Deck 2: A Further Look at Financial Statements

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

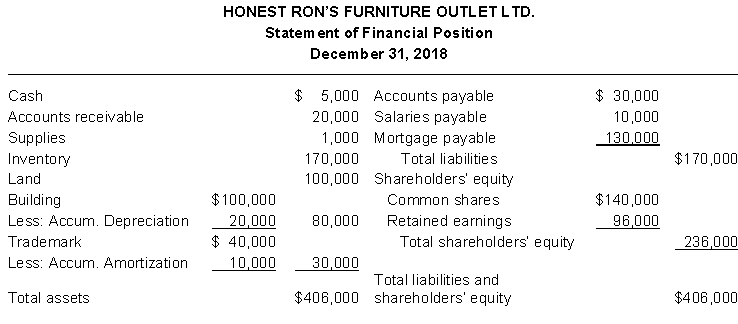

سؤال

سؤال

سؤال

سؤال

سؤال

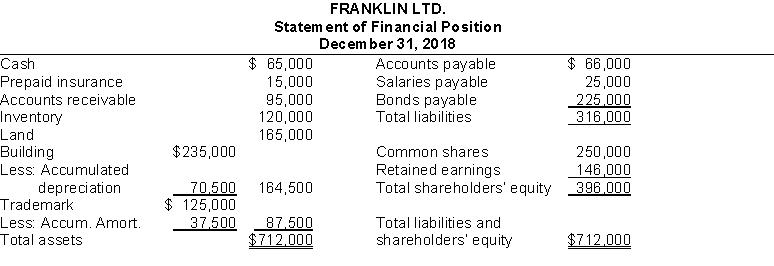

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/130

العب

ملء الشاشة (f)

Deck 2: A Further Look at Financial Statements

1

A liability is normally classified as a current liability if it is to be paid within the coming year.

True

2

Profitability means having enough funds on hand to pay debts when they fall due.

False

3

Long-term investments appear in the property, plant, and equipment section of the statement of financial position.

False

4

Listing assets and liabilities in reverse order of liquidity is not permitted in Canada.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

5

Solvency ratios measure the short-term ability of the company to pay its maturing obligations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

6

Calculating financial ratios can give clues to underlying conditions that may not be noticed by examining each financial statement item separately.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

7

Mortgages and pension liabilities are examples of non-current liabilities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

8

The statement of financial position is normally presented as follows, when ordered in order of liquidity: Current assets, current liabilities, non-current assets, non-current liabilities, and shareholders' equity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

9

A single ratio by itself is not very meaningful.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

10

From a creditor's point of view, the higher the total debt to total assets ratio, the lower the risk that the company may be unable to pay its obligations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

11

Solvency ratios measure the entity's ability to survive over a long period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

12

Special rights and privileges that provide a future economic benefit to the company are classified as intangible assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

13

Analysis of financial statements is enhanced with the use of comparative data.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

14

The most liquid resource is inventory.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

15

The debt to total assets ratio measures the percentage of assets financed by creditors rather than shareholders.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

16

The investment classification on the statement of financial position normally includes investments that are intended to be held for a short period of time (less than one year).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

17

The main difference between intangible assets and property, plant, and equipment is the length of the asset's life.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

18

The statement of financial position is normally presented as follows, when ordered in order of reverse liquidity: Non-current assets, current assets, shareholders' equity, non-current liabilities, and current liabilities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

19

Intracompany comparisons are based on comparisons with competitors in the same industry.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

20

Liquidity ratios are concerned with the frequency and amounts of dividend payments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

21

Financial reporting does not have to present the economic substance of a transaction in order to provide a faithful representation of what really happened.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

22

In general, standard setters require that most assets be recorded using historical cost because cost is representationally faithful.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

23

Information has verifiability if the information is comparable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

24

Under the going concern assumption, reporting assets, such as land, at their cost may be more appropriate than reporting land at its current value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

25

Enhancing qualitative characteristics include timeliness and comparability.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

26

Using a simplified version of Canadian GAAP for small companies in order to reduce the cost of providing financial information is an example of the application of materiality.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

27

The higher the price-earnings ratio, the higher are investors' expectations of the company's future profitability.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

28

Materiality and relevance are both defined in terms of what influences or makes a difference to a decision maker.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

29

In order for information to be relevant, it must be reported on a timely basis.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

30

Two measurement principles are historical cost and current value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

31

The price-earnings ratio is a measure of liquidity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

32

Comparability in accounting means that a company uses the same generally accepted accounting principles from one accounting period to the next.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

33

The cost basis of accounting states that assets and liabilities should be recorded at their cost not only when originally acquired, but also during the time the entity holds them.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

34

Elements of financial statements include assets, equity, and expenses, but not liabilities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

35

Comparability and understandability are examples of enhancing qualitative characteristics.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

36

Consistency aids comparability when a company uses the same accounting principles and methods from year to year or when companies with similar circumstances use the same accounting principles.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

37

The conceptual framework is fundamentally similar for both Canadian publicly traded companies and Canadian private companies.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

38

Companies using Accounting Standards for Private Enterprises (ASPE) are not required to present basic earnings per share information in their financial statements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

39

Qualitative characteristics help ensure that the information provided in financial statements is useful.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

40

Faithful representation means that accounting information must be complete, neutral, and free from error.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

41

The difference between cost and accumulated depreciation is referred to as

A) net depreciation.

B) book amount.

C) current value.

D) cost value.

A) net depreciation.

B) book amount.

C) current value.

D) cost value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

42

Office equipment is classified on the statement of financial position as

A) a current asset.

B) property, plant, and equipment.

C) shareholders' equity.

D) a long-term investment.

A) a current asset.

B) property, plant, and equipment.

C) shareholders' equity.

D) a long-term investment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

43

A current asset is

A) the last asset purchased by a business.

B) an asset which is not currently being used to produce a product or service.

C) usually found as a separate classification in the income statement.

D) expected to be converted to cash or used in the business within a relatively short period of time.

A) the last asset purchased by a business.

B) an asset which is not currently being used to produce a product or service.

C) usually found as a separate classification in the income statement.

D) expected to be converted to cash or used in the business within a relatively short period of time.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

44

Which of the following is not considered to be an asset?

A) equipment

B) dividends declared

C) accounts receivable

D) inventory

A) equipment

B) dividends declared

C) accounts receivable

D) inventory

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

45

Which of the following would not normally be classified as a non-current liability?

A) current portion of non-current debt

B) bonds payable

C) mortgage payable

D) lease liabilities

A) current portion of non-current debt

B) bonds payable

C) mortgage payable

D) lease liabilities

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

46

On a classified statement of financial position, prepaid expenses are classified as

A) a current liability.

B) property, plant, and equipment.

C) a current asset.

D) a long-term investment.

A) a current liability.

B) property, plant, and equipment.

C) a current asset.

D) a long-term investment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

47

Liabilities are generally classified on a statement of financial position as

A) small liabilities and large liabilities.

B) present liabilities and future liabilities.

C) tangible liabilities and intangible liabilities.

D) current liabilities and non-current liabilities.

A) small liabilities and large liabilities.

B) present liabilities and future liabilities.

C) tangible liabilities and intangible liabilities.

D) current liabilities and non-current liabilities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

48

All property, plant and equipment

A) including land have estimated useful lives over which they are expected to generate revenue.

B) are depreciated over their estimated useful lives including land.

C) with finite lives including land are depreciated.

D) including land contributes to the generation of revenue.

A) including land have estimated useful lives over which they are expected to generate revenue.

B) are depreciated over their estimated useful lives including land.

C) with finite lives including land are depreciated.

D) including land contributes to the generation of revenue.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

49

Shareholders' equity

A) is divided into at least two parts: share capital and retained earnings.

B) consists of two parts: common and preferred shares.

C) reflects two parts: dividends declared and share capital.

D) reflects retained earnings only.

A) is divided into at least two parts: share capital and retained earnings.

B) consists of two parts: common and preferred shares.

C) reflects two parts: dividends declared and share capital.

D) reflects retained earnings only.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

50

Long-lived assets without physical substance are

A) listed directly under current assets on the statement of financial position.

B) not listed on the statement of financial position because they do not have physical substance.

C) intangible assets.

D) listed as a long-term investment on the statement of financial position.

A) listed directly under current assets on the statement of financial position.

B) not listed on the statement of financial position because they do not have physical substance.

C) intangible assets.

D) listed as a long-term investment on the statement of financial position.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

51

On a statement of financial position

A) Cash and Office Supplies are both classified as current assets.

B) Inventories and Prepaid Expenses are classified as long-term investments.

C) Land and Buildings are classified as long-term investments.

D) Depreciation Expense is classified as property, plant and equipment.

A) Cash and Office Supplies are both classified as current assets.

B) Inventories and Prepaid Expenses are classified as long-term investments.

C) Land and Buildings are classified as long-term investments.

D) Depreciation Expense is classified as property, plant and equipment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

52

A conceptual framework is still under development for companies using International Financial Reporting Standards (IFRS).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

53

An intangible asset

A) derives its value from the rights and privileges it provides the company.

B) is worthless because it has no physical substance.

C) is converted into a tangible asset during the year.

D) cannot be classified on the statement of financial position because it lacks physical substance.

A) derives its value from the rights and privileges it provides the company.

B) is worthless because it has no physical substance.

C) is converted into a tangible asset during the year.

D) cannot be classified on the statement of financial position because it lacks physical substance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

54

Trademarks would appear in which section of the statement of financial position?

A) Shareholders' equity

B) Investments

C) Intangible assets

D) Current assets

A) Shareholders' equity

B) Investments

C) Intangible assets

D) Current assets

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

55

On a classified statement of financial position, current assets are often listed

A) in alphabetical order.

B) with the largest dollar amounts first.

C) in the order in which they are expected to be converted into cash.

D) in the order of acquisition.

A) in alphabetical order.

B) with the largest dollar amounts first.

C) in the order in which they are expected to be converted into cash.

D) in the order of acquisition.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

56

Which of the following is not classified as a current asset?

A) supplies

B) short-term (trading) investments

C) a fund to be used to purchase a building within the next year

D) equipment with an estimated useful life of five years

A) supplies

B) short-term (trading) investments

C) a fund to be used to purchase a building within the next year

D) equipment with an estimated useful life of five years

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

57

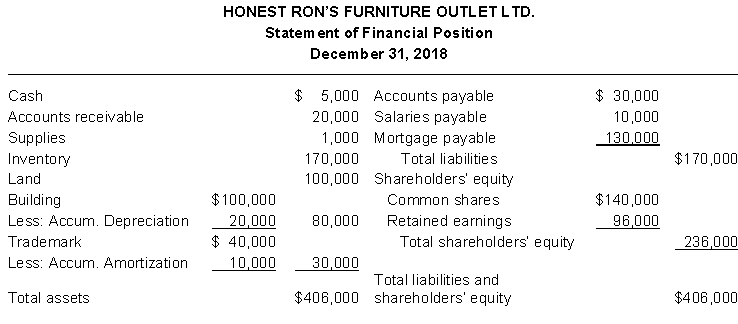

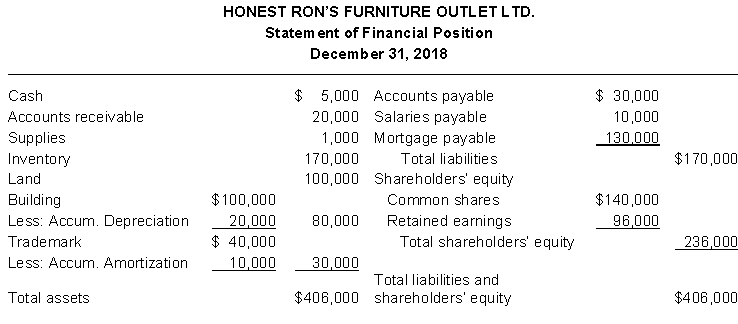

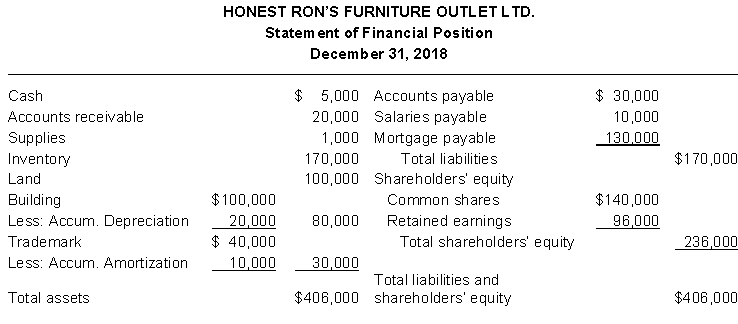

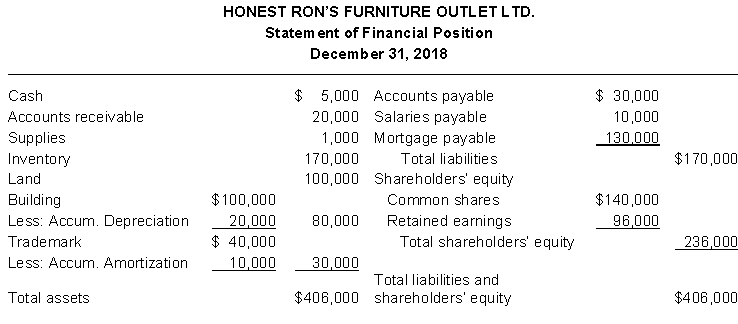

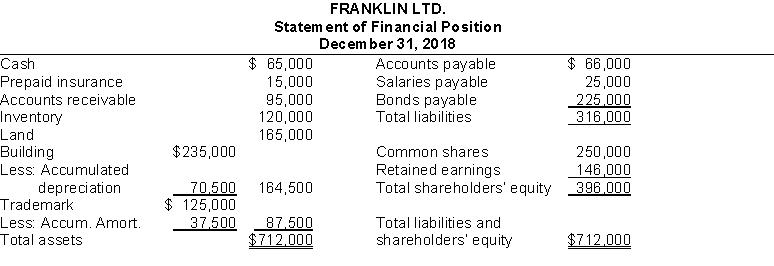

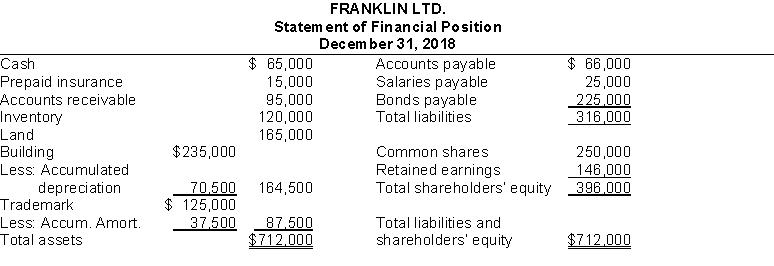

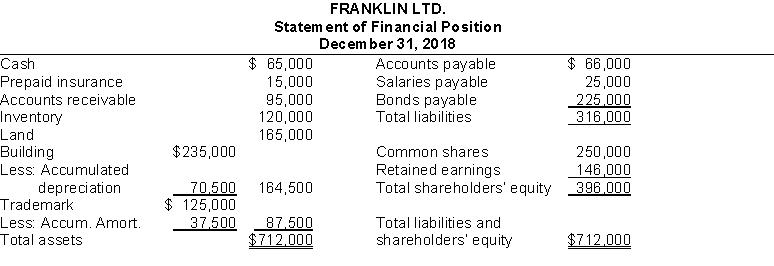

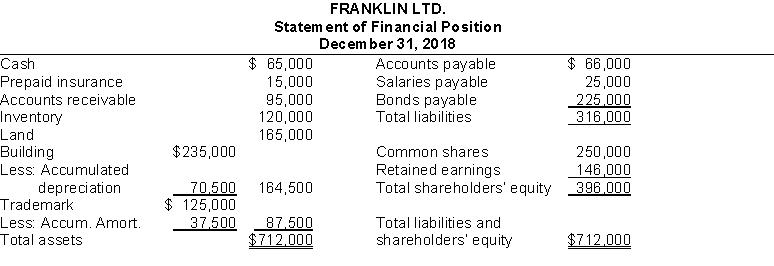

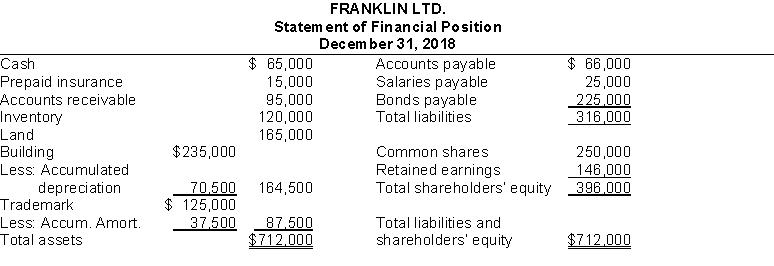

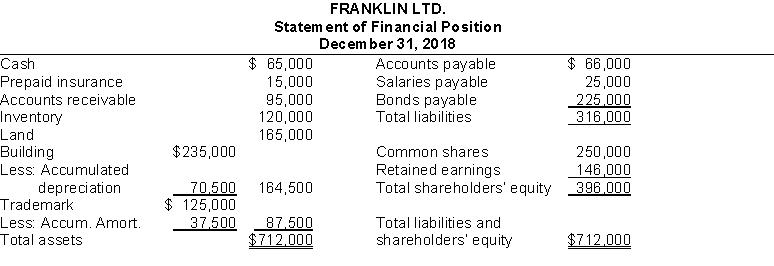

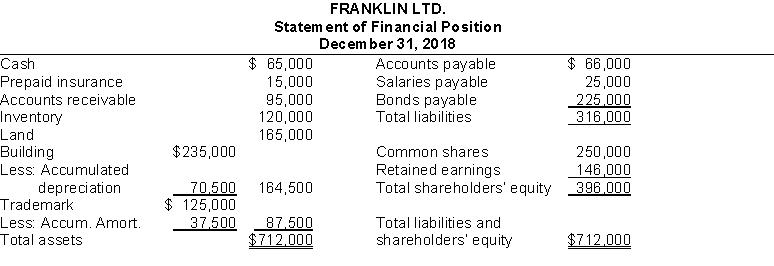

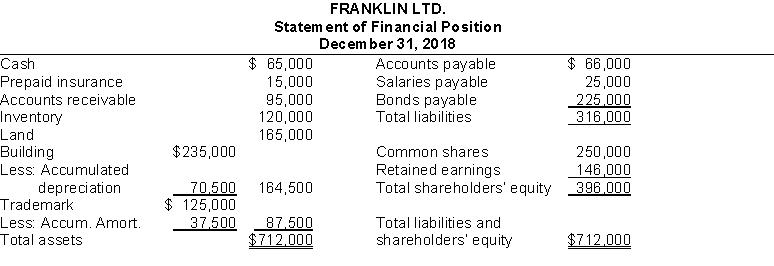

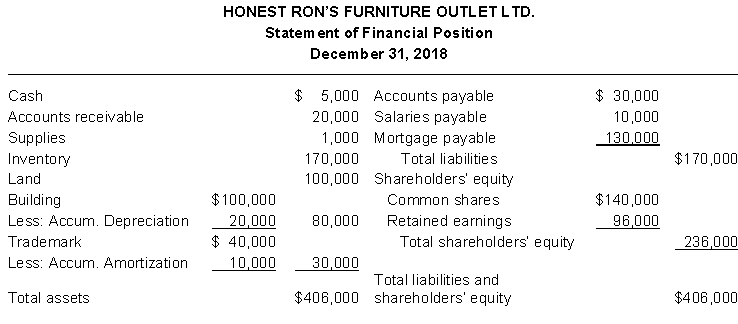

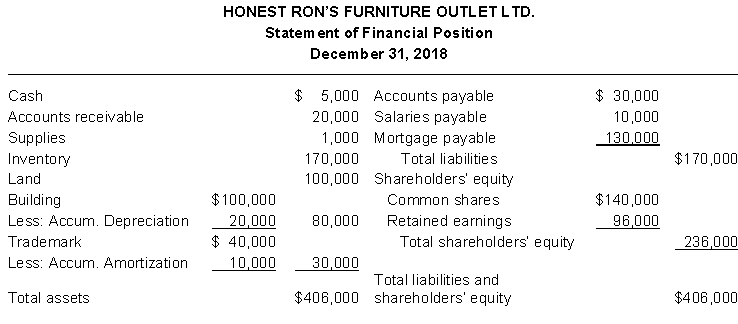

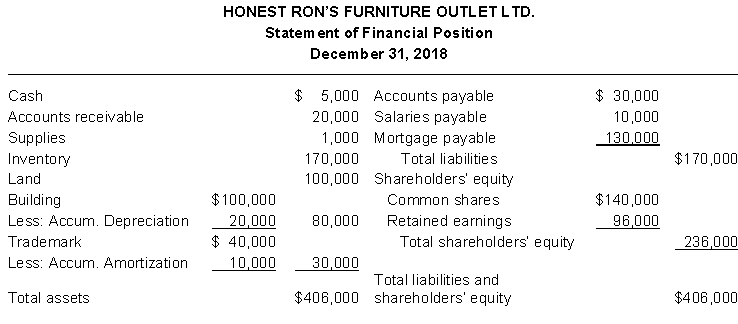

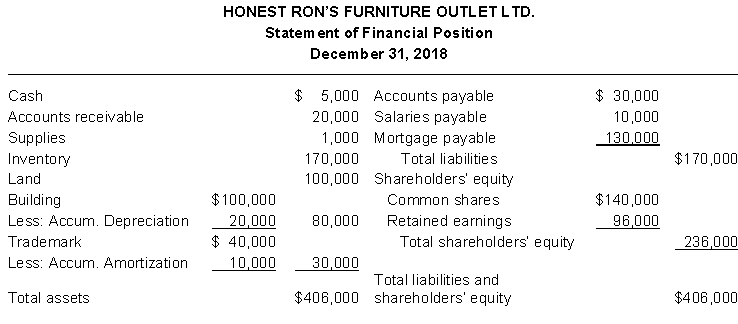

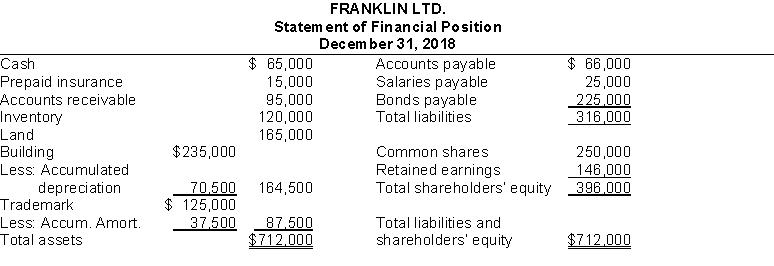

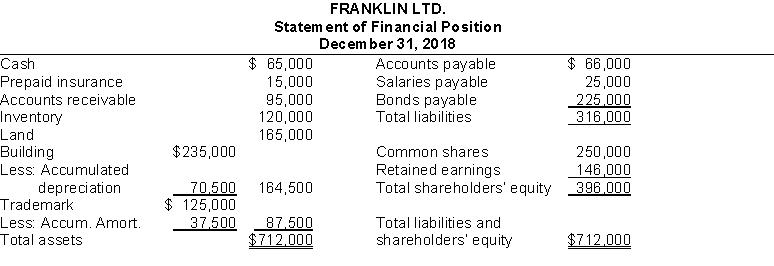

Use the following information to answer questions.

The dollar amount of current liabilities is

A) $196,000.

B) $170,000.

C) $ 40,000.

D) $ 30,000.

The dollar amount of current liabilities is

A) $196,000.

B) $170,000.

C) $ 40,000.

D) $ 30,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

58

Current liabilities are expected to be

A) converted to cash within one year.

B) paid within one year.

C) used in the business within one year.

D) acquired within one year.

A) converted to cash within one year.

B) paid within one year.

C) used in the business within one year.

D) acquired within one year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

59

Which of the following is not normally a current liability?

A) salaries payable

B) accounts payable

C) income tax payable

D) bonds payable

A) salaries payable

B) accounts payable

C) income tax payable

D) bonds payable

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

60

Use the following information to answer questions.

The dollar amount of net property, plant and equipment is

A) $ 80,000.

B) $180,000.

C) $210,000.

D) $350,000.

The dollar amount of net property, plant and equipment is

A) $ 80,000.

B) $180,000.

C) $210,000.

D) $350,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

61

Working capital is

A) the difference between total assets and current liabilities.

B) the excess of current assets over current liabilities.

C) the difference between current assets and total liabilities.

D) the excess of total assets over total liabilities.

A) the difference between total assets and current liabilities.

B) the excess of current assets over current liabilities.

C) the difference between current assets and total liabilities.

D) the excess of total assets over total liabilities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

62

Use the following information to answer questions.

Net income retained for use in the business is

A) $712,000.

B) $396,000.

C) $316,000.

D) $146,000.

Net income retained for use in the business is

A) $712,000.

B) $396,000.

C) $316,000.

D) $146,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

63

Use the following information to answer questions.

The dollar amount of current assets is

A) $ 26,000.

B) $ 40,000.

C) $ 25,000.

D) $196,000.

The dollar amount of current assets is

A) $ 26,000.

B) $ 40,000.

C) $ 25,000.

D) $196,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

64

Use the following information to answer questions.

The total dollar amount of assets to be classified as net property, plant, and equipment is

A) $329,500.

B) $164,500.

C) $252,000.

D) $235,000.

The total dollar amount of assets to be classified as net property, plant, and equipment is

A) $329,500.

B) $164,500.

C) $252,000.

D) $235,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

65

Use the following information to answer questions.

The total dollar amount of assets to be classified as investments is

A) $ 0.

B) $ 165,000.

C) $ 525,000.

D) $400,000.

The total dollar amount of assets to be classified as investments is

A) $ 0.

B) $ 165,000.

C) $ 525,000.

D) $400,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

66

Use the following information to answer questions.

The total amount in the contra asset accounts is

A) $ 37,500.

B) $ 108,000.

C) $70,500.

D) $252,000.

The total amount in the contra asset accounts is

A) $ 37,500.

B) $ 108,000.

C) $70,500.

D) $252,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

67

The current ratio is calculated as

A) current assets plus current liabilities.

B) current assets minus current liabilities.

C) current assets divided by current liabilities.

D) current assets times current liabilities.

A) current assets plus current liabilities.

B) current assets minus current liabilities.

C) current assets divided by current liabilities.

D) current assets times current liabilities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

68

The most important information needed to determine if companies can pay their current obligations is the

A) net income for this year.

B) projected net income for next year.

C) relationship between current assets and current liabilities.

D) relationship between current and non-current liabilities.

A) net income for this year.

B) projected net income for next year.

C) relationship between current assets and current liabilities.

D) relationship between current and non-current liabilities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

69

A measure of profitability is the

A) current ratio.

B) debt to total assets ratio.

C) basic earnings per share.

D) working capital.

A) current ratio.

B) debt to total assets ratio.

C) basic earnings per share.

D) working capital.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

70

The relationship between current assets and current liabilities is important in evaluating a company's

A) profitability.

B) liquidity.

C) current value.

D) solvency.

A) profitability.

B) liquidity.

C) current value.

D) solvency.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

71

Basic earnings per share is calculated by dividing

A) revenue by weighted average shareholders' equity.

B) revenue by the weighted average number of common shares.

C) income available to common shareholders by weighted average shareholders' equity.

D) income available to common shareholders by the weighted average number of common shares.

A) revenue by weighted average shareholders' equity.

B) revenue by the weighted average number of common shares.

C) income available to common shareholders by weighted average shareholders' equity.

D) income available to common shareholders by the weighted average number of common shares.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

72

Use the following information to answer questions.

The total dollar amount of assets to be classified as current assets is

A) $295,000.

B) $235,000.

C) $175,000.

D) $160,000.

The total dollar amount of assets to be classified as current assets is

A) $295,000.

B) $235,000.

C) $175,000.

D) $160,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

73

Use the following information to answer questions.

The dollar amount of share capital is

A) $406,000.

B) $236,000.

C) $140,000.

D) $ 96,000.

The dollar amount of share capital is

A) $406,000.

B) $236,000.

C) $140,000.

D) $ 96,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

74

Which of the following statements is true?

A) A current ratio of 1.2 to 1 indicates that a company's current assets are less than its current liabilities.

B) All companies, regardless of size, should have a current ratio of at least 2:1.

C) The current ratio is a more dependable indicator of liquidity than working capital.

D) The use of the current ratio does not make it possible to compare companies of different sizes.

A) A current ratio of 1.2 to 1 indicates that a company's current assets are less than its current liabilities.

B) All companies, regardless of size, should have a current ratio of at least 2:1.

C) The current ratio is a more dependable indicator of liquidity than working capital.

D) The use of the current ratio does not make it possible to compare companies of different sizes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

75

A short-term creditor is primarily interested in the ___ of the borrower.

A) liquidity

B) profitability

C) comparability

D) solvency

A) liquidity

B) profitability

C) comparability

D) solvency

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

76

The current ratio

A) is calculated by dividing total assets by total liabilities.

B) takes into account the composition of current assets.

C) takes into account the composition of current assets and current liabilities.

D) is calculated by dividing current assets by current liabilities.

A) is calculated by dividing total assets by total liabilities.

B) takes into account the composition of current assets.

C) takes into account the composition of current assets and current liabilities.

D) is calculated by dividing current assets by current liabilities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

77

Use the following information to answer questions.

The total obligations that have resulted from past transactions are

A) $ 20,000.

B) $ 40,000.

C) $ 96,000.

D) $170,000.

The total obligations that have resulted from past transactions are

A) $ 20,000.

B) $ 40,000.

C) $ 96,000.

D) $170,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

78

Use the following information to answer questions.

Non-current liabilities total

A) $712,000.

B) $316,000.

C) $225,000.

D) $ 25,000.

Non-current liabilities total

A) $712,000.

B) $316,000.

C) $225,000.

D) $ 25,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

79

The price-earnings ratio is calculated by dividing

A) the market price per share by basic earnings per share.

B) basic earnings per share by the average number of shares.

C) net income by the market price per share.

D) basic earnings per share by the market price per share.

A) the market price per share by basic earnings per share.

B) basic earnings per share by the average number of shares.

C) net income by the market price per share.

D) basic earnings per share by the market price per share.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

80

Basic earnings per share

A) is calculated by dividing income available to common shareholders for the period by the dollar value in the common shares account.

B) is the only ratio that must be presented in the financial statements for publicly traded companies.

C) is frequently compared across companies in the same industry.

D) is the only ratio that must be presented in the financial statements for both publicly traded companies and privately held companies.

A) is calculated by dividing income available to common shareholders for the period by the dollar value in the common shares account.

B) is the only ratio that must be presented in the financial statements for publicly traded companies.

C) is frequently compared across companies in the same industry.

D) is the only ratio that must be presented in the financial statements for both publicly traded companies and privately held companies.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck