Deck 7: Rate-Of-Return Analysis

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/15

العب

ملء الشاشة (f)

Deck 7: Rate-Of-Return Analysis

1

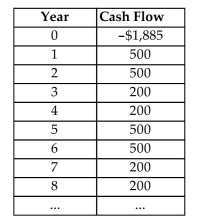

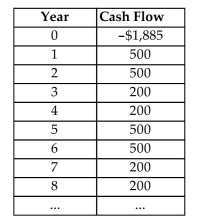

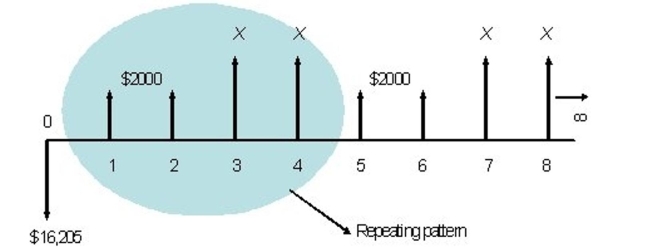

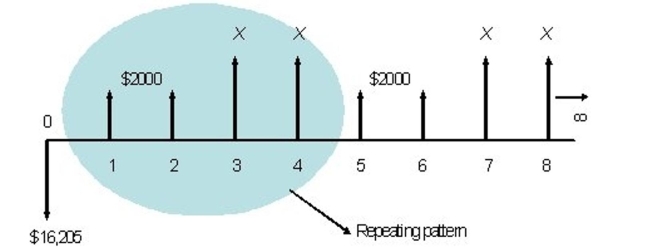

Find the rate of return for the following infinite cash flow series with repeating cycles.

2

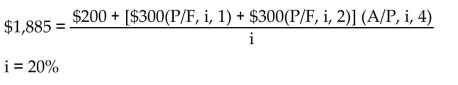

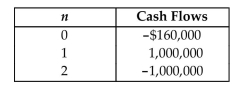

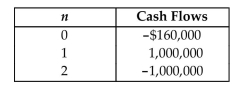

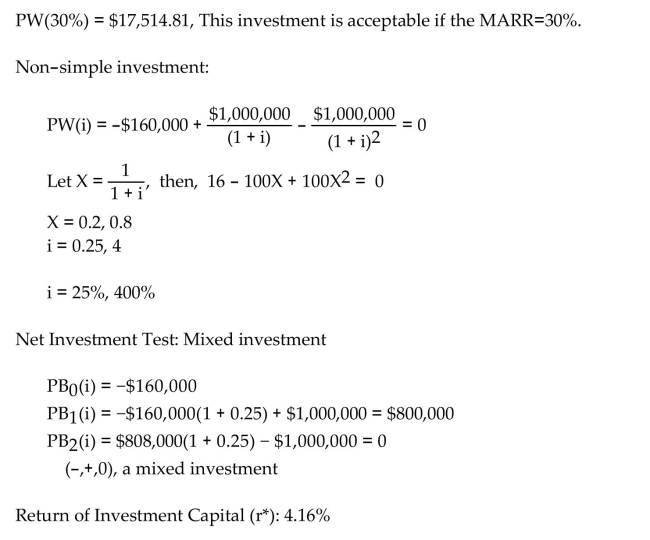

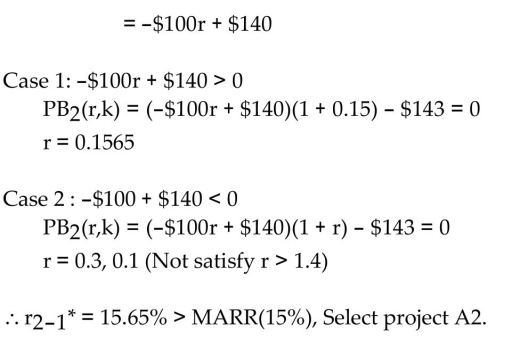

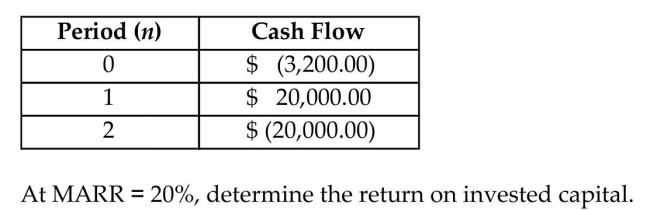

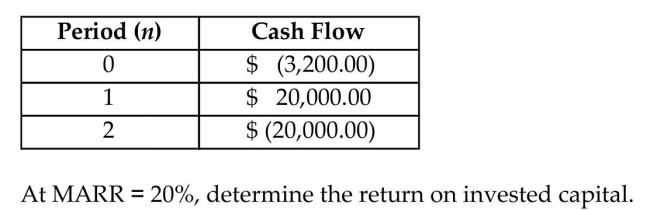

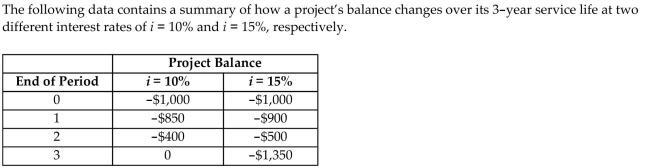

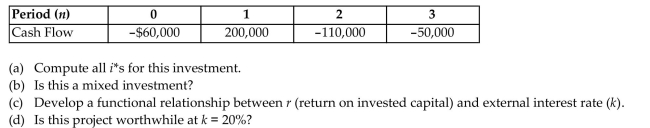

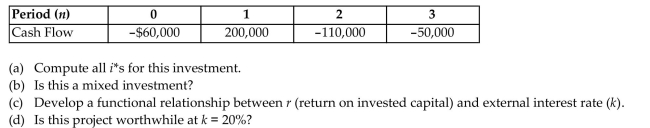

Consider the following project's expected net cash flows:  Which of the following statements is true?

Which of the following statements is true?

(a) This investment would be acceptable if the MARR is 30%.

(b) This investment has two rates of return.

(c) The return on invested capital at a MARR of 20% is 4.16%.

(d) All of the above

Which of the following statements is true?

Which of the following statements is true?(a) This investment would be acceptable if the MARR is 30%.

(b) This investment has two rates of return.

(c) The return on invested capital at a MARR of 20% is 4.16%.

(d) All of the above

(d)

3

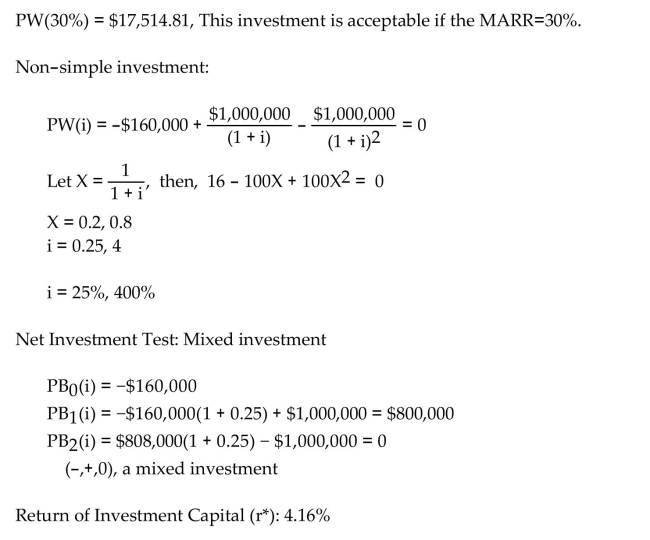

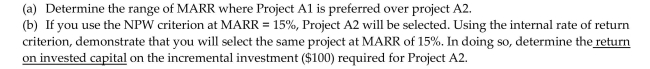

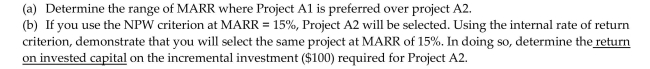

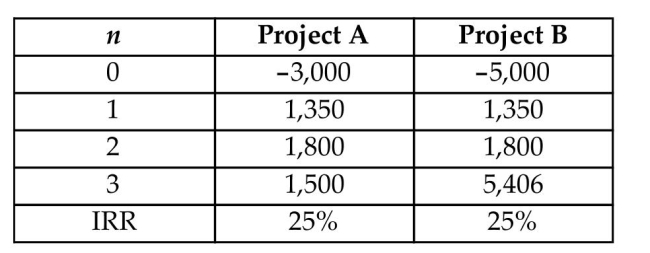

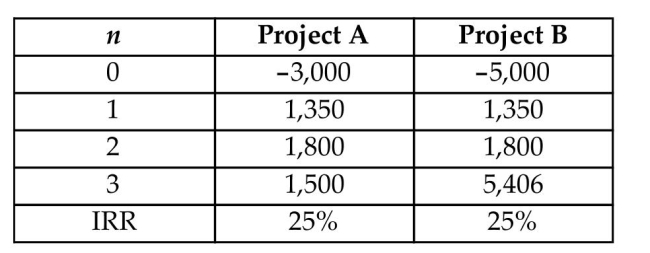

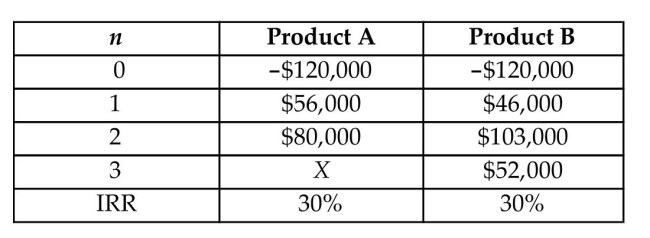

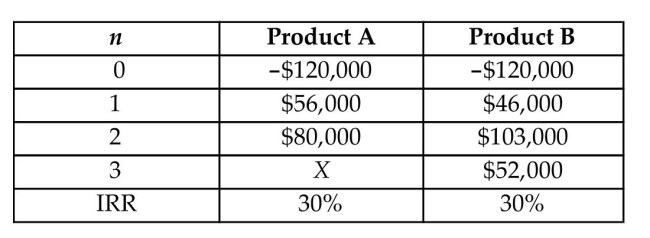

Consider the following two mutually exclusive investment proposals.

4

Consider a cash flow series for an investment project as follows:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 15 في هذه المجموعة.

فتح الحزمة

k this deck

5

The following information on two mutually exclusive projects is given below:  Which of the following statements is correct?

Which of the following statements is correct?

(a) Since the two projects have the same rate of return, they are indifferent.

(b) Project A would be a better choice, as the required investment is smaller with the same rate of return.

(c) Project B would be a better choice as long as the investor's MARR is less than 25%.

(d) Project B is a better choice regardless of the investor's MARR.

Which of the following statements is correct?

Which of the following statements is correct?(a) Since the two projects have the same rate of return, they are indifferent.

(b) Project A would be a better choice, as the required investment is smaller with the same rate of return.

(c) Project B would be a better choice as long as the investor's MARR is less than 25%.

(d) Project B is a better choice regardless of the investor's MARR.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 15 في هذه المجموعة.

فتح الحزمة

k this deck

6

You are considering purchasing a CNC machine that costs $150,000. This machine will have an estimated

service life of 10 years with a net after-tax salvage value of $15,000. Its annual after-tax operating and

maintenance costs are estimated to be $50,000. To expect an 18% rate of return on investment after-tax, what

would be the required minimum annual after-tax revenues?

service life of 10 years with a net after-tax salvage value of $15,000. Its annual after-tax operating and

maintenance costs are estimated to be $50,000. To expect an 18% rate of return on investment after-tax, what

would be the required minimum annual after-tax revenues?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 15 في هذه المجموعة.

فتح الحزمة

k this deck

7

Consider the following two investment situations:

• In 1970, when WalMart Stores, Inc. went public, an investment of 100 shares cost $1,650. That investment

would have been worth $10,854,400 after 40 years (2010). The WalMart investors' rate of return would be

around 24.58%.

• In 1980, if you bought 100 shares of Fidelity Mutual Funds, it would have cost $5,245. That investment

would have been worth $80,810 after 15 years.

Which of the following statements is correct?

(a) If you bought only 50 shares of the WalMart stocks in 1970 and kept it for 40 years, your rate of return

would be 0.5 times 24.58%.

(b) The investors in Fidelity Mutual Funds would have made profit at the annual rate of 30% on the funds

remaining invested during the first 15 years.

(c) If you bought 100 shares of WalMart in 1970 but sold them after 10 years. (Assume that the WalMart stocks

grew at the annual rate of 35% for the first 10 years.) Then immediately, you put all the proceeds into Fidelity

Mutual Funds. After 15 years, the total worth of your investment would be around $511,140.

(d) None of the above

• In 1970, when WalMart Stores, Inc. went public, an investment of 100 shares cost $1,650. That investment

would have been worth $10,854,400 after 40 years (2010). The WalMart investors' rate of return would be

around 24.58%.

• In 1980, if you bought 100 shares of Fidelity Mutual Funds, it would have cost $5,245. That investment

would have been worth $80,810 after 15 years.

Which of the following statements is correct?

(a) If you bought only 50 shares of the WalMart stocks in 1970 and kept it for 40 years, your rate of return

would be 0.5 times 24.58%.

(b) The investors in Fidelity Mutual Funds would have made profit at the annual rate of 30% on the funds

remaining invested during the first 15 years.

(c) If you bought 100 shares of WalMart in 1970 but sold them after 10 years. (Assume that the WalMart stocks

grew at the annual rate of 35% for the first 10 years.) Then immediately, you put all the proceeds into Fidelity

Mutual Funds. After 15 years, the total worth of your investment would be around $511,140.

(d) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 15 في هذه المجموعة.

فتح الحزمة

k this deck

8

The following infinite cash flow has a rate of return of 15%. Compute the unknown value of X.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 15 في هذه المجموعة.

فتح الحزمة

k this deck

9

A manufacturing firm is considering two types of gear coupling products. Due to insufficient production

capacity as well as anticipated market competition, the firm wants to manufacture and market only one type of

product at this time. The required investments as well as the projected cash flows over a three-year market life

for each product are as follows: The firm's MARR is known to be 15% for this type of project.

The firm's MARR is known to be 15% for this type of project.

(a) Determine the required cash flow in year 3 (X) for product A, to have a 30% return on investment.

(b) With the value of X determined in (a), which product should be undertaken based on the principle of IRR?

capacity as well as anticipated market competition, the firm wants to manufacture and market only one type of

product at this time. The required investments as well as the projected cash flows over a three-year market life

for each product are as follows:

The firm's MARR is known to be 15% for this type of project.

The firm's MARR is known to be 15% for this type of project.(a) Determine the required cash flow in year 3 (X) for product A, to have a 30% return on investment.

(b) With the value of X determined in (a), which product should be undertaken based on the principle of IRR?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 15 في هذه المجموعة.

فتح الحزمة

k this deck

10

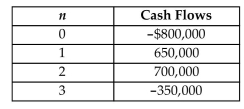

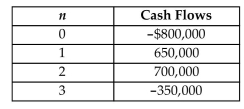

Consider the following project cash flows.  Which of the following statements is most correct?

Which of the following statements is most correct?

(a) The project is a mixed investment.

(b) The project has a unique rate of return.

(c) The project is a nonsimple investment.

(d) All of them above

Which of the following statements is most correct?

Which of the following statements is most correct?(a) The project is a mixed investment.

(b) The project has a unique rate of return.

(c) The project is a nonsimple investment.

(d) All of them above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 15 في هذه المجموعة.

فتح الحزمة

k this deck

11

Which of the following statements is correct? (a) The IRR of the project should be 15%.

Which of the following statements is correct? (a) The IRR of the project should be 15%.(b) The IRR of the project should be greater than 10%.

(c) The IRR of the project should be equal to 10%.

(d) It is not possible to determine the IRR from the given data.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 15 في هذه المجموعة.

فتح الحزمة

k this deck

12

Consider the following investment cash flow.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 15 في هذه المجموعة.

فتح الحزمة

k this deck

13

You are considering purchasing a new injection molding machine. This machine will have an estimated service

life of 10 years with a negligible after-tax salvage value. Its annual net after-tax operating cash flows are

estimated to be $60,000. To expect a 15% rate of return on investment, what would be the maximum amount

that should be spent on purchasing the injection molding machine?

life of 10 years with a negligible after-tax salvage value. Its annual net after-tax operating cash flows are

estimated to be $60,000. To expect a 15% rate of return on investment, what would be the maximum amount

that should be spent on purchasing the injection molding machine?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 15 في هذه المجموعة.

فتح الحزمة

k this deck

14

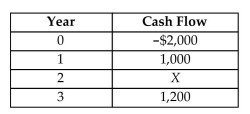

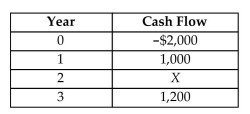

You are considering an investment that costs $2,000. It is expected to have a useful life of 3 years. You are very

confident about the revenues during the first and the third year, but you are unsure about the revenue in year 2.

If you hope to make at least a 10% rate of return on your investment ($2,000), what should be the minimum

revenue in year 2?

confident about the revenues during the first and the third year, but you are unsure about the revenue in year 2.

If you hope to make at least a 10% rate of return on your investment ($2,000), what should be the minimum

revenue in year 2?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 15 في هذه المجموعة.

فتح الحزمة

k this deck

15

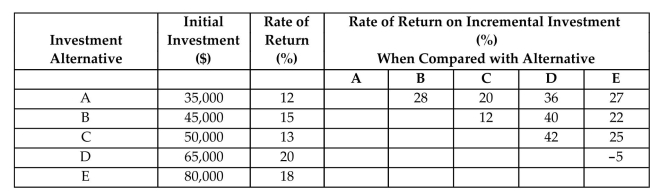

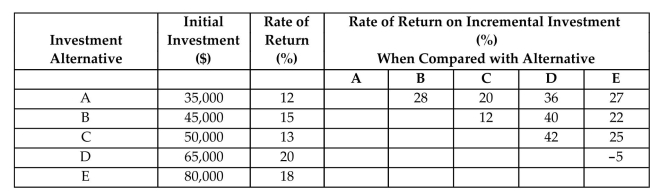

You are evaluating five investment projects. You already calculated the rate of return for each alternative

investment and incremental rate of return between the two-paired alternatives as well. In calculating the

incremental rate of return, a lower cost investment project is subtracted from the higher cost investment project.

All rate of return figures are rounded to the nearest integers. (a) If all investment alternatives are mutually independent and the MARR is 10%,

(a) If all investment alternatives are mutually independent and the MARR is 10%,

which projects would be selected?

(b) If all investment alternatives are mutually exclusive and the MARR is 12%, which alternative should be

chosen?

(c) Suppose all investment alternatives are mutually exclusive but the MARR is 25%, which alternative should

be chosen?

investment and incremental rate of return between the two-paired alternatives as well. In calculating the

incremental rate of return, a lower cost investment project is subtracted from the higher cost investment project.

All rate of return figures are rounded to the nearest integers.

(a) If all investment alternatives are mutually independent and the MARR is 10%,

(a) If all investment alternatives are mutually independent and the MARR is 10%,which projects would be selected?

(b) If all investment alternatives are mutually exclusive and the MARR is 12%, which alternative should be

chosen?

(c) Suppose all investment alternatives are mutually exclusive but the MARR is 25%, which alternative should

be chosen?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 15 في هذه المجموعة.

فتح الحزمة

k this deck