Deck 3: Basics of Interest Rate Risk Management

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/17

العب

ملء الشاشة (f)

Deck 3: Basics of Interest Rate Risk Management

1

Compute the 95% VaR for the following portfolio:

i. A 1.5-year ?xed rate bond paying 2% quarterly.

ii. A 0.75-year ?oating rate bond paying ?oat plus 80 basis points semi- annually. You know that the reference rate was set to 6% six months ago.

iii. A 0.25 zero coupon bond. Additionally you know that ?dr =0and?dr =0.4233.

i. A 1.5-year ?xed rate bond paying 2% quarterly.

ii. A 0.75-year ?oating rate bond paying ?oat plus 80 basis points semi- annually. You know that the reference rate was set to 6% six months ago.

iii. A 0.25 zero coupon bond. Additionally you know that ?dr =0and?dr =0.4233.

The 95%VaR=1.3116.

2

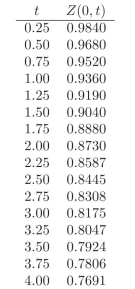

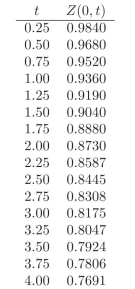

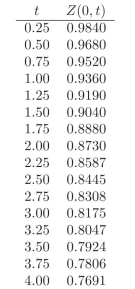

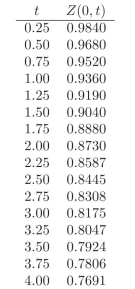

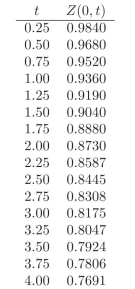

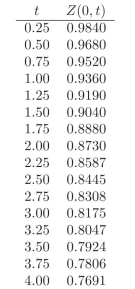

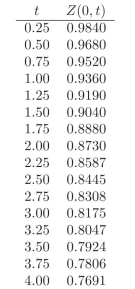

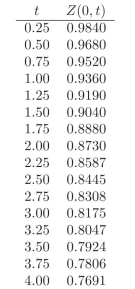

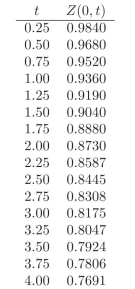

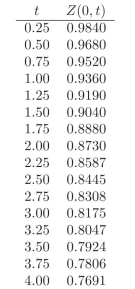

Use the following discount factors when needed.

-Calculate the duration of the following security: 5-year zero coupon bond.

-Calculate the duration of the following security: 5-year zero coupon bond.

The duration of the security is 5.00.

3

What is the dollar duration of the following portfolio?

i. Long a 1.5-year zero coupon bond.

ii. Short a 2-year ?xed coupon bond paying 1% quarterly.

i. Long a 1.5-year zero coupon bond.

ii. Short a 2-year ?xed coupon bond paying 1% quarterly.

Dollar duration for the portfolio is -41.0462.

4

What is the duration of the following portfolio?

i. Long a 1.5-year zero coupon bond.

ii. Short a 2-year ?xed coupon bond paying 1% quarterly.

i. Long a 1.5-year zero coupon bond.

ii. Short a 2-year ?xed coupon bond paying 1% quarterly.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 17 في هذه المجموعة.

فتح الحزمة

k this deck

5

Use the following discount factors when needed.

-Calculate the duration of the following security: 1.25-year ?oating coupon paying ?oat + 50 bps semiannually. You know that last quarter the semi- annual rate was 6.4%.

-Calculate the duration of the following security: 1.25-year ?oating coupon paying ?oat + 50 bps semiannually. You know that last quarter the semi- annual rate was 6.4%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 17 في هذه المجموعة.

فتح الحزمة

k this deck

6

What is the PV01 of the following portfolio?

i. Long a 1-year ?xed coupon bond paying 4% quarterly.

ii. Long a 1.75-year ?oating rate bond paying ?oat plus 80 bps semian- nually. You know that the reference rate was set at 6% six months ago.

iii. Short a 2-year zero coupon bond.

i. Long a 1-year ?xed coupon bond paying 4% quarterly.

ii. Long a 1.75-year ?oating rate bond paying ?oat plus 80 bps semian- nually. You know that the reference rate was set at 6% six months ago.

iii. Short a 2-year zero coupon bond.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 17 في هذه المجموعة.

فتح الحزمة

k this deck

7

Use the following discount factors when needed.

-Calculate the duration of the following portfolio:

i. 5 units of a 2-year ?xed rate bond paying 6% quarterly.

ii. 2 units of a 1.75-year ?oating rate bond paying ?oat + 80 bps semi- annually. You know that the reference rate was 6.5% three months ago.

iii. 6 units of a 1-year zero coupon bond.

iv. 5 units of a 1.5-year ?oating rate bond with no spread paid semian- nually.

-Calculate the duration of the following portfolio:

i. 5 units of a 2-year ?xed rate bond paying 6% quarterly.

ii. 2 units of a 1.75-year ?oating rate bond paying ?oat + 80 bps semi- annually. You know that the reference rate was 6.5% three months ago.

iii. 6 units of a 1-year zero coupon bond.

iv. 5 units of a 1.5-year ?oating rate bond with no spread paid semian- nually.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 17 في هذه المجموعة.

فتح الحزمة

k this deck

8

Calculate the Modified Duration for the same security.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 17 في هذه المجموعة.

فتح الحزمة

k this deck

9

Use the following discount factors when needed.

-Calculate the duration of the following portfolio:

i. 3 units of a 0.75-year ?xed rate bond paying 6% quarterly.

ii. 4 units of a 2-year ?xed rate bond paying 3% semiannually.

iii. 7 units of a 1.75-year zero coupon bond.

iv. 1 unit of a 2-year ?oating rate bond with no spread paid semiannually.

-Calculate the duration of the following portfolio:

i. 3 units of a 0.75-year ?xed rate bond paying 6% quarterly.

ii. 4 units of a 2-year ?xed rate bond paying 3% semiannually.

iii. 7 units of a 1.75-year zero coupon bond.

iv. 1 unit of a 2-year ?oating rate bond with no spread paid semiannually.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 17 في هذه المجموعة.

فتح الحزمة

k this deck

10

You have two bond coupon with the same maturity, one has a 9% coupon paid semiannually and the other a 8% coupon paid semiannually. Which one has a higher duration?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 17 في هذه المجموعة.

فتح الحزمة

k this deck

11

What is the PV01 of the following portfolio?

i. Long a 2-year ?xed coupon bond paying 7% quarterly.

ii. Short three 1.25-year ?oating rate bonds paying ?oat plus 80 bps semiannually. You know that the reference rate was set at 7% six months ago.

iii. Short two 0.5-year zero coupon bonds.

i. Long a 2-year ?xed coupon bond paying 7% quarterly.

ii. Short three 1.25-year ?oating rate bonds paying ?oat plus 80 bps semiannually. You know that the reference rate was set at 7% six months ago.

iii. Short two 0.5-year zero coupon bonds.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 17 في هذه المجموعة.

فتح الحزمة

k this deck

12

Use the following discount factors when needed.

-Calculate the duration of the following security: 2-year ?xed coupon pay- ing 5% quarterly.

-Calculate the duration of the following security: 2-year ?xed coupon pay- ing 5% quarterly.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 17 في هذه المجموعة.

فتح الحزمة

k this deck

13

Suppose that you calculate VaR from Duration. In your many results you ?nd that:

i. using historical data (of whatever length) or a normal distribution does not a?ect the result; 11

ii. you ?nd that kurtosis between historical data and the normal distri- bution is almost identical;

iii. You ?nd the expected change in the portfolio ?P = 0, with very small standard errors. Given the above, can you say that this Duration based VaR is an appro- priate approach to measure risk?

i. using historical data (of whatever length) or a normal distribution does not a?ect the result; 11

ii. you ?nd that kurtosis between historical data and the normal distri- bution is almost identical;

iii. You ?nd the expected change in the portfolio ?P = 0, with very small standard errors. Given the above, can you say that this Duration based VaR is an appro- priate approach to measure risk?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 17 في هذه المجموعة.

فتح الحزمة

k this deck

14

What is the dollar duration of the following portfolio:

i. Long a 1-year ?xed coupon bond paying 4% quarterly.

ii. Long a 1.75-year ?oating rate bond paying ?oat plus 80 bps semian- nually. You know that the reference rate was set at 6% six months ago.

iii. Short a 2-year zero coupon bond. 10

i. Long a 1-year ?xed coupon bond paying 4% quarterly.

ii. Long a 1.75-year ?oating rate bond paying ?oat plus 80 bps semian- nually. You know that the reference rate was set at 6% six months ago.

iii. Short a 2-year zero coupon bond. 10

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 17 في هذه المجموعة.

فتح الحزمة

k this deck

15

What is the dollar duration of the following portfolio:

i. Long a 2-year ?xed coupon bond paying 7% quarterly.

ii. Short three 1.25-year ?oating rate bonds paying ?oat plus 80 bps semiannually. You know that the reference rate was set at 7% six months ago.

iii. Short two 0.5-year zero coupon bonds.

i. Long a 2-year ?xed coupon bond paying 7% quarterly.

ii. Short three 1.25-year ?oating rate bonds paying ?oat plus 80 bps semiannually. You know that the reference rate was set at 7% six months ago.

iii. Short two 0.5-year zero coupon bonds.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 17 في هذه المجموعة.

فتح الحزمة

k this deck

16

Calculate the MacCaulay Duration for the following security: 1-year fixed rate coupon bond paying 6% semiannually. You know that the yield of the bond is 6.72%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 17 في هذه المجموعة.

فتح الحزمة

k this deck

17

Mr. Brown wants to invest $100,000 for the next ?ve years. He purchases an annuity from a ?nancial institution. Currently the term structure is ?at at 10% (yearly compounded).

i. If the payments are made yearly, what is the amount that the ?nan- cial institution will agree to pay Mr. Brown?

ii. Assume that there is a 5-year ?xed coupon bond that pays 12% coupon every year. What is the price and duration of the bond?

iii. How much must the ?nancial institution invest in the long-term bond in order to hedge the position? What should it do with the remainder of the money?

i. If the payments are made yearly, what is the amount that the ?nan- cial institution will agree to pay Mr. Brown?

ii. Assume that there is a 5-year ?xed coupon bond that pays 12% coupon every year. What is the price and duration of the bond?

iii. How much must the ?nancial institution invest in the long-term bond in order to hedge the position? What should it do with the remainder of the money?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 17 في هذه المجموعة.

فتح الحزمة

k this deck