Deck 3: Interest Rate and Economic Equivalence

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/17

العب

ملء الشاشة (f)

Deck 3: Interest Rate and Economic Equivalence

1

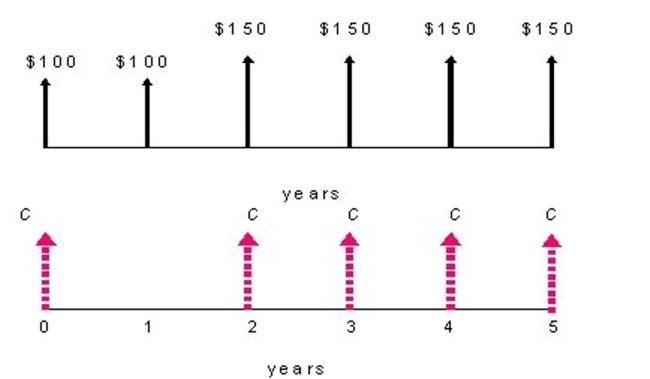

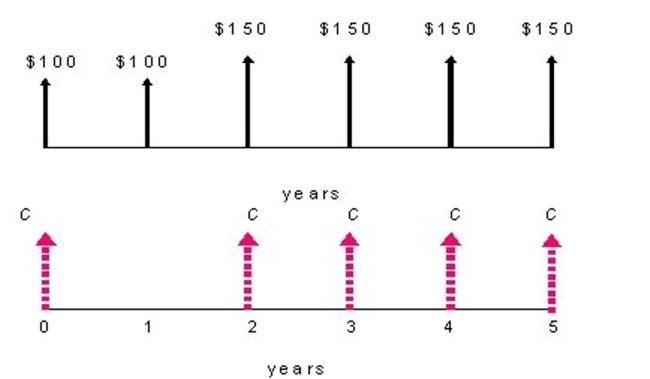

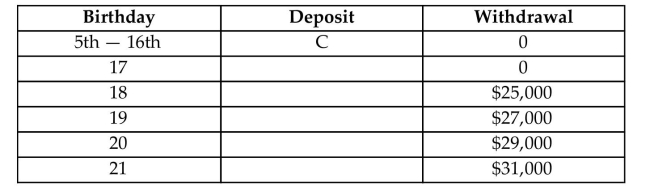

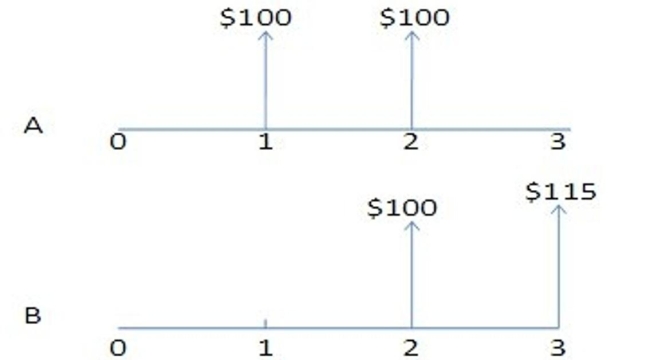

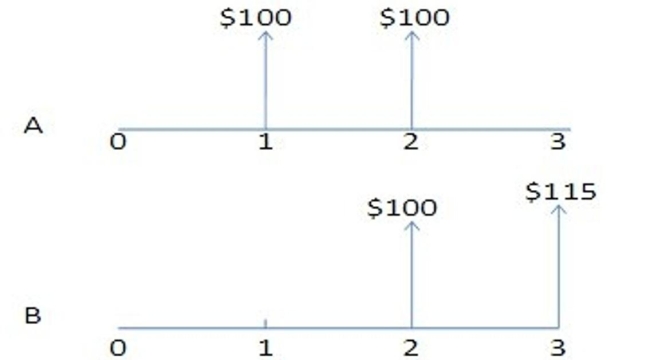

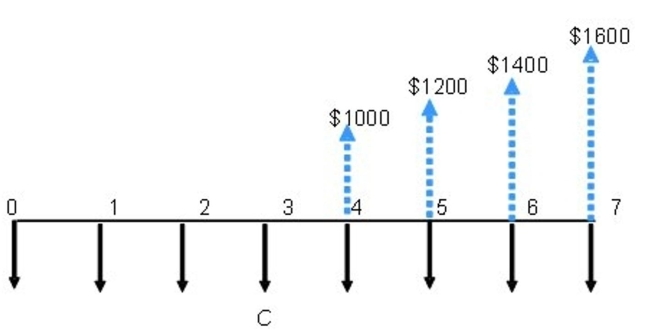

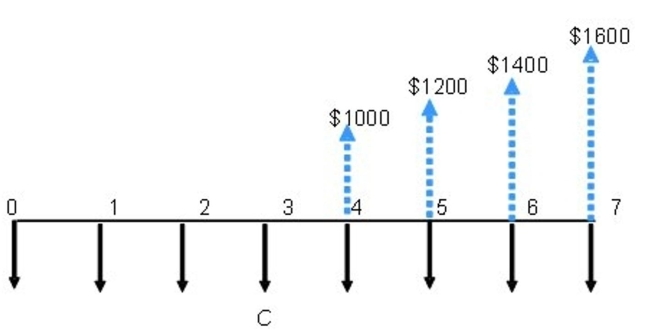

What value of C makes the following two annual cash flows equivalent at an annual rate of 10%?

2

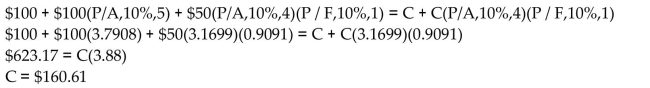

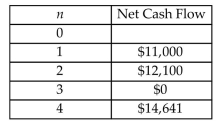

A couple is planning to finance their 5-year-old daughter's college education. They established a college fund

that earns 10%, compounded annually. What annual deposit must be made from the daughter's 5th birthday

(now) to her 16th birthday to meet the future college expenses shown in the following table? Assume that today

is her 5th birthday.

that earns 10%, compounded annually. What annual deposit must be made from the daughter's 5th birthday

(now) to her 16th birthday to meet the future college expenses shown in the following table? Assume that today

is her 5th birthday.

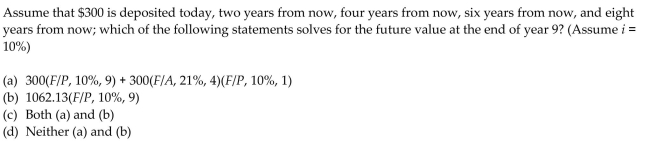

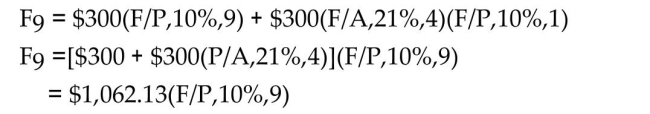

3

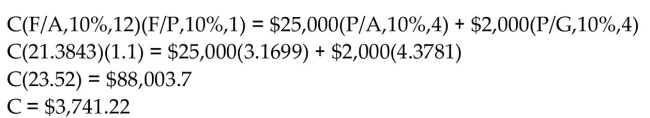

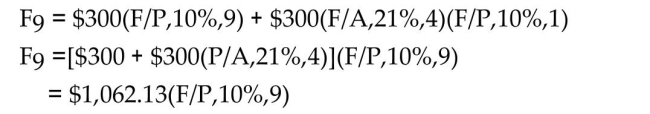

(c)

4

How much do you need to invest in equal annual amounts for the next 10 years if you want to withdraw $5,000

at the end of the eleventh year and increase the annual withdrawal by $1,000 each year thereafter until year 25?

The interest rate is 6%, compounded annually.

at the end of the eleventh year and increase the annual withdrawal by $1,000 each year thereafter until year 25?

The interest rate is 6%, compounded annually.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 17 في هذه المجموعة.

فتح الحزمة

k this deck

5

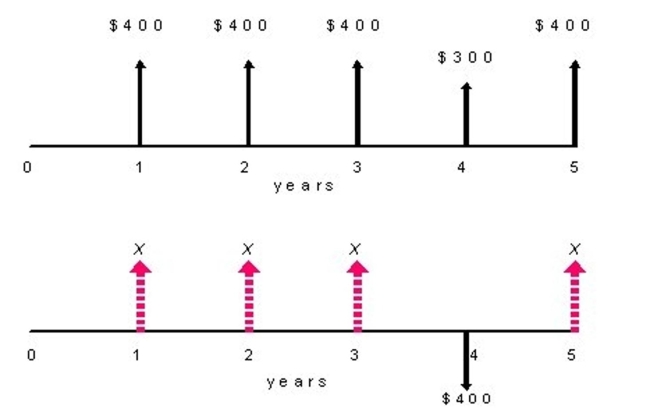

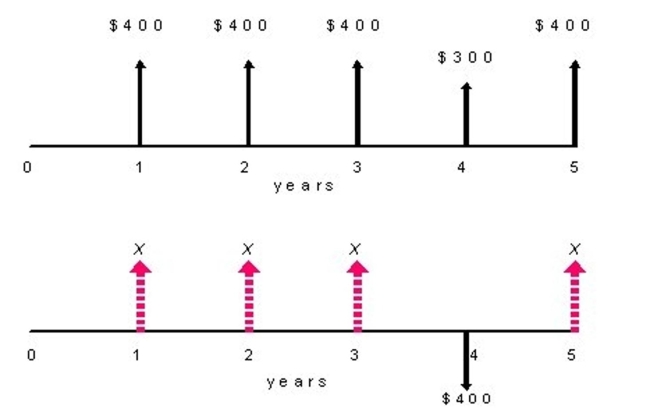

Find the value of X so that the following two cash flows are equivalent at an interest rate of 10%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 17 في هذه المجموعة.

فتح الحزمة

k this deck

6

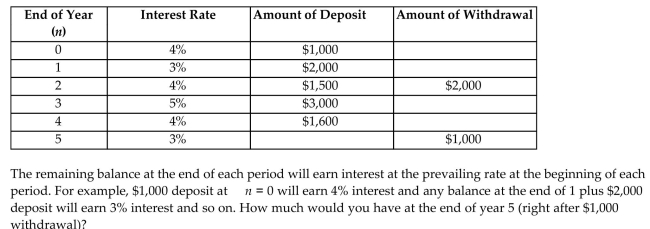

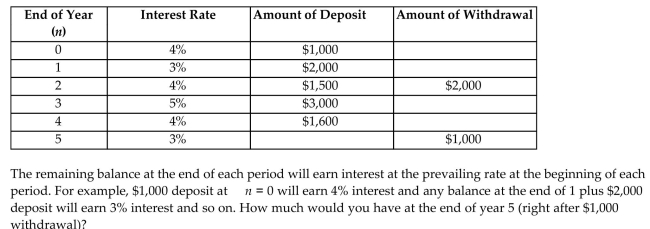

By looking at the history of your savings account, you learned the interest rate in each period during the last five

years was as follows:

years was as follows:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 17 في هذه المجموعة.

فتح الحزمة

k this deck

7

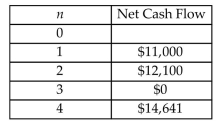

Consider the following two cash flow transactions that are said to be economically equivalent at an interest rate

of i. Determine the interest rate that establishes such an economic equivalence between the two cash flows.

of i. Determine the interest rate that establishes such an economic equivalence between the two cash flows.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 17 في هذه المجموعة.

فتح الحزمة

k this deck

8

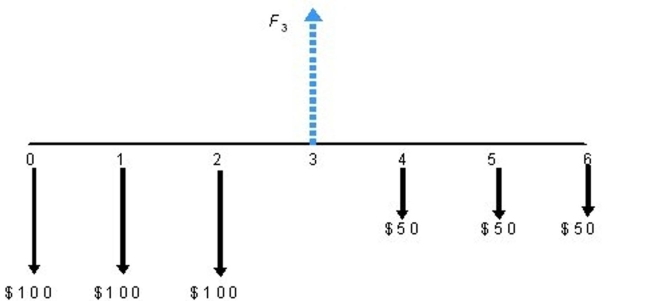

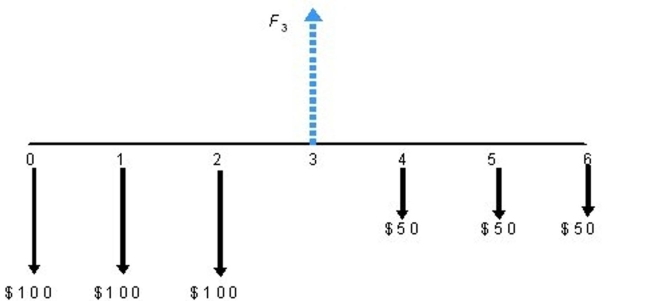

Whinterest rate is 10%, compoat value of F3 would be unded annually.equivalent to the payments shown in the cash flow diagram below? Assume the

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 17 في هذه المجموعة.

فتح الحزمة

k this deck

9

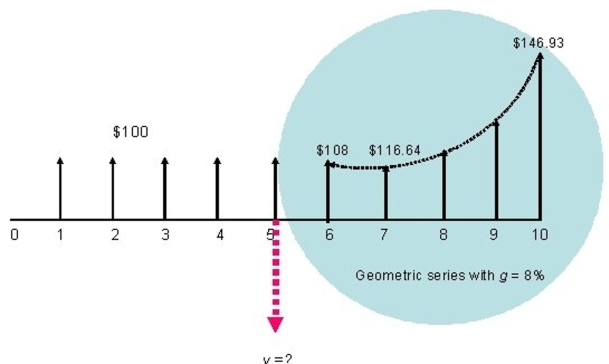

You want to find the equivalent present worth for the following cash flow series at an interest rate of 15%. Which of the following statements is incorrect?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 17 في هذه المجموعة.

فتح الحزمة

k this deck

10

Consider the cash flow series shown below. Determine the required annual deposits (end of year) that will

generate the cash flows from years 4 to 7. Assume the interest rate is 10%, compounded annually.

generate the cash flows from years 4 to 7. Assume the interest rate is 10%, compounded annually.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 17 في هذه المجموعة.

فتح الحزمة

k this deck

11

What is the present worth of the following income strings at an interest rate of 10%? (All cash flows occur at year

end.)

end.)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 17 في هذه المجموعة.

فتح الحزمة

k this deck

12

Your starting salary as a mechanical engineer is expected to be $55,000. A total of 10% of your salary each year

will be placed in the mutual fund of your choice. You can also count on a 5% annual salary increase for the next

30 years of employment. If the mutual fund will average 9% annual return over the course of your career, how

much can you expect at retirement?

will be placed in the mutual fund of your choice. You can also count on a 5% annual salary increase for the next

30 years of employment. If the mutual fund will average 9% annual return over the course of your career, how

much can you expect at retirement?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 17 في هذه المجموعة.

فتح الحزمة

k this deck

13

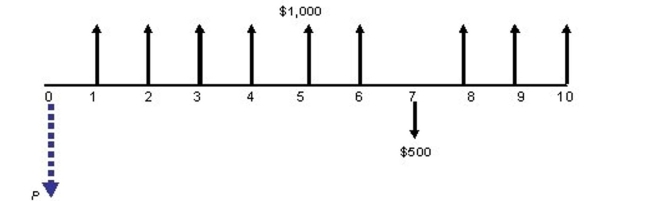

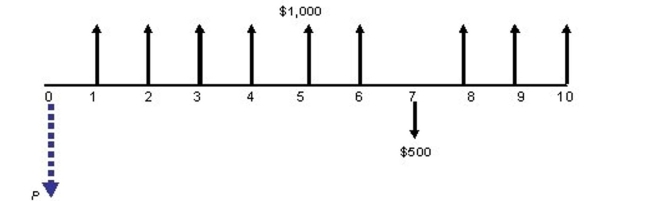

To withdraw the following $1,000 payment series, determine the absolute minimum amount of deposit (P) that

should be made now, assuming that deposits earn an interest rate of 10%, compounded annually. Note that you

are making another deposit at the end of year 7 in the amount of $500.

should be made now, assuming that deposits earn an interest rate of 10%, compounded annually. Note that you

are making another deposit at the end of year 7 in the amount of $500.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 17 في هذه المجموعة.

فتح الحزمة

k this deck

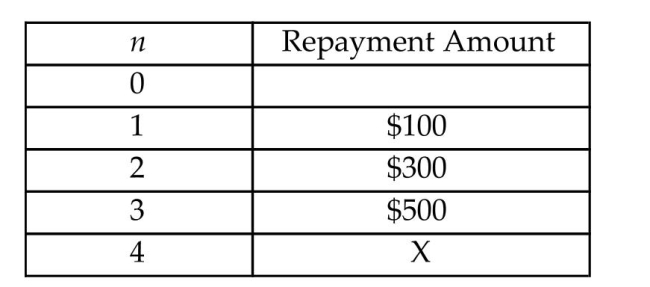

14

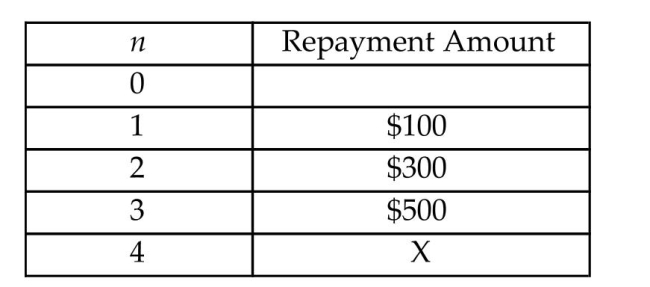

You borrowed $1,000 at 8%, compounded annually. The loan was repaid according to the following schedule.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 17 في هذه المجموعة.

فتح الحزمة

k this deck

15

If you deposit $1,000 over three years at 9% annual interest (meaning that you will make one lump sum

withdrawal at the end of three years), what is the interest earned in the 2nd year?

withdrawal at the end of three years), what is the interest earned in the 2nd year?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 17 في هذه المجموعة.

فتح الحزمة

k this deck

16

Compute the value of V in the following cash flow diagram. Assume

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 17 في هذه المجموعة.

فتح الحزمة

k this deck

17

Today is your birthday and you decide to start saving for your retirement. You will retire on your 65th birthday

and will need $50,000 per year at the end of each of following 20 years. You will make a first deposit one year

from today in an account paying 8% interest annually and continue to make an equal amount of deposit each

year up to the year before you plan to retire. If an annual deposit of $6,715 will allow you to reach your goal,

what birthday are you celebrating today?

and will need $50,000 per year at the end of each of following 20 years. You will make a first deposit one year

from today in an account paying 8% interest annually and continue to make an equal amount of deposit each

year up to the year before you plan to retire. If an annual deposit of $6,715 will allow you to reach your goal,

what birthday are you celebrating today?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 17 في هذه المجموعة.

فتح الحزمة

k this deck