Deck 11: Shareholders Equity

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/106

العب

ملء الشاشة (f)

Deck 11: Shareholders Equity

1

Pre-emptive rights prevent ownership interests from being diluted.

True

2

Preferred shares are normally non-voting.

True

3

Stock dividends are accounted for using the fair market value of the shares on the date of declaration.

True

4

Dividends are only paid in cash.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

5

Employees are not eligible to purchase their employers shares.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

6

Corporations generally issue shares through investment bankers known as "tellers".

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

7

Share capital represents the amount that investors paid for the shares when they were initially issued by the company.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

8

Shares that have been sold by the company are known as issued shares.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

9

Non-cumulative means that common shareholders must be paid for dividends in arrears before preferred shareholders are paid.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

10

Every corporation must have one class of shares that represents the company's basic voting ownership rights.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

11

Convertible preferred shares can be converted, at the option of the company, into other types of preferred shares.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

12

Common shareholders have the right to vote at shareholder meetings.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

13

All companies are obligated to declare dividends.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

14

Accumulated other comprehensive income is a revenue account reported on the statement of income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

15

If a company would like to issue additional shares, they do not need to amend their Articles of Incorporation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

16

Contributed surplus is reported on the statement of income because it is a recognized gain.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

17

Convertible preferred shares are convertible to common shares at the option of the shareholder.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

18

The repurchase of shares may result in a recognizable gain or loss.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

19

Repurchasing shares increases the number of shares outstanding.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

20

Retractable shares can be sold back to the company at the option of the shareholder.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

21

Reverse stock splits are also known as consolidations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

22

Stable companies usually pay out a lower portion of their earnings in dividends.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

23

Cash dividends are paid on the date of record.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

24

The date of record results in a legal obligation to pay the cash dividends.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

25

Stock splits do not impact the value of the share capital or retained earnings accounts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

26

The repurchase of shares at a price lower than what the shares were initially issued at is called

A) share capital.

B) retained earnings.

C) other comprehensive income.

D) contributed surplus.

A) share capital.

B) retained earnings.

C) other comprehensive income.

D) contributed surplus.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

27

A company may pay a one-time dividend if it has benefitted from an unusual gain.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

28

The price/earnings ratio provides a measure of the return to common shareholders.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

29

Bailey Inc. issues 100,000 shares at $11 / share in January. Later that year the company is able to repurchase 9,000 of these shares at $10 per share. The effect of this is

A) a decrease to the share capital account of $90,000.

B) an increase to the contributed surplus account of $9,000.

C) a decrease to total shareholders' equity of $99,000.

D) an increase in retained earnings by $9,000.

A) a decrease to the share capital account of $90,000.

B) an increase to the contributed surplus account of $9,000.

C) a decrease to total shareholders' equity of $99,000.

D) an increase in retained earnings by $9,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

30

The shareholders' equity section of the statement of financial position, includes all of the following accounts except for

A) contributed surplus.

B) accumulated OCI.

C) dividends.

D) share Capital.

A) contributed surplus.

B) accumulated OCI.

C) dividends.

D) share Capital.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

31

Dividend yield measure the dividends an investor will receive relative to the share price.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

32

Stock splits only apply to common shareholders.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

33

Unrealized gains and losses from the revaluation of certain types of investments to fair value would be reported on

A) the income statement.

B) the statement of financial position.

C) the statement of changes in shareholders' equity.

D) the comprehensive income statement.

A) the income statement.

B) the statement of financial position.

C) the statement of changes in shareholders' equity.

D) the comprehensive income statement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

34

Early-stage or growing companies do not normally pay dividends.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

35

Stock splits are normally associated with profitable growing companies.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

36

Earnings per share provides a measure of the earnings relative to the number of common shares outstanding.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

37

Public companies cannot pay a dividend on the date of declaration.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

38

The Statement of Financial Position shows all the dividends declared during the year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

39

A 2-for-1 stock split should have the effect of cutting the market price per share in half.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

40

The denominator in the return on equity calculation is the average number of common shares outstanding.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

41

The maximum number of shares that a firm can issue is the number of

A) issued shares.

B) authorized shares.

C) outstanding shares.

D) permissible shares.

A) issued shares.

B) authorized shares.

C) outstanding shares.

D) permissible shares.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

42

Which of the basic rights of shareholders does the preferred shareholder usually give up in order to acquire preferences over the common shareholder?

A) right to share in profits and losses

B) right to share in subsequent issues of shares

C) right to share in assets upon liquidation

D) right to vote

A) right to share in profits and losses

B) right to share in subsequent issues of shares

C) right to share in assets upon liquidation

D) right to vote

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

43

Dividends in arrears relate to which of the following?

A) cumulative preferred shares

B) participating preferred shares

C) cumulative common shares

D) participating common shares

A) cumulative preferred shares

B) participating preferred shares

C) cumulative common shares

D) participating common shares

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

44

In a situation where a CDN company has a dual class share structure and common shareholders have more than one vote, this is referred to as a

A) pre-emptive right.

B) participating common share.

C) super voting share.

D) hybrid share.

A) pre-emptive right.

B) participating common share.

C) super voting share.

D) hybrid share.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

45

When a company decides to repurchase shares it's previously sold, this is referred to as

A) retired share capital.

B) treasury shares.

C) a buyback.

D) contributed surplus.

A) retired share capital.

B) treasury shares.

C) a buyback.

D) contributed surplus.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

46

What type of preferred share is entitled to dividends above its specified dividend if the common shares receive excess dividends and must receive dividends in arrears before the common dividends can be declared?

A) cumulative and participating

B) cumulative and non-participating

C) redeemable and participating

D) redeemable and cumulative

A) cumulative and participating

B) cumulative and non-participating

C) redeemable and participating

D) redeemable and cumulative

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

47

The pre-emptive right is the right to

A) share in the management of the company.

B) share proportionately in any new sale of shares.

C) share in the profits and losses of the company.

D) share in any dividends paid by the company.

A) share in the management of the company.

B) share proportionately in any new sale of shares.

C) share in the profits and losses of the company.

D) share in any dividends paid by the company.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

48

Which of the following accounts is not reported on the Statement of Changes in Shareholders' Equity?

A) Accumulated Other Comprehensive Income

B) Retained Earnings

C) Goodwill

D) Share Capital

A) Accumulated Other Comprehensive Income

B) Retained Earnings

C) Goodwill

D) Share Capital

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

49

Which of the following is not a basic right of common shares?

A) right to share in profits and losses

B) right to participate in the management of the company

C) right to vote in the selection of the board of directors for the corporation

D) right to share in the assets upon liquidation

A) right to share in profits and losses

B) right to participate in the management of the company

C) right to vote in the selection of the board of directors for the corporation

D) right to share in the assets upon liquidation

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

50

Preferred shares that pay a fixed dividend for as long as the shares remain outstanding are called

A) floating rate shares.

B) rate reset shares.

C) fixed dividend rate shares.

D) perpetual shares.

A) floating rate shares.

B) rate reset shares.

C) fixed dividend rate shares.

D) perpetual shares.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

51

Which of the following statements is true?

A) Dividends are guaranteed to preferred shareholders.

B) Dividends accumulate on common shares.

C) Dividends are only issued if the board of directors declares them.

D) Dividends are paid to all classes of shares on the same basis.

A) Dividends are guaranteed to preferred shareholders.

B) Dividends accumulate on common shares.

C) Dividends are only issued if the board of directors declares them.

D) Dividends are paid to all classes of shares on the same basis.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

52

When the value of a company is determined by the trading price of its shares multiplied by the number of shares outstanding, this is referred to as

A) other comprehensive income.

B) share capital.

C) market capitalization.

D) contributed surplus.

A) other comprehensive income.

B) share capital.

C) market capitalization.

D) contributed surplus.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

53

The articles of incorporation include all of the following except

A) what kinds of shares are to be issued.

B) the costs of issuing the shares.

C) the type of business to be conducted.

D) how the board of directors is organized.

A) what kinds of shares are to be issued.

B) the costs of issuing the shares.

C) the type of business to be conducted.

D) how the board of directors is organized.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

54

The one class of shares that represent a company's basic voting rights are

A) preferred shares.

B) capital shares.

C) cumulative shares.

D) common shares.

A) preferred shares.

B) capital shares.

C) cumulative shares.

D) common shares.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

55

Which of the following is the largest number of shares?

A) outstanding shares

B) authorized shares

C) issued shares

D) approved shares

A) outstanding shares

B) authorized shares

C) issued shares

D) approved shares

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

56

For accounting purposes, the most important section of the articles of incorporation is the description of

A) the shares to be issued.

B) the type of business to be conducted.

C) how the board of directors will be organized.

D) who will make up the management.

A) the shares to be issued.

B) the type of business to be conducted.

C) how the board of directors will be organized.

D) who will make up the management.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

57

In the case of liquidation, where do preferred shareholders rank?

A) before creditors and common shareholders

B) after creditors and common shareholders

C) after creditors and equally with common shareholders

D) before common shareholders and after creditors

A) before creditors and common shareholders

B) after creditors and common shareholders

C) after creditors and equally with common shareholders

D) before common shareholders and after creditors

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

58

Calypso Inc. issues 100,000 shares at $10 / share in January. Later that year the company is able to repurchase 9,000 of these shares at $11 per share. The balance in the contributed surplus account is $0 prior to the share repurchase. The effect of this is

A) a decrease to the share capital account of $99,000.

B) an increase to the contributed surplus account of $9,000.

C) a increase to total shareholders' equity of $99,000.

D) a decrease in retained earnings by $9,000.

A) a decrease to the share capital account of $99,000.

B) an increase to the contributed surplus account of $9,000.

C) a increase to total shareholders' equity of $99,000.

D) a decrease in retained earnings by $9,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

59

Generally the major difference between preferred shares and common shares is

A) preferred shares are restricted by the amount of dividends that can be paid out.

B) common shares have a priority claim over corporate assets.

C) preferred shares have voting rights.

D) there are no significant differences between preferred and common shares.

A) preferred shares are restricted by the amount of dividends that can be paid out.

B) common shares have a priority claim over corporate assets.

C) preferred shares have voting rights.

D) there are no significant differences between preferred and common shares.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

60

The type of preferred share that can be bought back by the company at a specified time and price is a

A) cumulative preferred share.

B) convertible preferred share.

C) redeemable preferred share.

D) non-participating preferred share.

A) cumulative preferred share.

B) convertible preferred share.

C) redeemable preferred share.

D) non-participating preferred share.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

61

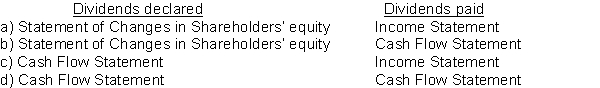

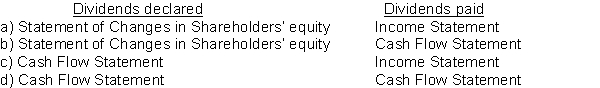

Information to determine the amount of dividends declared and the amount of dividends paid during the year is found on which financial statement?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

62

A legal liability for cash dividends occurs on which of the following dates?

A) date of record

B) ex-dividend date

C) date of payment

D) date of declaration

A) date of record

B) ex-dividend date

C) date of payment

D) date of declaration

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

63

Stock splits are usually declared in order to

A) increase the number of shares outstanding.

B) improve the earnings per share.

C) reduce the shareholders' equity.

D) reduce the shares' market price.

A) increase the number of shares outstanding.

B) improve the earnings per share.

C) reduce the shareholders' equity.

D) reduce the shares' market price.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

64

All of the following are terms used to refer to the number of company shares except

A) authorized.

B) available.

C) issued.

D) outstanding.

A) authorized.

B) available.

C) issued.

D) outstanding.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

65

At least one class of a company's common share must have all three of the following rights except

A) the right to vote at meetings of the company's shareholders.

B) the right to receive dividends, if declared.

C) the right to a share of the company's net assets upon liquidation of the company.

D) the right to convert shares to cumulative participating preferred shares.

A) the right to vote at meetings of the company's shareholders.

B) the right to receive dividends, if declared.

C) the right to a share of the company's net assets upon liquidation of the company.

D) the right to convert shares to cumulative participating preferred shares.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

66

On December 1, Murial Ltd. declared a 2 for 1 stock split when the market value was $40 per share. Prior to the split, there were 200,000 shares issued and outstanding. After the stock split, the number of shares outstanding and the share capital balance were Shares Capital

A) 200,000 $8,000,000.

B) 200,000 $4,000,000.

C) 400,000 $8,000,000.

D) 400,000 $4,000,000.

A) 200,000 $8,000,000.

B) 200,000 $4,000,000.

C) 400,000 $8,000,000.

D) 400,000 $4,000,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

67

Which of the following is the first date in the sequence required to pay dividends?

A) payment date

B) announcement date

C) date of record

D) declaration date

A) payment date

B) announcement date

C) date of record

D) declaration date

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

68

When common or preferred shares are made available for sale to the public, the details of the shares are discussed in a legal document called

A) articles of incorporation.

B) share repurchase agreement.

C) shareholder composition.

D) prospectus.

A) articles of incorporation.

B) share repurchase agreement.

C) shareholder composition.

D) prospectus.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

69

Repurchasing shares

A) increases the number of shares outstanding.

B) decreases the number of shares outstanding.

C) has no effect on the number of shares outstanding.

D) splits shares in half.

A) increases the number of shares outstanding.

B) decreases the number of shares outstanding.

C) has no effect on the number of shares outstanding.

D) splits shares in half.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

70

When shares are repurchased for less than their cost, the difference is recognized as

A) contributed surplus.

B) ordinary gains.

C) extraordinary gains.

D) an increase to retained earnings.

A) contributed surplus.

B) ordinary gains.

C) extraordinary gains.

D) an increase to retained earnings.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

71

Shares that have been issued and subsequently repurchased but not cancelled are called

A) issued shares.

B) re-issued shares.

C) treasury shares.

D) outstanding shares.

A) issued shares.

B) re-issued shares.

C) treasury shares.

D) outstanding shares.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

72

A new company just starting to pay dividends may choose to make a one-time dividend payment know as a(n)

A) unexpected dividend.

B) special dividend.

C) ex-dividend.

D) stock dividend.

A) unexpected dividend.

B) special dividend.

C) ex-dividend.

D) stock dividend.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

73

Which date is used to determine which shareholders will receive the declared dividend?

A) date of record

B) date of declaration

C) ex-dividend date

D) date of payment

A) date of record

B) date of declaration

C) ex-dividend date

D) date of payment

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

74

Which of the following is a reason a company would declare a stock split?

A) to increase the marketability of its shares

B) to increase the share price in the market

C) to increase the value of the company

D) to increase the share capital of the company

A) to increase the marketability of its shares

B) to increase the share price in the market

C) to increase the value of the company

D) to increase the share capital of the company

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

75

Dividends not declared in one year carry over to the next year for

A) cumulative preferred shares.

B) cumulative common shares.

C) arrears shares.

D) pre-emptive shares.

A) cumulative preferred shares.

B) cumulative common shares.

C) arrears shares.

D) pre-emptive shares.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

76

Dividends are not paid on

A) common shares.

B) preferred shares.

C) treasury shares.

D) outstanding shares.

A) common shares.

B) preferred shares.

C) treasury shares.

D) outstanding shares.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

77

Which of the following happens at the date of record of a cash dividend?

A) Dr. Dividends Declared, Cr. Dividends Payable

B) Dr. Dividends Declared, Cr. Cash

C) No entry is made in the accounts, but a list of shareholders entitled to receive the dividend is prepared.

D) The board of directors approves the dividend but no entry is made in the accounts.

A) Dr. Dividends Declared, Cr. Dividends Payable

B) Dr. Dividends Declared, Cr. Cash

C) No entry is made in the accounts, but a list of shareholders entitled to receive the dividend is prepared.

D) The board of directors approves the dividend but no entry is made in the accounts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

78

Which of the following happens at the date of declaration of a cash dividend?

A) Dr. Dividends Expense, Cr. Dividends Declared

B) Dr. Dividends Declared, Cr. Cash

C) Dr. Dividends Declared, Cr. Dividends Payable

D) The board of directors approves the dividend but no entry is made in the accounts.

A) Dr. Dividends Expense, Cr. Dividends Declared

B) Dr. Dividends Declared, Cr. Cash

C) Dr. Dividends Declared, Cr. Dividends Payable

D) The board of directors approves the dividend but no entry is made in the accounts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

79

Stock splits

A) decrease the Retained Earnings account.

B) increase the number of outstanding shares.

C) increase the Share Capital account.

D) all of the above.

A) decrease the Retained Earnings account.

B) increase the number of outstanding shares.

C) increase the Share Capital account.

D) all of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

80

In 2020, Bouchard Enterprises reported net income of $75,000 and declared a dividend of $40,000. The dividend is to be paid on February 1, 2021 to shareholders of record on January 15, 2021. The balance in the retained earnings account on January 1, 2020 was $140,000. At Bouchard's year end on December 31, 2020 the company reported the following ending balance for retained earnings on the statement of changes in shareholders' equity:

A) $35,000.

B) $115,000.

C) $175,000.

D) $215,000.

A) $35,000.

B) $115,000.

C) $175,000.

D) $215,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck