Deck 4: Revenue Recognition and the Statement of Income

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/78

العب

ملء الشاشة (f)

Deck 4: Revenue Recognition and the Statement of Income

1

Under IFRS, companies offering sales discounts must adjust the original amount of the sales revenue by the expected sales discount.

True

2

A single-step income statement requires several steps to reach a company's net profit or loss.

False

3

When a company uses a multi-step income statement, all revenues are presented first regardless of the source.

False

4

When following ASPE, part of the revenue recognition criteria includes reasonable assurance of collectability of at least some portion of the amount earned.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

5

Comprehensive income must be reported on a separate statement called the Statement of Comprehensive Income or on the statement of income, immediately below next income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

6

Revenue recognition approaches differ between IFRS and ASPE.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

7

Revenue and gains arise from a company's ordinary activities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

8

The choice of presenting expenses based on their nature or function rests with management.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

9

When customers are granted a right to return goods purchased, management must estimate the extent of expected returns.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

10

Private companies must report comprehensive income in their financial statements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

11

A service warranty is considered to be a separate performance obligation under the contract-based approach for revenue recognition.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

12

There must be a receipt of cash in order for a company to recognize revenue.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

13

When making sales on account, there are costs that may be incurred in the future; an example of a cost is bad debts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

14

At the time of sale, the selling price does not have to be determined in order for the selling company to quantify the economic benefits of the transactions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

15

The amount of revenue is one of the most significant amounts reported in the financial statements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

16

The multi-step income statement allows readers to easily identify gross profit and profits earned from operating activities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

17

A contract has commercial substance when the risk, timing, or amount of

the company's future cash flows is expected to change as a result of the contract.

the company's future cash flows is expected to change as a result of the contract.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

18

Under the accrual basis, accounting revenues are recognized when they are earned regardless of whether the related cash was received by the company.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

19

Under the contract-based approach, revenue is recognized whenever a company's net position in a contract decreases.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

20

In retail stores, revenue is normally recognized at the time of sale.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

21

Performance obligations relate to:

A) distinct goods or services

B) input costs of products or services

C) customer payment terms

D) the transaction price

A) distinct goods or services

B) input costs of products or services

C) customer payment terms

D) the transaction price

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

22

Under the contract-based approach, revenue is recognized when:

A) a company's net position is increased

B) when the transaction price is determined

C) when the performance obligation has been defined

D) the contract has commercial substance

A) a company's net position is increased

B) when the transaction price is determined

C) when the performance obligation has been defined

D) the contract has commercial substance

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

23

EPS may be reported either on the statement of financial position or the statement of income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

24

Frenzo Furniture Co. is a manufacturer of specialty furniture, and uses the contract-based approach for revenue recognition. Because each piece of furniture is custom manufactured, the company requires a contract prior to beginning the production process. Contract terms include a payment of 40% of the estimated cost of the finished piece before production begins. Frenzo Furniture Co. should record the collection as a

A) credit to sales revenue.

B) credit to unearned revenue.

C) credit to inventory.

D) credit to cost of goods sold.

A) credit to sales revenue.

B) credit to unearned revenue.

C) credit to inventory.

D) credit to cost of goods sold.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

25

When goods and services are bundled in a sales transaction

A) the service must be performed before any revenue is recognized.

B) collection must occur before any revenue is recognized

C) the amount of consideration received for the service must be recognized first.

D) each performance obligation under the contract must be measured separately.

A) the service must be performed before any revenue is recognized.

B) collection must occur before any revenue is recognized

C) the amount of consideration received for the service must be recognized first.

D) each performance obligation under the contract must be measured separately.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

26

Bailey Consulting, a Winnipeg based company that uses the contract-based approach to revenue recognition, has just signed a contract to complete a strategic plan for a local business. The five-step model Bailey Consulting should follow to recognize revenue should include all of the following, except for

A) Allocate the transaction price to performance obligations

B) Sign the contract

C) Identify the performance obligations

D) Determine the transaction price

A) Allocate the transaction price to performance obligations

B) Sign the contract

C) Identify the performance obligations

D) Determine the transaction price

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

27

The earnings per share figure expresses net income, after deducting common dividends, on a per-share basis.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

28

If a company generates gains,

A) this represents income from ordinary activities

B) this is not considered income

C) this is separate and distinct from sales revenue

D) this is considered a financing activity

A) this represents income from ordinary activities

B) this is not considered income

C) this is separate and distinct from sales revenue

D) this is considered a financing activity

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

29

Rainbow Designers took a $1,500 deposit from a customer when they signed the contract to paint the customer's residence. It took them three weeks to complete the job. On completion the customer paid the $3,500 balance. How should Rainbow Designers recognize revenue for this job assuming the job is performed on one accounting period?

A) The $1,500 as revenue when it is received, and the $3,500 as revenue when it is received.

B) The $1,500 as unearned revenue and the $3,500 as revenue when it is received.

C) $5,000 as revenue at the completion of the project.

D) The $1,500 as unearned revenue and $5,000 as revenue when the project is completed.

A) The $1,500 as revenue when it is received, and the $3,500 as revenue when it is received.

B) The $1,500 as unearned revenue and the $3,500 as revenue when it is received.

C) $5,000 as revenue at the completion of the project.

D) The $1,500 as unearned revenue and $5,000 as revenue when the project is completed.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

30

In which of the following businesses would the delivery of the product and the collection of cash occur at the same time?

A) a clothing retail store

B) a consulting firm

C) a home builder

D) an advertising firm

A) a clothing retail store

B) a consulting firm

C) a home builder

D) an advertising firm

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

31

Indicators that control has been transferred to a customer under the contract-based approach include all of the following, except for

A) payment has been received

B) transfer of risks and rewards of ownership

C) physical possession

D) legal title

A) payment has been received

B) transfer of risks and rewards of ownership

C) physical possession

D) legal title

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

32

For a contract to exist all of the following criteria must be met, except for

A) it has been approved and the parties are committed to their obligations

B) a contractual commitment in the form of a deposit

C) it must have commercial substance

D) it is legally enforceable

A) it has been approved and the parties are committed to their obligations

B) a contractual commitment in the form of a deposit

C) it must have commercial substance

D) it is legally enforceable

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

33

Earnings are considered to be of lower quality if

A) cash flow from operating activities is greater than net earnings.

B) cash flow from financing activities is less than net earnings.

C) cash flow from operating activities is less than net earnings.

D) cash flow from investing activities is less than net earnings.

A) cash flow from operating activities is greater than net earnings.

B) cash flow from financing activities is less than net earnings.

C) cash flow from operating activities is less than net earnings.

D) cash flow from investing activities is less than net earnings.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

34

Which of the following would indicate high quality earnings for a company?

A) Increasing revenue while cash from operations is stable.

B) Increasing net income while cash from operations decreases.

C) Revenue and net income that move together.

D) Net income and cash flow from operations that move together.

A) Increasing revenue while cash from operations is stable.

B) Increasing net income while cash from operations decreases.

C) Revenue and net income that move together.

D) Net income and cash flow from operations that move together.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

35

Variable consideration in the transaction price refers to, at least in part:

A) variations in the number of items ordered and delivered

B) the impact of price related to discounts or refunds

C) the selling company's return policies

D) the purchaser's payment terms

A) variations in the number of items ordered and delivered

B) the impact of price related to discounts or refunds

C) the selling company's return policies

D) the purchaser's payment terms

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

36

Under ASPE, when revenue is earned from the sale of goods under the earnings based approach, all of the following criteria must be met before revenue can be recognized except

A) the amount of consideration received can be measured with reasonable assurance.

B) collection is reasonably assured.

C) all sales returns and allowances have been recorded.

D) risks and rewards of ownership have been transferred to the customer.

A) the amount of consideration received can be measured with reasonable assurance.

B) collection is reasonably assured.

C) all sales returns and allowances have been recorded.

D) risks and rewards of ownership have been transferred to the customer.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

37

Earnings are considered to be of higher quality if

A) cash flow from operating activities is greater than net earnings.

B) cash flow from operating activities is less than net earnings.

C) cash flow from investing activities is greater than net earnings.

D) cash flow from investing activities is less than net earnings.

A) cash flow from operating activities is greater than net earnings.

B) cash flow from operating activities is less than net earnings.

C) cash flow from investing activities is greater than net earnings.

D) cash flow from investing activities is less than net earnings.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

38

When a company reports net income, financial statement users see this as a sign that

A) the company is viable.

B) the company has the ability to sustain itself.

C) the company has the ability to declare dividends.

D) all of the above.

A) the company is viable.

B) the company has the ability to sustain itself.

C) the company has the ability to declare dividends.

D) all of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

39

In the retail industry, when customers pay cash at the time of sale, revenue is recognized

A) when the inventory is purchased.

B) at the time of sale.

C) when the time frame for returns has passed.

D) when the cash is deposited in the bank.

A) when the inventory is purchased.

B) at the time of sale.

C) when the time frame for returns has passed.

D) when the cash is deposited in the bank.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

40

When there has been a change in the number of preferred shares during the period, a weighted average number of shares must be determined for the EPS calculation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

41

Operating expenses included all of the following except

A) advertising.

B) depreciation.

C) rent.

D) loss on sale of equipment.

A) advertising.

B) depreciation.

C) rent.

D) loss on sale of equipment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

42

During the current year, BMI Corporation sold $1,250,000 in goods that cost $750,000. Cash sales were $500,000 and credit sales $750,000. BMI collected $500,000 of the credit sales during the year. What amount of revenue should BMI recognize for the year under the revenue recognition criteria of the contract-based approach?

A) $1,250,000

B) $ 500,000

C) $ 750,000

D) $ 1,000,000

A) $1,250,000

B) $ 500,000

C) $ 750,000

D) $ 1,000,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

43

All of the following are examples of service revenues except

A) cell phone, internet, or television services.

B) cargo revenues when airlines provide flight services to their customers.

C) textbook sales by universities and colleges.

D) service and maintenance revenue by vehicle manufacturers.

A) cell phone, internet, or television services.

B) cargo revenues when airlines provide flight services to their customers.

C) textbook sales by universities and colleges.

D) service and maintenance revenue by vehicle manufacturers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

44

With consignment arrangements

A) the consignee owns the goods

B) the consignor has physical possession of the goods

C) the consignor recognizes revenue when it transfers the goods to the consignee

D) the consignor owns the goods until they are sold

A) the consignee owns the goods

B) the consignor has physical possession of the goods

C) the consignor recognizes revenue when it transfers the goods to the consignee

D) the consignor owns the goods until they are sold

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

45

The difference between sales revenue and cost of goods sold is

A) sales revenue.

B) gross profit.

C) operating income.

D) net income.

A) sales revenue.

B) gross profit.

C) operating income.

D) net income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

46

Factors that are indicative of a service warranty include all of the following except for

A) The warranty is legally required.

B) The warranty's price is negotiated separately.

C) The warranty is considered to be a separate performance obligation.

D) Warranty coverage period is longer.

A) The warranty is legally required.

B) The warranty's price is negotiated separately.

C) The warranty is considered to be a separate performance obligation.

D) Warranty coverage period is longer.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

47

On September 1, Duval Enterprises collected rent for 3 months in advance. The total collected was $1,200. How much rent revenue should Duval recognize for the month of September?

A) $1,200

B) $ 300

C) $ 600

D) $ 400

A) $1,200

B) $ 300

C) $ 600

D) $ 400

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

48

All of the following categories have established revenue recognition criteria except

A) sales of goods.

B) collection of accounts receivable.

C) provision of services.

D) contracts.

A) sales of goods.

B) collection of accounts receivable.

C) provision of services.

D) contracts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

49

Tuition services when universities and colleges provide educational services are considered revenue from

A) sale of goods.

B) provision of services.

C) receipt of interest.

D) none of the above.

A) sale of goods.

B) provision of services.

C) receipt of interest.

D) none of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

50

Melanie purchases an new Honda Civic. During the negotiations the sales representative gives her the opportunity to purchase a 10-year bumper to bumper warranty. This is referred to as a(n):

A) Assurance warranty

B) Purchase warranty

C) Money back guarantee

D) Service warranty

A) Assurance warranty

B) Purchase warranty

C) Money back guarantee

D) Service warranty

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

51

Oceans Limited sold $1,750,000 worth of goods during the current year. The cost of goods sold is $1,050,000. Credit sales were $1,575,000, of which 40% were still outstanding. How much cash was collected by Oceans Ltd.?

A) $1,575,000

B) $1,120,000

C) $ 805,000

D) $ 175,000

A) $1,575,000

B) $1,120,000

C) $ 805,000

D) $ 175,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

52

The final step in preparing the multi-step income statement is

A) sales revenue.

B) gross profit.

C) operating income.

D) net income.

A) sales revenue.

B) gross profit.

C) operating income.

D) net income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

53

Under the contract base approach, when management estimates the extent of expected returns as a form of variable consideration, the company must establish a(n):

A) Warranty expense account

B) Returns and allowances account

C) Refund liability account

D) Warranty liability account

A) Warranty expense account

B) Returns and allowances account

C) Refund liability account

D) Warranty liability account

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

54

How should Magic Mountain account for the corporate tickets not redeemed?

A) They should estimate an amount at the time of sale and recognize it as revenue then.

B) They should estimate an amount at the time of sale and recognize it as revenue evenly throughout the ski season.

C) They should estimate an amount at the time of sale and recognize it as revenue proportionally every time a coupon is redeemed.

D) They should recognize it as revenue at the end of the ski season.

A) They should estimate an amount at the time of sale and recognize it as revenue then.

B) They should estimate an amount at the time of sale and recognize it as revenue evenly throughout the ski season.

C) They should estimate an amount at the time of sale and recognize it as revenue proportionally every time a coupon is redeemed.

D) They should recognize it as revenue at the end of the ski season.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

55

When following ASPE, all of the following criteria must be satisfied in order to recognize revenue for the sales of goods under the earnings based approach, except

A) the service has been performed.

B) the risks and rewards have been transferred to the customer.

C) the seller has no continuing involvement.

D) collection is reasonably assured.

A) the service has been performed.

B) the risks and rewards have been transferred to the customer.

C) the seller has no continuing involvement.

D) collection is reasonably assured.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

56

The Carluccis decided to open a resort. In the first month of operation they collected cash and credit card receipts of $1,612.50. All rooms rent out at $75 a night and during the month they had 19 room rentals. In addition to the 19 rentals, they received non-refundable deposits of $37.50 each on another five nights of rentals. Two of those deposits related to the current month and the people failed to show up. The Carluccis did not refund the deposits for these two customers. The remaining three deposits are for future stays. The appropriate amount for them to recognize as revenue for their first month is

A) $1,425.

B) $1,500.

C) $1,800.

D) $1,575.

A) $1,425.

B) $1,500.

C) $1,800.

D) $1,575.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

57

With consignment sales, at the time of the sale to a third party:

A) the consignee only records revenue

B) the consignor only records revenue

C) the customer records the sale

D) the consignee and the consignor record revenue

A) the consignee only records revenue

B) the consignor only records revenue

C) the customer records the sale

D) the consignee and the consignor record revenue

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

58

The difference between gross profit and the company's operating expenses is

A) sales revenue.

B) gross profit.

C) operating income.

D) net income.

A) sales revenue.

B) gross profit.

C) operating income.

D) net income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

59

The contract-based approach to revenue recognition must be used under:

A) ASPE

B) IFRS

C) For both IFRS and ASPE

D) This is an option under both IFRS and ASPE, companies may choose the method that best reflect the firm's economic position.

A) ASPE

B) IFRS

C) For both IFRS and ASPE

D) This is an option under both IFRS and ASPE, companies may choose the method that best reflect the firm's economic position.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

60

When following ASPE, all of the following criteria must be satisfied in order to recognize revenue for the provision of services, under the earnings based approach, except

A) the service has been performed.

B) the amount of consideration to be received can be measured with reasonably assurance.

C) the seller has no continuing involvement.

D) collection is reasonably assured.

A) the service has been performed.

B) the amount of consideration to be received can be measured with reasonably assurance.

C) the seller has no continuing involvement.

D) collection is reasonably assured.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

61

Basic EPS is

A) a measurement of company growth.

B) required on the financial statements under IFRS.

C) used by creditors to make lending decisions.

D) used to determine share price, the lower the EPS the higher the share price.

A) a measurement of company growth.

B) required on the financial statements under IFRS.

C) used by creditors to make lending decisions.

D) used to determine share price, the lower the EPS the higher the share price.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

62

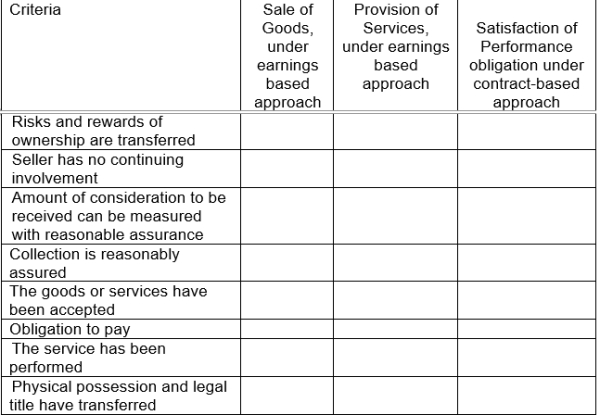

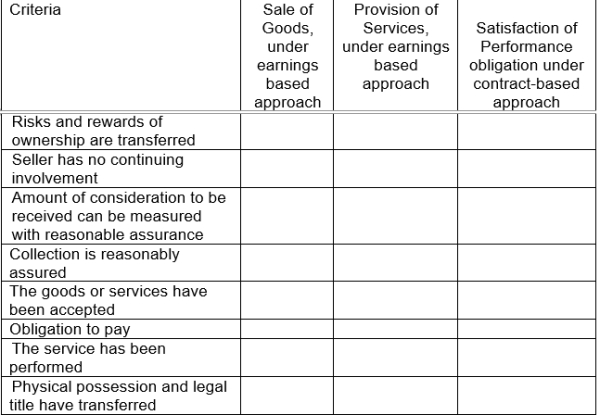

Place an X for each criterion that must be met in order to recognize revenue in each category.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

63

Standard setters provide guidelines for recognizing revenue. There are separate standards for IFRS versus ASPE regarding how and when revenue can be recognized.

Instructions

a) Identify and explain the method used to recognize revenue under IFRS.

b) How does the method allowed for IFRS differ from what is allowed under ASPE?

Instructions

a) Identify and explain the method used to recognize revenue under IFRS.

b) How does the method allowed for IFRS differ from what is allowed under ASPE?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

64

On September 25, Olive Oil Distributors receives an order from DeNarda Italian Supermarkets for 125 cases of extra virgin olive oil. Olive Oil accepts the order, which needs to be delivered to DeNarda's warehouse and DeNarda agrees to pay within 30 days of the receipt of the product. Each case of extra virgin olive oil contains 12 bottles at a selling price of $7.50 each. Olive Oil's cost is $3 / bottle. The shipment is received at DeNarda's warehouse on Oct 2 and DeNarda mails a cheque to Olive Oil at the end of the agreed upon payment terms. Olive Oil Distributors used a contact based approach to revenue recognition.

Instructions

a) Determine if there is a contract between Olive Oil Distributors and DeNarda Italian Supermarkets.

b) If there is a contract, record Olive Oil's entries related to these transactions.

Instructions

a) Determine if there is a contract between Olive Oil Distributors and DeNarda Italian Supermarkets.

b) If there is a contract, record Olive Oil's entries related to these transactions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

65

Buff it Up, a privately held corporation using ASPE, successfully operates two high-end fitness centres in the same town. Members pay a $150 non-refundable initiation fee, and then a one-year membership for unlimited access to the facilities costs an additional $900. They have 3,200 active members. Memberships are required to be paid in full, in three equal monthly instalments over the first 3 months of a membership year. Partial refunds of the annual fees are only given if a member moves more than 50 kilometres away. In addition to the facilities, there is a juice bar that sells fruit smoothies and healthy snacks. Members can sign for their purchases at the juice bar and then they are billed at the end of the month.

Instructions

Discuss when all revenues should be recognized at Buff it Up. Support your discussion with reference to the specific revenue recognition criteria.

Instructions

Discuss when all revenues should be recognized at Buff it Up. Support your discussion with reference to the specific revenue recognition criteria.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

66

Conquistitor Ltd. reported net income of $750,000 for the year ended July 31, 2020. During the year, the company also declared and paid dividends of $45,000 on the company's preferred shares. At the beginning of the year, Conquistitor had 350,000 common shares outstanding. No shares were issued or repurchased during the year.

Instructions

a) Calculate the basic earnings per-share ratio.

b) Assume 200,000 common shares were issued on Aug 1, 2019 and an additional 150,000 common shares issued on April 1, 2020. Calculate the basic earnings per-share ratio.

Instructions

a) Calculate the basic earnings per-share ratio.

b) Assume 200,000 common shares were issued on Aug 1, 2019 and an additional 150,000 common shares issued on April 1, 2020. Calculate the basic earnings per-share ratio.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

67

Comprehensive income is equal to

A) net income minus other comprehensive income.

B) net income plus other comprehensive income.

C) gross profit plus other comprehensive income.

D) gross profit minus other comprehensive income.

A) net income minus other comprehensive income.

B) net income plus other comprehensive income.

C) gross profit plus other comprehensive income.

D) gross profit minus other comprehensive income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

68

Identify and describe the differences between an assurance warranty and service warranty. What are the characteristics of a service warranty?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

69

If your university or college presents its expenses using the terms academic, administration, and student services, the university is presenting their expenses

A) by nature.

B) by function.

C) alphabetically.

D) arbitrarily.

A) by nature.

B) by function.

C) alphabetically.

D) arbitrarily.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

70

What is comprehensive income? How is it reflected in the financial statements? How does it differ from operating income? Provide examples.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

71

Basically Beautiful Wholesaler sells beauty products to salons and spas. The company's sales for the period ended December 31, 2020 were $1,175,000. The cost of sales are estimated at 60% of revenues, with an estimated return rate of 5%. Returned product is expected to be scrapped. All sales are made on account.

Instructions

a) Prepare Basically Beautiful's partial Statement of Income.

b) Record Basically Beautiful's sales for the period.

Instructions

a) Prepare Basically Beautiful's partial Statement of Income.

b) Record Basically Beautiful's sales for the period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

72

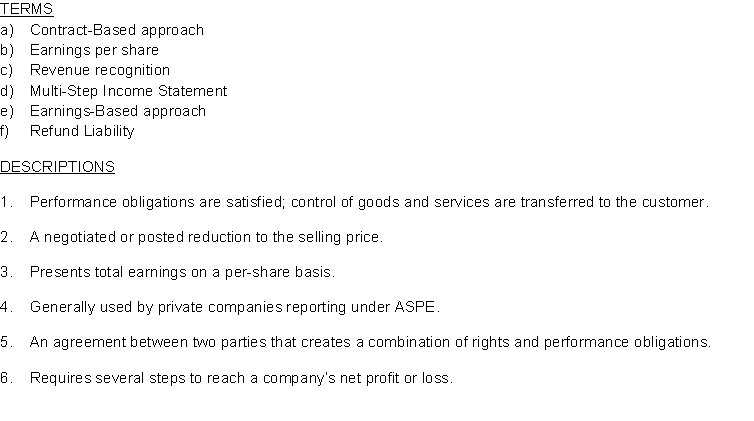

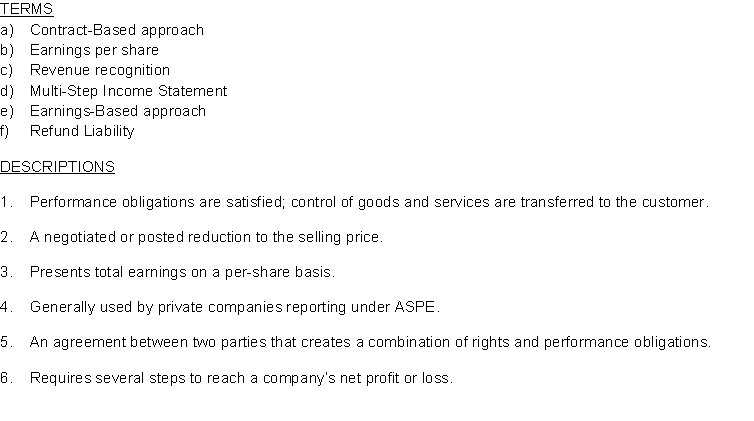

Match the following terms to the descriptions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

73

On January 2, 2020 Geek Computers enters into a contract with Bison Protection, a well-established fire protection company, to upgrade and install new computers at 65 work stations. As part of the contract Geek computers also agrees to connect and network all of the computers. Contract details include the following:

The total contract price is $67,500.

The normal retail price of the computers is $48,750. Geek Computers would normally charge $12,500 for an installation of this size and $10,750 for networking services.

The computers cost Geek Computers $500 each.

The contract requires Geek Computers to deliver the computers by January 25, 2020 and have the installation and networking completed by February 15, 2020.

Bison agrees to pay $45,000 upon the delivery of the computers and the balance once the installation is complete, the final payment was made February 28.

Geek Computers uses the contact based approach for revenue recognition.

Instructions

a) Determine if there is a contract between Geek Computers and Bison Protection.

b) If there is a contract, record Geek Computer's entries related to these transactions.

The total contract price is $67,500.

The normal retail price of the computers is $48,750. Geek Computers would normally charge $12,500 for an installation of this size and $10,750 for networking services.

The computers cost Geek Computers $500 each.

The contract requires Geek Computers to deliver the computers by January 25, 2020 and have the installation and networking completed by February 15, 2020.

Bison agrees to pay $45,000 upon the delivery of the computers and the balance once the installation is complete, the final payment was made February 28.

Geek Computers uses the contact based approach for revenue recognition.

Instructions

a) Determine if there is a contract between Geek Computers and Bison Protection.

b) If there is a contract, record Geek Computer's entries related to these transactions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

74

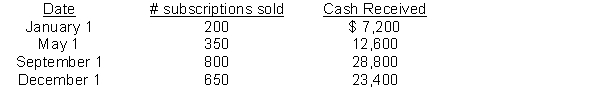

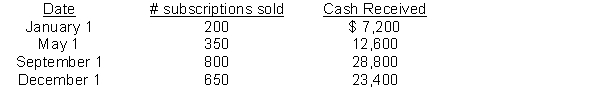

Gossip Girl publishes and sells magazines catering to teenage girls. Subscriptions are sold for $36 for twelve monthly issues. The following chart indicates how many magazines were sold during 2020 and what payment they had received from subscribers by year-end. The first magazine is delivered the same month the subscription is sold. Gossip Girl uses the earning approach for revenue recognition.  Instructions

Instructions

a) How much cash did Gossip Girl collect in 2020?

b) What amount of revenue should Great Gossip report for the year ended December 31, 2020?

c) Are there differences between the amount of cash collected and the revenues recognized? If so, explain why.

Instructions

Instructions a) How much cash did Gossip Girl collect in 2020?

b) What amount of revenue should Great Gossip report for the year ended December 31, 2020?

c) Are there differences between the amount of cash collected and the revenues recognized? If so, explain why.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

75

On March 15, Luxurious Landscapers enters into a contract with Direct Insurance Brokers to provide landscaping services for the spring and summer season. The contract is to begin on May 1 and terminate on October 31. Luxurious will provide weekly landscaping services during this period. The entire value of the contract is $7,200 for 6 months, to be paid monthly on the first day of each month. Luxurious Landscapers uses the contract-based approach for revenue recognition.

Instructions

a) Determine if there is a contract between Luxurious Landscapers and Direct Insurance Brokers.

b) If there is a contract, record Luxurious' entries related to these transactions for the month of May.

Instructions

a) Determine if there is a contract between Luxurious Landscapers and Direct Insurance Brokers.

b) If there is a contract, record Luxurious' entries related to these transactions for the month of May.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

76

Comprehensive income includes

A) gains or losses from the sale of property, plant and equipment.

B) gains or losses from the sale of intangible assets.

C) gains or losses from revaluing certain financial statement items to fair value.

D) all of the above

A) gains or losses from the sale of property, plant and equipment.

B) gains or losses from the sale of intangible assets.

C) gains or losses from revaluing certain financial statement items to fair value.

D) all of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

77

Examples of functional areas of the income statement are

A) sales, gross profit, and net income.

B) cost of sales, administrative activities, and selling activities.

C) wages expenses, depreciation, and rent expense.

D) gross profit, operating income, and net income.

A) sales, gross profit, and net income.

B) cost of sales, administrative activities, and selling activities.

C) wages expenses, depreciation, and rent expense.

D) gross profit, operating income, and net income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

78

Under IFRS the contract-based approach must be used for revenue recognition. Identify and describe the five-step model of revenue recognition that must be used.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck