Deck 5: Interest Rate Derivatives: Forwards and Swaps

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/15

العب

ملء الشاشة (f)

Deck 5: Interest Rate Derivatives: Forwards and Swaps

1

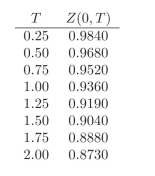

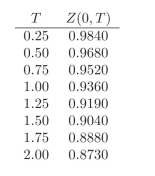

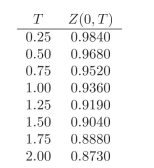

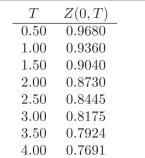

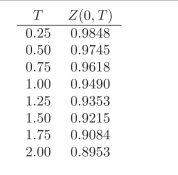

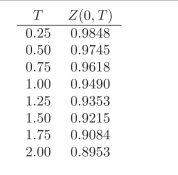

Determine the swap rate for the following maturities: 0.25, 0.50, 0.75, 1.00, 1.50, 2.00. Use the following discount factors:

The values are c(0.25) = 6.50%, c(0.50) = 6.56%, c(0.75) = 6.61%, c(1.00) = 6.67%, c(1.50) = 6.78%, c(2.00) = 6.84%.

2

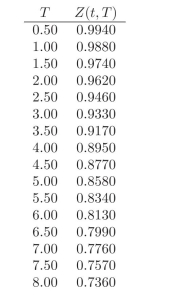

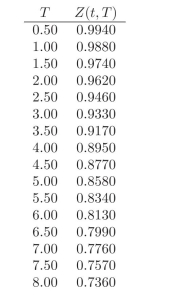

Use the following table when needed:

What is a forward discount factor?

What is a forward discount factor?

3

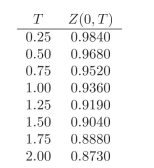

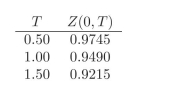

Consider the same swap as in the previous question. What is the value of the swap three months after initiation, where the discount factors are now:

The value of the swap is now: 222,408.

4

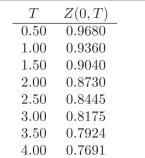

What is the Forward Price to purchase a 1.5-year ?xed rate Treasury paying 5% semiannually, a year from now? At t = 0 we have the following discounts:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 15 في هذه المجموعة.

فتح الحزمة

k this deck

5

Suppose you have entered into the Forward Contract from the previous ex- ercise, what is the value of the contract 6-months after initiation? Assume that the discount factors are now the ones presented at the beginning of this section.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 15 في هذه المجموعة.

فتح الحزمة

k this deck

6

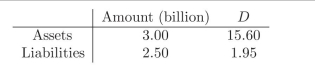

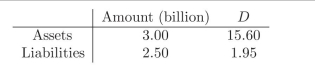

Use a swap to hedge the following Balance Sheet, so that parallel shifts in the term structure don't have an impact on the equity value:  The swap used to hedge is 1.5 year swap, you know the following discount factors:

The swap used to hedge is 1.5 year swap, you know the following discount factors:  In order to get the answer, compute the following:

In order to get the answer, compute the following:

i. What is the adequate swap rate?

ii. What is the dollar duration of the swap?

iii. What is the value of equity and its dollar duration, prior to any hedging?

iv. What is the value of notional needed so that the swap position hedges any impact that parallel shifts in the yield curve may have on the value of equity?

The swap used to hedge is 1.5 year swap, you know the following discount factors:

The swap used to hedge is 1.5 year swap, you know the following discount factors:  In order to get the answer, compute the following:

In order to get the answer, compute the following: i. What is the adequate swap rate?

ii. What is the dollar duration of the swap?

iii. What is the value of equity and its dollar duration, prior to any hedging?

iv. What is the value of notional needed so that the swap position hedges any impact that parallel shifts in the yield curve may have on the value of equity?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 15 في هذه المجموعة.

فتح الحزمة

k this deck

7

You notice that forward rates are below the spot rate. What can you say about the yield curve?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 15 في هذه المجموعة.

فتح الحزمة

k this deck

8

Assume that the swap spread at the moment is large, compared to histor- ical data. What would your expectations be? Will it increase, decrease or stay the same? To what extent?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 15 في هذه المجموعة.

فتح الحزمة

k this deck

9

If short term rates go up, what would happen to the swap rate?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 15 في هذه المجموعة.

فتح الحزمة

k this deck

10

What is the value of a swap at initiation?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 15 في هذه المجموعة.

فتح الحزمة

k this deck

11

Value a 1.5 year swap, with swap rate 5.52%. Notional is 100 million. Use the following discount factors.  You are told that this is a swap at initiation. Is the value accurate? Be sure to take into account any payment frequency conventions on the swap.

You are told that this is a swap at initiation. Is the value accurate? Be sure to take into account any payment frequency conventions on the swap.

You are told that this is a swap at initiation. Is the value accurate? Be sure to take into account any payment frequency conventions on the swap.

You are told that this is a swap at initiation. Is the value accurate? Be sure to take into account any payment frequency conventions on the swap.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 15 في هذه المجموعة.

فتح الحزمة

k this deck

12

The term structure of interest rates can be upward sloping or downward sloping. If this is so, can discount factors also be upward sloping or down- ward sloping?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 15 في هذه المجموعة.

فتح الحزمة

k this deck

13

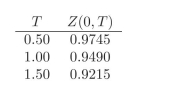

Determine the swap rate for the following maturities: 0.50, 1.00, 1.50, 2.00. Use the discount factors provided at the beginning of this section.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 15 في هذه المجموعة.

فتح الحزمة

k this deck

14

Today you notice that forward rates are well above the spot rate. What shape must the yield curve have?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 15 في هذه المجموعة.

فتح الحزمة

k this deck

15

Compute F (0, 3, 5), f2(0, 3, 5) and f(0, 3, 5).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 15 في هذه المجموعة.

فتح الحزمة

k this deck