilities of uncertain timing or amount, along with some uncertainty as to whether the liability will have to be paid.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

8

Secured notes are often also referred to as mortgages.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

9

Under IFRS, contingent liabilities should be recorded in the accounts if there is a remote possibility that the contingency will actually occur.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

10

If drawing on an operating line of credit results in a negative cash balance, a current liability known as bank indebtedness results.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

11

Amounts available to be drawn in the future from an operating line of credit improve a company's liquidity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

12

Interest expense on a bank loan payable is only recorded at maturity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

13

The debt to total assets ratio measures the percentage of the total assets provided by creditors.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

14

A financial liability means there is a contractual obligation to pay cash in the future.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

15

While short-term notes are generally repayable in full at maturity, most long-term notes are repayable in a series of periodic payments called instalments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

16

The classification of a liability as current or non-current is important because it may affect the evaluation of a company's liquidity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

17

Instalment payments consist of a mix of interest on the unpaid balance of the loan and a reduction of the loan principal.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

18

Account for current liabilities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

19

Unsecured notes are issued against the general credit of the borrower.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

20

Payroll liabilities include the employer's share of CPP contributions and EI premiums.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

21

Under IFRS, which of the following would most likely be classified as a current liability?

A) mortgage payable

B) bonds payable

C) bank indebtedness

D) contingent liability

A) mortgage payable

B) bonds payable

C) bank indebtedness

D) contingent liability

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

22

McMichael Exhibits Inc. received its annual property tax bill for $26,200 in January. It was paid when due on March 31. McMichael Exhibits year end is Dec 31. The Dec 31 balances should be

A) $6,550 for Prepaid Property Tax; $19,650 for Property Tax Expense.

B) $0 for Prepaid Property Tax; $0 for Property Tax Payable.

C) $6,550 for Prepaid Property Tax; $6,550 for Property Tax Payable.

D) $2,183 for Prepaid Property Tax; $24,017 for Property Tax Expense.

A) $6,550 for Prepaid Property Tax; $19,650 for Property Tax Expense.

B) $0 for Prepaid Property Tax; $0 for Property Tax Payable.

C) $6,550 for Prepaid Property Tax; $6,550 for Property Tax Payable.

D) $2,183 for Prepaid Property Tax; $24,017 for Property Tax Expense.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

23

"Off-balance-sheet financing" refers to a situation where liabilities are recorded in the income statement instead of the statement of financial position.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

24

Which of the following statements is false?

A) Notes payable usually require the borrower to pay interest.

B) Notes payable are sometimes used instead of accounts payable.

C) Most notes and bank loans are non-interest bearing.

D) Notes payable reflect a promise to repay a specified amount of money either at a fixed future date or on demand.

A) Notes payable usually require the borrower to pay interest.

B) Notes payable are sometimes used instead of accounts payable.

C) Most notes and bank loans are non-interest bearing.

D) Notes payable reflect a promise to repay a specified amount of money either at a fixed future date or on demand.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

25

The entry to record interest expense on a bank loan payable is a

A) debit to interest expense and credit to note payable.

B) debit to note payable and credit to interest revenue.

C) debit to interest payable and credit to interest revenue.

D) debit to interest expense and credit to interest payable.

A) debit to interest expense and credit to note payable.

B) debit to note payable and credit to interest revenue.

C) debit to interest payable and credit to interest revenue.

D) debit to interest expense and credit to interest payable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

26

The effective-interest method is required for companies reporting under IFRS, but optional for companies using ASPE if other methods do not result in material differences.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

27

Interest (finance) expenses are separately reported in the "other gain and revenues" section of the income statement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

28

Use the following information to answer questions.

Angel Eyes Corporation operates on a calendar year basis. The company is in its first year of operations and received its annual property tax bill on March 31 for $21,000. The bill is due May 1. Even though the company records adjusting entries on a monthly basis, no entries related to property taxes have been recorded.

The March 31 entry to record property tax should be

A) debit property tax expense $5,250 and credit property tax payable $5,250.

B) debit property tax expense $21,000 and credit property tax payable $21,000.

C) debits to prepaid property tax and property tax expense for $15,750 and $5,250, respectively and credits to property tax payable and cash for $15,750 and $5,250, respectively.

D) debits to prepaid property tax and property tax expense for $15,750 and $5,250, respectively and credit to property tax payable for $21,000.

Angel Eyes Corporation operates on a calendar year basis. The company is in its first year of operations and received its annual property tax bill on March 31 for $21,000. The bill is due May 1. Even though the company records adjusting entries on a monthly basis, no entries related to property taxes have been recorded.

The March 31 entry to record property tax should be

A) debit property tax expense $5,250 and credit property tax payable $5,250.

B) debit property tax expense $21,000 and credit property tax payable $21,000.

C) debits to prepaid property tax and property tax expense for $15,750 and $5,250, respectively and credits to property tax payable and cash for $15,750 and $5,250, respectively.

D) debits to prepaid property tax and property tax expense for $15,750 and $5,250, respectively and credit to property tax payable for $21,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

29

All transactions between bondholders and other investors must be recorded by the issuing corporation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

30

Detailed information such as a list showing the amounts of non-current debt that is scheduled to be paid off in each of the next five years should be disclosed in the notes to the financial statements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

31

Amortization of a bond premium decreases interest expense recorded by the issuer.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

32

The face value of a bond is the amount of principal and interest due at the maturity date.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

33

Use the following information to answer questions.

Angel Eyes Corporation operates on a calendar year basis. The company is in its first year of operations and received its annual property tax bill on March 31 for $21,000. The bill is due May 1. Even though the company records adjusting entries on a monthly basis, no entries related to property taxes have been recorded.

Assuming appropriate adjusting entries were completed for the April month end, what entry should be recorded for the payment on May 1?

A) debit prepaid property tax $21,000 and credit cash $21,000

B) debits to prepaid property tax and property tax expense for $14,000 and $7,000, respectively and credit to cash for $21,000

C) debits to prepaid property tax and property tax payable for $14,000 and $7,000, respectively and credit to cash $21,000

D) debit property tax payable $15,750 and credit to cash $15,750.

Angel Eyes Corporation operates on a calendar year basis. The company is in its first year of operations and received its annual property tax bill on March 31 for $21,000. The bill is due May 1. Even though the company records adjusting entries on a monthly basis, no entries related to property taxes have been recorded.

Assuming appropriate adjusting entries were completed for the April month end, what entry should be recorded for the payment on May 1?

A) debit prepaid property tax $21,000 and credit cash $21,000

B) debits to prepaid property tax and property tax expense for $14,000 and $7,000, respectively and credit to cash for $21,000

C) debits to prepaid property tax and property tax payable for $14,000 and $7,000, respectively and credit to cash $21,000

D) debit property tax payable $15,750 and credit to cash $15,750.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

34

Roofer's Inc. had an operating line of credit of $100,000 and overdrew its bank balance to result in a negative cash balance of $33,000 at year-end. This would be reported in the statement of financial position as

A) a current liability of $33,000.

B) a non-current liability of $67,000.

C) a current asset of $67,000.

D) a current asset of $(33,000).

A) a current liability of $33,000.

B) a non-current liability of $67,000.

C) a current asset of $67,000.

D) a current asset of $(33,000).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

35

Which of the following statements is true?

A) If any portion of a non-current liability is to be paid in the next year, the entire debt should be classified as a current liability.

B) "Current maturities of non-current debt" refers to the amount of interest on notes payable that must be paid in the current year.

C) Even though current and non-current debt must be shown separately on the statement of financial position, it is not necessary to prepare a journal entry to recognize this.

D) A non- current liability is an obligation that is expected to be paid within one year.

A) If any portion of a non-current liability is to be paid in the next year, the entire debt should be classified as a current liability.

B) "Current maturities of non-current debt" refers to the amount of interest on notes payable that must be paid in the current year.

C) Even though current and non-current debt must be shown separately on the statement of financial position, it is not necessary to prepare a journal entry to recognize this.

D) A non- current liability is an obligation that is expected to be paid within one year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

36

Interest expense on a note payable, with interest due at maturity, is

A) always equal to zero.

B) accrued over the life of the note.

C) only recorded at the time the note is issued.

D) only recorded at maturity when the note is paid.

A) always equal to zero.

B) accrued over the life of the note.

C) only recorded at the time the note is issued.

D) only recorded at maturity when the note is paid.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

37

Failure to record a liability will probably

A) result in overstated net income.

B) result in overstated total liabilities and shareholders' equity.

C) have no effect on net income.

D) result in overstated total assets.

A) result in overstated net income.

B) result in overstated total liabilities and shareholders' equity.

C) have no effect on net income.

D) result in overstated total assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

38

The terms of an operating line of credit and a notes (loans) payable are disclosed in the notes to the financial statements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

39

If the market interest rate at the date of a bond issue is greater than the coupon interest rate, the bond will be issued at a premium.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

40

If bonds are issued at a discount, the issuing corporation will pay a principal amount that is less than the face amount of the bonds on the maturity date.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

41

A long-term note secured by collateral maybe referred to as a

A) premium.

B) debenture.

C) bond.

D) mortgage.

A) premium.

B) debenture.

C) bond.

D) mortgage.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

42

A customer paid a total of $8,960 for a purchase, including 13% HST (Harmonized Sales Tax). How much was the HST?

A) $8,960

B) $8,000

C) $1,075

D) $1,031

A) $8,960

B) $8,000

C) $1,075

D) $1,031

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

43

Harmonized Sales Tax (HST) collected by a retailer are expenses

A) of the retailer.

B) of the customers.

C) of the government.

D) that are not recognized by the retailer until they are submitted to the government.

A) of the retailer.

B) of the customers.

C) of the government.

D) that are not recognized by the retailer until they are submitted to the government.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

44

Use the following information for questions.

On January 1 of this year, Gertoni Lenders agrees to lend Ester Corp. $150,000. Ester Corp. signs a $150,000, 6%, 9-month loan. Interest is due at maturity.

The entry made by Ester Corp. on January 1 to record the receipt of the loan is

On January 1 of this year, Gertoni Lenders agrees to lend Ester Corp. $150,000. Ester Corp. signs a $150,000, 6%, 9-month loan. Interest is due at maturity.

The entry made by Ester Corp. on January 1 to record the receipt of the loan is

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

45

Under ASPE, a contingent liability is recorded in the accounting records

A) if it is likely that a future event will confirm that a liability has been incurred and the amount of the related loss can be estimated.

B) if the contingency has not already been disclosed in the notes to the financial statements.

C) if the amount can be estimated, but the possibility of occurrence is remote.

D) under no circumstances.

A) if it is likely that a future event will confirm that a liability has been incurred and the amount of the related loss can be estimated.

B) if the contingency has not already been disclosed in the notes to the financial statements.

C) if the amount can be estimated, but the possibility of occurrence is remote.

D) under no circumstances.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

46

Which of the following statements is true?

A) With fixed principal payments on a long-term note payable, the principal portion increases each period.

B) With fixed principal payments on a long-term note payable, the interest portion decreases each period.

C) With fixed principal payments on a long-term note payable, the interest portion does not change each period.

D) With fixed principal payments on a long-term note payable, the interest portion increases each period.

A) With fixed principal payments on a long-term note payable, the principal portion increases each period.

B) With fixed principal payments on a long-term note payable, the interest portion decreases each period.

C) With fixed principal payments on a long-term note payable, the interest portion does not change each period.

D) With fixed principal payments on a long-term note payable, the interest portion increases each period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

47

Which of the following statements is false?

A) With blended principal and interest payments, the equal periodic payments result in the interest portion increasing each period.

B) With blended principal and interest payments, the equal periodic payments result in the principal portion increasing each period.

C) With blended principal and interest payments, the equal periodic payments result in the interest portion decreasing each period.

D) With blended principal and interest payments, the equal periodic payments are constant each period.

A) With blended principal and interest payments, the equal periodic payments result in the interest portion increasing each period.

B) With blended principal and interest payments, the equal periodic payments result in the principal portion increasing each period.

C) With blended principal and interest payments, the equal periodic payments result in the interest portion decreasing each period.

D) With blended principal and interest payments, the equal periodic payments are constant each period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

48

If interest is due at maturity, a $50,000, 4%, 9-month note payable requires an interest payment of

A) $1,500.

B) $222.

C) $167.

D) $2,000.

A) $1,500.

B) $222.

C) $167.

D) $2,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

49

A five-year, 4%, $80,000 note payable is issued on January 1. Terms include fixed annual principal payments of $16,000, plus interest on the outstanding balance. The entry to record the first instalment payment will include a

A) debit to Notes Payable of $16,000.

B) credit to Interest Expense of $3,200.

C) credit to Notes Payable of $12,800.

D) debit to Cash of $16,000.

A) debit to Notes Payable of $16,000.

B) credit to Interest Expense of $3,200.

C) credit to Notes Payable of $12,800.

D) debit to Cash of $16,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

50

Interest rates on notes and loans are usually stated as a(n)

A) monthly rate.

B) daily rate.

C) semi-annual rate.

D) annual rate.

A) monthly rate.

B) daily rate.

C) semi-annual rate.

D) annual rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

51

As blended principal and interest payments are made on a long-term loan,

A) the interest portion increases and the principal portion decreases.

B) the interest and principal portions remain the same.

C) the interest portion decreases and the principal portion increases.

D) both the interest portion and the principal portion decrease.

A) the interest portion increases and the principal portion decreases.

B) the interest and principal portions remain the same.

C) the interest portion decreases and the principal portion increases.

D) both the interest portion and the principal portion decrease.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

52

Use the following information to answer questions.

The following totals for the month of April were taken from the payroll register of Branson Corp.:

The journal entry to record the accrual of the employee's portion of Canada Pension Plan (CPP) would include a

A) debit to CPP Payable of $1,330.

B) debit to CPP Expense of $1,330.

C) credit to Employee Benefits Expense of $1,330.

D) credit to CPP Payable of $1,330.

The following totals for the month of April were taken from the payroll register of Branson Corp.:

The journal entry to record the accrual of the employee's portion of Canada Pension Plan (CPP) would include a

A) debit to CPP Payable of $1,330.

B) debit to CPP Expense of $1,330.

C) credit to Employee Benefits Expense of $1,330.

D) credit to CPP Payable of $1,330.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

53

On January 1, 2018, Junction Limited, a calendar-year company, issued $160,000 of notes payable, of which $65,000 is due on January 1 for each of the next four years. The proper statement of financial position presentation on December 31, 2018, is

A) Current Liabilities, $160,000.

B) Non-current Liabilities, $160,000.

C) Current Liabilities, $65,000; Non-current Liabilities, $95,000.

D) Current Liabilities, $95,000; Non-current Liabilities, $65,000.

A) Current Liabilities, $160,000.

B) Non-current Liabilities, $160,000.

C) Current Liabilities, $65,000; Non-current Liabilities, $95,000.

D) Current Liabilities, $95,000; Non-current Liabilities, $65,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

54

Under IFRS, if a company can determine a reasonable estimate of an expected loss from a lawsuit and it is probable it will lose the suit, it should

A) disclose the basic facts regarding the suit in the notes to its financial statements.

B) accrue the loss.

C) neither disclose in the notes nor accrue the loss.

D) pay the amount estimated.

A) disclose the basic facts regarding the suit in the notes to its financial statements.

B) accrue the loss.

C) neither disclose in the notes nor accrue the loss.

D) pay the amount estimated.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

55

Use the following information for questions.

On October 1, 2018, Mekhi's Golf Service Limited borrows $80,000 from Rigor Bank by signing a 3-month, $80,000, 4% bank loan. Interest is due the first of each month.

What adjusting entry is required at December 31, 2018?

On October 1, 2018, Mekhi's Golf Service Limited borrows $80,000 from Rigor Bank by signing a 3-month, $80,000, 4% bank loan. Interest is due the first of each month.

What adjusting entry is required at December 31, 2018?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

56

One example of a liability that is not a financial liability isa) notes payable.b) unearned revenue.c) bonds payable.d) financial lease.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

57

Use the following information for questions.

On October 1, 2018, Mekhi's Golf Service Limited borrows $80,000 from Rigor Bank by signing a 3-month, $80,000, 4% bank loan. Interest is due the first of each month.

The entry by Mekhi's Golf Service to record payment of the loan and accrued interest on January 1, 2019 is

On October 1, 2018, Mekhi's Golf Service Limited borrows $80,000 from Rigor Bank by signing a 3-month, $80,000, 4% bank loan. Interest is due the first of each month.

The entry by Mekhi's Golf Service to record payment of the loan and accrued interest on January 1, 2019 is

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

58

When a long-term note payable with a fixed interest rate has fixed principal payments, it means that

A) the periodic payment amount is fixed.

B) the periodic payment increases over time.

C) the periodic payment decreases over time.

D) no conclusion can be made on the periodic payment.

A) the periodic payment amount is fixed.

B) the periodic payment increases over time.

C) the periodic payment decreases over time.

D) no conclusion can be made on the periodic payment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

59

Use the following information to answer questions.

The following totals for the month of April were taken from the payroll register of Branson Corp.:

The journal entry to record payment of the net payroll would include a

A) debit to Salaries Payable for $17,881.

B) debit to Salaries Payable for $15,300.

C) debit to Salaries Payable for $21,065.

D) credit to Cash for $26,850.

The following totals for the month of April were taken from the payroll register of Branson Corp.:

The journal entry to record payment of the net payroll would include a

A) debit to Salaries Payable for $17,881.

B) debit to Salaries Payable for $15,300.

C) debit to Salaries Payable for $21,065.

D) credit to Cash for $26,850.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

60

A financial liability is a

A) contractual obligation to receive cash in the future.

B) contractual obligation to pay cash in the future.

C) contractual obligation to issue common shares in the future.

D) contractual obligation to issue a mortgage payable.

A) contractual obligation to receive cash in the future.

B) contractual obligation to pay cash in the future.

C) contractual obligation to issue common shares in the future.

D) contractual obligation to issue a mortgage payable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

61

On March 1, Brutto Corp. issues a 3 year, 5%, $60,000 note payable. The terms of the note include monthly blended principal and interest payments of $1,799. The entry to record the first instalment payment will include a

A) debit to Notes Payable of $1,799.

B) debit to Cash of $1,799.

C) credit to Interest Expense of $3,000.

D) debit to Interest Expense of $250.

A) debit to Notes Payable of $1,799.

B) debit to Cash of $1,799.

C) credit to Interest Expense of $3,000.

D) debit to Interest Expense of $250.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

62

Liquidity ratios measure a company's

A) operating cycle.

B) revenue-producing ability.

C) short-term debt-paying ability.

D) long-range solvency.

A) operating cycle.

B) revenue-producing ability.

C) short-term debt-paying ability.

D) long-range solvency.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

63

A bond with a face value of $100,000 and a quoted price of 102.25 would have a selling price of

A) $ 97,800.

B) $100,000.

C) $102,250.

D) $122,250.

A) $ 97,800.

B) $100,000.

C) $102,250.

D) $122,250.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

64

Which of the following statements is true?

A) Current liabilities are generally presented on the statement of financial position in order of liquidity, but IFRS allows presentation in reverse order of liquidity as well.

B) Current liabilities are listed in order of descending dollar value.

C) All companies are prohibited to report current liabilities in reverse order of liquidity.

D) Current liabilities are listed in order of ascending dollar value.

A) Current liabilities are generally presented on the statement of financial position in order of liquidity, but IFRS allows presentation in reverse order of liquidity as well.

B) Current liabilities are listed in order of descending dollar value.

C) All companies are prohibited to report current liabilities in reverse order of liquidity.

D) Current liabilities are listed in order of ascending dollar value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

65

Last year, Hadley Bakery's income statement reported the following: net income, $325,600; interest expense, $81,400; and income tax expense, $113,960. The company's times interest earned ratio is

A) 5.0 times.

B) 6.4 times.

C) 4.0 times.

D) 4.6 times.

A) 5.0 times.

B) 6.4 times.

C) 4.0 times.

D) 4.6 times.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

66

On March 2, Conroy and Conrad Inc. obtained a loan for $120,000 for 5 years at 7%. Payments are $2,000. What type of loan is this considered to be?a) fixed principal paymentsb) blended principal paymentsc) floating principal paymentsd) prime principal payments

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

67

Long-term notes may havea) fixed rates of interest only.b) floating interest rates only.c) no interest rates.d) fixed or floating interest rates.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

68

A measure of a company's solvency is the

A) inventory turnover ratio.

B) current ratio.

C) times interest earned ratio.

D) asset turnover ratio.

A) inventory turnover ratio.

B) current ratio.

C) times interest earned ratio.

D) asset turnover ratio.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

69

With fixed principal payments, the interest ___ each period as the principal ___.a) decreases, decreasesb) increases, increasesc) increases, decreasesd) decreases, increases

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

70

Blended principal and interest payments are repayable ina) equal periodic amounts plus interest.b) varying periodic amounts plus interest.c) equal periodic amounts including interest.d) varying periodic amounts including interest.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

71

If a bond has a face value of $10,000, a 6% coupon interest rate and a 4% market interest rate, then the semi-annual interest payment will be

A) $600.

B) $400.

C) $200.

D) $300.

A) $600.

B) $400.

C) $200.

D) $300.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

72

The relationship between current assets and current liabilities is

A) useful in determining profitability.

B) useful in evaluating a company's liquidity.

C) useful in evaluating a company's solvency.

D) useful in determining the amount of a company's non-current debt.

A) useful in determining profitability.

B) useful in evaluating a company's liquidity.

C) useful in evaluating a company's solvency.

D) useful in determining the amount of a company's non-current debt.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

73

Bonds that are subject to retirement at a stated dollar amount prior to maturity at the option of the issuer are called

A) early retirement bonds.

B) redeemable bonds.

C) options.

D) debentures.

A) early retirement bonds.

B) redeemable bonds.

C) options.

D) debentures.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

74

On March 1, Brutto Corp. issues a 3 year 5%, $60,000 note payable. The terms of the note include monthly blended principal and interest payments of $1,799. The entry to record the second instalment payment will include a

A) debit to Notes Payable of $1,555.

B) debit to Cash of $1,799.

C) debit to Interest Expense of $250.

D) credit to Interest Expense of $244.

A) debit to Notes Payable of $1,555.

B) debit to Cash of $1,799.

C) debit to Interest Expense of $250.

D) credit to Interest Expense of $244.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

75

Instalments can be paida) monthly.b) quarterly.c) semi-annually.d) all of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

76

Which of the following statements is true?

A) Liquidity ratios measure a company's long-term ability to pay debt.

B) Solvency ratios measure a company's ability to repay current debt.

C) A high liquidity ratio generally indicates that a company has a greater ability to meet its current obligations.

D) Solvency ratios measure a company's ability to survive on a short-term basis.

A) Liquidity ratios measure a company's long-term ability to pay debt.

B) Solvency ratios measure a company's ability to repay current debt.

C) A high liquidity ratio generally indicates that a company has a greater ability to meet its current obligations.

D) Solvency ratios measure a company's ability to survive on a short-term basis.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

77

Which of the following statements is true?

A) The carrying amount of bonds issued at a discount will initially be higher than the face value.

B) The carrying amount of a bond is its face value less any unamortized premium or plus any unamortized discount.

C) The carrying amount of a bond is its face value plus any unamortized premium or less any unamortized discount.

D) The carrying amount of bonds issued at a premium will initially be lower than the face value.

A) The carrying amount of bonds issued at a discount will initially be higher than the face value.

B) The carrying amount of a bond is its face value less any unamortized premium or plus any unamortized discount.

C) The carrying amount of a bond is its face value plus any unamortized premium or less any unamortized discount.

D) The carrying amount of bonds issued at a premium will initially be lower than the face value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

78

With fixed principal loans, principal payments and interest are repayable ina) equal periodic amounts plus interest.b) varying periodic amounts plus interest.c) equal periodic amounts including interest.d) varying periodic amounts including interest.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

79

Off-balance sheet financing usually is found in connection with

A) finance leases.

B) operating leases.

C) both finance and operating leases.

D) neither finance nor operating leases.

A) finance leases.

B) operating leases.

C) both finance and operating leases.

D) neither finance nor operating leases.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

80

The times interest earned ratio is calculated by dividing

A) net income by interest expense.

B) net income plus income tax expense by interest expense.

C) net income plus interest expense by interest expense.

D) net income plus interest expense plus income tax expense by interest expense.

A) net income by interest expense.

B) net income plus income tax expense by interest expense.

C) net income plus interest expense by interest expense.

D) net income plus interest expense plus income tax expense by interest expense.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck