Deck 9: Receivables

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

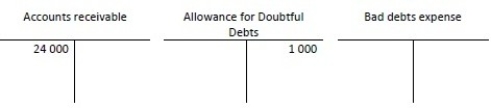

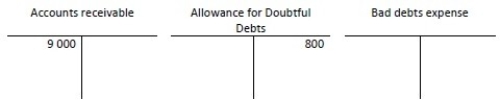

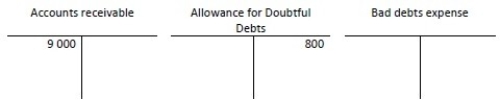

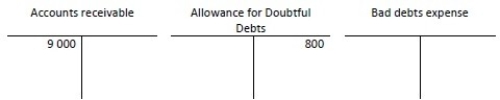

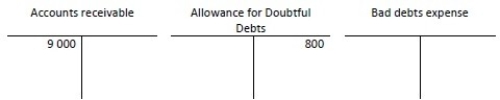

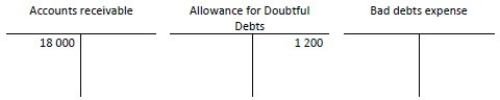

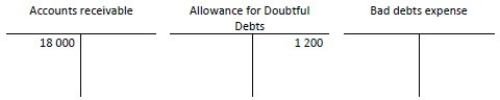

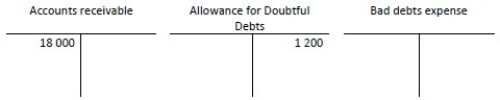

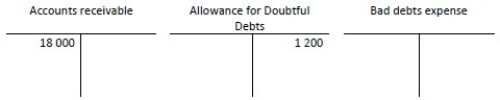

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

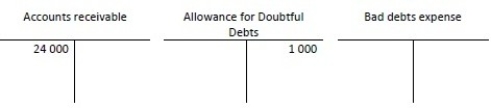

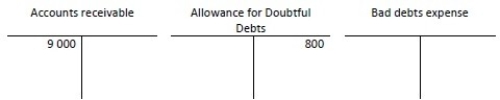

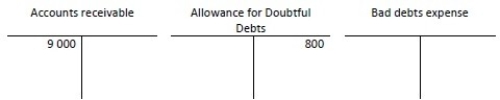

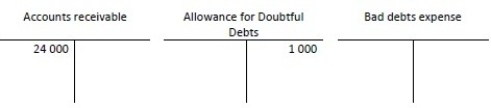

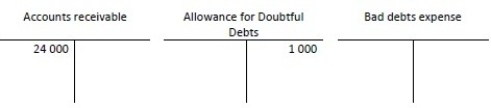

سؤال

سؤال

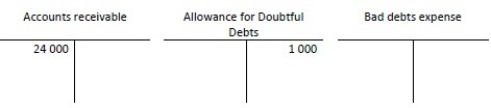

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

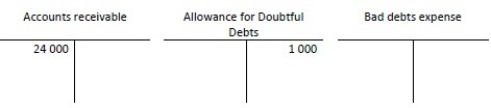

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/157

العب

ملء الشاشة (f)

Deck 9: Receivables

1

AASB requires companies to use the:

A)allowance method to evaluate bad debts.

B)amortisation method to evaluate bad debts.

C)direct write- off method to evaluate bad debts.

D)360- day method to evaluate bad debts.

A)allowance method to evaluate bad debts.

B)amortisation method to evaluate bad debts.

C)direct write- off method to evaluate bad debts.

D)360- day method to evaluate bad debts.

A

2

The percentage of sales method computes bad debts expense as a percentage of net credit sales.

True

3

Bills receivable are usually longer in term than accounts receivable.

True

4

The creditor is the entity that signs a bill.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

5

Which of the following is a benefit of selling on credit?

A)Revenues are increased by making sales to a wider range of customers.

B)Cash is received sooner.

C)Some customers do not pay, creating an expense.

D)Expenses are reduced by making sales to a wide range of customers.

A)Revenues are increased by making sales to a wider range of customers.

B)Cash is received sooner.

C)Some customers do not pay, creating an expense.

D)Expenses are reduced by making sales to a wide range of customers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

6

The two major types of receivables are interest receivable and taxes receivable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

7

Which of the following is NOT a key issue in controlling and managing receivables?

A)Pursue collection from customers to maximise cash flow.

B)Separate the responsibility for custody and protection of inventory assets from the accounting for inventory assets.

C)Extend credit only to customers who are most likely to pay.

D)Separate cash- handling, credit, and accounting duties to keep employees from stealing cash collected from customers.

A)Pursue collection from customers to maximise cash flow.

B)Separate the responsibility for custody and protection of inventory assets from the accounting for inventory assets.

C)Extend credit only to customers who are most likely to pay.

D)Separate cash- handling, credit, and accounting duties to keep employees from stealing cash collected from customers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

8

Which of the following duties should NOT be performed by a credit department?

A)Evaluate customers who apply for credit.

B)Review applicant's income and credit history.

C)Handle cash receipts.

D)Monitor customer payment records.

A)Evaluate customers who apply for credit.

B)Review applicant's income and credit history.

C)Handle cash receipts.

D)Monitor customer payment records.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

9

The allowance method is a method of recording collection losses by estimating uncollectable amounts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

10

Which of the following statements is TRUE?

A)Bills receivable are always due in 30 days.

B)Accounts receivable are more liquid than cash.

C)Bills receivable are longer in term than accounts receivable.

D)Accounts receivable are liabilities.

A)Bills receivable are always due in 30 days.

B)Accounts receivable are more liquid than cash.

C)Bills receivable are longer in term than accounts receivable.

D)Accounts receivable are liabilities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

11

Which of the following are the two methods of accounting for uncollectable receivables?

A)The asset method and the sales method

B)The allowance method and the direct write- off method

C)The direct write- off method and the liability method

D)The allowance method and the liability method

A)The asset method and the sales method

B)The allowance method and the direct write- off method

C)The direct write- off method and the liability method

D)The allowance method and the liability method

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

12

Which of the following is included in the category Other receivables?

A)Accounts receivable

B)Investments

C)Loans to employees

D)Bills receivable

A)Accounts receivable

B)Investments

C)Loans to employees

D)Bills receivable

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

13

Which of the following is a disadvantage of selling on credit?

A)Some customers do not pay, creating an expense.

B)Sales can be made to a more diverse group of customers.

C)Prices must be reduced when selling on credit.

D)Profits are increased by making sales to a wider range of customers.

A)Some customers do not pay, creating an expense.

B)Sales can be made to a more diverse group of customers.

C)Prices must be reduced when selling on credit.

D)Profits are increased by making sales to a wider range of customers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

14

A creditor is a person or business who:

A)purchases goods on credit.

B)invests money in the shares of a company.

C)has a receivable from another party.

D)has a payable to another party.

A)purchases goods on credit.

B)invests money in the shares of a company.

C)has a receivable from another party.

D)has a payable to another party.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

15

A company may collect its own receivables or alternatively hire a third- party collection agency to do this for a fee.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

16

Which of the following is NOT a cost of selling on credit?

A)Increased advertising

B)Opportunity cost of not having the cash immediately

C)Bad debt expense

D)Collection costs

A)Increased advertising

B)Opportunity cost of not having the cash immediately

C)Bad debt expense

D)Collection costs

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

17

A record that contains the details by customer or vendor of the individual account balances would be called a:

A)journal.

B)liability account.

C)subsidiary ledger.

D)control account.

A)journal.

B)liability account.

C)subsidiary ledger.

D)control account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

18

The ageing- of- accounts- receivable method computes bad debts expense as a percentage of net credit sales.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

19

The two major types of receivables are accounts receivable and bills receivable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

20

The percentage of sales method computes bad debts expense by analysing accounts receivable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

21

A newly created design business called Smart Art is just finishing up its first year of operations. During the year, there were credit sales of $40 000 and collections of $36 000. One account for $650 was written off. Smart Art uses the percentage- of- sales method to account for Bad debts expense, and has decided to use a factor of 2% for their year- end adjustment of Bad debts expense. At the end of the year, what is the ending balance in Accounts receivable?

A)$39 350

B)$3 350

C)$36 000

D)$4 000

A)$39 350

B)$3 350

C)$36 000

D)$4 000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

22

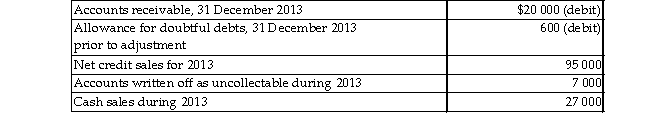

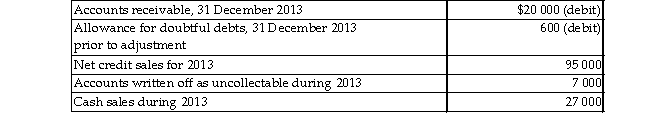

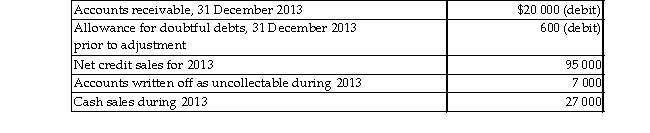

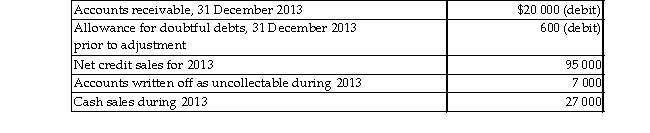

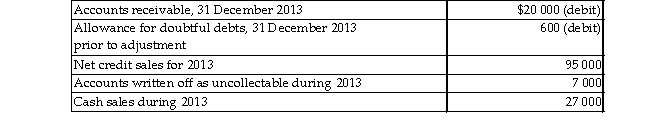

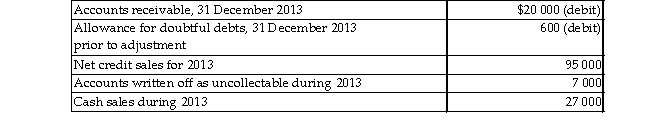

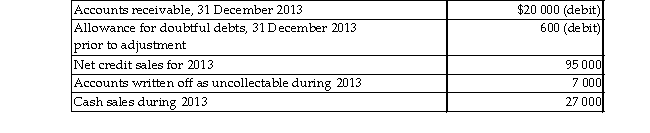

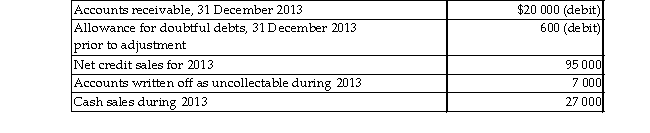

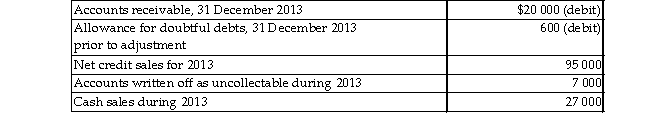

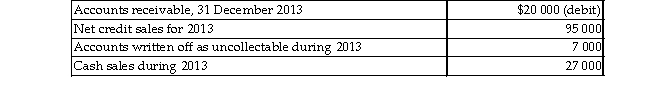

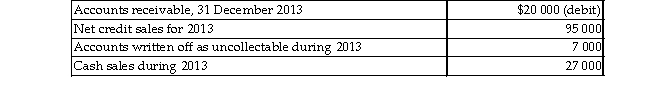

The following information is from the 2013 records of Armadillo Camera Shop:  Bad debts expense is estimated by the ageing- of- accounts- receivable method. Management estimates that $2 850 of accounts receivable will be uncollectable. Which of the following will be the amount of Net accounts receivable after adjustment?

Bad debts expense is estimated by the ageing- of- accounts- receivable method. Management estimates that $2 850 of accounts receivable will be uncollectable. Which of the following will be the amount of Net accounts receivable after adjustment?

A)$17 750

B)$17 150

C)$13 000

D)$16 550

Bad debts expense is estimated by the ageing- of- accounts- receivable method. Management estimates that $2 850 of accounts receivable will be uncollectable. Which of the following will be the amount of Net accounts receivable after adjustment?

Bad debts expense is estimated by the ageing- of- accounts- receivable method. Management estimates that $2 850 of accounts receivable will be uncollectable. Which of the following will be the amount of Net accounts receivable after adjustment?A)$17 750

B)$17 150

C)$13 000

D)$16 550

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

23

The Allowance for doubtful debts currently has a credit balance of $200. The company's management estimates that 2.5% of net credit sales will be uncollectable. Net credit sales are $115 000. What will be the balance of the Allowance for doubtful debts reported on the balance sheet?

A)$3 275

B)$2 875

C)$3 075

D)$2 675

A)$3 275

B)$2 875

C)$3 075

D)$2 675

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

24

A newly created design business called Smart Art is just finishing up its first year of operations. During the year, there were credit sales of $40 000 and collections of $36 000. One account for $650 was written off. Smart Art uses the percentage- of- sales method to account for Bad debts expense, and has decided to use a factor of 2% for their year- end adjustment of Bad debts expense. At the end of the year, what is the balance in Bad debts expense?

A)$150

B)$1 450

C)$800

D)$250

A)$150

B)$1 450

C)$800

D)$250

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

25

The Allowance for doubtful debts currently has a debit balance of $750. After analysing the accounts in the accounts receivable subsidiary ledger, the company's management estimates that bad debts will be $16 000. What will be the balance of the Allowance for doubtful debts reported on the balance sheet?

A)$14 900

B)$16 000

C)$16 250

D)$15 250

A)$14 900

B)$16 000

C)$16 250

D)$15 250

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

26

The following information is from the 2013 records of Armadillo Camera Shop:  Bad debts expense is estimated by the percentage- of- sales method. Management estimates that 3% of net credit sales will be uncollectable. Which of the following will be the balance of the Allowance for doubtful debts after adjustment?

Bad debts expense is estimated by the percentage- of- sales method. Management estimates that 3% of net credit sales will be uncollectable. Which of the following will be the balance of the Allowance for doubtful debts after adjustment?

A)$3 450

B)$2 850

C)$7 000

D)$2 250

Bad debts expense is estimated by the percentage- of- sales method. Management estimates that 3% of net credit sales will be uncollectable. Which of the following will be the balance of the Allowance for doubtful debts after adjustment?

Bad debts expense is estimated by the percentage- of- sales method. Management estimates that 3% of net credit sales will be uncollectable. Which of the following will be the balance of the Allowance for doubtful debts after adjustment?A)$3 450

B)$2 850

C)$7 000

D)$2 250

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

27

The following information is from the 2013 records of Armadillo Camera Shop:  Bad debts expense is estimated by the percentage- of- sales method. Management estimates that 3% of net credit sales will be uncollectable. Which of the following will be the amount of Bad debts expense?

Bad debts expense is estimated by the percentage- of- sales method. Management estimates that 3% of net credit sales will be uncollectable. Which of the following will be the amount of Bad debts expense?

A)$3 450

B)$2 850

C)$7 000

D)$2 250

Bad debts expense is estimated by the percentage- of- sales method. Management estimates that 3% of net credit sales will be uncollectable. Which of the following will be the amount of Bad debts expense?

Bad debts expense is estimated by the percentage- of- sales method. Management estimates that 3% of net credit sales will be uncollectable. Which of the following will be the amount of Bad debts expense?A)$3 450

B)$2 850

C)$7 000

D)$2 250

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

28

The following information is from the 2013 records of Armadillo Camera Shop:  Bad debts expense is estimated by the percentage- of- sales method. Management estimates that 3% of net credit sales will be uncollectable. Which of the following will be the amount of Net accounts receivable after adjustment?

Bad debts expense is estimated by the percentage- of- sales method. Management estimates that 3% of net credit sales will be uncollectable. Which of the following will be the amount of Net accounts receivable after adjustment?

A)$17 750

B)$13 000

C)$16 550

D)$17 150

Bad debts expense is estimated by the percentage- of- sales method. Management estimates that 3% of net credit sales will be uncollectable. Which of the following will be the amount of Net accounts receivable after adjustment?

Bad debts expense is estimated by the percentage- of- sales method. Management estimates that 3% of net credit sales will be uncollectable. Which of the following will be the amount of Net accounts receivable after adjustment?A)$17 750

B)$13 000

C)$16 550

D)$17 150

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

29

The Allowance for doubtful debts currently has a credit balance of $200. The company's management estimates that 2.5% of net credit sales will be uncollectable. Net credit sales are $115 000. What will be the amount of Bad debts expense reported on the income statement?

A)$2 875

B)$3 075

C)$2 675

D)$3 275

A)$2 875

B)$3 075

C)$2 675

D)$3 275

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

30

Which of the following entries would be used to account for uncollectable receivables using the allowance method?

A)Bad debts expense is debited and Accounts receivable is credited.

B)Allowance for doubtful debts is debited and Bad debts expense is credited.

C)Bad debts expense is debited and Allowance for doubtful debts is credited.

D)Accounts receivable is debited and Bad debts expense is credited.

A)Bad debts expense is debited and Accounts receivable is credited.

B)Allowance for doubtful debts is debited and Bad debts expense is credited.

C)Bad debts expense is debited and Allowance for doubtful debts is credited.

D)Accounts receivable is debited and Bad debts expense is credited.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

31

The Allowance for doubtful debts currently has a credit balance of $900. After analysing the accounts in the accounts receivable subsidiary ledger using the ageing of accounts method, the company's management estimates that bad debts will be $15 000. What will be the balance of the Allowance for doubtful debts reported on the balance sheet?

A)$14 100

B)$15 900

C)$14 900

D)$15 000

A)$14 100

B)$15 900

C)$14 900

D)$15 000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

32

The Allowance for doubtful debts currently has a debit balance of $900. After analysing the accounts in the accounts receivable subsidiary ledger using the ageing of accounts method, the company's management estimates that bad debts will be $15 000. What will be the amount of Bad debts expense reported on the income statement?

A)$15 900

B)$14 900

C)$14 100

D)$15 000

A)$15 900

B)$14 900

C)$14 100

D)$15 000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

33

A newly created design business called Smart Art is just finishing up its first year of operations. During the year, there were credit sales of $40 000 and collections of $36 000. One account for $650 was written off. Smart Art uses the percentage- of- sales method to account for Bad debts expense, and has decided to use a factor of 2% for their year- end adjustment of Bad debts expense. At the end of the year, what is the ending balance in the Allowance for doubtful debts?

A)$250

B)$150

C)$800

D)$1 450

A)$250

B)$150

C)$800

D)$1 450

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

34

The following information is from the 2013 records of Armadillo Camera Shop:  Bad debts expense is estimated by the ageing- of- accounts- receivable method. Management estimates that $2 850 of accounts receivable will be uncollectable. Which of the following will be the amount of Bad debts expense?

Bad debts expense is estimated by the ageing- of- accounts- receivable method. Management estimates that $2 850 of accounts receivable will be uncollectable. Which of the following will be the amount of Bad debts expense?

A)$2 850

B)$7 000

C)$3 450

D)$2 250

Bad debts expense is estimated by the ageing- of- accounts- receivable method. Management estimates that $2 850 of accounts receivable will be uncollectable. Which of the following will be the amount of Bad debts expense?

Bad debts expense is estimated by the ageing- of- accounts- receivable method. Management estimates that $2 850 of accounts receivable will be uncollectable. Which of the following will be the amount of Bad debts expense?A)$2 850

B)$7 000

C)$3 450

D)$2 250

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

35

The Allowance for doubtful debts currently has a debit balance of $200. The company's management estimates that 2.5% of net credit sales will be uncollectable. Net credit sales are $115 000. What will be the balance of the Allowance for doubtful debts reported on the balance sheet?

A)$3 075

B)$2 675

C)$2 875

D)$3 275

A)$3 075

B)$2 675

C)$2 875

D)$3 275

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

36

The ageing of accounts method is a balance sheet approach of estimating bad debts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

37

The Allowance for doubtful debts currently has a debit balance of $200. The company's management estimates that 2.5% of net credit sales will be uncollectable. Net credit sales are $115 000. What will be the amount of Bad debts expense reported on the income statement?

A)$2 875

B)$3 275

C)$3 075

D)$2 675

A)$2 875

B)$3 275

C)$3 075

D)$2 675

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

38

Which of the following are the two methods of estimating uncollectable receivables?

A)The direct write- off method and the percentage- of- completion method

B)The ageing- of- accounts- receivable method and the percentage- of- sales method

C)The gross- up method and the direct write- off method

D)The allowance method and the amortisation method

A)The direct write- off method and the percentage- of- completion method

B)The ageing- of- accounts- receivable method and the percentage- of- sales method

C)The gross- up method and the direct write- off method

D)The allowance method and the amortisation method

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

39

The following information is from the 2013 records of Armadillo Camera Shop:  Bad debts expense is estimated by the ageing- of- accounts- receivable method. Management estimates that $2 850 of accounts receivable will be uncollectable. Which of the following will be the balance of the Allowance for doubtful debts after adjustment?

Bad debts expense is estimated by the ageing- of- accounts- receivable method. Management estimates that $2 850 of accounts receivable will be uncollectable. Which of the following will be the balance of the Allowance for doubtful debts after adjustment?

A)$3 450

B)$2 250

C)$7 000

D)$2 850

Bad debts expense is estimated by the ageing- of- accounts- receivable method. Management estimates that $2 850 of accounts receivable will be uncollectable. Which of the following will be the balance of the Allowance for doubtful debts after adjustment?

Bad debts expense is estimated by the ageing- of- accounts- receivable method. Management estimates that $2 850 of accounts receivable will be uncollectable. Which of the following will be the balance of the Allowance for doubtful debts after adjustment?A)$3 450

B)$2 250

C)$7 000

D)$2 850

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

40

The Allowance for doubtful debts currently has a credit balance of $900. After analysing the accounts in the accounts receivable subsidiary ledger using the ageing of accounts method, the company's management estimates that bad debts will be $15 000. What will be the amount of Bad debts expense reported on the income statement?

A)$14 900

B)$15 000

C)$14 100

D)$15 900

A)$14 900

B)$15 000

C)$14 100

D)$15 900

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

41

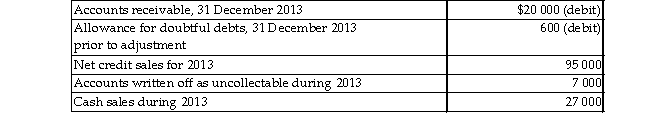

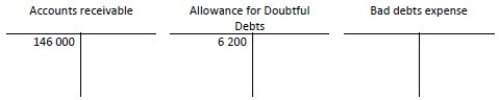

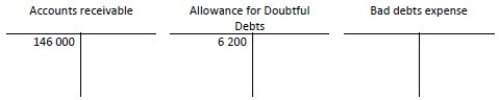

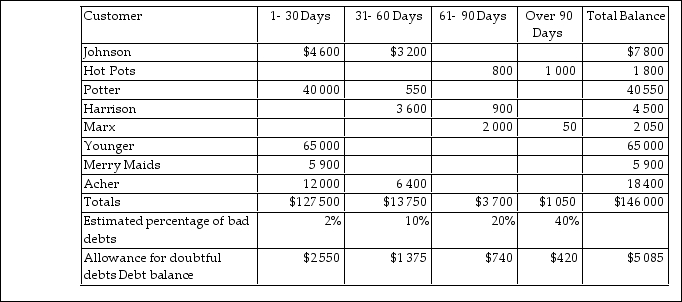

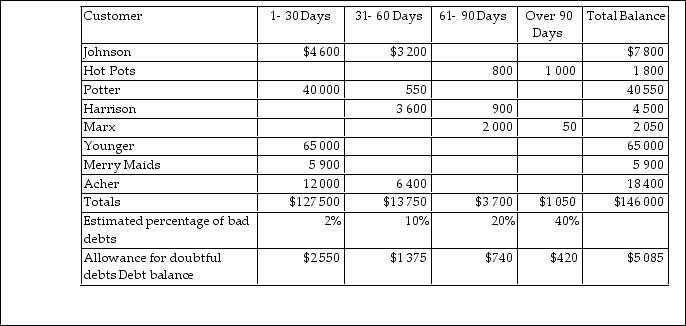

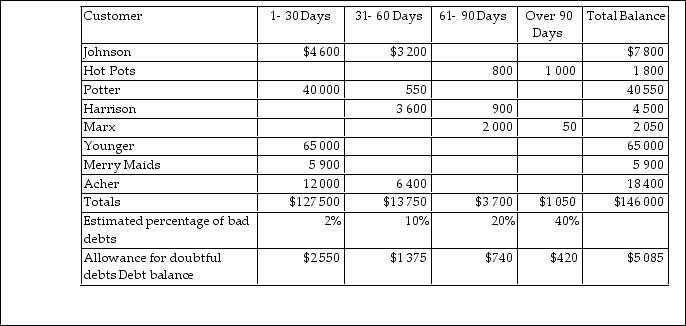

As Perry Materials Supply was preparing for the year- end close, their balances were as follows:  Perry Materials uses the ageing- of- accounts method and has completed the following analysis of the accounts receivable:

Perry Materials uses the ageing- of- accounts method and has completed the following analysis of the accounts receivable:

How much will the Bad debts expense for the year be?

How much will the Bad debts expense for the year be?

A)$1 115

B)$2 550

C)$11 285

D)$5 085

Perry Materials uses the ageing- of- accounts method and has completed the following analysis of the accounts receivable:

Perry Materials uses the ageing- of- accounts method and has completed the following analysis of the accounts receivable: How much will the Bad debts expense for the year be?

How much will the Bad debts expense for the year be?A)$1 115

B)$2 550

C)$11 285

D)$5 085

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

42

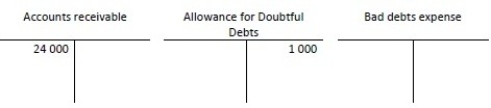

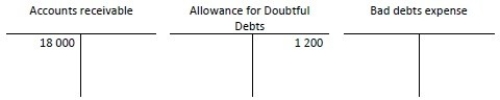

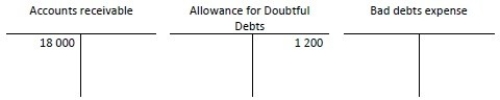

At the beginning of 2014, Mark's sales had the following ledger balances:

A)$14 000

B)$21 300

C)$3 700

D)$10 300

A)$14 000

B)$21 300

C)$3 700

D)$10 300

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

43

At the beginning of 2014, Mark's sales had the following ledger balances:  During the year there were $450 000 of credit sales, $460 000 of collections, and $3 700 of write- offs. At the end of the year, Mark's adjusted for Bad debts expense using the ageing- of- accounts method, and calculated an amount of $1 600 as their estimate of bad debts. At the end of the year, what was the balance in the Bad debts expense?

During the year there were $450 000 of credit sales, $460 000 of collections, and $3 700 of write- offs. At the end of the year, Mark's adjusted for Bad debts expense using the ageing- of- accounts method, and calculated an amount of $1 600 as their estimate of bad debts. At the end of the year, what was the balance in the Bad debts expense?

A)$2 300

B)$2 700

C)$5 400

D)$4 300

During the year there were $450 000 of credit sales, $460 000 of collections, and $3 700 of write- offs. At the end of the year, Mark's adjusted for Bad debts expense using the ageing- of- accounts method, and calculated an amount of $1 600 as their estimate of bad debts. At the end of the year, what was the balance in the Bad debts expense?

During the year there were $450 000 of credit sales, $460 000 of collections, and $3 700 of write- offs. At the end of the year, Mark's adjusted for Bad debts expense using the ageing- of- accounts method, and calculated an amount of $1 600 as their estimate of bad debts. At the end of the year, what was the balance in the Bad debts expense?A)$2 300

B)$2 700

C)$5 400

D)$4 300

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

44

As Perry Materials Supply was preparing for the year- end close, their balances were as follows:  Perry Materials uses the ageing- of- accounts method and has completed the following analysis of the accounts receivable:

Perry Materials uses the ageing- of- accounts method and has completed the following analysis of the accounts receivable:

What will the final balance in the Allowance account be, after adjusting for Bad debts expense?

What will the final balance in the Allowance account be, after adjusting for Bad debts expense?

A)$11 285

B)$5 085

C)$2 550

D)$1 115

Perry Materials uses the ageing- of- accounts method and has completed the following analysis of the accounts receivable:

Perry Materials uses the ageing- of- accounts method and has completed the following analysis of the accounts receivable: What will the final balance in the Allowance account be, after adjusting for Bad debts expense?

What will the final balance in the Allowance account be, after adjusting for Bad debts expense?A)$11 285

B)$5 085

C)$2 550

D)$1 115

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

45

Accounts receivable has a balance of $5 000 and the Allowance for doubtful debts has a credit balance of $440. What is Net accounts receivable after a $160 account receivable is written off?

A)$5 000

B)$4 400

C)$4 720

D)$4 560

A)$5 000

B)$4 400

C)$4 720

D)$4 560

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

46

Accounts receivable has a balance of $16 000 and the Allowance for doubtful debts has a credit balance of $1 700. What is Net accounts receivable before and after a $60 account receivable is written off?

A)$16 000 before and $15 940 after

B)$14 300 before and $14 300 after

C)$14 300 before and $14 240 after

D)$16 000 before and $16 000 after

A)$16 000 before and $15 940 after

B)$14 300 before and $14 300 after

C)$14 300 before and $14 240 after

D)$16 000 before and $16 000 after

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

47

At the beginning of 2014, Mark's sales had the following ledger balances:  During the year there were $450 000 of credit sales, $460 000 of collections, and $3 700 of write- offs. At the end of the year, Mark's adjusted for Bad debts expense using the ageing- of- accounts method, and calculated an amount of $1 600 as their estimate of bad debts. At the end of the year, what was the balance in the Accounts receivable?

During the year there were $450 000 of credit sales, $460 000 of collections, and $3 700 of write- offs. At the end of the year, Mark's adjusted for Bad debts expense using the ageing- of- accounts method, and calculated an amount of $1 600 as their estimate of bad debts. At the end of the year, what was the balance in the Accounts receivable?

A)$14 000

B)$21 300

C)$10 300

D)$3 700

During the year there were $450 000 of credit sales, $460 000 of collections, and $3 700 of write- offs. At the end of the year, Mark's adjusted for Bad debts expense using the ageing- of- accounts method, and calculated an amount of $1 600 as their estimate of bad debts. At the end of the year, what was the balance in the Accounts receivable?

During the year there were $450 000 of credit sales, $460 000 of collections, and $3 700 of write- offs. At the end of the year, Mark's adjusted for Bad debts expense using the ageing- of- accounts method, and calculated an amount of $1 600 as their estimate of bad debts. At the end of the year, what was the balance in the Accounts receivable?A)$14 000

B)$21 300

C)$10 300

D)$3 700

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

48

At the beginning of 2014, Mark's sales had the following ledger balances:  During the year there were $450 000 of credit sales, $460 000 of collections, and $3 700 of write- offs. At the end of the year, Mark's adjusted for Bad debts expense using the percentage- of- sales method, and applied a rate, based on past history, of 1.2%. At the end of the year, what was the balance in the Allowance account?

During the year there were $450 000 of credit sales, $460 000 of collections, and $3 700 of write- offs. At the end of the year, Mark's adjusted for Bad debts expense using the percentage- of- sales method, and applied a rate, based on past history, of 1.2%. At the end of the year, what was the balance in the Allowance account?

A)$1 700

B)$6 400

C)$2 700

D)$2 300

During the year there were $450 000 of credit sales, $460 000 of collections, and $3 700 of write- offs. At the end of the year, Mark's adjusted for Bad debts expense using the percentage- of- sales method, and applied a rate, based on past history, of 1.2%. At the end of the year, what was the balance in the Allowance account?

During the year there were $450 000 of credit sales, $460 000 of collections, and $3 700 of write- offs. At the end of the year, Mark's adjusted for Bad debts expense using the percentage- of- sales method, and applied a rate, based on past history, of 1.2%. At the end of the year, what was the balance in the Allowance account?A)$1 700

B)$6 400

C)$2 700

D)$2 300

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

49

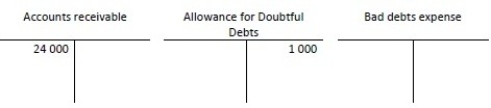

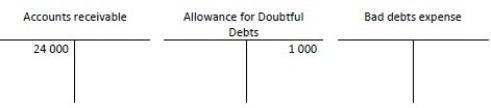

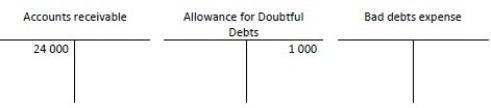

At 1 January, Davidson Services has the following balances:  During the year, Davidson had $104 000 of credit sales, collections of $100 000, and write- offs of $1 400.

During the year, Davidson had $104 000 of credit sales, collections of $100 000, and write- offs of $1 400.

Davidson records Bad debts expense at the end of the year using the percentage- of- sales method, and applies a rate of 1.1%, based on past history.

After the year- end entry to adjust the Bad debts expense, what is the ending balance in the Allowance for doubtful debts?

A)Debit of $1 400

B)Debit of $1 144

C)Credit of $544

D)Credit of $1 944

During the year, Davidson had $104 000 of credit sales, collections of $100 000, and write- offs of $1 400.

During the year, Davidson had $104 000 of credit sales, collections of $100 000, and write- offs of $1 400.Davidson records Bad debts expense at the end of the year using the percentage- of- sales method, and applies a rate of 1.1%, based on past history.

After the year- end entry to adjust the Bad debts expense, what is the ending balance in the Allowance for doubtful debts?

A)Debit of $1 400

B)Debit of $1 144

C)Credit of $544

D)Credit of $1 944

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

50

At 1 January, Davidson Services has the following balances:  During the year, Davidson had $104 000 of credit sales, collections of $100 000, and write- offs of $1 400.

During the year, Davidson had $104 000 of credit sales, collections of $100 000, and write- offs of $1 400.

Davidson records Bad debts expense at the end of the year using the percentage- of- sales method, and applies a rate of 1.1%, based on past history.

Prior to the year- end entry to adjust the Bad debts expense, what is the balance in Accounts receivable?

A)$13 000

B)$11 600

C)$2 600

D)$4 000

During the year, Davidson had $104 000 of credit sales, collections of $100 000, and write- offs of $1 400.

During the year, Davidson had $104 000 of credit sales, collections of $100 000, and write- offs of $1 400.Davidson records Bad debts expense at the end of the year using the percentage- of- sales method, and applies a rate of 1.1%, based on past history.

Prior to the year- end entry to adjust the Bad debts expense, what is the balance in Accounts receivable?

A)$13 000

B)$11 600

C)$2 600

D)$4 000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

51

At 1 January, Everbright Sales has the following balances:  During the year, Everbright had $150 000 of credit sales, collections of $140 000, and write- offs of $3 000. Everbright records Bad debts expense at the end of the year using the ageing- of- accounts method. At the end of the year, the ageing analysis produces a figure of $1 900, being the estimate of bad debts at end of year.

During the year, Everbright had $150 000 of credit sales, collections of $140 000, and write- offs of $3 000. Everbright records Bad debts expense at the end of the year using the ageing- of- accounts method. At the end of the year, the ageing analysis produces a figure of $1 900, being the estimate of bad debts at end of year.

After the year- end entry to adjust the Bad debts expense is made, what is the final balance in the Bad debts expense?

A)Debit of $3 700

B)Debit of $1 900

C)Debit of $3 000

D)Credit of $4 200

During the year, Everbright had $150 000 of credit sales, collections of $140 000, and write- offs of $3 000. Everbright records Bad debts expense at the end of the year using the ageing- of- accounts method. At the end of the year, the ageing analysis produces a figure of $1 900, being the estimate of bad debts at end of year.

During the year, Everbright had $150 000 of credit sales, collections of $140 000, and write- offs of $3 000. Everbright records Bad debts expense at the end of the year using the ageing- of- accounts method. At the end of the year, the ageing analysis produces a figure of $1 900, being the estimate of bad debts at end of year.After the year- end entry to adjust the Bad debts expense is made, what is the final balance in the Bad debts expense?

A)Debit of $3 700

B)Debit of $1 900

C)Debit of $3 000

D)Credit of $4 200

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

52

At 1 January, Everbright Sales has the following balances:  During the year, Everbright had $150 000 of credit sales, collections of $140 000, and write- offs of $3 000. Everbright records Bad debts expense at the end of the year using the ageing- of- accounts method. At the end of the year, the ageing analysis produces a figure of $1 900, being the estimate of bad debts at end of year.

During the year, Everbright had $150 000 of credit sales, collections of $140 000, and write- offs of $3 000. Everbright records Bad debts expense at the end of the year using the ageing- of- accounts method. At the end of the year, the ageing analysis produces a figure of $1 900, being the estimate of bad debts at end of year.

Before the year- end entry to adjust the Bad debts expense is made, what is the balance in the Allowance for doubtful debts?

A)Credit of $4 200

B)Debit of $3 000

C)Debit of $1 800

D)Zero balance

During the year, Everbright had $150 000 of credit sales, collections of $140 000, and write- offs of $3 000. Everbright records Bad debts expense at the end of the year using the ageing- of- accounts method. At the end of the year, the ageing analysis produces a figure of $1 900, being the estimate of bad debts at end of year.

During the year, Everbright had $150 000 of credit sales, collections of $140 000, and write- offs of $3 000. Everbright records Bad debts expense at the end of the year using the ageing- of- accounts method. At the end of the year, the ageing analysis produces a figure of $1 900, being the estimate of bad debts at end of year.Before the year- end entry to adjust the Bad debts expense is made, what is the balance in the Allowance for doubtful debts?

A)Credit of $4 200

B)Debit of $3 000

C)Debit of $1 800

D)Zero balance

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

53

At 1 January, Davidson Services has the following balances:  During the year, Davidson had $104 000 of credit sales, collections of $100 000, and write- offs of $1 400. Davidson records Bad debts expense at the end of the year using the percentage- of- sales method, and applies a rate of 1.1%, based on past history.

During the year, Davidson had $104 000 of credit sales, collections of $100 000, and write- offs of $1 400. Davidson records Bad debts expense at the end of the year using the percentage- of- sales method, and applies a rate of 1.1%, based on past history.

Prior to the year- end entry to adjust the Bad debts expense, what is the balance in the Allowance for doubtful debts?

A)Credit of $2 200

B)Credit of $800

C)Debit of $600

D)Debit of $1 400

During the year, Davidson had $104 000 of credit sales, collections of $100 000, and write- offs of $1 400. Davidson records Bad debts expense at the end of the year using the percentage- of- sales method, and applies a rate of 1.1%, based on past history.

During the year, Davidson had $104 000 of credit sales, collections of $100 000, and write- offs of $1 400. Davidson records Bad debts expense at the end of the year using the percentage- of- sales method, and applies a rate of 1.1%, based on past history.Prior to the year- end entry to adjust the Bad debts expense, what is the balance in the Allowance for doubtful debts?

A)Credit of $2 200

B)Credit of $800

C)Debit of $600

D)Debit of $1 400

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

54

At 1 January, Everbright Sales has the following balances:  During the year, Everbright had $150 000 of credit sales, collections of $140 000, and write- offs of

During the year, Everbright had $150 000 of credit sales, collections of $140 000, and write- offs of

$3 000. Everbright records Bad debts expense at the end of the year using the ageing- of- accounts method. At the end of the year, the ageing analysis produces a figure of $1 900, being the estimate of bad debts at end of year.

Before the year- end entry to adjust the Bad debts expense is made, what is the balance in the Bad debts expense?

A)Credit of $544

B)Debit of $1 400

C)Zero balance

D)Credit of $1 944

During the year, Everbright had $150 000 of credit sales, collections of $140 000, and write- offs of

During the year, Everbright had $150 000 of credit sales, collections of $140 000, and write- offs of$3 000. Everbright records Bad debts expense at the end of the year using the ageing- of- accounts method. At the end of the year, the ageing analysis produces a figure of $1 900, being the estimate of bad debts at end of year.

Before the year- end entry to adjust the Bad debts expense is made, what is the balance in the Bad debts expense?

A)Credit of $544

B)Debit of $1 400

C)Zero balance

D)Credit of $1 944

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

55

At the beginning of 2014, Mark's sales had the following ledger balances:  During the year there were $450 000 of credit sales, $460 000 of collections, and $3 700 of write- offs. At the end of the year, Mark's adjusted for Bad debts expense using the percentage- of- sales method, and applied a rate, based on past history, of 1.2%. At the end of the year, what was the balance in the Bad debts expense?

During the year there were $450 000 of credit sales, $460 000 of collections, and $3 700 of write- offs. At the end of the year, Mark's adjusted for Bad debts expense using the percentage- of- sales method, and applied a rate, based on past history, of 1.2%. At the end of the year, what was the balance in the Bad debts expense?

A)$6 400

B)$2 300

C)$5 400

D)$2 700

During the year there were $450 000 of credit sales, $460 000 of collections, and $3 700 of write- offs. At the end of the year, Mark's adjusted for Bad debts expense using the percentage- of- sales method, and applied a rate, based on past history, of 1.2%. At the end of the year, what was the balance in the Bad debts expense?

During the year there were $450 000 of credit sales, $460 000 of collections, and $3 700 of write- offs. At the end of the year, Mark's adjusted for Bad debts expense using the percentage- of- sales method, and applied a rate, based on past history, of 1.2%. At the end of the year, what was the balance in the Bad debts expense?A)$6 400

B)$2 300

C)$5 400

D)$2 700

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

56

At 1 January, Everbright Sales has the following balances:  During the year, Everbright had $150 000 of credit sales, collections of $140 000, and write- offs of

During the year, Everbright had $150 000 of credit sales, collections of $140 000, and write- offs of

$3 000. Everbright records Bad debts expense at the end of the year using the ageing- of- accounts method. At the end of the year, the ageing analysis produces a figure of $1 900, being the estimate of bad debts at end of year.

After the year- end entry to adjust the Bad debts expense is made, what is the final balance in the Allowance for doubtful debts?

A)Credit of $1 900

B)Debit of $1 800

C)Credit of $4 200

D)Debit of $3 000

During the year, Everbright had $150 000 of credit sales, collections of $140 000, and write- offs of

During the year, Everbright had $150 000 of credit sales, collections of $140 000, and write- offs of$3 000. Everbright records Bad debts expense at the end of the year using the ageing- of- accounts method. At the end of the year, the ageing analysis produces a figure of $1 900, being the estimate of bad debts at end of year.

After the year- end entry to adjust the Bad debts expense is made, what is the final balance in the Allowance for doubtful debts?

A)Credit of $1 900

B)Debit of $1 800

C)Credit of $4 200

D)Debit of $3 000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

57

At the beginning of 2014, Mark's sales had the following ledger balances:  During the year there were $450 000 of credit sales, $460 000 of collections, and $3 700 of write- offs. At the end of the year, Mark's adjusted for Bad debts expense using the ageing- of- accounts method, and calculated an amount of $1 600 as their estimate of bad debts. At the end of the year, what was the balance in the Allowance account?

During the year there were $450 000 of credit sales, $460 000 of collections, and $3 700 of write- offs. At the end of the year, Mark's adjusted for Bad debts expense using the ageing- of- accounts method, and calculated an amount of $1 600 as their estimate of bad debts. At the end of the year, what was the balance in the Allowance account?

A)$2 700

B)$6 400

C)$1 600

D)$1 700

During the year there were $450 000 of credit sales, $460 000 of collections, and $3 700 of write- offs. At the end of the year, Mark's adjusted for Bad debts expense using the ageing- of- accounts method, and calculated an amount of $1 600 as their estimate of bad debts. At the end of the year, what was the balance in the Allowance account?

During the year there were $450 000 of credit sales, $460 000 of collections, and $3 700 of write- offs. At the end of the year, Mark's adjusted for Bad debts expense using the ageing- of- accounts method, and calculated an amount of $1 600 as their estimate of bad debts. At the end of the year, what was the balance in the Allowance account?A)$2 700

B)$6 400

C)$1 600

D)$1 700

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

58

At 1 January, Davidson Services has the following balances:  During the year, Davidson had $104 000 of credit sales, collections of $100 000, and write- offs of $1 400. Davidson records Uncollectible Account Expense at the end of the year using the percentage- of- sales method, and applies a rate of 1.1%, based on past history.

During the year, Davidson had $104 000 of credit sales, collections of $100 000, and write- offs of $1 400. Davidson records Uncollectible Account Expense at the end of the year using the percentage- of- sales method, and applies a rate of 1.1%, based on past history.

After the year- end entry to adjust the Bad debts expense, what is the ending balance in the Bad debts expense?

A)Debit of $1 400

B)Debit of $1 144

C)Credit of $544

D)Credit of $1 944

During the year, Davidson had $104 000 of credit sales, collections of $100 000, and write- offs of $1 400. Davidson records Uncollectible Account Expense at the end of the year using the percentage- of- sales method, and applies a rate of 1.1%, based on past history.

During the year, Davidson had $104 000 of credit sales, collections of $100 000, and write- offs of $1 400. Davidson records Uncollectible Account Expense at the end of the year using the percentage- of- sales method, and applies a rate of 1.1%, based on past history.After the year- end entry to adjust the Bad debts expense, what is the ending balance in the Bad debts expense?

A)Debit of $1 400

B)Debit of $1 144

C)Credit of $544

D)Credit of $1 944

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

59

A newly created design business called Smart Art is just finishing up its first year of operations. During the year, there were credit sales of $40 000 and collections of $36 000. One account for $650 was written off. Smart Art uses the ageing- of- accounts method to account for Bad debts expense, and has calculated an amount of $200 as their estimate of uncollectable amounts at year- end. At the end of the year, what is the ending balance in the Allowance for doubtful debts?

A)$1 450

B)$800

C)$150

D)$200

A)$1 450

B)$800

C)$150

D)$200

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

60

A newly created design business called Smart Art is just finishing up its first year of operations. During the year, there were credit sales of $40 000 and collections of $36 000. One account for $650 was written off. Smart Art uses the ageing- of- accounts method to account for Bad debts expense, and has calculated an amount of $200 as their estimate of uncollectable amounts at year- end. At the end of the year, what is the ending balance in Accounts receivable?

A)$36 000

B)$3 350

C)$39 350

D)$4 000

A)$36 000

B)$3 350

C)$39 350

D)$4 000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

61

The following information is from the 2013 records of Armadillo Camera Shop:  Bad debts expense is determined by the direct write- off method. Which of the following will be the amount of Bad debts expense?

Bad debts expense is determined by the direct write- off method. Which of the following will be the amount of Bad debts expense?

A)$3 450

B)$7 000

C)$2 850

D)$2 250

Bad debts expense is determined by the direct write- off method. Which of the following will be the amount of Bad debts expense?

Bad debts expense is determined by the direct write- off method. Which of the following will be the amount of Bad debts expense?A)$3 450

B)$7 000

C)$2 850

D)$2 250

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

62

When a company is using the direct write- off method, and an account is written off, the journal entry consists of a:

A)credit to Accounts receivable and a debit to Interest expense.

B)debit to Accounts receivable and a credit to Cash.

C)debit to the Allowance for doubtful debts and a credit to Accounts receivable.

D)credit to Accounts receivable and a debit to Bad debts expense.

A)credit to Accounts receivable and a debit to Interest expense.

B)debit to Accounts receivable and a credit to Cash.

C)debit to the Allowance for doubtful debts and a credit to Accounts receivable.

D)credit to Accounts receivable and a debit to Bad debts expense.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

63

At 1 January, Davidson Services has the following balances: Davidson has the following transactions during January:  Credit sales of $80 000, collections of $76 000, and write- offs of $12 000. Davidson uses the direct write- off method. At the end of January, the balance in Bad debts expense is:

Credit sales of $80 000, collections of $76 000, and write- offs of $12 000. Davidson uses the direct write- off method. At the end of January, the balance in Bad debts expense is:

A)$12 000.

B)$4 000.

C)$28 000.

D)$16 000.

Credit sales of $80 000, collections of $76 000, and write- offs of $12 000. Davidson uses the direct write- off method. At the end of January, the balance in Bad debts expense is:

Credit sales of $80 000, collections of $76 000, and write- offs of $12 000. Davidson uses the direct write- off method. At the end of January, the balance in Bad debts expense is:A)$12 000.

B)$4 000.

C)$28 000.

D)$16 000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

64

Archer Company has significant amounts of accounts receivable, and experiences bad debts from time to time. Archer uses the ageing- of- accounts method to account for bad debts. When Archer Company writes off an uncollectable receivable, what is the effect of that single transaction?

A)It will have no effect on profit.

B)It will increase total assets of the company.

C)It will generate negative cash flow.

D)It will reduce profit.

A)It will have no effect on profit.

B)It will increase total assets of the company.

C)It will generate negative cash flow.

D)It will reduce profit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

65

The direct write- off method conforms to the matching principle better than the allowance method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

66

The direct write- off method requires an entry with a credit to Accounts receivable to record the Bad debts expense.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

67

A company uses the direct write- off method to account for uncollectable receivables. Bad debts expense will be estimated as a percentage of sales.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

68

At 1 January, Davidson Services has the following balances:  Davidson has the following transactions during January:

Davidson has the following transactions during January:

Credit sales of $80 000, collections of $76 000, and write- offs of $12 000.

Davidson uses the direct write- off method. At the end of January, the balance in Accounts receivable is:

A)$4 000.

B)$68 000.

C)$16 000.

D)$28 000.

Davidson has the following transactions during January:

Davidson has the following transactions during January:Credit sales of $80 000, collections of $76 000, and write- offs of $12 000.

Davidson uses the direct write- off method. At the end of January, the balance in Accounts receivable is:

A)$4 000.

B)$68 000.

C)$16 000.

D)$28 000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

69

Which of the following entries would be used to account for uncollectable receivables using the direct write- off method?

A)Accounts receivable is debited and Bad debts expense is credited.

B)Bad debts expense is debited and Accounts receivable is credited.

C)Bad debts expense is debited and Allowance for doubtful debts is credited.

D)Allowance for doubtful debts is debited and Bad debts expense is credited.

A)Accounts receivable is debited and Bad debts expense is credited.

B)Bad debts expense is debited and Accounts receivable is credited.

C)Bad debts expense is debited and Allowance for doubtful debts is credited.

D)Allowance for doubtful debts is debited and Bad debts expense is credited.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

70

Under the direct write- off method, a customer who doesn't pay their bills is written off with what journal entry?

A)Debit Lost revenue and credit Accounts receivable

B)Debit Accounts receivable and credit Bad debts expense

C)Debit Bad debts expense and credit Cash

D)Debit Bad debts expense and credit Accounts receivable

A)Debit Lost revenue and credit Accounts receivable

B)Debit Accounts receivable and credit Bad debts expense

C)Debit Bad debts expense and credit Cash

D)Debit Bad debts expense and credit Accounts receivable

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

71

A company uses the direct write- off method to account for uncollectable receivables. Which of the following is included in the entry to write off a bad debt?

A)A debit to the customer's Account receivable

B)A credit to the Allowance for doubtful debts

C)A debit to Bad debts expense

D)No entry is made to write off bad debts.

A)A debit to the customer's Account receivable

B)A credit to the Allowance for doubtful debts

C)A debit to Bad debts expense

D)No entry is made to write off bad debts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

72

Archer Company and Zorro Company both have significant amounts of accounts receivable at any time, and both experience bad debts from time to time. Archer uses the ageing- of- accounts method to account for bad debts, and Zorro uses the direct write- off method. Zorro Company's method complies with IFRS and produces a better matching of revenues and expenses than does Archer Company's method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

73

Archer Company and Zorro Company both have significant amounts of accounts receivable at any time, and both experience bad debts from time to time. Archer uses the percentage- of- sales method to account for bad debts, and Zorro uses the direct write- off method. Which of the following statements is FALSE?

A)Archer Company's profit is more accurate due to their accounting method.

B)Zorro Company's method follows the accrual method of accounting.

C)Archer Company's method will provide better matching of revenues and expenses.

D)Zorro Company's method does not provide good matching of revenues and expenses.

A)Archer Company's profit is more accurate due to their accounting method.

B)Zorro Company's method follows the accrual method of accounting.

C)Archer Company's method will provide better matching of revenues and expenses.

D)Zorro Company's method does not provide good matching of revenues and expenses.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

74

The direct write- off method would be considered acceptable if uncollectable receivables are very low.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

75

The direct write- off method is used primarily by large, publicly owned companies.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

76

Archer Company has significant amounts of accounts receivable, and experiences bad debts from time to time. Archer uses the percentage- of- sales method to account for bad debts. When Archer Company writes off an uncollectable receivable, what is the effect of that single transaction?

A)It will have no effect on profit.

B)It will increase total assets of the company.

C)It will reduce profit.

D)It will generate negative cash flow.

A)It will have no effect on profit.

B)It will increase total assets of the company.

C)It will reduce profit.

D)It will generate negative cash flow.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

77

Archer Company and Zorro Company both have significant amounts of accounts receivable at any time, and both experience bad debts from time to time. Archer uses the percentage- of- sales method to account for bad debts, and Zorro uses the direct write- off method. Archer Company's method complies with IFRS and produces a better matching of revenues and expenses than does Zorro Company's method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

78

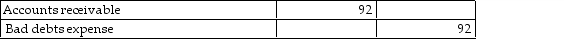

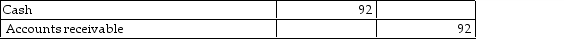

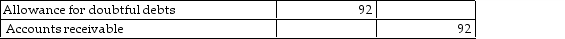

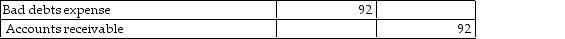

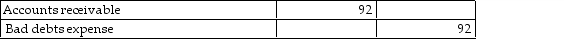

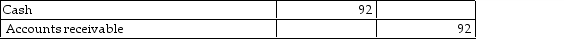

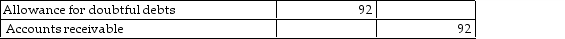

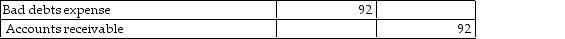

Charlton Sales has a receivable for $92 that they now deem to be uncollectable. Charlton uses the direct write- off method. Which of the following entries correctly records the write- off?

A)

B)

C)

D)

A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

79

A company has significant uncollectable receivables. Why is the direct write- off method unacceptable?

A)It is not allowed for tax reasons.

B)Assets will be understated on the balance sheet.

C)Direct write- offs would be immaterial.

D)It violates the matching principle.

A)It is not allowed for tax reasons.

B)Assets will be understated on the balance sheet.

C)Direct write- offs would be immaterial.

D)It violates the matching principle.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

80

A company uses the direct write- off method to account for uncollectable receivables. Which of the following is included in the entry to write off a bad debt?

A)A debit to Allowance for doubtful debts

B)A credit to the customer's Account receivable

C)A credit to the Allowance for doubtful debts

D)No entry is made to write off bad debts.

A)A debit to Allowance for doubtful debts

B)A credit to the customer's Account receivable

C)A credit to the Allowance for doubtful debts

D)No entry is made to write off bad debts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck