Deck 12: Responsibility Accounting, Operational Performance Measures, and the Balanced Scorecard

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

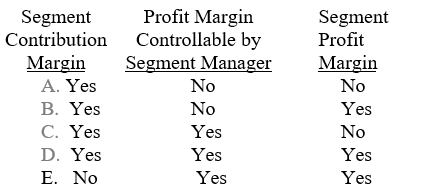

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

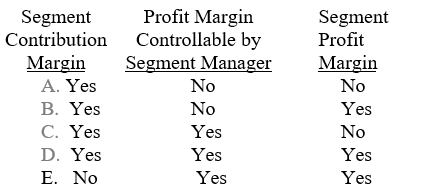

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

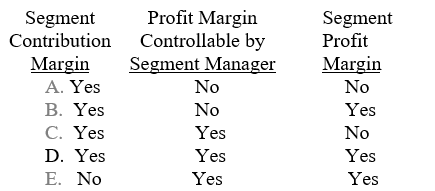

سؤال

سؤال

سؤال

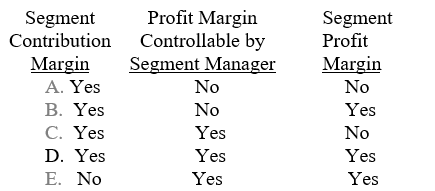

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/89

العب

ملء الشاشة (f)

Deck 12: Responsibility Accounting, Operational Performance Measures, and the Balanced Scorecard

1

A cost center manager does not have the ability to produce revenue.

True

2

A cost center manager:

A) does not have the ability to produce revenue.

B) may be involved with the sale of new marketing programs to clients.

C) would normally be held accountable for producing an adequate return on invested capital.

D) often oversees divisional operations.

E) may be the manager who oversees the operations of a retail store.

A) does not have the ability to produce revenue.

B) may be involved with the sale of new marketing programs to clients.

C) would normally be held accountable for producing an adequate return on invested capital.

D) often oversees divisional operations.

E) may be the manager who oversees the operations of a retail store.

A

3

The continual search for the most effective method of accomplishing a task by comparing existing methods and performance levels with those of other organizations, or with other subunits within the same organization is known as a gain-sharing plan.

False

4

Performance reports are unique in that they do not incorporate budgets and variance analysis.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

5

Halpern Corporation is in the process of overhauling the performance evaluation system for its San Diego manufacturing division, which produces and sells parts that are popular in the aerospace industry. Which of the following is least likely to be chosen to evaluate the overall operations of the San Diego division?

A) Cost center.

B) Responsibility center.

C) Profit center.

D) Investment center.

E) The profit center and investment center are equally unlikely to be chosen.

A) Cost center.

B) Responsibility center.

C) Profit center.

D) Investment center.

E) The profit center and investment center are equally unlikely to be chosen.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

6

Inventory control is important in achieving the benefits of a just-in-time (JIT) philosophy.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

7

Costs that are traceable to a segment and are completely beyond the influence of the segment manager can be advantageously divided in segment reports into two distinct responsibilities - those for segments and those for segment managers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

8

The typical balanced scorecard is best described as containing both financial and nonfinancial performance measures.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

9

A company-owned restaurant in a fast-food chain is considered an investment center.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

10

The concepts and tools used to measure the performance of people and departments are known as:

A) goal congruence.

B) planning and control.

C) responsibility accounting.

D) delegation of decision making.

E) strategic control.

A) goal congruence.

B) planning and control.

C) responsibility accounting.

D) delegation of decision making.

E) strategic control.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

11

When managers of subunits throughout an organization strive to achieve the goals set by top management, the result is:

A) goal congruence.

B) planning and control.

C) responsibility accounting.

D) delegation of decision making.

E) strategic control.

A) goal congruence.

B) planning and control.

C) responsibility accounting.

D) delegation of decision making.

E) strategic control.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

12

A manufacturer's raw-material purchasing department would likely be classified as a:

A) cost center.

B) revenue center.

C) profit center.

D) investment center.

E) contribution center.

A) cost center.

B) revenue center.

C) profit center.

D) investment center.

E) contribution center.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

13

Responsibility accounting refers to the various concepts and tools used by managers to measure the performance of people and departments in order to foster goal congruence.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

14

A collection of costs to be assigned is called a cost pool.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

15

Common costs are charged to a company's operating segments when preparing a segmented income statement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

16

Each department, responsible for different processes, should have goals different from the company as a whole.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

17

Which of the following is not an example of a responsibility center?

A) Cost center.

B) Revenue center.

C) Profit center.

D) Investment center.

E) Contribution center.

A) Cost center.

B) Revenue center.

C) Profit center.

D) Investment center.

E) Contribution center.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

18

An allocation base for a cost pool should ideally be a cost object.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

19

A company's balanced scorecard should focus on the performance measurements that are most important to its key competitor.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

20

Performance reports help managers use management by exception and effectively control operations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

21

Performance reports help managers:

A) use management by exception and effectively control operations.

B) decide whether a cost, profit, or investment center framework is appropriate.

C) design their organizational hierarchy.

D) pinpoint trouble spots.

E) use management by exception and effectively control operations and pinpoint trouble spots.

A) use management by exception and effectively control operations.

B) decide whether a cost, profit, or investment center framework is appropriate.

C) design their organizational hierarchy.

D) pinpoint trouble spots.

E) use management by exception and effectively control operations and pinpoint trouble spots.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

22

The Telemarketing Department of a residential remodeling company would most likely be evaluated as a:

A) cost center.

B) revenue center.

C) profit center.

D) investment center.

E) contribution center.

A) cost center.

B) revenue center.

C) profit center.

D) investment center.

E) contribution center.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

23

An allocation base for a cost pool should ideally be:

A) machine hours.

B) a cost object.

C) a common cost.

D) a cost driver.

E) direct labor, either cost or hours.

A) machine hours.

B) a cost object.

C) a common cost.

D) a cost driver.

E) direct labor, either cost or hours.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

24

Which of the following would have a low likelihood of being organized as a profit center?

A) A movie theater of a company that operates a chain of theaters.

B) A maintenance department that charges users for its services.

C) The billing department of an Internet Services Provider (ISP).

D) The mayor's office in a large city.

E) Both the billing department of an Internet Services Provider (ISP) and the mayor's office in a large city.

A) A movie theater of a company that operates a chain of theaters.

B) A maintenance department that charges users for its services.

C) The billing department of an Internet Services Provider (ISP).

D) The mayor's office in a large city.

E) Both the billing department of an Internet Services Provider (ISP) and the mayor's office in a large city.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

25

A responsibility center in which the manager is held accountable for the profitable use of assets and capital is commonly known as a (n):

A) cost center.

B) revenue center.

C) profit center.

D) investment center.

E) contribution center.

A) cost center.

B) revenue center.

C) profit center.

D) investment center.

E) contribution center.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

26

A revenue center manager:

A) does not have the ability to produce revenue.

B) may be involved with the sale of new marketing programs to clients.

C) would normally be held accountable for producing an adequate return on invested capital.

D) often oversees divisional operations.

E) may be the manager who oversees the operations of a retail store.

A) does not have the ability to produce revenue.

B) may be involved with the sale of new marketing programs to clients.

C) would normally be held accountable for producing an adequate return on invested capital.

D) often oversees divisional operations.

E) may be the manager who oversees the operations of a retail store.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

27

A cost object is:

A) a collection of costs to be assigned.

B) a responsibility center, product, or service to which cost is to be assigned.

C) the tool used to charge cost dollars to user departments.

D) the primary function of a responsibility accounting system.

E) a common cost.

A) a collection of costs to be assigned.

B) a responsibility center, product, or service to which cost is to be assigned.

C) the tool used to charge cost dollars to user departments.

D) the primary function of a responsibility accounting system.

E) a common cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

28

A profit center manager:

A) does not have the ability to produce revenue.

B) may be involved with the sale of new marketing programs to clients.

C) would normally be held accountable for producing an adequate return on invested capital.

D) often oversees divisional operations.

E) may be the manager who oversees the operations of a retail store.

A) does not have the ability to produce revenue.

B) may be involved with the sale of new marketing programs to clients.

C) would normally be held accountable for producing an adequate return on invested capital.

D) often oversees divisional operations.

E) may be the manager who oversees the operations of a retail store.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

29

Decentralized firms can delegate authority by structuring an organization into responsibility centers. Which of the following organizational segments is most like a totally independent, standalone business where managers are expected to "make it on their own"?

A) Cost center.

B) Revenue center.

C) Profit center.

D) Investment center.

E) Contribution center.

A) Cost center.

B) Revenue center.

C) Profit center.

D) Investment center.

E) Contribution center.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

30

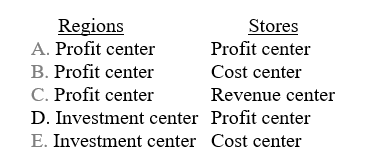

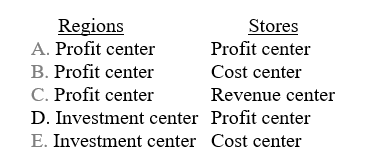

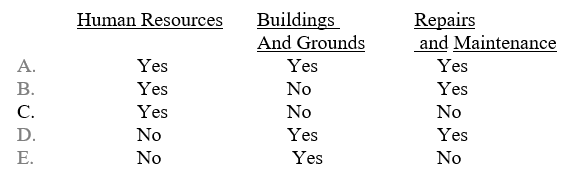

Swift Software operates stores within five regions. Regional managers are held accountable for marketing, advertising, and sales decisions, and all costs incurred within their region. In addition, regional managers decide whether new stores will open, where the stores will be located, and whether the stores will lease or purchase the facilities. Store managers, in contrast, are accountable for marketing, advertising, sales decisions, and costs incurred within their stores. Ideally, on the basis of this information, what type of responsibility center should the software company use to evaluate its regions and stores?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

31

Which of the following is an appropriate base to distribute the cost of building depreciation to responsibility centers?

A) Number of employees in the responsibility centers.

B) Budgeted sales dollars of the responsibility centers.

C) Square feet occupied by the responsibility centers.

D) Budgeted net income of the responsibility centers.

E) Total budgeted direct operating costs of the responsibility centers.

A) Number of employees in the responsibility centers.

B) Budgeted sales dollars of the responsibility centers.

C) Square feet occupied by the responsibility centers.

D) Budgeted net income of the responsibility centers.

E) Total budgeted direct operating costs of the responsibility centers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

32

Tranquil Beaches owns six hotels in Hawaii, collectively known as the Hawaiian Division. The various hotels, including the Surf & Sun, have operating departments (such as Maintenance, Housekeeping, and Food and Beverage) that are evaluated as either cost centers or profit centers. The Food and Beverage Department, for example, is a profit center, with activities divided into three segments: Banquets and Catering, Restaurants, and Kitchen. If Tranquil Beaches uses a performance-reporting system that is based on responsibility accounting, which of the following disclosures is likely to occur?

A) The detailed operating costs of the Surf & Sun's Kitchen Department will appear on the Hawaiian Division's performance report.

B) The Food and Beverage Department's profit will appear on Kitchen's performance report.

C) The profit of the Surf & Sun hotel will appear on the Hawaiian Division's performance report.

D) The Food and Beverage profit at the Surf & Sun will appear on Tranquil Beaches' performance report.

E) The profit of the Surf & Sun hotel will appear on Food and Beverage's performance report.

A) The detailed operating costs of the Surf & Sun's Kitchen Department will appear on the Hawaiian Division's performance report.

B) The Food and Beverage Department's profit will appear on Kitchen's performance report.

C) The profit of the Surf & Sun hotel will appear on the Hawaiian Division's performance report.

D) The Food and Beverage profit at the Surf & Sun will appear on Tranquil Beaches' performance report.

E) The profit of the Surf & Sun hotel will appear on Food and Beverage's performance report.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

33

An investment center manager:

A) does not have the ability to produce revenue.

B) may be involved with the sale of new marketing programs to clients.

C) would normally be held accountable for producing an adequate return on invested capital.

D) often oversees divisional operations.

E) may be the manager who oversees the operations of a retail store.

A) does not have the ability to produce revenue.

B) may be involved with the sale of new marketing programs to clients.

C) would normally be held accountable for producing an adequate return on invested capital.

D) often oversees divisional operations.

E) may be the manager who oversees the operations of a retail store.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

34

Compton Corporation, with operations throughout the country, will soon allocate corporate overhead to the firm's various responsibility centers. Which of the following is definitely not a cost object in this situation?

A) The maintenance department.

B) Product no. 675.

C) Compton Corporation.

D) The Midwest division.

E) The telemarketing center.

A) The maintenance department.

B) Product no. 675.

C) Compton Corporation.

D) The Midwest division.

E) The telemarketing center.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

35

A cost pool is:

A) a collection of homogeneous costs to be assigned.

B) almost always the combined result of decisions made by different responsibility center managers.

C) the primary function of a responsibility accounting system.

D) the amount of cost that has been allocated, say, 10%, to a user department.

E) the tool used to allocate cost dollars to user departments.

A) a collection of homogeneous costs to be assigned.

B) almost always the combined result of decisions made by different responsibility center managers.

C) the primary function of a responsibility accounting system.

D) the amount of cost that has been allocated, say, 10%, to a user department.

E) the tool used to allocate cost dollars to user departments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

36

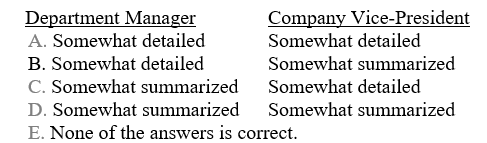

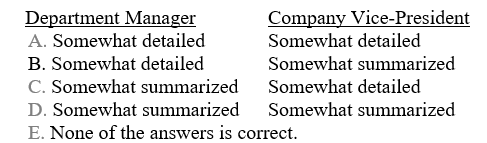

Republic Resorts owns numerous hotels on each of the Hawaiian Islands. The company's performance reporting system is structured around the firm's organizational structure, with information flowing from operating departments at a particular property and later respectively grouped by individual hotel, island operation (i.e., division), and the company as a whole. Which of the following best depicts the detail level of the information given to a department manager versus that reported to a company vice-president?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

37

Consider the following statements about performance reports:

I) Performance reports provide feedback to managers and allow them to better control operations.

II) Many performance reports have budget, actual, and variance data.

III) Performance reports are often structured around a firm's organizational hierarchy-that is, data relating to lower-level units (e.g., departments) are combined and flow into higher-level units (e.g., stores).

Which of the above statements is (are) true?

A) I only.

B) I and II.

C) I and III.

D) II and III.

E) I, II, and III.

I) Performance reports provide feedback to managers and allow them to better control operations.

II) Many performance reports have budget, actual, and variance data.

III) Performance reports are often structured around a firm's organizational hierarchy-that is, data relating to lower-level units (e.g., departments) are combined and flow into higher-level units (e.g., stores).

Which of the above statements is (are) true?

A) I only.

B) I and II.

C) I and III.

D) II and III.

E) I, II, and III.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

38

The Asian Division of a multinational manufacturing organization would likely be classified as a:

A) cost center.

B) revenue center.

C) profit center.

D) investment center.

E) contribution center.

A) cost center.

B) revenue center.

C) profit center.

D) investment center.

E) contribution center.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

39

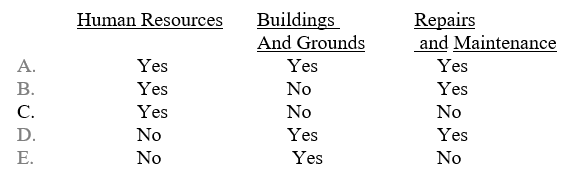

Crimson Industries is in the process of evaluating allocation bases so that selected costs can be charged to responsibility centers. Would the number of employees likely be a good base for allocating the costs of Human Resources, Building and Grounds, and Repairs and Maintenance to user centers?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

40

If the head of a hotel's food and beverage operation is held accountable for revenues and costs, the food and beverage operation would be considered a (n):

A) cost center.

B) revenue center.

C) profit center.

D) investment center.

E) contribution center.

A) cost center.

B) revenue center.

C) profit center.

D) investment center.

E) contribution center.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

41

The profit margin controllable by the segment manager would not include:

A) variable operating expenses.

B) fixed expenses controllable by the segment manager.

C) a share of the company's common fixed expenses.

D) income tax expense.

E) a share of the company's common fixed expenses and income tax expense.

A) variable operating expenses.

B) fixed expenses controllable by the segment manager.

C) a share of the company's common fixed expenses.

D) income tax expense.

E) a share of the company's common fixed expenses and income tax expense.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

42

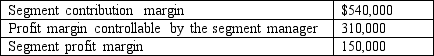

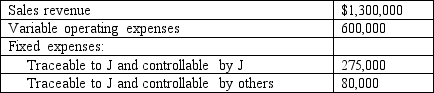

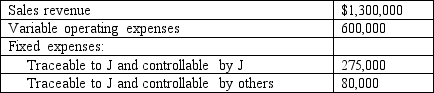

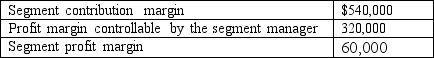

The following data relate to Department no. 3 of Winslett Corporation:

On the basis of this information, Department no. 3's variable operating expenses are:

A) $80,000.

B) $160,000.

C) $230,000.

D) $390,000.

E) Not determinable.

On the basis of this information, Department no. 3's variable operating expenses are:

A) $80,000.

B) $160,000.

C) $230,000.

D) $390,000.

E) Not determinable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

43

Which of the following would be the best measure on which to base a segment manager's performance evaluation for purposes of granting a bonus?

A) Segment sales revenue.

B) Segment contribution margin.

C) Profit margin controllable by the segment manager.

D) Segment profit margin.

E) Segment net income.

A) Segment sales revenue.

B) Segment contribution margin.

C) Profit margin controllable by the segment manager.

D) Segment profit margin.

E) Segment net income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

44

Common costs:

A) are not easily related to a segment's activities.

B) are easily related to a segment's activities.

C) are charged to a company's operating segments when preparing a segmented income statement.

D) are not charged to a company's operating segments when preparing a segmented income statement.

E) are not easily related to a segment's activities and also are not charged to a company's operating segments when preparing a segmented income statement.

A) are not easily related to a segment's activities.

B) are easily related to a segment's activities.

C) are charged to a company's operating segments when preparing a segmented income statement.

D) are not charged to a company's operating segments when preparing a segmented income statement.

E) are not easily related to a segment's activities and also are not charged to a company's operating segments when preparing a segmented income statement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

45

The difference between the profit margin controllable by a segment manager and the segment profit margin is caused by:

A) variable operating expenses.

B) allocated common expenses.

C) fixed expenses controllable by the segment manager.

D) fixed expenses traceable to the segment but controllable by others.

E) sales revenue.

A) variable operating expenses.

B) allocated common expenses.

C) fixed expenses controllable by the segment manager.

D) fixed expenses traceable to the segment but controllable by others.

E) sales revenue.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

46

For a company that uses responsibility accounting, which of the following costs is least likely to appear on a performance report of an assembly-line supervisor?

A) Direct materials used.

B) Departmental supplies.

C) Assembly-line labor.

D) Repairs and maintenance.

E) Assembly-line facilities depreciation.

A) Direct materials used.

B) Departmental supplies.

C) Assembly-line labor.

D) Repairs and maintenance.

E) Assembly-line facilities depreciation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

47

Distinguishing between controllable and noncontrollable costs on a performance report may result in:

A) an increase in the effectiveness of a cost management system.

B) a decrease in goal congruent behavior by managers.

C) an increase in the quality of performance information.

D) an increase in feelings of blame by managers.

E) an increase in the effectiveness of a cost management system and an increase in the quality of performance information.

A) an increase in the effectiveness of a cost management system.

B) a decrease in goal congruent behavior by managers.

C) an increase in the quality of performance information.

D) an increase in feelings of blame by managers.

E) an increase in the effectiveness of a cost management system and an increase in the quality of performance information.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

48

Cost pools should be charged to responsibility centers by using:

A) budgeted amounts of allocation bases because the cost allocation to one responsibility center should influence the allocations to others.

B) budgeted amounts of allocation bases because the cost allocation to one responsibility center should not influence the allocations to others.

C) actual amounts of allocation bases because the cost allocation to one responsibility center should influence the allocations to others.

D) actual amounts of allocation bases because the cost allocation to one responsibility center should not influence the allocations to others.

E) some other approach.

A) budgeted amounts of allocation bases because the cost allocation to one responsibility center should influence the allocations to others.

B) budgeted amounts of allocation bases because the cost allocation to one responsibility center should not influence the allocations to others.

C) actual amounts of allocation bases because the cost allocation to one responsibility center should influence the allocations to others.

D) actual amounts of allocation bases because the cost allocation to one responsibility center should not influence the allocations to others.

E) some other approach.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

49

Which of the following measures would reflect the variable costs incurred by a business segment?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

50

A segment contribution margin would reflect the impact of:

A) variable operating expenses.

B) fixed expenses controllable by the segment manager.

C) fixed expenses traceable to the segment but controllable by others.

D) common fixed expenses.

E) All answers except common fixed expenses are correct.

A) variable operating expenses.

B) fixed expenses controllable by the segment manager.

C) fixed expenses traceable to the segment but controllable by others.

D) common fixed expenses.

E) All answers except common fixed expenses are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

51

Controllable costs, as used in a responsibility accounting system, consist of:

A) only fixed costs.

B) only direct materials and direct labor.

C) those costs that a manager can influence in the time period under review.

D) those costs about which a manager has some knowledge.

E) those costs that are influenced by parties external to the organization.

A) only fixed costs.

B) only direct materials and direct labor.

C) those costs that a manager can influence in the time period under review.

D) those costs about which a manager has some knowledge.

E) those costs that are influenced by parties external to the organization.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

52

Which of the following measures would reflect the fixed costs controllable by a segment manager?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

53

Gulf Coast Enterprises (GCE) operates 87 stores and has three divisions: Florida, Georgia, and Alabama. Which of the following costs would not appear on Georgia's portion of GCE's segmented income statement?

A) Costs related to statewide advertising contracts, negotiated by Georgia's divisional manager.

B) Variable sales commissions paid to Georgia's salespeople.

C) Compensation paid to Georgia's chief operating officer, as determined by GCE's management.

D) Georgia's allocated share of general GCE corporate overhead.

E) Compensation paid to Georgia's chief operating officer, as determined by GCE's management and Georgia's allocated share of general GCE corporate overhead.

A) Costs related to statewide advertising contracts, negotiated by Georgia's divisional manager.

B) Variable sales commissions paid to Georgia's salespeople.

C) Compensation paid to Georgia's chief operating officer, as determined by GCE's management.

D) Georgia's allocated share of general GCE corporate overhead.

E) Compensation paid to Georgia's chief operating officer, as determined by GCE's management and Georgia's allocated share of general GCE corporate overhead.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

54

On a segmented income statement, common fixed expenses will have an effect on a company's:

A) segment contribution margin.

B) profit margin controllable by the segment manager.

C) segment profit margin.

D) segment contribution margin and segment profit margin.

E) None of the answers is correct.

A) segment contribution margin.

B) profit margin controllable by the segment manager.

C) segment profit margin.

D) segment contribution margin and segment profit margin.

E) None of the answers is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

55

Sandy Shores Corporation operates two stores: J and K. The following information relates to J:

J's segment contribution margin is:

A) $345,000.

B) $425,000.

C) $620,000.

D) $700,000.

E) $745,000.

J's segment contribution margin is:

A) $345,000.

B) $425,000.

C) $620,000.

D) $700,000.

E) $745,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

56

Thurmon Retail has three stores in West Virginia. Which of the following costs would likely be excluded when computing the profit margin controllable by store no. 3's manager?

A) Hourly labor costs incurred by personnel at store no. 3.

B) Property taxes attributable to store no. 3.

C) The salary of Thurmon's president.

D) The salary of store no. 3's manager.

E) All answers except hourly labor costs incurred by personnel at store no. 3 are correct.

A) Hourly labor costs incurred by personnel at store no. 3.

B) Property taxes attributable to store no. 3.

C) The salary of Thurmon's president.

D) The salary of store no. 3's manager.

E) All answers except hourly labor costs incurred by personnel at store no. 3 are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

57

Responsibility accounting systems strive to:

A) place blame on guilty individuals.

B) provide information to managers.

C) hold managers accountable for both controllable and noncontrollable costs.

D) identify unfavorable variances.

E) provide information so that managers can make decisions that are in the best interest of their individual centers rather than in the best interests of the firm as a whole.

A) place blame on guilty individuals.

B) provide information to managers.

C) hold managers accountable for both controllable and noncontrollable costs.

D) identify unfavorable variances.

E) provide information so that managers can make decisions that are in the best interest of their individual centers rather than in the best interests of the firm as a whole.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

58

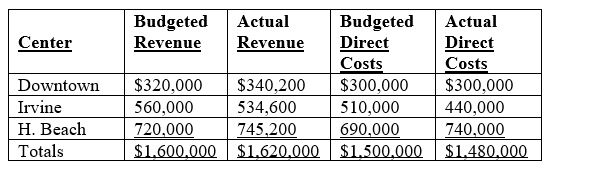

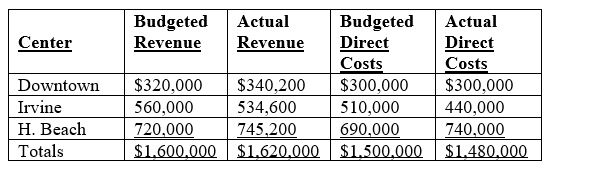

Use the following information to answer the following Questions

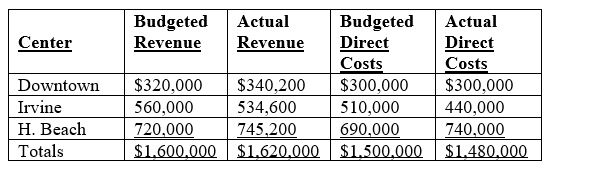

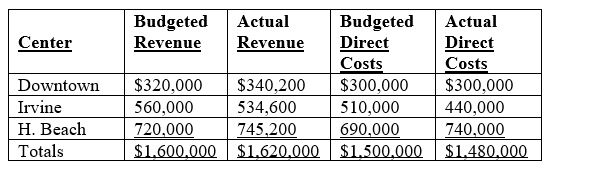

Management of Wee Ones (WO), an operator of day-care facilities, wants the company's profit to be subdivided by center. The firm's accountant has provided the following data:

WO's advertising, which is handled by the home office, is not reflected in the preceding figures and amounted to $60,000.

-If advertising expense were allocated to centers based on actual center profitability, the amount of advertising expense allocated to the Irvine center would be closest to:

A) $19,800.

B) $21,000.

C) $30,000.

D) $40,543.

E) None of the answers is correct.

Management of Wee Ones (WO), an operator of day-care facilities, wants the company's profit to be subdivided by center. The firm's accountant has provided the following data:

WO's advertising, which is handled by the home office, is not reflected in the preceding figures and amounted to $60,000.

-If advertising expense were allocated to centers based on actual center profitability, the amount of advertising expense allocated to the Irvine center would be closest to:

A) $19,800.

B) $21,000.

C) $30,000.

D) $40,543.

E) None of the answers is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

59

Use the following information to answer the following Questions

Management of Wee Ones (WO), an operator of day-care facilities, wants the company's profit to be subdivided by center. The firm's accountant has provided the following data:

WO's advertising, which is handled by the home office, is not reflected in the preceding figures and amounted to $60,000.

-Assume that management used the allocation base that is most influenced by advertising effort and consistent with sound managerial accounting practices. How much advertising would be allocated to the Irvine center?

A) $17,838.

B) $19,800.

C) $20,000.

D) $20,400.

E) $21,000.

Management of Wee Ones (WO), an operator of day-care facilities, wants the company's profit to be subdivided by center. The firm's accountant has provided the following data:

WO's advertising, which is handled by the home office, is not reflected in the preceding figures and amounted to $60,000.

-Assume that management used the allocation base that is most influenced by advertising effort and consistent with sound managerial accounting practices. How much advertising would be allocated to the Irvine center?

A) $17,838.

B) $19,800.

C) $20,000.

D) $20,400.

E) $21,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

60

Pride Company is preparing a segmented income statement, subdivided into departments (billing, purchasing, and telemarketing). Which of the following choices correctly describes the accounting treatment of the firm's compensation cost for key executives (president and vice-presidents)?

A) The cost is charged to the departments.

B) The cost is not charged to the departments because, although easily traceable to the departments, it is not controllable at the departmental level.

C) The cost is not charged to the departments because, although controllable at the departmental level, it is not easily traceable to the departments.

D) The cost is not charged to the departments because it is both easily traceable to the departments and controllable by the departments.

E) The cost is not charged to the departments because it is neither easily traceable to the departments nor controllable by the departments.

A) The cost is charged to the departments.

B) The cost is not charged to the departments because, although easily traceable to the departments, it is not controllable at the departmental level.

C) The cost is not charged to the departments because, although controllable at the departmental level, it is not easily traceable to the departments.

D) The cost is not charged to the departments because it is both easily traceable to the departments and controllable by the departments.

E) The cost is not charged to the departments because it is neither easily traceable to the departments nor controllable by the departments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

61

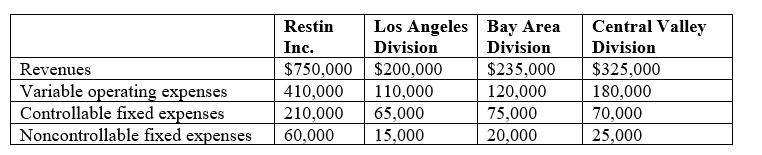

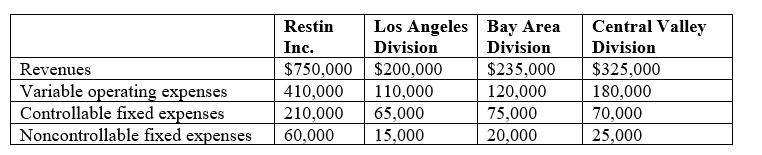

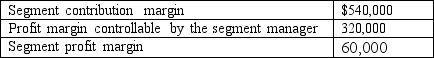

Use the following information to answer the following Questions

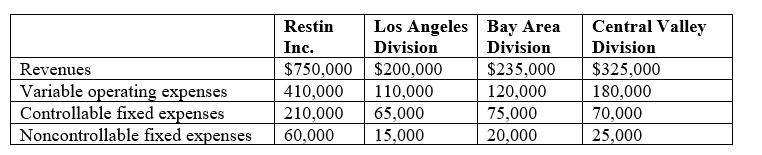

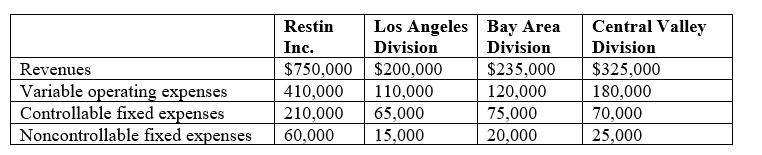

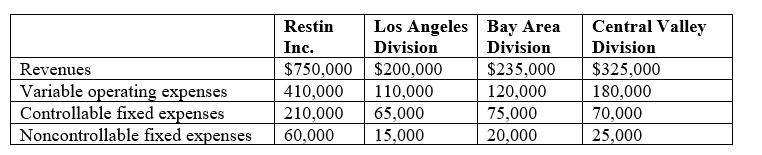

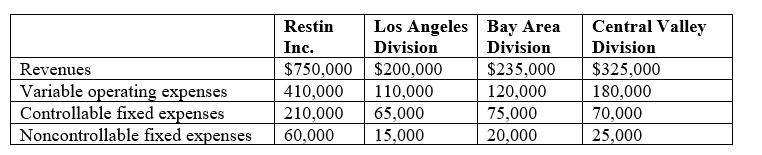

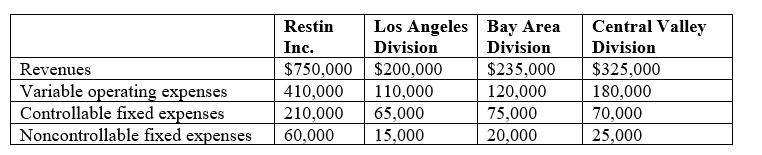

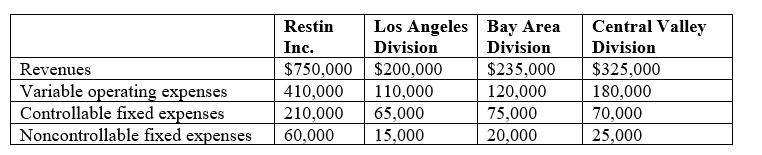

The following information was taken from the segmented income statement of Restin, Inc., and the company's three divisions:

In addition, the company incurred common fixed costs of $18,000.

-Which of the following amounts should be used to evaluate whether Restin, Inc., should continue to invest company resources in the Los Angeles division?

A) $4,000.

B) $8,000.

C) $10,000.

D) $25,000.

E) $90,000.

The following information was taken from the segmented income statement of Restin, Inc., and the company's three divisions:

In addition, the company incurred common fixed costs of $18,000.

-Which of the following amounts should be used to evaluate whether Restin, Inc., should continue to invest company resources in the Los Angeles division?

A) $4,000.

B) $8,000.

C) $10,000.

D) $25,000.

E) $90,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

62

When using a balanced scorecard, which of the following is typically classified as an internal-operations performance measure?

A) Cash flow.

B) Number of customer complaints.

C) Employee training hours.

D) Number of employee suggestions.

E) Number of suppliers used.

A) Cash flow.

B) Number of customer complaints.

C) Employee training hours.

D) Number of employee suggestions.

E) Number of suppliers used.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

63

The typical balanced scorecard is best described as containing:

A) financial performance measures.

B) nonfinancial performance measures.

C) neither financial nor nonfinancial performance measures.

D) both financial and nonfinancial performance measures.

E) either financial or nonfinancial performance measures but not both.

A) financial performance measures.

B) nonfinancial performance measures.

C) neither financial nor nonfinancial performance measures.

D) both financial and nonfinancial performance measures.

E) either financial or nonfinancial performance measures but not both.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

64

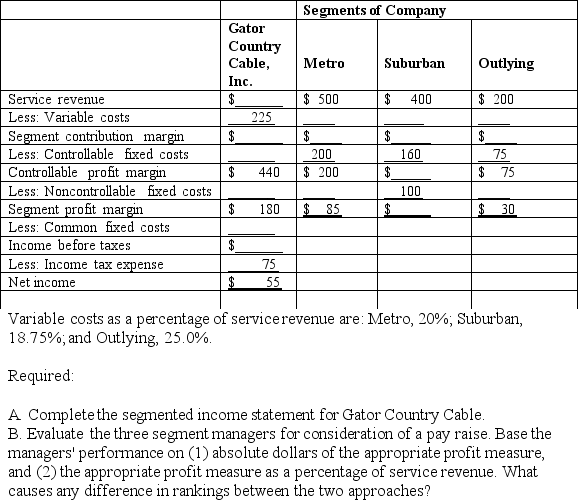

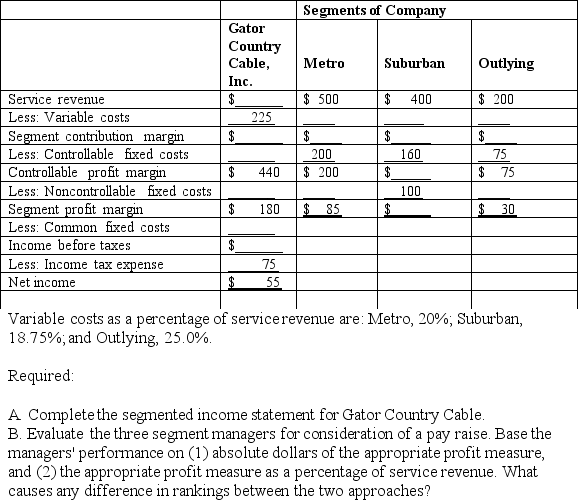

Gator Country Cable, Inc. is organized in three segments: Metro, Suburban, and Outlying. Data for the company and for these segments follow.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

65

Consider the following situation:

The marketing manager of Gramblin, Inc. accepted a rush order for a nonstock item from a valued customer. The manager filed the necessary paperwork with the production department, and a production manager did the same with purchasing for needed raw materials. Unfortunately, a purchasing clerk temporarily lost the paperwork; by the time it was found, it was too late to order from Gramblin's regular supplier. A new supplier was located that quoted a very attractive price.

The materials soon arrived and were found to be of poor quality, thus giving rise to a favorable materials price variance, an unfavorable materials quantity variance, and an unfavorable labor efficiency variance. These latter two variances, based on normal practice, appeared on the production manager's performance report for the period just ended.

Required:

A. Given that the company uses a responsibility accounting system, should the production manager be penalized for poor performance? Briefly discuss, keeping in mind that a production manager is generally in a very good position to control material usage and labor efficiency.

B. Should anything be done to correct the situation? If "yes," briefly explain.

The marketing manager of Gramblin, Inc. accepted a rush order for a nonstock item from a valued customer. The manager filed the necessary paperwork with the production department, and a production manager did the same with purchasing for needed raw materials. Unfortunately, a purchasing clerk temporarily lost the paperwork; by the time it was found, it was too late to order from Gramblin's regular supplier. A new supplier was located that quoted a very attractive price.

The materials soon arrived and were found to be of poor quality, thus giving rise to a favorable materials price variance, an unfavorable materials quantity variance, and an unfavorable labor efficiency variance. These latter two variances, based on normal practice, appeared on the production manager's performance report for the period just ended.

Required:

A. Given that the company uses a responsibility accounting system, should the production manager be penalized for poor performance? Briefly discuss, keeping in mind that a production manager is generally in a very good position to control material usage and labor efficiency.

B. Should anything be done to correct the situation? If "yes," briefly explain.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

66

Startup, Inc. provides a variety of telecommunications services to residential and commercial customers from its massive campus-like headquarters in suburban Tampa. For a number of years the firm's maintenance group has been organized as a cost center, rendering services free of charge to the company's user departments (sales, billing, accounting, marketing, research, and so forth).

Requests for maintenance have grown considerably, and demand is approaching the point where quality and timeliness of services provided are becoming an issue. As a result, management is studying whether the maintenance operation should be converted from a cost center to a profit center, with users to be billed for services performed.

Required:

A. Differentiate between a cost center and a profit center. How is each of these centers evaluated?

B. What will likely happen to the number of user service requests if the company makes the switch to a profit-center form of organization? Why?

C. Assume that a user department has requested a particular service, one that is time consuming and costly to perform. The maintenance group's actual cost incurred in providing this service is $17,800, and the user has agreed to pay $20,800 if the switch to a profit center is made. If this case is fairly typical within the firm, which of the two forms of organization (cost center or profit center) will result in a more responsive, service-oriented maintenance group for Startup? Why?

Requests for maintenance have grown considerably, and demand is approaching the point where quality and timeliness of services provided are becoming an issue. As a result, management is studying whether the maintenance operation should be converted from a cost center to a profit center, with users to be billed for services performed.

Required:

A. Differentiate between a cost center and a profit center. How is each of these centers evaluated?

B. What will likely happen to the number of user service requests if the company makes the switch to a profit-center form of organization? Why?

C. Assume that a user department has requested a particular service, one that is time consuming and costly to perform. The maintenance group's actual cost incurred in providing this service is $17,800, and the user has agreed to pay $20,800 if the switch to a profit center is made. If this case is fairly typical within the firm, which of the two forms of organization (cost center or profit center) will result in a more responsive, service-oriented maintenance group for Startup? Why?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

67

Norwegian Resort Tours (NRT), which operates in a very competitive marketplace, is considering four categories of performance measures: (1) profitability measures, (2) customer-satisfaction measures, (3) efficiency and quality measures, and (4) learning and growth measures. The company assigns one manager to each tour resort to oversee the resort's general operations. If NRT desired to adopt a balanced-scorecard approach, which measures should the firm use in the evaluation of its managers?

A) 1.

B) 1, 2.

C) 2, 3.

D) 1, 2, 4.

E) 1, 2, 3, 4.

A) 1.

B) 1, 2.

C) 2, 3.

D) 1, 2, 4.

E) 1, 2, 3, 4.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

68

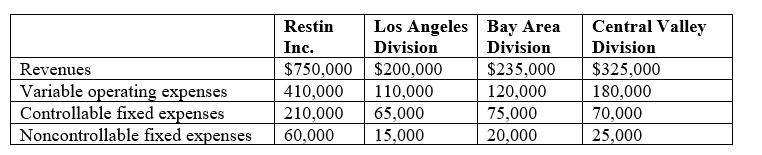

Use the following information to answer the following Questions

The following information was taken from the segmented income statement of Restin, Inc., and the company's three divisions:

In addition, the company incurred common fixed costs of $18,000.

-The profit margin controllable by the Central Valley segment manager is:

A) $32,000.

B) $44,000.

C) $50,000.

D) $75,000.

E) $145,000.

The following information was taken from the segmented income statement of Restin, Inc., and the company's three divisions:

In addition, the company incurred common fixed costs of $18,000.

-The profit margin controllable by the Central Valley segment manager is:

A) $32,000.

B) $44,000.

C) $50,000.

D) $75,000.

E) $145,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

69

The performance reports generated by a responsibility accounting system often form a "hierarchy of performance reports." Explain what is meant by this term.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

70

The allocation of costs gives rise to several unique terms. Briefly discuss the following: cost object, cost allocation base, and cost allocation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

71

An increasingly popular approach that integrates financial and customer performance measures with measures in the areas of internal operations and learning and growth is known as:

A) the integrated performance measurement tool (IPMT).

B) the balanced scorecard.

C) gain sharing.

D) cycle efficiency.

E) overall quality assessment (OQA).

A) the integrated performance measurement tool (IPMT).

B) the balanced scorecard.

C) gain sharing.

D) cycle efficiency.

E) overall quality assessment (OQA).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

72

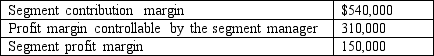

The following data relate to Department no. 2 of Velma Corporation:

On the basis of this information, fixed costs traceable to Department no. 2 but controllable by others are:

A) $160,000.

B) $220,000.

C) $260,000.

D) $480,000.

E) Not determinable.

On the basis of this information, fixed costs traceable to Department no. 2 but controllable by others are:

A) $160,000.

B) $220,000.

C) $260,000.

D) $480,000.

E) Not determinable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

73

Brilliant Stone Corporation (BSC) manufactures decorative, sculpted accessories that are sold by interior decorators and home furnishing stores. The following situation concerns two BSC employees: Mika George, head of the company's Billing Department, and Frank Merser, the firm's general manager.

George's Billing Department makes heavy use of hourly employees and is evaluated as a cost center. Understanding the need for prompt collection of receivables, George strives to run a first-class operation. George also understands the need to contribute in a big way to BSC's financial performance so she continually strives to minimize Billing Department expenses.

Unfortunately, George experienced a heated discussion with Merser several weeks ago, the subject being the shoddy operation that she is running. Merser complained loudly about the lack of timely billings to customers and the general lack of attention to detail, as many complaints have surfaced about erroneous invoices and customer statements.

Required:

A. What is meant by the term "responsibility accounting?"

B. What measure(s) of performance would companies normally use to evaluate a cost-center manager?

C. Does Merser have a valid reason to be upset with George? Given the nature of the Billing Department, did George err in her quest to minimize expenses? Explain.

D. Is it likely that the Billing Department could be evaluated as a profit center? Why?

George's Billing Department makes heavy use of hourly employees and is evaluated as a cost center. Understanding the need for prompt collection of receivables, George strives to run a first-class operation. George also understands the need to contribute in a big way to BSC's financial performance so she continually strives to minimize Billing Department expenses.

Unfortunately, George experienced a heated discussion with Merser several weeks ago, the subject being the shoddy operation that she is running. Merser complained loudly about the lack of timely billings to customers and the general lack of attention to detail, as many complaints have surfaced about erroneous invoices and customer statements.

Required:

A. What is meant by the term "responsibility accounting?"

B. What measure(s) of performance would companies normally use to evaluate a cost-center manager?

C. Does Merser have a valid reason to be upset with George? Given the nature of the Billing Department, did George err in her quest to minimize expenses? Explain.

D. Is it likely that the Billing Department could be evaluated as a profit center? Why?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

74

Lead indicators guide management to:

A) take actions now that will have positive effects on organizational performance now.

B) take actions now that will have positive effects on organizational performance in the future.

C) take actions in the future that will have positive effects on organizational performance now.

D) take actions in the past that will have positive effects on organizational performance in the future.

E) pursue identical strategies as those implemented with lag indicators.

A) take actions now that will have positive effects on organizational performance now.

B) take actions now that will have positive effects on organizational performance in the future.

C) take actions in the future that will have positive effects on organizational performance now.

D) take actions in the past that will have positive effects on organizational performance in the future.

E) pursue identical strategies as those implemented with lag indicators.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

75

Which of the following would not be considered a proper financial perspective measure?

A) Percentage of profit growth.

B) Percentage of revenue growth.

C) Increased percentage of return on assets.

D) Percentage of automated transactions.

E) Increased percentage of segment contribution margins.

A) Percentage of profit growth.

B) Percentage of revenue growth.

C) Increased percentage of return on assets.

D) Percentage of automated transactions.

E) Increased percentage of segment contribution margins.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

76

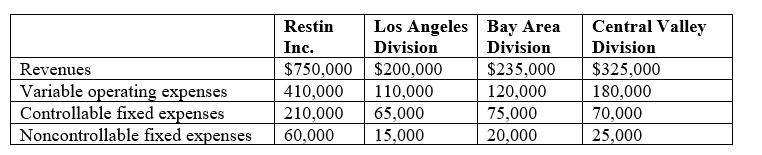

Use the following information to answer the following Questions

The following information was taken from the segmented income statement of Restin, Inc., and the company's three divisions:

In addition, the company incurred common fixed costs of $18,000.

-Bay Area's segment profit margin is:

A) $14,000.

B) $18,000.

C) $20,000.

D) $40,000.

E) $115,000.

The following information was taken from the segmented income statement of Restin, Inc., and the company's three divisions:

In addition, the company incurred common fixed costs of $18,000.

-Bay Area's segment profit margin is:

A) $14,000.

B) $18,000.

C) $20,000.

D) $40,000.

E) $115,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

77

Which of the following balanced-scorecard perspectives is influenced by a company's vision and strategy?

A) Financial.

B) Customer.

C) Internal operations.

D) Learning and growth.

E) All of the answers are correct.

A) Financial.

B) Customer.

C) Internal operations.

D) Learning and growth.

E) All of the answers are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

78

When using a balanced scorecard, a company's market share is typically classified as an element of the firm's:

A) financial performance measures.

B) customer performance measures.

C) learning and growth performance measures.

D) internal-operations performance measures.

E) interdisciplinary performance measures.

A) financial performance measures.

B) customer performance measures.

C) learning and growth performance measures.

D) internal-operations performance measures.

E) interdisciplinary performance measures.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

79

Use the following information to answer the following Questions

The following information was taken from the segmented income statement of Restin, Inc., and the company's three divisions:

In addition, the company incurred common fixed costs of $18,000.

-Assume that the Los Angeles division increases its promotion expense, a controllable fixed cost, by $10,000. As a result, revenues increased by $50,000. If variable expenses are tied directly to revenues, the new Los Angeles segment contribution margin is:

A) $12,500.

B) $22,500.

C) $32,500.

D) $50,000.

E) $60,000

The following information was taken from the segmented income statement of Restin, Inc., and the company's three divisions:

In addition, the company incurred common fixed costs of $18,000.

-Assume that the Los Angeles division increases its promotion expense, a controllable fixed cost, by $10,000. As a result, revenues increased by $50,000. If variable expenses are tied directly to revenues, the new Los Angeles segment contribution margin is:

A) $12,500.

B) $22,500.

C) $32,500.

D) $50,000.

E) $60,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

80

Use the following information to answer the following Questions

The following information was taken from the segmented income statement of Restin, Inc., and the company's three divisions:

In addition, the company incurred common fixed costs of $18,000.

-Assuming use of a responsibility accounting system, which of the following amounts should be used to evaluate the performance of the Los Angeles division manager?

A) $4,000.

B) $8,000.

C) $10,000.

D) $25,000.

E) $90,000.

The following information was taken from the segmented income statement of Restin, Inc., and the company's three divisions:

In addition, the company incurred common fixed costs of $18,000.

-Assuming use of a responsibility accounting system, which of the following amounts should be used to evaluate the performance of the Los Angeles division manager?

A) $4,000.

B) $8,000.

C) $10,000.

D) $25,000.

E) $90,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck