Deck 2: Accounting and Financial Decision-Making

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/5

العب

ملء الشاشة (f)

Deck 2: Accounting and Financial Decision-Making

1

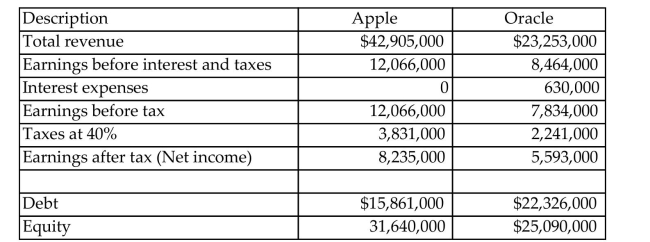

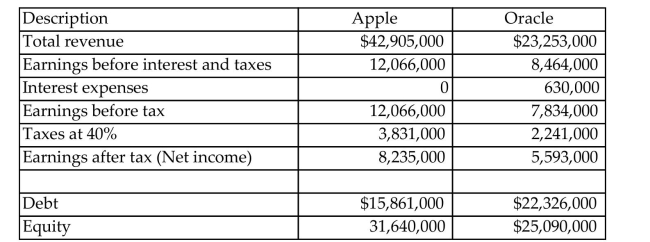

The following data are available for two companies, Apple and Oracle, all stated in thousands of dollars.  (a) Calculate each company's return on equity (ROE) and return on asset (ROA)

(a) Calculate each company's return on equity (ROE) and return on asset (ROA)

(b) Which company has performed better in terms of profitability?

(c) If two companies were combined (merged), what would be the impact on the results on ROE? Under what

conditions would such a combination make sense?

(a) Calculate each company's return on equity (ROE) and return on asset (ROA)

(a) Calculate each company's return on equity (ROE) and return on asset (ROA)(b) Which company has performed better in terms of profitability?

(c) If two companies were combined (merged), what would be the impact on the results on ROE? Under what

conditions would such a combination make sense?

It seems merging improves the shareholders' value.

2

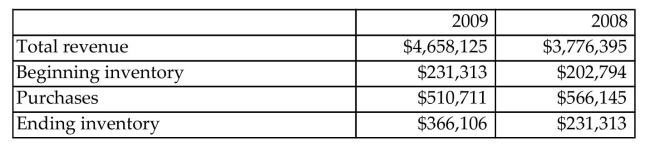

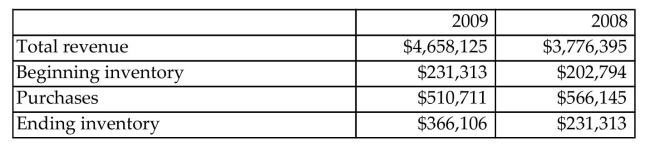

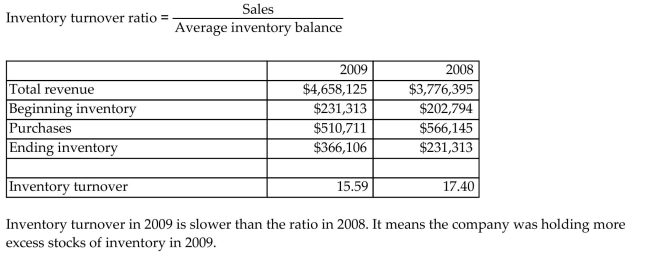

The following data were taken from the income statements of Broadcom Corporation (BRCM).  Compute for each year the inventory turnover ratio and what conclusions concerning the management of the

Compute for each year the inventory turnover ratio and what conclusions concerning the management of the

inventory can be drawn from the data?

Compute for each year the inventory turnover ratio and what conclusions concerning the management of the

Compute for each year the inventory turnover ratio and what conclusions concerning the management of theinventory can be drawn from the data?

3

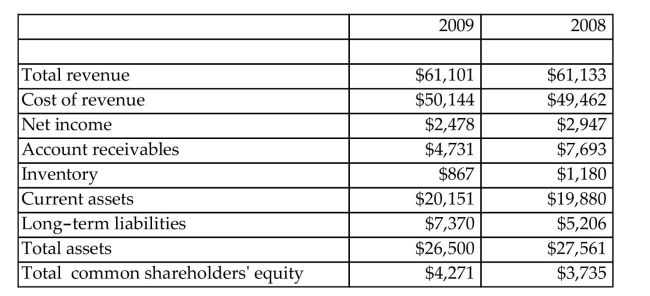

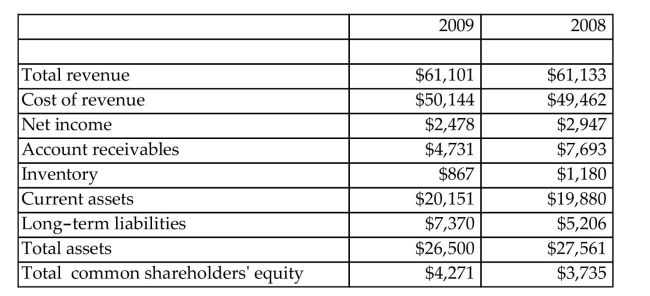

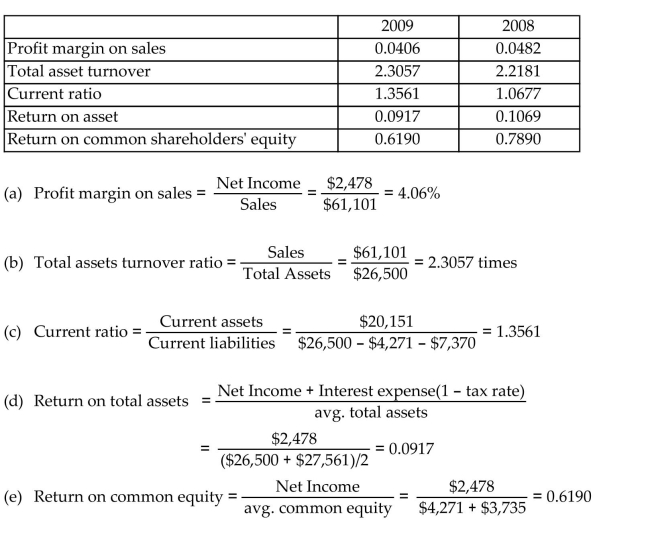

The following shows selected comparative statement data for Dell Corporation. All financial data are as of

January 31 in millions. For year 2009,

For year 2009,

(a) What is the profit margin?

(b) What is the total asset turnover?

(c) What is the current ratio?

(d) What is the return on asset?

(e) What is the return on common shareholders' equity?

January 31 in millions.

For year 2009,

For year 2009,(a) What is the profit margin?

(b) What is the total asset turnover?

(c) What is the current ratio?

(d) What is the return on asset?

(e) What is the return on common shareholders' equity?

4

In 2010, a biotechnology firm, DNA Map Inc., had $700 million of assets and $280 million of liabilities.

Earnings before interest and taxes were $215 million, interest expense was $10 million, and the tax rate was

32%.

(a) Calculate the times-interest-earned.

(b) Calculate the debt-to-equity ratio.

(c) Calculate the net margin.

Earnings before interest and taxes were $215 million, interest expense was $10 million, and the tax rate was

32%.

(a) Calculate the times-interest-earned.

(b) Calculate the debt-to-equity ratio.

(c) Calculate the net margin.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 5 في هذه المجموعة.

فتح الحزمة

k this deck

5

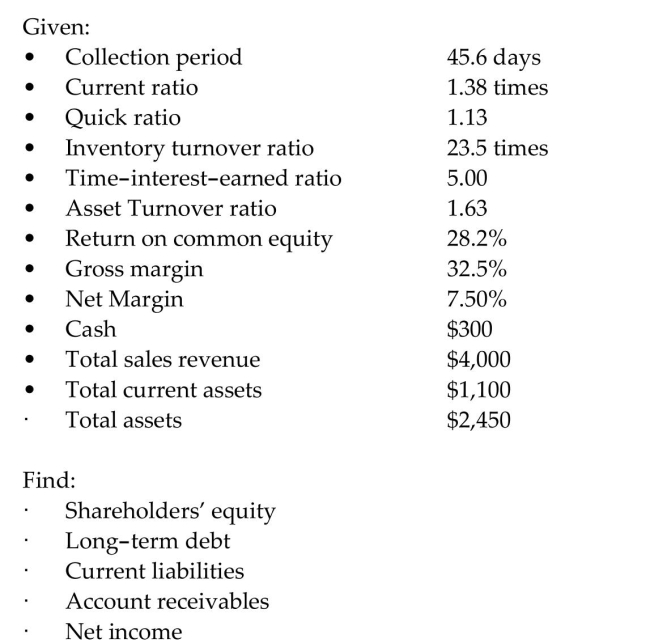

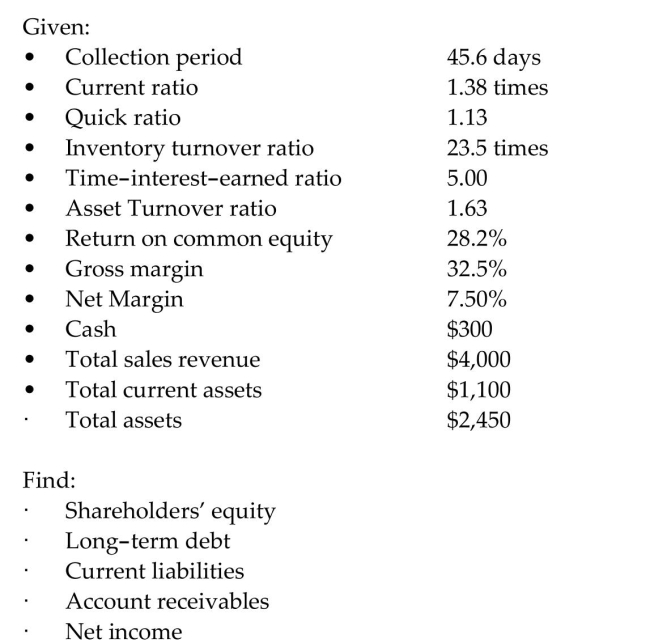

Given the following facts, complete the balance sheet:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 5 في هذه المجموعة.

فتح الحزمة

k this deck