Deck 12: Markets with Private Information

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/103

العب

ملء الشاشة (f)

Deck 12: Markets with Private Information

1

In the used car market with no warranties,the market for lemons (poor quality used cars)is ________ and the market for good cars is ________.

A) efficient; efficient

B) inefficient because of oversupply; inefficient because of undersupply

C) inefficient because of oversupply; inefficient because of oversupply

D) efficient; inefficient because of undersupply

E) inefficient because of oversupply; efficient

A) efficient; efficient

B) inefficient because of oversupply; inefficient because of undersupply

C) inefficient because of oversupply; inefficient because of oversupply

D) efficient; inefficient because of undersupply

E) inefficient because of oversupply; efficient

inefficient because of oversupply; inefficient because of undersupply

2

The used car market without warranties suffers from

A) perfect competition.

B) a separating equilibrium.

C) oligopoly.

D) adverse selection and moral hazard.

E) excessive signaling.

A) perfect competition.

B) a separating equilibrium.

C) oligopoly.

D) adverse selection and moral hazard.

E) excessive signaling.

adverse selection and moral hazard.

3

Suppose that there are only two types of used cars,peaches and lemons.Peaches are worth $10,000,and lemons are worth $6,000.Three fourths of all used cars are peaches,and one fourth are lemons.In a market with no signals,for instance,a market without warranties,the average value of cars actually sold will be

A) $6,000.

B) $7,000.

C) $7,500.

D) $9,000.

E) $10,000.

A) $6,000.

B) $7,000.

C) $7,500.

D) $9,000.

E) $10,000.

$6,000.

4

Of the following,the best example of private information is when

A) Michael knows the price of a gallon of milk at the minimart but Michelle doesn't know.

B) you are selling a used car and you know your used car's defects but a potential buyer cannot find out about them until after buying.

C) you are selling a used car and you do not know your used car's defects

D) you don't know the quality of a used car and must hire a trained mechanic who tells you all its defects.

E) you pay the owner of a used car a little extra and she lets you know all of the car's defects.

A) Michael knows the price of a gallon of milk at the minimart but Michelle doesn't know.

B) you are selling a used car and you know your used car's defects but a potential buyer cannot find out about them until after buying.

C) you are selling a used car and you do not know your used car's defects

D) you don't know the quality of a used car and must hire a trained mechanic who tells you all its defects.

E) you pay the owner of a used car a little extra and she lets you know all of the car's defects.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

5

Used car buyers believe a car is good quality when the seller signals the car's quality by offering a warranty because

A) a warranty on a lemon is costly to the seller.

B) warranties are only offered on lemons.

C) the signal cannot be false.

D) adverse selection means that warranties will not be used as a signal.

E) a false signal has no effect on the seller.

A) a warranty on a lemon is costly to the seller.

B) warranties are only offered on lemons.

C) the signal cannot be false.

D) adverse selection means that warranties will not be used as a signal.

E) a false signal has no effect on the seller.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

6

Warranties in the used car market ________ the problem of private information thereby causing the price of good and bad used cars to ________.

A) reduce; be the same

B) reduce; differ

C) magnify; be the same

D) magnify; differ

E) None of the above answers is correct because warranties have nothing to do with private information.

A) reduce; be the same

B) reduce; differ

C) magnify; be the same

D) magnify; differ

E) None of the above answers is correct because warranties have nothing to do with private information.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

7

Suppose there are only two kinds of cars in the market for used cars: lemons and good cars.A lemon is worth $1,000 both to its current owner and to anyone who buys it.A good car is worth $8,000 to its current and potential owners.Buyers can't tell whether a car is a lemon until after they have bought the car,and there is no warranty.What is the equilibrium price of a used car?

A) $8,000

B) $1,000

C) $4,500

D) $9,000

E) The equilibrium price depends on how many lemons and how many good cars are traded.

A) $8,000

B) $1,000

C) $4,500

D) $9,000

E) The equilibrium price depends on how many lemons and how many good cars are traded.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

8

Adverse selection is created by

A) incentives to change behavior after two parties have reached an agreement.

B) risk.

C) signaling.

D) taxes.

E) private information.

A) incentives to change behavior after two parties have reached an agreement.

B) risk.

C) signaling.

D) taxes.

E) private information.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

9

In the used car market,adverse selection is a problem primarily when

A) sellers cannot judge buyers' creditworthiness.

B) buyers cannot signal their willingness to buy.

C) buyers cannot determine the quality of a used car.

D) sellers offer warranties on all used cars.

E) sellers and buyers both agree that a particular used car is a lemon.

A) sellers cannot judge buyers' creditworthiness.

B) buyers cannot signal their willingness to buy.

C) buyers cannot determine the quality of a used car.

D) sellers offer warranties on all used cars.

E) sellers and buyers both agree that a particular used car is a lemon.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

10

Suppose that there are only two types of used cars,peaches and lemons.Peaches are worth $10,000 and lemons are worth $4,000.Without effective signals such as warranties,the owners of peaches cannot sell their cars for $10,000 because the

A) owners of peaches cannot convince buyers that their cars are worth $10,000.

B) buyers cannot convince owners of peaches to sell their cars for $10,000.

C) owners of lemons cannot convince buyers that their cars are worth more than $4,000.

D) buyers cannot convince owners of lemons to sell their cars for more than $4,000.

E) buyers cannot convince owners of lemons to sell their cars for $4,000.

A) owners of peaches cannot convince buyers that their cars are worth $10,000.

B) buyers cannot convince owners of peaches to sell their cars for $10,000.

C) owners of lemons cannot convince buyers that their cars are worth more than $4,000.

D) buyers cannot convince owners of lemons to sell their cars for more than $4,000.

E) buyers cannot convince owners of lemons to sell their cars for $4,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

11

Signals are believable when the cost of sending a ________ is known to be ________.

A) false signal; low

B) false signal; high

C) true signal; low

D) true or false signal; low

E) true signal; high

A) false signal; low

B) false signal; high

C) true signal; low

D) true or false signal; low

E) true signal; high

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

12

Adverse selection is the tendency for people who accept contracts to be those who

A) buy goods and then regret it later.

B) buy goods for more than their own reservation price.

C) want to avoid the lemons problem.

D) plan to use private information to the disadvantage of the less well-informed party.

E) engage in a number of searches larger than that specified in the contract.

A) buy goods and then regret it later.

B) buy goods for more than their own reservation price.

C) want to avoid the lemons problem.

D) plan to use private information to the disadvantage of the less well-informed party.

E) engage in a number of searches larger than that specified in the contract.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

13

Private information is a situation in which

A) two parties to an exchange have information that is available to outsiders if they ask.

B) one party to an exchange has information that is not available to the other.

C) the marginal cost of a person's obtaining additional information is zero.

D) the marginal cost of making information available to one more person is zero.

E) outsiders have relevant information that is not available to the people in the market.

A) two parties to an exchange have information that is available to outsiders if they ask.

B) one party to an exchange has information that is not available to the other.

C) the marginal cost of a person's obtaining additional information is zero.

D) the marginal cost of making information available to one more person is zero.

E) outsiders have relevant information that is not available to the people in the market.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

14

Without warranties,used car buyers can assume that all used cars are "lemons" because of

A) moral hazard.

B) false signals.

C) moral dilemma.

D) adverse selection.

E) adverse reaction.

A) moral hazard.

B) false signals.

C) moral dilemma.

D) adverse selection.

E) adverse reaction.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

15

In the used car market without warranties,adverse selection results in

A) sellers of "lemons" claiming that their car is a lemon.

B) only lemons being available for sale.

C) the market price of used cars equal to that of good used cars.

D) an efficient pooling equilibrium.

E) all of the above

A) sellers of "lemons" claiming that their car is a lemon.

B) only lemons being available for sale.

C) the market price of used cars equal to that of good used cars.

D) an efficient pooling equilibrium.

E) all of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

16

One of the ways the market for used cars copes with the problems associated with private information is through the offering of

A) leases.

B) warranties.

C) low interest rates.

D) high prices for high-quality used cars.

E) low prices.

A) leases.

B) warranties.

C) low interest rates.

D) high prices for high-quality used cars.

E) low prices.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

17

Used car buyers believe a car is good quality when the seller signals the car's quality by offering a warranty because

A) car sellers would never lie.

B) car buyers are gullible.

C) signals lead to efficient pooling equilibriums.

D) the signal cannot be false.

E) a false signal can be costly to the seller.

A) car sellers would never lie.

B) car buyers are gullible.

C) signals lead to efficient pooling equilibriums.

D) the signal cannot be false.

E) a false signal can be costly to the seller.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

18

Your grade point average acts as ________ to potential employers.

A) a signal

B) private information

C) a reservation price

D) a guarantee

E) insurance

A) a signal

B) private information

C) a reservation price

D) a guarantee

E) insurance

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

19

The tendency for people to enter into agreements in which they can use their private information to their own advantage and to the disadvantage of the less informed party is known as

A) adverse selection.

B) a pooling selection.

C) moral hazard.

D) the market for oranges.

E) a signal.

A) adverse selection.

B) a pooling selection.

C) moral hazard.

D) the market for oranges.

E) a signal.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

20

Adverse selection can occur when

A) all parties have full information.

B) one party has information not available to the other party.

C) information is not full but both parties have the same information.

D) incentives result in one party not reaching an agreement with the other party.

E) nobody has any information.

A) all parties have full information.

B) one party has information not available to the other party.

C) information is not full but both parties have the same information.

D) incentives result in one party not reaching an agreement with the other party.

E) nobody has any information.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

21

In the auto insurance market,who is most likely to have private information that leads to adverse selection?

A) the government agency that regulates insurance companies

B) the insurance company

C) the drivers

D) the insurance company and the drivers

E) the government regulating agency and the insurance company

A) the government agency that regulates insurance companies

B) the insurance company

C) the drivers

D) the insurance company and the drivers

E) the government regulating agency and the insurance company

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

22

The fact that people who know they are risky drivers are more likely to buy auto insurance reflects

A) adverse selection.

B) moral hazard.

C) a separating equilibrium.

D) signaling.

E) the lemons problem.

A) adverse selection.

B) moral hazard.

C) a separating equilibrium.

D) signaling.

E) the lemons problem.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

23

In the used car market,with a pooling equilibrium the price of a lemon is ________ the price of a good used car and with a separating equilibrium the price of a lemon is ________ the price of a good used car.

A) less than; equal to

B) equal to; less than

C) equal to; more than

D) more than; more than

E) equal to; equal to

A) less than; equal to

B) equal to; less than

C) equal to; more than

D) more than; more than

E) equal to; equal to

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

24

In the used car market with no warranties,the equilibrium is a ________ and there is ________.

A) pooling equilibrium; inefficiency, partly because of oversupply of good cars

B) pooling equilibrium; inefficiency, partly because of oversupply of lemons

C) separating equilibrium; no inefficiency

D) separating equilibrium; inefficiency, partly because of oversupply of lemons

E) pooling equilibrium; no inefficiency

A) pooling equilibrium; inefficiency, partly because of oversupply of good cars

B) pooling equilibrium; inefficiency, partly because of oversupply of lemons

C) separating equilibrium; no inefficiency

D) separating equilibrium; inefficiency, partly because of oversupply of lemons

E) pooling equilibrium; no inefficiency

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

25

In the insurance market,private information

A) creates moral hazard but eliminates adverse selection.

B) creates adverse selection but eliminates moral hazard.

C) creates both moral hazard and adverse selection.

D) eliminates both moral hazard and adverse selection.

E) means that screening is unnecessary.

A) creates moral hazard but eliminates adverse selection.

B) creates adverse selection but eliminates moral hazard.

C) creates both moral hazard and adverse selection.

D) eliminates both moral hazard and adverse selection.

E) means that screening is unnecessary.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

26

In an insurance market,moral hazard exists chiefly because of

A) economies of scale.

B) adverse selection.

C) diseconomies of scale.

D) private information.

E) public information.

A) economies of scale.

B) adverse selection.

C) diseconomies of scale.

D) private information.

E) public information.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

27

In the used car market with warranties,the equilibrium is a ________ and there is ________.

A) pooling equilibrium; inefficiency, partly because of oversupply of good cars

B) pooling equilibrium; inefficiency, partly because of oversupply of lemons (poor quality used cars)

C) separating equilibrium; no inefficiency

D) separating equilibrium; inefficiency, partly because of oversupply of lemons (poor quality used cars)

E) pooling equilibrium; no inefficiency

A) pooling equilibrium; inefficiency, partly because of oversupply of good cars

B) pooling equilibrium; inefficiency, partly because of oversupply of lemons (poor quality used cars)

C) separating equilibrium; no inefficiency

D) separating equilibrium; inefficiency, partly because of oversupply of lemons (poor quality used cars)

E) pooling equilibrium; no inefficiency

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

28

If buyers cannot assess the quality of used cars and there are no warranties,

A) only lemons are sold.

B) only good used cars are sold.

C) good cars are sold at a higher price than bad cars.

D) there is no adverse selection problem.

E) lemons and good cars sell for the same price.

A) only lemons are sold.

B) only good used cars are sold.

C) good cars are sold at a higher price than bad cars.

D) there is no adverse selection problem.

E) lemons and good cars sell for the same price.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

29

Moral hazard is

A) the tendency for people to enter into agreements in which they can use their private information to their own advantage and to the disadvantage of the less informed party.

B) when one of the parties to an agreement has an incentive after the agreement is made to act in a manner that brings additional benefits to himself or herself at the expense of the other party.

C) a situation in which only bad quality items are bought and sold.

D) absent after a person who dislikes risk buys insurance against the risk.

E) an action taken outside a market that conveys information that can be used by that market.

A) the tendency for people to enter into agreements in which they can use their private information to their own advantage and to the disadvantage of the less informed party.

B) when one of the parties to an agreement has an incentive after the agreement is made to act in a manner that brings additional benefits to himself or herself at the expense of the other party.

C) a situation in which only bad quality items are bought and sold.

D) absent after a person who dislikes risk buys insurance against the risk.

E) an action taken outside a market that conveys information that can be used by that market.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

30

In the market for automobile insurance,moral hazard implies that

A) those who are insured might take greater risks.

B) those who are uninsured might take greater risks.

C) insured and uninsured alike will take greater risks.

D) screening will have no effect in the market.

E) drivers with greater risks are more likely to buy insurance.

A) those who are insured might take greater risks.

B) those who are uninsured might take greater risks.

C) insured and uninsured alike will take greater risks.

D) screening will have no effect in the market.

E) drivers with greater risks are more likely to buy insurance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

31

In the used car market with warranties,the equilibrium is a ________ and the lemons problem is ________.

A) pooling equilibrium; solved

B) pooling equilibrium; unresolved

C) separating equilibrium; unresolved

D) separating equilibrium; solved

E) pooling equilibrium; possibly solved and possibly unresolved, depending on whether good used cars sell for a higher price than do lemons

A) pooling equilibrium; solved

B) pooling equilibrium; unresolved

C) separating equilibrium; unresolved

D) separating equilibrium; solved

E) pooling equilibrium; possibly solved and possibly unresolved, depending on whether good used cars sell for a higher price than do lemons

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

32

If Sally drives less carefully after buying auto insurance,she illustrates

A) adverse selection.

B) negative selection.

C) screening risk.

D) moral hazard.

E) lemon hazard.

A) adverse selection.

B) negative selection.

C) screening risk.

D) moral hazard.

E) lemon hazard.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

33

JCPenney guarantees to refund a customer's money if the customer returns poorly made clothing.This guarantee is an example of

A) the adverse selection problem.

B) the moral hazard problem.

C) the cost of risk.

D) signaling.

E) a lemon problem.

A) the adverse selection problem.

B) the moral hazard problem.

C) the cost of risk.

D) signaling.

E) a lemon problem.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

34

The lemons problem in the used car market is that

A) the price of a lemon is too high.

B) the price of a lemon is too low.

C) no lemons are bought and sold.

D) only lemons are bought and sold.

E) Both answers A and D are correct.

A) the price of a lemon is too high.

B) the price of a lemon is too low.

C) no lemons are bought and sold.

D) only lemons are bought and sold.

E) Both answers A and D are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

35

The idea of an insurance company "pooling" the risk means that

A) the risk is completely eliminated from society.

B) the insurance company requires buyers to pay a large deductible.

C) the risk is spread over a large population.

D) the insurance company insists on a pooling equilibrium.

E) moral hazard and adverse selection are eliminated.

A) the risk is completely eliminated from society.

B) the insurance company requires buyers to pay a large deductible.

C) the risk is spread over a large population.

D) the insurance company insists on a pooling equilibrium.

E) moral hazard and adverse selection are eliminated.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

36

In the used car market with warranties,the market for lemons (poor quality used cars)is ________ and the market for good cars is ________.

A) efficient; efficient

B) inefficient because of oversupply; inefficient because of undersupply

C) inefficient because of oversupply; inefficient because of oversupply

D) efficient; inefficient because of undersupply

E) inefficient because of oversupply; efficient

A) efficient; efficient

B) inefficient because of oversupply; inefficient because of undersupply

C) inefficient because of oversupply; inefficient because of oversupply

D) efficient; inefficient because of undersupply

E) inefficient because of oversupply; efficient

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

37

Because Don has health insurance,he is more likely to see the doctor when he has a cold.This is an example of

A) adverse selection.

B) moral hazard.

C) the lemons problem.

D) both moral hazard and adverse selection.

E) private information.

A) adverse selection.

B) moral hazard.

C) the lemons problem.

D) both moral hazard and adverse selection.

E) private information.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

38

In the insurance market,moral hazard and adverse selection are the result of

A) poorly functioning markets.

B) government intervention.

C) private information.

D) treachery.

E) a separating equilibrium.

A) poorly functioning markets.

B) government intervention.

C) private information.

D) treachery.

E) a separating equilibrium.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

39

Asymmetric information means that

A) the buyer must have information that the seller does not have.

B) the seller must have information that the buyer does not have.

C) the buyer and seller have the same information.

D) either the buyer has information that the seller does not have or the seller has information that the buyer does not have.

E) None of the above answers is correct.

A) the buyer must have information that the seller does not have.

B) the seller must have information that the buyer does not have.

C) the buyer and seller have the same information.

D) either the buyer has information that the seller does not have or the seller has information that the buyer does not have.

E) None of the above answers is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

40

Dan,age 19,may have trouble buying auto insurance at a low price because insurance companies

A) have private information that he is a risky driver.

B) have private information that his signals are valid.

C) fear that he has private information that his deductible is too high.

D) fear that he has private information that he is a risky driver.

E) operate in markets in which screening is inefficient.

A) have private information that he is a risky driver.

B) have private information that his signals are valid.

C) fear that he has private information that his deductible is too high.

D) fear that he has private information that he is a risky driver.

E) operate in markets in which screening is inefficient.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

41

Screening

A) leads to a pooling equilibrium in the insurance market.

B) means an uninformed person passes knowledge to an informed person.

C) makes no-claim bonuses unnecessary.

D) explains why insurance companies offer low-premium, high-deductible policies and high-premium, low-deductible policies.

E) makes the insurance market inefficient.

A) leads to a pooling equilibrium in the insurance market.

B) means an uninformed person passes knowledge to an informed person.

C) makes no-claim bonuses unnecessary.

D) explains why insurance companies offer low-premium, high-deductible policies and high-premium, low-deductible policies.

E) makes the insurance market inefficient.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

42

Ben is an aggressive driver so he is more likely to buy auto insurance.This situation illustrates the idea of

A) moral hazard.

B) adverse selection.

C) the lemon problem.

D) inefficiency.

E) a pooling equilibrium.

A) moral hazard.

B) adverse selection.

C) the lemon problem.

D) inefficiency.

E) a pooling equilibrium.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

43

When Sam makes an agreement and then behaves after the agreement in a way to increase his benefits and harm then other party to the agreement,Sam is illustrating

A) moral hazard.

B) adverse selection.

C) signaling.

D) the cost of contracting.

E) a pooling equilibrium.

A) moral hazard.

B) adverse selection.

C) signaling.

D) the cost of contracting.

E) a pooling equilibrium.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

44

One way of screening in the automobile insurance market is for companies to

A) offer policies with different deductibles and different premiums.

B) insure only careful drivers.

C) insure only risky drivers.

D) eliminate policies with no-claim bonuses because these policies are usually not profitable.

E) offer warranties.

A) offer policies with different deductibles and different premiums.

B) insure only careful drivers.

C) insure only risky drivers.

D) eliminate policies with no-claim bonuses because these policies are usually not profitable.

E) offer warranties.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

45

When an auto insurance company is screening,it is

A) ignoring the possibility of moral hazard in order to minimize adverse selection.

B) attempting to keep its private information private.

C) trying to determine if a driver is an aggressive driver or a safe driver.

D) making its private information public.

E) marketing its policies to customers.

A) ignoring the possibility of moral hazard in order to minimize adverse selection.

B) attempting to keep its private information private.

C) trying to determine if a driver is an aggressive driver or a safe driver.

D) making its private information public.

E) marketing its policies to customers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

46

Auto insurance companies charge a lower premium to drivers who carry a higher deductible because

A) insurance companies are not profit maximizers.

B) a driver's riskiness increases as the driver's deductible increases.

C) a high deductible signals a high risk.

D) insurance companies prefer that drivers carry no deductible.

E) a high deductible reveals that driver is a careful driver.

A) insurance companies are not profit maximizers.

B) a driver's riskiness increases as the driver's deductible increases.

C) a high deductible signals a high risk.

D) insurance companies prefer that drivers carry no deductible.

E) a high deductible reveals that driver is a careful driver.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

47

In the market for auto insurance,with a pooling equilibrium ________ and with a separating equilibrium ________.

A) aggressive drivers pay a higher premium than do safer drivers; aggressive drivers pay a higher premium than do safer drivers

B) no one can buy auto insurance; aggressive drivers pay a higher premium than do safer drivers

C) aggressive and safe drivers pay the same premium; aggressive and safe drivers pay the same premium

D) aggressive and safe drivers pay the same premium; aggressive drivers pay a higher premium than do safer drivers

E) aggressive drivers pay a higher premium than do safer drivers; aggressive and safe drivers pay the same premium

A) aggressive drivers pay a higher premium than do safer drivers; aggressive drivers pay a higher premium than do safer drivers

B) no one can buy auto insurance; aggressive drivers pay a higher premium than do safer drivers

C) aggressive and safe drivers pay the same premium; aggressive and safe drivers pay the same premium

D) aggressive and safe drivers pay the same premium; aggressive drivers pay a higher premium than do safer drivers

E) aggressive drivers pay a higher premium than do safer drivers; aggressive and safe drivers pay the same premium

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

48

Bill purchases property insurance for his office building,which includes coverage for fire damage.The policy offers premium discounts for smoke detectors,fire alarms,fire extinguishers and sprinkler systems.This is an incentive system to help avoid

A) adverse selection.

B) adverse signals.

C) moral hazard.

D) screening.

E) None of the above answers is correct.

A) adverse selection.

B) adverse signals.

C) moral hazard.

D) screening.

E) None of the above answers is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

49

In the market for automobile insurance,adverse selection implies that

A) those who are insured might take greater risks.

B) those who are uninsured might take greater risks.

C) private information cannot be successfully screened.

D) insured and uninsured alike will take greater risks.

E) drivers with greater risks are more likely to buy insurance.

A) those who are insured might take greater risks.

B) those who are uninsured might take greater risks.

C) private information cannot be successfully screened.

D) insured and uninsured alike will take greater risks.

E) drivers with greater risks are more likely to buy insurance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

50

Insurance companies

A) pool risk and enable everyone to share the costs of bad outcomes.

B) never can earn a profit because they accept risk.

C) eliminate the risk of a bad outcome.

D) know who will have a bad outcome.

E) are risk averse.

A) pool risk and enable everyone to share the costs of bad outcomes.

B) never can earn a profit because they accept risk.

C) eliminate the risk of a bad outcome.

D) know who will have a bad outcome.

E) are risk averse.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

51

If you have private information that you are a riskier driver than your record indicates,you are likely to buy an insurance policy that has a ________ deductible and a ________ premium.

A) high; high

B) high; low

C) low; high

D) low; low

E) None of the above answers is correct because private information has no effect in the market for auto insurance.

A) high; high

B) high; low

C) low; high

D) low; low

E) None of the above answers is correct because private information has no effect in the market for auto insurance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

52

In the market for auto insurance,in a pooling equilibrium,

A) risky and safe drivers pay the same premium for insurance.

B) risky drivers pay a larger premium than do safe drivers for insurance.

C) risky drivers pay a smaller premium than do safe drivers for insurance.

D) risky drivers cannot obtain insurance.

E) safe drivers cannot obtain insurance.

A) risky and safe drivers pay the same premium for insurance.

B) risky drivers pay a larger premium than do safe drivers for insurance.

C) risky drivers pay a smaller premium than do safe drivers for insurance.

D) risky drivers cannot obtain insurance.

E) safe drivers cannot obtain insurance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

53

In the market for auto insurance,in a separating equilibrium,

A) risky and safe drivers pay the same premium for insurance.

B) risky drivers pay a larger premium than do safe drivers for insurance.

C) risky drivers pay a smaller premium than do safe drivers for insurance.

D) risky drivers cannot obtain insurance.

E) safe drivers cannot obtain insurance.

A) risky and safe drivers pay the same premium for insurance.

B) risky drivers pay a larger premium than do safe drivers for insurance.

C) risky drivers pay a smaller premium than do safe drivers for insurance.

D) risky drivers cannot obtain insurance.

E) safe drivers cannot obtain insurance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

54

If a health insurance company offers coverage regardless of age,health status,or smoking history,it is likely to suffer

A) moral hazard problems.

B) adverse selection problems.

C) lower costs.

D) low demand for its product.

E) a screening equilibrium.

A) moral hazard problems.

B) adverse selection problems.

C) lower costs.

D) low demand for its product.

E) a screening equilibrium.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

55

"Screening" means that an auto insurance company is

A) enforcing a pooling equilibrium.

B) ignoring all private information.

C) creating an incentive to eliminate moral hazard even though it reinforces the possibility of adverse selection.

D) creating an incentive to eliminate adverse selection even though it reinforces the possibility of moral hazard.

E) creating an incentive for a risky driver to reveal that he or she is risky.

A) enforcing a pooling equilibrium.

B) ignoring all private information.

C) creating an incentive to eliminate moral hazard even though it reinforces the possibility of adverse selection.

D) creating an incentive to eliminate adverse selection even though it reinforces the possibility of moral hazard.

E) creating an incentive for a risky driver to reveal that he or she is risky.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

56

In the health insurance market,adverse selection occurs when

A) chronically ill people buy health insurance.

B) insured people go to the doctor unnecessarily.

C) patients sue their doctor.

D) people with health insurance tend to behave more recklessly.

E) chronically ill people are unable to buy health insurance.

A) chronically ill people buy health insurance.

B) insured people go to the doctor unnecessarily.

C) patients sue their doctor.

D) people with health insurance tend to behave more recklessly.

E) chronically ill people are unable to buy health insurance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

57

In the market for automobile insurance,adverse selection implies that

A) drivers with greater risks want to buy a policy without deductibles.

B) drivers with greater risks want to buy a policy with large deductibles.

C) uninsured drivers will drive recklessly.

D) insured drivers will drive recklessly.

E) moral hazard does not exist in this market.

A) drivers with greater risks want to buy a policy without deductibles.

B) drivers with greater risks want to buy a policy with large deductibles.

C) uninsured drivers will drive recklessly.

D) insured drivers will drive recklessly.

E) moral hazard does not exist in this market.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

58

A safe drive is likely to prefer an auto insurance policy that has a ________ deductible and a ________ premium.

A) high; high

B) high; low

C) low; high

D) low; low

E) None of the above answers is correct because private information has no effect in the market for auto insurance.

A) high; high

B) high; low

C) low; high

D) low; low

E) None of the above answers is correct because private information has no effect in the market for auto insurance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

59

Life insurance companies often give applicants a physical examination to prevent

A) moral hazard.

B) screening.

C) adverse selection.

D) signaling.

E) warranties.

A) moral hazard.

B) screening.

C) adverse selection.

D) signaling.

E) warranties.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

60

In the United States,of all types of insurance,people spend the most on ________ insurance.

A) health

B) hurricane

C) auto

D) life

E) property and casualty

A) health

B) hurricane

C) auto

D) life

E) property and casualty

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

61

Moral hazard results from ________ information,and adverse selection results from ________ information.

A) private; private

B) private; public

C) public; private

D) public; public

E) None of the above answers is correct because both are the result of the lemons problem.

A) private; private

B) private; public

C) public; private

D) public; public

E) None of the above answers is correct because both are the result of the lemons problem.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

62

Which of the following is not a problem in health-care markets?

A) Hospitals are not trying to maximize their profit.

B) asymmetric information

C) public-health externalities

D) a missing insurance market

E) None of the above answers is correct; that is, all the answers are problems in health-care markets.

A) Hospitals are not trying to maximize their profit.

B) asymmetric information

C) public-health externalities

D) a missing insurance market

E) None of the above answers is correct; that is, all the answers are problems in health-care markets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

63

Health-care vouchers have been proposed.These vouchers would

A) cap total expenditure on health care but do nothing to solve the problem of uninsurance.

B) limit choice and would create long waiting times for health care service.

C) solve the problem of the doctor shortage but would not affect the problem of over spending on health care.

D) ensure universal coverage for health care and would cap total expenditure on health care.

E) None of the above answers is correct.

A) cap total expenditure on health care but do nothing to solve the problem of uninsurance.

B) limit choice and would create long waiting times for health care service.

C) solve the problem of the doctor shortage but would not affect the problem of over spending on health care.

D) ensure universal coverage for health care and would cap total expenditure on health care.

E) None of the above answers is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

64

Which of the following has a positive externality and hence can be underprovided?

A) Chronically ill people are not allowed to buy insurance.

B) health insurance purchased through an employer

C) vaccination

D) Health Maintenance Organizations

E) None of the above has a positive externality.

A) Chronically ill people are not allowed to buy insurance.

B) health insurance purchased through an employer

C) vaccination

D) Health Maintenance Organizations

E) None of the above has a positive externality.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

65

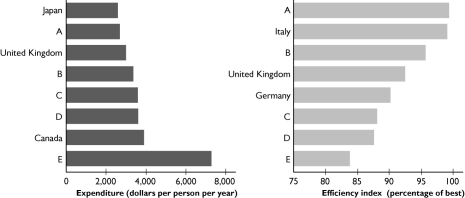

The figures show the expenditures per person on health care and the efficiency of the health care system in 8 different nations.The United States is bar ________ in expenditures per person and is bar ________ in efficiency index.

A) A; A

B) B; A

C) A; D

D) E; E

E) D; B

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

66

Compared to other major nations,the United States spends ________ on health care and achieves ________ efficiency.

A) less; greater

B) more; about the same

C) less; less

D) more; less

E) about the same; less

A) less; greater

B) more; about the same

C) less; less

D) more; less

E) about the same; less

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

67

Moral hazard typically occurs because

A) people are dishonest.

B) agreements sometimes create incentives that are costly to monitor so people can act in their self-interest.

C) workers possess diminishing marginal productivity.

D) screening leads to informed people revealing their relevant private information.

E) workers possess adverse selection.

A) people are dishonest.

B) agreements sometimes create incentives that are costly to monitor so people can act in their self-interest.

C) workers possess diminishing marginal productivity.

D) screening leads to informed people revealing their relevant private information.

E) workers possess adverse selection.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

68

Most observers suggest that health care in the United States faces two major problems:

A) too many people have health insurance, and health care costs too much.

B) a significant shortage of doctors, and health care costs too much.

C) a vast oversupply of hospital rooms and a significant shortage of doctors.

D) Health Maintenance Organizations are too common, and too many people do not have health insurance.

E) too many people do not have health insurance, and health care costs too much.

A) too many people have health insurance, and health care costs too much.

B) a significant shortage of doctors, and health care costs too much.

C) a vast oversupply of hospital rooms and a significant shortage of doctors.

D) Health Maintenance Organizations are too common, and too many people do not have health insurance.

E) too many people do not have health insurance, and health care costs too much.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

69

Which of the following statements about health-care systems is correct?

A) Most major nations do not have extensive government-funded insurance programs.

B) U.S. expenditure per person on health care is near the middle of the range of expenditures made in major nations.

C) Unlike other major nations, private health insurance is available only in the United States.

D) In the United States, Medicare and Medicaid account for slightly less than 90 percent of total expenditures on health care.

E) Every major country except the United States has a comprehensive national health-care system.

A) Most major nations do not have extensive government-funded insurance programs.

B) U.S. expenditure per person on health care is near the middle of the range of expenditures made in major nations.

C) Unlike other major nations, private health insurance is available only in the United States.

D) In the United States, Medicare and Medicaid account for slightly less than 90 percent of total expenditures on health care.

E) Every major country except the United States has a comprehensive national health-care system.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

70

Vaccination against infectious diseases ________ so private markets will provide ________ efficient quantity of vaccination.

A) is a public good; less than

B) is a public good; the

C) leads to adverse selection; less than

D) has a positive externality; less than

E) has a positive externality; the

A) is a public good; less than

B) is a public good; the

C) leads to adverse selection; less than

D) has a positive externality; less than

E) has a positive externality; the

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

71

Moral hazard in the market for health-care services leads

A) patients to adopt healthy life styles.

B) to a separating equilibrium.

C) to all people buying health insurance.

D) to healthy people not buying health insurance.

E) to providers overtreating patients..

A) patients to adopt healthy life styles.

B) to a separating equilibrium.

C) to all people buying health insurance.

D) to healthy people not buying health insurance.

E) to providers overtreating patients..

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

72

In the health insurance market,moral hazard occurs when

A) chronically ill people buy insurance.

B) chronically ill people cannot buy insurance.

C) insured people adopt an unhealthy lifestyle.

D) patients sue their doctor.

E) chronically ill people refuse appropriate medical treatment.

A) chronically ill people buy insurance.

B) chronically ill people cannot buy insurance.

C) insured people adopt an unhealthy lifestyle.

D) patients sue their doctor.

E) chronically ill people refuse appropriate medical treatment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

73

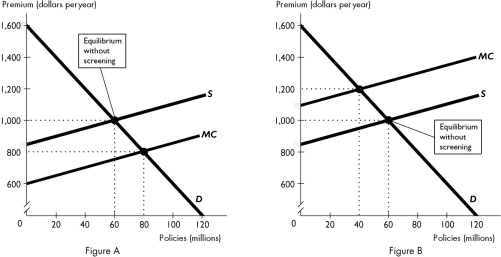

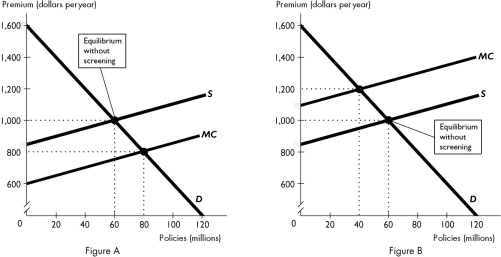

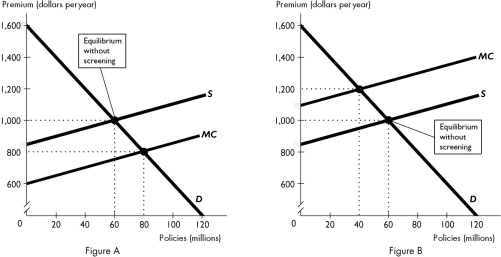

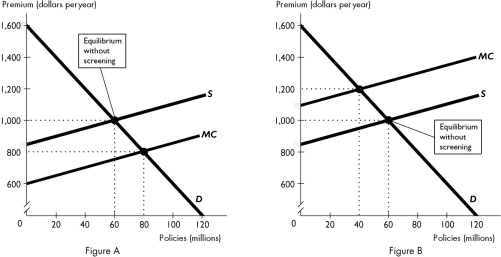

The figures show two auto insurance markets, one market for safe drivers and one market for aggressive drivers.

In a pooling equilibrium,there ________ a deadweight loss in the market for safe drivers,and there ________ a deadweight loss in the market for aggressive drivers.

A) is; is

B) is; is not

C) is not; is

D) is not; is not

E) might be; might be

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

74

The figures show two auto insurance markets, one market for safe drivers and one market for aggressive drivers.

In a pooling equilibrium,there is ________ of insurance in the market for safe drivers,and there is ________ of insurance in the market for aggressive drivers.

A) overprovision; underprovision

B) overprovision; overprovision

C) underprovision; underprovision

D) underprovision; overprovision

E) underprovision; an efficient quantity

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

75

The figures show two auto insurance markets, one market for safe drivers and one market for aggressive drivers.

In a separating equilibrium,aggressive drivers pay a premium of ________ and safe drivers pay a premium of ________.

A) $1,000; $1,000

B) $800; $1,200

C) $1,200; $800

D) $1,000; $800

E) $1,200; $1,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

76

The missing insurance market in health care is the insurance market for

A) young healthy people.

B) infectious diseases.

C) people who have pre-existing health problems.

D) people in Health Maintenance Organizations.

E) vaccinations.

A) young healthy people.

B) infectious diseases.

C) people who have pre-existing health problems.

D) people in Health Maintenance Organizations.

E) vaccinations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

77

The figures show two auto insurance markets, one market for safe drivers and one market for aggressive drivers.

In a pooling equilibrium,aggressive drivers pay a premium of ________ and safe drivers pay a premium of ________.

A) $1,000; $1,000

B) $800; $1,200

C) $1,200; $800

D) $1,000; $800

E) $1,200; $1,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

78

In the market for health care services,Health Maintenance Organizations

A) exist to insure people with pre-existing medical conditions.

B) overprovide medical care and thereby result in increased costs.

C) help overcome adverse selection by enrolling only healthy clients.

D) help overcome moral hazard by monitoring the quality of the service.

E) None of the above answers is correct.

A) exist to insure people with pre-existing medical conditions.

B) overprovide medical care and thereby result in increased costs.

C) help overcome adverse selection by enrolling only healthy clients.

D) help overcome moral hazard by monitoring the quality of the service.

E) None of the above answers is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

79

The figures show two auto insurance markets, one market for safe drivers and one market for aggressive drivers.

In a separating equilibrium,there is ________ of insurance in the market for safe drivers,and there is ________ of insurance in the market for aggressive drivers.

A) overprovision; underprovision

B) overprovision; overprovision

C) underprovision; underprovision

D) underprovision; overprovision

E) an efficient quantity; an efficient quantity

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

80

The figures show two auto insurance markets, one market for safe drivers and one market for aggressive drivers.

The market for aggressive drivers is illustrated in ________,and the market for safe drivers is illustrated in ________.

A) Figure A; Figure A also

B) Figure B; Figure A

C) Figure A; Figure B

D) Figure B; Figure B also

E) More information is needed to answer the question.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck