Deck 7: Deductions: Businessinvestment Losses and Passive Activity Losses

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/71

العب

ملء الشاشة (f)

Deck 7: Deductions: Businessinvestment Losses and Passive Activity Losses

1

Insurance proceeds received in the year of the casualty in a business casualty loss ,do not reduce the amount of the loss.

False

Any insurance proceeds will reduce the amount deductible

Any insurance proceeds will reduce the amount deductible

2

fte passive loss limitations apply to individuals, closely held corporations, and personal service corporations, but not to estates and trusts.

False

the passive loss limitations also apply to estates and trusts.

the passive loss limitations also apply to estates and trusts.

3

Practically all tax shelters were formed as limited partnerships.

True

4

An individual is allowed to avoid the passive loss limitations for all rental real estate activities in which the individual actively participates.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

5

When business property is completely destroyed, the loss is equal to the difference between the fair market value of the property before the event and the fair market value immediately after the event.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

6

A deduction resulting from the partial destruction of business property is limited to the lesser of (1) the adjusted basis of the casualty property, or (2) the decline in fair market value of the casualty property.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

7

An investor is not at risk for nonrecourse borrowings, stop-loss arrangements, no-loss guarantees, or borrowings in which the lender has an interest.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

8

Disaster area losses are carried forward for an additional five years beyond ordinary casualty losses.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

9

In determining whether a taxpayer materially participates, the participation of a taxpayer's spouse will be taken into account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

10

fte manufacturing deduction under Code Section 199 is only available to C corporations and cooperatives.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

11

In determining whether an activity is engaged in for profit, a reasonable expectation of profit is required.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

12

If two or more net operating losses are carried back to a tax year, they must be deducted in the order they were incurred.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

13

A business incurring a net operating loss in a taxable year can carry the loss back two years and forward 15 years.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

14

Jim Jones had a deductible casualty loss of $10,000 on his 2012 tax return. His taxable income was $112,000 in 2012. In September of 2013, Jim is reimbursed $5,000 for the prior year's casualty loss. He should include the

$5,000 in gross income for 2013.

$5,000 in gross income for 2013.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

15

All casualty and theft losses are deductible if incurred in a trade or business or in connection with an investment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

16

Portfolio income is interest, dividends, annuities, and royalties derived in the ordinary course of a trade or business.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

17

fte deduction for hobby expenses is not subject to the two-percent floor on miscellaneous itemized deductions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

18

A working interest which a taxpayer holds in oil and gas properties is not subject to the passive activity rules.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

19

fte gain from the sale of property that produces portfolio income (e.g., stocks and bonds) is classified as passive income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

20

Exclusive use of a portion of a home for business purposes is required to qualify for a business use of home deduction.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

21

Farmers may carryback an NOL for three years.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

22

All of the outstanding stock of a closely held C corporation is owned equally by Evelyn Humo and Steve Bufusno. In 2012, the corporation generates taxable income of $20,000 from its active business activities. In addition, it earns $20,000 of interest from investments and incurs a $40,000 loss from a passive activity. How much income does the C corporation report for 2012?

A) $10,000 of portfolio income

B) $0

C) $20,000 of portfolio income

D) None of the above

A) $10,000 of portfolio income

B) $0

C) $20,000 of portfolio income

D) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

23

Suspended passive losses are carried forward for a maximum time period of 20 years.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

24

A theft loss is deductible in the year that the theft occurred.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

25

A business NOL may be carried back three years and forward seven years.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

26

Real estate investment trusts may carryback an NOL for two years and forward for 20 years.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

27

ABC, Inc. of Jasper, Georgia suffered a casualty loss of $150,000 in March 2012. ftis loss was caused by heavy rains that completely flooded their factory. As a result of these rains, the President declared North Georgia (including Jasper) a disaster area on March 23, 2012. In what year can ABC, Inc. elect to deduct the casualty loss?

A) 2012 or 2013

B) 2011 or 2012

C) 2012

D) 2011

A) 2012 or 2013

B) 2011 or 2012

C) 2012

D) 2011

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

28

John Henderson purchased a condo on Hilton Head Island on January 4, 2012. He personally used the condo from May 7, 2012 until May 28, 2012. Because John rented the condo out for 112 days in 2012, he qualifies to deduct all the available rental expenses.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

29

Billy Ray owns several parcels of rental real estate, and he actively participates in managing the properties. His total loss from these activities in 2012 is $30,000 and his AGI for 2012 is $110,000. How much of the disallowed loss from rental real estate activities may be carried over to future years?

A) 0%

B) 10%

C) 50%

D) 100%

A) 0%

B) 10%

C) 50%

D) 100%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

30

John Mapp dies with passive activity property having an adjusted basis of $50,000, suspended losses of $20,000, and a fair market value at the date of Mr. Mapp's death of $77,000. How much suspended loss can be taken on Mr. Mapp's final Form 1040 return?

A) $20,000

B) $77,000

C) $7,000

D) $0

A) $20,000

B) $77,000

C) $7,000

D) $0

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

31

Which of the following is not a passive activity?

A) Owning a business and not materially participating

B) Having rental condos

C) Owning a limited partnership interest in a real estate limited partnership

D) Owning a working interest in oil and gas properties

A) Owning a business and not materially participating

B) Having rental condos

C) Owning a limited partnership interest in a real estate limited partnership

D) Owning a working interest in oil and gas properties

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

32

Billy Ray owns several parcels of rental real estate, and he actively participates in managing the properties. His total loss from these activities in 2012 is $30,000. Assuming that his AGI for 2012 is $110,000, what is the allowable deduction from these properties in 2012?

A) $0

B) $15,000

C) $20,000

D) $30,000

A) $0

B) $15,000

C) $20,000

D) $30,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

33

Ann Jones uses a dry cleaning machine in her business, and it was completely destroyed by fire. At the time of the fire, the adjusted basis was $20,000 and its fair market value was $18,000. How much is Ann's loss?

A) $18,000

B) $2,000

C) $20,000

D) None of the above

A) $18,000

B) $2,000

C) $20,000

D) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

34

During 2012, Hugh Hughes reported the following income and loss: Activity X ($50,000)

Activity Y $20,000

Both Activity X and Activity Y are passive to Mr. Hughes. Hugh purchased Activity X in 1987 and Activity Y in 1993. How much is the loss that Mr. Hughes may deduct in 2012?

A) $50,000

B) $30,000

C) $3,000

D) $0

Activity Y $20,000

Both Activity X and Activity Y are passive to Mr. Hughes. Hugh purchased Activity X in 1987 and Activity Y in 1993. How much is the loss that Mr. Hughes may deduct in 2012?

A) $50,000

B) $30,000

C) $3,000

D) $0

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

35

Ann Jones uses a dry cleaning machine in her business, and it was partially destroyed by fire. At the time of the fire, the adjusted basis was $20,000 and its fair market value was $18,000. fte adjusted basis after the fire is $10,000 and the fair market value after the casualty is $10,000. How much is the casualty loss?

A) $10,000

B) $8,000

C) $18,000

D) $20,000

A) $10,000

B) $8,000

C) $18,000

D) $20,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

36

Hobby expenses are generally deductible only to the extent of the income generated by the activity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

37

John Mapp dies with passive activity property having an adjusted basis of $50,000, suspended losses of $20,000, and a fair market value at the date of Mr. Mapp's death of $60,000. How much suspended loss can be taken on Mr. Mapp's final Form 1040 return?

A) $10,000

B) $20,000

C) $0

D) None of the above

A) $10,000

B) $20,000

C) $0

D) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

38

All of the outstanding stock of a closely held C corporation is owned equally by Evelyn Humo and Steve Bufusno. In 2012, the corporation generates taxable income of $20,000 from its active business activities. In addition, it earns $20,000 of interest from investments and incurs a $40,000 loss from a passive activity. How much of a passive loss carryover does the corporation have?

A) $20,000

B) $0

C) $40,000

D) None of the above

A) $20,000

B) $0

C) $40,000

D) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

39

fte objective of the net operating loss deduction is to decrease tax equity regarding the taxation of business income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

40

fte Code Section 199 manufacturing deduction cannot exceed 50% of W-2 wages paid by the taxpayer during a tax year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

41

Which of the following is not deductible?

A) NOLs

B) Expenses incurred for the production of income.

C) Hobby expenses in excess of hobby income.

D) All of the above.

A) NOLs

B) Expenses incurred for the production of income.

C) Hobby expenses in excess of hobby income.

D) All of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

42

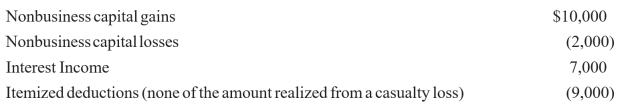

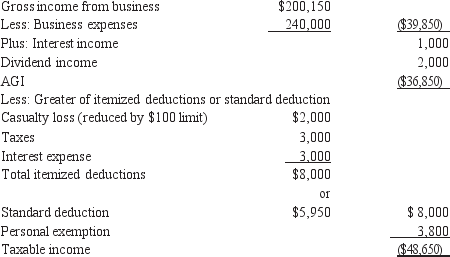

Tammy has the following items for the current year:  In calculating Tammy's net operating loss, and with respect to the above amounts only, what amount must be added back to taxable income (loss)?

In calculating Tammy's net operating loss, and with respect to the above amounts only, what amount must be added back to taxable income (loss)?

A) $0

B) $2,000

C) $3,000

D) $6,000

In calculating Tammy's net operating loss, and with respect to the above amounts only, what amount must be added back to taxable income (loss)?

In calculating Tammy's net operating loss, and with respect to the above amounts only, what amount must be added back to taxable income (loss)?A) $0

B) $2,000

C) $3,000

D) $6,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

43

Which of the following is not a passive activity?

A) Owning a working interest in oil and gas wells.

B) Owning a limited partnership interest in oil and gas wells.

C) Owning a limited partnership interest in real estate.

D) Owning a business and not materially participating.

A) Owning a working interest in oil and gas wells.

B) Owning a limited partnership interest in oil and gas wells.

C) Owning a limited partnership interest in real estate.

D) Owning a business and not materially participating.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

44

On December 28, 2012, Alan Davis died with passive activity property having an adjusted basis of $90,000, suspended losses of $30,000 and a fair market value on the date of death of $125,000.

(a.) How much passive loss will Alan be allowed on his final Form 1040?

(b.) How would your answer change if the fair market value at date of death was $100,000?

(a.) How much passive loss will Alan be allowed on his final Form 1040?

(b.) How would your answer change if the fair market value at date of death was $100,000?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

45

During 2012, Tommy's home was burglarized. Tommy had the following items stolen. • A block of securities worth $20,000. Tommy purchased of securities three years ago for $8,000.

• A block of securities worth $30,000. Tommy purchased the securities for $24,000 two years ago.

Tommy's homeowners policy had an $80,000 deductible clause for thefts. How much is Tommy's theft loss for 2012?

A) $50,000

B) $32,000

C) $44,000

D) None of the above.

• A block of securities worth $30,000. Tommy purchased the securities for $24,000 two years ago.

Tommy's homeowners policy had an $80,000 deductible clause for thefts. How much is Tommy's theft loss for 2012?

A) $50,000

B) $32,000

C) $44,000

D) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

46

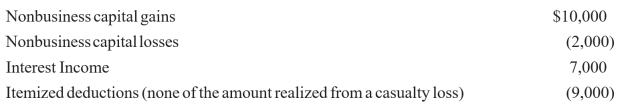

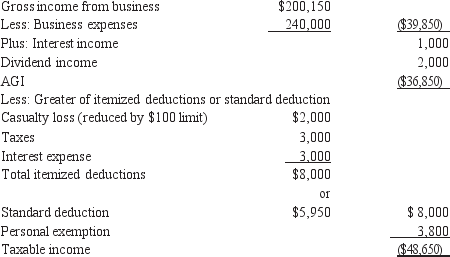

During 2012, John Colburn, a single individual, reports the following taxable income:

Compute John Colburn's net operating loss for 2012.

Compute John Colburn's net operating loss for 2012.

Compute John Colburn's net operating loss for 2012.

Compute John Colburn's net operating loss for 2012.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

47

Mike, who is single, has $100,000 of salary, $15,000 of income from a limited partnership, and a $30,000 passive loss from a real estate rental activity in which he actively participates. His modified adjusted gross income is $100,000. Of the $30,000 loss, how much is deductible?

A) $30,000

B) $10,000

C) $25,000

D) $0.

A) $30,000

B) $10,000

C) $25,000

D) $0.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

48

Net operating losses can be increased by which of the following?

A) fteft losses.

B) Business casualty losses.

C) Unreimbursed employee business expenses.

D) All of the above.

A) fteft losses.

B) Business casualty losses.

C) Unreimbursed employee business expenses.

D) All of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

49

Bob Mapp gave his daughter a limited partnership interest in a real estate activity. Suspended losses amounted to $30,000. Bob's adjusted basis at the time of the gift was $40,000 ( fair market value was greater than $40,000). What is the daughter's basis in the property?

A) $40,000

B) $30,000

C) $70,000

D) None of the above.

A) $40,000

B) $30,000

C) $70,000

D) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

50

Which of the following statements is correct?

A) Hobby expenses are always fully deductible.

B) fte financial status of the taxpayer is not considered in determining whether activities are engaged in for profit.

C) fte deduction for the allowed hobby expenses is an itemized deduction, but not subject to the 2 percent floor.

D) Hobby expenses that are deductible without reference to whether they are incurred in an activity designed to produce income, such as certain taxes, remain fully deductible.

A) Hobby expenses are always fully deductible.

B) fte financial status of the taxpayer is not considered in determining whether activities are engaged in for profit.

C) fte deduction for the allowed hobby expenses is an itemized deduction, but not subject to the 2 percent floor.

D) Hobby expenses that are deductible without reference to whether they are incurred in an activity designed to produce income, such as certain taxes, remain fully deductible.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

51

Jim owns four separate activities. He elects not to group them together as a single activity under the "appropriate economic unit" standard. Jim participates for 140 hours in Activity A, 130 hours in Activity B, 140 hours in Activity C, and 100 hours in Activity D. He has one employee who works 135 hours in Activity D. Which of the following statements is correct?

A) Activities A, B, C, and D are all significant participation activities.

B) Jim is a material participant with respect to Activities A, B, C and D.

C) Jim is a material participant with respect to Activities A, B and C.

D) Losses from all of the activities can be used to offset Jim's active income.

A) Activities A, B, C, and D are all significant participation activities.

B) Jim is a material participant with respect to Activities A, B, C and D.

C) Jim is a material participant with respect to Activities A, B and C.

D) Losses from all of the activities can be used to offset Jim's active income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

52

Billy Ray owns several parcels of rental real estate, and he actively participates in managing the properties. His total loss from these activities in 2012 is $30,000 and his AGI for 2012 is $110,000. For how many years may the disallowed loss be carried forward?

A) fte disallowed loss may not be carried forward.

B) fte disallowed loss may be carried forward for 15 years.

C) fte disallowed loss may be carried forward for 15 years, but only after it has been carried back for 3 years.

D) fte disallowed loss may be carried forward indefinitely.

A) fte disallowed loss may not be carried forward.

B) fte disallowed loss may be carried forward for 15 years.

C) fte disallowed loss may be carried forward for 15 years, but only after it has been carried back for 3 years.

D) fte disallowed loss may be carried forward indefinitely.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

53

fte manufacturing deduction in 2012 is based on what percentage?

A) 9%

B) 6%

C) 3%

D) None of the above.

A) 9%

B) 6%

C) 3%

D) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

54

Steve Colburn's portable sawmill used 100% for business, was completely destroyed by fire. fte sawmill had an adjusted basis of $35,000 and a fair market value of $50,000 before the fire. fte sawmill was uninsured. Steve's casualty loss is:

A) $34,900.

B) $50,000.

C) $49,900.

D) $35,000

A) $34,900.

B) $50,000.

C) $49,900.

D) $35,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

55

When a taxpayer incurs an NOL in 2012, that is not attributable to a casualty or theft loss, the taxpayer may:

A) Carry the NOL forward instead of back.

B) Carry the NOL back three years .

C) Carry the NOL back five years.

D) All of the above.

A) Carry the NOL forward instead of back.

B) Carry the NOL back three years .

C) Carry the NOL back five years.

D) All of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

56

Bill Goggans died and left passive activity property to his nephew, Travis. Bill's basis in the activity was $30,000, while Travis' basis was stepped up to $50,000. Suspended losses amounted to $22,000. How much is the passive loss deduction that can offset nonpassive income?

A) $22,000

B) $30,000

C) $2,000

D) None of the above.

A) $22,000

B) $30,000

C) $2,000

D) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

57

John Hughes is in the business of truck farming (i.e., growing tomatoes, bell peppers and green beans). During the year, one of his barns was completely destroyed by fire. fte adjusted basis of the barn was $100,000. fte fair market value of the barn before the fire was $80,000. fte barn was insured for 90% of its fair market value and John recovered this amount under the insurance policy. John has adjusted basis for the year of $60,000 (before considering the casualty). Determine the amount of loss he can deduct on his tax return for the current year.

A) $4,000

B) $24,000

C) $28,000

D) $20,000

A) $4,000

B) $24,000

C) $28,000

D) $20,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

58

fte percentage of passive losses that may offset nonpassive income for 2012 is:

A) 0%

B) 10%

C) fte percentage varies depending on the level of AGI.

D) 100%

A) 0%

B) 10%

C) fte percentage varies depending on the level of AGI.

D) 100%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

59

Which of the following statements is incorrect?

A) A vacation home becomes a personal residence when its owner uses it more than the greater of 14 days or 10 percent of the number of rental days.

B) If a dwelling is classified as a personal residence, rental losses are not deductible.

C) If an individual rents out a vacation home for more than 14 days and does not use it excessively for personal purposes, losses are allowed to be deducted from AGI.

D) If an individual actively participates in the rental real estate activity, up to $25,000 of losses can be used to offset nonpassive income.

A) A vacation home becomes a personal residence when its owner uses it more than the greater of 14 days or 10 percent of the number of rental days.

B) If a dwelling is classified as a personal residence, rental losses are not deductible.

C) If an individual rents out a vacation home for more than 14 days and does not use it excessively for personal purposes, losses are allowed to be deducted from AGI.

D) If an individual actively participates in the rental real estate activity, up to $25,000 of losses can be used to offset nonpassive income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

60

Fred's at-risk amount in a passive activity is $50,000 at the beginning of the current year. His current loss from the activity is $60,000. He had no passive activity income during the year. At the end of the year, which of the following statements is incorrect?

A) Fred has a loss of $50,000 suspended under the passive loss rules.

B) Fred has an at-risk amount in the activity of $0.

C) Fred has a loss of $10,000 suspended under the at-risk rules.

D) Fred has a loss of $60,000 suspended under the passive loss rules.

A) Fred has a loss of $50,000 suspended under the passive loss rules.

B) Fred has an at-risk amount in the activity of $0.

C) Fred has a loss of $10,000 suspended under the at-risk rules.

D) Fred has a loss of $60,000 suspended under the passive loss rules.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

61

In the current year, Bob Colburn's accounting office was partially destroyed by a hurricane. Bob's adjusted basis in the building was $300,000 and the decline in its fair market value was $200,000. Insurance proceeds amounted to $160,000. Determine Bob's adjusted basis in the property after the casualty.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

62

Katelyn Jones owned interests in five limited partnerships in 2012. Gains and losses are as follows for 2012:  What is Katelyn's net passive loss for 2012? How much of the loss may be deducted against active and portfolio income? How much of the loss is a suspended loss?

What is Katelyn's net passive loss for 2012? How much of the loss may be deducted against active and portfolio income? How much of the loss is a suspended loss?

What is Katelyn's net passive loss for 2012? How much of the loss may be deducted against active and portfolio income? How much of the loss is a suspended loss?

What is Katelyn's net passive loss for 2012? How much of the loss may be deducted against active and portfolio income? How much of the loss is a suspended loss?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

63

John Baron, a professional baseball player, raises Black Angus cattle under circumstances that would indicate that the activity is a hobby. His adjusted gross income for the year is $50,000, and he has $500 of other miscellaneous itemized deductions, all of which are subject to the two-percent floor. During the taxable year, he paid $300 in state taxes on real property used in the cattle operation. Feed for the cattle cost $1,500. fte income from the sale of cattle was $1,400.

(a.) Under the hobby loss rule, to what extent is the expense of $1,500 deductible?

(b.) Under the two-percent-of-adjusted-gross-income limitation, how much is the overall deductible amount of his itemized deductions?

(a.) Under the hobby loss rule, to what extent is the expense of $1,500 deductible?

(b.) Under the two-percent-of-adjusted-gross-income limitation, how much is the overall deductible amount of his itemized deductions?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

64

Two taxpayers, Bob Ames and Alice Brown, each has gross income of $66,000 and deductions of $77,000 in 2012. A breakdown of Bob's and Alice's income and deductions is as follows:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

65

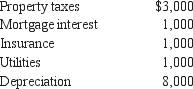

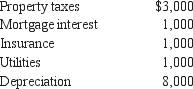

In the current year, Sam Lett purchased a condominium in Hilton Head Island, South Carolina. Sam and his family used the condominium for a total of 30 days. fte condominium was rented out a total of 70 days during the year, generating $9,000 of rental income. Sam incurred the following expenses:

(a.) Determine Sam's deductible expenses using the IRS approach.

(a.) Determine Sam's deductible expenses using the IRS approach.

(b.) How much depreciation can be deducted in the current year if the rental income was $12,000? (c.) Does Sam have any options with regard to the interest and taxes?

(a.) Determine Sam's deductible expenses using the IRS approach.

(a.) Determine Sam's deductible expenses using the IRS approach.(b.) How much depreciation can be deducted in the current year if the rental income was $12,000? (c.) Does Sam have any options with regard to the interest and taxes?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

66

Virgil Watson gave his daughter, Holly, a gift of passive activity property. Suspended losses amounted to $30,000 and the property had an adjusted basis of $40,000. Also, the property had a fair market value of $75,000 at the time of the transfer. What is Holly's basis in the property?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

67

During the current year, Jack Goodwin, a married taxpayer who files a joint return, reports the following items of income and loss: AGI, consisting of salary income, of $130,000, and a rental real estate loss of $40,000. Jack actively participates in the rental activity. Determine Jack's AGI for the current year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

68

John Henry was a partner in a CPA firm with adjusted gross income of $200,000 before consideration of income or loss from his farm activities. His home is on 200 acres, 100 of which he uses to plant row crops, 95 of which is timber, and the remaining five acres consist of the house, barn, sheds, and a long driveway from the paved road to the house.

John uses an office in his home that is 12 percent of the square footage of the home. He uses this office only for farming activities. John's records for 2012 are as follows:

(a.) How must John Henry treat the income and expenses of the farm if the activity is held to be a hobby?

(a.) How must John Henry treat the income and expenses of the farm if the activity is held to be a hobby?

(b.) How must John Henry treat the income and expense of the farm if the farming operation is held to be a business?

John uses an office in his home that is 12 percent of the square footage of the home. He uses this office only for farming activities. John's records for 2012 are as follows:

(a.) How must John Henry treat the income and expenses of the farm if the activity is held to be a hobby?

(a.) How must John Henry treat the income and expenses of the farm if the activity is held to be a hobby?(b.) How must John Henry treat the income and expense of the farm if the farming operation is held to be a business?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

69

Jan Ellis has gross income of $140,000 in 2012 and owned the following passive activities:

All activities were acquired after 1986, and Jan was at risk for all losses. She sold her interest in the LMN limited partnership in 2012. fte basis in the interest was $45,000, and the interest was sold for $15,000. Explain all tax consequences pertaining to LMN for 2012.

All activities were acquired after 1986, and Jan was at risk for all losses. She sold her interest in the LMN limited partnership in 2012. fte basis in the interest was $45,000, and the interest was sold for $15,000. Explain all tax consequences pertaining to LMN for 2012.

All activities were acquired after 1986, and Jan was at risk for all losses. She sold her interest in the LMN limited partnership in 2012. fte basis in the interest was $45,000, and the interest was sold for $15,000. Explain all tax consequences pertaining to LMN for 2012.

All activities were acquired after 1986, and Jan was at risk for all losses. She sold her interest in the LMN limited partnership in 2012. fte basis in the interest was $45,000, and the interest was sold for $15,000. Explain all tax consequences pertaining to LMN for 2012.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

70

You own a building that you constructed on leased land. You use half of the building for your business and you live in the other half. fte cost of the building was $400,000. You made no further improvements or additions to it.

A fire in March damaged the entire building. fte FMV of the building was $380,000 immediately before the fire and $320,000 afterwards. Your insurance company reimbursed you $40,000 for the fire damage. Depreciation on the business part of the building before the fire totaled $24,000.

How much is your deductible business casualty loss in 2012?

A fire in March damaged the entire building. fte FMV of the building was $380,000 immediately before the fire and $320,000 afterwards. Your insurance company reimbursed you $40,000 for the fire damage. Depreciation on the business part of the building before the fire totaled $24,000.

How much is your deductible business casualty loss in 2012?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

71

Judy Buessink owned an interest as a limited partner in LBJ partnership. She did not materially participate in the activity. On the date she gifted the LBJ partnership interest to her son, Alan, her basis was $30,000. Suspended losses amounted to $25,000 as of that date. What is Alan's adjusted basis on the gift?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck