Deck 8: Cost Concepts Relevant to Decision Making

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/4

العب

ملء الشاشة (f)

Deck 8: Cost Concepts Relevant to Decision Making

1

Korea Rice Wine Company (KRWC) produces and sells the highly popular rice wine in Asia. In the current year,

it will sell 3 million gallons of rice wine in Japan. (One case of rice wine is equivalent to 12 pack/750 ml bottles

or 2.38 gallons.) For many years it has sold in the Japanese market through a Tokyo-based importer. The

contract with the importer is up for renewal and KRWC decides to reconsider its Japanese market strategy.

After much analysis, it decides that three alternatives warrant further consideration:

• Option 1: Renew the contract with the current importer who manages all the marketing and distribution of

rice wine in Japan. KRWC receives a net payment of $10 per case (net after transportation costs and import

duties) sold in the Japanese market.

• Option 2: Licenses production of rice wine to a Japanese wine-maker who also will manage its marketing

and distribution. This wine-maker will charge KWRC a fixed fee of $10 million each year to cover its costs of

maintaining the quality of KRWC products. It will pay KRWC $20 per case of rice wine it sells in Japan.

• Option 3: Purchases a fully operational winery plant from a Japanese wine-maker with excess capacity.

The annual fixed costs of operating the plant are $40 million and the variable costs are $80 per case. KWRC will

sell to independent wholesalers in Japan at $120 case.

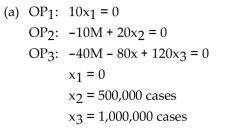

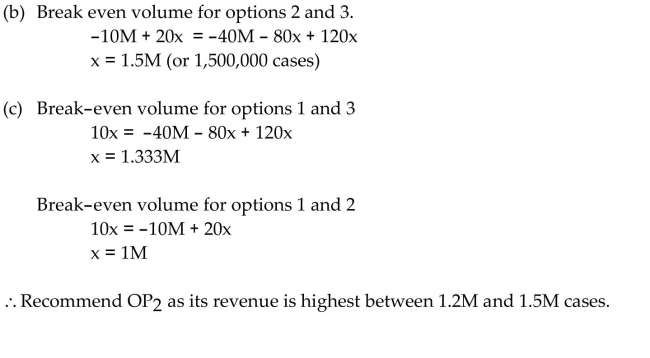

(a) Compute the breakeven point for each of the three options that KWRC is considering.

(b) At which unit sales level (cases) of rice wine in Japan would KWRC report the same operating income

under Options B and C?

(c) If KWRC expects the rice wine sales volume in Japan to be somewhere between 1,200,000 cases and

1,500,000 cases, which option would you recommend?

it will sell 3 million gallons of rice wine in Japan. (One case of rice wine is equivalent to 12 pack/750 ml bottles

or 2.38 gallons.) For many years it has sold in the Japanese market through a Tokyo-based importer. The

contract with the importer is up for renewal and KRWC decides to reconsider its Japanese market strategy.

After much analysis, it decides that three alternatives warrant further consideration:

• Option 1: Renew the contract with the current importer who manages all the marketing and distribution of

rice wine in Japan. KRWC receives a net payment of $10 per case (net after transportation costs and import

duties) sold in the Japanese market.

• Option 2: Licenses production of rice wine to a Japanese wine-maker who also will manage its marketing

and distribution. This wine-maker will charge KWRC a fixed fee of $10 million each year to cover its costs of

maintaining the quality of KRWC products. It will pay KRWC $20 per case of rice wine it sells in Japan.

• Option 3: Purchases a fully operational winery plant from a Japanese wine-maker with excess capacity.

The annual fixed costs of operating the plant are $40 million and the variable costs are $80 per case. KWRC will

sell to independent wholesalers in Japan at $120 case.

(a) Compute the breakeven point for each of the three options that KWRC is considering.

(b) At which unit sales level (cases) of rice wine in Japan would KWRC report the same operating income

under Options B and C?

(c) If KWRC expects the rice wine sales volume in Japan to be somewhere between 1,200,000 cases and

1,500,000 cases, which option would you recommend?

2

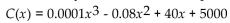

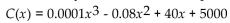

Intelligent Inc. specializes in the manufacture of components for personal computers. Management has

determined the daily cumulative cost of producing these components (in dollars) is given by:

where x is the number of components produced.

is the number of components produced.

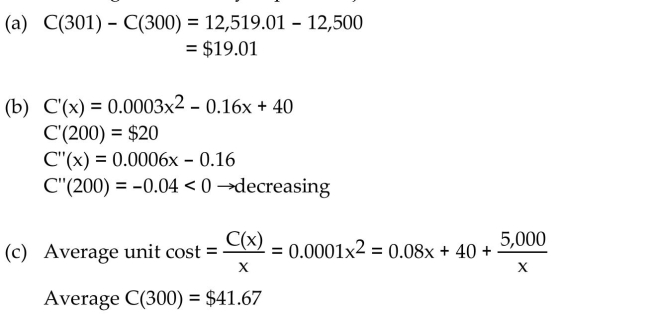

(a) What is the actual cost incurred for manufacturing the 301st component?

(b) What is the marginal cost of the 200th component? What can you say about the marginal cost as a function

of x (increasing or decreasing)?

(c) What is the average unit cost if you produce just 300 units?

determined the daily cumulative cost of producing these components (in dollars) is given by:

where x

is the number of components produced.

is the number of components produced.(a) What is the actual cost incurred for manufacturing the 301st component?

(b) What is the marginal cost of the 200th component? What can you say about the marginal cost as a function

of x (increasing or decreasing)?

(c) What is the average unit cost if you produce just 300 units?

3

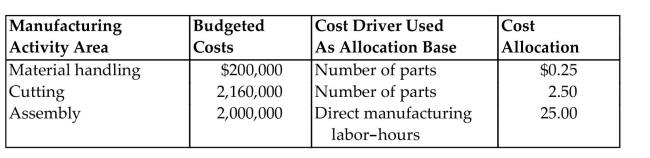

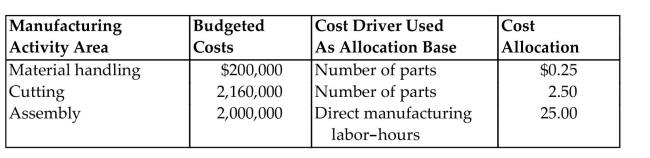

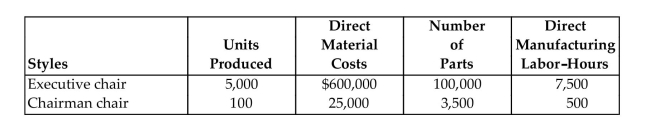

The Alabama Office Furniture Company manufactures a variety of prestige boardroom chairs. Its job costing

system was designed using an activity-based approach. There are two direct cost categories (direct materials

and direct manufacturing labor) and three indirect cost pools. These three cost pools represent three activity

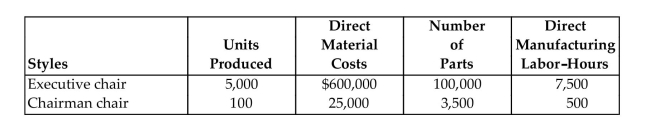

areas at the plant. Two styles chairs were produced in January, 2010, the executive chair and the chairman chair. Their quantities,

Two styles chairs were produced in January, 2010, the executive chair and the chairman chair. Their quantities,

direct material costs, and other data for January follow: The direct manufacturing labor rate is $20 per hour.

The direct manufacturing labor rate is $20 per hour.

(a) Compute the January total manufacturing costs and unit costs of the executive chair and the chairman chair

based on the activity-based approach.

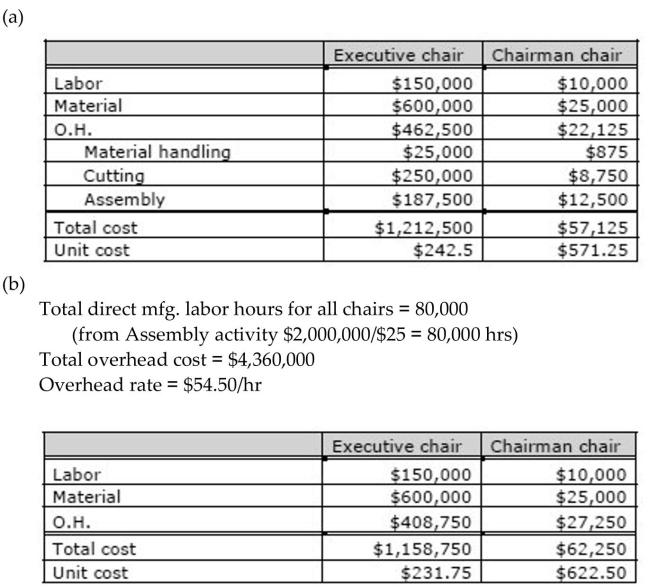

(b) Repeat (a) assuming that the overhead cost will be allocated according to the traditional direct

manufacturing labor-hours.

2

system was designed using an activity-based approach. There are two direct cost categories (direct materials

and direct manufacturing labor) and three indirect cost pools. These three cost pools represent three activity

areas at the plant.

Two styles chairs were produced in January, 2010, the executive chair and the chairman chair. Their quantities,

Two styles chairs were produced in January, 2010, the executive chair and the chairman chair. Their quantities,direct material costs, and other data for January follow:

The direct manufacturing labor rate is $20 per hour.

The direct manufacturing labor rate is $20 per hour.(a) Compute the January total manufacturing costs and unit costs of the executive chair and the chairman chair

based on the activity-based approach.

(b) Repeat (a) assuming that the overhead cost will be allocated according to the traditional direct

manufacturing labor-hours.

2

4

The Austin Electric Company has three product lines of surge protectors commonly used in PC-A, B, and C

-having contribution margin of $3, $2, and $1, respectively. The president foresees sales of 200,000 units in the

coming period, consisting of 20,000 units of A, 100,000 units of B, and 80,000 units of C. The company's fixed

costs for the period are $255,000.

(a) What is the company's breakeven point in units, assuming that the given sales mix is maintained?

(b) If the mix is maintained, what is the total contribution margin when 200,000 units are sold? What is

operating income?

(c) Determine the operating income if 20,000 units of A, 80,000 units of B, and 100,000 units of C were sold.

What is the new breakeven point in units if these relationships persist in the next period?

-having contribution margin of $3, $2, and $1, respectively. The president foresees sales of 200,000 units in the

coming period, consisting of 20,000 units of A, 100,000 units of B, and 80,000 units of C. The company's fixed

costs for the period are $255,000.

(a) What is the company's breakeven point in units, assuming that the given sales mix is maintained?

(b) If the mix is maintained, what is the total contribution margin when 200,000 units are sold? What is

operating income?

(c) Determine the operating income if 20,000 units of A, 80,000 units of B, and 100,000 units of C were sold.

What is the new breakeven point in units if these relationships persist in the next period?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 4 في هذه المجموعة.

فتح الحزمة

k this deck