Deck 6: Retail Inventory

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

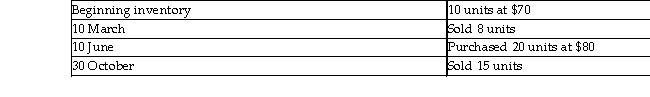

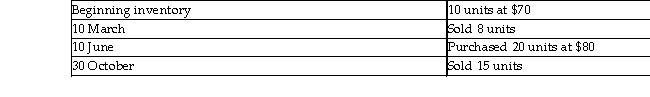

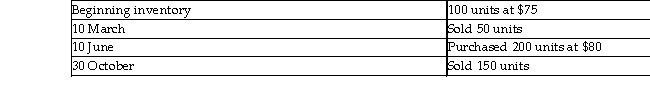

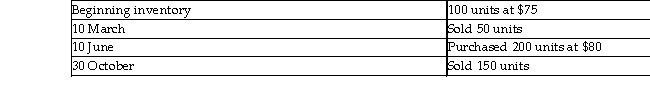

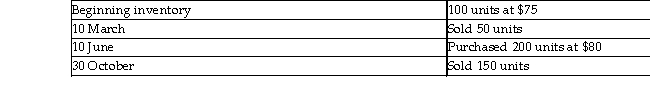

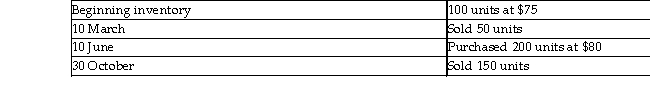

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

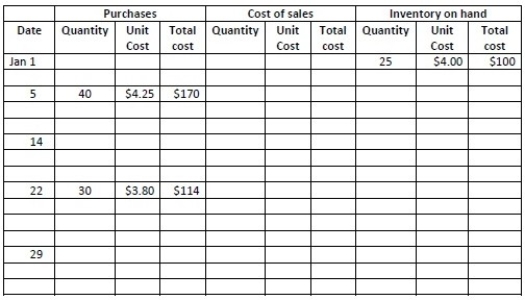

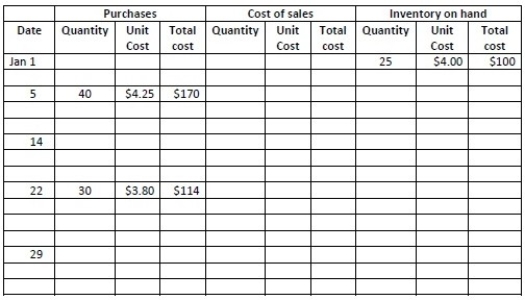

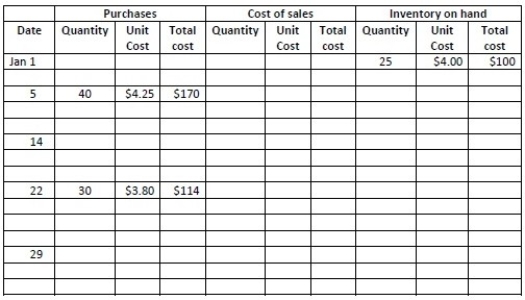

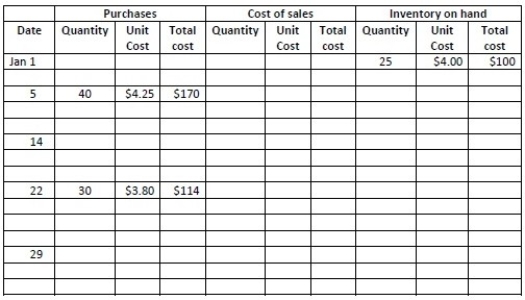

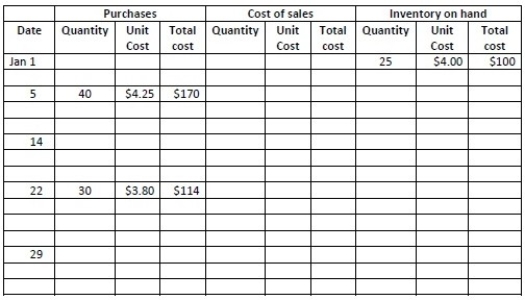

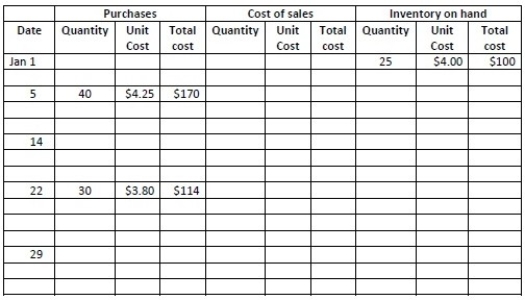

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/141

العب

ملء الشاشة (f)

Deck 6: Retail Inventory

1

A company is uncertain whether a complex transaction should be recorded as an asset or an expense. Under the conservatism principle, they should choose to treat it as an asset.

False

2

Which of the following states that a business must report enough information for outsiders to make knowledgeable decisions about the company?

A)Materiality concept

B)Accounting conservatism

C)Comparability principle

D)Relevance principle

A)Materiality concept

B)Accounting conservatism

C)Comparability principle

D)Relevance principle

D

3

Ending inventory equals the cost of goods available for sale less beginning inventory.

False

4

Which of the following states that a company must perform strictly proper accounting ONLY for items that are significant to the business's financial statements?

A)Accounting conservatism

B)Relevance principle

C)Comparability principle

D)Materiality concept

A)Accounting conservatism

B)Relevance principle

C)Comparability principle

D)Materiality concept

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

5

Under Last- In, First- Out, the Cost of sales is based on the oldest purchases.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

6

Which of the following states that the business should use the same accounting methods from period to period?

A)Comparability principle

B)Materiality concept

C)Relevance principle

D)Accounting conservatism

A)Comparability principle

B)Materiality concept

C)Relevance principle

D)Accounting conservatism

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

7

A company should NOT change the inventory costing method each period in order to maximise profit. This is an example of the materiality principle.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

8

A company discovers that its Cost of sales is understated by an insignificant amount. They do not need to correct the error because of the materiality concept.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

9

A company changes its inventory costing method each period in order to maximise profit. This is a violation of the consistency principle.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

10

Which of the following concepts states that a company must perform strictly proper accounting ONLY for significant items?

A)Consistency principle

B)Accounting conservatism

C)Materiality concept

D)Disclosure principle

A)Consistency principle

B)Accounting conservatism

C)Materiality concept

D)Disclosure principle

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

11

The materiality concept requires that a company should report enough information for outsiders to make wise decisions about the company.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

12

The comparability principle states that a business should use the same accounting methods from period to period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

13

Which of the following requires that financial statements should report the LEAST favourable figures?

A)Accounting conservatism

B)Relevance principle

C)Materiality concept

D)Comparability principle

A)Accounting conservatism

B)Relevance principle

C)Materiality concept

D)Comparability principle

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

14

A company is uncertain whether a complex transaction should result in an asset being recorded at

$100 000 or at $150 000. Under the conservatism principle, they should choose to show it at the lower amount.

$100 000 or at $150 000. Under the conservatism principle, they should choose to show it at the lower amount.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

15

The accounting principle that states that we should never anticipate gains is which of the following?

A)Materiality concept

B)Comparability principle

C)Relevance principle

D)Accounting conservatism

A)Materiality concept

B)Comparability principle

C)Relevance principle

D)Accounting conservatism

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

16

A company is uncertain whether a complex transaction should be recorded as gain or loss. Under the conservatism principle, they should choose to treat it as a loss.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

17

A company discovers that its Cost of sales is understated by an insignificant amount. They do NOT need to correct the error because of the conservatism principle.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

18

Ending inventory equals the number of units on hand multiplied by the unit cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

19

Changing from the LIFO (Last- In, First- Out)to specific- identification method of valuing inventory ignores the:

A)Principle of comparability.

B)Concept of materiality.

C)Principle of relevance.

D)Principle of conservatism.

A)Principle of comparability.

B)Concept of materiality.

C)Principle of relevance.

D)Principle of conservatism.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

20

A company decides to ignore a very small error in their inventory balance. This is an example of which of the following principles?

A)Comparability principle

B)Materiality concept

C)Accounting conservatism

D)Relevance principle

A)Comparability principle

B)Materiality concept

C)Accounting conservatism

D)Relevance principle

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

21

A company purchased 100 units for $20 each on 31 January. It purchased 100 units for $30 on 28 February. It sold 150 units for $45 each from 1 March through to 31 December. If the company uses the Last- In, First- Out inventory costing method, what is the amount of Cost of sales on the 31 December income statement?

A)$3 500

B)$4 000

C)$6 750

D)$3 750

A)$3 500

B)$4 000

C)$6 750

D)$3 750

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

22

A company purchased 100 units for $20 each on 31 January. It purchased 100 units for $30 on 28 February. It sold 150 units for $45 each from 1 March through to 31 December. If the company uses the First- In, First- Out inventory costing method, what is the amount of ending inventory on 31 December?

A)$1 000

B)$1 250

C)$2 250

D)$1 500

A)$1 000

B)$1 250

C)$2 250

D)$1 500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

23

The specific- unit- cost method of inventory costing is recommended when a business deals in unique and high- priced inventory items.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

24

A company purchased 100 units for $20 each on 31 January. It purchased 100 units for $30 on 28 February. It sold 150 units for $45 each from 1 March through to 31 December. If the company uses the Last- In, First- Out inventory costing method, what is the amount of ending inventory on 31 December?

A)$1 250

B)$2 250

C)$1 500

D)$1 000

A)$1 250

B)$2 250

C)$1 500

D)$1 000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

25

A new average cost is calculated after each purchase when a business is using which of the following methods?

A)Last- In, First- Out

B)Specific- unit- cost

C)Average- cost

D)First- In, First- Out

A)Last- In, First- Out

B)Specific- unit- cost

C)Average- cost

D)First- In, First- Out

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

26

When a company uses FIFO, the Cost of sales correlates to the most recently purchased goods, and the ending inventory correlates to the oldest goods in stock.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

27

Under which of the following inventory costing methods is the Cost of sales based on the cost of the oldest purchases?

A)Last- In, First- Out

B)Average- cost

C)First- In, First- Out

D)Specific- unit- cost

A)Last- In, First- Out

B)Average- cost

C)First- In, First- Out

D)Specific- unit- cost

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

28

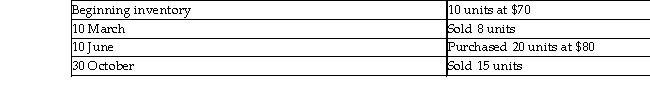

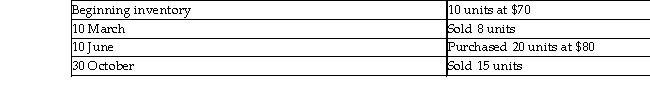

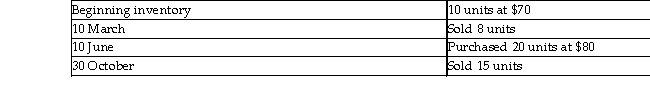

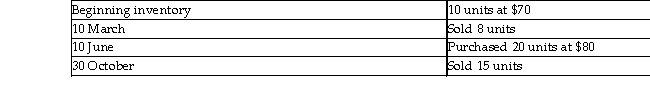

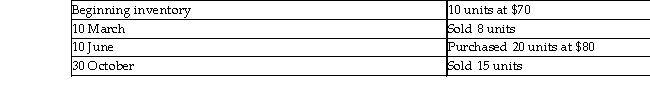

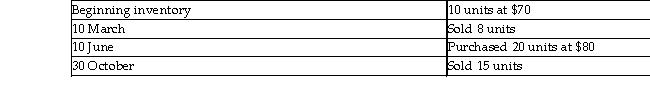

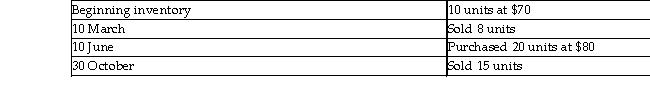

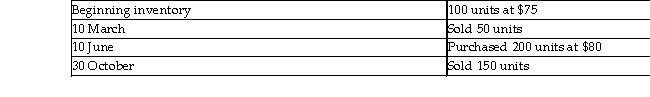

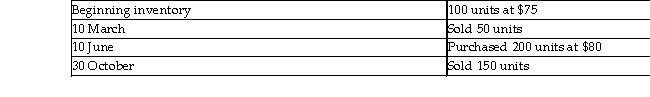

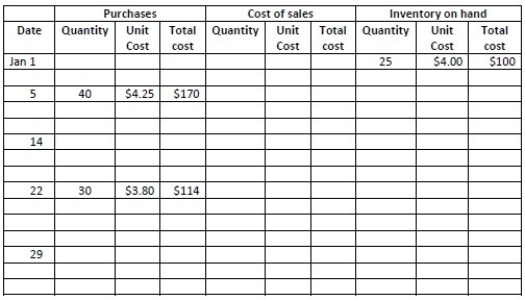

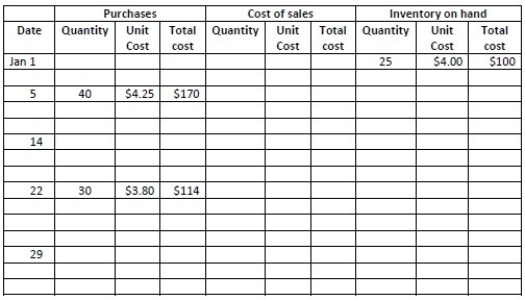

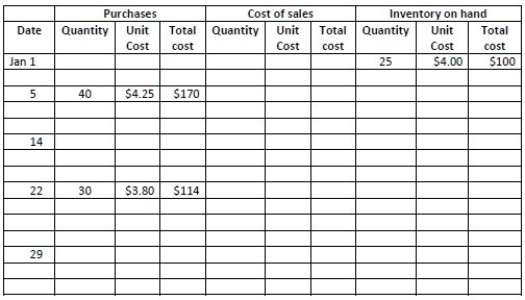

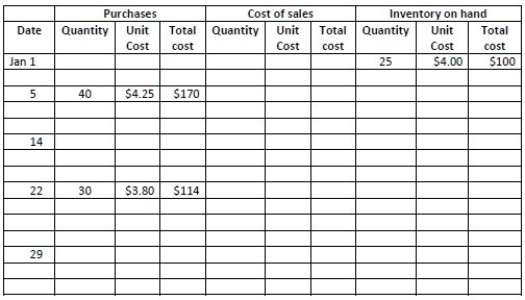

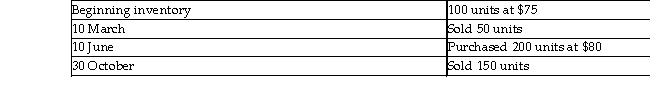

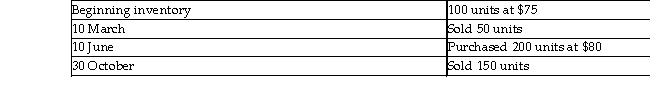

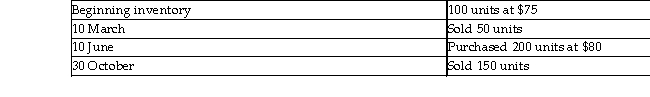

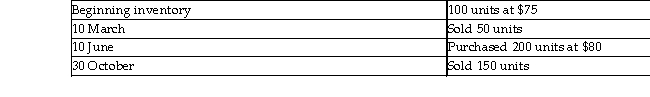

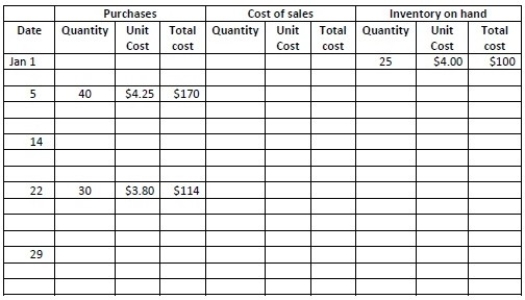

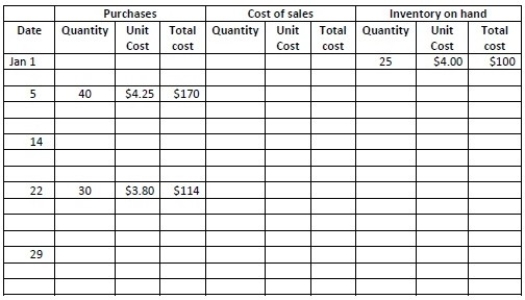

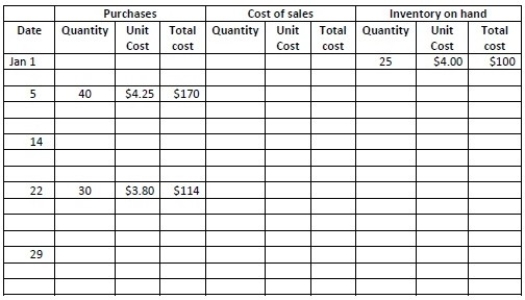

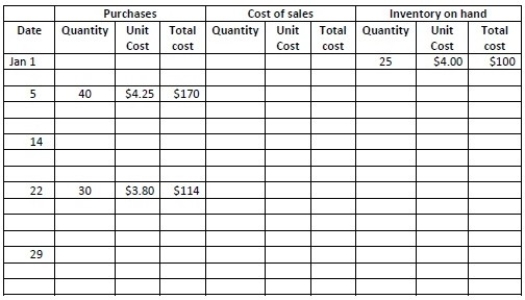

Samson Company had the following balances and transactions during 2013.  What would the company's Inventory amount be on the 31 December 2013 balance sheet if the perpetual Last- In, First- Out costing method is used? (Answers are rounded to the nearest dollar.)

What would the company's Inventory amount be on the 31 December 2013 balance sheet if the perpetual Last- In, First- Out costing method is used? (Answers are rounded to the nearest dollar.)

A)$560

B)$490

C)$540

D)$554

What would the company's Inventory amount be on the 31 December 2013 balance sheet if the perpetual Last- In, First- Out costing method is used? (Answers are rounded to the nearest dollar.)

What would the company's Inventory amount be on the 31 December 2013 balance sheet if the perpetual Last- In, First- Out costing method is used? (Answers are rounded to the nearest dollar.)A)$560

B)$490

C)$540

D)$554

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

29

Which of the following inventory costing methods is based on the actual cost of each particular unit of inventory?

A)Specific- unit- cost

B)First- In, First- Out

C)Average- cost

D)Last- In, First- Out

A)Specific- unit- cost

B)First- In, First- Out

C)Average- cost

D)Last- In, First- Out

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

30

A company purchased 100 units for $20 each on 31 January. It purchased 100 units for $30 on 28 February. It sold 150 units for $45 each from 1 March through to 31 December. If the company uses the average cost inventory costing method, what is the amount of Cost of sales on the 31 December income statement?

A)$6 750

B)$3 750

C)$3 500

D)$4 000

A)$6 750

B)$3 750

C)$3 500

D)$4 000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

31

The various costing methods are necessary because the cost per unit of acquiring new inventory fluctuates frequently.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

32

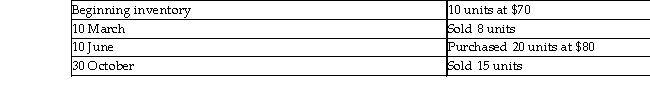

Samson Company had the following balances and transactions during 2013.  What would the company's Cost of sales be on the 31 December 2013 income statement if the perpetual First- In, First- Out costing method is used? (Answers are rounded to the nearest dollar.)

What would the company's Cost of sales be on the 31 December 2013 income statement if the perpetual First- In, First- Out costing method is used? (Answers are rounded to the nearest dollar.)

A)$1 740

B)$1 840

C)$1 760

D)$1 610

What would the company's Cost of sales be on the 31 December 2013 income statement if the perpetual First- In, First- Out costing method is used? (Answers are rounded to the nearest dollar.)

What would the company's Cost of sales be on the 31 December 2013 income statement if the perpetual First- In, First- Out costing method is used? (Answers are rounded to the nearest dollar.)A)$1 740

B)$1 840

C)$1 760

D)$1 610

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

33

Under which of the following inventory costing methods is ending inventory based on the cost of the oldest purchases?

A)Last- In, First- Out

B)Average- cost

C)First- In, First- Out

D)Specific- unit- cost

A)Last- In, First- Out

B)Average- cost

C)First- In, First- Out

D)Specific- unit- cost

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

34

A company purchased 100 units for $20 each on 31 January. It purchased 100 units for $30 on 28 February. It sold 150 units for $45 each from 1 March through to 31 December. If the company uses the First- In, First- Out inventory costing method, what is the amount of Cost of sales on the 31 December income statement?

A)$4 000

B)$3 500

C)$6 750

D)$3 750

A)$4 000

B)$3 500

C)$6 750

D)$3 750

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

35

Samson Company had the following balances and transactions during 2013.  What would the company's Inventory amount be on the 31 December 2013 balance sheet if the perpetual First- In, First- Out costing method is used? (Answers are rounded to the nearest dollar.)

What would the company's Inventory amount be on the 31 December 2013 balance sheet if the perpetual First- In, First- Out costing method is used? (Answers are rounded to the nearest dollar.)

A)$560

B)$490

C)$554

D)$540

What would the company's Inventory amount be on the 31 December 2013 balance sheet if the perpetual First- In, First- Out costing method is used? (Answers are rounded to the nearest dollar.)

What would the company's Inventory amount be on the 31 December 2013 balance sheet if the perpetual First- In, First- Out costing method is used? (Answers are rounded to the nearest dollar.)A)$560

B)$490

C)$554

D)$540

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

36

Samson Company had the following balances and transactions during 2013.  What would the company's Inventory amount be on the 31 December 2013 balance sheet if the perpetual average- costing method is used? (Answers are rounded to the nearest dollar.)

What would the company's Inventory amount be on the 31 December 2013 balance sheet if the perpetual average- costing method is used? (Answers are rounded to the nearest dollar.)

A)$490

B)$554

C)$560

D)$537

What would the company's Inventory amount be on the 31 December 2013 balance sheet if the perpetual average- costing method is used? (Answers are rounded to the nearest dollar.)

What would the company's Inventory amount be on the 31 December 2013 balance sheet if the perpetual average- costing method is used? (Answers are rounded to the nearest dollar.)A)$490

B)$554

C)$560

D)$537

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

37

Samson Company had the following balances and transactions during 2013.  What would the company's Cost of sales be on the 31 December 2013 income statement if the perpetual Last- In, First- Out costing method is used? (Answers are rounded to the nearest dollar.)

What would the company's Cost of sales be on the 31 December 2013 income statement if the perpetual Last- In, First- Out costing method is used? (Answers are rounded to the nearest dollar.)

A)$1 690

B)$1 760

C)$1 810

D)$1 540

What would the company's Cost of sales be on the 31 December 2013 income statement if the perpetual Last- In, First- Out costing method is used? (Answers are rounded to the nearest dollar.)

What would the company's Cost of sales be on the 31 December 2013 income statement if the perpetual Last- In, First- Out costing method is used? (Answers are rounded to the nearest dollar.)A)$1 690

B)$1 760

C)$1 810

D)$1 540

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

38

A company purchased 100 units for $20 each on 31 January. It purchased 100 units for $30 on 28 February. It sold 150 units for $45 each from 1 March through to 31 December. If the company uses the average- cost inventory costing method, what is the amount of ending inventory on 31 December?

A)$1 000

B)$1 500

C)$2 250

D)$1 250

A)$1 000

B)$1 500

C)$2 250

D)$1 250

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

39

Under which of the following inventory costing methods is ending inventory based on the cost of the most recent purchases?

A)First- In, First- Out

B)Specific- unit- cost

C)Average- cost

D)Last- In, First- Out

A)First- In, First- Out

B)Specific- unit- cost

C)Average- cost

D)Last- In, First- Out

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

40

When a company uses LIFO, the Cost of sales correlates to the most recently purchased goods, and the ending inventory correlates to the oldest goods in stock.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

41

Martin Sales had a Beginning inventory balance of $120 made up of 10 units purchased for $12.00 per unit. Early in the month, they purchased 16 units at $10.00 per unit. Later that month, they sold 15 units. Martin uses a perpetual inventory system, and applies the average- costing method. How much is Cost of sales for the month? (When calculating average cost, please round to the nearest cent. When calculating Cost of sales and Ending inventory, please round to the nearest whole dollar.)

A)$170

B)$162

C)$168

D)$158

A)$170

B)$162

C)$168

D)$158

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

42

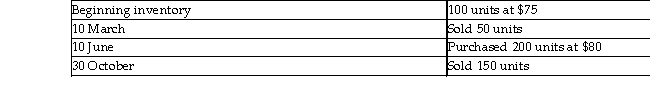

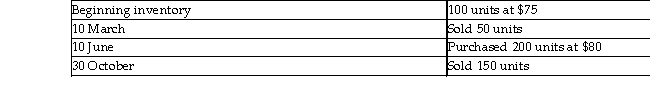

Metro Computer Company had the following balances and transactions during 2014.  What would the Inventory amount be as reported on the balance sheet at 31 December 2014 if the perpetual First- In, First- Out costing method is used? (Answers are rounded to the nearest dollar.)

What would the Inventory amount be as reported on the balance sheet at 31 December 2014 if the perpetual First- In, First- Out costing method is used? (Answers are rounded to the nearest dollar.)

A)$8 600

B)$7 750

C)$7 000

D)$8 000

What would the Inventory amount be as reported on the balance sheet at 31 December 2014 if the perpetual First- In, First- Out costing method is used? (Answers are rounded to the nearest dollar.)

What would the Inventory amount be as reported on the balance sheet at 31 December 2014 if the perpetual First- In, First- Out costing method is used? (Answers are rounded to the nearest dollar.)A)$8 600

B)$7 750

C)$7 000

D)$8 000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

43

Metro Computer Company had the following balances and transactions during 2014.  What would the Cost of sales be as reported on the income statement at 31 December 2014 if the perpetual First- In, First- Out costing method is used? (Answers are rounded to the nearest dollar.)

What would the Cost of sales be as reported on the income statement at 31 December 2014 if the perpetual First- In, First- Out costing method is used? (Answers are rounded to the nearest dollar.)

A)$16 000

B)$15 500

C)$15 000

D)$12 000

What would the Cost of sales be as reported on the income statement at 31 December 2014 if the perpetual First- In, First- Out costing method is used? (Answers are rounded to the nearest dollar.)

What would the Cost of sales be as reported on the income statement at 31 December 2014 if the perpetual First- In, First- Out costing method is used? (Answers are rounded to the nearest dollar.)A)$16 000

B)$15 500

C)$15 000

D)$12 000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

44

Martin Sales had a Beginning inventory balance of $120 made up of 10 units purchased for $12.00 per unit. Early in the month, they purchased 16 units at $10.00 per unit. Later that month, they sold 15 units. Martin uses a perpetual inventory system, and applies FIFO. How much is the Cost of sales for the month?

A)$180

B)$150

C)$170

D)$165

A)$180

B)$150

C)$170

D)$165

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

45

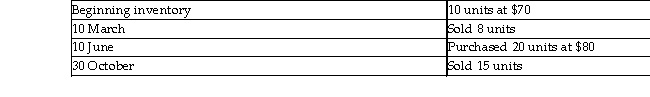

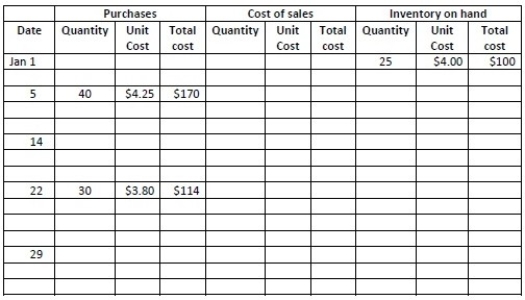

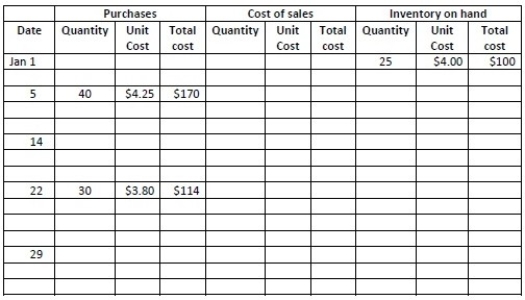

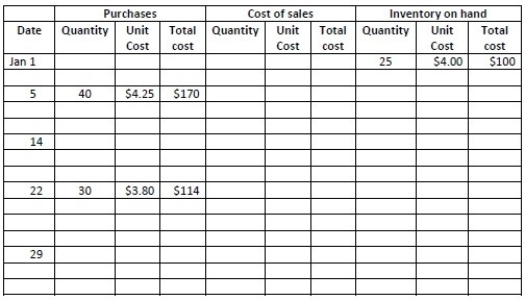

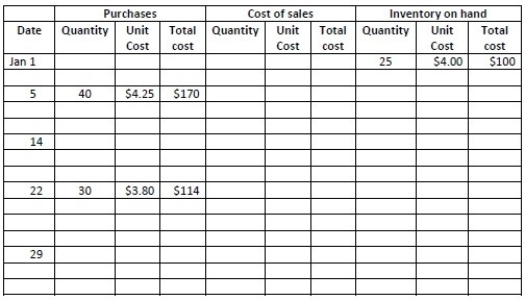

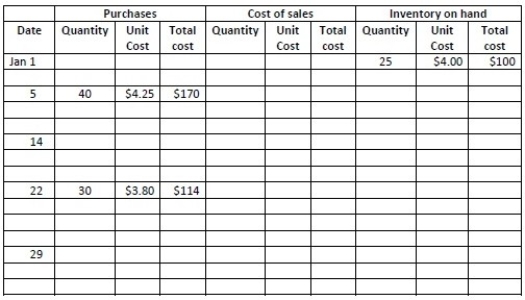

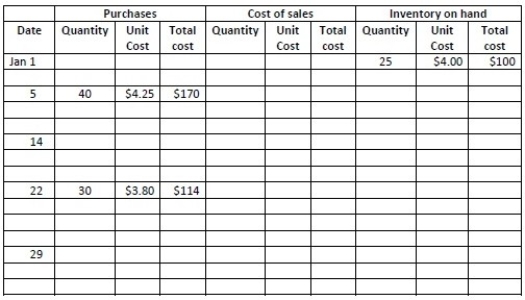

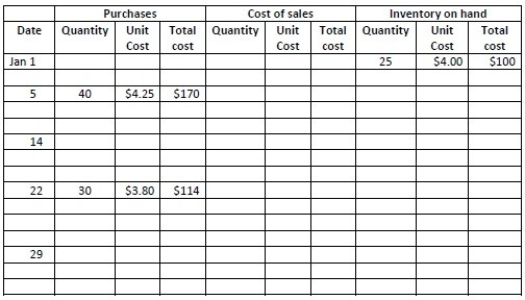

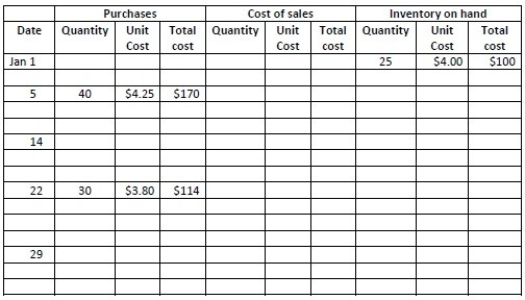

Berring Sales uses FIFO. The partially completed inventory record for January appears below.  On 14 January, the company sold 10 units. On 29 January, the company sold 50 units. Complete the inventory record and calculate the Ending inventory balance at the end of January. (Please round to the nearest whole dollar.)

On 14 January, the company sold 10 units. On 29 January, the company sold 50 units. Complete the inventory record and calculate the Ending inventory balance at the end of January. (Please round to the nearest whole dollar.)

A)$112

B)$388

C)$135

D)$128

On 14 January, the company sold 10 units. On 29 January, the company sold 50 units. Complete the inventory record and calculate the Ending inventory balance at the end of January. (Please round to the nearest whole dollar.)

On 14 January, the company sold 10 units. On 29 January, the company sold 50 units. Complete the inventory record and calculate the Ending inventory balance at the end of January. (Please round to the nearest whole dollar.)A)$112

B)$388

C)$135

D)$128

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

46

Berring Sales uses LIFO. The partially completed inventory record for January appears below.  On 14 January, the company sold 10 units. On 29 January, the company sold 50 units. Complete the inventory record through to the 14 January sale, and calculate the Cost of sales for the 14 January sale. (Please round to the nearest whole dollar.)

On 14 January, the company sold 10 units. On 29 January, the company sold 50 units. Complete the inventory record through to the 14 January sale, and calculate the Cost of sales for the 14 January sale. (Please round to the nearest whole dollar.)

A)$38

B)$33

C)$40

D)$43

On 14 January, the company sold 10 units. On 29 January, the company sold 50 units. Complete the inventory record through to the 14 January sale, and calculate the Cost of sales for the 14 January sale. (Please round to the nearest whole dollar.)

On 14 January, the company sold 10 units. On 29 January, the company sold 50 units. Complete the inventory record through to the 14 January sale, and calculate the Cost of sales for the 14 January sale. (Please round to the nearest whole dollar.)A)$38

B)$33

C)$40

D)$43

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

47

Samson Company had the following balances and transactions during 2013.  What would the company's Cost of sales be on the 31 December 2013 income statement if the perpetual average- costing method is used? (Answers are rounded to the nearest dollar.)

What would the company's Cost of sales be on the 31 December 2013 income statement if the perpetual average- costing method is used? (Answers are rounded to the nearest dollar.)

A)$1 746

B)$1 590

C)$1 652

D)$1 840

What would the company's Cost of sales be on the 31 December 2013 income statement if the perpetual average- costing method is used? (Answers are rounded to the nearest dollar.)

What would the company's Cost of sales be on the 31 December 2013 income statement if the perpetual average- costing method is used? (Answers are rounded to the nearest dollar.)A)$1 746

B)$1 590

C)$1 652

D)$1 840

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

48

Berring Sales uses FIFO. The partially completed inventory record for January appears below.  On 14 January, the company sold 10 units. On 29 January, the company sold 50 units. Complete the inventory record and calculate the Cost of sales for the month of January. (Please round to the nearest whole dollar.)

On 14 January, the company sold 10 units. On 29 January, the company sold 50 units. Complete the inventory record and calculate the Cost of sales for the month of January. (Please round to the nearest whole dollar.)

A)$388

B)$249

C)$240

D)$246

On 14 January, the company sold 10 units. On 29 January, the company sold 50 units. Complete the inventory record and calculate the Cost of sales for the month of January. (Please round to the nearest whole dollar.)

On 14 January, the company sold 10 units. On 29 January, the company sold 50 units. Complete the inventory record and calculate the Cost of sales for the month of January. (Please round to the nearest whole dollar.)A)$388

B)$249

C)$240

D)$246

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

49

Metro Computer Company had the following balances and transactions during 2014.  What would the Inventory amount be as reported on the balance sheet at 31 December 2014 if the perpetual average- costing method is used? (Answers are rounded to the nearest dollar.)

What would the Inventory amount be as reported on the balance sheet at 31 December 2014 if the perpetual average- costing method is used? (Answers are rounded to the nearest dollar.)

A)$8 000

B)$7 900

C)$8 600

D)$7 750

What would the Inventory amount be as reported on the balance sheet at 31 December 2014 if the perpetual average- costing method is used? (Answers are rounded to the nearest dollar.)

What would the Inventory amount be as reported on the balance sheet at 31 December 2014 if the perpetual average- costing method is used? (Answers are rounded to the nearest dollar.)A)$8 000

B)$7 900

C)$8 600

D)$7 750

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

50

Martin Sales had a Beginning inventory balance of $120 made up of 10 units purchased for $12.00 per unit. Early in the month, they purchased 16 units at $10.00 per unit. Later that month, they sold 15 units. Martin uses a perpetual inventory system, and applies LIFO. How much is Cost of sales for the month?

A)$150

B)$170

C)$110

D)$180

A)$150

B)$170

C)$110

D)$180

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

51

Martin Sales had a Beginning inventory balance of $120 made up of 10 units purchased for $12.00 per unit. Early in the month, they purchased 16 units at $10.00 per unit. Later that month, they sold 15 units. Martin uses a perpetual inventory system, and applies the average- costing method. How much is the Ending inventory balance? (When calculating average cost, please round to the nearest cent. When calculating Cost of sales and Ending inventory, please round to the nearest whole dollar.)

A)$126

B)$118

C)$109

D)$122

A)$126

B)$118

C)$109

D)$122

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

52

Berring Sales uses LIFO. The partially completed inventory record for January appears below.  On 14 January, the company sold 10 units. On 29 January, the company sold 50 units. Complete the inventory record and calculate the Cost of sales for the month of January. (Please round to the nearest whole dollar.)

On 14 January, the company sold 10 units. On 29 January, the company sold 50 units. Complete the inventory record and calculate the Cost of sales for the month of January. (Please round to the nearest whole dollar.)

A)$230

B)$249

C)$228

D)$242

On 14 January, the company sold 10 units. On 29 January, the company sold 50 units. Complete the inventory record and calculate the Cost of sales for the month of January. (Please round to the nearest whole dollar.)

On 14 January, the company sold 10 units. On 29 January, the company sold 50 units. Complete the inventory record and calculate the Cost of sales for the month of January. (Please round to the nearest whole dollar.)A)$230

B)$249

C)$228

D)$242

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

53

Berring Sales uses FIFO. The partially completed inventory record for January appears below.  On 14 January, the company sold 10 units. On 29 January, the company sold 50 units. Complete the inventory record through to the 14 January sale and calculate the inventory balance after the sale on 14 January. (Please round to the nearest whole dollar.)

On 14 January, the company sold 10 units. On 29 January, the company sold 50 units. Complete the inventory record through to the 14 January sale and calculate the inventory balance after the sale on 14 January. (Please round to the nearest whole dollar.)

A)$230

B)$228

C)$216

D)$330

On 14 January, the company sold 10 units. On 29 January, the company sold 50 units. Complete the inventory record through to the 14 January sale and calculate the inventory balance after the sale on 14 January. (Please round to the nearest whole dollar.)

On 14 January, the company sold 10 units. On 29 January, the company sold 50 units. Complete the inventory record through to the 14 January sale and calculate the inventory balance after the sale on 14 January. (Please round to the nearest whole dollar.)A)$230

B)$228

C)$216

D)$330

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

54

Martin Sales had a Beginning inventory balance of $120 made up of 10 units purchased for $12.00 per unit. Early in the month, they purchased 16 units at $10.00 per unit. Later that month, they sold 15 units. Martin uses a perpetual inventory system, and applies LIFO. How much is the Ending inventory balance?

A)$130

B)$110

C)$132

D)$116

A)$130

B)$110

C)$132

D)$116

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

55

Metro Computer Company had the following balances and transactions during 2014.  What would the Cost of sales be as reported on the income statement at 31 December 2014 if the perpetual average- costing method is used? (Answers are rounded to the nearest dollar.)

What would the Cost of sales be as reported on the income statement at 31 December 2014 if the perpetual average- costing method is used? (Answers are rounded to the nearest dollar.)

A)$17 750

B)$14 600

C)$13 900

D)$15 600

What would the Cost of sales be as reported on the income statement at 31 December 2014 if the perpetual average- costing method is used? (Answers are rounded to the nearest dollar.)

What would the Cost of sales be as reported on the income statement at 31 December 2014 if the perpetual average- costing method is used? (Answers are rounded to the nearest dollar.)A)$17 750

B)$14 600

C)$13 900

D)$15 600

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

56

Martin Sales had a Beginning inventory balance of $120 made up of 10 units purchased for $12.00 per unit. Early in the month, they purchased 16 units at $10.00 per unit. Later that month, they sold 15 units. Martin uses a perpetual inventory system, and applies FIFO. How much is the Ending inventory balance?

A)$132

B)$130

C)$116

D)$110

A)$132

B)$130

C)$116

D)$110

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

57

Berring Sales uses FIFO. The partially completed inventory record for January appears below.  On 14 January, the company sold 10 units. On 29 January, the company sold 50 units. Complete the inventory record through to the 14 January sale and calculate the Cost of sales for the sale on 14 January. (Please round to the nearest whole dollar.)

On 14 January, the company sold 10 units. On 29 January, the company sold 50 units. Complete the inventory record through to the 14 January sale and calculate the Cost of sales for the sale on 14 January. (Please round to the nearest whole dollar.)

A)$43

B)$40

C)$46

D)$38

On 14 January, the company sold 10 units. On 29 January, the company sold 50 units. Complete the inventory record through to the 14 January sale and calculate the Cost of sales for the sale on 14 January. (Please round to the nearest whole dollar.)

On 14 January, the company sold 10 units. On 29 January, the company sold 50 units. Complete the inventory record through to the 14 January sale and calculate the Cost of sales for the sale on 14 January. (Please round to the nearest whole dollar.)A)$43

B)$40

C)$46

D)$38

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

58

Berring Sales uses LIFO. The partially completed inventory record for January appears below.

On 14 January, the company sold 10 units. On 29 January, the company sold 50 units. Complete the inventory record through to the 14 January sale, and calculate the Inventory balance after the 14 January sale. (Please round to the nearest whole dollar.)

On 14 January, the company sold 10 units. On 29 January, the company sold 50 units. Complete the inventory record through to the 14 January sale, and calculate the Inventory balance after the 14 January sale. (Please round to the nearest whole dollar.)

A)$330

B)$228

C)$380

D)$230

On 14 January, the company sold 10 units. On 29 January, the company sold 50 units. Complete the inventory record through to the 14 January sale, and calculate the Inventory balance after the 14 January sale. (Please round to the nearest whole dollar.)

On 14 January, the company sold 10 units. On 29 January, the company sold 50 units. Complete the inventory record through to the 14 January sale, and calculate the Inventory balance after the 14 January sale. (Please round to the nearest whole dollar.)A)$330

B)$228

C)$380

D)$230

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

59

Metro Computer Company had the following balances and transactions during 2014.  What would the company's Inventory amount be on the 31 December 2014 balance sheet if the perpetual Last- In, First- Out costing method is used? (Answers are rounded to the nearest dollar.)

What would the company's Inventory amount be on the 31 December 2014 balance sheet if the perpetual Last- In, First- Out costing method is used? (Answers are rounded to the nearest dollar.)

A)$8 000

B)$7 300

C)$7 750

D)$7 500

What would the company's Inventory amount be on the 31 December 2014 balance sheet if the perpetual Last- In, First- Out costing method is used? (Answers are rounded to the nearest dollar.)

What would the company's Inventory amount be on the 31 December 2014 balance sheet if the perpetual Last- In, First- Out costing method is used? (Answers are rounded to the nearest dollar.)A)$8 000

B)$7 300

C)$7 750

D)$7 500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

60

Metro Computer Company had the following balances and transactions during 2014.  What would the Cost of sales be as reported on the income statement at 31 December 2014 if the perpetual Last- In, First- Out costing method is used? (Answers are rounded to the nearest dollar.)

What would the Cost of sales be as reported on the income statement at 31 December 2014 if the perpetual Last- In, First- Out costing method is used? (Answers are rounded to the nearest dollar.)

A)$12 000

B)$15 750

C)$15 000

D)$3 750

What would the Cost of sales be as reported on the income statement at 31 December 2014 if the perpetual Last- In, First- Out costing method is used? (Answers are rounded to the nearest dollar.)

What would the Cost of sales be as reported on the income statement at 31 December 2014 if the perpetual Last- In, First- Out costing method is used? (Answers are rounded to the nearest dollar.)A)$12 000

B)$15 750

C)$15 000

D)$3 750

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

61

Given the same purchase and sales data, the three major costing methods will result in three different amounts for Gross profit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

62

The Cost of goods available for sale is equal to the:

A)Ending inventory plus the Sales revenues.

B)Sales revenue minus the Cost of sales.

C)Cost of sales plus the Ending inventory.

D)Cost of sales minus the Ending inventory.

A)Ending inventory plus the Sales revenues.

B)Sales revenue minus the Cost of sales.

C)Cost of sales plus the Ending inventory.

D)Cost of sales minus the Ending inventory.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

63

Which of the following inventory costing methods yields the lowest Ending inventory when costs are rising during the accounting period?

A)Last- In, First- Out

B)First- In, First- Out

C)Specific- unit- cost

D)Average- cost

A)Last- In, First- Out

B)First- In, First- Out

C)Specific- unit- cost

D)Average- cost

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

64

Which of the following inventory costing methods yields the highest cost of sales when costs are rising during the accounting period?

A)Last- In, First- Out

B)First- In, First- Out

C)Average- cost

D)Specific- unit- cost

A)Last- In, First- Out

B)First- In, First- Out

C)Average- cost

D)Specific- unit- cost

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

65

Which of the following inventory costing methods yields the lowest Gross profit when costs are rising during the accounting period?

A)First- In, First- Out

B)Average- cost

C)Last- In, First- Out

D)Specific- unit- cost

A)First- In, First- Out

B)Average- cost

C)Last- In, First- Out

D)Specific- unit- cost

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

66

Which inventory valuation model serves as a middle- of- the- road approach for taxes and income?

A)Last- In, First- Out

B)Specific- unit- cost

C)Average- cost

D)First- In, First- Out

A)Last- In, First- Out

B)Specific- unit- cost

C)Average- cost

D)First- In, First- Out

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

67

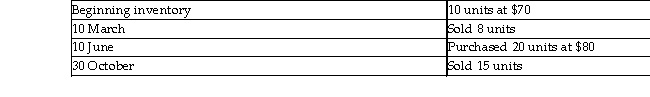

Berring Sales uses the average- cost method. The partially completed inventory record for January appears below.  On 14 January, the company sold 10 units. On 29 January, the company sold 50 units. Complete the inventory record through to the 14 January sale, and calculate the Inventory balance after the 14 January sale. (Please round to the nearest whole dollar.)

On 14 January, the company sold 10 units. On 29 January, the company sold 50 units. Complete the inventory record through to the 14 January sale, and calculate the Inventory balance after the 14 January sale. (Please round to the nearest whole dollar.)

A)$330

B)$228

C)$230

D)$380

On 14 January, the company sold 10 units. On 29 January, the company sold 50 units. Complete the inventory record through to the 14 January sale, and calculate the Inventory balance after the 14 January sale. (Please round to the nearest whole dollar.)

On 14 January, the company sold 10 units. On 29 January, the company sold 50 units. Complete the inventory record through to the 14 January sale, and calculate the Inventory balance after the 14 January sale. (Please round to the nearest whole dollar.)A)$330

B)$228

C)$230

D)$380

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

68

In a period of rising costs, FIFO produces lower Cost of sales and higher Gross profit than LIFO.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

69

Which of the following inventory costing methods yields the highest Gross profit when costs are rising during the accounting period?

A)Specific- unit- cost

B)Last- In, First- Out

C)Average- cost

D)First- In, First- Out

A)Specific- unit- cost

B)Last- In, First- Out

C)Average- cost

D)First- In, First- Out

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

70

Berring Sales uses the average- cost method. The partially completed inventory record for January appears below.  On 14 January, the company sold 10 units. On 29 January, the company sold 50 units. Complete the inventory record through to the 14 January sale, and calculate the Cost of sales for the 14 January sale. (Please round to the nearest whole dollar.)

On 14 January, the company sold 10 units. On 29 January, the company sold 50 units. Complete the inventory record through to the 14 January sale, and calculate the Cost of sales for the 14 January sale. (Please round to the nearest whole dollar.)

A)$42

B)$40

C)$38

D)$33

On 14 January, the company sold 10 units. On 29 January, the company sold 50 units. Complete the inventory record through to the 14 January sale, and calculate the Cost of sales for the 14 January sale. (Please round to the nearest whole dollar.)

On 14 January, the company sold 10 units. On 29 January, the company sold 50 units. Complete the inventory record through to the 14 January sale, and calculate the Cost of sales for the 14 January sale. (Please round to the nearest whole dollar.)A)$42

B)$40

C)$38

D)$33

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

71

The sum of the Cost of sales and the Ending inventory equals the Cost of goods available.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

72

If the historical cost of inventory falls below replacement cost, the business must write down the inventory cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

73

Given the same purchase and sales data, the three major costing methods will result in three different amounts for Cost of sales.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

74

Which of the following inventory costing methods yields the highest Ending inventory when costs are rising during the accounting period?

A)Last- In, First- Out

B)Specific- unit- cost

C)First- In, First- Out

D)Average- cost

A)Last- In, First- Out

B)Specific- unit- cost

C)First- In, First- Out

D)Average- cost

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

75

Berring Sales uses the average- cost method. The partially completed inventory record for January appears below.

On 14 January, the company sold 10 units. On 29 January, the company sold 50 units. Complete the inventory record and calculate the Inventory balance at the end of January. (Please round to the nearest whole dollar.)

On 14 January, the company sold 10 units. On 29 January, the company sold 50 units. Complete the inventory record and calculate the Inventory balance at the end of January. (Please round to the nearest whole dollar.)

A)$228

B)$141

C)$249

D)$135

On 14 January, the company sold 10 units. On 29 January, the company sold 50 units. Complete the inventory record and calculate the Inventory balance at the end of January. (Please round to the nearest whole dollar.)

On 14 January, the company sold 10 units. On 29 January, the company sold 50 units. Complete the inventory record and calculate the Inventory balance at the end of January. (Please round to the nearest whole dollar.)A)$228

B)$141

C)$249

D)$135

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

76

Given the same purchase and sales data, the three major costing methods will result in three different amounts for Sales revenue.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

77

Which of the following inventory costing methods yields the lowest Cost of sales when costs are rising during the accounting period?

A)Last- In, First- Out

B)First- In, First- Out

C)Specific- unit- cost

D)Average- cost

A)Last- In, First- Out

B)First- In, First- Out

C)Specific- unit- cost

D)Average- cost

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

78

Which inventory valuation model minimises income tax when costs are rising?

A)Specific- unit- cost

B)Average- cost

C)Last- In, First- Out

D)First- In, First- Out

A)Specific- unit- cost

B)Average- cost

C)Last- In, First- Out

D)First- In, First- Out

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

79

Berring Sales uses the average- cost method. The partially completed inventory record for January appears below.  On 14 January, the company sold 10 units. On 29 January, the company sold 50 units. Complete the inventory record and calculate the Cost of sales for the month of January. (Please round to the nearest whole dollar.)

On 14 January, the company sold 10 units. On 29 January, the company sold 50 units. Complete the inventory record and calculate the Cost of sales for the month of January. (Please round to the nearest whole dollar.)

A)$243

B)$228

C)$249

D)$230

On 14 January, the company sold 10 units. On 29 January, the company sold 50 units. Complete the inventory record and calculate the Cost of sales for the month of January. (Please round to the nearest whole dollar.)

On 14 January, the company sold 10 units. On 29 January, the company sold 50 units. Complete the inventory record and calculate the Cost of sales for the month of January. (Please round to the nearest whole dollar.)A)$243

B)$228

C)$249

D)$230

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

80

Berring Sales uses LIFO. The partially completed inventory record for January appears below.  On 14 January, the company sold 10 units. On 29 January, the company sold 50 units. Complete the inventory record and calculate the Inventory balance at the end of January. (Please round to the nearest whole dollar.)

On 14 January, the company sold 10 units. On 29 January, the company sold 50 units. Complete the inventory record and calculate the Inventory balance at the end of January. (Please round to the nearest whole dollar.)

A)$143

B)$249

C)$228

D)$135

On 14 January, the company sold 10 units. On 29 January, the company sold 50 units. Complete the inventory record and calculate the Inventory balance at the end of January. (Please round to the nearest whole dollar.)

On 14 January, the company sold 10 units. On 29 January, the company sold 50 units. Complete the inventory record and calculate the Inventory balance at the end of January. (Please round to the nearest whole dollar.)A)$143

B)$249

C)$228

D)$135

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck