Deck 8: Variable Costing and the Costs of Quality and Sustainability

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/74

العب

ملء الشاشة (f)

Deck 8: Variable Costing and the Costs of Quality and Sustainability

1

All of the following costs are inventoried under absorption costing except:

A) direct materials.

B) direct labor.

C) variable manufacturing overhead.

D) fixed manufacturing overhead.

E) fixed administrative salaries.

A) direct materials.

B) direct labor.

C) variable manufacturing overhead.

D) fixed manufacturing overhead.

E) fixed administrative salaries.

E

2

All of the following are inventoried under variable costing except:

A) direct materials.

B) direct labor.

C) variable manufacturing overhead.

D) fixed manufacturing overhead.

E) variable manufacturing overhead and fixed manufacturing overhead.

A) direct materials.

B) direct labor.

C) variable manufacturing overhead.

D) fixed manufacturing overhead.

E) variable manufacturing overhead and fixed manufacturing overhead.

D

3

Absorption costing is inconsistent with CVP analysis.

True

4

Cost-volume-profit analysis and break-even calculations account for fixed manufacturing overhead as a lump sum.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

5

On an absorption-costing income statement, fixed overhead costs are period costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

6

The quality of conformance refers to how well a product is conceived or designed for its intended use.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

7

Total quality management or TQM refers to the broad set of management and control processes designed to focus the entire organization and all of its employees on providing products or services that do the best possible job of satisfying the customer.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

8

Variable manufacturing overhead becomes part of a unit's cost when variable costing is used.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

9

An analytical method that aims at achieving near-perfect results in a production process is known as the zero-defect perspective.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

10

All of the following are expensed under variable costing except:

A) variable manufacturing overhead.

B) fixed manufacturing overhead.

C) variable selling and administrative costs.

D) fixed selling and administrative costs.

E) variable selling and administrative costs and fixed selling and administrative costs.

A) variable manufacturing overhead.

B) fixed manufacturing overhead.

C) variable selling and administrative costs.

D) fixed selling and administrative costs.

E) variable selling and administrative costs and fixed selling and administrative costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

11

When discussing the costs of quality, the costs of determining whether defects exist are known as appraisal costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

12

Hid?den private environmental costs are those that are caused by environmental issues but have not been so identified by the accounting system.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

13

On a global scale, there are four primary environmental agreements addressing the atmosphere, hazardous substances, the marine environment, nature conservation, and nuclear power issues.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

14

Fixed manufacturing overhead is not inventoried under absorption costing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

15

On a variable-costing income state?ment, fixed overhead is not treated as a period cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

16

Income reported under absorption and variable costing can be reconciled by focusing on the effects of the five places where the two statements differ.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

17

Under variable costing, fixed manufacturing overhead is:

A) expensed immediately when incurred.

B) never expensed.

C) applied directly to Finished-Goods Inventory.

D) applied directly to Work-in-Process Inventory.

E) treated in the same manner as variable manufacturing overhead.

A) expensed immediately when incurred.

B) never expensed.

C) applied directly to Finished-Goods Inventory.

D) applied directly to Work-in-Process Inventory.

E) treated in the same manner as variable manufacturing overhead.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

18

On a variable-costing income state?ment, the cost of goods sold is measured at variable cost, which includes direct material, direct labor, and variable manufacturing overhead.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

19

Absorption costing is required for tax purposes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

20

When units sold exceed units produced, absorption-costing income will be lower than variable-costing income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

21

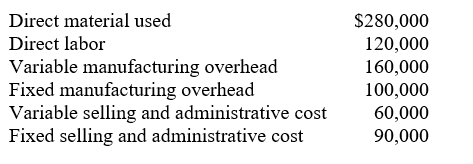

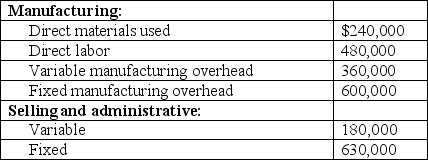

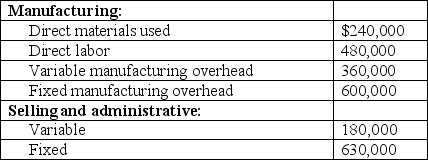

ProTech began business at the start of the current year. The company planned to produce 40,000 units, and actual production conformed to expectations. Sales totaled 37,000 units at $42 each. Costs incurred were:

-

If there were no variances, the company's variable-costing income would be:

A) $155,000.

B) $212,000.

C) $240,500.

D) $592,000.

E) None of the answers is correct.

-

If there were no variances, the company's variable-costing income would be:

A) $155,000.

B) $212,000.

C) $240,500.

D) $592,000.

E) None of the answers is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

22

Consider the following comments about absorption- and variable-costing income statements:

I) A variable-costing income statement discloses a firm's gross margin.

II) Cost of goods sold on an absorption-costing income statement includes fixed costs.

III) The amount of variable selling and administrative cost is the same on absorption- and variable-costing income statements.

Which of the above statements is (are) true?

A) I only.

B) II only.

C) I and II.

D) II and III.

E) I, II, and III.

I) A variable-costing income statement discloses a firm's gross margin.

II) Cost of goods sold on an absorption-costing income statement includes fixed costs.

III) The amount of variable selling and administrative cost is the same on absorption- and variable-costing income statements.

Which of the above statements is (are) true?

A) I only.

B) II only.

C) I and II.

D) II and III.

E) I, II, and III.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

23

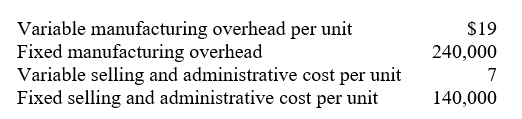

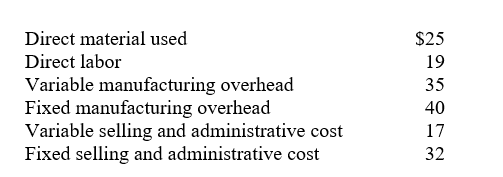

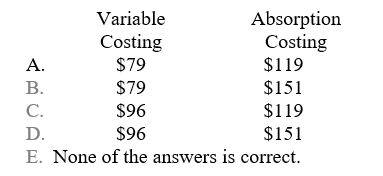

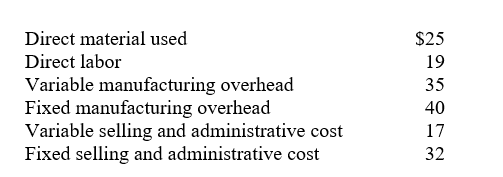

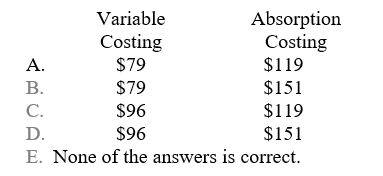

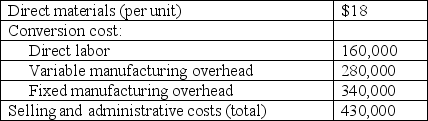

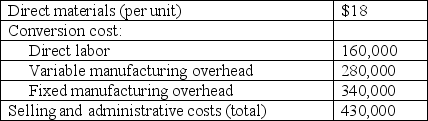

Falisari Corporation has computed the following unit costs for the year just ended:

Which of the following choices correctly depicts the per-unit cost of inventory under variable costing and absorption costing?

Which of the following choices correctly depicts the per-unit cost of inventory under variable costing and absorption costing?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

24

Consider the following comments about absorption- and variable-costing income statements:

I) A variable-costing income statement discloses a firm's contribution margin.

II) Cost of goods sold on an absorption-costing income statement includes fixed costs.

III) The amount of variable selling and administrative cost is the same on absorption- and variable-costing income statements.

Which of the above statements is (are) true?

A) I only.

B) II only.

C) I and II.

D) II and III.

E) I, II, and III.

I) A variable-costing income statement discloses a firm's contribution margin.

II) Cost of goods sold on an absorption-costing income statement includes fixed costs.

III) The amount of variable selling and administrative cost is the same on absorption- and variable-costing income statements.

Which of the above statements is (are) true?

A) I only.

B) II only.

C) I and II.

D) II and III.

E) I, II, and III.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

25

All of the following are inventoried under absorption costing except:

A) direct labor.

B) raw materials used in production.

C) utilities cost consumed in manufacturing.

D) sales commissions.

E) machine lubricant used in production.

A) direct labor.

B) raw materials used in production.

C) utilities cost consumed in manufacturing.

D) sales commissions.

E) machine lubricant used in production.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

26

Income reported under absorption costing and variable costing is:

A) always the same.

B) typically different.

C) always higher under absorption costing.

D) always higher under variable costing.

E) always the same or higher under absorption costing.

A) always the same.

B) typically different.

C) always higher under absorption costing.

D) always higher under variable costing.

E) always the same or higher under absorption costing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

27

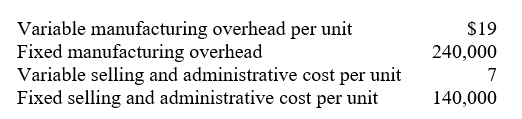

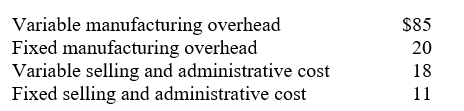

Montana Industries has computed the following unit costs for the year just ended:

Which of the following choices correctly depict amounts included in the per-unit cost of inventory under variable costing and absorption costing?

A) Variable, $85; absorption, $105.

B) Variable, $85; absorption, $116.

C) Variable, $103; absorption, $105.

D) Variable, $103; absorption, $116.

E) None of the answers is correct.

Which of the following choices correctly depict amounts included in the per-unit cost of inventory under variable costing and absorption costing?

A) Variable, $85; absorption, $105.

B) Variable, $85; absorption, $116.

C) Variable, $103; absorption, $105.

D) Variable, $103; absorption, $116.

E) None of the answers is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

28

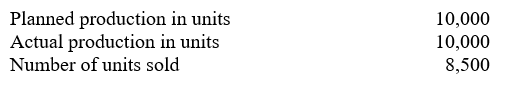

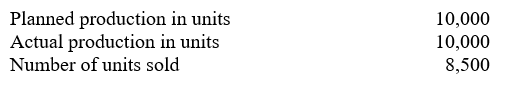

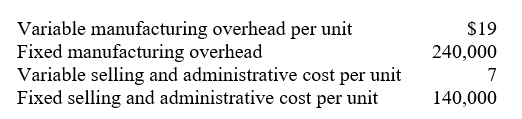

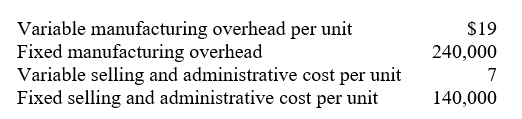

Use the following information to answer the following Questions

Favaz began business at the start of this year and had the following costs: variable manufacturing cost per unit, $9; fixed manufacturing costs, $60,000; variable selling and administrative costs per unit, $2; and fixed selling and administrative costs, $220,000. The company sells its units for $45 each. Additional data follow.

-The income (loss) under absorption costing is:

A) $(7,500).

B) $9,000.

C) $15,000.

D) $18,000.

E) None of the answers is correct.

Favaz began business at the start of this year and had the following costs: variable manufacturing cost per unit, $9; fixed manufacturing costs, $60,000; variable selling and administrative costs per unit, $2; and fixed selling and administrative costs, $220,000. The company sells its units for $45 each. Additional data follow.

-The income (loss) under absorption costing is:

A) $(7,500).

B) $9,000.

C) $15,000.

D) $18,000.

E) None of the answers is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

29

The underlying difference between absorption costing and variable costing lies in the treatment of:

A) direct labor.

B) variable manufacturing overhead.

C) fixed manufacturing overhead.

D) variable selling and administrative expenses.

E) fixed selling and administrative expenses.

A) direct labor.

B) variable manufacturing overhead.

C) fixed manufacturing overhead.

D) variable selling and administrative expenses.

E) fixed selling and administrative expenses.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

30

Variable costing of inventory and absorption costing of inventory is relevant for which of the following types of businesses?

A) Manufacturing firms.

B) Not-for-profit companies.

C) Governmental units.

D) Service firms.

E) All of the answers are correct.

A) Manufacturing firms.

B) Not-for-profit companies.

C) Governmental units.

D) Service firms.

E) All of the answers are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

31

Which of the following product-costing systems is/are required for tax purposes?

A) Absorption costing.

B) Variable costing.

C) Throughput costing.

D) Either absorption or variable costing.

E) Either absorption, variable costing, or throughput costing.

A) Absorption costing.

B) Variable costing.

C) Throughput costing.

D) Either absorption or variable costing.

E) Either absorption, variable costing, or throughput costing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

32

Which of the following statements pertain to both variable costing and absorption costing?

A) The income statement discloses the amount of gross margin generated during the reporting period.

B) Fixed selling and administrative expenses are treated in the same manner as fixed manufacturing overhead.

C) Both variable and absorption costing can be used for external financial reporting.

D) Variable selling costs are written-off as expenses of the accounting period.

E) Fixed manufacturing overhead is attached to each unit produced.

A) The income statement discloses the amount of gross margin generated during the reporting period.

B) Fixed selling and administrative expenses are treated in the same manner as fixed manufacturing overhead.

C) Both variable and absorption costing can be used for external financial reporting.

D) Variable selling costs are written-off as expenses of the accounting period.

E) Fixed manufacturing overhead is attached to each unit produced.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

33

ProTech began business at the start of the current year. The company planned to produce 40,000 units, and actual production conformed to expectations. Sales totaled 37,000 units at $42 each. Costs incurred were:

-

If there were no variances, the company's absorption-costing income would be:

A) $155,000.

B) $230,000.

C) $240,500.

D) $592,000.

E) None of the answers is correct.

-

If there were no variances, the company's absorption-costing income would be:

A) $155,000.

B) $230,000.

C) $240,500.

D) $592,000.

E) None of the answers is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

34

Use the following information to answer the following Questions

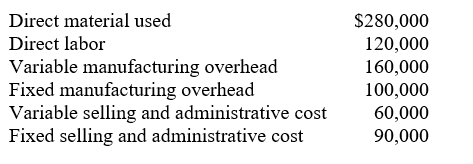

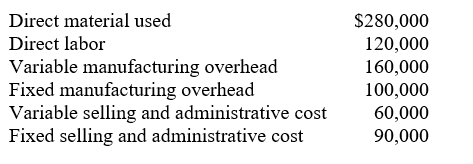

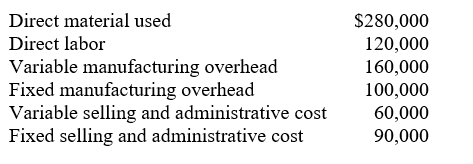

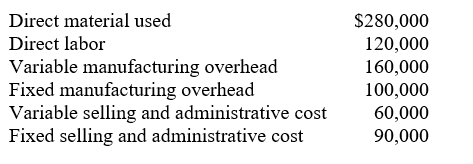

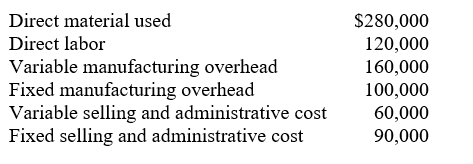

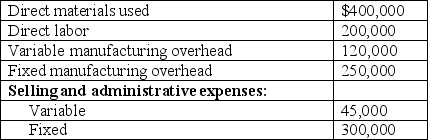

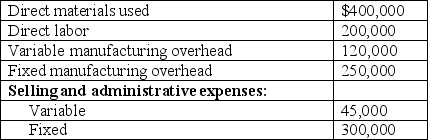

Fort Smith Technologies incurred the following costs during the past year when planned production and actual production each totaled 20,000 units:

-If Fort Smith uses absorption costing, the total inventoriable costs for the year would be:

A) $400,000.

B) $460,000.

C) $560,000.

D) $620,000.

E) $660,000.

Fort Smith Technologies incurred the following costs during the past year when planned production and actual production each totaled 20,000 units:

-If Fort Smith uses absorption costing, the total inventoriable costs for the year would be:

A) $400,000.

B) $460,000.

C) $560,000.

D) $620,000.

E) $660,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

35

Use the following information to answer the following Questions

Favaz began business at the start of this year and had the following costs: variable manufacturing cost per unit, $9; fixed manufacturing costs, $60,000; variable selling and administrative costs per unit, $2; and fixed selling and administrative costs, $220,000. The company sells its units for $45 each. Additional data follow.

-The income (loss) under variable costing is:

A) $(7,500).

B) $9,000.

C) $15,000.

D) $18,000.

E) None of the answers is correct.

Favaz began business at the start of this year and had the following costs: variable manufacturing cost per unit, $9; fixed manufacturing costs, $60,000; variable selling and administrative costs per unit, $2; and fixed selling and administrative costs, $220,000. The company sells its units for $45 each. Additional data follow.

-The income (loss) under variable costing is:

A) $(7,500).

B) $9,000.

C) $15,000.

D) $18,000.

E) None of the answers is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

36

Use the following information to answer the following Questions

Fort Smith Technologies incurred the following costs during the past year when planned production and actual production each totaled 20,000 units:

-Fort Smith's per-unit inventoriable cost under absorption costing is:

A) $9.50.

B) $25.00.

C) $28.00.

D) $33.00.

E) $40.50.

Fort Smith Technologies incurred the following costs during the past year when planned production and actual production each totaled 20,000 units:

-Fort Smith's per-unit inventoriable cost under absorption costing is:

A) $9.50.

B) $25.00.

C) $28.00.

D) $33.00.

E) $40.50.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

37

Which of the following statements pertain to variable costing?

A) This method must be used for external financial reporting.

B) Fixed manufacturing overhead is attached to each unit produced.

C) The income statement not does disclose a company's contribution margin.

D) Variable manufacturing overhead becomes part of a unit's cost.

E) None of the answers is correct.

A) This method must be used for external financial reporting.

B) Fixed manufacturing overhead is attached to each unit produced.

C) The income statement not does disclose a company's contribution margin.

D) Variable manufacturing overhead becomes part of a unit's cost.

E) None of the answers is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

38

Use the following information to answer the following Questions

Fort Smith Technologies incurred the following costs during the past year when planned production and actual production each totaled 20,000 units:

-If Fort Smith uses variable costing, the total inventoriable costs for the year would be:

A) $400,000.

B) $460,000.

C) $560,000.

D) $620,000.

E) $660,000.

Fort Smith Technologies incurred the following costs during the past year when planned production and actual production each totaled 20,000 units:

-If Fort Smith uses variable costing, the total inventoriable costs for the year would be:

A) $400,000.

B) $460,000.

C) $560,000.

D) $620,000.

E) $660,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

39

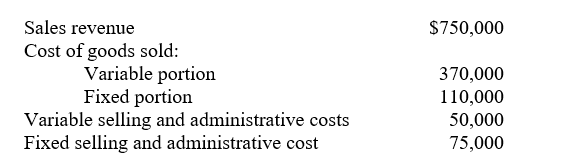

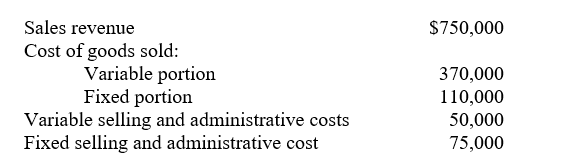

The following data relate to Lebeaux Corporation for the year just ended:

Which of the following statements is correct?

A) Lebeaux's variable-costing income statement would show a gross margin of $270,000.

B) Lebeaux's variable costing income statement would show a contribution margin of $330,000.

C) Lebeaux's absorption-costing income statement would show a contribution margin of $330,000.

D) Lebeaux's absorption costing income statement would show a gross margin of $330,000.

E) Lebeaux's absorption-costing income statement would show a gross margin of $145,000.

Which of the following statements is correct?

A) Lebeaux's variable-costing income statement would show a gross margin of $270,000.

B) Lebeaux's variable costing income statement would show a contribution margin of $330,000.

C) Lebeaux's absorption-costing income statement would show a contribution margin of $330,000.

D) Lebeaux's absorption costing income statement would show a gross margin of $330,000.

E) Lebeaux's absorption-costing income statement would show a gross margin of $145,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

40

Use the following information to answer the following Questions

Fort Smith Technologies incurred the following costs during the past year when planned production and actual production each totaled 20,000 units:

-Fort Smith's per-unit inventoriable cost under variable costing is:

A) $9.50.

B) $25.00.

C) $28.00.

D) $33.00.

E) $40.50.

Fort Smith Technologies incurred the following costs during the past year when planned production and actual production each totaled 20,000 units:

-Fort Smith's per-unit inventoriable cost under variable costing is:

A) $9.50.

B) $25.00.

C) $28.00.

D) $33.00.

E) $40.50.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

41

Razor Technologies reported $106,000 of income for the year by using variable costing. The company had no beginning inventory, planned and actual production of 50,000 units, and sales of 47,000 units. Standard variable manufacturing costs were $15 per unit, and total budgeted fixed manufacturing overhead was $150,000. If there were no variances, income under absorption costing would be:

A) $52,000.

B) $97,000.

C) $106,000.

D) $115,000.

E) $160,000.

A) $52,000.

B) $97,000.

C) $106,000.

D) $115,000.

E) $160,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

42

Consider the following statements about absorption costing and variable costing:

I) Variable costing is consistent with contribution reporting and cost-volume-profit analysis.

II) Absorption costing must be used for external financial reporting.

III) A number of companies use both absorption costing and variable costing.

Which of the above statements is (are) true?

A) I only.

B) II only.

C) III only.

D) I and II.

E) I, II, and III.

I) Variable costing is consistent with contribution reporting and cost-volume-profit analysis.

II) Absorption costing must be used for external financial reporting.

III) A number of companies use both absorption costing and variable costing.

Which of the above statements is (are) true?

A) I only.

B) II only.

C) III only.

D) I and II.

E) I, II, and III.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

43

Which of the following situations would cause variable-costing income to be higher than absorption-costing income?

A) Units sold equaled 39,000 and units produced equaled 42,000.

B) Units sold and units produced were both 42,000.

C) Units sold equaled 55,000 and units produced equaled 49,000.

D) Sales prices decreased by $7 per unit during the accounting period.

E) Selling expenses increased by 10% during the accounting period.

A) Units sold equaled 39,000 and units produced equaled 42,000.

B) Units sold and units produced were both 42,000.

C) Units sold equaled 55,000 and units produced equaled 49,000.

D) Sales prices decreased by $7 per unit during the accounting period.

E) Selling expenses increased by 10% during the accounting period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

44

Which of the following formulas can often reconcile the difference between absorption- and variable-costing income?

A) Change in inventory units * predetermined variable-overhead rate per unit.

B) Change in inventory units / predetermined variable-overhead rate per unit.

C) Change in inventory units* predetermined fixed-overhead rate per unit.

D) Change in inventory units / predetermined fixed-overhead rate per unit.

E) (Absorption-costing income - variable-costing income) * fixed-overhead rate per unit.

A) Change in inventory units * predetermined variable-overhead rate per unit.

B) Change in inventory units / predetermined variable-overhead rate per unit.

C) Change in inventory units* predetermined fixed-overhead rate per unit.

D) Change in inventory units / predetermined fixed-overhead rate per unit.

E) (Absorption-costing income - variable-costing income) * fixed-overhead rate per unit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

45

Consider the following statements about absorption costing and variable costing:

I) Variable costing is consistent with contribution reporting and cost-volume-profit analysis.

II) Variable costing must be used for external financial reporting.

III) A number of companies use both absorption costing and variable costing.

Which of the above statements is (are) true?

A) I only.

B) II only.

C) III only.

D) I and II.

E) I and III.

I) Variable costing is consistent with contribution reporting and cost-volume-profit analysis.

II) Variable costing must be used for external financial reporting.

III) A number of companies use both absorption costing and variable costing.

Which of the above statements is (are) true?

A) I only.

B) II only.

C) III only.

D) I and II.

E) I and III.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

46

Costs of determining whether defects exist are called:

A) appraisal costs.

B) external failure costs.

C) internal failure costs.

D) prevention costs.

E) defects costs.

A) appraisal costs.

B) external failure costs.

C) internal failure costs.

D) prevention costs.

E) defects costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

47

Foxtrot reported $65,000 of income for the year by using absorption costing. The company had no beginning inventory, planned and actual production of 20,000 units, and sales of 18,000 units. Standard variable manufacturing costs were $20 per unit, and total budgeted fixed manufacturing overhead was $100,000. If there were no variances, income under variable costing would be:

A) $15,000.

B) $55,000.

C) $65,000.

D) $75,000.

E) $115,000.

A) $15,000.

B) $55,000.

C) $65,000.

D) $75,000.

E) $115,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

48

Which of the following conditions would cause absorption-costing income to be higher than variable-costing income?

A) Units sold exceeded units produced.

B) Units sold equaled units produced.

C) Units sold were less than units produced.

D) Sales prices decreased.

E) Selling expenses increased.

A) Units sold exceeded units produced.

B) Units sold equaled units produced.

C) Units sold were less than units produced.

D) Sales prices decreased.

E) Selling expenses increased.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

49

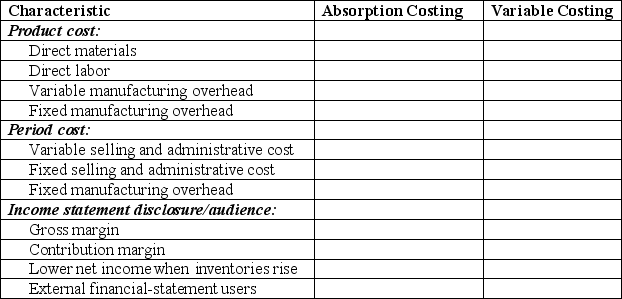

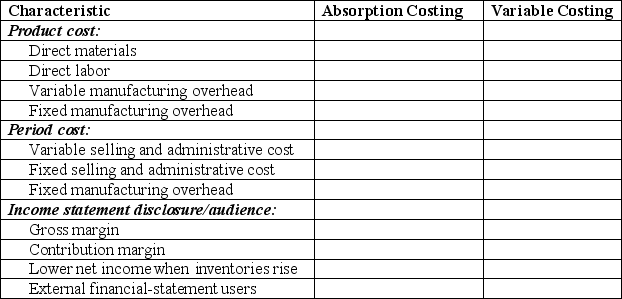

The table that follows denotes selected characteristics of absorption costing and/or variable costing.

Required:

Evaluate each product-cost, period-cost, and income-statement/disclosure characteristic and determine whether it relates to absorption costing, variable costing, or both methods. Place an "X" in the proper column.

Required:

Evaluate each product-cost, period-cost, and income-statement/disclosure characteristic and determine whether it relates to absorption costing, variable costing, or both methods. Place an "X" in the proper column.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

50

Consider the statements that follow.

1. Variable selling costs are expensed when incurred.

2. The income statement discloses a company's contribution margin.

3. Fixed manufacturing overhead is attached to each unit produced.

4. Direct labor becomes part of a unit's cost.

5. Sales revenue minus cost of goods sold equals contribution margin.

6. This method must be used for external financial reporting.

7. Fixed selling and administrative expenses are treated in the same manner as fixed manufacturing overhead.

8. This method is sometimes called full costing.

9. This method requires the calculation of a fixed manufacturing cost per unit.

Required:

A. Relate only to absorption costing.

B. Relate only to variable costing.

C. Relate to both absorption costing and variable costing.

D. Relate to neither absorption costing nor variable costing.

1. Variable selling costs are expensed when incurred.

2. The income statement discloses a company's contribution margin.

3. Fixed manufacturing overhead is attached to each unit produced.

4. Direct labor becomes part of a unit's cost.

5. Sales revenue minus cost of goods sold equals contribution margin.

6. This method must be used for external financial reporting.

7. Fixed selling and administrative expenses are treated in the same manner as fixed manufacturing overhead.

8. This method is sometimes called full costing.

9. This method requires the calculation of a fixed manufacturing cost per unit.

Required:

A. Relate only to absorption costing.

B. Relate only to variable costing.

C. Relate to both absorption costing and variable costing.

D. Relate to neither absorption costing nor variable costing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

51

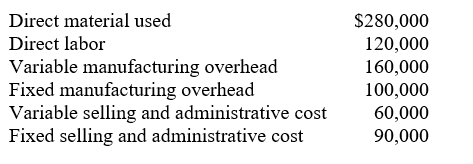

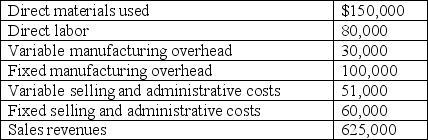

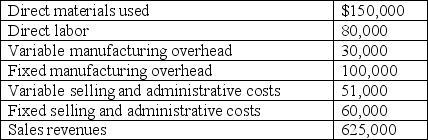

Information taken from Horner Corporation's May accounting records follows.

Required:

A. Assuming the use of variable costing, compute the inventoriable costs for the month.

B. Compute the month's inventoriable costs by using absorption costing.

C. Assume that anticipated and actual production totaled 20,000 units, and that 18,000 units were sold during May. Determine the amount of fixed manufacturing overhead and fixed selling and administrative costs that would be expensed for the month under (1) variable costing and (2) absorption costing.

D. Assume the same data as in requirement "C." Compute the contribution margin that would be reported on a variable-costing income statement.

Required:

A. Assuming the use of variable costing, compute the inventoriable costs for the month.

B. Compute the month's inventoriable costs by using absorption costing.

C. Assume that anticipated and actual production totaled 20,000 units, and that 18,000 units were sold during May. Determine the amount of fixed manufacturing overhead and fixed selling and administrative costs that would be expensed for the month under (1) variable costing and (2) absorption costing.

D. Assume the same data as in requirement "C." Compute the contribution margin that would be reported on a variable-costing income statement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

52

Which of the following situations would cause variable-costing income to be lower than absorption-costing income?

A) Units sold equaled 39,000 and units produced equaled 42,000.

B) Units sold and units produced were both 42,000.

C) Units sold equaled 55,000 and units produced equaled 49,000.

D) Sales prices decreased by $7 per unit during the accounting period.

E) Selling expenses increased by 10% during the accounting period.

A) Units sold equaled 39,000 and units produced equaled 42,000.

B) Units sold and units produced were both 42,000.

C) Units sold equaled 55,000 and units produced equaled 49,000.

D) Sales prices decreased by $7 per unit during the accounting period.

E) Selling expenses increased by 10% during the accounting period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

53

The optimum level of product quality is where:

A) external failure costs are at a minimum.

B) total quality costs are at a minimum.

C) prevention costs are at a minimum.

D) internal failure costs are at a minimum.

E) all of the answers are correct.

A) external failure costs are at a minimum.

B) total quality costs are at a minimum.

C) prevention costs are at a minimum.

D) internal failure costs are at a minimum.

E) all of the answers are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

54

For external-reporting purposes, generally accepted accounting principles require that net income be based on:

A) absorption costing.

B) variable costing.

C) direct costing.

D) semivariable costing.

E) activity-based costing.

A) absorption costing.

B) variable costing.

C) direct costing.

D) semivariable costing.

E) activity-based costing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

55

Which of the following conditions would cause absorption-costing income to be lower than variable-costing income?

A) Units sold exceeded units produced.

B) Units sold equaled units produced.

C) Units sold were less than units produced.

D) Sales prices decreased.

E) Selling expenses increased.

A) Units sold exceeded units produced.

B) Units sold equaled units produced.

C) Units sold were less than units produced.

D) Sales prices decreased.

E) Selling expenses increased.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

56

Consider the following statements about absorption- and variable-costing income:

I) Yearly income reported under absorption costing will differ from income reported under variable costing if production and sales volumes differ.

II) In the long-run, total income reported under absorption costing will often be close to that reported under variable costing.

III) Differences in income under absorption and variable costing can often be reconciled by multiplying the change in inventory (in units) by the variable manufacturing overhead cost per unit.

Which of the above statements is (are) true?

A) I only.

B) II only.

C) III only.

D) I and II.

E) II and III.

I) Yearly income reported under absorption costing will differ from income reported under variable costing if production and sales volumes differ.

II) In the long-run, total income reported under absorption costing will often be close to that reported under variable costing.

III) Differences in income under absorption and variable costing can often be reconciled by multiplying the change in inventory (in units) by the variable manufacturing overhead cost per unit.

Which of the above statements is (are) true?

A) I only.

B) II only.

C) III only.

D) I and II.

E) II and III.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

57

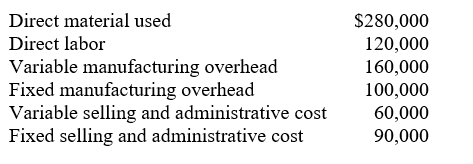

Vero, Inc. began operations at the start of the current year, having a production target of 60,000 units. Actual production totaled 60,000 units, and the company sold 95% of its manufacturing output at $50 per unit. The following costs were incurred:

Required:

A. Assuming the use of variable costing, compute the cost of Vero's ending finished-goods inventory.

B. Compute the company's contribution margin. Would Vero disclose the contribution margin on a variable-costing income statement or an absorption-costing income statement?

C. Assuming the use of absorption costing, how much fixed selling and administrative cost would Vero include in the ending finished-goods inventory?

D. Compute the company's gross margin.

Required:

A. Assuming the use of variable costing, compute the cost of Vero's ending finished-goods inventory.

B. Compute the company's contribution margin. Would Vero disclose the contribution margin on a variable-costing income statement or an absorption-costing income statement?

C. Assuming the use of absorption costing, how much fixed selling and administrative cost would Vero include in the ending finished-goods inventory?

D. Compute the company's gross margin.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

58

Chu Enterprise's inventory increased during the year. On the basis of this information, income reported under absorption costing:

A) will be the same as that reported under variable costing.

B) will be higher than that reported under variable costing.

C) will be lower than that reported under variable costing.

D) will differ from that reported under variable costing, the direction of which cannot be determined from the information given.

E) will be less than that reported in the previous period.

A) will be the same as that reported under variable costing.

B) will be higher than that reported under variable costing.

C) will be lower than that reported under variable costing.

D) will differ from that reported under variable costing, the direction of which cannot be determined from the information given.

E) will be less than that reported in the previous period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

59

Which of the following statements about environmental costs is false?

A) Remediation costs include offsite, but not onsite, remediation costs.

B) Abatement costs include costs to reduce or eliminate pollution.

C) Monitoring costs include the costs of monitoring the regulatory environment as well as monitoring the production process to determine if pollution is being generated.

D) Private environmental costs are those borne by a company or individual.

E) Social environmental costs are those borne by the public at large.

A) Remediation costs include offsite, but not onsite, remediation costs.

B) Abatement costs include costs to reduce or eliminate pollution.

C) Monitoring costs include the costs of monitoring the regulatory environment as well as monitoring the production process to determine if pollution is being generated.

D) Private environmental costs are those borne by a company or individual.

E) Social environmental costs are those borne by the public at large.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

60

Which of the following is not a type of quality cost?

A) External failure costs.

B) Internal failure costs.

C) All of the answers are correct.

D) Prevention costs.

E) Appraisal costs.

A) External failure costs.

B) Internal failure costs.

C) All of the answers are correct.

D) Prevention costs.

E) Appraisal costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

61

List and define four types of product quality costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

62

Carolina Corporation, which uses throughput costing, began operations at the start of the current year. Planned and actual production equaled 20,000 units, and sales totaled 17,500 units at $95 per unit. Cost data for the year were as follows:

Required:

A. Compute the company's total cost for the year.

B. How much of this cost would be held in year-end inventory under (1) absorption costing and (2) variable costing?

C. How much of the company's total cost for the year would appear on the period's income statement under (1) absorption costing and (2) variable costing?

Required:

A. Compute the company's total cost for the year.

B. How much of this cost would be held in year-end inventory under (1) absorption costing and (2) variable costing?

C. How much of the company's total cost for the year would appear on the period's income statement under (1) absorption costing and (2) variable costing?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

63

The following costs were incurred by Home Master, a company that makes washing machines.

a. The company requires each machine to complete 5 spin cycles before it is boxed and shipped.

b. The company replaced switches on 10% of machines sold last year.

c. Cost of rewiring the machines that failed the 5-spin cycle test.

d. The company sent its machine inspectors to a two-week training program on the new model that is to be released this year. It is hoped that this will lower the defect rate on the new model.

Required: Classify each of these costs as a prevention, appraisal, internal failure, or external failure cost.

a. The company requires each machine to complete 5 spin cycles before it is boxed and shipped.

b. The company replaced switches on 10% of machines sold last year.

c. Cost of rewiring the machines that failed the 5-spin cycle test.

d. The company sent its machine inspectors to a two-week training program on the new model that is to be released this year. It is hoped that this will lower the defect rate on the new model.

Required: Classify each of these costs as a prevention, appraisal, internal failure, or external failure cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

64

What is a product's grade, as a characteristic of quality? Give a service industry example.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

65

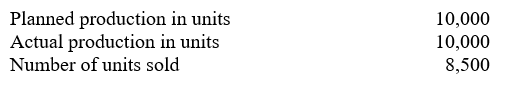

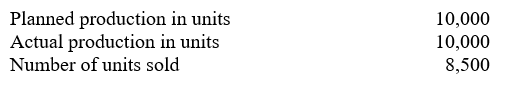

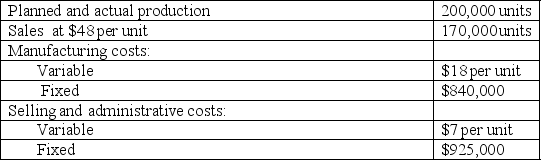

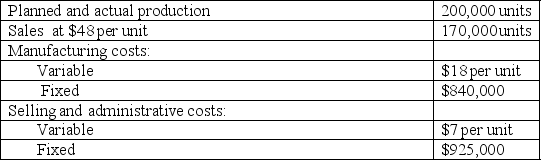

The following data relate to Santa Mia, Inc., a new company:

There were no variances during the period.

Required:

A. Determine the number of units in the ending finished-goods inventory.

B. Calculate the cost of the ending finished-goods inventory under (1) variable costing and (2) absorption costing.

C. Determine the company's variable-costing income.

D. Determine the company's absorption-costing income.

There were no variances during the period.

Required:

A. Determine the number of units in the ending finished-goods inventory.

B. Calculate the cost of the ending finished-goods inventory under (1) variable costing and (2) absorption costing.

C. Determine the company's variable-costing income.

D. Determine the company's absorption-costing income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

66

Craig Company has per-unit fixed and variable manufacturing costs of $40 and $15, respectively. Variable selling and administrative costs are $9 per unit. Consider the two independent cases that follow for the firm.

Case A: Variable-costing income, $110,000; sales, 6,000 units; production, 6,000 units

Case B: Variable-costing income, $178,000; sales, 7,500 units; production, 7,100 units

Required:

A. From a product-costing perspective, what is the basic difference between absorption costing and variable costing?

B. Compute Craig's absorption-costing income in Case

C. Compute Craig's absorption-costing income in Case

Case A: Variable-costing income, $110,000; sales, 6,000 units; production, 6,000 units

Case B: Variable-costing income, $178,000; sales, 7,500 units; production, 7,100 units

Required:

A. From a product-costing perspective, what is the basic difference between absorption costing and variable costing?

B. Compute Craig's absorption-costing income in Case

C. Compute Craig's absorption-costing income in Case

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

67

Dalton Corporation has fixed manufacturing cost of $12 per unit. Consider the three independent cases that follow.

Case A: Absorption- and variable costing income each totaled $240,000 in a period when the firm produced 18,000 units.

Case B: Absorption-costing income totaled $320,000 in a period when finished-goods inventory levels rose by 7,000 units.

Case C: Absorption-costing income and variable-costing income respectively totaled $220,000 and $250,000 in a period when the beginning finished-goods inventory was 14,000 units.

Required:

A. In Case A, how many units were sold during the period?

B. In Case B, how much income would Dalton report under variable costing?

C. In Case C, how many units were in the ending finished-goods inventory?

Case A: Absorption- and variable costing income each totaled $240,000 in a period when the firm produced 18,000 units.

Case B: Absorption-costing income totaled $320,000 in a period when finished-goods inventory levels rose by 7,000 units.

Case C: Absorption-costing income and variable-costing income respectively totaled $220,000 and $250,000 in a period when the beginning finished-goods inventory was 14,000 units.

Required:

A. In Case A, how many units were sold during the period?

B. In Case B, how much income would Dalton report under variable costing?

C. In Case C, how many units were in the ending finished-goods inventory?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

68

Absorption and variable costing are two different methods of measuring income and costing inventory.

Required:

A. Product costs are defined as costs associated with the manufacturing process. How does the operational definition of product cost differ between absorption costing and variable costing?

B. An absorption-costing income statement will report gross profit or gross margin whereas a variable-costing income statement will report contribution margin. What is the difference between these terms?

Required:

A. Product costs are defined as costs associated with the manufacturing process. How does the operational definition of product cost differ between absorption costing and variable costing?

B. An absorption-costing income statement will report gross profit or gross margin whereas a variable-costing income statement will report contribution margin. What is the difference between these terms?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

69

The difference in income between absorption and variable costing can be explained by the change in finished-goods inventory (in units) multiplied by the standard fixed manufacturing overhead rate.

Required:

Explain why this calculation accounts for the difference noted.

Required:

Explain why this calculation accounts for the difference noted.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

70

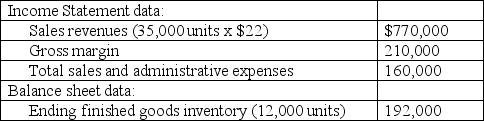

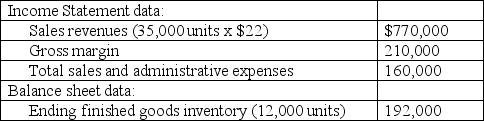

Carrington, Inc. began business at the start of the current year and maintains its accounting records on an absorption-cost basis. The following selected information appeared on the company's income statement and end-of-year balance sheet:

Carrington achieved its planned production level for the year. The company's fixed manufacturing overhead totaled $141,000, and the firm paid a 10% commission based on gross sales dollars to its sales force.

Required:

A. How many units did Carrington plan to produce during the year?

B. How much fixed manufacturing overhead did the company apply to each unit produced?

C. Compute Carrington's cost of goods sold.

D. How much variable cost did the company attach to each unit manufactured?

Carrington achieved its planned production level for the year. The company's fixed manufacturing overhead totaled $141,000, and the firm paid a 10% commission based on gross sales dollars to its sales force.

Required:

A. How many units did Carrington plan to produce during the year?

B. How much fixed manufacturing overhead did the company apply to each unit produced?

C. Compute Carrington's cost of goods sold.

D. How much variable cost did the company attach to each unit manufactured?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

71

What is the difference between a product's quality of design and its quality of conformance?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

72

Take Two manufactures electrical switches for a variety of purposes. The following costs related to maintaining product quality were incurred in April.

Required:

Prepare a quality-cost report.

Required:

Prepare a quality-cost report.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

73

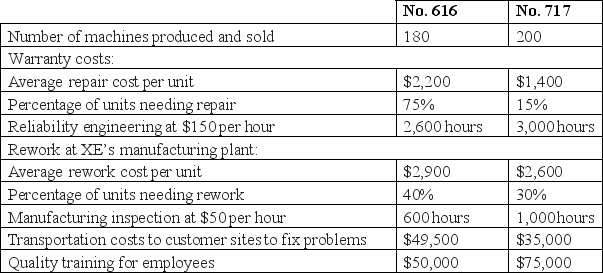

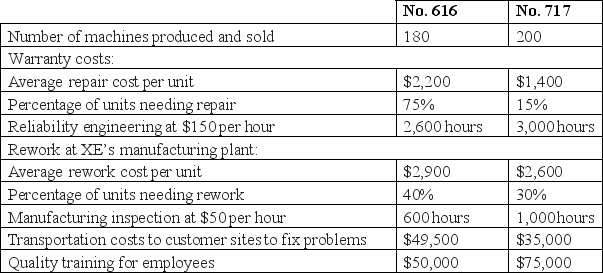

Xenon Enterprises (XE) produces two extruding machines that are popular with food processors: No. 616 and No. 717. Machine No. 616 has an average selling price of $160,000, whereas No. 717 typically sells for approximately $155,000. The company is extremely focused on quality and has provided the following information:

Required:

a. Classify the preceding costs as prevention, appraisal, internal failure, or external failure.

b. Using the classifications in requirement (1), compute XE’s quality costs for machine No. 616 in dollars and as a percentage of sales revenues. Also calculate prevention, appraisal, internal failure, and external failure costs as a percentage of total quality costs.

c. Repeat requirement (b) for machine No. 717.

d. Comment on your findings, noting whether the company is “investing” its quality expenditures differently for the two machines.

e. Quality costs can be classified as observable or hidden. What are hidden quality costs, and how do these costs differ from observable costs?

Required:

a. Classify the preceding costs as prevention, appraisal, internal failure, or external failure.

b. Using the classifications in requirement (1), compute XE’s quality costs for machine No. 616 in dollars and as a percentage of sales revenues. Also calculate prevention, appraisal, internal failure, and external failure costs as a percentage of total quality costs.

c. Repeat requirement (b) for machine No. 717.

d. Comment on your findings, noting whether the company is “investing” its quality expenditures differently for the two machines.

e. Quality costs can be classified as observable or hidden. What are hidden quality costs, and how do these costs differ from observable costs?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

74

The following data relate to Jupiter Company, a new corporation, during a period when the firm produced and sold 100,000 units and 90,000 units, respectively:

The company met its original planned production target of 100,000 units. There were no variances during the period, and the firm's selling price is $15 per unit.

Required:

A. What is the cost of Jupiter's end-of-period finished-goods inventory under the variable-costing method?

B. Calculate the company's variable-costing income.

C. Calculate the company's absorption-costing income.

The company met its original planned production target of 100,000 units. There were no variances during the period, and the firm's selling price is $15 per unit.

Required:

A. What is the cost of Jupiter's end-of-period finished-goods inventory under the variable-costing method?

B. Calculate the company's variable-costing income.

C. Calculate the company's absorption-costing income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck