Deck 1: Accounting As a Form of Communication

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/487

العب

ملء الشاشة (f)

Deck 1: Accounting As a Form of Communication

1

Which of the following statements best describes the term "revenues"?

A) Revenues represent an outflow of assets resulting from the sale of goods or services.

B) Revenues represent assets received from the sale of products or services.

C) Revenues represent assets used or consumed in the sale of products or services.

D) Revenues represent the dollar amount of bonds sold to the public.

A) Revenues represent an outflow of assets resulting from the sale of goods or services.

B) Revenues represent assets received from the sale of products or services.

C) Revenues represent assets used or consumed in the sale of products or services.

D) Revenues represent the dollar amount of bonds sold to the public.

B

2

Is the name of the branch of accounting concerned with providing managers and administrators with information to facilitate the planning and control of business operations?

A) Management accounting

B) Auditing

C) Financial accounting

D) Bookkeeping

A) Management accounting

B) Auditing

C) Financial accounting

D) Bookkeeping

A

3

Which of the following statements would be true if you own stock in a company?

A) You are an owner of the retained earnings and capital stock of the company.

B) You have a claim to the assets of the business.

C) You have the right to receive interest on an annual basis.

D) You have the right to a portion of the company's revenues each accounting period.

A) You are an owner of the retained earnings and capital stock of the company.

B) You have a claim to the assets of the business.

C) You have the right to receive interest on an annual basis.

D) You have the right to a portion of the company's revenues each accounting period.

B

4

Which one of the following is least likely to be a user of financial information of a grocery store?

A) The manager of the grocery store.

B) The supplier of milk to the grocery store.

C) A stockbroker looking for a possible investment.

D) A customer at the grocery store.

A) The manager of the grocery store.

B) The supplier of milk to the grocery store.

C) A stockbroker looking for a possible investment.

D) A customer at the grocery store.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 487 في هذه المجموعة.

فتح الحزمة

k this deck

5

The costs of doing business through the sale of goods and services are called:

A) Net income.

B) Expenses.

C) Revenues.

D) Dividends.

A) Net income.

B) Expenses.

C) Revenues.

D) Dividends.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 487 في هذه المجموعة.

فتح الحزمة

k this deck

6

Which of the following best describes the term "assets"?

A) The amount of total profits earned by a business since it began operations.

B) The amount of interest or claim that the owners have in the business.

C) The economic resources of a business entity.

D) The cumulative profits earned by a business less any dividends distributed.

A) The amount of total profits earned by a business since it began operations.

B) The amount of interest or claim that the owners have in the business.

C) The economic resources of a business entity.

D) The cumulative profits earned by a business less any dividends distributed.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 487 في هذه المجموعة.

فتح الحزمة

k this deck

7

Which one of the following is not an external user of financial statements?

A) Suppliers

B) Creditors

C) Investors

D) The company's controller

A) Suppliers

B) Creditors

C) Investors

D) The company's controller

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 487 في هذه المجموعة.

فتح الحزمة

k this deck

8

Which one of the following events involves a liability for a business?

A) Loans to be repaid to banks

B) Inventories purchased for cash

C) Amounts invested by the owners

D) Stock sold to the general public

A) Loans to be repaid to banks

B) Inventories purchased for cash

C) Amounts invested by the owners

D) Stock sold to the general public

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 487 في هذه المجموعة.

فتح الحزمة

k this deck

9

Which one of the following is not an external user of financial information?

A) Company management

B) Internal Revenue Service

C) Creditors

D) Stockholders

A) Company management

B) Internal Revenue Service

C) Creditors

D) Stockholders

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 487 في هذه المجموعة.

فتح الحزمة

k this deck

10

Which of the following would be classified as external users of financial statements?

A) Stockholders and management of the company

B) The controller of the company and a company's stockholders

C) The company's marketing managers

D) The creditors and stockholders of the company

A) Stockholders and management of the company

B) The controller of the company and a company's stockholders

C) The company's marketing managers

D) The creditors and stockholders of the company

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 487 في هذه المجموعة.

فتح الحزمة

k this deck

11

Which of the following would be internal users of accounting information?

A) Customers and vendors

B) Employees and managers

C) Government and banks

D) Employees and customers

A) Customers and vendors

B) Employees and managers

C) Government and banks

D) Employees and customers

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 487 في هذه المجموعة.

فتح الحزمة

k this deck

12

The three forms of business entities are:

A) Government, cooperatives, and philanthropic organizations.

B) Financing, investing, and operating.

C) Sole proprietorships, partnerships, and corporations.

D) Wholesaler, manufacturer, and retailer.

A) Government, cooperatives, and philanthropic organizations.

B) Financing, investing, and operating.

C) Sole proprietorships, partnerships, and corporations.

D) Wholesaler, manufacturer, and retailer.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 487 في هذه المجموعة.

فتح الحزمة

k this deck

13

Which of the following best describes the term "expenses"?

A) The amount of total profits earned by a business since it began operations.

B) The amount of interest or claim that the owners have in the business.

C) The future economic resources of a business entity.

D) The outflow of assets resulting from the sale of goods and services.

A) The amount of total profits earned by a business since it began operations.

B) The amount of interest or claim that the owners have in the business.

C) The future economic resources of a business entity.

D) The outflow of assets resulting from the sale of goods and services.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 487 في هذه المجموعة.

فتح الحزمة

k this deck

14

Which one of the following business decisions will least likely require financial information?

A) The Gulf Coast Bank is reviewing the loan application from Tuo's Restaurant.

B) Tuo's Restaurant is attempting to sell its stock to the public.

C) The labor union representing Flaggler's Fitness Spa employees is negotiating a pay raise as part of a new labor agreement.

D) Tuo's Restaurant management is deciding whether to wash its catering vans today or tomorrow.

A) The Gulf Coast Bank is reviewing the loan application from Tuo's Restaurant.

B) Tuo's Restaurant is attempting to sell its stock to the public.

C) The labor union representing Flaggler's Fitness Spa employees is negotiating a pay raise as part of a new labor agreement.

D) Tuo's Restaurant management is deciding whether to wash its catering vans today or tomorrow.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 487 في هذه المجموعة.

فتح الحزمة

k this deck

15

United Airlines is an example of a:

A) producer.

B) supplier.

C) retailer.

D) service provider.

A) producer.

B) supplier.

C) retailer.

D) service provider.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 487 في هذه المجموعة.

فتح الحزمة

k this deck

16

Which of the following invests funds into a business and is considered an owner?

A) Stockholders

B) Creditors

C) Bankers

D) Lenders

A) Stockholders

B) Creditors

C) Bankers

D) Lenders

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 487 في هذه المجموعة.

فتح الحزمة

k this deck

17

Barton Building Company is ready to sell its bonds. Which one of the following financial questions is most relevant to the issue of the bonds and that investors will most likely want answered before they purchase the bonds?

A) How many product lines did Barton Building Company have last year?

B) What will be Barton Building Company's cost to start operations in another city?

C) How much debt does Barton Building Company already have?

D) Will Barton Building Company pay dividends?

A) How many product lines did Barton Building Company have last year?

B) What will be Barton Building Company's cost to start operations in another city?

C) How much debt does Barton Building Company already have?

D) Will Barton Building Company pay dividends?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 487 في هذه المجموعة.

فتح الحزمة

k this deck

18

All of the following are examples of retailers except:

A) Sports Authority.

B) Boeing.

C) Home Depot.

D) Best Buy.

A) Sports Authority.

B) Boeing.

C) Home Depot.

D) Best Buy.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 487 في هذه المجموعة.

فتح الحزمة

k this deck

19

Which one of the following is not one of the three activities included in the definition of accounting?

A) Communicating

B) Identifying

C) Measuring

D) Operating

A) Communicating

B) Identifying

C) Measuring

D) Operating

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 487 في هذه المجموعة.

فتح الحزمة

k this deck

20

The inflow of assets resulting from the sale of products and services is called an:

A) asset.

B) liability.

C) revenue.

D) expense.

A) asset.

B) liability.

C) revenue.

D) expense.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 487 في هذه المجموعة.

فتح الحزمة

k this deck

21

Which one of the following correctly represents one of the basic financial statement models?

A) Assets - Liabilities = Net Income

B) Assets + Liabilities = Owners' Equity

C) Revenues + Expenses = Net Income

D) Beginning Retained Earnings + Net Income - Dividends = Ending Retained Earnings

A) Assets - Liabilities = Net Income

B) Assets + Liabilities = Owners' Equity

C) Revenues + Expenses = Net Income

D) Beginning Retained Earnings + Net Income - Dividends = Ending Retained Earnings

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 487 في هذه المجموعة.

فتح الحزمة

k this deck

22

How is the balance sheet linked to the other financial statements?

A) The amount of retained earnings reported on the balance sheet is equal to net income.

B) Retained earnings is added to total assets and reported on the balance sheet.

C) Net income increases retained earnings on the statement of retained earnings, which ultimately increases retained earnings on the balance sheet.

D) There is no link between the balance sheet and other statements, as each contains different accounts and provides different information.

A) The amount of retained earnings reported on the balance sheet is equal to net income.

B) Retained earnings is added to total assets and reported on the balance sheet.

C) Net income increases retained earnings on the statement of retained earnings, which ultimately increases retained earnings on the balance sheet.

D) There is no link between the balance sheet and other statements, as each contains different accounts and provides different information.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 487 في هذه المجموعة.

فتح الحزمة

k this deck

23

Which of the following statements is true?

A) Profits distributed to the creditors are called dividends.

B) The balance sheet shows the assets, liabilities, and profits of a company.

C) Dividends are an expense, and are reported on the income statement as a deduction from net income.

D) The income statement reports the revenues and expenses of a company.

A) Profits distributed to the creditors are called dividends.

B) The balance sheet shows the assets, liabilities, and profits of a company.

C) Dividends are an expense, and are reported on the income statement as a deduction from net income.

D) The income statement reports the revenues and expenses of a company.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 487 في هذه المجموعة.

فتح الحزمة

k this deck

24

Which one of the following items is correct concerning the time element of financial statements?

A) The balance sheet covers a period of time.

B) The statement of retained earnings explains changes during a particular period.

C) An income statement lists amounts at a specific point in time.

D) Both the income statement and the balance sheet cover a period of time.

A) The balance sheet covers a period of time.

B) The statement of retained earnings explains changes during a particular period.

C) An income statement lists amounts at a specific point in time.

D) Both the income statement and the balance sheet cover a period of time.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 487 في هذه المجموعة.

فتح الحزمة

k this deck

25

Which of the following is the correct date format for the financial statement heading?

A) Balance sheet for the year ended June 30, 2015

B) Income statement at December 31, 2015

C) Balance sheet at December 31, 2015

D) Statement of retained earnings at December 31, 2015

A) Balance sheet for the year ended June 30, 2015

B) Income statement at December 31, 2015

C) Balance sheet at December 31, 2015

D) Statement of retained earnings at December 31, 2015

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 487 في هذه المجموعة.

فتح الحزمة

k this deck

26

Which statement summarizes the income earned and the dividends paid?

A) Statement of cash flows

B) Statement of retained earnings

C) Balance sheet

D) Income statement

A) Statement of cash flows

B) Statement of retained earnings

C) Balance sheet

D) Income statement

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 487 في هذه المجموعة.

فتح الحزمة

k this deck

27

Which one of the following groups is considered an internal user of financial statements?

A) A bank reviewing a loan application from a corporation.

B) The labor union representing employees of a company that is involved in labor negotiations.

C) The financial analysts for a brokerage firm who are preparing recommendations for the firm's brokers on companies in a certain industry.

D) Factory managers that supervise production line workers.

A) A bank reviewing a loan application from a corporation.

B) The labor union representing employees of a company that is involved in labor negotiations.

C) The financial analysts for a brokerage firm who are preparing recommendations for the firm's brokers on companies in a certain industry.

D) Factory managers that supervise production line workers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 487 في هذه المجموعة.

فتح الحزمة

k this deck

28

Which one of the following financial statements reports an entity's financial position at a specific date?

A) Balance sheet

B) Statement of retained earnings

C) Income statement

D) Both the income statement and the balance sheet

A) Balance sheet

B) Statement of retained earnings

C) Income statement

D) Both the income statement and the balance sheet

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 487 في هذه المجموعة.

فتح الحزمة

k this deck

29

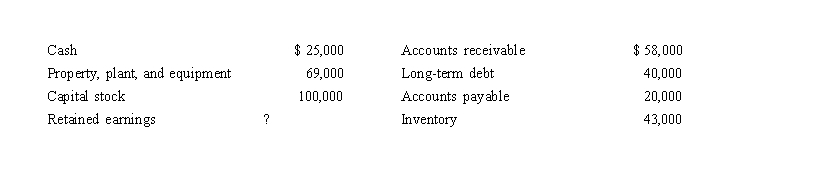

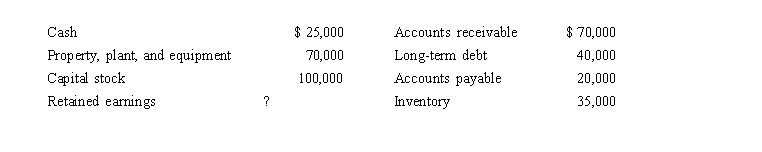

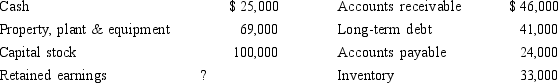

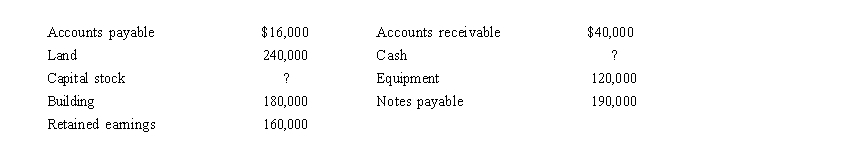

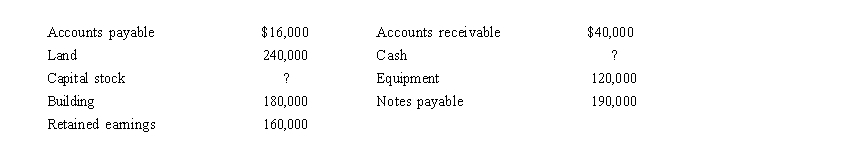

Lawton Corporation's endofyear balance sheet consisted of the following amounts:  What amount should Lawton report on its balance sheet for total assets?

What amount should Lawton report on its balance sheet for total assets?

A) $100,000

B) $161,000

C) $194,000

D) $195,000

What amount should Lawton report on its balance sheet for total assets?

What amount should Lawton report on its balance sheet for total assets?A) $100,000

B) $161,000

C) $194,000

D) $195,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 487 في هذه المجموعة.

فتح الحزمة

k this deck

30

Which of the following is an organization that lends funds to a business entity and expects repayment of the funds?

A) A partner

B) A stockholder

C) An owner

D) A creditor

A) A partner

B) A stockholder

C) An owner

D) A creditor

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 487 في هذه المجموعة.

فتح الحزمة

k this deck

31

Which financial statement would you analyze to determine if a company distributed any of its profits to its shareholders?

A) Balance Sheet

B) Statement of Retained Earnings

C) Income Statement

D) Statement of Public Accounting

A) Balance Sheet

B) Statement of Retained Earnings

C) Income Statement

D) Statement of Public Accounting

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 487 في هذه المجموعة.

فتح الحزمة

k this deck

32

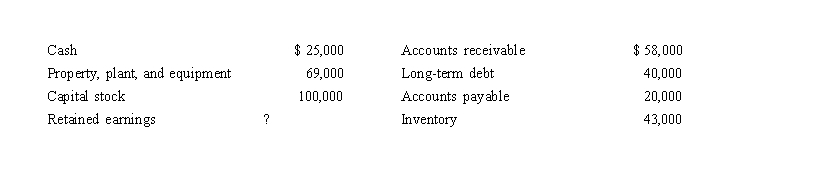

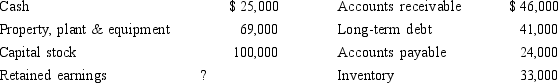

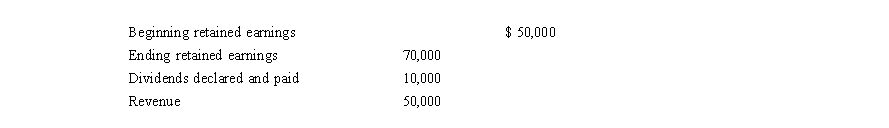

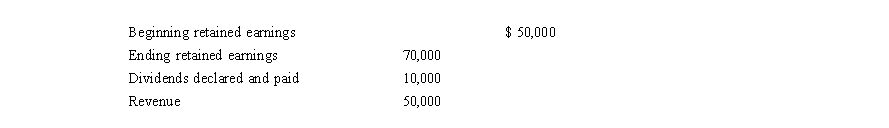

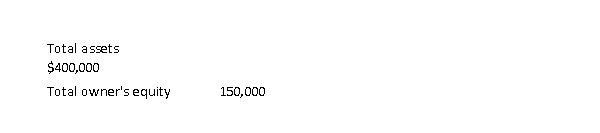

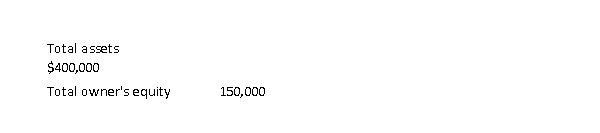

Harbor City Corporation's endofyear balance sheet consisted of the following amounts:  What is Harbor City's retained earnings balance at the end of the current year?

What is Harbor City's retained earnings balance at the end of the current year?

A) $10,000

B) $110,000

C) $160,000

D) $170,000

What is Harbor City's retained earnings balance at the end of the current year?

What is Harbor City's retained earnings balance at the end of the current year?A) $10,000

B) $110,000

C) $160,000

D) $170,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 487 في هذه المجموعة.

فتح الحزمة

k this deck

33

Which one of the following items appears on a balance sheet?

A) Accounts payable

B) Sales revenue

C) Utilities expense

D) Cost of goods sold

A) Accounts payable

B) Sales revenue

C) Utilities expense

D) Cost of goods sold

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 487 في هذه المجموعة.

فتح الحزمة

k this deck

34

Which of the following best describes the term "retained earnings"?

A) The amount of total profits earned by a business since it began operations.

B) The amount of interest or claim that the owners have on the assets of the business.

C) The future economic resources of a business entity.

D) The cumulative profits earned by the business less any dividends distributed.

A) The amount of total profits earned by a business since it began operations.

B) The amount of interest or claim that the owners have on the assets of the business.

C) The future economic resources of a business entity.

D) The cumulative profits earned by the business less any dividends distributed.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 487 في هذه المجموعة.

فتح الحزمة

k this deck

35

Which one of the following is an economic obligation for a business entity?

A) Salaries paid to employees for services rendered

B) Amounts owed to creditors

C) Materials used in manufacturing products

D) Payment of rent for the next year

A) Salaries paid to employees for services rendered

B) Amounts owed to creditors

C) Materials used in manufacturing products

D) Payment of rent for the next year

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 487 في هذه المجموعة.

فتح الحزمة

k this deck

36

Which financial statement would you refer to in order to determine whether a company owed funds to creditors?

A) Balance Sheet

B) Statement of Retained Earnings

C) Income Statement

D) Statement of Public Accounting

A) Balance Sheet

B) Statement of Retained Earnings

C) Income Statement

D) Statement of Public Accounting

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 487 في هذه المجموعة.

فتح الحزمة

k this deck

37

You are a potential stockholder and are concerned that a particular company you are ready to invest in might have too much debt. Which financial statement would provide you information needed in order to evaluate your concern?

A) Balance sheet

B) Income statement

C) Statement of retained earnings

D) Statement of public accounting

A) Balance sheet

B) Income statement

C) Statement of retained earnings

D) Statement of public accounting

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 487 في هذه المجموعة.

فتح الحزمة

k this deck

38

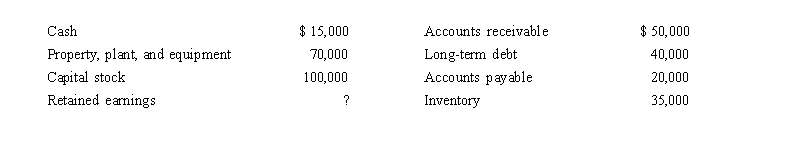

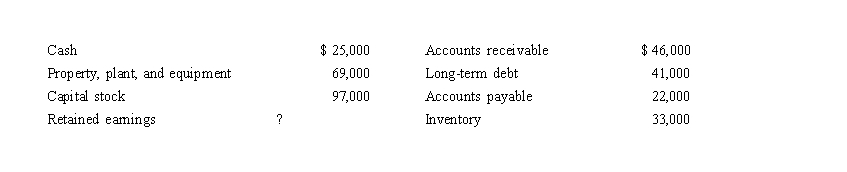

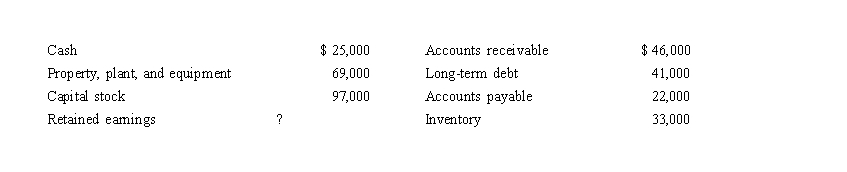

Sun City Corporation's endofyear balance sheet consisted of the following amounts:  What amount should Sun City report on its balance sheet for total assets?

What amount should Sun City report on its balance sheet for total assets?

A) $100,000

B) $95,000

C) $165,000

D) $200,000

What amount should Sun City report on its balance sheet for total assets?

What amount should Sun City report on its balance sheet for total assets?A) $100,000

B) $95,000

C) $165,000

D) $200,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 487 في هذه المجموعة.

فتح الحزمة

k this deck

39

Which of the following terms best describes a distribution of the net income of a business to its owners?

A) Revenue

B) Dividends

C) Earnings

D) Monetary unit

A) Revenue

B) Dividends

C) Earnings

D) Monetary unit

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 487 في هذه المجموعة.

فتح الحزمة

k this deck

40

Which one of the following is a correct expression of the accounting equation?

A) Assets + Liabilities = Owners' Equity

B) Assets = Liabilities Owners' Equity

C) Assets + Owners' Equity = Liabilities

D) Assets = Liabilities + Owners' Equity

A) Assets + Liabilities = Owners' Equity

B) Assets = Liabilities Owners' Equity

C) Assets + Owners' Equity = Liabilities

D) Assets = Liabilities + Owners' Equity

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 487 في هذه المجموعة.

فتح الحزمة

k this deck

41

Gyro's Shop reported a net loss of $15,000 and total expenses of $80,000. How much are total revenues?

A) $ 15,000

B) $ 65,000

C) $ 95,000

D) The answer cannot be determined from the information given.

A) $ 15,000

B) $ 65,000

C) $ 95,000

D) The answer cannot be determined from the information given.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 487 في هذه المجموعة.

فتح الحزمة

k this deck

42

If a company has $152,000 of revenues, declares and pays $55,000 in dividends, and has net income of $89,000, how much were expenses for the year?

A) $ 8,000

B) $ 63,000

C) $144,000

D) Unable to determine the amount due to incomplete information.

A) $ 8,000

B) $ 63,000

C) $144,000

D) Unable to determine the amount due to incomplete information.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 487 في هذه المجموعة.

فتح الحزمة

k this deck

43

Front Corporation's endofyear balance sheet consisted of the following amounts:  What is Front's owners' equity balance at the end of the current year?

What is Front's owners' equity balance at the end of the current year?

A) $3,000

B) $110,000

C) $63,000

D) $173,000

What is Front's owners' equity balance at the end of the current year?

What is Front's owners' equity balance at the end of the current year?A) $3,000

B) $110,000

C) $63,000

D) $173,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 487 في هذه المجموعة.

فتح الحزمة

k this deck

44

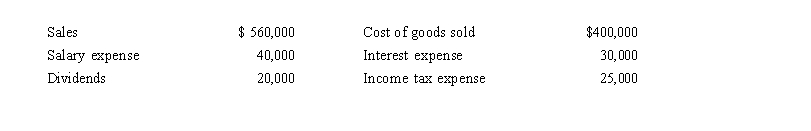

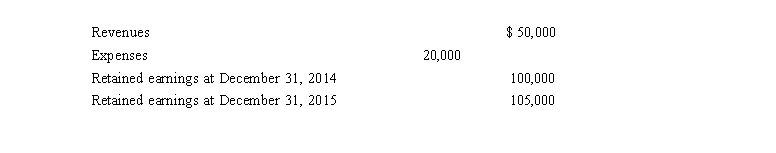

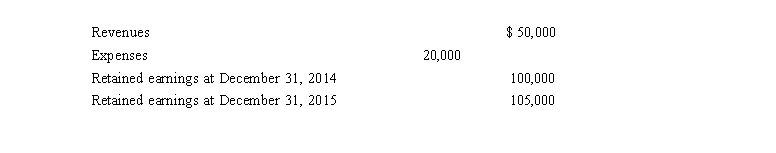

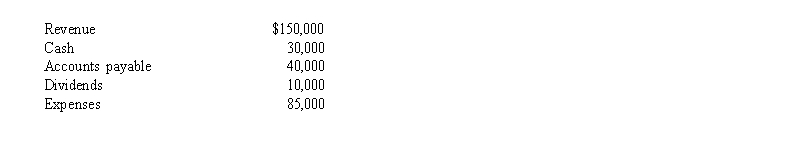

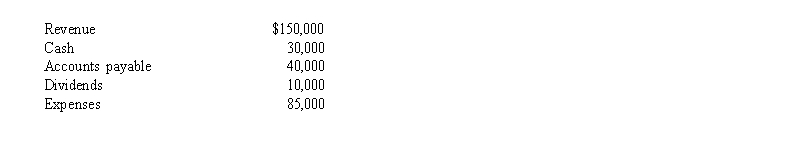

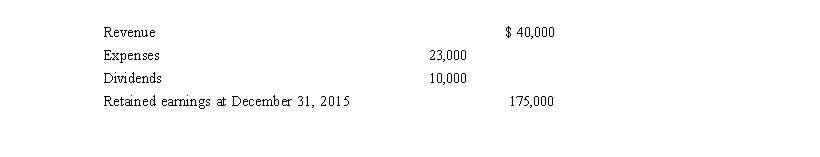

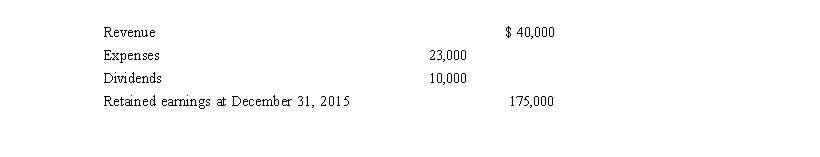

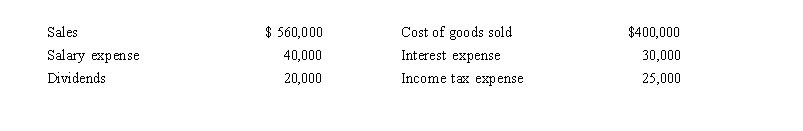

Marcos Company reported the following items on its financial statements for the year ending December 31, 2015:  How much will be reported as retained earnings on Marcos' balance sheet at December 31, 2015, if this is the first year of operations?

How much will be reported as retained earnings on Marcos' balance sheet at December 31, 2015, if this is the first year of operations?

A) $ 45,000

B) $ 65,000

C) $ 85,000

D) Not enough information is provided.

How much will be reported as retained earnings on Marcos' balance sheet at December 31, 2015, if this is the first year of operations?

How much will be reported as retained earnings on Marcos' balance sheet at December 31, 2015, if this is the first year of operations?A) $ 45,000

B) $ 65,000

C) $ 85,000

D) Not enough information is provided.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 487 في هذه المجموعة.

فتح الحزمة

k this deck

45

Global Inc. had net income for 2015 of $24,000. It declared and paid a $13,000 cash dividend in 2015. If the company's retained earnings for the end of the year was $39,600, what was the company's retained earnings balance at the beginning of 2015?

A) $28,600

B) $50,600

C) $76,600

D) $2,600

A) $28,600

B) $50,600

C) $76,600

D) $2,600

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 487 في هذه المجموعة.

فتح الحزمة

k this deck

46

On January 1, 2015, Flaggler Company's balance in retained earnings was $70,000. During 2015, the company earned net income of $43,000 and paid $15,000 in dividends. Calculate the retained earnings balance at December 31, 2015.

A)$42,000

B)$90,000

C)$98,000

D)$113,00

A)$42,000

B)$90,000

C)$98,000

D)$113,00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 487 في هذه المجموعة.

فتح الحزمة

k this deck

47

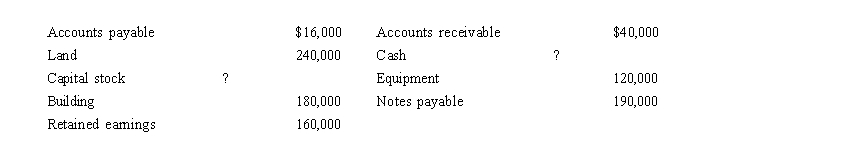

At December 31, 2015, the accounting records of Farmer Corporation contain the following:  If Cash is $26,000, what is the December 31, 2015 capital stock balance?

If Cash is $26,000, what is the December 31, 2015 capital stock balance?

A) $272,000

B) $240,000

C) $220,000

D) $400,000

If Cash is $26,000, what is the December 31, 2015 capital stock balance?

If Cash is $26,000, what is the December 31, 2015 capital stock balance?A) $272,000

B) $240,000

C) $220,000

D) $400,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 487 في هذه المجموعة.

فتح الحزمة

k this deck

48

Cerrato Company has assets of $350,000, liabilities of $130,000, and retained earnings of $180,000. How much is total owners' equity?

A) $ 40,000

B) $ 170,000

C) $ 220,000

D) $ 350,000

A) $ 40,000

B) $ 170,000

C) $ 220,000

D) $ 350,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 487 في هذه المجموعة.

فتح الحزمة

k this deck

49

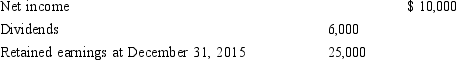

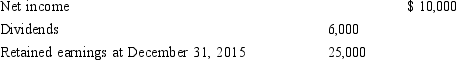

Volt Corp. reported the following information for the year ended December 31, 2015:  How much was paid out in dividends by Volt in 2015?

How much was paid out in dividends by Volt in 2015?

A) $ 20,000

B) $ 25,000

C) $ 30,000

D) $ 50,000

How much was paid out in dividends by Volt in 2015?

How much was paid out in dividends by Volt in 2015?A) $ 20,000

B) $ 25,000

C) $ 30,000

D) $ 50,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 487 في هذه المجموعة.

فتح الحزمة

k this deck

50

Morton Corporation reported the following information for the year ended December 31, 2015:  What was the balance of Morton's' retained earnings at January 1, 2015?

What was the balance of Morton's' retained earnings at January 1, 2015?

A) $21,000

B) $29,000

C) $31,000

D) $35,000

What was the balance of Morton's' retained earnings at January 1, 2015?

What was the balance of Morton's' retained earnings at January 1, 2015?A) $21,000

B) $29,000

C) $31,000

D) $35,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 487 في هذه المجموعة.

فتح الحزمة

k this deck

51

On January 1, 2015, A-Best Company's balance in retained earnings was $70,000. At the end of the year, December 31, 2015, the balance in retained earnings was $94,000. During 2015, the company earned net income of $40,000. How much were dividends?

A) $16,000 b .$24000

C) $40,000

D) $64,000

A) $16,000 b .$24000

C) $40,000

D) $64,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 487 في هذه المجموعة.

فتح الحزمة

k this deck

52

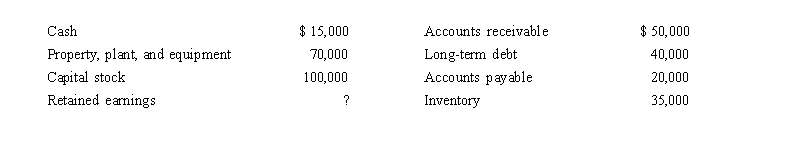

Brock Corporation's endofyear balance sheet consisted of the following amounts:  What is Brock's total liabilities balance at the end of the current year?

What is Brock's total liabilities balance at the end of the current year?

A) $8,000

B) $65,000

C) $108,000

D) $173,000

What is Brock's total liabilities balance at the end of the current year?

What is Brock's total liabilities balance at the end of the current year?A) $8,000

B) $65,000

C) $108,000

D) $173,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 487 في هذه المجموعة.

فتح الحزمة

k this deck

53

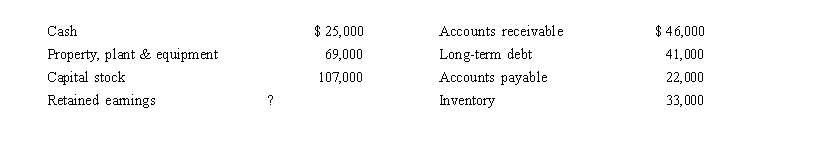

Lakeland Corporation's endofyear balance sheet consisted of the following amounts:  What is Lakeland's retained earnings balance at the end of the current year?

What is Lakeland's retained earnings balance at the end of the current year?

A) $13,000

B) $34,000

C) $76,000

D) $173,000

What is Lakeland's retained earnings balance at the end of the current year?

What is Lakeland's retained earnings balance at the end of the current year?A) $13,000

B) $34,000

C) $76,000

D) $173,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 487 في هذه المجموعة.

فتح الحزمة

k this deck

54

The following information is provided by the Ferrara Corporation:  Calculate Ferrara Corporation's expenses. a $20,000

Calculate Ferrara Corporation's expenses. a $20,000

B) $30,000

C) $40,000

D) Cannot tell from the information provided.

Calculate Ferrara Corporation's expenses. a $20,000

Calculate Ferrara Corporation's expenses. a $20,000B) $30,000

C) $40,000

D) Cannot tell from the information provided.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 487 في هذه المجموعة.

فتح الحزمة

k this deck

55

Surge Company reports the following information at December 31, 2015:  What is Surge Company's net income?

What is Surge Company's net income?

A) $ 15,000

B) $ 45,000

C) $ 55,000

D) $ 65,000

What is Surge Company's net income?

What is Surge Company's net income?A) $ 15,000

B) $ 45,000

C) $ 55,000

D) $ 65,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 487 في هذه المجموعة.

فتح الحزمة

k this deck

56

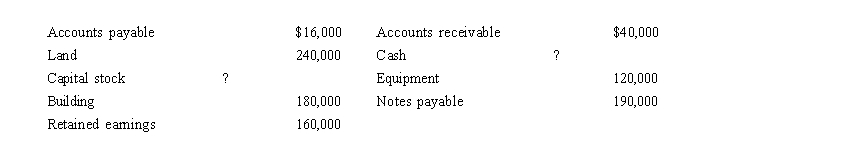

At December 31, 2015, the accounting records of Wyndam Corporation contain the following:  If capital stock is $260,000, what is the December 31, 2015 cash balance?

If capital stock is $260,000, what is the December 31, 2015 cash balance?

A) $46,000

B) $506,000

C) $94,000

D) $86,000

If capital stock is $260,000, what is the December 31, 2015 cash balance?

If capital stock is $260,000, what is the December 31, 2015 cash balance?A) $46,000

B) $506,000

C) $94,000

D) $86,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 487 في هذه المجموعة.

فتح الحزمة

k this deck

57

Mobile Power Corp. reported the following information for the year ended December 31, 2015.  What was the retained earnings balance for Mobile Power at December 31, 2014?

What was the retained earnings balance for Mobile Power at December 31, 2014?

A) $ 165,000

B) $ 168,000

C) $ 182,000

D) $ 192,000

What was the retained earnings balance for Mobile Power at December 31, 2014?

What was the retained earnings balance for Mobile Power at December 31, 2014?A) $ 165,000

B) $ 168,000

C) $ 182,000

D) $ 192,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 487 في هذه المجموعة.

فتح الحزمة

k this deck

58

Marcos Inc. had net income for 2014 of $40,000. It declared and paid a $3,500 cash dividend in 2014. If the company's retained earnings for the end of the year was $38,200, what was the company's retained earnings balance at the beginning of 2014?

A) $81,700

B) $74,700

C) $5,300

D) $1,700

A) $81,700

B) $74,700

C) $5,300

D) $1,700

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 487 في هذه المجموعة.

فتح الحزمة

k this deck

59

Native Mike's Consultants had the following balance sheet amounts at the beginning of the year:  During the year, total assets increased by $100,000 and total liabilities increased by $40,000. The company also paid $30,000 in dividends. No other transactions occurred except revenues and expenses. How much is net income for the year?

During the year, total assets increased by $100,000 and total liabilities increased by $40,000. The company also paid $30,000 in dividends. No other transactions occurred except revenues and expenses. How much is net income for the year?

A) $30,000

B) $60,000

C) $70,000

D) $90,000

During the year, total assets increased by $100,000 and total liabilities increased by $40,000. The company also paid $30,000 in dividends. No other transactions occurred except revenues and expenses. How much is net income for the year?

During the year, total assets increased by $100,000 and total liabilities increased by $40,000. The company also paid $30,000 in dividends. No other transactions occurred except revenues and expenses. How much is net income for the year?A) $30,000

B) $60,000

C) $70,000

D) $90,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 487 في هذه المجموعة.

فتح الحزمة

k this deck

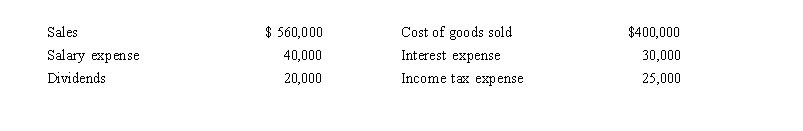

60

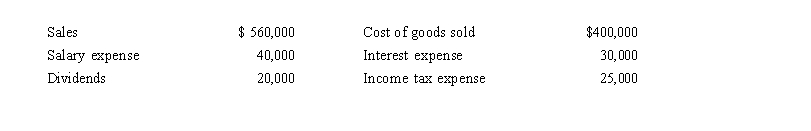

Wei Company reported the following items on its financial statements for the year ending December 31, 2015:  The income statement for Wei will report net income for the current year in the amount of

The income statement for Wei will report net income for the current year in the amount of

A) $ 45,000

B) $ 65,000

C) $ 85,000

D) $ 465,000

The income statement for Wei will report net income for the current year in the amount of

The income statement for Wei will report net income for the current year in the amount ofA) $ 45,000

B) $ 65,000

C) $ 85,000

D) $ 465,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 487 في هذه المجموعة.

فتح الحزمة

k this deck

61

Macon Enterprises purchased land for $2,000,000 in 2001. In 2015, an independent appraiser assessed the value at $3,400,000. What amount should appear on the financial statements in 2015 with respect to the land?

A) $2,000,000

B) $1,400,000

C) $3,400,000

D) Whatever amount the company believes is the best indicator of the true value of the land.

A) $2,000,000

B) $1,400,000

C) $3,400,000

D) Whatever amount the company believes is the best indicator of the true value of the land.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 487 في هذه المجموعة.

فتح الحزمة

k this deck

62

The Securities and Exchange Commission SEC is concerned with

A) All companies in the United States regardless of size.

B) Companies that issue securities to the general public.

C) Accounting reports issued by government entities.

D) All domestic and international companies that issue accounting reports.

A) All companies in the United States regardless of size.

B) Companies that issue securities to the general public.

C) Accounting reports issued by government entities.

D) All domestic and international companies that issue accounting reports.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 487 في هذه المجموعة.

فتح الحزمة

k this deck

63

The natural progression in items from one statement to another and preparation of financial statements is best represented by the following order:

A) Balance sheet and statement of cash flows > statement of retained earnings > income statement

B) Balance sheet and statement of cash flows > income statement > statement of retained earnings

C) Statement of retained earnings > income statement > balance sheet and statement of cash flows

D) Income statement > statement of retained earnings > balance sheet and statement of cash flows

A) Balance sheet and statement of cash flows > statement of retained earnings > income statement

B) Balance sheet and statement of cash flows > income statement > statement of retained earnings

C) Statement of retained earnings > income statement > balance sheet and statement of cash flows

D) Income statement > statement of retained earnings > balance sheet and statement of cash flows

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 487 في هذه المجموعة.

فتح الحزمة

k this deck

64

The statement of retained earnings accomplishes which of the following?

A) It summarizes income earned and dividends paid over a single period of the business.

B) It accumulates all revenues for the year.

C) It summarizes the balance sheet accounts.

D) It summarizes the capital stock accounts over the life of the business.

A) It summarizes income earned and dividends paid over a single period of the business.

B) It accumulates all revenues for the year.

C) It summarizes the balance sheet accounts.

D) It summarizes the capital stock accounts over the life of the business.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 487 في هذه المجموعة.

فتح الحزمة

k this deck

65

Sawaddee Enterprises began the year with total assets of $450,000 and total liabilities of $230,000. If Sawaddee's total assets increased by $80,000 and its total liabilities increased by $57,000 during the year, what is the amount of Sawaddee's owners' equity at the end of the year?

A) $197,000

B) $543,000

C) $243,000

D) $220,000

A) $197,000

B) $543,000

C) $243,000

D) $220,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 487 في هذه المجموعة.

فتح الحزمة

k this deck

66

Which concept is the reason the dollar is used in the preparation of financial statements?

A) Going concern

B) Legal entity

C) Monetary unit

D) Time Period

A) Going concern

B) Legal entity

C) Monetary unit

D) Time Period

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 487 في هذه المجموعة.

فتح الحزمة

k this deck

67

Which one of the following statements is true concerning assets?

A) They are recorded at market value and then adjusted for inflation.

B) They are recorded at market value for financial reporting purposes as historical cost may be arbitrary.

C) Accountants use the term historical cost to refer to the original cost of an asset.

D) Assets are measured using the time-period approach.

A) They are recorded at market value and then adjusted for inflation.

B) They are recorded at market value for financial reporting purposes as historical cost may be arbitrary.

C) Accountants use the term historical cost to refer to the original cost of an asset.

D) Assets are measured using the time-period approach.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 487 في هذه المجموعة.

فتح الحزمة

k this deck

68

Which of the following is a five-member body that has the authority from Congress to set standards for conducting audits?

A) FASB

B) SEC

C) PCAOB

D) AICPA

A) FASB

B) SEC

C) PCAOB

D) AICPA

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 487 في هذه المجموعة.

فتح الحزمة

k this deck

69

The second step in the ethical decision-making model is to:

A) list alternatives and evaluate the impact of each on those affected.

B) select the best alternative.

C) recognize an ethical dilemma.

D) analyze the key elements in the situation.

A) list alternatives and evaluate the impact of each on those affected.

B) select the best alternative.

C) recognize an ethical dilemma.

D) analyze the key elements in the situation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 487 في هذه المجموعة.

فتح الحزمة

k this deck

70

To which of the following entities must a company report if it sells its stock on the organized stock market?

A) American Institute of Certified Public Accountants AICPA

B) American Accounting Association AAA

C) International Accounting Standards Board IASB

D) Securities and Exchange Commission SEC

A) American Institute of Certified Public Accountants AICPA

B) American Accounting Association AAA

C) International Accounting Standards Board IASB

D) Securities and Exchange Commission SEC

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 487 في هذه المجموعة.

فتح الحزمة

k this deck

71

Which one of the following is an assumption made in the preparation of financial statements?

A) Financial statements are prepared for a specific entity that is distinct from the entity owners.

B) Financial statements are prepared assuming that inflation has a distinct effect on the monetary unit.

C) Preparation of financial statements for a specific time period assumes that the balance sheet covers a period of time.

D) Market values are always assumed to be irrelevant when preparing financial statements.

A) Financial statements are prepared for a specific entity that is distinct from the entity owners.

B) Financial statements are prepared assuming that inflation has a distinct effect on the monetary unit.

C) Preparation of financial statements for a specific time period assumes that the balance sheet covers a period of time.

D) Market values are always assumed to be irrelevant when preparing financial statements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 487 في هذه المجموعة.

فتح الحزمة

k this deck

72

In order for accounting information to be useful in making informed decisions, it must be:

A) relevant.

B) reliable.

C) both relevant and reliable.

D) neither relevant nor reliable.

A) relevant.

B) reliable.

C) both relevant and reliable.

D) neither relevant nor reliable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 487 في هذه المجموعة.

فتح الحزمة

k this deck

73

Sawaddee Enterprises began the year with total assets of $450,000 and total liabilities of $230,000. If Sawaddee's total assets doubled to $900,000 and its owners' equity remained the same during the year, what was the amount of its total liabilities at the end of the year?

A) $670,000

B) $680,000

C) $440,000

D) $900,000

A) $670,000

B) $680,000

C) $440,000

D) $900,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 487 في هذه المجموعة.

فتح الحزمة

k this deck

74

Sawaddee Enterprises began the year with total assets of $450,000 and total liabilities of $230,000. If Sawaddee total liabilities increased by $31,000 and its owners' equity decreased by $53,000 during the year, what was the amount of its total assets at the end of the year?

A) $472,000

B) $242,000

C) $198,000

D) $428,000

A) $472,000

B) $242,000

C) $198,000

D) $428,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 487 في هذه المجموعة.

فتح الحزمة

k this deck

75

Which of the following organizations is responsible for setting auditing standards followed by public accounting firms in conducting independent audits of financial statements?

A) Financial Accounting Standards Board FASB

B) Securities and Exchange Commission SEC

C) Public Company Accounting Oversight Board PCAOB

D) International Accounting Standards Board IASB

A) Financial Accounting Standards Board FASB

B) Securities and Exchange Commission SEC

C) Public Company Accounting Oversight Board PCAOB

D) International Accounting Standards Board IASB

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 487 في هذه المجموعة.

فتح الحزمة

k this deck

76

The reliability of the information in a company's financial statements is the responsibility of which of the following?

A) The Securities and Exchange Commission SEC

B) The Certified Public Accountant in charge of the audit of the company's financial statements

C) The company's management

D) The stockholders of the company

A) The Securities and Exchange Commission SEC

B) The Certified Public Accountant in charge of the audit of the company's financial statements

C) The company's management

D) The stockholders of the company

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 487 في هذه المجموعة.

فتح الحزمة

k this deck

77

Which organization, in addition to the Financial Accounting Standards Board FASB, occasionally issues authoritative rules for financial statements?

A) The Accounting Profession

B) International Accounting Standards Board IASB

C) Securities and Exchange Commission SEC

D) Internal Revenue Service IRS

A) The Accounting Profession

B) International Accounting Standards Board IASB

C) Securities and Exchange Commission SEC

D) Internal Revenue Service IRS

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 487 في هذه المجموعة.

فتح الحزمة

k this deck

78

Why is the time period assumption required?

A) Inflation exists

B) External users of financial statements want statements that accurately reflect net income or earnings for a specific time period.

C) The dollar is the monetary unit in the United States.

D) The federal government requires it.

A) Inflation exists

B) External users of financial statements want statements that accurately reflect net income or earnings for a specific time period.

C) The dollar is the monetary unit in the United States.

D) The federal government requires it.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 487 في هذه المجموعة.

فتح الحزمة

k this deck

79

Which the following organizations are primarily responsible for establishing GAAP today?

A) Financial Accounting Standards Board FASB

B) Securities and Exchange Commission SEC

C) Internal Revenue Service IRS

D) Federal Government

A) Financial Accounting Standards Board FASB

B) Securities and Exchange Commission SEC

C) Internal Revenue Service IRS

D) Federal Government

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 487 في هذه المجموعة.

فتح الحزمة

k this deck

80

All of the following are different expressions for net income except:

A) Profits

B) Excess of revenues over expenses

C) Capital

D) Earnings

A) Profits

B) Excess of revenues over expenses

C) Capital

D) Earnings

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 487 في هذه المجموعة.

فتح الحزمة

k this deck