Deck 10: Foreign Currency Transactions

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

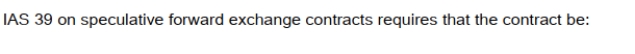

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/63

العب

ملء الشاشة (f)

Deck 10: Foreign Currency Transactions

1

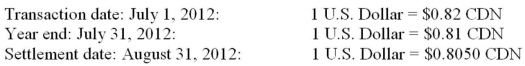

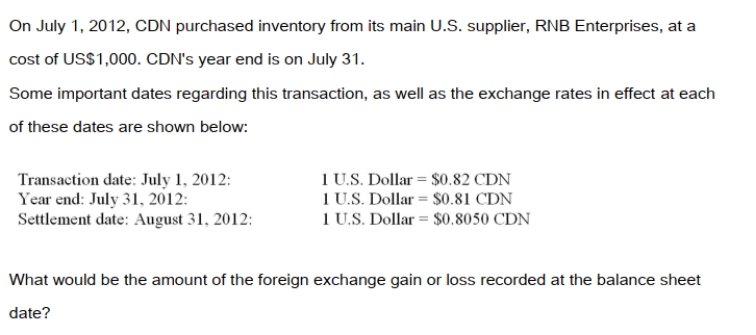

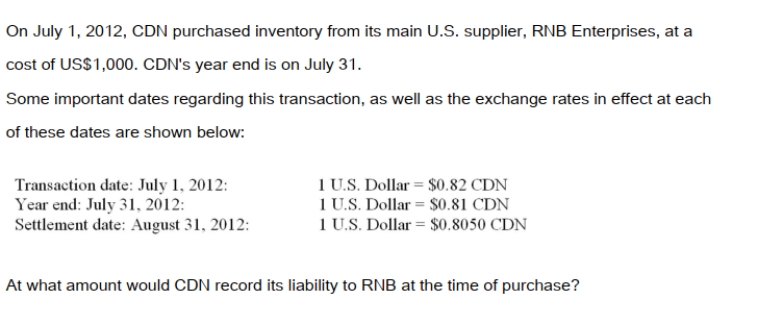

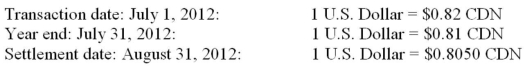

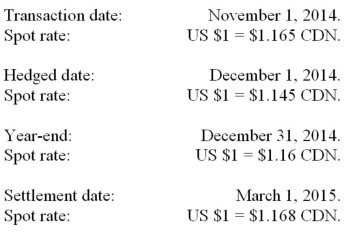

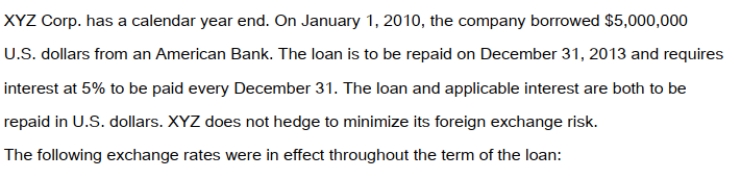

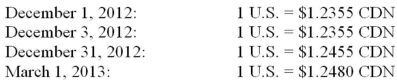

On July 1, 2012, CDN purchased inventory from its main U.S. supplier, RNB Enterprises, at a cost of US$1,000. CDN's year end is on July 31. Some important dates regarding this transaction, as well as the exchange rates in effect at each of these dates are shown below:  What was the cost to CDN of the amount paid to RNB on the settlement date?

What was the cost to CDN of the amount paid to RNB on the settlement date?

A) $805 CDN.

B) $810 CDN.

C) $820 CDN.

D) $820 US.

What was the cost to CDN of the amount paid to RNB on the settlement date?

What was the cost to CDN of the amount paid to RNB on the settlement date?A) $805 CDN.

B) $810 CDN.

C) $820 CDN.

D) $820 US.

A

2

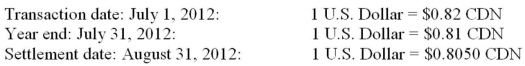

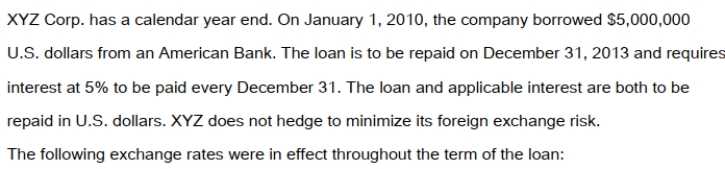

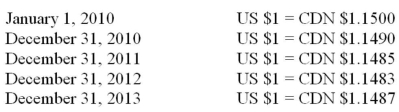

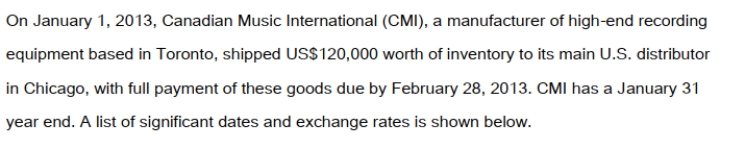

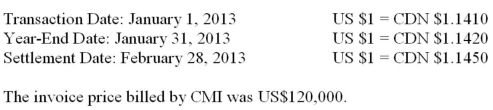

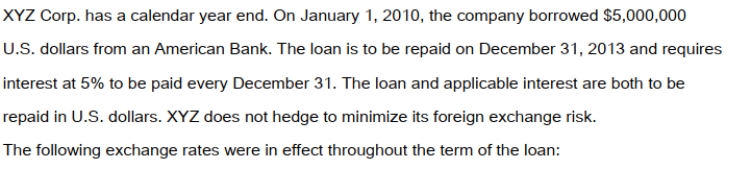

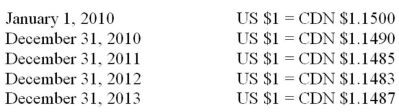

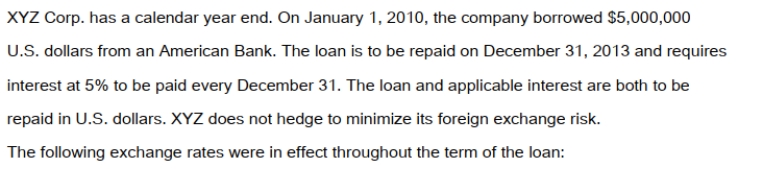

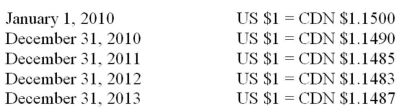

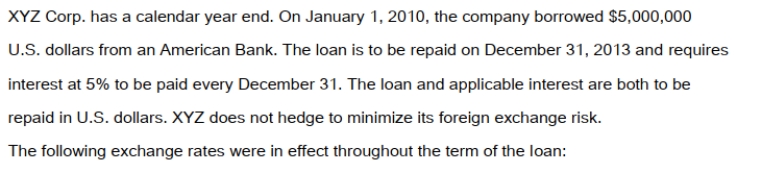

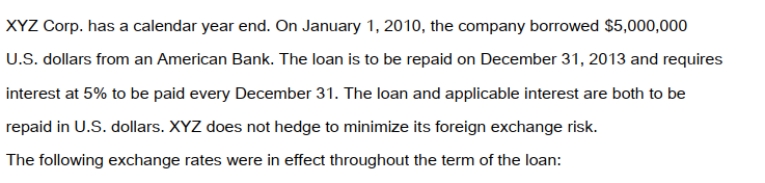

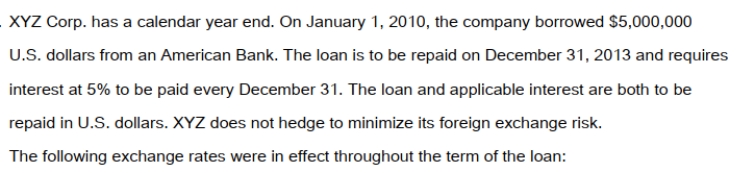

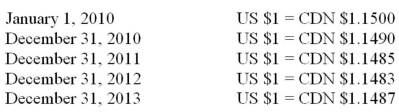

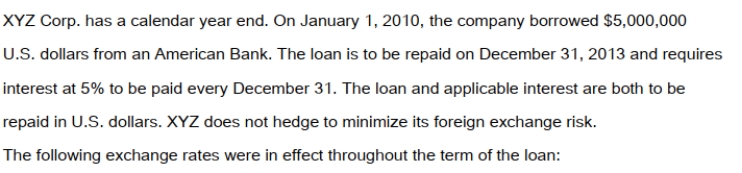

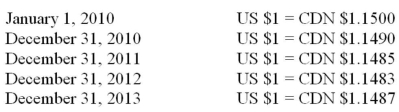

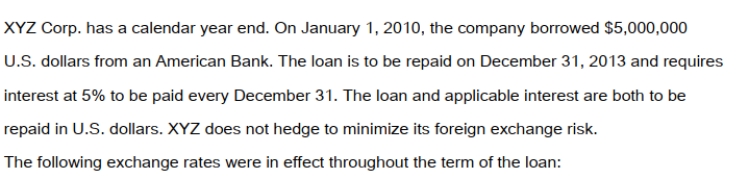

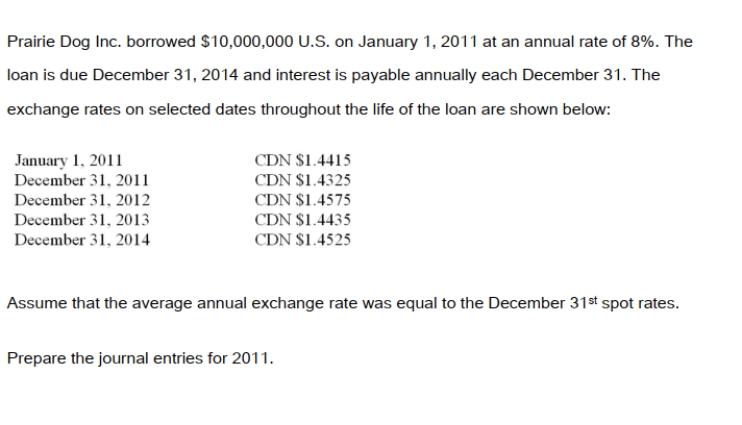

The average rates in effect for 2010 and 2011 were as follows:

The average rates in effect for 2010 and 2011 were as follows:  What is the amount of interest paid (in Canadian Dollars) during 2010?

What is the amount of interest paid (in Canadian Dollars) during 2010?A) $250,000.

B) $287,250.

C) $287,325.

D) $372,500.

B

3

A) A $15 exchange loss.

B) A $10 exchange loss.

C) Nil.

D) A $10 exchange gain.

D

4

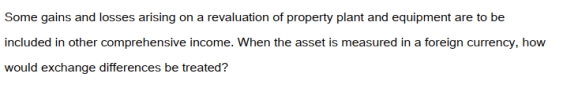

A) As an item to be included in income or loss for the year.

B) As a reduction or increase in the carry cost of the asset.

C) As a contra account to be fully disclosed and to show the impact of foreign exchange differences.

D) The differences should be included in the calculation of other comprehensive income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

5

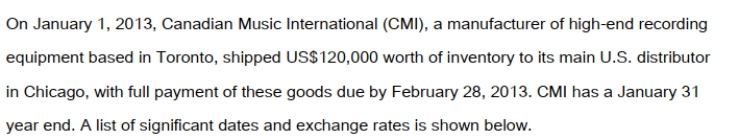

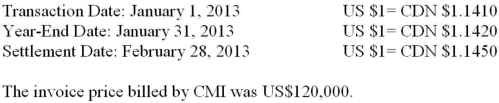

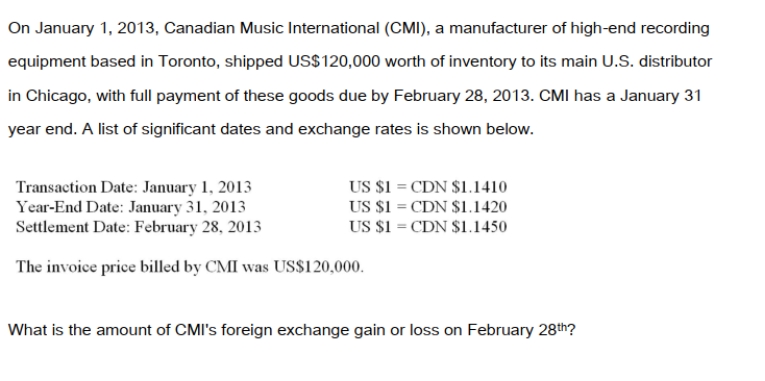

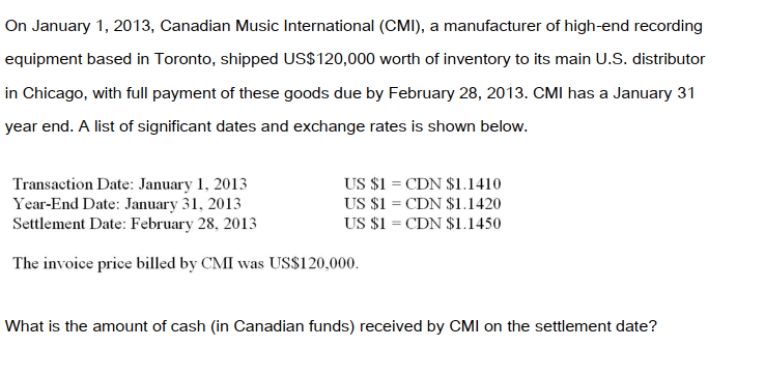

At what value would CMI record the initial sale to its American distributor?

At what value would CMI record the initial sale to its American distributor?A) $105,171 CDN

B) $120,000 U.S.

C) $120,000 CDN.

D) $136,920 CDN.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

6

A) $805 CDN.

B) $810 CDN.

C) $820 CDN.

D) $820 US.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

7

The rate charged by commercial banks for the purchase of any foreign currency (in Canadian dollars) on any given day would be based on which of the following?

A) The average rate.

B) The closing rate.

C) The spot rate.

D) The forward rate.

A) The average rate.

B) The closing rate.

C) The spot rate.

D) The forward rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

8

A) $360 loss.

B) $120 gain.

C) $360 gain.

D) $480 gain.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

9

A) All individual transactions must be translated into the functional currency of the reporting entity.

B) All individual transactions must be converted into the local currency of the reporting entity.

C) All individual transactions are to be reported into the currency of the jurisdiction where the majority of shareholders reside.

D) All individual transactions may be reported into the currency of the country where the corporation does the majority of its business.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

10

Which of the following is NOT currently a cause of fluctuation in foreign exchange rates?

A) Inflation rates.

B) The pegging of a currency to the American (U.S.) dollar.

C) Interest rates.

D) Trade surpluses and deficits.

A) Inflation rates.

B) The pegging of a currency to the American (U.S.) dollar.

C) Interest rates.

D) Trade surpluses and deficits.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

11

A) A $15 exchange loss.

B) A $10 exchange loss.

C) A $5 exchange gain.

D) A $10 exchange gain.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

12

A) $136,920.

B) $137,040.

C) $137,400.

D) $137,880.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

13

Which of the following statements is correct?

A) The historical rate is the exchange rate on the date of the transaction and the closing rate is the exchange rate at the end of the reporting period.

B) The historical rate is the exchange rate on the date of the transaction and the closing rate is the rate on which any hedge transactions mature.

C) The spot rate is the rate on the date of the transaction and the relevant forward rate is the exchange rate used at the end of the reporting period.

D) None of the above are correct.

A) The historical rate is the exchange rate on the date of the transaction and the closing rate is the exchange rate at the end of the reporting period.

B) The historical rate is the exchange rate on the date of the transaction and the closing rate is the rate on which any hedge transactions mature.

C) The spot rate is the rate on the date of the transaction and the relevant forward rate is the exchange rate used at the end of the reporting period.

D) None of the above are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

14

Which of the following statements is correct?

A) In Canada, the cost of a unit of foreign currency in Canadian dollars is a direct quotation, while the cost in that foreign currency of purchasing one Canadian dollar is referred to as an indirect quotation.

B) In Canada, the cost of a unit of foreign currency in Canadian dollars is an indirect quotation, while the cost in that foreign currency of purchasing one Canadian dollar is referred to as a direct quotation.

C) In Canada, the cost of a unit of foreign currency in Canadian dollars is a direct quotation, and the cost in that foreign currency of purchasing one Canadian dollar is also referred to as a direct quotation.

D) In Canada, the cost of a unit of foreign currency in Canadian dollars is an indirect quotation, while the cost in that foreign currency of purchasing one Canadian dollar is also referred to as an indirect quotation.

A) In Canada, the cost of a unit of foreign currency in Canadian dollars is a direct quotation, while the cost in that foreign currency of purchasing one Canadian dollar is referred to as an indirect quotation.

B) In Canada, the cost of a unit of foreign currency in Canadian dollars is an indirect quotation, while the cost in that foreign currency of purchasing one Canadian dollar is referred to as a direct quotation.

C) In Canada, the cost of a unit of foreign currency in Canadian dollars is a direct quotation, and the cost in that foreign currency of purchasing one Canadian dollar is also referred to as a direct quotation.

D) In Canada, the cost of a unit of foreign currency in Canadian dollars is an indirect quotation, while the cost in that foreign currency of purchasing one Canadian dollar is also referred to as an indirect quotation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

15

At the balance sheet date, monetary items denominated in a foreign currency should be adjusted to reflect the exchange rate in effect at the:

A) time of settlement of the contract.

B) time the sale was recorded.

C) balance sheet date.

D) time of payment.

A) time of settlement of the contract.

B) time the sale was recorded.

C) balance sheet date.

D) time of payment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

16

What is the amount of CMI's foreign exchange gain or loss at year-end?

What is the amount of CMI's foreign exchange gain or loss at year-end?A) $120 loss.

B) Nil.

C) $120 gain.

D) $480 gain.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

17

The average rates in effect for 2010 and 2011 were as follows:

The average rates in effect for 2010 and 2011 were as follows:  At what amount (in Canadian Dollars) would XYZ record its initial Loan Liability on January 1, 2010?

At what amount (in Canadian Dollars) would XYZ record its initial Loan Liability on January 1, 2010?A) $5,471,500.

B) $5,476,500.

C) $5,747,500.

D) $5,750,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

18

A) $360 loss.

B) $120 gain.

C) $360 gain.

D) $480 gain.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

19

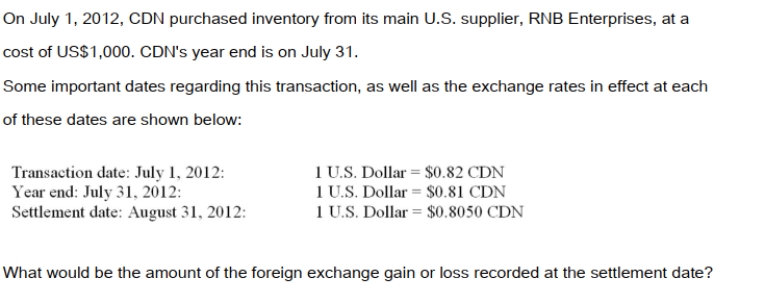

On July 1, 2012, CDN purchased inventory from its main U.S. supplier, RNB Enterprises, at a cost of US$1,000. CDN's year end is on July 31. Some important dates regarding this transaction, as well as the exchange rates in effect at each of these dates are shown below:  At what amount would CDN record its inventory purchase from RNB at the time of purchase?

At what amount would CDN record its inventory purchase from RNB at the time of purchase?

A) $805 CDN.

B) $810 CDN.

C) $820 CDN.

D) $820 US.

At what amount would CDN record its inventory purchase from RNB at the time of purchase?

At what amount would CDN record its inventory purchase from RNB at the time of purchase?A) $805 CDN.

B) $810 CDN.

C) $820 CDN.

D) $820 US.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

20

The average rates in effect for 2010 and 2011 were as follows:

The average rates in effect for 2010 and 2011 were as follows:  What is the amount of interest expense (in Canadian Dollars) recorded for 2010?

What is the amount of interest expense (in Canadian Dollars) recorded for 2010?A) $250,000.

B) $287,250.

C) $287,325.

D) $372,500.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

21

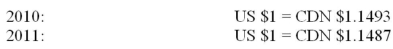

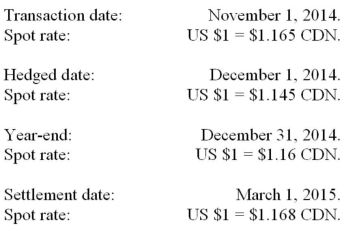

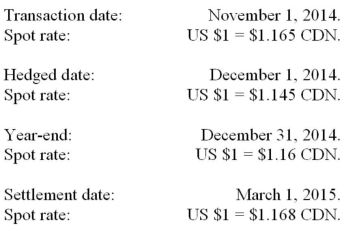

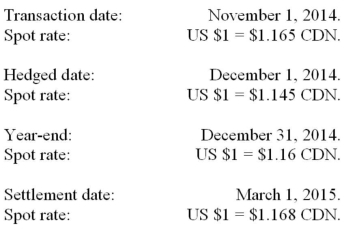

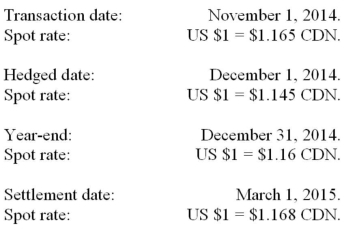

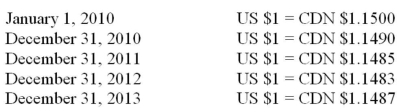

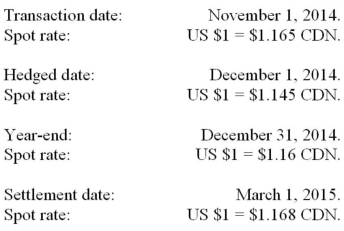

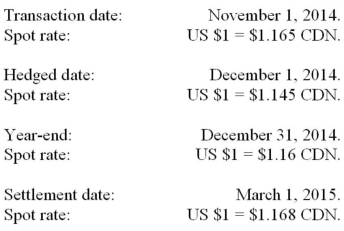

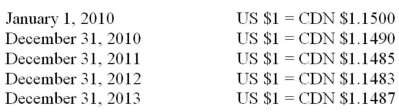

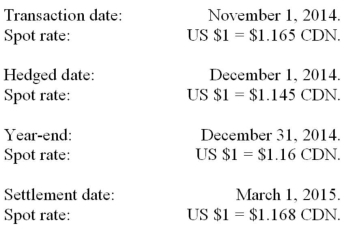

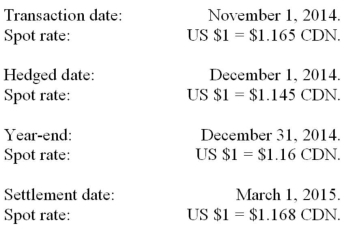

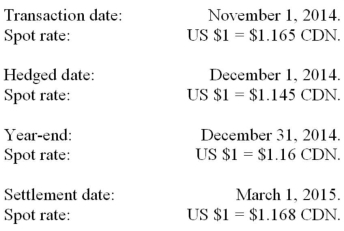

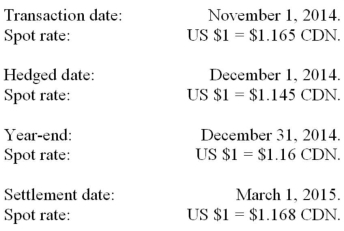

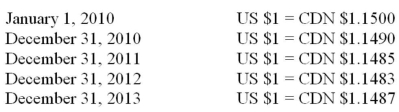

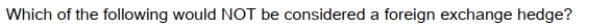

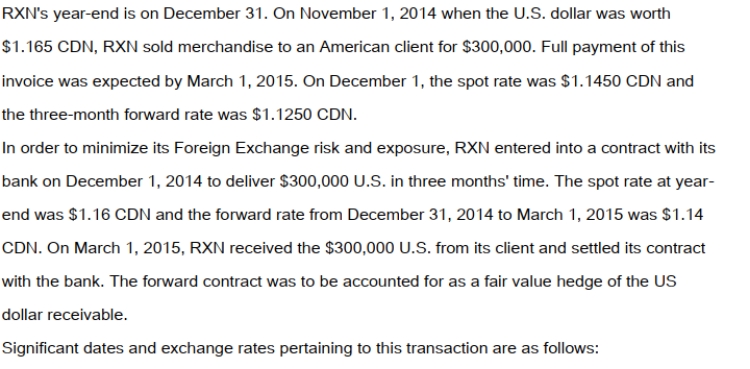

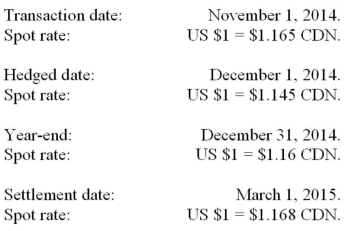

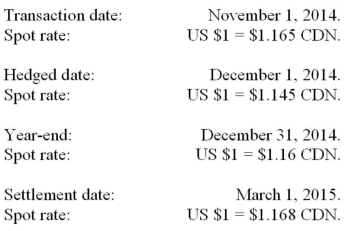

RXN's year-end is on December 31. On November 1, 2014 when the U.S. dollar was worth $1.165 CDN, RXN sold merchandise to an American client for $300,000. Full payment of this invoice was expected by March 1, 2015. On December 1, the spot rate was $1.1450 CDN and the three-month forward rate was $1.1250 CDN. In order to minimize its Foreign Exchange risk and exposure, RXN entered into a contract with its bank on December 1, 2014 to deliver $300,000 U.S. in three months' time. The spot rate at year-end was $1.16 CDN and the forward rate from December 31, 2014 to March 1, 2015 was $1.14 CDN. On March 1, 2015, RXN received the $300,000 U.S. from its client and settled its contract with the bank. The forward contract was to be accounted for as a fair value hedge of the US dollar receivable. Significant dates and exchange rates pertaining to this transaction are as follows:  What is the amount of the discount on the forward contract?

What is the amount of the discount on the forward contract?

A) $1,000.

B) $1,500.

C) $3,000.

D) $6,000.

What is the amount of the discount on the forward contract?

What is the amount of the discount on the forward contract?A) $1,000.

B) $1,500.

C) $3,000.

D) $6,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

22

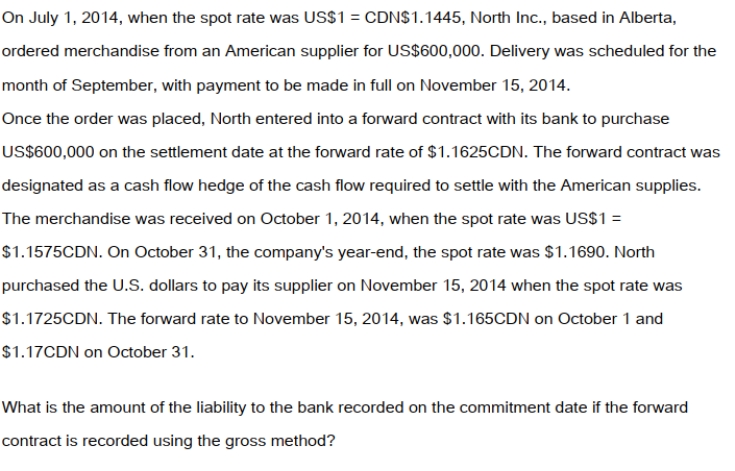

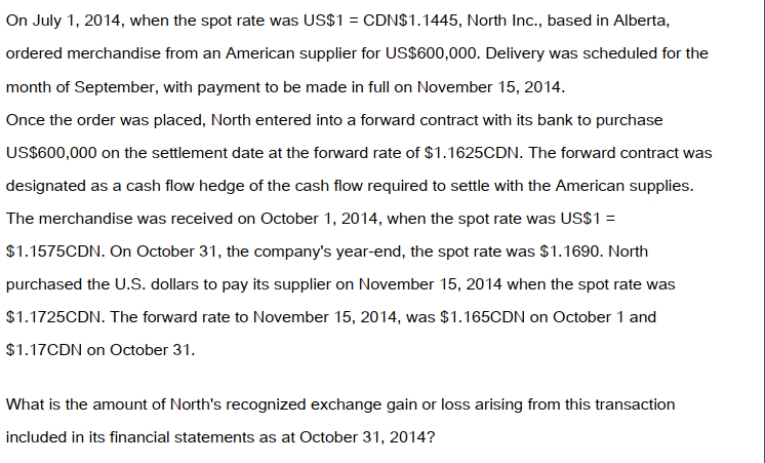

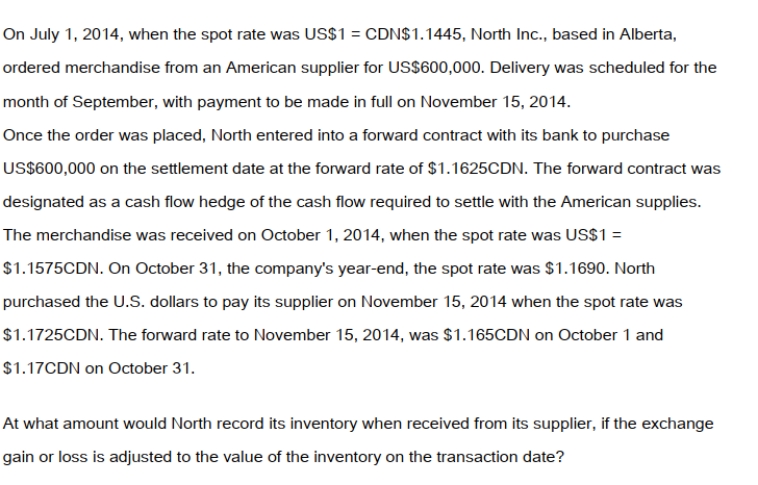

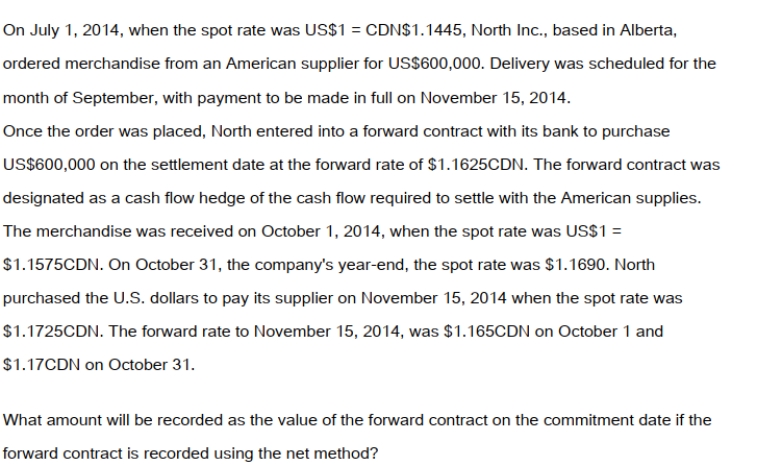

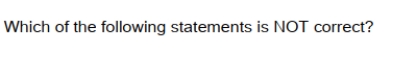

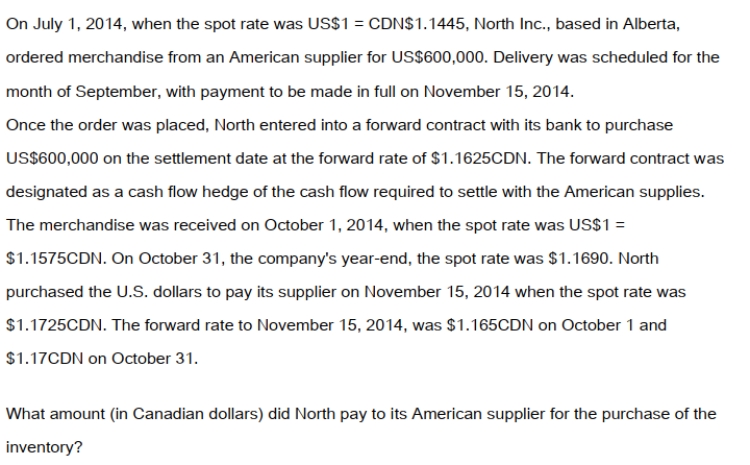

On July 1, 2014, when the spot rate was US$1 = CDN$1.1445, North Inc., based in Alberta, ordered merchandise from an American supplier for US$600,000. Delivery was scheduled for the month of September, with payment to be made in full on November 15, 2014. Once the order was placed, North entered into a forward contract with its bank to purchase US$600,000 on the settlement date at the forward rate of $1.1625CDN. The forward contract was designated as a cash flow hedge of the cash flow required to settle with the American supplies. The merchandise was received on October 1, 2014, when the spot rate was US$1 = $1.1575CDN. On October 31, the company's year-end, the spot rate was $1.1690. North purchased the U.S. dollars to pay its supplier on November 15, 2014 when the spot rate was $1.1725CDN. The forward rate to November 15, 2014, was $1.165CDN on October 1 and $1.17CDN on October 31. What is the amount of the forward contract in Canadian dollars?

A) $686,700.

B) $697,500.

C) $701,400.

D) $703,500.

A) $686,700.

B) $697,500.

C) $701,400.

D) $703,500.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

23

RXN's year-end is on December 31. On November 1, 2014 when the U.S. dollar was worth $1.165 CDN, RXN sold merchandise to an American client for $300,000. Full payment of this invoice was expected by March 1, 2015. On December 1, the spot rate was $1.1450 CDN and the three-month forward rate was $1.1250 CDN. In order to minimize its Foreign Exchange risk and exposure, RXN entered into a contract with its bank on December 1, 2014 to deliver $300,000 U.S. in three months' time. The spot rate at year-end was $1.16 CDN and the forward rate from December 31, 2014 to March 1, 2015 was $1.14 CDN. On March 1, 2015, RXN received the $300,000 U.S. from its client and settled its contract with the bank. The forward contract was to be accounted for as a fair value hedge of the US dollar receivable. Significant dates and exchange rates pertaining to this transaction are as follows:  At what amount (in Canadian Dollars) would the forward contract with the bank be recorded, if recorded gross?

At what amount (in Canadian Dollars) would the forward contract with the bank be recorded, if recorded gross?

A) $337,500.

B) $343,500.

C) $347,500.

D) $349,500.

At what amount (in Canadian Dollars) would the forward contract with the bank be recorded, if recorded gross?

At what amount (in Canadian Dollars) would the forward contract with the bank be recorded, if recorded gross?A) $337,500.

B) $343,500.

C) $347,500.

D) $349,500.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

24

A) $686,700.

B) $697,500.

C) $701,400.

D) $703,500.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

25

The average rates in effect for 2010 and 2011 were as follows:

The average rates in effect for 2010 and 2011 were as follows:  What is the amount of interest expense (in Canadian Dollars) recorded for 2011?

What is the amount of interest expense (in Canadian Dollars) recorded for 2011?A) $249,920.

B) $250,080.

C) $287,175.

D) $287,250.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

26

RXN's year-end is on December 31. On November 1, 2014 when the U.S. dollar was worth $1.165 CDN, RXN sold merchandise to an American client for $300,000. Full payment of this invoice was expected by March 1, 2015. On December 1, the spot rate was $1.1450 CDN and the three-month forward rate was $1.1250 CDN. In order to minimize its Foreign Exchange risk and exposure, RXN entered into a contract with its bank on December 1, 2014 to deliver $300,000 U.S. in three months' time. The spot rate at year-end was $1.16 CDN and the forward rate from December 31, 2014 to March 1, 2015 was $1.14 CDN. On March 1, 2015, RXN received the $300,000 U.S. from its client and settled its contract with the bank. The forward contract was to be accounted for as a fair value hedge of the US dollar receivable. Significant dates and exchange rates pertaining to this transaction are as follows:  What is the amount of the exchange gain or loss from the recognition of the hedge discount recognized during 2014?

What is the amount of the exchange gain or loss from the recognition of the hedge discount recognized during 2014?

A) A loss of $4,500.

B) A loss of $3,000.

C) Nil.

D) A gain of $4,500.

What is the amount of the exchange gain or loss from the recognition of the hedge discount recognized during 2014?

What is the amount of the exchange gain or loss from the recognition of the hedge discount recognized during 2014?A) A loss of $4,500.

B) A loss of $3,000.

C) Nil.

D) A gain of $4,500.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

27

The average rates in effect for 2010 and 2011 were as follows:

The average rates in effect for 2010 and 2011 were as follows:  By what amount (in Canadian Dollars) would XYZ have to adjust its Loan Liability on December 31, 2010 as a result of the year's foreign exchange rate fluctuations?

By what amount (in Canadian Dollars) would XYZ have to adjust its Loan Liability on December 31, 2010 as a result of the year's foreign exchange rate fluctuations?A) A $5,000 decrease.

B) A $2,500 decrease

C) Nil.

D) A $5,000 increase.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

28

RXN's year-end is on December 31. On November 1, 2014 when the U.S. dollar was worth $1.165 CDN, RXN sold merchandise to an American client for $300,000. Full payment of this invoice was expected by March 1, 2015. On December 1, the spot rate was $1.1450 CDN and the three-month forward rate was $1.1250 CDN. In order to minimize its Foreign Exchange risk and exposure, RXN entered into a contract with its bank on December 1, 2014 to deliver $300,000 U.S. in three months' time. The spot rate at year-end was $1.16 CDN and the forward rate from December 31, 2014 to March 1, 2015 was $1.14 CDN. On March 1, 2015, RXN received the $300,000 U.S. from its client and settled its contract with the bank. The forward contract was to be accounted for as a fair value hedge of the US dollar receivable. Significant dates and exchange rates pertaining to this transaction are as follows:  Assuming that the accounts receivable balance was not adjusted on December 1, 2014, what adjustment (if any) would be required to RXN's year-end accounts receivable balance?

Assuming that the accounts receivable balance was not adjusted on December 1, 2014, what adjustment (if any) would be required to RXN's year-end accounts receivable balance?

A) A $3,000 decrease.

B) A $1,500 decrease.

C) No adjustment is required.

D) A $3,000 increase.

Assuming that the accounts receivable balance was not adjusted on December 1, 2014, what adjustment (if any) would be required to RXN's year-end accounts receivable balance?

Assuming that the accounts receivable balance was not adjusted on December 1, 2014, what adjustment (if any) would be required to RXN's year-end accounts receivable balance?A) A $3,000 decrease.

B) A $1,500 decrease.

C) No adjustment is required.

D) A $3,000 increase.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

29

A) $3,900 loss.

B) Nil.

C) $3,000 gain.

D) $3,900 gain.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

30

A) $686,700.

B) $693,000.

C) $694,500.

D) $696,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

31

The average rates in effect for 2010 and 2011 were as follows:

The average rates in effect for 2010 and 2011 were as follows:  What is the amount of foreign exchange gain or loss recognized on the 2011 Income Statement as a result of revaluing the loan payable?

What is the amount of foreign exchange gain or loss recognized on the 2011 Income Statement as a result of revaluing the loan payable?A) $2,500 loss.

B) $800 loss.

C) $800 gain.

D) $2,500 gain.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

32

On July 1, 2014, when the spot rate was US$1 = CDN$1.1445, North Inc., based in Alberta, ordered merchandise from an American supplier for US$600,000. Delivery was scheduled for the month of September, with payment to be made in full on November 15, 2014. Once the order was placed, North entered into a forward contract with its bank to purchase US$600,000 on the settlement date at the forward rate of $1.1625CDN. The forward contract was designated as a cash flow hedge of the cash flow required to settle with the American supplies. The merchandise was received on October 1, 2014, when the spot rate was US$1 = $1.1575CDN. On October 31, the company's year-end, the spot rate was $1.1690. North purchased the U.S. dollars to pay its supplier on November 15, 2014 when the spot rate was $1.1725CDN. The forward rate to November 15, 2014, was $1.165CDN on October 1 and $1.17CDN on October 31. What is the journal entry required to record the ordering of North's merchandise?

A) No entry is required.

B)

C)

D)

A) No entry is required.

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

33

RXN's year-end is on December 31. On November 1, 2014 when the U.S. dollar was worth $1.165 CDN, RXN sold merchandise to an American client for $300,000. Full payment of this invoice was expected by March 1, 2015. On December 1, the spot rate was $1.1450 CDN and the three-month forward rate was $1.1250 CDN. In order to minimize its Foreign Exchange risk and exposure, RXN entered into a contract with its bank on December 1, 2014 to deliver $300,000 U.S. in three months' time. The spot rate at year-end was $1.16 CDN and the forward rate from December 31, 2014 to March 1, 2015 was $1.14 CDN. On March 1, 2015, RXN received the $300,000 U.S. from its client and settled its contract with the bank. The forward contract was to be accounted for as a fair value hedge of the US dollar receivable. Significant dates and exchange rates pertaining to this transaction are as follows:  What is the amount of RXN's foreign exchange gain or loss prior to its hedge?

What is the amount of RXN's foreign exchange gain or loss prior to its hedge?

A) A $6,000 loss.

B) Nil.

C) A $4,500 gain.

D) A $6,000 gain.

What is the amount of RXN's foreign exchange gain or loss prior to its hedge?

What is the amount of RXN's foreign exchange gain or loss prior to its hedge?A) A $6,000 loss.

B) Nil.

C) A $4,500 gain.

D) A $6,000 gain.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

34

The average rates in effect for 2010 and 2011 were as follows:

The average rates in effect for 2010 and 2011 were as follows:  By what amount (in Canadian Dollars) would XYZ have to adjust its Loan Liability on December 31, 2011 as a result of the year's foreign exchange rate fluctuations?

By what amount (in Canadian Dollars) would XYZ have to adjust its Loan Liability on December 31, 2011 as a result of the year's foreign exchange rate fluctuations?A) $3,500 decrease.

B) $2,500 decrease.

C) Nil.

D) $2,500 increase.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

35

The average rates in effect for 2010 and 2011 were as follows:

The average rates in effect for 2010 and 2011 were as follows:  What is the amount of interest paid (in Canadian Dollars) during 2011?

What is the amount of interest paid (in Canadian Dollars) during 2011?A) $250,000.

B) $287,125.

C) $287,330.

D) $372,500.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

36

A) The placement of large amounts of Canadian funds with a bank in Zurich, Switzerland.

B) A foreign currency futures contract.

C) A foreign currency option contract.

D) A forward exchange contract.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

37

At what amount (in Canadian Dollars) would RXN's sale be recorded initially?

At what amount (in Canadian Dollars) would RXN's sale be recorded initially?A) $343,500.

B) $348,000.

C) $349,500.

D) $350,400.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

38

RXN's year-end is on December 31. On November 1, 2014 when the U.S. dollar was worth $1.165 CDN, RXN sold merchandise to an American client for $300,000. Full payment of this invoice was expected by March 1, 2015. On December 1, the spot rate was $1.1450 CDN and the three-month forward rate was $1.1250 CDN. In order to minimize its Foreign Exchange risk and exposure, RXN entered into a contract with its bank on December 1, 2014 to deliver $300,000 U.S. in three months' time. The spot rate at year-end was $1.16 CDN and the forward rate from December 31, 2014 to March 1, 2015 was $1.14 CDN. On March 1, 2015, RXN received the $300,000 U.S. from its client and settled its contract with the bank. The forward contract was to be accounted for as a fair value hedge of the US dollar receivable. Significant dates and exchange rates pertaining to this transaction are as follows:  How much (in Canadian Dollars) will RXN expect to receive from the bank when its forward contract is settled?

How much (in Canadian Dollars) will RXN expect to receive from the bank when its forward contract is settled?

A) $337,500.

B) $343,500.

C) $347,500.

D) $349,500.

How much (in Canadian Dollars) will RXN expect to receive from the bank when its forward contract is settled?

How much (in Canadian Dollars) will RXN expect to receive from the bank when its forward contract is settled?A) $337,500.

B) $343,500.

C) $347,500.

D) $349,500.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

39

A) A liability of $6,000.

B) Nil.

C) An asset of $6,000.

D) An asset of $10,800

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

40

The average rates in effect for 2010 and 2011 were as follows:

The average rates in effect for 2010 and 2011 were as follows:  What is the amount of the foreign exchange gain or loss recognized on the 2010 Income Statement as a result of revaluing the loan payable?

What is the amount of the foreign exchange gain or loss recognized on the 2010 Income Statement as a result of revaluing the loan payable?A) A $10,000 loss.

B) A $5,000 loss.

C) A $5,000 gain.

D) A $10,000 gain.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

41

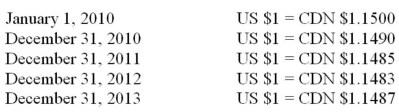

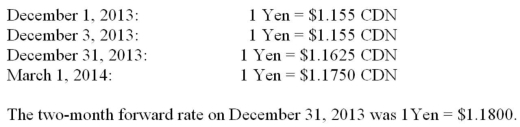

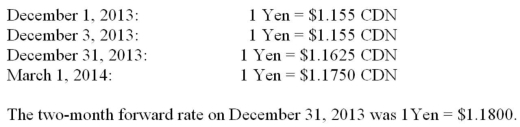

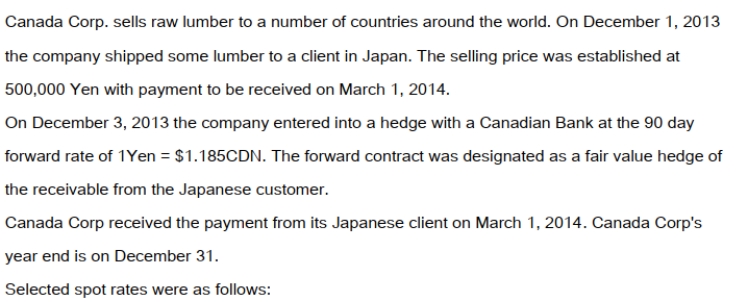

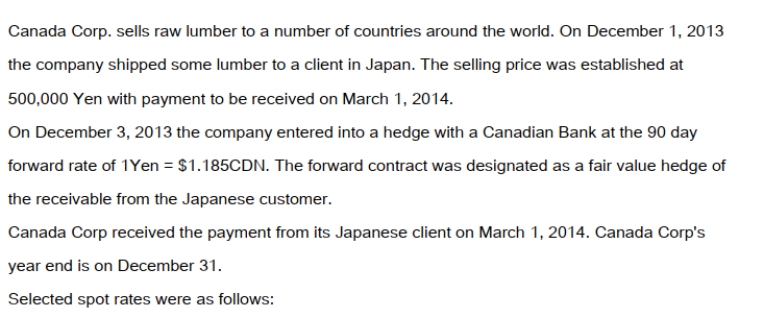

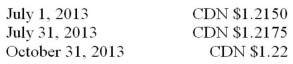

Canada Corp. sells raw lumber to a number of countries around the world. On December 1, 2013 the company shipped some lumber to a client in Japan. The selling price was established at 500,000 Yen with payment to be received on March 1, 2014. On December 3, 2013 the company entered into a hedge with a Canadian Bank at the 90 day forward rate of 1Yen = $1.185CDN. The forward contract was designated as a fair value hedge of the receivable from the Japanese customer. Canada Corp received the payment from its Japanese client on March 1, 2014. Canada Corp's year end is on December 31. Selected spot rates were as follows:  Prepare the journal entries to record the receipt of the 500,000 Yen on March 1, 2014, assuming that Canada Corp did not enter into a hedge transaction in December 2013.

Prepare the journal entries to record the receipt of the 500,000 Yen on March 1, 2014, assuming that Canada Corp did not enter into a hedge transaction in December 2013.

Prepare the journal entries to record the receipt of the 500,000 Yen on March 1, 2014, assuming that Canada Corp did not enter into a hedge transaction in December 2013.

Prepare the journal entries to record the receipt of the 500,000 Yen on March 1, 2014, assuming that Canada Corp did not enter into a hedge transaction in December 2013.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

42

A) $70,500.

B) $70,950.

C) $71,850.

D) $72,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

43

A) $300 decrease.

B) Nil.

C) $300 increase.

D) $375 increase.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

44

A) Nil.

B) $450.

C) $900.

D) $1,500.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

45

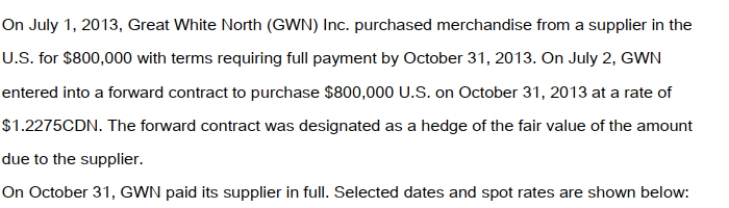

GWN has a July 31st year end. On that date the forward rate for US dollars for three months was CDN $1.2225. Prepare any and all Journal Entries you deem necessary to record the above transaction.

GWN has a July 31st year end. On that date the forward rate for US dollars for three months was CDN $1.2225. Prepare any and all Journal Entries you deem necessary to record the above transaction.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

46

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

47

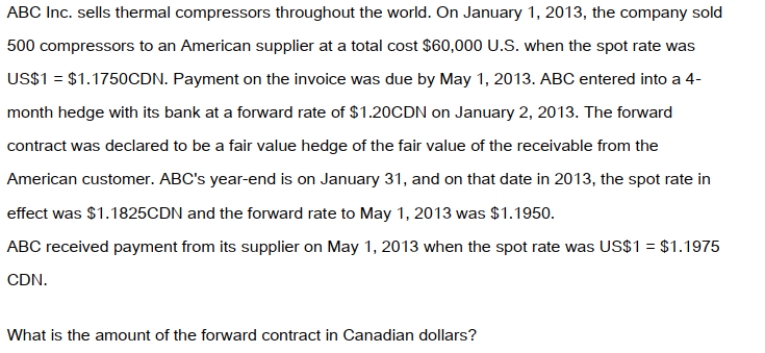

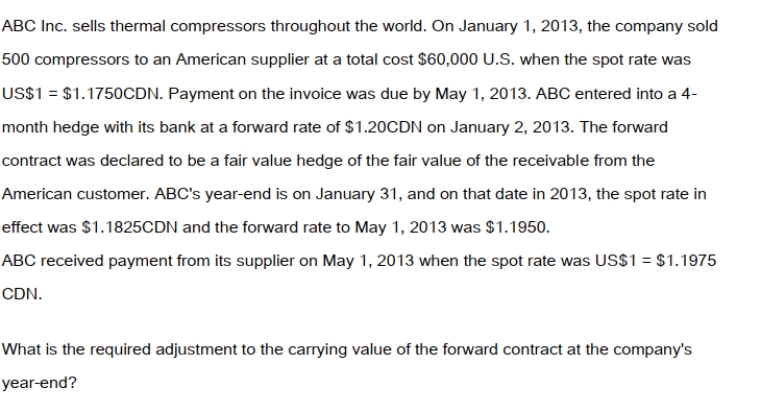

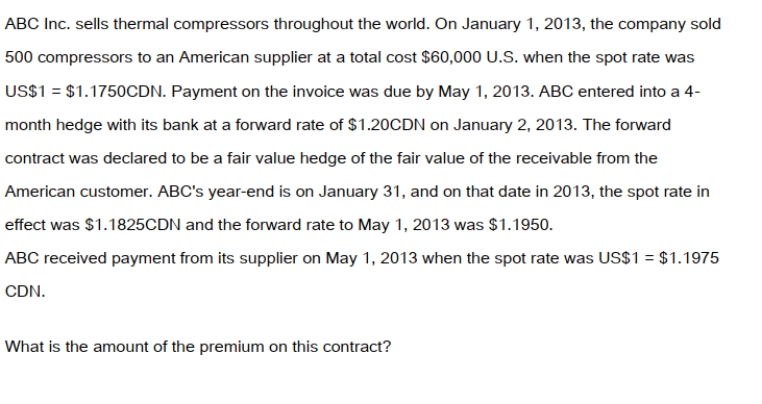

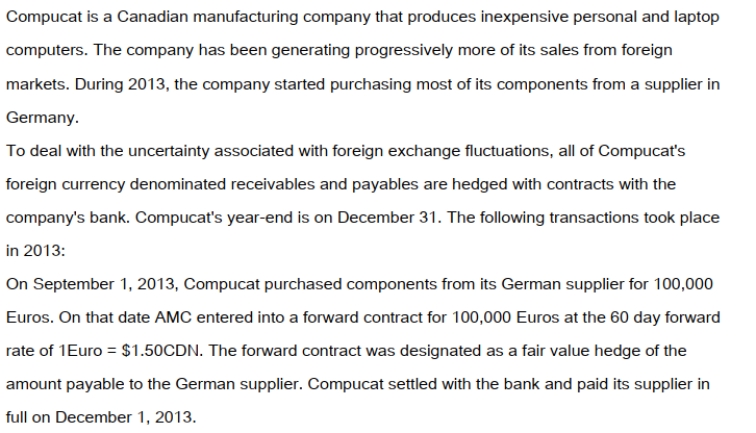

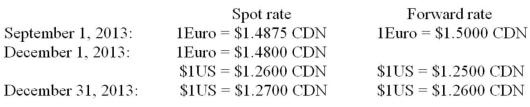

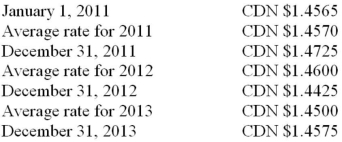

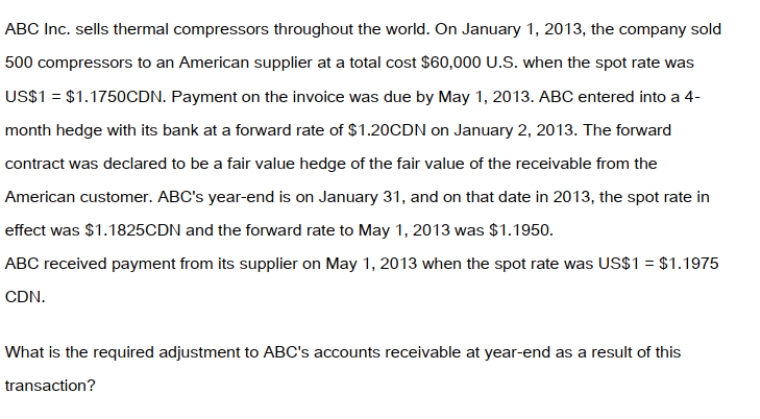

Prepare any and all journal entries arising from this transaction.

Prepare any and all journal entries arising from this transaction.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

48

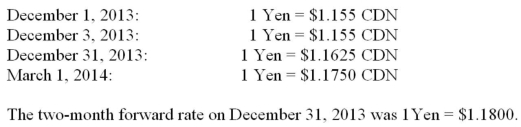

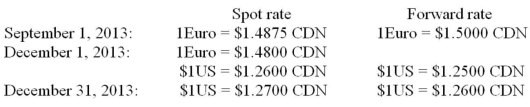

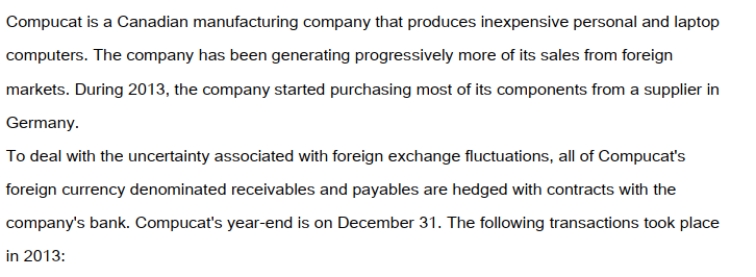

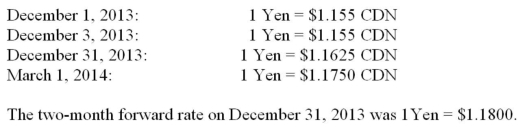

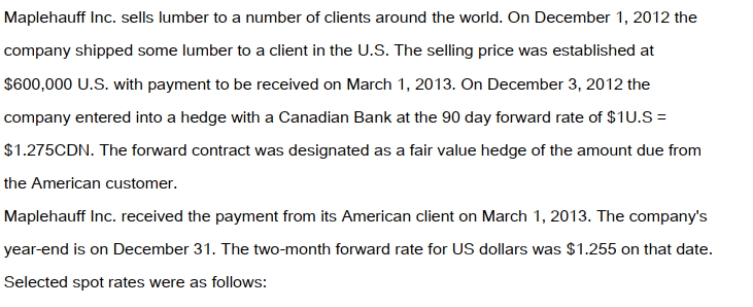

On December 1, 2013 Compucat also shipped a batch of laptop computers to an American client for $250,000US. The invoice required that Compucat receive its payment in full by January 31, 2013. On the date of the sale, the company entered into a forward contract for $250,000US at the two-month forward rate of $1US = $1.25CDN. This forward contract was designated to be a fair value hedge of the amount due from the American customer. The dates and exchange rates relevant to these transactions are shown below.

On December 1, 2013 Compucat also shipped a batch of laptop computers to an American client for $250,000US. The invoice required that Compucat receive its payment in full by January 31, 2013. On the date of the sale, the company entered into a forward contract for $250,000US at the two-month forward rate of $1US = $1.25CDN. This forward contract was designated to be a fair value hedge of the amount due from the American customer. The dates and exchange rates relevant to these transactions are shown below.  Prepare the 2013 journal entries to record the above transactions. In addition, prepare any adjusting journal entries that you deem necessary.

Prepare the 2013 journal entries to record the above transactions. In addition, prepare any adjusting journal entries that you deem necessary.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

49

A) In a fair value hedge, the entity uses a hedging instrument to hedge against the fluctuation in the fair value of the hedged item. This method will be used when the hedged item will be valued at fair value.

B) In a cash flow hedge, the entity uses a hedging instrument to hedge against the fluctuation in the Canadian dollar value of future cash flows.

C) The gain or loss on the hedging instrument in a cash flow hedge is initially reported in other comprehensive income and reclassified to profit and loss when the hedged item affects profit.

D) The gain or loss on the hedging instrument in a fair value hedge is initially recognized in other comprehensive income and transferred to profit and loss when the hedged item has be revalued for accounting purposes in accordance with IFRS.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

50

Which of the following provides the best hedge against exchange variations in the value of a stream of income in a foreign currency where the payments are expected to occur in equal amounts over a period of five years?

A) Borrowing in the foreign currency with repayment due at the end of the five years.

B) Borrowing in Canadian dollars with repayment due at the end of the five years.

C) Borrowing in the foreign currency with annual repayments equal to the expected annual revenue cash flows.

D) Borrowing in Canadian dollars with annual repayments equal to the expected annual

Revenue cash flows.

A) Borrowing in the foreign currency with repayment due at the end of the five years.

B) Borrowing in Canadian dollars with repayment due at the end of the five years.

C) Borrowing in the foreign currency with annual repayments equal to the expected annual revenue cash flows.

D) Borrowing in Canadian dollars with annual repayments equal to the expected annual

Revenue cash flows.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

51

A) $686,700.

B) $694,500.

C) $697,500.

D) $703,500.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

52

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

53

On September 1, 2013, Compucat purchased components from its German supplier for 100,000 Euros. On that date AMC entered into a forward contract for 100,000 Euros at the 60 day forward rate of 1Euro = $1.50CDN. The forward contract was designated as a fair value hedge of the amount payable to the German supplier. Compucat settled with the bank and paid its supplier in full on December 1, 2013. On December 1, 2013 Compucat also shipped a batch of laptop computers to an American client for $250,000US. The invoice required that Compucat receive its payment in full by January 31, 2013. On the date of the sale, the company entered into a forward contract for $250,000US at the two-month forward rate of $1US = $1.25CDN. This forward contract was designated to be a fair value hedge of the amount due from the American customer. The dates and exchange rates relevant to these transactions are shown below.

On September 1, 2013, Compucat purchased components from its German supplier for 100,000 Euros. On that date AMC entered into a forward contract for 100,000 Euros at the 60 day forward rate of 1Euro = $1.50CDN. The forward contract was designated as a fair value hedge of the amount payable to the German supplier. Compucat settled with the bank and paid its supplier in full on December 1, 2013. On December 1, 2013 Compucat also shipped a batch of laptop computers to an American client for $250,000US. The invoice required that Compucat receive its payment in full by January 31, 2013. On the date of the sale, the company entered into a forward contract for $250,000US at the two-month forward rate of $1US = $1.25CDN. This forward contract was designated to be a fair value hedge of the amount due from the American customer. The dates and exchange rates relevant to these transactions are shown below.  Prepare the December 31, 2013 Balance Sheet Presentation of the Receivable from the American client and the accounts associated with the hedge.

Prepare the December 31, 2013 Balance Sheet Presentation of the Receivable from the American client and the accounts associated with the hedge.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

54

A) $70,500.

B) $70,950.

C) $71,850.

D) $72,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

55

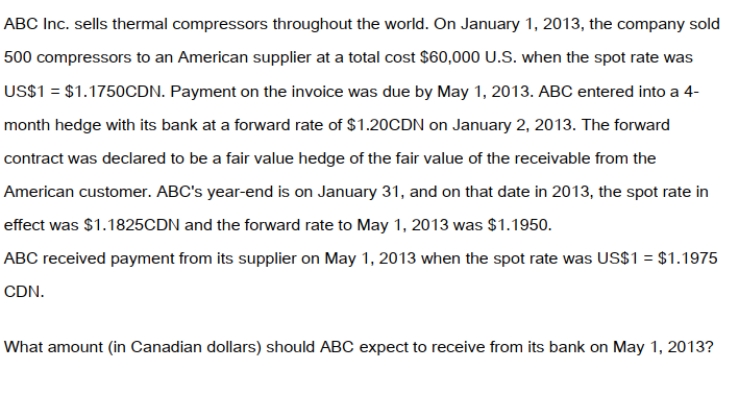

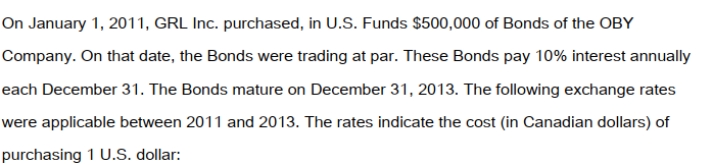

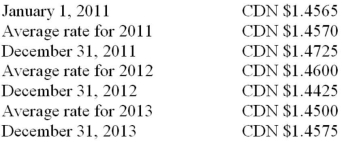

Compute the carrying value of the investment at the end of each year:

Compute the carrying value of the investment at the end of each year:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

56

In which of the following situations is a gain or loss recorded on a commitment assets or liability which would not otherwise be recorded?

A) A speculative forward contract.

B) A fair value hedge of a firm commitment.

C) A fair value hedge of a recognized monetary item.

D) A cash flow hedge of a forecasted transaction.

A) A speculative forward contract.

B) A fair value hedge of a firm commitment.

C) A fair value hedge of a recognized monetary item.

D) A cash flow hedge of a forecasted transaction.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

57

A) $450 decrease.

B) Nil.

C) $450 increase.

D) $900 increase.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

58

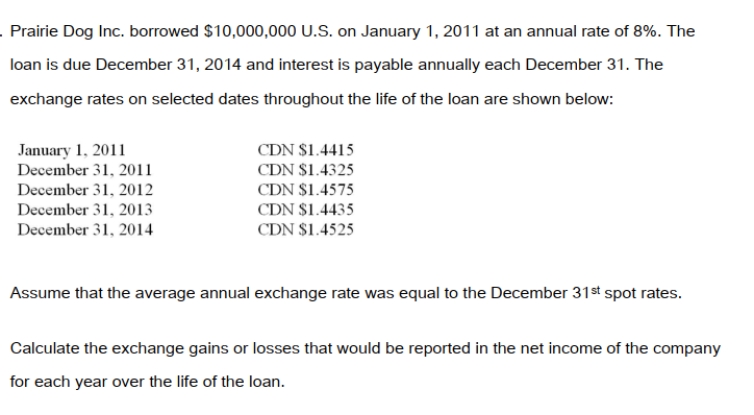

Prepare GRL's journal entries for each of 2011, 2012 and 2013.

Prepare GRL's journal entries for each of 2011, 2012 and 2013.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

59

A) revalued using spot rates throughout its life with any gains or losses to be deferred and amortized as they occur.

B) revalued at fair value throughout its life with any gains or losses to be deferred and amortized as they occur.

C) valued using spot rates throughout its life with any gains or losses to be taken into income as they occur.

D) revalued at fair value throughout its life with any gains or losses to be taken into income as they occur.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

60

Prepare a partial Balance Sheet for Canada Corp on December 31, 2013 showing the account receivable from the Japanese client as well as the accounts associated with the hedge.

Prepare a partial Balance Sheet for Canada Corp on December 31, 2013 showing the account receivable from the Japanese client as well as the accounts associated with the hedge.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

61

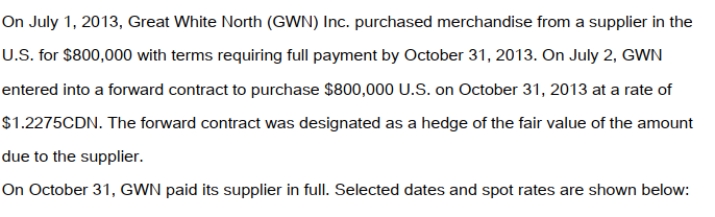

On July 1, 2013, Great White North (GWN) Inc. purchased merchandise from a supplier in the U.S. for $800,000 with terms requiring full payment by October 31, 2013. On July 2, GWN entered into a forward contract to purchase $800,000 U.S. on October 31, 2013 at a rate of $1.2275CDN. The forward contract was designated as a hedge of the fair value of the amount due to the supplier. On October 31, GWN paid its supplier in full. Selected dates and spot rates are shown below:  GWN has a July 31st year end. On that date the forward rate for US dollars for three months was CDN $1.2225. Prepare the journal entries assuming that no forward contract was entered into.

GWN has a July 31st year end. On that date the forward rate for US dollars for three months was CDN $1.2225. Prepare the journal entries assuming that no forward contract was entered into.

GWN has a July 31st year end. On that date the forward rate for US dollars for three months was CDN $1.2225. Prepare the journal entries assuming that no forward contract was entered into.

GWN has a July 31st year end. On that date the forward rate for US dollars for three months was CDN $1.2225. Prepare the journal entries assuming that no forward contract was entered into.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

62

Prepare any and all journal entries arising from this transaction.

Prepare any and all journal entries arising from this transaction.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

63

GWN has a July 31st year end. On that date the forward rate for US dollars for three months was CDN $1.2225. Prepare a July 31, 2013 Partial Trial Balance, indicating how each account balance would appear on the company's financial statements.

GWN has a July 31st year end. On that date the forward rate for US dollars for three months was CDN $1.2225. Prepare a July 31, 2013 Partial Trial Balance, indicating how each account balance would appear on the company's financial statements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck