Deck 11: Property Dispositions

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/120

العب

ملء الشاشة (f)

Deck 11: Property Dispositions

1

Adjustments to gross selling price include I. the amount of a seller's expenses paid by the buyer. II. the amount of the buyer's debt assumed by the seller.

A) Only statement I is correct.

B) Only statement II is correct.

C) Both statements are correct.

D) Neither statement is correct.

A) Only statement I is correct.

B) Only statement II is correct.

C) Both statements are correct.

D) Neither statement is correct.

C

2

All of the gain from the sale of qualified small business stock, purchased between 9/27/2010 and 1/1/2014, and held more than five years is excluded from tax.

True

3

Section 1231 assets are certain trade or business assets that are not capital assets but are treated as such when sold at a gain or a loss.

False

4

Unrecaptured Section 1250 gain is taxed at a maximum rate of 25%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

5

Unrecaptured Section 1250 gain is the amount of gain on the sale of personal assets by individuals not otherwise treated as ordinary income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

6

Carlos received an antique dresser from his aunt. Since the dresser is worth $6,000 more than what his aunt paid for it, the holding period begins with the date of the gift.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

7

Marilyn sells 200 shares of General Motors stock for $80 per share. She pays a $100 commission on the sale and has an adjusted basis of $8,000 on the stock. I. The amount realized from the sale is $15,900. II. Marilyn has a recognized gain of $8,000.

A) Only statement I is correct.

B) Only statement II is correct.

C) Both statements are correct.

D) Neither statement is correct.

A) Only statement I is correct.

B) Only statement II is correct.

C) Both statements are correct.

D) Neither statement is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

8

The lookback recapture rule nets the current-year net Section 1231 gain against Section 1231 ordinary loss deductions taken in the previous three years.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

9

When a taxpayer sells only a portion of the securities that they own, the average cost method is used to establish the cost basis for the shares sold.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

10

For depreciable real property, all depreciation taken must be recaptured and treated as ordinary income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

11

Gross selling price includes I. the amount of a seller's debt assumed by the buyer. II. the fair market value of services received by the seller from the buyer.

A) Only statement I is correct.

B) Only statement II is correct.

C) Both statements are correct.

D) Neither statement is correct.

A) Only statement I is correct.

B) Only statement II is correct.

C) Both statements are correct.

D) Neither statement is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

12

The gain from the sale of qualified small business stock held for more than six months can be rolled over if stock from another qualified small business is purchased within 60 days.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

13

Net collectibles gains are taxed at a maximum rate of 28%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

14

The amount realized equals the gross selling price less any selling expenses.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

15

Gains on the sale of certain types of business assets, referred to as Section 1231 property, are always treated as capital gains.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

16

Section 1245 property is subject to a full recapture of all depreciation taken as ordinary income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

17

Brock exchanges property with an adjusted basis of $40,000 subject to a mortgage of $20,000 for other property owned by Reese with a fair market value of $80,000. Reese assumes the mortgage. No cash or other assets were part of the trade. Brock's amount realized is

A) $ 40,000

B) $ 50,000

C) $ 80,000

D) $ 90,000

E) $100,000

A) $ 40,000

B) $ 50,000

C) $ 80,000

D) $ 90,000

E) $100,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

18

Allie, a well-known artist, gave one of her paintings to her nephew Alfred. When Alfred sells the painting he will have a capital gain.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

19

A buyer's assumption of the seller's debt increases the gross sales price and any debt of the buyer assumed by the seller in the transaction also increases the gross sales price.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

20

Drew traded his office copier in for a new one. The old copier had an adjusted basis of $400. The new copier cost $1,350, and he was given a trade-in allowance of $500. I. The amount realized is $400. II. Drew has a realized gain of $100.

A) Only statement I is correct.

B) Only statement II is correct.

C) Both statements are correct.

D) Neither statement is correct.

A) Only statement I is correct.

B) Only statement II is correct.

C) Both statements are correct.

D) Neither statement is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

21

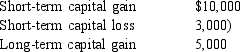

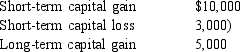

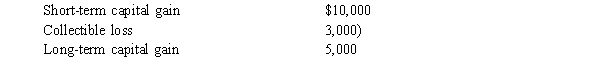

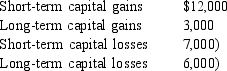

William has the following capital gains and losses for the current year:  What is William's net capital gain or loss position for the year?

What is William's net capital gain or loss position for the year?

A) Short-term capital gain $7,000; Long-term capital gain $5,000.

B) Short-term capital gain $10,000; Long-term capital gain $2,000.

C) Short-term capital gain $7,000; Long-term capital gain $2,000.

D) Short-term capital gain $10,000; Long-term capital gain $5,000

What is William's net capital gain or loss position for the year?

What is William's net capital gain or loss position for the year?A) Short-term capital gain $7,000; Long-term capital gain $5,000.

B) Short-term capital gain $10,000; Long-term capital gain $2,000.

C) Short-term capital gain $7,000; Long-term capital gain $2,000.

D) Short-term capital gain $10,000; Long-term capital gain $5,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

22

Virginia and Dan each own investment realty that they would like to trade. Virginia's property is subject to mortgage debt of $2,000 and has a net of mortgage value of $6,000. Dan's property is subject to mortgage debt of $30,000 and has a net of mortgage value of $5,000. Virginia and Dan agree to exchange properties and assume each other's debt. Dan pays Virginia $1,000 cash, and the exchange is completed. What is the gross selling price of Virginia's property?

A) $ 2,000

B) $ 6,000

C) $ 8,000

D) $ 5,000

E) $35,000

A) $ 2,000

B) $ 6,000

C) $ 8,000

D) $ 5,000

E) $35,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

23

Corky receives a gift of property from her Aunt Cynthia. Cynthia purchased the property 17 years ago for $375,000. On the date of the gift, the property is appraised at $500,000. What is Corky's holding period for the property if she sells it one month after the gift was completed?

A) Short-term.

B) Long-term.

C) Holding period is not relevant since the gain is ordinary.

D) Holding period classification cannot be determined without knowing the selling price.

A) Short-term.

B) Long-term.

C) Holding period is not relevant since the gain is ordinary.

D) Holding period classification cannot be determined without knowing the selling price.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

24

All of the following are capital assets with the exception of

A) Stocks and bonds.

B) Office furniture used in a business

C) Monet painting privately held.

D) Apartment building held for investment.

E) Personal residence.

A) Stocks and bonds.

B) Office furniture used in a business

C) Monet painting privately held.

D) Apartment building held for investment.

E) Personal residence.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

25

A capital asset includes which of the following? I. real estate held as an investment in rental property. II. the copyright to a song held by its writer. III. real estate used in a trade or business. IV. accounts receivable.

A) Only statement I is correct.

B) Statements I and II are correct.

C) Statements III and IV are correct.

D) Statements I, II, and III are correct.

E) Statements I, II, III, and IV are correct.

A) Only statement I is correct.

B) Statements I and II are correct.

C) Statements III and IV are correct.

D) Statements I, II, and III are correct.

E) Statements I, II, III, and IV are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

26

Melissa sells stock she purchased in 2004 for a $7,500 gain in 2014. In August 2014, she also sells land she purchased as an investment in December 2013 at a loss of $12,000. I. Melissa's tax on the $7,500 gain is $1,125. II. Melissa has a deductible capital loss of $3,000 in 2014.

A) Only statement I is correct.

B) Only statement II is correct.

C) Both statements are correct.

D) Neither statement is correct.

A) Only statement I is correct.

B) Only statement II is correct.

C) Both statements are correct.

D) Neither statement is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

27

When her property was fully depreciated and was still encumbered by a mortgage of $6,000, Jamelle sells it subject to the mortgage to David for $1,000. What is Jamelle's realized gain or loss?

A) $ - 0 -

B) $1,000 gain

C) $5,000 gain

D) $6,000 gain

E) $7,000 gain

A) $ - 0 -

B) $1,000 gain

C) $5,000 gain

D) $6,000 gain

E) $7,000 gain

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

28

Terry receives investment property from her mother as a gift in 2014. Her mother paid $15,000 for the property in 2011, and it is valued at $18,000 on the date of the gift. Terry sells the property eight months later for $16,000. Terry's gain or loss is

A) Short-term ordinary loss.

B) Short-term capital gain.

C) Short-term capital loss.

D) Long-term ordinary gain.

E) Long-term capital gain.

A) Short-term ordinary loss.

B) Short-term capital gain.

C) Short-term capital loss.

D) Long-term ordinary gain.

E) Long-term capital gain.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

29

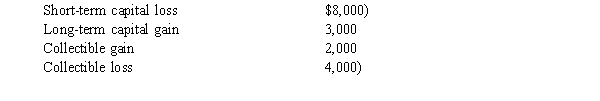

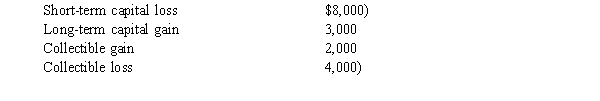

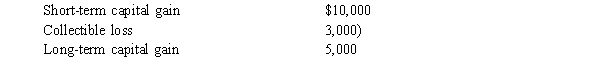

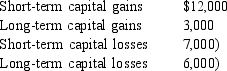

Serenity has the following capital gains and losses for the current year:  If Serenity is single and has taxable income from other sources of $75,000, what is the impact of her capital gains and losses on her income tax liability?

If Serenity is single and has taxable income from other sources of $75,000, what is the impact of her capital gains and losses on her income tax liability?

A) $ 690 decrease.

B) $ 750 decrease.

C) $ 840 decrease.

D) $1,050 decrease.

E) $1,960 decrease.

If Serenity is single and has taxable income from other sources of $75,000, what is the impact of her capital gains and losses on her income tax liability?

If Serenity is single and has taxable income from other sources of $75,000, what is the impact of her capital gains and losses on her income tax liability?A) $ 690 decrease.

B) $ 750 decrease.

C) $ 840 decrease.

D) $1,050 decrease.

E) $1,960 decrease.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

30

Brenda sells stock she purchased in 2004 for a $7,500 gain in 2014. In August 2014, she also sells land she purchased as an investment in December 2013 at a loss of $9,000. I. For 2014, Brenda's tax on the $7,500 gain is $1,125. II. Brenda can deduct $3,000 of the $9,000 loss in 2014. III. For 2014, Brenda has a net long-term capital loss of $9,000. IV. Brenda can only deduct a capital loss of $1,500 in 2014.

A) Statements I and II are correct.

B) Statements I, II and IV are correct.

C) Only statement II is correct.

D) Only statement IV is correct.

E) Statements I, II and III are correct.

A) Statements I and II are correct.

B) Statements I, II and IV are correct.

C) Only statement II is correct.

D) Only statement IV is correct.

E) Statements I, II and III are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

31

Cathy owns property subject to a mortgage of $5,000. Annual real estate taxes are $800 and are due and payable on December 31. Cathy sells her property on July 1 of the current year. The buyer assumes her $5,000 mortgage, and Cathy agrees to finance the sale by taking a mortgage note of $50,000 and property valued at $7,500. The buyer agrees to pay the seller's portion of the property taxes. What is Cathy's amount realized?

A) $50,000

B) $57,500

C) $62,500

D) $62,900

E) $63,300

A) $50,000

B) $57,500

C) $62,500

D) $62,900

E) $63,300

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

32

Joyce receives investment property from her mother as a gift in 2014. Her mother paid $15,000 for the property in 2011, and it is valued at $18,000 on the date of the gift. Joyce sells the property eight months later for $16,000. Joyce's realized gain or loss is

A) $ 1,000 loss

B) $ 2,000 loss

C) $ 1,000 gain

D) $ 2,000 gain

E) $16,000 gain

A) $ 1,000 loss

B) $ 2,000 loss

C) $ 1,000 gain

D) $ 2,000 gain

E) $16,000 gain

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

33

In July 2014, Hillary sells a stamp from her stamp collection at a gain of $500. Hillary purchased the stamp in 2010. If Hillary is in the 25% marginal tax rate bracket and has no other capital asset sales in 2014, what is her tax on the sale of the stamp?

A) $ - 0 -

B) $ 25

C) $ 50

D) $ 75

E) $125

A) $ - 0 -

B) $ 25

C) $ 50

D) $ 75

E) $125

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

34

In September 2014, Eduardo sells stock he purchased in October 2013 at a gain of $5,000. If Eduardo is in the 10% marginal tax rate bracket and he has no other capital asset sales in 2014, what is his tax on the sale of the stock?

A) $ - 0 -

B) $ 500

C) $ 750

D) $1,000

E) $1,250

A) $ - 0 -

B) $ 500

C) $ 750

D) $1,000

E) $1,250

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

35

Long-term capital gain classification is advantageous to taxpayers because of which of the following? I. Long-term capital gains are generally taxed at a lower rate than ordinary income. II. Part of a long-term capital game is excluded from income.

A) Only statement I is correct.

B) Only statement II is correct.

C) Both statements are correct.

D) Neither statement is correct.

A) Only statement I is correct.

B) Only statement II is correct.

C) Both statements are correct.

D) Neither statement is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

36

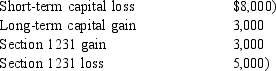

LeRoy has the following capital gains and losses for the current year:  If LeRoy is single and has taxable income from other sources of $52,000, what is the tax on his capital gains?

If LeRoy is single and has taxable income from other sources of $52,000, what is the tax on his capital gains?

A) $1,800

B) $2,800

C) $2,910

D) $3,000

If LeRoy is single and has taxable income from other sources of $52,000, what is the tax on his capital gains?

If LeRoy is single and has taxable income from other sources of $52,000, what is the tax on his capital gains?A) $1,800

B) $2,800

C) $2,910

D) $3,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

37

Courtney and Nikki each own investment realty that they would like to trade. Courtney's property is subject to mortgage debt of $10,000, and its appraised fair market value is $25,000. Nikki's property is subject to mortgage debt of $17,000, and its appraised fair market value is $25,000. Courtney and Nikki agree to exchange the properties and assume each other's debt. To complete the exchange, who pays cash and how much will that person have to pay?

A) Courtney pays $15,000.

B) Nikki pays $7,000.

C) Nikki pays $8,000.

D) Courtney pays $7,000.

E) Neither person pays anything.

A) Courtney pays $15,000.

B) Nikki pays $7,000.

C) Nikki pays $8,000.

D) Courtney pays $7,000.

E) Neither person pays anything.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

38

Gabrielle has the following gains and losses for the current year:  What is Gabrielle's net capital gain or loss position for the year?

What is Gabrielle's net capital gain or loss position for the year?

A) $7,000 net short-term capital loss.

B) $3,000 net short-term capital gain.

C) $5,000 net short-term capital loss.

D) $3,000 net short-term capital gain.

What is Gabrielle's net capital gain or loss position for the year?

What is Gabrielle's net capital gain or loss position for the year?A) $7,000 net short-term capital loss.

B) $3,000 net short-term capital gain.

C) $5,000 net short-term capital loss.

D) $3,000 net short-term capital gain.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

39

Morgan has the following capital gains and losses for the current tax year  What is Morgan's net capital gain or loss position for the year?

What is Morgan's net capital gain or loss position for the year?

A) $5,000 net short-term capital gain.

B) $2,000 net long-term capital loss.

C) $2,000 net short-term capital gain.

D) $3,000 net long-term capital loss.

E) $4,000 net short-term capital loss.

What is Morgan's net capital gain or loss position for the year?

What is Morgan's net capital gain or loss position for the year?A) $5,000 net short-term capital gain.

B) $2,000 net long-term capital loss.

C) $2,000 net short-term capital gain.

D) $3,000 net long-term capital loss.

E) $4,000 net short-term capital loss.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

40

In July 2014, Harriet sells a stamp from her stamp collection at a gain of $500. Harriet purchased the stamp in 2009. If Harriet is in the 33% marginal tax rate bracket and has no other capital asset sales in 2014, what is her tax on the sale of the stamp?

A) $ 50

B) $ 75

C) $125

D) $140

E) $165

A) $ 50

B) $ 75

C) $125

D) $140

E) $165

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

41

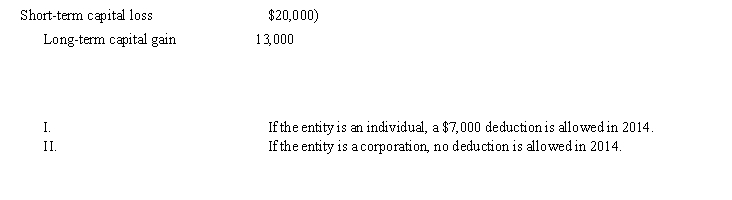

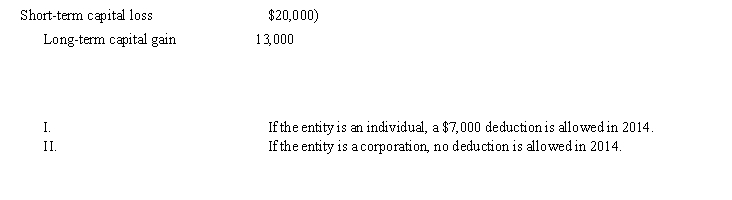

A taxable entity has the following capital gains and losses in 2014:

A) Only statement I is correct.

B) Only statement II is correct.

C) Both statements are correct.

D) Neither statement is correct.

A) Only statement I is correct.

B) Only statement II is correct.

C) Both statements are correct.

D) Neither statement is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

42

When securities are sold and the securities were purchased on different dates and at different prices I. the basis of the shares may be determined on a first-in, first-out basis. II. the basis of the shares may be determined on a last-in, first-out basis.

A) Only statement I is correct.

B) Only statement II is correct.

C) Both statements are correct.

D) Neither statement is correct.

A) Only statement I is correct.

B) Only statement II is correct.

C) Both statements are correct.

D) Neither statement is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

43

Santana purchased 200 shares of Neffer, Inc. Common Stock on November 13, 2013, for $3,400 and paid a $200 commission. On December 28, 2013, Santana received a $2 per share cash dividend from Neffer. On June 17, 2014, Neffer declares and distributes a 2 for 1 stock split. On August 4, 2014, Santana purchased an additional 300 shares of Neffer, Inc. Common Stock for $4,200 plus a $300 commission. On November 22, 2014, Santana sells 500 shares of Neffer, Inc. stock for $6,000 and pays a $400 commission on the sale. Santana's gain loss) on the sale is

A) $ 500 loss

B) $ 500 gain

C) $2,700 loss

D) $2,000 gain

E) $3,600 loss

A) $ 500 loss

B) $ 500 gain

C) $2,700 loss

D) $2,000 gain

E) $3,600 loss

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

44

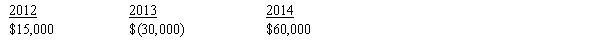

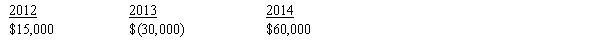

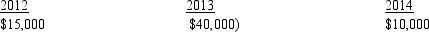

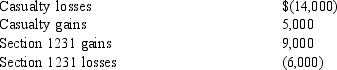

Omicron Corporation had the following capital gains and losses for 2012 through 2014:  Omicron's net capital gain for 2014 is:

Omicron's net capital gain for 2014 is:

A) $20,000

B) $30,000

C) $45,000

D) $60,000

Omicron's net capital gain for 2014 is:

Omicron's net capital gain for 2014 is:A) $20,000

B) $30,000

C) $45,000

D) $60,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

45

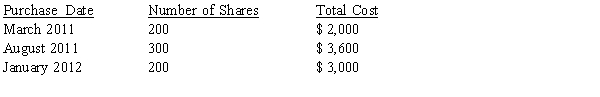

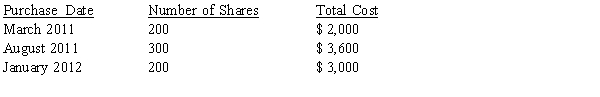

Sally owns 700 shares of Fashion Styles Clothing common stock. Sally purchased the 700 shares as follows:

As of December 29, 2014, Sally has not sold any securities. She needs to send a tuition payment of $5,200 to her daughter's boarding school in Zurich before year-end. Since the Fashion Styles Clothing stock is selling for $13 per share, Sally plans to dispose of 400 shares to cover the tuition. Ignoring commissions and transaction costs, what is the optimal tax result of selling 400 shares?

As of December 29, 2014, Sally has not sold any securities. She needs to send a tuition payment of $5,200 to her daughter's boarding school in Zurich before year-end. Since the Fashion Styles Clothing stock is selling for $13 per share, Sally plans to dispose of 400 shares to cover the tuition. Ignoring commissions and transaction costs, what is the optimal tax result of selling 400 shares?

A) $- 0 - gain or loss.

B) $200 long-term capital loss.

C) $100 long-term capital gain.

D) $800 long-term capital loss

E) $800 long-term capital gain

As of December 29, 2014, Sally has not sold any securities. She needs to send a tuition payment of $5,200 to her daughter's boarding school in Zurich before year-end. Since the Fashion Styles Clothing stock is selling for $13 per share, Sally plans to dispose of 400 shares to cover the tuition. Ignoring commissions and transaction costs, what is the optimal tax result of selling 400 shares?

As of December 29, 2014, Sally has not sold any securities. She needs to send a tuition payment of $5,200 to her daughter's boarding school in Zurich before year-end. Since the Fashion Styles Clothing stock is selling for $13 per share, Sally plans to dispose of 400 shares to cover the tuition. Ignoring commissions and transaction costs, what is the optimal tax result of selling 400 shares?A) $- 0 - gain or loss.

B) $200 long-term capital loss.

C) $100 long-term capital gain.

D) $800 long-term capital loss

E) $800 long-term capital gain

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

46

Sidney, a single taxpayer, has taxable income of $45,000 from all sources except capital gains. He has a long-term capital gain of $1,000. What is the actual tax savings Sidney receives because of any special treatment of his $1,000 long-term capital gain?

A) $ -0-

B) $ 50

C) $100

D) $150

E) $250

A) $ -0-

B) $ 50

C) $100

D) $150

E) $250

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

47

Capital gain and loss planning strategies include I. the optimal action of using capital gains to reduce an individual taxpayer's net capital loss for a year to zero. II. selling enough capital assets to create a $3,000 capital loss.

A) Only statement I is correct.

B) Only statement II is correct.

C) Both statements are correct.

D) Neither statement is correct.

A) Only statement I is correct.

B) Only statement II is correct.

C) Both statements are correct.

D) Neither statement is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

48

Pamela purchased 500 shares of Qualified Small Business Stock QSB) for $900,000 on October 2, 2012. On November 29, 2017, she sells the stock for $1,000,000. Pamela also sells 100 shares of stock she acquired two years ago realizing a loss of $10,000. Pamela has $100,000 of other income. Which of the following statements about the stock sale is/are true? I. Pamela will pay no tax on the two stock sales. II. Pamela can only deduct $3,000 of the $10,000 loss on the sale of the stock.

A) Only statement I is correct.

B) Only statement II is correct.

C) Both statements are correct.

D) Neither statement is correct.

A) Only statement I is correct.

B) Only statement II is correct.

C) Both statements are correct.

D) Neither statement is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

49

Dwight, a single taxpayer, has taxable income of $75,000 from all sources except capital gains. He has a collectibles gain of $1,000. What is the actual tax saving Dwight receives because of any special treatment of his $1,000 collectibles gain?

A) $ -0-

B) $ 15

C) $130

D) $150

E) $280

A) $ -0-

B) $ 15

C) $130

D) $150

E) $280

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

50

Sybil purchased 500 shares of Qualified Small Business Stock QSB) for $25,000 on March 2, 2003. On November 29, 2014, she sells the stock for $125,000. Sybil also sells 100 shares of stock she acquired two years ago realizing a gain of $20,000. Sybil has $100,000 of other income. Which of the following statements about the stock sale is/are true? I. The tax paid on Sybil's two stock sales is $17,000. II. The tax rate on the $20,000 gain is 15%.

A) Only statement I is correct.

B) Only statement II is correct.

C) Both statements are correct.

D) Neither statement is correct.

A) Only statement I is correct.

B) Only statement II is correct.

C) Both statements are correct.

D) Neither statement is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

51

Rachael purchased 500 shares of Qualified Small Business Stock QSB) for $900,000 on March 2, 2009. On November 29, 2014, she sells the stock for $1,000,000. Rachael also sells 100 shares of stock she acquired two years ago realizing a loss of $10,000. Which of the following explains) tax consequences of the QSB stock sale? I. The effective tax rate applied to the net gain on the sale of the QSB stock is 15%. II. Rachael nets her $10,000 loss with her $100,000 gain before applying her exclusion rate. III. Rachael is eligible for a 50% exclusion of the gain from the QSB stock sale. IV. The QSB stock is QSB stock partly because Rachael held the stock for the required 3-year minimum.

A) Statements I and II are correct.

B) Statements II and III are correct.

C) Statements III and IV are correct.

D) Statements I, II, and III are correct.

E) Statements I, II, III, and IV are correct.

A) Statements I and II are correct.

B) Statements II and III are correct.

C) Statements III and IV are correct.

D) Statements I, II, and III are correct.

E) Statements I, II, III, and IV are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

52

The exclusion of a percentage of the capital gain realized on the sale of qualified small business stock acquired after September 27, 2010, and before January 1, 2014, results in an effective tax rate on these capital gains of

A) 0%

B) 7.0%

C) 14.0%

D) 15.0%

E) 28.0%

A) 0%

B) 7.0%

C) 14.0%

D) 15.0%

E) 28.0%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

53

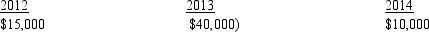

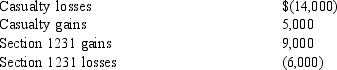

Phi Corporation had the following capital gains and losses for 2012 through 2014:  I. Phi can deduct a loss of $15,000 in 2014. II. Phi will carry forward a $15,000 capital loss to 2015.

I. Phi can deduct a loss of $15,000 in 2014. II. Phi will carry forward a $15,000 capital loss to 2015.

A) Only statement I is correct.

B) Only statement II is correct.

C) Both statements are correct.

D) Neither statement is correct.

I. Phi can deduct a loss of $15,000 in 2014. II. Phi will carry forward a $15,000 capital loss to 2015.

I. Phi can deduct a loss of $15,000 in 2014. II. Phi will carry forward a $15,000 capital loss to 2015.A) Only statement I is correct.

B) Only statement II is correct.

C) Both statements are correct.

D) Neither statement is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

54

The exclusion of a percentage of the capital gain realized on the sale of qualified small business stock acquired after February 17, 2009, and before September 27, 2010, results in an effective tax rate on these capital gains of

A) 7.0%

B) 14.0%

C) 15.0%

D) 27.0%

E) 30.0%

A) 7.0%

B) 14.0%

C) 15.0%

D) 27.0%

E) 30.0%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

55

Raymond, a single taxpayer, has taxable income of $155,000 from all sources except capital gains. He has a $10,000 gain from the sale of qualified small business stock he acquired in 1995. What is the total tax saving Raymond receives because of any special treatment of his $10,000 long-term capital gain on small business stock?

A) $ 700

B) $1,150

C) $1,400

D) $2,100

E) $2,800

A) $ 700

B) $1,150

C) $1,400

D) $2,100

E) $2,800

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

56

Cheryl purchased 500 shares of Qualified Small Business Stock QSB) for $900,000 on March 2, 2011. On November 29, 2016, she sells the stock for $1,000,000. Cheryl also sells 100 shares of stock she acquired two years ago realizing a loss of $10,000. Cheryl has $100,000 of other income. Which of the following statements about the stock sale is/are true? I. The tax paid on Cheryl's two stock sales is $4,200. II. Cheryl can only deduct $3,000 of the $10,000 loss on the sale of the stock.

A) Only statement I is correct.

B) Only statement II is correct.

C) Both statements are correct.

D) Neither statement is correct.

A) Only statement I is correct.

B) Only statement II is correct.

C) Both statements are correct.

D) Neither statement is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

57

Victor bought 100 shares of stock of Wabash Manufacturing Corporation from an unrelated individual paying $1 per share on December 20, 2013. On April 17, 2014, the corporation is declared bankrupt and the shares are deemed worthless. What is the amount and character of Victor's recognized loss as a result of the bankruptcy?

A) $100 short-term capital loss.

B) $100 long-term capital loss.

C) $100 ordinary loss.

D) No gain or loss until the stock is sold.

E) The amount is $100, but the character is indeterminable from the information given.

A) $100 short-term capital loss.

B) $100 long-term capital loss.

C) $100 ordinary loss.

D) No gain or loss until the stock is sold.

E) The amount is $100, but the character is indeterminable from the information given.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

58

A taxable entity has the following capital gains and losses in 2014: Short-term capital loss $22,000) Long-term capital gain 15,000 I If the entity is an individual, a $3,000 deduction is allowed in 2014. II. If the entity is a corporation, a $7,000 deduction is allowed in 2014.

A) Only statement I is correct.

B) Only statement II is correct.

C) Both statements are correct.

D) Neither statement is correct.

A) Only statement I is correct.

B) Only statement II is correct.

C) Both statements are correct.

D) Neither statement is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

59

Tracey sells General Electric stock owned 10 years) for a $40,000 gain in the current year. In addition, she has a loss of $20,000 on the sale of one acre of land used in her trade or business. The land was purchased five years ago. Tracey's net capital gain loss) for the current year is:

A) $ 20,000)

B) $ - 0 -

C) $ 20,000

D) $ 40,000

A) $ 20,000)

B) $ - 0 -

C) $ 20,000

D) $ 40,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

60

When a security becomes worthless I. no loss can be deducted because a realization has not occurred. II. the measure of the loss is the adjusted basis of the securities.

A) Only statement I is correct.

B) Only statement II is correct.

C) Both statements are correct.

D) Neither statement is correct.

A) Only statement I is correct.

B) Only statement II is correct.

C) Both statements are correct.

D) Neither statement is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

61

Stan sells a piece of land he used in his auto repair business at a gain of $13,000 in 2014. In addition, Stan sells equipment he purchased in 2011 for $8,000. He paid $20,000 for the equipment that had an adjusted basis of $12,000 when it was sold. He also sells some stock in 2014 at a loss of $11,000. No losses on the disposition of assets were recognized in prior years. The effect of these transactions on Stan's 2014 taxable income is:

A) Decrease of $ 2,000.

B) Decrease of $ 3,000.

C) Increase of $ 6,000.

D) Increase of $10,000.

A) Decrease of $ 2,000.

B) Decrease of $ 3,000.

C) Increase of $ 6,000.

D) Increase of $10,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

62

Benjamin has a $15,000 Section 1231 gain from the sale of business-use real estate and a $3,500 long-term capital gain from the sale of Rhyne Corporation stock. Also, he suffers an $18,000 net of insurance reimbursements and the $100 floor) personal-use property casualty loss. No net Section 1231 losses have been deducted as ordinary losses in prior years. Benjamin's current-year adjusted gross income will increase decrease) by what amount?

A) $ 500

B) $ 3,500

C) $15,000

D) $15,800

E) $18,500

A) $ 500

B) $ 3,500

C) $15,000

D) $15,800

E) $18,500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

63

Which of the following is not a capital asset?

A) Office building used by a CPA firm.

B) Antique automobile held by an antique automobile collector.

C) Land held for investment.

D) Stock held for investment.

A) Office building used by a CPA firm.

B) Antique automobile held by an antique automobile collector.

C) Land held for investment.

D) Stock held for investment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

64

Section 1231 property receives preferential tax treatment. The preferences) includes) I. Net Section 1231 losses are deductible as short-term capital losses. II. Net Section 1231 gains are reportable as long-term capital gains. III. Net Section 1231 losses are deductible as long-term capital losses. IV. Net Section 1231 losses are deductible as ordinary losses.

A) Statements I and II are correct.

B) Only statement I is correct.

C) Statements II and IV are correct.

D) Only statement III is correct.

E) Statements II and III are correct.

A) Statements I and II are correct.

B) Only statement I is correct.

C) Statements II and IV are correct.

D) Only statement III is correct.

E) Statements II and III are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

65

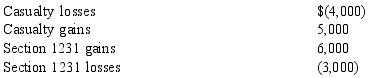

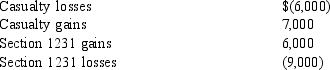

Knox Cable Corporation has the following gains and losses from Section 1231 property during 2014:

No net Section 1231 losses have been deducted as ordinary losses in prior years. How will this information affect Knox's 2014 taxable income?

No net Section 1231 losses have been deducted as ordinary losses in prior years. How will this information affect Knox's 2014 taxable income?

A) Knox will report a net section 1231 loss of $6,000.

B) Knox will report a capital loss of $9,000 and ordinary income of $3,000.

C) The transactions have no effect on Knox's 2014 taxable income.

D) Knox will deduct a $3,000 capital loss and have ordinary income of $3,000.

E) Knox will report an ordinary loss of $9,000 and a long-term capital gain of $3,000.

No net Section 1231 losses have been deducted as ordinary losses in prior years. How will this information affect Knox's 2014 taxable income?

No net Section 1231 losses have been deducted as ordinary losses in prior years. How will this information affect Knox's 2014 taxable income?A) Knox will report a net section 1231 loss of $6,000.

B) Knox will report a capital loss of $9,000 and ordinary income of $3,000.

C) The transactions have no effect on Knox's 2014 taxable income.

D) Knox will deduct a $3,000 capital loss and have ordinary income of $3,000.

E) Knox will report an ordinary loss of $9,000 and a long-term capital gain of $3,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

66

Which of the following is not a capital asset?

A) Office building used as a rental property by a real estate professional..

B) Antique automobile.

C) Land held for investment.

D) Stock held for investment.

A) Office building used as a rental property by a real estate professional..

B) Antique automobile.

C) Land held for investment.

D) Stock held for investment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

67

Tory sells General Electric stock owned 10 years) for a $40,000 gain in the current year. In addition, she had a loss of $20,000 on the sale of one acre of land used in her trade or business. The land was purchased five years ago. Tory's net Section 1231 gain loss) for the current year is:

A) $ - 0 -

B) $ 20,000

C) $ 20,000)

D) $ 40,000

A) $ - 0 -

B) $ 20,000

C) $ 20,000)

D) $ 40,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

68

Stan sells a piece of land he used in his auto repair business at a gain of $9,000 in 2014. In addition, Stan sells equipment he purchased in 2011 for $8,000. He paid $20,000 for the equipment that had an adjusted basis of $12,000 when it was sold. He also sells some stock in 2014 at a loss of $11,000. No losses on the disposition of assets were recognized in prior years. The effect of these transactions on Stan's 2014 taxable income is:

A) Decrease of $ 6,000.

B) Decrease of $ 3,000.

C) Increase of $ 6,000.

D) Zero, with a long-term capital loss carryback of $2,000.

E) Zero, with a long-term capital loss carryback of $6,000.

A) Decrease of $ 6,000.

B) Decrease of $ 3,000.

C) Increase of $ 6,000.

D) Zero, with a long-term capital loss carryback of $2,000.

E) Zero, with a long-term capital loss carryback of $6,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

69

Trojan Inc. was incorporated in 2011. In 2011, it had no Section 1231 transactions. In 2012, Trojan had a net Section 1231 loss of $35,000. In 2013, Trojan had a Net Section 1231 gain of $10,000. In 2014 Trojan has a $50,000 net Section 1231 gain. Trojan should treat the 2014 gain as

A) An ordinary gain of $40,000.

B) A long-term capital gain of $50,000.

C) An ordinary gain of $35,000 and a long-term capital gain of $15,000.

D) An ordinary gain of $25,000 and a long-term capital gain of $25,000.

E) An ordinary gain of $15,000 and a long-term capital gain of $35,000.

A) An ordinary gain of $40,000.

B) A long-term capital gain of $50,000.

C) An ordinary gain of $35,000 and a long-term capital gain of $15,000.

D) An ordinary gain of $25,000 and a long-term capital gain of $25,000.

E) An ordinary gain of $15,000 and a long-term capital gain of $35,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

70

During 2014, Thomas has a net Section 1231 gain of $57,000. In 2013, Thomas reported a net Section 1231 loss of $60,000. What is the character of the 2014 gain?

A) $60,000 long-term capital gain.

B) $60,000 ordinary gain.

C) $57,000 ordinary gain.

D) $57,000 long-term capital loss.

E) $57,000 long-term capital gain.

A) $60,000 long-term capital gain.

B) $60,000 ordinary gain.

C) $57,000 ordinary gain.

D) $57,000 long-term capital loss.

E) $57,000 long-term capital gain.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

71

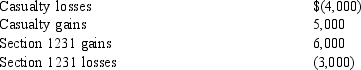

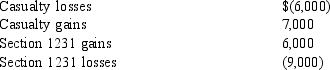

Pidgeon, Inc. has the following gains and losses from Section 1231 property during 2014:

No net Section 1231 losses have been deducted as ordinary losses in prior years. How much of the 2014 Section 1231 gains and losses are recognized as long-term capital gains?

No net Section 1231 losses have been deducted as ordinary losses in prior years. How much of the 2014 Section 1231 gains and losses are recognized as long-term capital gains?

A) $ - 0 -

B) $ 1,000

C) $ 3,000

D) $ 4,000

E) $ 6,000

No net Section 1231 losses have been deducted as ordinary losses in prior years. How much of the 2014 Section 1231 gains and losses are recognized as long-term capital gains?

No net Section 1231 losses have been deducted as ordinary losses in prior years. How much of the 2014 Section 1231 gains and losses are recognized as long-term capital gains?A) $ - 0 -

B) $ 1,000

C) $ 3,000

D) $ 4,000

E) $ 6,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

72

Which of the following properties that was sold during January 2014 is Section 1231 property for Baylan Toy Manufacturing Corporation? I. Automobile purchased in 2009. II. Land used in the business since 2008. III. Factory building purchased and placed into service in May 2013. IV. Office building purchased and placed into service in June 2010.

A) Only statement I is correct.

B) Statements I, II, and IV are correct.

C) Statements III and IV are correct.

D) Statements II and III are correct.

E) Statements I, II, III, and IV are correct.

A) Only statement I is correct.

B) Statements I, II, and IV are correct.

C) Statements III and IV are correct.

D) Statements II and III are correct.

E) Statements I, II, III, and IV are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

73

Section 1231 assets include

A) Inventory.

B) Stocks and bonds.

C) Personal residence.

D) Business-use realty.

E) Personal automobile.

A) Inventory.

B) Stocks and bonds.

C) Personal residence.

D) Business-use realty.

E) Personal automobile.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

74

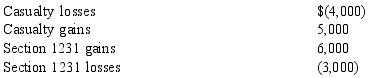

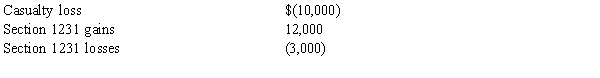

Davidson Corporation has the following gains and losses from Section 1231 property during 2014:

No net Section 1231 losses have been deducted as ordinary losses in prior years. How much of the 2014 Section 1231 gains and losses are recognized as long-term capital gains?

No net Section 1231 losses have been deducted as ordinary losses in prior years. How much of the 2014 Section 1231 gains and losses are recognized as long-term capital gains?

A) $ - 0 -

B) $ 1,000

C) $ 2,000

D) $ 3,000

E) $ 6,000

No net Section 1231 losses have been deducted as ordinary losses in prior years. How much of the 2014 Section 1231 gains and losses are recognized as long-term capital gains?

No net Section 1231 losses have been deducted as ordinary losses in prior years. How much of the 2014 Section 1231 gains and losses are recognized as long-term capital gains?A) $ - 0 -

B) $ 1,000

C) $ 2,000

D) $ 3,000

E) $ 6,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

75

During 2014, Ester recognizes a $10,000 Section 1231 gain, a $25,000 Section 1231 loss, and ordinary income of $20,000. What are the results of Ester's netting of these items?

A) $5,000 capital loss.

B) $5,000 Section 1231 gain.

C) $5,000 ordinary income.

D) $17,000 ordinary income and $12,000 capital loss.

E) $20,000 ordinary income and $15,000 capital loss.

A) $5,000 capital loss.

B) $5,000 Section 1231 gain.

C) $5,000 ordinary income.

D) $17,000 ordinary income and $12,000 capital loss.

E) $20,000 ordinary income and $15,000 capital loss.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

76

Assets eligible for preferential treatment under Section 1231 include I. Certain assets held for less than a year. II. Real estate used in a business held for more than a year. III. Horses held for more than two years. IV. Lumber held by a lumber store.

A) Only statement I is correct.

B) Statements II, III, and IV are correct.

C) Statements I, III, and IV are correct.

D) Statements II and III are correct.

E) Statements I, II, III, and IV are correct.

A) Only statement I is correct.

B) Statements II, III, and IV are correct.

C) Statements I, III, and IV are correct.

D) Statements II and III are correct.

E) Statements I, II, III, and IV are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

77

Tonya purchased 500 shares of Home Depot, Inc. common stock on December 13, 2011, at a cost of $3,600. She paid a commission of $150 on the purchase. On February 18, 2013, she received 250 shares of Home Depot, Inc. common stock as a tax-free dividend. Tonya sells 600 shares for $3,700 on January 8, 2014, and pays a $100 commission on the sale. Tonya's gain loss) on the sale is characterized as:

A) Long-term capital gain of $600.

B) Long-term capital gain of $500; short-term capital gain of $100.

C) Long-term capital loss of $50.

D) Short-term capital gain of $600.

A) Long-term capital gain of $600.

B) Long-term capital gain of $500; short-term capital gain of $100.

C) Long-term capital loss of $50.

D) Short-term capital gain of $600.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

78

The Section 1231 netting procedure involves several steps. What is the proper order of these steps? I. All Section 1231 gains and losses for the year are netted. II. All casualty theft) gains and losses on Section 1231 property are netted. III. Current-year net Section 1231 gain is netted against any Section 1231 ordinary loss deductions taken in the previous 5 years.

A) Statements I, III, and II.

B) Statements II, I, and III.

C) Statements III, I, and II.

D) Statements III, II, and I.

E) Statements I, II, and III.

A) Statements I, III, and II.

B) Statements II, I, and III.

C) Statements III, I, and II.

D) Statements III, II, and I.

E) Statements I, II, and III.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

79

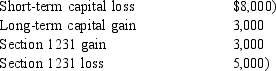

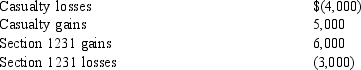

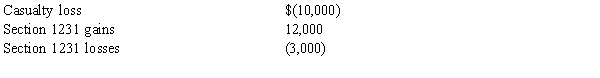

During 2014, Silverado Corporation has the following Section 1231 gains and losses:  During the period 2009 - 2013, the corporation recognized $8,000 of net Section 1231 losses as ordinary losses that have not been recaptured. How much of the 2014 Section 1231 gains and losses are recognized as long-term capital gains?

During the period 2009 - 2013, the corporation recognized $8,000 of net Section 1231 losses as ordinary losses that have not been recaptured. How much of the 2014 Section 1231 gains and losses are recognized as long-term capital gains?

A) $ - 0 -

B) $ 1,000

C) $ 9,000

D) $10,000

E) $12,000

During the period 2009 - 2013, the corporation recognized $8,000 of net Section 1231 losses as ordinary losses that have not been recaptured. How much of the 2014 Section 1231 gains and losses are recognized as long-term capital gains?

During the period 2009 - 2013, the corporation recognized $8,000 of net Section 1231 losses as ordinary losses that have not been recaptured. How much of the 2014 Section 1231 gains and losses are recognized as long-term capital gains?A) $ - 0 -

B) $ 1,000

C) $ 9,000

D) $10,000

E) $12,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

80

Hank realizes Section 1231 losses of $12,000 and Section 1231 gains of $7,000 during the current year. Hank's current-year adjusted gross income will increase decrease) by what amount?

A) $12,000)

B) $ 5,000)

C) $ 3,000)

D) $ 7,000

A) $12,000)

B) $ 5,000)

C) $ 3,000)

D) $ 7,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck