Deck 5: Gross Income--Exclusions

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/65

العب

ملء الشاشة (f)

Deck 5: Gross Income--Exclusions

1

Social security benefits are always included in gross income.

False

If modified adjusted gross income exceeds $25,000 for a single taxpayer and $32,000 for a married taxpayer, then a portion of the social security benefits must be included in taxable income

Ultimately, up to 85 percent of the social security benefits may be included in AGI.

If modified adjusted gross income exceeds $25,000 for a single taxpayer and $32,000 for a married taxpayer, then a portion of the social security benefits must be included in taxable income

Ultimately, up to 85 percent of the social security benefits may be included in AGI.

2

An annuity is a contract that pays a fixed income at set regular intervals for a specific period of time.

True

3

Dina Durham purchased U.S. savings bonds which she had issued in her name and that of her child as co-owners. Dina let her child redeem the bonds and keep all the proceeds. The interest is taxable to her child.

True

4

Mindy, a hotel manager, is required to reside in the hotel she manages as a condition of her employment. Mindy's hotel residence is provided free-of-charge because Mindy is on call 24 hours a day to handle hotel emergencies. The value of the hotel residence provided to Mindy is not taxable income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

5

In 2012, Bill, a single individual, earned a salary of $10,000 and received $2,000 in unemployment benefits. The unemployment benefits received by Bill are included in Bill's 2012 gross income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

6

Amounts received under worker's compensation as compensation for personal injuries are excludable from gross income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

7

Unemployment compensation is always included in gross income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

8

Gina Gander, a cash basis taxpayer, purchased a Series EE savings bond. She must include the increase in redemption value as interest income each year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

9

Insurance policy dividends used to purchase additional life insurance are not taxable to the policyowner.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

10

Ben is a waiter at a small restaurant. On working days, Ben is required to have lunch on the premises; however, the meal is furnished free-of-charge by Ben's employer. Additionally, Ben is permitted to have lunch free-of- charge on his day off. Under these circumstances, only the value of the lunches eaten by Ben on his day off is includible in Ben's taxable income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

11

An example of a qualified benefit is an employer-subsidized cafeteria.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

12

Max Miller, the owner of a boutique, has a valuable employee for whom he pays a $200 annual premium for a $50,000 life insurance policy. The employee's husband is the beneficiary. This benefit when added to her regular salary does not make the total compensation unreasonable. Max may deduct the premium as a business expense.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

13

Thomas Thinne, a cash basis taxpayer, may either defer reporting the interest on Series E bonds until he cashes the bonds or he may choose to report the increase in redemption value as interest each year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

14

Payments up to a total of $5,000 to the beneficiaries of a deceased employee by an employer because of that employee's death are excludable from income by the beneficiaries if the employee had no right to receive these payments during life.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

15

James Jenkins, a key employee, has group-term life insurance coverage of $100,000 paid for by his employer. The plan discriminates in favor of key employees. James must include the actual cost of the $100,000 policy in his income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

16

Dividend payments made by an insurance company that are based on an policy and that exceed the total amount of premiums paid by the insured are taxable to the insured.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

17

Wade Woods is an employee of a meat packing plant that allows him to purchase goods at a discount that exceeds the gross profit percentage of the price at which the goods are offered to regular customers. Wade must include the portion of the discounts that exceeds the gross profit percentage in his income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

18

Meals furnished to employees as part of their compensation are deductible by the employer at their fair market value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

19

Interest on insurance dividends left on deposit with an insurance company and withdrawable upon demand is taxable to the policyholder only when actually withdrawn.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

20

In September 2012, Bill and Linda, a married couple with $50,000 gross income, cashed qualified Series EE U.S. Savings Bonds which they had purchased in 2008. The proceeds were used to help pay for their son's 2012 college tuition. They received gross proceeds of $3,500, representing principal of $3,000 and interest of $500. The qualified higher education expenses they paid in 2012 totaled $2,100. Their modified adjusted gross income for the year was $20,000. How much of the $500 interest can Bill and Linda exclude from gross income in 2012?

A) $0

B) $200

C) $300

D) $500

A) $0

B) $200

C) $300

D) $500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

21

On June 3, 2012, Leon Wren, an electrician, was injured in an accident during the course of his employment. As a result of injuries sustained, he received the following payments during 2012:  The amount to be included in Wren's 2012 gross income should be:

The amount to be included in Wren's 2012 gross income should be:

A) $0

B) $1,200

C) $3,000

D) $12,200

The amount to be included in Wren's 2012 gross income should be:

The amount to be included in Wren's 2012 gross income should be:A) $0

B) $1,200

C) $3,000

D) $12,200

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

22

Mr. and Mrs. Birch are both over 65 years of age and are filing a joint return. Their income for 2012 consisted of the following:  They did not have any adjustments to income. What amount of Mr. and Mrs. Birch's social security benefits is taxable?

They did not have any adjustments to income. What amount of Mr. and Mrs. Birch's social security benefits is taxable?

A) $0

B) $4,250

C) $7,500

D) $7,750

They did not have any adjustments to income. What amount of Mr. and Mrs. Birch's social security benefits is taxable?

They did not have any adjustments to income. What amount of Mr. and Mrs. Birch's social security benefits is taxable?A) $0

B) $4,250

C) $7,500

D) $7,750

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

23

All of the following income items are includible in an employee's gross income except:

A) Severance pay for cancellation of employment

B) Unemployment compensation

C) Payments from employer while sick or injured

D) Medical insurance premium paid by employer for employee and spouse

E) Moving expense reimbursement

A) Severance pay for cancellation of employment

B) Unemployment compensation

C) Payments from employer while sick or injured

D) Medical insurance premium paid by employer for employee and spouse

E) Moving expense reimbursement

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

24

Based on the following, how much should Ben Brenner include in income in his federal income tax return?

A) $10,000

B) $15,000

C) $16,000

D) $23,000

E) $24,000

A) $10,000

B) $15,000

C) $16,000

D) $23,000

E) $24,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

25

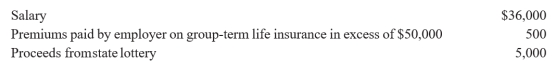

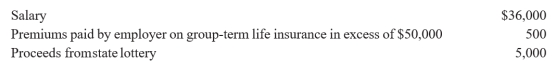

The following information is available for Ann Drury for 2012:  How much should Drury report as gross income on her 2012 tax return?

How much should Drury report as gross income on her 2012 tax return?

A) $36,000

B) $36,500

C) $41,000

D) $41,500

How much should Drury report as gross income on her 2012 tax return?

How much should Drury report as gross income on her 2012 tax return?A) $36,000

B) $36,500

C) $41,000

D) $41,500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

26

During the current year, Alfred Allen sustained a serious injury in the course of his employment. As a result of this injury, Allen received the following amounts during the same year:  How much of the above amounts should Allen include in his gross income for the current year?

How much of the above amounts should Allen include in his gross income for the current year?

A) $12,000

B) $8,000

C) $1,800

D) $0

How much of the above amounts should Allen include in his gross income for the current year?

How much of the above amounts should Allen include in his gross income for the current year?A) $12,000

B) $8,000

C) $1,800

D) $0

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

27

Frank Clarke, an employee of Smithson Company, was covered under a noncontributory pension plan. Frank died on April 15, 2012, at age 64 and pursuant to the plan, his widow received monthly pension payments of $500 beginning May 1, 2012. In addition, Mrs. Clarke received an employee death payment of $10,000 in May 2012. This nonforfeitable death benefit was part of a group plan. What is the total amount of the above receipts that the widow should exclude from her gross income for 2012?

A) $0

B) $5,000

C) $9,000

D) $14,000

A) $0

B) $5,000

C) $9,000

D) $14,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

28

Which of the following items should be included in gross income?

A) Life insurance proceeds

B) Child support payments

C) Accident and health insurance proceeds

D) Cash rebate from a dealer on a car purchase

E) Moving expense reimbursements by an employer

A) Life insurance proceeds

B) Child support payments

C) Accident and health insurance proceeds

D) Cash rebate from a dealer on a car purchase

E) Moving expense reimbursements by an employer

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

29

Randi, a flight attendant, received wages of $30,000 in 2012. The airline provided transportation on a stand- by basis, at no charge, from her home in Detroit to the airline's hub in Chicago. The fair market value of the commuting flights was $5,000. Also in 2012, Randi received reimbursements, under an accountable plan, of $10,000 for overnight travel, but only spent $6,000. The excess was returned. Randi became disabled in November 2012 and received worker's compensation of $4,000. What amount must Randi include in gross income on her 2012 tax return?

A) $30,000

B) $34,000

C) $35,000

D) $37,000

A) $30,000

B) $34,000

C) $35,000

D) $37,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

30

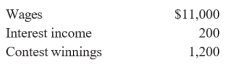

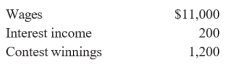

Douglas Druper is single and was unemployed from August through November 2012. During this time, he received $2,000 in unemployment compensation. Douglas also received the following income during 2012:  Douglas did not have any adjustments to income for 2012. How much, if any, of the unemployment compensation should Douglas include in gross income?

Douglas did not have any adjustments to income for 2012. How much, if any, of the unemployment compensation should Douglas include in gross income?

A) $0

B) $500

C) $1,100

D) $1,200

E) $2,000

Douglas did not have any adjustments to income for 2012. How much, if any, of the unemployment compensation should Douglas include in gross income?

Douglas did not have any adjustments to income for 2012. How much, if any, of the unemployment compensation should Douglas include in gross income?A) $0

B) $500

C) $1,100

D) $1,200

E) $2,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

31

Rachel Reeves has medical insurance coverage from her employer's medical insurance policy. The annual premium is $2,000 for Rachel's coverage, of which Rachel's employer pays 75 percent. Rachel pays the rest. In 2012, Rachel received an excess reimbursement of $200 from her insurance company. What amount must Rachel include in her gross income?

A) $0

B) $50

C) $75

D) $150

E) $200

A) $0

B) $50

C) $75

D) $150

E) $200

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

32

Victor and Claire Anet, residents of a separate property state, were divorced in February 2012. Specific requirements of the divorce decree and Mr. Anet's performance of those requirements follow: Transfer title in their personal residence to Claire as part of a lump-sum property settlement. On the day of the transfer, Victor's basis in the house was $38,000, the fair market value was $42,000, and the property was subject to a mortgage of $20,000.

Make the mortgage payments on the 20-year mortgage. He paid $2,500 from March 1, 2012, through December 31, 2012.

Repay to Claire a $3,000 loan, which he did on April 1, 2012.

Pay Claire $700 per month of which $200 is designated as child support. He made ten such payments in 2012. Assuming that Claire has no other income, her 2012 gross income should be:

A) $7,500

B) $9,500

C) $12,500

D) $16,000

Make the mortgage payments on the 20-year mortgage. He paid $2,500 from March 1, 2012, through December 31, 2012.

Repay to Claire a $3,000 loan, which he did on April 1, 2012.

Pay Claire $700 per month of which $200 is designated as child support. He made ten such payments in 2012. Assuming that Claire has no other income, her 2012 gross income should be:

A) $7,500

B) $9,500

C) $12,500

D) $16,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

33

With regard to tax recognition of alimony in connection with a 2012 divorce, which one of the following statements is correct?

A) The divorced couple may be members of the same household at the time payments are made.

B) Payments may be made either in cash or in property.

C) If the payor-spouse pays premiums for life insurance as a requirement under the divorce agreement, the premiums are alimony if the payor-spouse owns the policy.

D) Payment must terminate at the death of the payee-spouse.

A) The divorced couple may be members of the same household at the time payments are made.

B) Payments may be made either in cash or in property.

C) If the payor-spouse pays premiums for life insurance as a requirement under the divorce agreement, the premiums are alimony if the payor-spouse owns the policy.

D) Payment must terminate at the death of the payee-spouse.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

34

Marnie purchased a bond on August 15, 2012 for $2,100. $200 of the purchase price represented accrued interest. She received $210 in interest income on the bond on December 1, 2012. What is the proper treatment of the $210 interest income for federal income tax purposes?

A) $200 return of capital, the $10 can be currently included as interest income or deferred until the bond is cashed.

B) Marnie can elect to include the $210 as interest income in 2012 or defer the reporting until she cashes the bond.

C) $210 taxable as interest income.

D) Report the total payment as taxable interest, then report $200 as an adjustment to income.

A) $200 return of capital, the $10 can be currently included as interest income or deferred until the bond is cashed.

B) Marnie can elect to include the $210 as interest income in 2012 or defer the reporting until she cashes the bond.

C) $210 taxable as interest income.

D) Report the total payment as taxable interest, then report $200 as an adjustment to income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

35

Ms. Green is single and over 65 years old. She received the following income in 2012:  She did not have any adjustments to income. What is the taxable amount of Ms. Green's social security?

She did not have any adjustments to income. What is the taxable amount of Ms. Green's social security?

A) $7,000

B) $7,650

C) $9,000

D) $11,900

She did not have any adjustments to income. What is the taxable amount of Ms. Green's social security?

She did not have any adjustments to income. What is the taxable amount of Ms. Green's social security?A) $7,000

B) $7,650

C) $9,000

D) $11,900

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

36

Don Driller, who is 56 years old, is provided with $120,000 of group-term life insurance by his employer. Based on the IRS uniform premium cost table, the total annual cost of a policy of this type is $9.00 per $1,000 of coverage. Don's required contribution to the cost of the policy is $2.00 per $1,000 of coverage per year. Don was covered for the full 12 months of 2012. How much of the cost must Don include in his income for 2012?

A) $0

B) $390

C) $630

D) $840

A) $0

B) $390

C) $630

D) $840

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

37

On February 10, 2012, Rose was in an automobile accident while she was going to work. The doctor advised her to stay home for six months due to her injuries. On February 25, 2012, she files a lawsuit. On July 20, 2012, Rose returned to work. On December 15, 2012 the lawsuit was settled received the following amounts:  How much of the settlement must Rose include in ordinary income on her 2012 tax return?

How much of the settlement must Rose include in ordinary income on her 2012 tax return?

A) $0

B) $25,000

C) $40,000

D) $65,000

How much of the settlement must Rose include in ordinary income on her 2012 tax return?

How much of the settlement must Rose include in ordinary income on her 2012 tax return?A) $0

B) $25,000

C) $40,000

D) $65,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

38

Mr. W. is 66 years old and single. His income for 2012 consisted of the following:  He did not have any adjustments to income. What amount of W's social security benefits is taxable?

He did not have any adjustments to income. What amount of W's social security benefits is taxable?

A) $0

B) $750

C) $1,500

D) $2,000

He did not have any adjustments to income. What amount of W's social security benefits is taxable?

He did not have any adjustments to income. What amount of W's social security benefits is taxable?A) $0

B) $750

C) $1,500

D) $2,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

39

During 2012, Anne Apple received tangible personal property as a safety achievement award from her employer. The award was not a qualified plan award. The property cost the employer $500 and had a fair market value of $600. How much must Anne include in her 2012 gross income?

A) $0

B) $200

C) $500

D) $600

A) $0

B) $200

C) $500

D) $600

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

40

During 2012, Edward East had wages of $10,000 and received unemployment compensation of $6,200 from the state. Edward is single and 45 years old. What is the amount of unemployment compensation to be included in his gross income?

A) $0

B) $2,100

C) $3,800

D) $6,200

A) $0

B) $2,100

C) $3,800

D) $6,200

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

41

Mr. and Mrs. Clark are both 72 years of age, married, filing jointly. They received social security benefits of $7,500 each. Additional income is a taxable pension of $12,000 for Mr. Clark and $6,000 for Mrs. Clark. What is the taxable portion of the social security benefits received by the Clarks?

A) $15,000

B) $7,500

C) $3,750

D) $0

A) $15,000

B) $7,500

C) $3,750

D) $0

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

42

During 2012, under a qualified written plan for educational assistance, Jake Jenner's employer paid Local University $9,200 on Jake's behalf: $7,500 for tuition, books, supplies, and lab fees and $1,700 for lodging. What is the amount of assistance that Jake should include in his gross income for 2012 if the payment was before May 1, 2012?

A) $9,200

B) $3,950

C) $2,350

D) $1,700

A) $9,200

B) $3,950

C) $2,350

D) $1,700

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

43

Sherwood received disability income of $6,000 for 2012. All premiums on the health and accident policy were paid by his employer and included in Sherwood's income. In addition, he received compensatory damages of $10,000 as a result of inadvertent poisoning at a local restaurant. He received no other income this year. How much income must Sherwood include on his 2012 tax return?

A) $16,000

B) $10,000

C) $6,000

D) $0

A) $16,000

B) $10,000

C) $6,000

D) $0

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

44

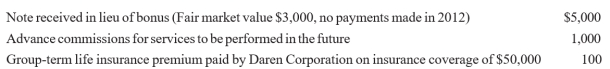

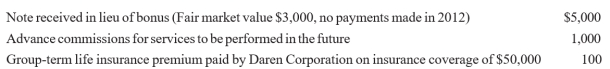

Todd is a cash-basis taxpayer. Daren Corporation made the following payments to or on behalf of Todd during 2012.  What amount should Todd report as income in 2012?

What amount should Todd report as income in 2012?

A) $6,100

B) $5,100

C) $4,100

D) $4,000

What amount should Todd report as income in 2012?

What amount should Todd report as income in 2012?A) $6,100

B) $5,100

C) $4,100

D) $4,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

45

Cyril, who is 68 years of age, received Social Security benefits of $12,000, wages of $5,000, interest and dividends of $4,000, unemployment compensation of $5,400 and municipal bond interest of $1,500. Calculate Cyril's adjusted gross income.

A) $14,400.

B) $25,500.

C) $19,200.

D) $12,000.

A) $14,400.

B) $25,500.

C) $19,200.

D) $12,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

46

Sandra Bellows purchased a 15-year annuity for $25,000. Starting at the beginning of the year, Sandra will receive $200 per month. What is the total amount that Sandra can exclude from her gross income from her annuity this year?

A) $2,400

B) $2,000

C) $1,867

D) $1,667

A) $2,400

B) $2,000

C) $1,867

D) $1,667

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

47

Henry Adams, an unmarried taxpayer, received the following amounts during 2012:

How much taxable income should Henry report for 2012?

How much taxable income should Henry report for 2012?

How much taxable income should Henry report for 2012?

How much taxable income should Henry report for 2012?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

48

Linda Smith paid $25,000 in premiums on a 20-year endowment policy on her life. The policy has a face value of $40,000. At age 60, Linda decides to collect the face value of the policy. In the year of collection, how much will Linda include in her taxable income?

A) $0

B) $15,000

C) $25,000

D) $40,000

A) $0

B) $15,000

C) $25,000

D) $40,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

49

All of the following would be excluded from income as a qualified scholarship by an individual who is a candidate for a degree at a qualified educational institution, except:

A) Tuition

B) Student fees

C) Course books

D) Room and board

A) Tuition

B) Student fees

C) Course books

D) Room and board

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

50

Claire is a sophomore in the University of Nebraska's degree program in dentistry. In 2012, Claire paid $3,000 in tuition, $500 for books, and $250 for rented dental equipment. Claire also paid room and board of $3,500. What is the total qualifying educational expense for Claire in 2012?

A) $3,500

B) $3,750

C) $7,250

D) $3,000

A) $3,500

B) $3,750

C) $7,250

D) $3,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

51

BWS Corporation pays the premiums on an $80,000 group-term life insurance policy on the life of its 45- year-old vice-president, Warren. The annual cost per $1000 of coverage for a person aged 45 to 49 is $1.80. If Warren has paid $25 toward the cost of the insurance, what is the cost of the policy includible in Warren's gross income?

A) $278.00

B) $144.00

C) $54.00

D) $29.00

E) $0

A) $278.00

B) $144.00

C) $54.00

D) $29.00

E) $0

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

52

In 2012, Jake and Mary Jacobs, a married couple, have specially modified adjusted gross income of $25,000 and $10,000 in social security benefits. If the Jacobs file a joint return, what portion of their social security benefits are included in income for federal income tax purposes?

A) $10,000

B) $5,000

C) $2,500

D) $1,000

E) $0

A) $10,000

B) $5,000

C) $2,500

D) $1,000

E) $0

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

53

In 2012, Max is 85 years of age and single. He received Social Security payments totaling $14,000 (this includes Medicare premium of $600), dividend and interest income of $21,000, a pension of $30,000 and a taxable IRA benefits of $16,000. What is Max's adjusted gross income for 2012?

A) $80,400.

B) $78,900.

C) $78,390

D) $67,000

A) $80,400.

B) $78,900.

C) $78,390

D) $67,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

54

Ms. Abby, age 28, is single and received $10,000 in unemployment benefits from the state for 2012. She also received $3,000 from the state to reduce the costs of her winter fuel bill. What amount of income should Ms. Abby report for 2012?

A) $10,000

B) $13,000

C) $3,000

D) $7,600

A) $10,000

B) $13,000

C) $3,000

D) $7,600

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

55

Mr. and Mrs. Garden filed a joint return for 2012. Mr. Garden received $8,000 in Social Security benefits and Mrs. Garden received $4,000. Their income also included $10,000 taxable pension income and interest income of $2,000. What part of their Social Security benefits will be taxable for 2012?

A) $ 0

B) $6,000

C) $24,000

D) $12,000

A) $ 0

B) $6,000

C) $24,000

D) $12,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

56

Ron Rake is a candidate for a master's degree at State University. During 2012, he was granted a fellowship that provided:  What is the amount Ron may exclude from gross income for 2012?

What is the amount Ron may exclude from gross income for 2012?

A) $12,500

B) $11,500

C) $9,500

D) $8,000

What is the amount Ron may exclude from gross income for 2012?

What is the amount Ron may exclude from gross income for 2012?A) $12,500

B) $11,500

C) $9,500

D) $8,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

57

Which of the following items is not tax deductible as an education related expense?

A) Certain transportation and travel costs

B) The dollar value of vacation time or annual leave you take to attend a class

C) Tuition, books, supplies, lab fees, and similaritems

D) Costs of research and typing when writing a paper as part of an educational program

A) Certain transportation and travel costs

B) The dollar value of vacation time or annual leave you take to attend a class

C) Tuition, books, supplies, lab fees, and similaritems

D) Costs of research and typing when writing a paper as part of an educational program

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

58

Ned Norton, a calendar year taxpayer, purchased an annuity contract which pays him $54 per month beginning June 1, 2012. This annuity cost him $2,400, and it has an expected return of $7,200. How much of this annuity is includible in gross income for the 2012 calendar year?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

59

Mr. Ainspan is a college student working on a degree in accounting. He received the following in 2012: • A $4,000 scholarship used for tuition at State University

• A $1,000 scholarship used for fees and books

• An $8,000 fellowship used for his room and board

Compute the amount Mr. Brown must include in income for 2012.

A) $8,000

B) $5,000

C) $13,000

D) $9,000

• A $1,000 scholarship used for fees and books

• An $8,000 fellowship used for his room and board

Compute the amount Mr. Brown must include in income for 2012.

A) $8,000

B) $5,000

C) $13,000

D) $9,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

60

Participation in a cafeteria plan is allowed to which of the following:

A) employee

B) spouse of employee

C) child of employee

D) all of the above

A) employee

B) spouse of employee

C) child of employee

D) all of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

61

Dirk and Diane Davis are both employed solely by XYZ Corporation and each earned $15,000 in wages for 2012. With respect to the following items, what amount should be reported as income in addition to their wages?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

62

Mrs. Norman has the following sources of income:

Mrs. Norman is 68 years of age. Determine her taxable income.

Mrs. Norman is 68 years of age. Determine her taxable income.

Mrs. Norman is 68 years of age. Determine her taxable income.

Mrs. Norman is 68 years of age. Determine her taxable income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

63

Leah Sarah earns $8,500 as a waitress in the local pizza parlor. Bruce, her husband, earned $9,000 as a security officer for a local department store. On August 1 he was laid off, and he collected $4,000 in unemployment compensation through year-end. Must Bruce and Leah include any of the unemployment compensation in their taxable income?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

64

On January 1, 2012, Peter Piper invested in two series HH bonds. Bond No. 1 was issued in the name of Peter and his son as co-owners. Bond No. 2 was issued in the name of Peter's son, although Peter was named as the sole beneficiary. In 2012, Bonds No. 1 and No. 2 paid interest of $2,000 and $1,000, respectively. What is the amount of interest income to be reported by Peter and by his son for 2012?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

65

Matt and Becky are both 66 years of age. Matt still works and earned $38,000 last year. Matt and Becky also have the following income:

Interest income $2,000

Social security benefits 9,000

Determine their taxable income.

Interest income $2,000

Social security benefits 9,000

Determine their taxable income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck