Deck 4: Basic Refinements in Interest Rate Risk Management

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/18

العب

ملء الشاشة (f)

Deck 4: Basic Refinements in Interest Rate Risk Management

1

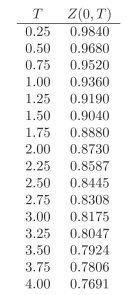

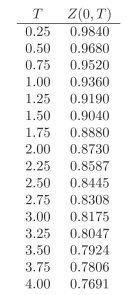

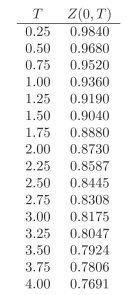

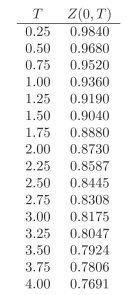

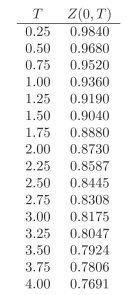

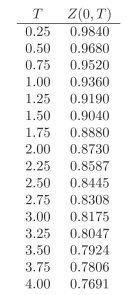

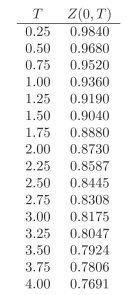

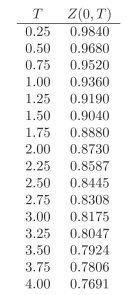

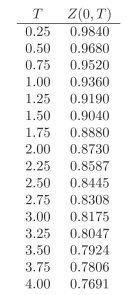

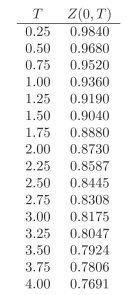

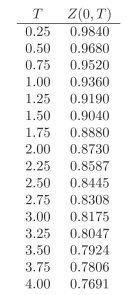

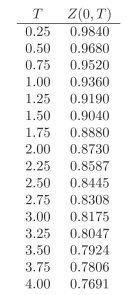

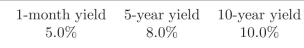

Use the following discount factors when needed.

-Calculate the convexity of the following portfolio:

i. 4 units of a 1.5-year ?xed rate bond paying 4% quarterly.

ii. 5 units of a 1.5-year ?xed rate bond paying 5% semiannually.

iii. 10 units of a 1.5-year zero coupon bond.

iv. 3 units of a 1.5-year ?oating rate bond with no spread paid semian- nually.

-Calculate the convexity of the following portfolio:

i. 4 units of a 1.5-year ?xed rate bond paying 4% quarterly.

ii. 5 units of a 1.5-year ?xed rate bond paying 5% semiannually.

iii. 10 units of a 1.5-year zero coupon bond.

iv. 3 units of a 1.5-year ?oating rate bond with no spread paid semian- nually.

Annualized expected return on the bond is 0.0815%.

2

How many securities do you need to hedge three factors? Why?

To hedge three factors you need three securities, because the three factors generate a system of equations with three unknowns. In order to solve it you must include a security for each of these unknowns.

3

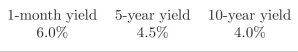

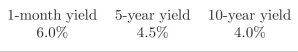

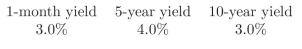

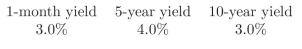

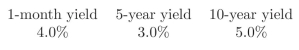

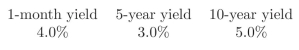

Compute the Term Spread and the Butterfly Spread for the following data. What shape does the yield curve have?

The term spread is -2% and the Butterfly Spread is -1%. The shape of the yield cure is decreasing.

4

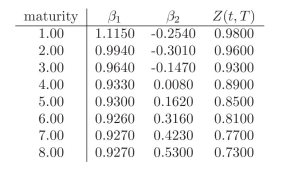

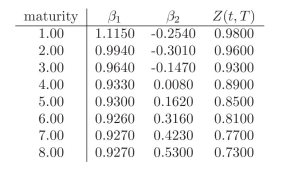

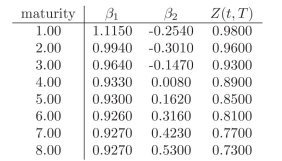

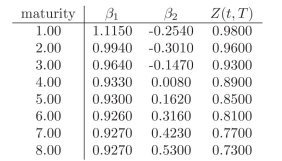

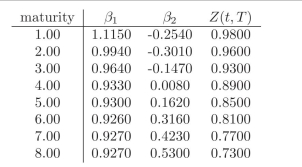

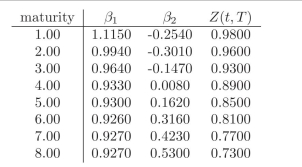

You currently hold a 2-year fixed rate bond paying 1% annually. You would like to hedge against changes in the level and the slope of the yield curve and you plan to use a 1-year zero coupon bond and a 8-year zero coupon bond as hedging instruments. Use the following table to compute the adequate positions in the hedging instruments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 18 في هذه المجموعة.

فتح الحزمة

k this deck

5

Use the following discount factors when needed.

-Calculate the convexity of the following portfolio:

i. 1 unit of a 2-year ?xed coupon bond paying 10% coupon quarterly.

ii. 1 unit of a 2-year ?xed coupon bond paying 1% coupon semiannually.

iii. 1 unit of a 2-year zero coupon bond.

-Calculate the convexity of the following portfolio:

i. 1 unit of a 2-year ?xed coupon bond paying 10% coupon quarterly.

ii. 1 unit of a 2-year ?xed coupon bond paying 1% coupon semiannually.

iii. 1 unit of a 2-year zero coupon bond.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 18 في هذه المجموعة.

فتح الحزمة

k this deck

6

You currently hold a 7-year fixed rate bond paying 1% annually. You would like to hedge against changes in the level and the slope of the yield curve and you plan to use a 2-year zero coupon bond and a 6-year zero coupon bond as hedging instruments. Use the following table to compute the adequate positions in the hedging instruments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 18 في هذه المجموعة.

فتح الحزمة

k this deck

7

If you need three securities to hedge three factors, can you do the follow- ing? Take two securities and make a third "synthetic" security from these two (i.e. it is the average of both prices). Use it to solve the system of equations. Is this valid?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 18 في هذه المجموعة.

فتح الحزمة

k this deck

8

What is the advantage of a factor model?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 18 في هذه المجموعة.

فتح الحزمة

k this deck

9

Use the following discount factors when needed.

-Calculate the convexity of the following security: a 5-year zero coupon bond.

-Calculate the convexity of the following security: a 5-year zero coupon bond.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 18 في هذه المجموعة.

فتح الحزمة

k this deck

10

You currently hold a 7-year ?xed rate bond paying 5% annually. You would like to hedge against changes in the level and the slope of the yield curve and you plan to use a 1-year zero coupon bond and a 7-year zero coupon bond. Use the following table to compute the adequate positions in the hedging instruments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 18 في هذه المجموعة.

فتح الحزمة

k this deck

11

Use the following discount factors when needed.

-Calculate the convexity of the following security: a 3-year ?xed rate bond paying 4% coupon on a semiannual basis.

-Calculate the convexity of the following security: a 3-year ?xed rate bond paying 4% coupon on a semiannual basis.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 18 في هذه المجموعة.

فتح الحزمة

k this deck

12

Suppose you hold a bond and interest rates suddenly fall. Duration says that bond prices will raise a given amount. If Convexity is included in this estimate, will bond prices go above or below what Duration predicts?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 18 في هذه المجموعة.

فتح الحزمة

k this deck

13

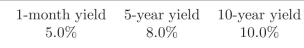

Compute the Term Spread and the Butterfly Spread for the following data. What shape does the yield curve have?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 18 في هذه المجموعة.

فتح الحزمة

k this deck

14

Use the following discount factors when needed.

-Calculate the convexity of the following security: a 3-year ?oating rate bond with no spread paid quarterly.

-Calculate the convexity of the following security: a 3-year ?oating rate bond with no spread paid quarterly.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 18 في هذه المجموعة.

فتح الحزمة

k this deck

15

Suppose you hold a bond and interest rates suddenly rise. Duration says that bond prices will fall a given amount. If Convexity is included in this estimate, will bond prices go above or below what Duration predicts?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 18 في هذه المجموعة.

فتح الحزمة

k this deck

16

Compute the Term Spread and the Butterfly Spread for the following data. What shape does the yield curve have?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 18 في هذه المجموعة.

فتح الحزمة

k this deck

17

Use the following discount factors when needed.

-Calculate the convexity of the following portfolio:

i. 2 units of a 1.5-year ?xed rate bond paying 6% quarterly.

ii. 4 units of a 1.75-year ?oating rate bond paying ?oat + 80 bps semi- annually. You know that the reference rate was 7% three months ago. 13

iii. 6 units of a 2-year zero coupon bond.

iv. 1 units of a 1.5-year ?oating rate bond with no spread paid semian- nually.

-Calculate the convexity of the following portfolio:

i. 2 units of a 1.5-year ?xed rate bond paying 6% quarterly.

ii. 4 units of a 1.75-year ?oating rate bond paying ?oat + 80 bps semi- annually. You know that the reference rate was 7% three months ago. 13

iii. 6 units of a 2-year zero coupon bond.

iv. 1 units of a 1.5-year ?oating rate bond with no spread paid semian- nually.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 18 في هذه المجموعة.

فتح الحزمة

k this deck

18

Compute the Term Spread and the Butter?y Spread for the following data. What shape does the yield curve have?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 18 في هذه المجموعة.

فتح الحزمة

k this deck