Deck 6: Reporting and Analyzing Inventory

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

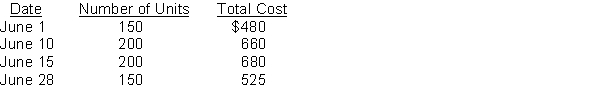

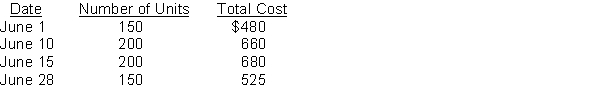

سؤال

سؤال

سؤال

سؤال

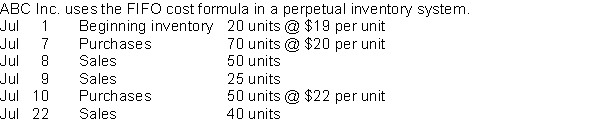

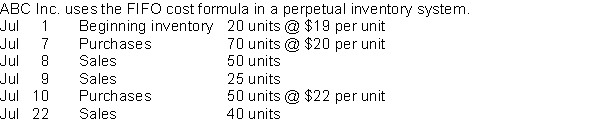

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/98

العب

ملء الشاشة (f)

Deck 6: Reporting and Analyzing Inventory

1

A company may use more than one inventory cost formula if it has different types of inventory.

False

2

Once goods leave the premises of the seller, they should never be added to the seller's physical inventory count.

False

3

The first-in, first-out (FIFO) inventory cost formula results in an ending inventory valued at the most recent cost.

True

4

A change in the method of cost formula for inventory must be disclosed in the financial statements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

5

A system of internal control is not needed when a company regularly takes a physical inventory.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

6

When using the perpetual system, the average cost formula relies on a simple average calculation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

7

All three methods of inventory cost formula will produce the same cumulative cost of goods sold over the life cycle of the business.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

8

Approximating the physical flow of inventory is not important when selecting an inventory cost formula.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

9

The cost formula a company chooses should correspond as closely as possible to the actual physical flow of goods.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

10

If prices never changed, there would be no need for alternative inventory cost formulas.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

11

Inventory cost formulas such as FIFO and average cost, deal more with the flow of costs than with the flow of goods.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

12

Apply the cost formulas using specific identification, FIFO, and average cost under a perpetual inventory system.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

13

The inventory cost formula that best matches cost and revenues is FIFO.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

14

The specific identification formula is desirable when a company sells a large number of low-unit-cost items.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

15

If a company has no beginning inventory and the unit cost of inventory items does not change during the year, the unit cost assigned to the cost of goods sold will be the same under FIFO and average cost formulas.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

16

Describe the steps in determining inventory quantities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

17

The FIFO inventory cost formula agrees closely to the actual physical movement of goods in most businesses.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

18

Explain the effects on the financial statements of choosing each of the inventory cost formulas.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

19

Consigned goods are held for sale by one party, although ownership of the goods is retained by another party.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

20

In order to remove the cost of items sold from inventory, a unit cost must be determined.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

21

A low inventory turnover ratio could mean a company is at risk of experiencing inventory shortages.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

22

A company just starting a business purchased three inventory items at the following prices: March 2, $150; March 7, $160; and March 15, $180. If the company sold one unit for $230 on March 10 and one unit for $250 on March 20 and uses the average cost formula in a perpetual inventory system, what is the cost of ending inventory?

A) $163.34

B) $167.50

C) $180.00

D) $250.00

A) $163.34

B) $167.50

C) $180.00

D) $250.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

23

Inventory cost methods make assumptions about the flow of

A) costs.

B) goods.

C) resale prices.

D) fair values.

A) costs.

B) goods.

C) resale prices.

D) fair values.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

24

When the value of inventory is lower than its cost, the inventory is written down to its net realizable value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

25

An inventory writedown from cost to net realizable value should not be made in the period in which the price decline occurs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

26

In the average cost formula used in a periodic inventory system, the same weighted average cost per unit is used to calculate all of the goods sold during the period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

27

The lower of cost and net realizable value should be applied to the total inventory, rather than to individual inventory items.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

28

Goods in transit shipped

A) FOB shipping point should be included in the buyer's ending inventory.

B) FOB destination should not be excluded from the buyer's ending inventory.

C) FOB shipping point should not be included in the buyer's ending inventory.

D) FOB destination should not be included in the seller's ending inventory.

A) FOB shipping point should be included in the buyer's ending inventory.

B) FOB destination should not be excluded from the buyer's ending inventory.

C) FOB shipping point should not be included in the buyer's ending inventory.

D) FOB destination should not be included in the seller's ending inventory.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

29

A company just starting in business purchased three merchandise inventory items at the following prices. March 2, $150; March 7, $160; and March 15, $180. If the company sold two units for $250 each on March 10 and March 20, and used the FIFO cost formula in a perpetual inventory system, the gross profit for March would be

A) $200.

B) $190.

C) $180.

D) $150.

A) $200.

B) $190.

C) $180.

D) $150.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

30

If goods in transit are shipped FOB destination,

A) the seller has legal title to the goods until they are delivered.

B) the buyer has legal title to the goods during transit.

C) the transportation company has legal title to the goods while the goods are in transit.

D) no one has legal title to the goods until they are delivered.

A) the seller has legal title to the goods until they are delivered.

B) the buyer has legal title to the goods during transit.

C) the transportation company has legal title to the goods while the goods are in transit.

D) no one has legal title to the goods until they are delivered.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

31

If net realizable value of the inventory is lower than its cost, the total assets on the statement of financial position and net income on the income statement will be reduced.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

32

The factor that determines whether or not goods should be included in a physical count of inventory is

A) physical possession.

B) ownership.

C) management's judgement.

D) whether or not the purchase price has been paid.

A) physical possession.

B) ownership.

C) management's judgement.

D) whether or not the purchase price has been paid.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

33

Goods held on consignment are

A) never owned by the consignee.

B) included in the consignee's ending inventory.

C) kept for sale on the premises of the consignor.

D) not included in anyone's ending inventory.

A) never owned by the consignee.

B) included in the consignee's ending inventory.

C) kept for sale on the premises of the consignor.

D) not included in anyone's ending inventory.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

34

Inventory that originally cost $100 had been written down to its net realizable value (NRV) of $75. Subsequently, the NRV of the inventory recovered to equal its cost of $100. In this situation, the amount of the $25 ($100 - $75) prior writedown in value should be reversed.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

35

Westcom Corporation's goods in transit at December 31 include (1) sales made FOB destination, (2) sales made FOB shipping point, (3) purchases made FOB destination, and (4) purchases made FOB shipping point. Which items should be included in Westcom's inventory at December 31?

A) (2) and (3)

B) (1) and (4)

C) (1) and (3)

D) (2) and (4)

A) (2) and (3)

B) (1) and (4)

C) (1) and (3)

D) (2) and (4)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

36

To accurately determine inventory quantities, a company must

A) use the perpetual inventory system.

B) employ an independent company to conduct inventory counts.

C) rely on the warehouse records.

D) take a physical inventory.

A) use the perpetual inventory system.

B) employ an independent company to conduct inventory counts.

C) rely on the warehouse records.

D) take a physical inventory.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

37

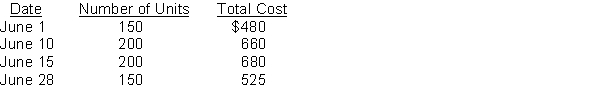

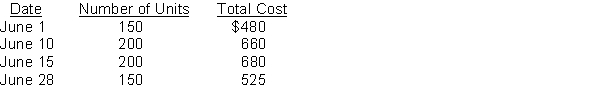

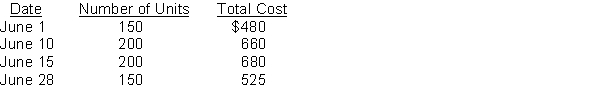

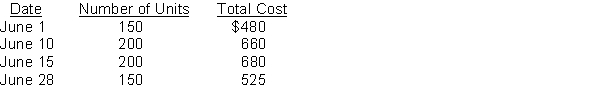

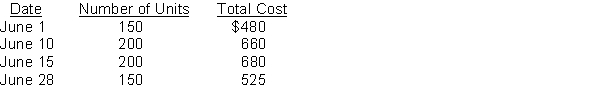

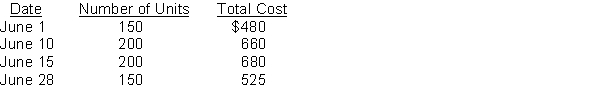

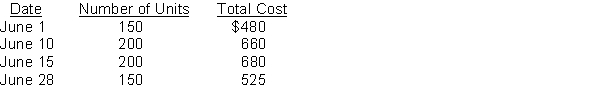

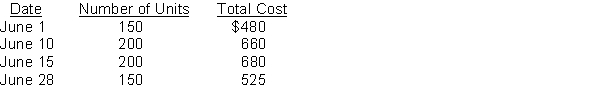

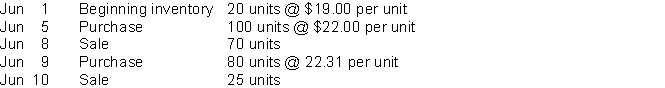

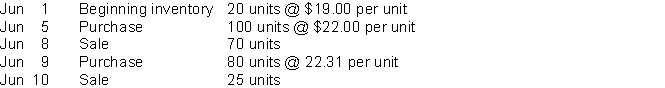

Use the following information for questions.

A company just starting its business made the following four inventory purchases in June: On June 25, the company made its first sale when a local customer purchased 500 units for $3,500. The company uses a perpetual inventory system.

On June 25, the company made its first sale when a local customer purchased 500 units for $3,500. The company uses a perpetual inventory system.

Using the FIFO cost formula, the cost of the ending inventory on June 30 is

A) $645.

B) $695.

C) $1,650.

D) $1,700.

A company just starting its business made the following four inventory purchases in June:

On June 25, the company made its first sale when a local customer purchased 500 units for $3,500. The company uses a perpetual inventory system.

On June 25, the company made its first sale when a local customer purchased 500 units for $3,500. The company uses a perpetual inventory system.Using the FIFO cost formula, the cost of the ending inventory on June 30 is

A) $645.

B) $695.

C) $1,650.

D) $1,700.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

38

In periods of falling prices

A) FIFO will result in a higher ending inventory valuation than the average cost formula.

B) FIFO will result in a higher cost of goods sold than the average cost formula.

C) the average cost formula will result in a higher cost of goods sold than the FIFO cost formula.

D) the average cost formula will result in a lower ending inventory valuation than the FIFO cost formula.

A) FIFO will result in a higher ending inventory valuation than the average cost formula.

B) FIFO will result in a higher cost of goods sold than the average cost formula.

C) the average cost formula will result in a higher cost of goods sold than the FIFO cost formula.

D) the average cost formula will result in a lower ending inventory valuation than the FIFO cost formula.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

39

A high inventory turnover ratio indicates that minimal funds are tied up in inventory.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

40

The results under FIFO in a perpetual inventory system are the same as in a periodic inventory system.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

41

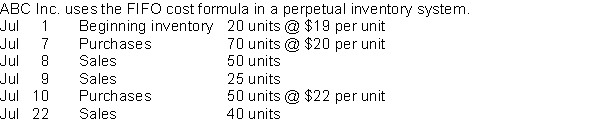

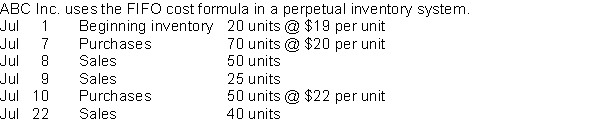

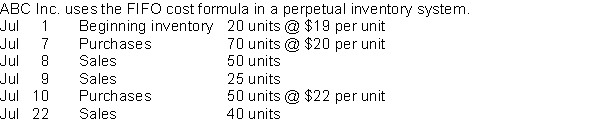

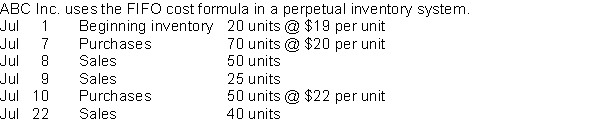

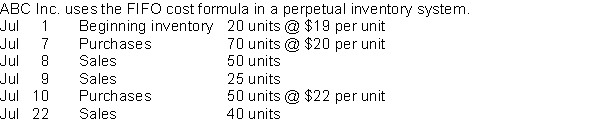

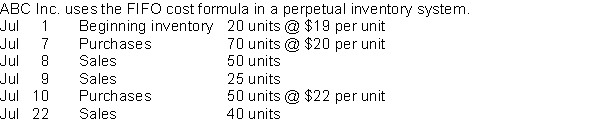

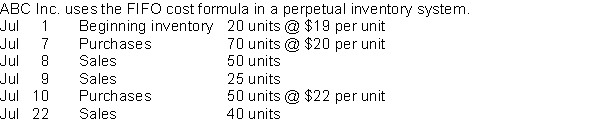

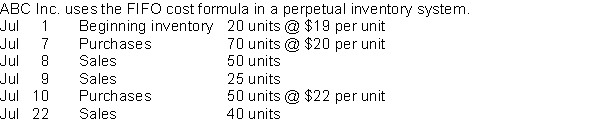

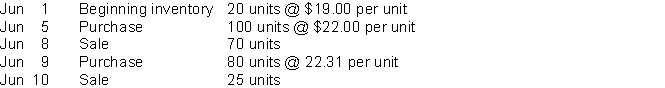

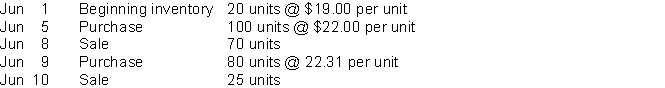

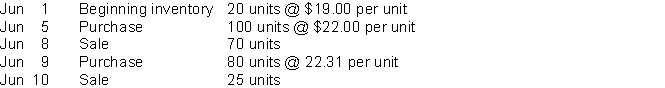

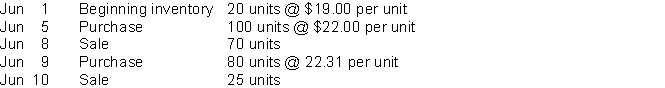

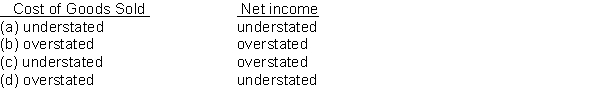

Use the following information for the month of July for questions.

The cost of goods sold for the July 8 sale was

A) $950.

B) $980.

C) $989.

D) $1,000.

The cost of goods sold for the July 8 sale was

A) $950.

B) $980.

C) $989.

D) $1,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

42

Of the following businesses, which one would not be likely to use the specific identification formula for inventory costing?

A) piano store

B) car dealership

C) antique shop

D) grocery store

A) piano store

B) car dealership

C) antique shop

D) grocery store

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

43

Which of the following statements regarding inventories is correct?

A) FIFO assumes that the costs of the earliest goods acquired are the last to be sold.

B) It is generally good business management to sell the most recently acquired goods first.

C) Under FIFO, the ending inventory is based on the latest units purchased.

D) FIFO seldom coincides with the actual physical flow of inventory.

A) FIFO assumes that the costs of the earliest goods acquired are the last to be sold.

B) It is generally good business management to sell the most recently acquired goods first.

C) Under FIFO, the ending inventory is based on the latest units purchased.

D) FIFO seldom coincides with the actual physical flow of inventory.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

44

Use the following information for the month of July for questions.

The cost of goods sold for the July 9 sale was

A) $475.

B) $480.

C) $495.

D) $500.

The cost of goods sold for the July 9 sale was

A) $475.

B) $480.

C) $495.

D) $500.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

45

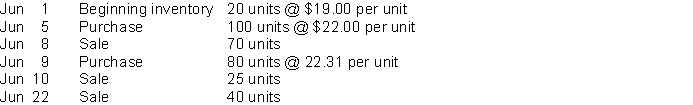

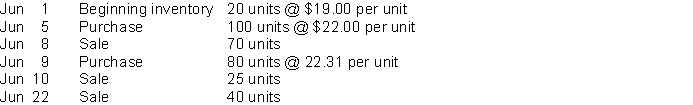

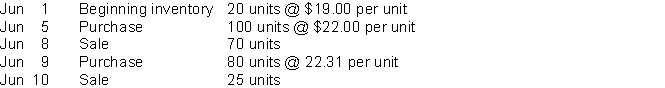

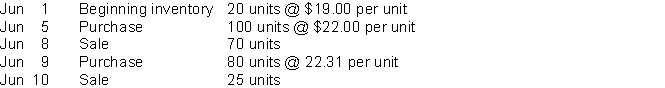

XYZ Inc. uses the average cost formula in a perpetual inventory system.(Use unrounded numbers in your calculations but round to the nearest cent for presentation purposes in your answer.)  If XYZ Inc. was using the FIFO cost formula instead of average, gross profit from the June 8 sale would be

If XYZ Inc. was using the FIFO cost formula instead of average, gross profit from the June 8 sale would be

A) higher.

B) lower.

C) the same.

D) cannot be determined.

If XYZ Inc. was using the FIFO cost formula instead of average, gross profit from the June 8 sale would be

If XYZ Inc. was using the FIFO cost formula instead of average, gross profit from the June 8 sale would beA) higher.

B) lower.

C) the same.

D) cannot be determined.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

46

Management may be able to manipulate net income using

A) the FIFO cost formula.

B) specific identification.

C) the average cost formula.

D) need more information to answer.

A) the FIFO cost formula.

B) specific identification.

C) the average cost formula.

D) need more information to answer.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

47

Use the following information for the month of July for questions.

Total cost of goods sold for the month of July is

A) $2,330.

B) $2,530.

C) $2,830.

D) $2,880.

Total cost of goods sold for the month of July is

A) $2,330.

B) $2,530.

C) $2,830.

D) $2,880.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

48

Use the following information for the month of June for questions.

XYZ Inc. uses the average cost formula in a perpetual inventory system.

(Use unrounded numbers in your calculations but round to the nearest cent for presentation purposes in your answer.) Jun 22 Sale 40 units

Jun 22 Sale 40 units

XYZ Inc. has an ending inventory on June 30 of

A) $1,370.00.

B) $1,418.56.

C) $1,429.90.

D) $1,450.15.

XYZ Inc. uses the average cost formula in a perpetual inventory system.

(Use unrounded numbers in your calculations but round to the nearest cent for presentation purposes in your answer.)

Jun 22 Sale 40 units

Jun 22 Sale 40 unitsXYZ Inc. has an ending inventory on June 30 of

A) $1,370.00.

B) $1,418.56.

C) $1,429.90.

D) $1,450.15.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

49

Use the following information for questions.

A company just starting its business made the following four inventory purchases in June: On June 25, the company made its first sale when a local customer purchased 500 units for $3,500. The company uses a perpetual inventory system.

On June 25, the company made its first sale when a local customer purchased 500 units for $3,500. The company uses a perpetual inventory system.

Using the average cost formula, the cost of the ending inventory on June 30 is

A) $670.00.

B) $690.50.

C) $1,645.55.

D) $1,675.00.

A company just starting its business made the following four inventory purchases in June:

On June 25, the company made its first sale when a local customer purchased 500 units for $3,500. The company uses a perpetual inventory system.

On June 25, the company made its first sale when a local customer purchased 500 units for $3,500. The company uses a perpetual inventory system.Using the average cost formula, the cost of the ending inventory on June 30 is

A) $670.00.

B) $690.50.

C) $1,645.55.

D) $1,675.00.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

50

Use the following information for the month of July for questions.

Ending inventory at July 31 is

A) $2,330.

B) $720.

C) $680.

D) $550.

Ending inventory at July 31 is

A) $2,330.

B) $720.

C) $680.

D) $550.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

51

Use the following information for questions.

A company just starting its business made the following four inventory purchases in June: On June 25, the company made its first sale when a local customer purchased 500 units for $3,500. The company uses a perpetual inventory system.

On June 25, the company made its first sale when a local customer purchased 500 units for $3,500. The company uses a perpetual inventory system.

The inventory cost formula that results in the highest gross profit for June is

A) FIFO.

B) average.

C) Gross profit is the same under both cost formulas.

D) not determinable.

A company just starting its business made the following four inventory purchases in June:

On June 25, the company made its first sale when a local customer purchased 500 units for $3,500. The company uses a perpetual inventory system.

On June 25, the company made its first sale when a local customer purchased 500 units for $3,500. The company uses a perpetual inventory system.The inventory cost formula that results in the highest gross profit for June is

A) FIFO.

B) average.

C) Gross profit is the same under both cost formulas.

D) not determinable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

52

Use the following information for the month of July for questions.

If ABC Inc. used the average cost formula instead of FIFO, gross profit from the July 8 sale would be

A) higher.

B) lower.

C) the same.

D) cannot be determined.

If ABC Inc. used the average cost formula instead of FIFO, gross profit from the July 8 sale would be

A) higher.

B) lower.

C) the same.

D) cannot be determined.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

53

Use the following information for questions.

A company just starting its business made the following four inventory purchases in June: On June 25, the company made its first sale when a local customer purchased 500 units for $3,500. The company uses a perpetual inventory system.

On June 25, the company made its first sale when a local customer purchased 500 units for $3,500. The company uses a perpetual inventory system.

Mandy Corp. purchased inventory as follows:March 3 500 units at $18March 4 300 units at $20March 7 200 units at $22On March 5, Mandy sold 600 units for $18 each. The average unit cost to be used for the cost of goods sold on March 5, in a perpetual inventory system, is

A) $18.80.

B) $19.40.

C) $25.00.

D) $16.67.

A company just starting its business made the following four inventory purchases in June:

On June 25, the company made its first sale when a local customer purchased 500 units for $3,500. The company uses a perpetual inventory system.

On June 25, the company made its first sale when a local customer purchased 500 units for $3,500. The company uses a perpetual inventory system.Mandy Corp. purchased inventory as follows:March 3 500 units at $18March 4 300 units at $20March 7 200 units at $22On March 5, Mandy sold 600 units for $18 each. The average unit cost to be used for the cost of goods sold on March 5, in a perpetual inventory system, is

A) $18.80.

B) $19.40.

C) $25.00.

D) $16.67.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

54

Use the following information for the month of June for questions.

XYZ Inc. uses the average cost formula in a perpetual inventory system.

(Use unrounded numbers in your calculations but round to the nearest cent for presentation purposes in your answer.) Jun 22 Sale 40 units

Jun 22 Sale 40 units

Total cost of goods sold for the month of June is

A) $2,914.65.

B) $2,934.96.

C) $2,946.24.

D) $2,994.80.

XYZ Inc. uses the average cost formula in a perpetual inventory system.

(Use unrounded numbers in your calculations but round to the nearest cent for presentation purposes in your answer.)

Jun 22 Sale 40 units

Jun 22 Sale 40 unitsTotal cost of goods sold for the month of June is

A) $2,914.65.

B) $2,934.96.

C) $2,946.24.

D) $2,994.80.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

55

A problem with the specific identification formula is that

A) inventories can be reported at actual costs.

B) management can manipulate net income.

C) matching is not achieved.

D) lower of cost and net realizable value cannot be applied.

A) inventories can be reported at actual costs.

B) management can manipulate net income.

C) matching is not achieved.

D) lower of cost and net realizable value cannot be applied.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

56

Use the following information for questions.

A company just starting its business made the following four inventory purchases in June: On June 25, the company made its first sale when a local customer purchased 500 units for $3,500. The company uses a perpetual inventory system.

On June 25, the company made its first sale when a local customer purchased 500 units for $3,500. The company uses a perpetual inventory system.

Using the FIFO cost formula, the amount of the cost of goods sold for June is

A) $645.

B) $695.

C) $1,650.

D) $1,700.

A company just starting its business made the following four inventory purchases in June:

On June 25, the company made its first sale when a local customer purchased 500 units for $3,500. The company uses a perpetual inventory system.

On June 25, the company made its first sale when a local customer purchased 500 units for $3,500. The company uses a perpetual inventory system.Using the FIFO cost formula, the amount of the cost of goods sold for June is

A) $645.

B) $695.

C) $1,650.

D) $1,700.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

57

Use the following information for the month of June for questions.

XYZ Inc. uses the average cost formula in a perpetual inventory system.

(Use unrounded numbers in your calculations but round to the nearest cent for presentation purposes in your answer.) Jun 22 Sale 40 units

Jun 22 Sale 40 units

The cost of goods sold for the June 8 sale is

A) $1,480.00.

B) $1,505.00.

C) $1,527.68.

D) $1,540.00.

XYZ Inc. uses the average cost formula in a perpetual inventory system.

(Use unrounded numbers in your calculations but round to the nearest cent for presentation purposes in your answer.)

Jun 22 Sale 40 units

Jun 22 Sale 40 unitsThe cost of goods sold for the June 8 sale is

A) $1,480.00.

B) $1,505.00.

C) $1,527.68.

D) $1,540.00.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

58

The selection of an appropriate inventory cost formula for a company is made by

A) external auditors.

B) Canada Revenue Agency (CRA).

C) industry standards.

D) management.

A) external auditors.

B) Canada Revenue Agency (CRA).

C) industry standards.

D) management.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

59

Use the following information for the month of June for questions.

XYZ Inc. uses the average cost formula in a perpetual inventory system.

(Use unrounded numbers in your calculations but round to the nearest cent for presentation purposes in your answer.) Jun 22 Sale 40 units

Jun 22 Sale 40 units

The cost of goods sold for the June 10 sale is

A) $545.60.

B) $549.96.

C) $550.00.

D) $557.75.

XYZ Inc. uses the average cost formula in a perpetual inventory system.

(Use unrounded numbers in your calculations but round to the nearest cent for presentation purposes in your answer.)

Jun 22 Sale 40 units

Jun 22 Sale 40 unitsThe cost of goods sold for the June 10 sale is

A) $545.60.

B) $549.96.

C) $550.00.

D) $557.75.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

60

Anderson's Used Cars uses the specific identification formula of costing inventory. During March, Anderson purchased three cars: a Honda Civic for $6,200, a Chevy Malibu for $7,300, and a Ford Pinto $8,400, respectively. During March, two cars are sold for $8,600 each. Anderson determines that at March 31, the Ford Pinto is still on hand. What is Anderson's cost of goods sold for March?

A) $8,400

B) $13,500

C) $15,700

D) $17,200

A) $8,400

B) $13,500

C) $15,700

D) $17,200

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

61

In a period of declining prices, which of the following inventory cost formulas generally results in the lowest inventory figure on the statement of financial position?

A) average cost

B) FIFO

C) The figure would be the same under both FIFO and average cost.

D) need more information to answer

A) average cost

B) FIFO

C) The figure would be the same under both FIFO and average cost.

D) need more information to answer

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

62

During a period of inflation, using ___ will approximate a company's current cost of ending inventory.

A) the average cost formula

B) FIFO

C) the lower of cost and net realizable value

D) both FIFO and the average cost formula

A) the average cost formula

B) FIFO

C) the lower of cost and net realizable value

D) both FIFO and the average cost formula

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

63

The specific identification method of inventory cost formula must be used

A) for goods that are produced and segregated for specific projects.

B) when goods are not ordinarily interchangeable.

C) when high priced goods are purchased.

D) for goods that are produced and segregated for specific projects, and/or when goods are not ordinarily interchangeable.

A) for goods that are produced and segregated for specific projects.

B) when goods are not ordinarily interchangeable.

C) when high priced goods are purchased.

D) for goods that are produced and segregated for specific projects, and/or when goods are not ordinarily interchangeable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

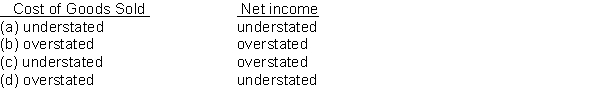

64

An error in the physical count of goods on hand at the end of a period resulted in a $10,000 overstatement of the ending inventory. The effect of this error in the current period is

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

65

Two companies report the same cost of goods available for sale but each employs a different inventory cost formula. If the price of goods has increased during the period, then the company using

A) FIFO will report lower ending inventory.

B) average cost will report lower ending inventory.

C) FIFO will report higher cost of goods sold.

D) average cost will report lower cost of goods sold.

A) FIFO will report lower ending inventory.

B) average cost will report lower ending inventory.

C) FIFO will report higher cost of goods sold.

D) average cost will report lower cost of goods sold.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

66

Which of the following should a business consider when choosing between the FIFO and average cost formulas?

A) whether the method closely follows the physical flow of goods

B) whether the method reports an inventory cost that approximates recent cost

C) using the same method for inventory of similar nature and use

D) all of the above.

A) whether the method closely follows the physical flow of goods

B) whether the method reports an inventory cost that approximates recent cost

C) using the same method for inventory of similar nature and use

D) all of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

67

Which cost formula smooths the effects of price changes?

A) specific identification

B) FIFO

C) average cost

D) lower of cost and net realizable value

A) specific identification

B) FIFO

C) average cost

D) lower of cost and net realizable value

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

68

Cost of goods available for sale consists of the

A) cost of beginning inventory plus the cost of ending inventory.

B) cost of ending inventory plus the cost of goods purchased during the year.

C) cost of beginning inventory plus the cost of goods purchased during the year.

D) difference between the cost of goods purchased and the cost of goods sold during the year.

A) cost of beginning inventory plus the cost of ending inventory.

B) cost of ending inventory plus the cost of goods purchased during the year.

C) cost of beginning inventory plus the cost of goods purchased during the year.

D) difference between the cost of goods purchased and the cost of goods sold during the year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

69

In a period of inflation (prices are rising), which inventory cost formula will result in higher net income?

A) FIFO

B) average cost

C) Cost of goods sold for the period will be the same under both formulas.

D) There would be no effect on net income.

A) FIFO

B) average cost

C) Cost of goods sold for the period will be the same under both formulas.

D) There would be no effect on net income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

70

The specific identification formula of costing inventories is used when the

A) physical flow of units cannot be determined.

B) company sells large quantities of relatively homogeneous items.

C) company has sophisticated technology to account for its inventory.

D) company sells a small number of expensive, easily distinguishable items.

A) physical flow of units cannot be determined.

B) company sells large quantities of relatively homogeneous items.

C) company has sophisticated technology to account for its inventory.

D) company sells a small number of expensive, easily distinguishable items.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

71

The inventory cost formula that results in the inventory value on the statement of financial position that is closest to its actual cost is

A) FIFO.

B) specific identification.

C) average cost.

D) either FIFO or average cost.

A) FIFO.

B) specific identification.

C) average cost.

D) either FIFO or average cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

72

The specific identification formula of inventory costing

A) always maximizes a company's net income.

B) always minimizes a company's net income.

C) has no effect on a company's net income.

D) may enable management to manipulate net income.

A) always maximizes a company's net income.

B) always minimizes a company's net income.

C) has no effect on a company's net income.

D) may enable management to manipulate net income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

73

An error

A) in the ending inventory of the current period will have no effect on net income of the next accounting period.

B) that understates the ending inventory will cause net income for the period to be overstated.

C) that understates the ending inventory will cause assets to be understated.

D) that understates the ending inventory will cause the cost of goods sold for the period to be understated.

A) in the ending inventory of the current period will have no effect on net income of the next accounting period.

B) that understates the ending inventory will cause net income for the period to be overstated.

C) that understates the ending inventory will cause assets to be understated.

D) that understates the ending inventory will cause the cost of goods sold for the period to be understated.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

74

Which cost formula provides the better (1) income statement and (2) statement of financial position valuations, respectively?

A) (1) average and (2) FIFO

B) (1) FIFO and (2) average

C) (1) FIFO and (2) FIFO

D) (1) average and (2) average

A) (1) average and (2) FIFO

B) (1) FIFO and (2) average

C) (1) FIFO and (2) FIFO

D) (1) average and (2) average

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

75

Which of the following statements regarding inventory cost formulas is correct?

A) A company may use more than one inventory cost formula.

B) A company should use the method that is easiest.

C) A company must use the method that allows them to manage net income.

D) A company may never change its inventory cost method once it has chosen it.

A) A company may use more than one inventory cost formula.

B) A company should use the method that is easiest.

C) A company must use the method that allows them to manage net income.

D) A company may never change its inventory cost method once it has chosen it.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

76

In a period of rising prices, which of the following inventory cost formulas generally results in the lowest net income figure?

A) average cost

B) FIFO

C) The inventory cost formula only affects the statement of financial position.

D) Need more information to answer.

A) average cost

B) FIFO

C) The inventory cost formula only affects the statement of financial position.

D) Need more information to answer.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

77

The consistent application of an inventory cost formula is essential for

A) neutrality.

B) accuracy.

C) comparability.

D) relevance.

A) neutrality.

B) accuracy.

C) comparability.

D) relevance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

78

The cost of goods available for sale is allocated between

A) beginning inventory and ending inventory.

B) beginning inventory and cost of goods on hand.

C) beginning inventory and cost of goods purchased.

D) ending inventory and cost of goods sold.

A) beginning inventory and ending inventory.

B) beginning inventory and cost of goods on hand.

C) beginning inventory and cost of goods purchased.

D) ending inventory and cost of goods sold.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

79

Selection of an inventory cost formula by management should be influenced most by the

A) fiscal year end.

B) physical flow of goods.

C) goal of reporting inventory at its lowest cost.

D) income tax effects.

A) fiscal year end.

B) physical flow of goods.

C) goal of reporting inventory at its lowest cost.

D) income tax effects.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

80

The managers of Winning Ways Ltd. receive performance bonuses based on the company's net income. Which inventory cost formula are they likely to favour in periods of declining prices?

A) FIFO

B) average cost

C) They would have no preference.

D) Need more information to answer.

A) FIFO

B) average cost

C) They would have no preference.

D) Need more information to answer.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck