Deck 5: Retailing Operations

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/130

العب

ملء الشاشة (f)

Deck 5: Retailing Operations

1

ABC Ltd. has made credit sales of $2 200, including GST. ABC Ltd. will debit accounts receivable with:

A)2 000

B)1 800

C)2 420

D)2 200

A)2 000

B)1 800

C)2 420

D)2 200

D

2

What is the first step in the operating cycle for a retailing business?

A)The firm sells inventory to customers, creating accounts receivable.

B)The firm buys inventory.

C)The firm collects cash.

D)The firm delivers inventory to customers.

A)The firm sells inventory to customers, creating accounts receivable.

B)The firm buys inventory.

C)The firm collects cash.

D)The firm delivers inventory to customers.

B

3

Credit terms of 2/10, n/30 mean that the purchaser may deduct 2 percent if the invoice is paid within 10 days, with the full amount due in 30 days if the early payment option is NOT exercised.

True

4

Inventory is the:

A)items purchased to run the daily operations of a business.

B)expenses of a firm that were incurred.

C)equipment that was purchased.

D)items held by a firm to be sold to customers.

A)items purchased to run the daily operations of a business.

B)expenses of a firm that were incurred.

C)equipment that was purchased.

D)items held by a firm to be sold to customers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

5

The ATO will refund any GST a registered firm pays to a supplier.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

6

When a firm uses the perpetual inventory method, the inventory account should be constantly updated.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

7

The perpetual inventory system keeps a running record of inventory and cost of sales.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

8

All else being equal, a firm that is not registered for GST is likely to report a higher profit than a registered firm.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

9

Which of the following assets MUST a retailing business have for daily operations?

A)Accounts receivable

B)Equipment

C)Prepaid insurance

D)Inventory

A)Accounts receivable

B)Equipment

C)Prepaid insurance

D)Inventory

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

10

Retailing consists of:

A)buying and selling products.

B)providing a service.

C)purchasing raw materials.

D)manufacturing products.

A)buying and selling products.

B)providing a service.

C)purchasing raw materials.

D)manufacturing products.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

11

HiLo Running Store is not registered for GST. Which of the following statements is INCORRECT?

A)The firm will not be able to claim a refund from the ATO on GST paid to suppliers.

B)Journal entries for sales and purchases will not include a GST Clearing account.

C)Purchases of inventory will be recorded at the 'gross' amount, that is, the amount including GST.

D)The firm will charge a flat rate of GST on all goods sold.

A)The firm will not be able to claim a refund from the ATO on GST paid to suppliers.

B)Journal entries for sales and purchases will not include a GST Clearing account.

C)Purchases of inventory will be recorded at the 'gross' amount, that is, the amount including GST.

D)The firm will charge a flat rate of GST on all goods sold.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

12

In a periodic system, inventory balances and the cost of sales for the current period are determined:

A)on the first day of each year.

B)when a physical inventory count is taken.

C)on a frequent basis.

D)at the time of sale.

A)on the first day of each year.

B)when a physical inventory count is taken.

C)on a frequent basis.

D)at the time of sale.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

13

Under a perpetual inventory system, which of the following would NOT be required?

A)Updating the inventory balance with each sale

B)Record cost of sales with each sale

C)Detailed inventory records

D)A weekly count of the inventory

A)Updating the inventory balance with each sale

B)Record cost of sales with each sale

C)Detailed inventory records

D)A weekly count of the inventory

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

14

The accounting cycle for a retailing business begins with the purchase of inventory.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

15

The periodic inventory system keeps a running record of inventory and cost of sales.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

16

The GST payable to the ATO represents the GST the firm has paid to its suppliers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

17

ABC Ltd. has made credit sales of $2 200, including GST. ABC Ltd. will credit sales revenue with:

A)2 000

B)2 420

C)1 800

D)2 200

A)2 000

B)2 420

C)1 800

D)2 200

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

18

The periodic inventory system is normally used for relatively inexpensive goods.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

19

GST is a flat percentage charge levied on the supply of goods and services.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

20

Which of the following assets does a retailer-but NOT a service business-need?

A)Inventory

B)Equipment

C)Prepaid insurance

D)Accounts receivable

A)Inventory

B)Equipment

C)Prepaid insurance

D)Accounts receivable

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

21

A firm that uses the perpetual inventory method purchases inventory of $1 000 on credit, including GST, with terms of 2/10, n/30. Which of the following entries would be made to record the payment if it is made within 10 days?

A)$980 debit to Accounts payable, a $20 debit to Inventory and a $1 000 credit to Cash

B)$18.18 debit to Inventory, a $1.82 debit to GST Clearing, a $1 000 debit to Accounts payable and a $1 020 credit to Cash

C)$1 000 debit to Accounts payable and a $1 000 credit to Cash

D)$1 000 debit to Accounts payable, a $18.18 credit to Inventory, a $1.82 credit to GST Clearing and a $980 credit to Cash

A)$980 debit to Accounts payable, a $20 debit to Inventory and a $1 000 credit to Cash

B)$18.18 debit to Inventory, a $1.82 debit to GST Clearing, a $1 000 debit to Accounts payable and a $1 020 credit to Cash

C)$1 000 debit to Accounts payable and a $1 000 credit to Cash

D)$1 000 debit to Accounts payable, a $18.18 credit to Inventory, a $1.82 credit to GST Clearing and a $980 credit to Cash

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

22

What is freight out?

A)Transportation costs to ship goods out of the warehouse

B)Costs that are not expensed

C)Inventory costs

D)Transportation costs to ship goods into the warehouse

A)Transportation costs to ship goods out of the warehouse

B)Costs that are not expensed

C)Inventory costs

D)Transportation costs to ship goods into the warehouse

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

23

Freight out is an addition to the Inventory account if the firm uses the perpetual inventory method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

24

A firm receives an invoice that indicates that title to the inventory will pass to the firm when they receive the goods. This situation is described as FOB destination.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

25

A firm that uses the perpetual inventory method purchases inventory of $1 000 on credit with terms of 2/10, n/30. Defective inventory of $200 is returned 2 days later and the accounts are appropriately adjusted. If the firm paid the vendor within 10 days, which of the following entries would be made to record the payment? All amounts include GST.

A)$800 debit to Accounts payable and an $800 credit to Cash

B)$14.55 debit to Inventory, a $1.45 debit to GST Clearing, an $800 debit to Accounts payable and an $816 credit to Cash

C)$800 debit to Accounts payable, a $14.55 credit to Inventory, a $1.45 debit to GST Clearing and a $784 credit to Cash

D)$784 debit to Accounts payable, a $14.55 debit to Inventory, a $1.45 debit to GST Clearing and an $800 credit to Cash

A)$800 debit to Accounts payable and an $800 credit to Cash

B)$14.55 debit to Inventory, a $1.45 debit to GST Clearing, an $800 debit to Accounts payable and an $816 credit to Cash

C)$800 debit to Accounts payable, a $14.55 credit to Inventory, a $1.45 debit to GST Clearing and a $784 credit to Cash

D)$784 debit to Accounts payable, a $14.55 debit to Inventory, a $1.45 debit to GST Clearing and an $800 credit to Cash

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

26

In the credit terms of 2/10, n/30, what does the 2/10 mean?

A)The invoice was printed 2 days after the sale and is due in 10 days.

B)The invoice must be paid in 2 days or a 10% late charge will be assessed.

C)The goods shipped took 2 days to arrive and the charge was $10.00.

D)The purchaser may take a 2% discount if the invoice is paid in 10 days.

A)The invoice was printed 2 days after the sale and is due in 10 days.

B)The invoice must be paid in 2 days or a 10% late charge will be assessed.

C)The goods shipped took 2 days to arrive and the charge was $10.00.

D)The purchaser may take a 2% discount if the invoice is paid in 10 days.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

27

Freight in should be added to the inventory account if the firm uses the perpetual inventory method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

28

If a firm, using a perpetual inventory system, purchases inventory on credit, and later returns $200 of goods to the vendor, including GST, what entry would be made to record the return of goods to the vendor?

A)$200 debit to Purchases and a $200 credit to Accounts payable

B)$200 debit to Accounts payable and a $200 credit to Purchases

C)$181.82 debit to Inventory, a $18.18 debit to GST Clearing and a $200 credit to Accounts payable

D)$200 debit to Accounts payable, a $181.82 credit to Inventory and a $18.18 credit to GST Clearing

A)$200 debit to Purchases and a $200 credit to Accounts payable

B)$200 debit to Accounts payable and a $200 credit to Purchases

C)$181.82 debit to Inventory, a $18.18 debit to GST Clearing and a $200 credit to Accounts payable

D)$200 debit to Accounts payable, a $181.82 credit to Inventory and a $18.18 credit to GST Clearing

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

29

In a perpetual inventory system, the entry to record the inventory purchased includes a credit to Cost of sales.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

30

What is freight in?

A)Transportation costs to ship goods out of the warehouse

B)Costs that are expensed

C)Transportation costs that are not recorded

D)Transportation costs to ship goods into the warehouse

A)Transportation costs to ship goods out of the warehouse

B)Costs that are expensed

C)Transportation costs that are not recorded

D)Transportation costs to ship goods into the warehouse

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

31

A firm uses the perpetual inventory method. Which of the following entries would be made to record a purchase of inventory on credit?

A)The accounting entry would be a debit to Inventory and GST Clearing and a credit to Accounts payable.

B)The accounting entry would be a debit to Accounts payable and a credit to Purchases and GST Clearing.

C)The accounting entry would be a debit to Accounts payable and GST Clearing and a credit to Inventory.

D)The accounting entry would be a debit to Purchases and GST Clearing and a credit to Accounts payable.

A)The accounting entry would be a debit to Inventory and GST Clearing and a credit to Accounts payable.

B)The accounting entry would be a debit to Accounts payable and a credit to Purchases and GST Clearing.

C)The accounting entry would be a debit to Accounts payable and GST Clearing and a credit to Inventory.

D)The accounting entry would be a debit to Purchases and GST Clearing and a credit to Accounts payable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

32

Purchase returns and allowances decrease the net amount of cash that will be paid for the inventory, and so they should reduce the cost of the inventory as recorded in the Inventory account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

33

A firm that uses the perpetual inventory method purchases inventory of $1 000 on credit with terms of 2/10, n/30. Defective inventory of $200 is returned 2 days later and the accounts are appropriately adjusted. If the firm paid the vendor 25 days later, which of the following entries would be made to record the payment? All amounts include GST.

A)$800 debit to Accounts payable and an $800 credit to Cash

B)$14.55 debit to Inventory, a $1.45 debit to GST Clearing, an $800 debit to Accounts payable and an $816 credit to Cash

C)$800 debit to Accounts payable, a $16 credit to Inventory and a $784 credit to Cash

D)$784 debit to Accounts payable, a $14.55 debit to Inventory, a $1.45 debit to GST Clearing and an $800 credit to Cash

A)$800 debit to Accounts payable and an $800 credit to Cash

B)$14.55 debit to Inventory, a $1.45 debit to GST Clearing, an $800 debit to Accounts payable and an $816 credit to Cash

C)$800 debit to Accounts payable, a $16 credit to Inventory and a $784 credit to Cash

D)$784 debit to Accounts payable, a $14.55 debit to Inventory, a $1.45 debit to GST Clearing and an $800 credit to Cash

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

34

When a firm is purchasing inventory, and pays early to take advantage of the purchase discount offered by the vendor, that amount is debited to the Inventory account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

35

When a firm is purchasing inventory, and there are either returns or allowances for damaged goods, those amounts are recorded as a debit to the Sales returns and allowances account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

36

What is a purchase return?

A)A customer refund from the sale of inventory

B)A return of cash to the purchaser

C)A return of inventory that is defective or damaged

D)A price reduction

A)A customer refund from the sale of inventory

B)A return of cash to the purchaser

C)A return of inventory that is defective or damaged

D)A price reduction

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

37

Credit terms of 2/10, n/30 indicate that a 2% discount may be taken if the invoice is paid within 10 days, but the total invoice amount is due if paid on the 11th to the 30th day after the invoice date.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

38

A firm that uses the perpetual inventory method purchases inventory of $1 000 on credit, including GST, with terms of 2/10, n/30. Which of the following entries would be made to record the payment if it is made 20 days later?

A)$1 000 debit to Accounts payable and a $1 000 credit to Cash

B)$1 000 debit to Accounts payable, a $18.18 credit to Inventory, a $1.82 credit to GST Clearing and a $980 credit to Cash

C)$980 debit to Accounts payable, a $20 debit to Inventory and a $1 000 credit to Cash

D)$20 debit to Inventory, a $1 000 debit to Accounts payable and a $1 020 credit to Cash

A)$1 000 debit to Accounts payable and a $1 000 credit to Cash

B)$1 000 debit to Accounts payable, a $18.18 credit to Inventory, a $1.82 credit to GST Clearing and a $980 credit to Cash

C)$980 debit to Accounts payable, a $20 debit to Inventory and a $1 000 credit to Cash

D)$20 debit to Inventory, a $1 000 debit to Accounts payable and a $1 020 credit to Cash

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

39

Which of the following is TRUE about freight in?

A)Freight in is deducted from Accounts payable.

B)Freight in is added to the cost of inventory.

C)Freight in is a selling expense.

D)Freight in is an operating expense.

A)Freight in is deducted from Accounts payable.

B)Freight in is added to the cost of inventory.

C)Freight in is a selling expense.

D)Freight in is an operating expense.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

40

A purchase return of goods purchased on credit is recorded by the purchasing firm as a debit to what account?

A)Inventory

B)Cost of sales

C)Accounts payable

D)Accounts receivable

A)Inventory

B)Cost of sales

C)Accounts payable

D)Accounts receivable

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

41

Using the perpetual inventory system, discounts taken on an invoice, such as 3/10, n/30, would be:

A)debited to Inventory.

B)debited to Cost of sales.

C)credited to Inventory.

D)credited to Cost of sales.

A)debited to Inventory.

B)debited to Cost of sales.

C)credited to Inventory.

D)credited to Cost of sales.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

42

FOB shipping point means that the:

A)seller normally pays the transportation costs.

B)buyer and the seller split the shipping costs.

C)buyer normally pays the transportation costs.

D)shipping costs are billed to the seller.

A)seller normally pays the transportation costs.

B)buyer and the seller split the shipping costs.

C)buyer normally pays the transportation costs.

D)shipping costs are billed to the seller.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

43

A firm that uses the perpetual inventory method purchased inventory for $2 000 from a vendor on credit, FOB shipping point, with terms of 2/10, n/30. The firm paid the shipper $100 cash for freight in. The firm paid the vendor 9 days after the sale. Assuming this was the only transaction affecting inventory, and that there was no beginning balance, what is the overall cost of the inventory? All amounts include GST.

A)$2 060.00

B)$2 100.00

C)$2 000.00

D)$1 872.73

A)$2 060.00

B)$2 100.00

C)$2 000.00

D)$1 872.73

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

44

A sales allowance is recorded with a debit to Inventory.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

45

An invoice is dated 28 April for $235.00 and is shown with payment terms of 5/10, n/30. If the invoice is paid on 12 May, the amount to pay will be:

A)$223.25.

B)$211.50.

C)$235.00.

D)$230.00.

A)$223.25.

B)$211.50.

C)$235.00.

D)$230.00.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

46

A firm that uses the perpetual inventory method purchases inventory for $2 000 from a vendor on credit, FOB shipping point, with terms of 2/10, n/30. The firm paid the shipper $100 cash for freight in. Which of the following entries would be made to record payment to the vendor if the payment is made within 10 days? All amounts include GST.

A)$2 000 debit to Accounts payable, a $100 debit to Inventory and a $1 960 credit to Cash

B)$2 000 debit to Accounts payable, a $36.36 credit to Inventory, a $3.64 credit to GST Clearing and a $1 960 credit to Cash

C)$1 960 debit to Accounts payable, a $36.36 debit to Inventory, a $3.64 debit to GST Clearing and a $2 000 credit to Cash

D)$1 960 debit to Accounts payable and a $1 960 credit to Cash

A)$2 000 debit to Accounts payable, a $100 debit to Inventory and a $1 960 credit to Cash

B)$2 000 debit to Accounts payable, a $36.36 credit to Inventory, a $3.64 credit to GST Clearing and a $1 960 credit to Cash

C)$1 960 debit to Accounts payable, a $36.36 debit to Inventory, a $3.64 debit to GST Clearing and a $2 000 credit to Cash

D)$1 960 debit to Accounts payable and a $1 960 credit to Cash

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

47

Compute the amount of payment for an invoice of $5 600, 4/10, n/30 paid on the 7th day.

A)$5 600

B)$5 040

C)$5 570

D)$5 376

A)$5 600

B)$5 040

C)$5 570

D)$5 376

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

48

Which of the following means that the shipment is free on board at the point of shipment and the buyer pays all shipping costs?

A)4/10 eom

B)COD

C)FOB destination

D)FOB shipping point

A)4/10 eom

B)COD

C)FOB destination

D)FOB shipping point

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

49

When a firm ships goods to a customer and pays for freight out, how is that cost recorded?

A)As an addition to cost of sales

B)As an operating expense

C)As an addition to the cost of inventory

D)As a reduction of sales revenue

A)As an addition to cost of sales

B)As an operating expense

C)As an addition to the cost of inventory

D)As a reduction of sales revenue

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

50

An invoice in the amount of $600.00 for inventory purchased is shown with a 4/10, n/30 discount. To get the discount, the amount to pay on or before the tenth day is:

A)$552.50.

B)$600.00.

C)$576.00.

D)$540.25.

A)$552.50.

B)$600.00.

C)$576.00.

D)$540.25.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

51

The terms on an invoice are 3/10, n/25. This means that a:

A)discount of 3% is allowed if the invoice is paid in 10 days.

B)discount of 10% is allowed if the invoice is paid in 3 days.

C)discount of 25% is allowed if the invoice is paid in 10 days.

D)discount of 3% is allowed if the invoice is paid after 25 days.

A)discount of 3% is allowed if the invoice is paid in 10 days.

B)discount of 10% is allowed if the invoice is paid in 3 days.

C)discount of 25% is allowed if the invoice is paid in 10 days.

D)discount of 3% is allowed if the invoice is paid after 25 days.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

52

A sales return is recorded with a credit to Accounts receivable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

53

A sales allowance is recorded with a credit to Accounts receivable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

54

A firm uses the perpetual inventory method. To record a sale of inventory on credit will require an entry to record revenue and an entry to record cost of sales.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

55

Which of the following is GENERALLY the major cost of inventory?

A)Cost of sales

B)Advertising

C)Buildings

D)Salary expense

A)Cost of sales

B)Advertising

C)Buildings

D)Salary expense

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

56

FOB Destination means that the:

A)shipping costs are billed to the buyer.

B)buyer normally pays the transportation costs.

C)seller normally pays the transportation costs.

D)buyer and the seller split the shipping costs.

A)shipping costs are billed to the buyer.

B)buyer normally pays the transportation costs.

C)seller normally pays the transportation costs.

D)buyer and the seller split the shipping costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

57

A firm that uses the perpetual inventory method purchased inventory for $2 000 from a vendor on credit, FOB shipping point, with terms of 2/10, n/30. The firm paid the shipper $100 cash for freight in. The firm then returned $200 of damaged goods and got an allowance from the vendor. The firm paid the vendor 8 days after the sale. Assuming this was the only transaction affecting inventory, and that there was no beginning balance, what is the overall cost of the inventory? All amounts include GST.

A)$1 694.55

B)$2 100.00

C)$1 764.00

D)$1 864.00

A)$1 694.55

B)$2 100.00

C)$1 764.00

D)$1 864.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

58

A firm has purchased inventory and receives an invoice that indicates that the buyer must pay the transportation costs of delivering the inventory. Which of the following will most likely be noted as the delivery terms?

A)FOB 2/10, n/30

B)FOB destination

C)FOB shipping point

D)None of the above

A)FOB 2/10, n/30

B)FOB destination

C)FOB shipping point

D)None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

59

Net sales revenue is equal to Sales revenue less Cost of sales.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

60

A sales return is recorded with a credit to Inventory.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

61

Which of the following are the normal balances of Sales, Sales discounts, and Sales returns and allowances, respectively?

A)Debit, debit, and credit

B)Debit, credit, and credit

C)Credit, credit, and debit

D)Credit, debit, and debit

A)Debit, debit, and credit

B)Debit, credit, and credit

C)Credit, credit, and debit

D)Credit, debit, and debit

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

62

On 1 November 2014, Everett Janitorial Supply sold inventory for $5 000, FOB destination, 2/10, n/30. The inventory cost $3 200. Everett paid transportation costs of $100. On 6 November 2014, inventory of $1 000 from the 1 November sale was returned. The returned inventory had cost $600. Everett received payment for the balance of the sale on 10 November 2014. If this were the only sales transaction of the period, what amount of Net sales revenue would be shown on the income statement? All figures include GST.

A)$3 920.00

B)$2 400.00

C)$3 563.64

D)$1 636.36

A)$3 920.00

B)$2 400.00

C)$3 563.64

D)$1 636.36

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

63

Which of the following defines Gross profit?

A)Net sales revenue less Sales discounts

B)Net sales revenue less Cost of sales

C)Sales revenue less Overhead expenses

D)Sales revenue less Sales discounts and allowances

A)Net sales revenue less Sales discounts

B)Net sales revenue less Cost of sales

C)Sales revenue less Overhead expenses

D)Sales revenue less Sales discounts and allowances

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

64

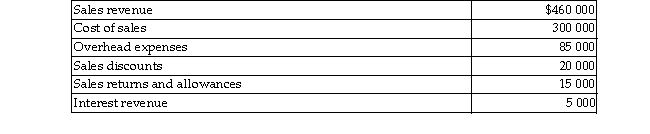

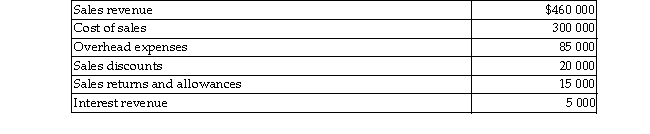

Referring to the following table, what is Net sales revenue?

A)$400 000

B)$455 000

C)$415 000

D)$425 000

A)$400 000

B)$455 000

C)$415 000

D)$425 000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

65

In a perpetual inventory system, inventory returned by the customer for a refund is called a:

A)sales adjustment.

B)sales discount.

C)sales allowance.

D)sales return.

A)sales adjustment.

B)sales discount.

C)sales allowance.

D)sales return.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

66

What is the difference between a sales return and a sales allowance?

A)A sales allowance is deducted from Sales revenue to calculate net sales, but a sales return is not.

B)A sales return requires a debit to Sales returns and allowances, but a sales allowance does not.

C)A sales return reduces the amount receivable from the customer, but an allowance does not.

D)A sales return involves an adjustment to Inventory, but a sales allowance does not.

A)A sales allowance is deducted from Sales revenue to calculate net sales, but a sales return is not.

B)A sales return requires a debit to Sales returns and allowances, but a sales allowance does not.

C)A sales return reduces the amount receivable from the customer, but an allowance does not.

D)A sales return involves an adjustment to Inventory, but a sales allowance does not.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

67

On 1 November 2014, Everett Janitorial Supply sold inventory for $5 000, FOB destination, 2/10, n/30. The inventory cost $3 200. Everett paid transportation costs of $100. On 6 November 2014, inventory of $1 000 from the 1 November sale was returned. The returned inventory had cost $600. Everett received payment for the balance of the sale on 10 November 2014. If this were the only sales transaction of the period, what amount of Gross profit would be shown on the income statement? All figures EXCLUDE GST.

A)$1 320

B)$2 400

C)$3 920

D)$1 800

A)$1 320

B)$2 400

C)$3 920

D)$1 800

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

68

A firm sells inventory for $1 000, including GST, on credit with terms of 2/10, n/30. Defective inventory of $200, including GST, is returned 2 days later. Which of the following entries would be made to record the cash receipt for the sale if the payment is received 20 days later?

A)The accounting entry would be an $800 debit to Cash, a $14.55 credit to Sales discounts, a $1.45 credit to GST Clearing and a $784 credit to Accounts receivable.

B)The accounting entry would be a $784 debit to Cash, a $14.55 debit to Sales discounts, a $1.45 debit to GST Clearing and an $800 credit to Accounts receivable.

C)The accounting entry would be an $800 debit to Cash and an $800 credit to Accounts receivable.

D)The accounting entry would be a $14.55 debit to Sales discounts, a $1.45 debit to GST Clearing, an $800 debit to Cash and an $816 credit to Accounts receivable.

A)The accounting entry would be an $800 debit to Cash, a $14.55 credit to Sales discounts, a $1.45 credit to GST Clearing and a $784 credit to Accounts receivable.

B)The accounting entry would be a $784 debit to Cash, a $14.55 debit to Sales discounts, a $1.45 debit to GST Clearing and an $800 credit to Accounts receivable.

C)The accounting entry would be an $800 debit to Cash and an $800 credit to Accounts receivable.

D)The accounting entry would be a $14.55 debit to Sales discounts, a $1.45 debit to GST Clearing, an $800 debit to Cash and an $816 credit to Accounts receivable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

69

Which of the following describes Net sales revenue?

A)Sales less Sales returns and allowances

B)Sales less Sales discounts less Sales returns and allowances

C)Sales less Cost of sales

D)Sales less Sales discounts

A)Sales less Sales returns and allowances

B)Sales less Sales discounts less Sales returns and allowances

C)Sales less Cost of sales

D)Sales less Sales discounts

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

70

Michelin Jewellers completed the following transactions. Michelin Jewellers uses the perpetual inventory system. On 2 April, Michelin sold $9 900 of inventory, including GST, to a customer on credit with terms of 3/15, n/30. Michelin's cost of the inventory sold was $5 000, net of GST. On 4 April, the customer reported damaged goods and Michelin granted a $1 100 sales allowance, including GST. On 10 April, Michelin received payment from the customer. If this were the only transaction for the period, what amount would be shown on the income statement for Net sales revenue?

A)$8 760

B)$8 000

C)$9 000

D)$7 760

A)$8 760

B)$8 000

C)$9 000

D)$7 760

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

71

Gross profit is equal to Sales revenue less Sales returns and allowances, and Sales discounts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

72

When a firm uses the perpetual inventory method, it should NOT be necessary to conduct a physical count of inventory.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

73

Net sales revenue is equal to Sales revenue less Sales returns and allowances, and Sales discounts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

74

A firm sold inventory for $350 that cost $221. The entry to record the cost of the inventory sold would be a:

A)debit to Sales and a credit to Cash for $350.

B)debit to Cost of sales and a credit to Inventory for $221.

C)debit to Cash and a credit to Sales for $350.

D)debit to Inventory for $221 and a credit to Cost of sales for $221.

A)debit to Sales and a credit to Cash for $350.

B)debit to Cost of sales and a credit to Inventory for $221.

C)debit to Cash and a credit to Sales for $350.

D)debit to Inventory for $221 and a credit to Cost of sales for $221.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

75

Michelin Jewellers completed the following transactions. Michelin Jewellers uses the perpetual inventory system. On 2 April, Michelin sold $9 900 of inventory, including GST, to a customer on credit with terms of 3/15, n/30. Michelin's cost of the inventory sold was $5 000, net of GST. On 4 April, the customer reported damaged goods and Michelin granted a $1 100 sales allowance, including GST. On 10 April, Michelin received payment from the customer. How much cash was received from the customer?

A)$8 800

B)$8 536

C)$8 730

D)$3 800

A)$8 800

B)$8 536

C)$8 730

D)$3 800

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

76

A firm sells inventory for $1 000, including GST, on credit with terms of 2/10, n/30. Defective inventory of $200, including GST, is returned 2 days later. Which of the following entries would be made to record the cash receipt for the sale if the payment is received within 10 days?

A)The accounting entry would be an $800 debit to Cash and an $800 credit to Accounts receivable.

B)The accounting entry would be a $14.55 debit to Sales discounts, a $1.45 debit to GST Clearing, an $800 debit to Cash and an $816 credit to Accounts receivable.

C)The accounting entry would be a $784 debit to Cash, a $14.55 debit to Sales discounts, a $1.45 debit to GST Clearing and an $800 credit to Accounts receivable.

D)The accounting entry would be an $800 debit to Cash, a $14.55 credit to Sales discounts, a $1.45 credit to GST Clearing and a $784 credit to Accounts receivable.

A)The accounting entry would be an $800 debit to Cash and an $800 credit to Accounts receivable.

B)The accounting entry would be a $14.55 debit to Sales discounts, a $1.45 debit to GST Clearing, an $800 debit to Cash and an $816 credit to Accounts receivable.

C)The accounting entry would be a $784 debit to Cash, a $14.55 debit to Sales discounts, a $1.45 debit to GST Clearing and an $800 credit to Accounts receivable.

D)The accounting entry would be an $800 debit to Cash, a $14.55 credit to Sales discounts, a $1.45 credit to GST Clearing and a $784 credit to Accounts receivable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

77

Which of the following defines Net sales revenue?

A)Sales revenue less Overhead expenses

B)Sales revenue less Sales discounts

C)Sales revenue less Cost of sales

D)Sales revenue less Sales returns and allowances, and Sales discounts

A)Sales revenue less Overhead expenses

B)Sales revenue less Sales discounts

C)Sales revenue less Cost of sales

D)Sales revenue less Sales returns and allowances, and Sales discounts

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

78

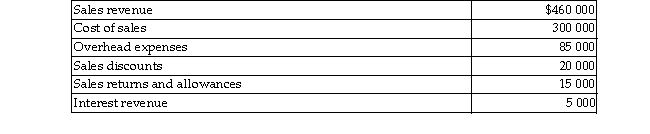

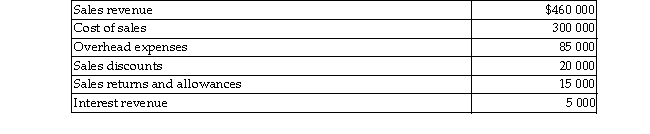

Referring to the following table, what is Gross profit?

A)$160 000

B)$125 000

C)$90 000

D)$140 000

A)$160 000

B)$125 000

C)$90 000

D)$140 000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

79

Michelin Jewellers completed the following transactions. Michelin Jewellers uses the perpetual inventory system. On 2 April, Michelin sold $9 900 of inventory, including GST, to a customer on credit with terms of 3/15, n/30. Michelin's cost of the inventory sold was $5 000, net of GST. On 4 April, the customer reported damaged goods and Michelin granted a $1 100 sales allowance, including GST. On 22 April, Michelin received payment from the customer. How much cash was received from the customer?

A)$3 800

B)$8 536

C)$8 730

D)$8 800

A)$3 800

B)$8 536

C)$8 730

D)$8 800

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

80

Michelin Jewellers completed the following transactions. Michelin Jewellers uses the perpetual inventory system. On 2 April, Michelin sold $9 900 of inventory, including GST, to a customer on credit with terms of 3/15, n/30. Michelin's cost of the inventory sold was $5 000, net of GST. On 4 April, the customer reported damaged goods and Michelin granted a $1 100 sales allowance, including GST. On 10 April, Michelin received payment from the customer. If this were the only transaction for the period, what amount would be shown on the income statement for Gross profit?

A)$4 500

B)$2 260

C)$2 760

D)$4 000

A)$4 500

B)$2 260

C)$2 760

D)$4 000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck