Deck 10: Multi-Step Binomial Trees

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/15

العب

ملء الشاشة (f)

Deck 10: Multi-Step Binomial Trees

1

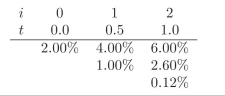

Compute the spot rate duration for a call option on a 1.5 year zero coupon bond with K = 99.00, maturity at t = 1. Assume that p? = 0.7038 is constant over time.

Spot rate duration is -9.2354.

2

In order to compute the spot rate duration do you use risk neutral prob- abilities or risk natural probabilities?

You use risk neutral probabilities, since it is derived from pricing bonds in different scenarios (see spot rate duration formula).

3

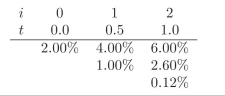

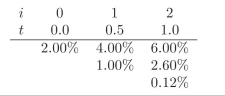

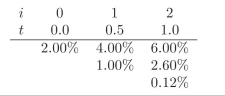

You are given the following interest rate tree. Use it when required in the

exercises.

-Using risk neutral pricing obtain the value for a put option on a 1.5 year zero coupon bond with K = 97.40, maturity at t = 1. Assume that p? = 0.7038 is constant over time.

exercises.

-Using risk neutral pricing obtain the value for a put option on a 1.5 year zero coupon bond with K = 97.40, maturity at t = 1. Assume that p? = 0.7038 is constant over time.

The price is 0.1709.

4

Using risk neutral pricing obtain the value for a straddle on a 1.5 year zero coupon bond with K = 98.00, maturity at t = 1. Assume that p? = 0.7038 is constant over time.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 15 في هذه المجموعة.

فتح الحزمة

k this deck

5

How realistic is it to speak about negative interest rate in nominal terms?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 15 في هذه المجموعة.

فتح الحزمة

k this deck

6

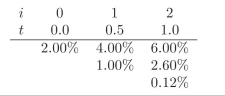

You are given the following interest rate tree. Use it when required in the

exercises.

-Using risk neutral pricing obtain the value for a call option on a 1.5 year zero coupon bond with K = 99.00, maturity at t = 1. Assume that p? = 0.7038 is constant over time.

exercises.

-Using risk neutral pricing obtain the value for a call option on a 1.5 year zero coupon bond with K = 99.00, maturity at t = 1. Assume that p? = 0.7038 is constant over time.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 15 في هذه المجموعة.

فتح الحزمة

k this deck

7

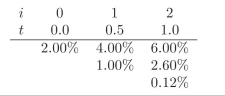

You are given the following interest rate tree. Use it when required in the

exercises.

-Using risk neutral pricing obtain the value for a 1.5 year zero coupon bond. Assume that p? = 0.7038 is constant over time.

exercises.

-Using risk neutral pricing obtain the value for a 1.5 year zero coupon bond. Assume that p? = 0.7038 is constant over time.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 15 في هذه المجموعة.

فتح الحزمة

k this deck

8

How realistic is it to speak about negative interest rate in real terms?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 15 في هذه المجموعة.

فتح الحزمة

k this deck

9

Which of the following prices should be higher: a call option, a put option or a straddle. All of them have the same maturity, underlying security and strike price. Explain.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 15 في هذه المجموعة.

فتح الحزمة

k this deck

10

What is one major drawback from using empirical estimates to fit the "true" interest rate tree?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 15 في هذه المجموعة.

فتح الحزمة

k this deck

11

What is the difference between risk neutral probability and risk natural probability?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 15 في هذه المجموعة.

فتح الحزمة

k this deck

12

When talking about options, what is a straddle?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 15 في هذه المجموعة.

فتح الحزمة

k this deck

13

Compute the spot rate duration for a put option on a 1.5 year zero coupon bond with K = 97.40, maturity at t = 1. Assume that p? = 0.7038 is constant over time.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 15 في هذه المجموعة.

فتح الحزمة

k this deck

14

Why do we say that the dynamic replication strategy is self-financing?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 15 في هذه المجموعة.

فتح الحزمة

k this deck

15

Compute the spot rate duration for a straddle on a 1.5 year zero coupon bond with K = 98.00, maturity at t = 1. Assume that p? = 0.7038 is constant over time.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 15 في هذه المجموعة.

فتح الحزمة

k this deck