Deck 6: Interest Rate Derivatives: Futures and Options

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/15

العب

ملء الشاشة (f)

Deck 6: Interest Rate Derivatives: Futures and Options

1

What is a European Put option?

Given an underlying variable F (t), maturity T and strike price K;aEu- ropean Put option is a contract between two counterparties, option buyer and option seller, according to which:

i. At maturity T the option buyer has the right to ask the option seller for the payment of the following e?ective payo?: Payo? = (max(K ? F (T), 0)

ii. The option seller has the obligation to pay this amount to the option buyer at T.

iii. In return for this right to obtain this payment (exercise) at T,the option buyer pays an option premium to the option seller at time 0.

i. At maturity T the option buyer has the right to ask the option seller for the payment of the following e?ective payo?: Payo? = (max(K ? F (T), 0)

ii. The option seller has the obligation to pay this amount to the option buyer at T.

iii. In return for this right to obtain this payment (exercise) at T,the option buyer pays an option premium to the option seller at time 0.

2

What are the main di?erences between a forward contract and a futures contract?

The main di?erences are:

i. Futures contracts are traded in a regulated exchange, while forward contracts are traded in the over-the-counter (OTC) market.

ii. Futures contracts are "standardized", while forward contracts are customized to clients' requests.

iii. Pro?ts and losses in futures contracts are marked-to-market. Forward contracts are not.

i. Futures contracts are traded in a regulated exchange, while forward contracts are traded in the over-the-counter (OTC) market.

ii. Futures contracts are "standardized", while forward contracts are customized to clients' requests.

iii. Pro?ts and losses in futures contracts are marked-to-market. Forward contracts are not.

3

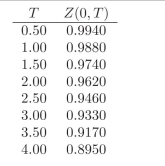

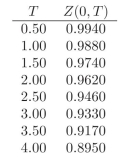

You are given the following discount factors:  You are told that the price of a European Call option on a 2-year ?xed rate bond paying 5% semiannually, with T =2andK = 101 is 4.6155. While the price of a European Put option with the exact same speci?cation is: 3.0500. Are the securities adequately priced?

You are told that the price of a European Call option on a 2-year ?xed rate bond paying 5% semiannually, with T =2andK = 101 is 4.6155. While the price of a European Put option with the exact same speci?cation is: 3.0500. Are the securities adequately priced?

You are told that the price of a European Call option on a 2-year ?xed rate bond paying 5% semiannually, with T =2andK = 101 is 4.6155. While the price of a European Put option with the exact same speci?cation is: 3.0500. Are the securities adequately priced?

You are told that the price of a European Call option on a 2-year ?xed rate bond paying 5% semiannually, with T =2andK = 101 is 4.6155. While the price of a European Put option with the exact same speci?cation is: 3.0500. Are the securities adequately priced?Yes, according to the Put-Call parity the price of the Call option should be 4.6155.

4

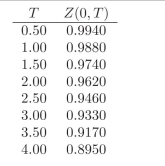

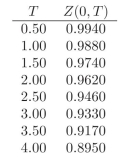

You are given the following discount factors:  You are told that the price of a European Call option on a 6-month zero coupon bond, with T =0.5andK =99.35 is 0.13. While the price of a European Put option with the exact same specification is: 0.11. Are the securities adequately priced?

You are told that the price of a European Call option on a 6-month zero coupon bond, with T =0.5andK =99.35 is 0.13. While the price of a European Put option with the exact same specification is: 0.11. Are the securities adequately priced?

You are told that the price of a European Call option on a 6-month zero coupon bond, with T =0.5andK =99.35 is 0.13. While the price of a European Put option with the exact same specification is: 0.11. Are the securities adequately priced?

You are told that the price of a European Call option on a 6-month zero coupon bond, with T =0.5andK =99.35 is 0.13. While the price of a European Put option with the exact same specification is: 0.11. Are the securities adequately priced?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 15 في هذه المجموعة.

فتح الحزمة

k this deck

5

What is the difference between a European option and an American op- tion?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 15 في هذه المجموعة.

فتح الحزمة

k this deck

6

What is an American Put option?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 15 في هذه المجموعة.

فتح الحزمة

k this deck

7

What will be the value of a futures contract at maturity?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 15 في هذه المجموعة.

فتح الحزمة

k this deck

8

What does mark-to-market mean?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 15 في هذه المجموعة.

فتح الحزمة

k this deck

9

What is a margin call?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 15 في هذه المجموعة.

فتح الحزمة

k this deck

10

What are the shortcomings of futures, when compared to forward con- tracts?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 15 في هذه المجموعة.

فتح الحزمة

k this deck

11

What is a European Call option?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 15 في هذه المجموعة.

فتح الحزمة

k this deck

12

What is an American Call option?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 15 في هذه المجموعة.

فتح الحزمة

k this deck

13

What is to tail the hedge?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 15 في هذه المجموعة.

فتح الحزمة

k this deck

14

Under what conditions are futures and forwards the same? Is this realistic?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 15 في هذه المجموعة.

فتح الحزمة

k this deck

15

What are the advantages of futures contracts, when compared to forward contracts?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 15 في هذه المجموعة.

فتح الحزمة

k this deck