Deck 14: Management Accounting in a Changing Environment

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/18

العب

ملء الشاشة (f)

Deck 14: Management Accounting in a Changing Environment

1

Applying TQM in Manufacturing versus Administration

One large company that has been successful in applying Total Quality Management (TQM) principles in manufacturing reports that it has had less success in applying the same techniques in improving administrative functions such as order taking, distribution, and human resources. This company (which has won several quality awards and has significantly improved its product quality) used state-of-the-art TQM methods to train all of its employees in how to apply TQM. However, the company has not been able to achieve the same cost reductions and service quality enhancements in administrative areas as it has in the manufacturing area. Assuming that this phenomenon extends to other companies, why do you think that TQM works better in manufacturing than in nonmanufacturing/service areas?

One large company that has been successful in applying Total Quality Management (TQM) principles in manufacturing reports that it has had less success in applying the same techniques in improving administrative functions such as order taking, distribution, and human resources. This company (which has won several quality awards and has significantly improved its product quality) used state-of-the-art TQM methods to train all of its employees in how to apply TQM. However, the company has not been able to achieve the same cost reductions and service quality enhancements in administrative areas as it has in the manufacturing area. Assuming that this phenomenon extends to other companies, why do you think that TQM works better in manufacturing than in nonmanufacturing/service areas?

The ability of TQM to deliver cost savings and performance enhancements depends directly on how easy it is to measure and observe the output of the process. If a TQM team's output is easy to measure, it is easier to hold the team members responsible for improving quality. If quality improvements are difficult to observe, then holding team members responsible imposes more risk on them. It is easier for them to argue that they didn't achieve their goals because they were hard to observe. If the benefits from TQM are lower because it is more difficult to observe the TQM output, less will be invested in such activities.

Measuring quality improvements in a manufactured process tends to be easier than a service. Engineering standards can be set for a manufactured good and conformance to the standards can be relatively easy to measure. But the output of many administrative departments is multidimensional and often hard to observe. Manufacturing involves repetitive processes with few exceptions. Administrative functions often involve handling numerous exceptions. It is likely to be easier to observe quality improvements in a television set than it is in a human resources department or a legal department.

Measuring quality improvements in a manufactured process tends to be easier than a service. Engineering standards can be set for a manufactured good and conformance to the standards can be relatively easy to measure. But the output of many administrative departments is multidimensional and often hard to observe. Manufacturing involves repetitive processes with few exceptions. Administrative functions often involve handling numerous exceptions. It is likely to be easier to observe quality improvements in a television set than it is in a human resources department or a legal department.

2

Old Town Roasters

Old Town Roasters (OTR) owns and operates a chain of 12 coffee shops around town. OTR's strategy is to provide the highest-quality coffee and baked goods in a warm, friendly environment. Each OTR provides its customers Internet access and current newspapers. Some shops are open 24 hours a day, especially those located around college campuses. Each shop manager is responsible for deciding the hours that the store is open, the selection of baked goods to stock, and the number of Internet terminals to provide in the store.

Required:

Design a balanced scorecard to evaluate and reward the manager of each shop.

Old Town Roasters (OTR) owns and operates a chain of 12 coffee shops around town. OTR's strategy is to provide the highest-quality coffee and baked goods in a warm, friendly environment. Each OTR provides its customers Internet access and current newspapers. Some shops are open 24 hours a day, especially those located around college campuses. Each shop manager is responsible for deciding the hours that the store is open, the selection of baked goods to stock, and the number of Internet terminals to provide in the store.

Required:

Design a balanced scorecard to evaluate and reward the manager of each shop.

Balance Scorecard:

It is a planning tool or technique which is being used by many organizations worldwide. It helps in using the main products or services of the organization towards the completion of objectives and plans of the organization.

Balance Scorecard also helps in formulating various techniques due to which the daily working is aligned in connection with the goals of the organization.

For any organization, balance scorecard plays an important for its stability and providing various ways to counter many difficult situations. The balanced scorecard should have many important aspects of influencing the organization team for the betterment of work and results. The four main perspective of the balanced scorecard is as follows:

1.Perspective Related to Finance:

Under this, the management of the company should try to increase the wealth of the company by investing in higher return generating projects with a lower rate of interest as per the rules of the balance scorecard techniques.

2.Perspective Related to Customer:

Every organization who has adopted the balanced scorecard should always keen towards increasing its customer base and work towards the satisfaction of their customers.

3.The perspective of Internal Business:

This perspective is linked with the internal controls implemented by the organization. These controls help the staff and the management to work efficiently and proving the services to the customers on time so that they do not have to wait for getting the service.

4.Perspective in relation to learning and growth:

This perspective is completely focused upon the working of the employees in the organization as it deals with the training of employees from time to time. The employees are also ordered to learn new innovative ideas which will help the company in the long run.

It is a planning tool or technique which is being used by many organizations worldwide. It helps in using the main products or services of the organization towards the completion of objectives and plans of the organization.

Balance Scorecard also helps in formulating various techniques due to which the daily working is aligned in connection with the goals of the organization.

For any organization, balance scorecard plays an important for its stability and providing various ways to counter many difficult situations. The balanced scorecard should have many important aspects of influencing the organization team for the betterment of work and results. The four main perspective of the balanced scorecard is as follows:

1.Perspective Related to Finance:

Under this, the management of the company should try to increase the wealth of the company by investing in higher return generating projects with a lower rate of interest as per the rules of the balance scorecard techniques.

2.Perspective Related to Customer:

Every organization who has adopted the balanced scorecard should always keen towards increasing its customer base and work towards the satisfaction of their customers.

3.The perspective of Internal Business:

This perspective is linked with the internal controls implemented by the organization. These controls help the staff and the management to work efficiently and proving the services to the customers on time so that they do not have to wait for getting the service.

4.Perspective in relation to learning and growth:

This perspective is completely focused upon the working of the employees in the organization as it deals with the training of employees from time to time. The employees are also ordered to learn new innovative ideas which will help the company in the long run.

3

The Pottery Store

The Pottery Store is a chain of retail stores in upscale malls that sells pottery, woodcarvings, and other craft items. The typical customer is shopping for a gift and spends between $50 and $200. Buyers in the corporate office contact artists around the country and buy inventory for the stores. Corporate headquarters sets the final selling price for each item and determines when to mark them down for sales. Each store manager is responsible for store staffing and layout. Store managers do not have responsibility for choosing the merchandise, store hours (set by the mall), or pricing decisions.

Required:

a. Design a balanced scorecard for the store managers.

b. How would your answer to ( a ) change if the store managers also had decision-making responsibilities for both selecting the merchandise to carry in the store and pricing?

The Pottery Store is a chain of retail stores in upscale malls that sells pottery, woodcarvings, and other craft items. The typical customer is shopping for a gift and spends between $50 and $200. Buyers in the corporate office contact artists around the country and buy inventory for the stores. Corporate headquarters sets the final selling price for each item and determines when to mark them down for sales. Each store manager is responsible for store staffing and layout. Store managers do not have responsibility for choosing the merchandise, store hours (set by the mall), or pricing decisions.

Required:

a. Design a balanced scorecard for the store managers.

b. How would your answer to ( a ) change if the store managers also had decision-making responsibilities for both selecting the merchandise to carry in the store and pricing?

a.The balanced scorecard should have four measures:

Financial perspective. Sales less the cost of labor and any other expenses the store manager controls (such as utilities and maintenance)

Customer perspective. Customer satisfaction as measured by survey cards asking feedback on the store's appearance, service, friendliness of service providers, and so forth. Sales growth.

Internal business perspective. Breakage and shrinkage.

Learning and growth perspective. Employee turnover.

b.If the manager has decision-making responsibilities over inventory and pricing, the financial perspective should include either return on assets or economic value added. These metrics create better incentives to control excessive inventory and also reward managers for setting prices that maximize firm value.

Financial perspective. Sales less the cost of labor and any other expenses the store manager controls (such as utilities and maintenance)

Customer perspective. Customer satisfaction as measured by survey cards asking feedback on the store's appearance, service, friendliness of service providers, and so forth. Sales growth.

Internal business perspective. Breakage and shrinkage.

Learning and growth perspective. Employee turnover.

b.If the manager has decision-making responsibilities over inventory and pricing, the financial perspective should include either return on assets or economic value added. These metrics create better incentives to control excessive inventory and also reward managers for setting prices that maximize firm value.

4

Software Development Inc.

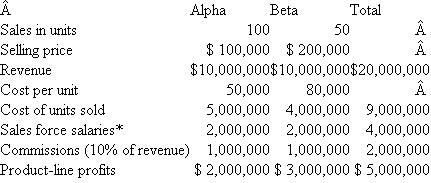

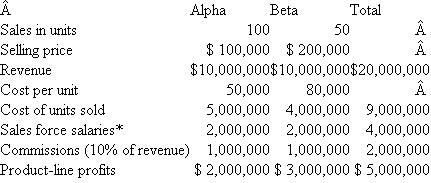

Software Development Inc. (SDI) produces and markets software for personal computers, including spreadsheet, word processing, desktop publishing, and database management programs. SDI has annual sales of $800 million.

Producing software is a time-consuming, labor-intensive process. Software quality is an extremely important aspect of success in computer software markets. One aspect of quality is program reliability. Does the software perform as expected? Does it work with other software in terms of data transfers and interfaces? Does it terminate abnormally? In spite of extensive testing of the software, programs always contain some bugs. Once the software is released, SDI stands behind the product with phone-in customer service consultants who answer questions and help the customer work around problems in the software. SDI's software maintenance group fixes bugs and sends out revised versions of the programs to customers.

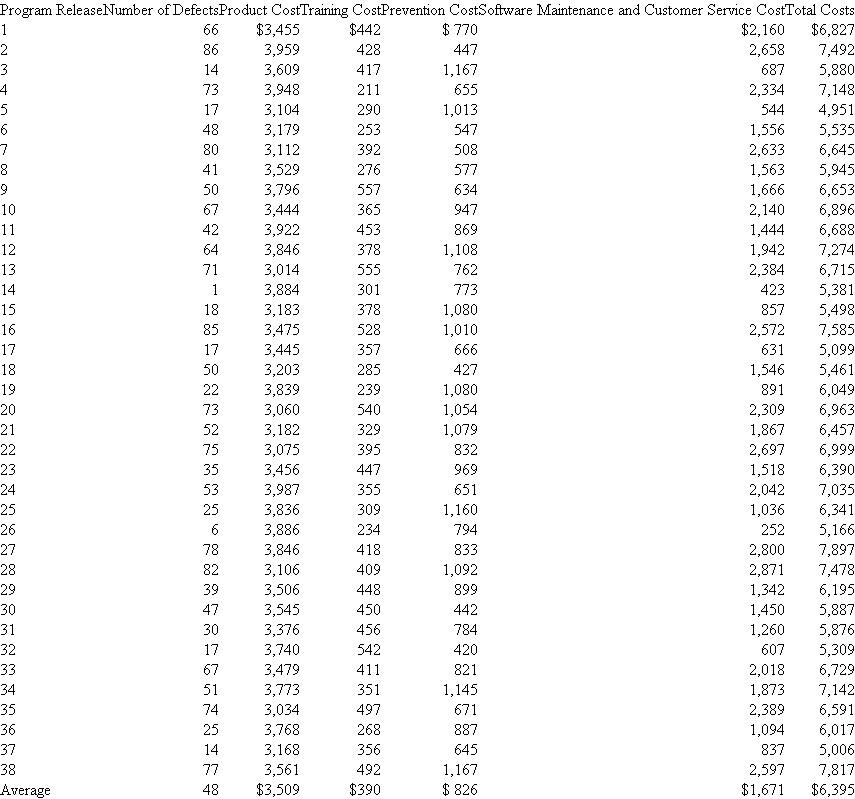

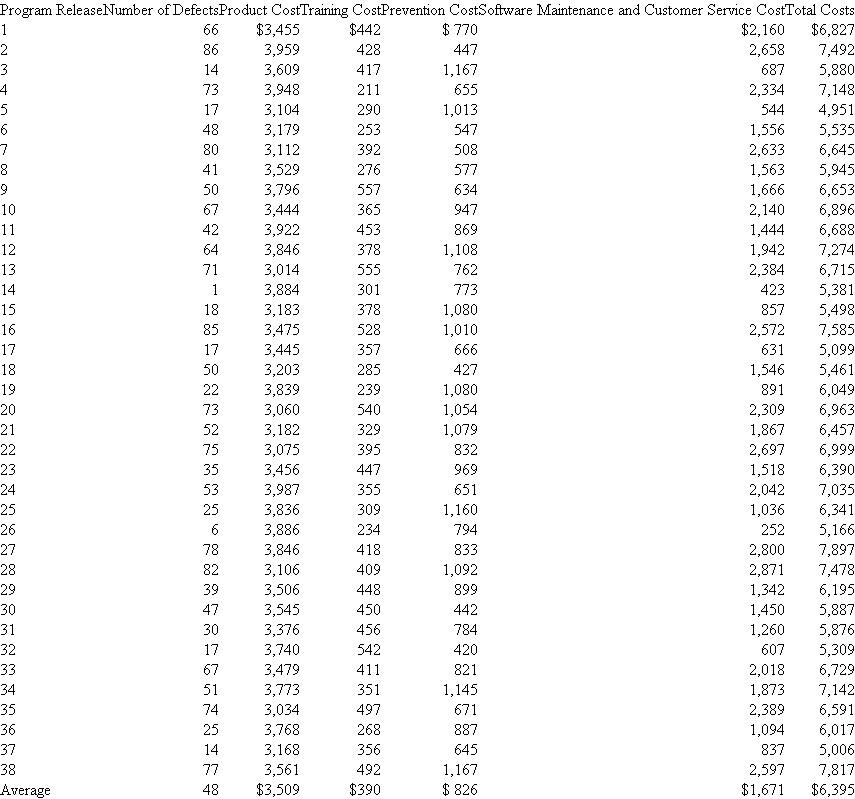

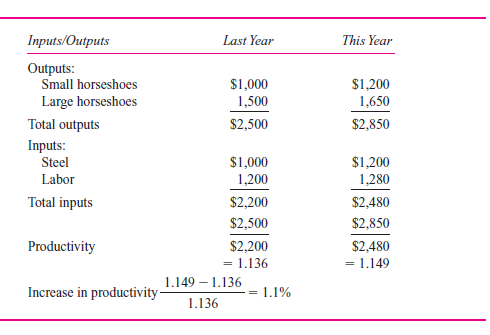

SDI tracks the relation between quality costs and quality. The quality measure it uses is the number of documented bugs in a software package. These bugs are counted when a customer calls in with a complaint and the SDI customer service representative determines that this is a new problem. The software maintenance programmers then attempt to fix the program and eliminate the bug. To manage quality, SDI tracks quality costs. It has released 38 new packages or major revisions in existing packages in the last three years. The accompanying table reports the number of defects (bugs) documented in the first six months following release. Also listed in the table are total product cost and quality cost per software package release.

Product costs include all the costs incurred to produce and market the software, excluding the quality costs in the table. Quality costs consist of three components: training, prevention, and software maintenance and customer service costs. Training costs are expenditures for educating the programmers and updating their training. Better-educated programmers produce fewer bugs. Prevention costs include expenditures for testing the software before it is released. Maintenance and customer service costs include (1) the programmers charged with fixing the bugs and reissuing the revised software and (2) the customer service representatives answering phone questions. The training and prevention costs are measured over the period the software was being developed. The number of defects and maintenance and service costs are measured in the first six months following release.

SDI Defects and Quality Costs by Program Release* * Per 100,000 lines of computer code.

* Per 100,000 lines of computer code.

All the numbers in the table have been divided by lines of computer code in the particular program release. Programs with more lines of code cost more and also have more bugs. Prior studies find that using lines of code is an acceptable way to control for program complexity. Thus, the numbers in the table are stated in terms of defects and cost per 100,000 lines of code.

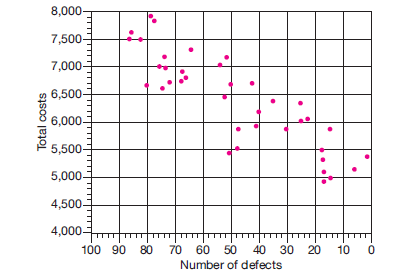

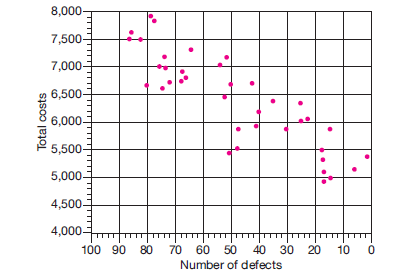

The figure below plots the relation between total cost and number of defects. The vice president of quality of SDI likes to use it to emphasize that costs and quality are inversely related. She is fond of saying, "Quality pays! Our total costs fall as the number of defects declines. The more we spend on quality, the lower our costs."

SDI total costs by defects

Required:

Critically evaluate the vice president's analysis.

Software Development Inc. (SDI) produces and markets software for personal computers, including spreadsheet, word processing, desktop publishing, and database management programs. SDI has annual sales of $800 million.

Producing software is a time-consuming, labor-intensive process. Software quality is an extremely important aspect of success in computer software markets. One aspect of quality is program reliability. Does the software perform as expected? Does it work with other software in terms of data transfers and interfaces? Does it terminate abnormally? In spite of extensive testing of the software, programs always contain some bugs. Once the software is released, SDI stands behind the product with phone-in customer service consultants who answer questions and help the customer work around problems in the software. SDI's software maintenance group fixes bugs and sends out revised versions of the programs to customers.

SDI tracks the relation between quality costs and quality. The quality measure it uses is the number of documented bugs in a software package. These bugs are counted when a customer calls in with a complaint and the SDI customer service representative determines that this is a new problem. The software maintenance programmers then attempt to fix the program and eliminate the bug. To manage quality, SDI tracks quality costs. It has released 38 new packages or major revisions in existing packages in the last three years. The accompanying table reports the number of defects (bugs) documented in the first six months following release. Also listed in the table are total product cost and quality cost per software package release.

Product costs include all the costs incurred to produce and market the software, excluding the quality costs in the table. Quality costs consist of three components: training, prevention, and software maintenance and customer service costs. Training costs are expenditures for educating the programmers and updating their training. Better-educated programmers produce fewer bugs. Prevention costs include expenditures for testing the software before it is released. Maintenance and customer service costs include (1) the programmers charged with fixing the bugs and reissuing the revised software and (2) the customer service representatives answering phone questions. The training and prevention costs are measured over the period the software was being developed. The number of defects and maintenance and service costs are measured in the first six months following release.

SDI Defects and Quality Costs by Program Release*

* Per 100,000 lines of computer code.

* Per 100,000 lines of computer code.All the numbers in the table have been divided by lines of computer code in the particular program release. Programs with more lines of code cost more and also have more bugs. Prior studies find that using lines of code is an acceptable way to control for program complexity. Thus, the numbers in the table are stated in terms of defects and cost per 100,000 lines of code.

The figure below plots the relation between total cost and number of defects. The vice president of quality of SDI likes to use it to emphasize that costs and quality are inversely related. She is fond of saying, "Quality pays! Our total costs fall as the number of defects declines. The more we spend on quality, the lower our costs."

SDI total costs by defects

Required:

Critically evaluate the vice president's analysis.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 18 في هذه المجموعة.

فتح الحزمة

k this deck

5

Stirling Acquisition

You are working for an investment banking firm. One of your clients is examining the possibility of purchasing Stirling Manufacturing, a parts supplier (specifically, tail-light assemblies) to the automobile industry. Stirling has sales of $130 million and assets of $93 million.

Your client has asked your firm to evaluate Stirling (a privately held company) and indicate how much should be paid for Stirling. Stirling has a batch-manufacturing process. Raw materials inventories are held until they are placed into production. Batches of between 2,000 and 2,500 tail-light assemblies are manufactured. These are then delivered daily, 100 to 150 at a time, to satisfy Stirling's customers' demand for just-in-time (JIT) deliveries. Your client is considering installing JIT production methods at Stirling if the acquisition is completed.

Your boss asks you to write a memo that outlines the various likely results if Stirling adopts JIT production techniques and the likely impact on Stirling's cash flows and eventual market value. Your memo will provide background information for your colleagues who are actually estimating Stirling's current price and future value after acquisition. Your client is planning on making a number of changes at Stirling. JIT is just one of them. Your memo will assist the analysts in your firm and should direct them in their data gathering and valuation efforts. Your memo should describe specifically what additional data your colleagues should collect in order to estimate JIT's cash flow effects.

You are working for an investment banking firm. One of your clients is examining the possibility of purchasing Stirling Manufacturing, a parts supplier (specifically, tail-light assemblies) to the automobile industry. Stirling has sales of $130 million and assets of $93 million.

Your client has asked your firm to evaluate Stirling (a privately held company) and indicate how much should be paid for Stirling. Stirling has a batch-manufacturing process. Raw materials inventories are held until they are placed into production. Batches of between 2,000 and 2,500 tail-light assemblies are manufactured. These are then delivered daily, 100 to 150 at a time, to satisfy Stirling's customers' demand for just-in-time (JIT) deliveries. Your client is considering installing JIT production methods at Stirling if the acquisition is completed.

Your boss asks you to write a memo that outlines the various likely results if Stirling adopts JIT production techniques and the likely impact on Stirling's cash flows and eventual market value. Your memo will provide background information for your colleagues who are actually estimating Stirling's current price and future value after acquisition. Your client is planning on making a number of changes at Stirling. JIT is just one of them. Your memo will assist the analysts in your firm and should direct them in their data gathering and valuation efforts. Your memo should describe specifically what additional data your colleagues should collect in order to estimate JIT's cash flow effects.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 18 في هذه المجموعة.

فتح الحزمة

k this deck

6

TQM at the Stowbridge Division

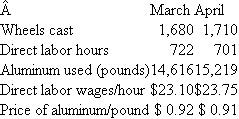

The Stowbridge Division is analyzing expanding its Total Quality Management program. It already has a TQM program in place. However, one of its customers, Amlan Equipment, is asking all suppliers to become ISO 9000-qualified, a process that certifies that the firm meets various standards. Once suppliers are ISO 9000-qualified, Amlan can reduce its inspection costs. Not all of the suppliers will be certified, and those that are will receive more business from Amlan.

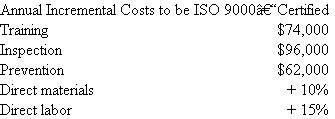

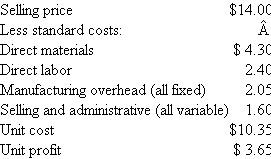

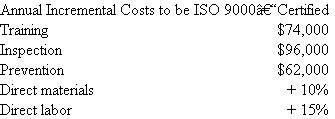

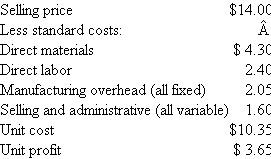

Amlan purchases a stainless steel rotor from Stowbridge. After earning ISO 9000 certification, Stowbridge estimates that it will have to incur the following annual incremental costs as long as it wants to maintain its certification: To manufacture the current quality of the rotors (before ISO 9000 certification), the budgeted selling price and standard cost data per rotor follow.

To manufacture the current quality of the rotors (before ISO 9000 certification), the budgeted selling price and standard cost data per rotor follow.  Unless Stowbridge receives ISO 9000 certification, it will lose Amlan's business of 120,000 units per year. Management estimates that the higher quality of the rotor that meets quality criteria will allow Stowbridge to add 14,000 rotors to its existing sales from new and continuing customers. Stowbridge is currently selling 480,000 rotors per year, including the Amlan sales. The 480,000 current sales amount to 63 percent of plant capacity. The additional 14,000 units sold can be manufactured without exceeding plant capacity. The higher-quality process after ISO 9000 certification is received would apply to all the rotors produced.

Unless Stowbridge receives ISO 9000 certification, it will lose Amlan's business of 120,000 units per year. Management estimates that the higher quality of the rotor that meets quality criteria will allow Stowbridge to add 14,000 rotors to its existing sales from new and continuing customers. Stowbridge is currently selling 480,000 rotors per year, including the Amlan sales. The 480,000 current sales amount to 63 percent of plant capacity. The additional 14,000 units sold can be manufactured without exceeding plant capacity. The higher-quality process after ISO 9000 certification is received would apply to all the rotors produced.

Required:

Should Stowbridge seek ISO 9000 certification? Support your recommendation with an analysis of the costs and benefits of certification.

The Stowbridge Division is analyzing expanding its Total Quality Management program. It already has a TQM program in place. However, one of its customers, Amlan Equipment, is asking all suppliers to become ISO 9000-qualified, a process that certifies that the firm meets various standards. Once suppliers are ISO 9000-qualified, Amlan can reduce its inspection costs. Not all of the suppliers will be certified, and those that are will receive more business from Amlan.

Amlan purchases a stainless steel rotor from Stowbridge. After earning ISO 9000 certification, Stowbridge estimates that it will have to incur the following annual incremental costs as long as it wants to maintain its certification:

To manufacture the current quality of the rotors (before ISO 9000 certification), the budgeted selling price and standard cost data per rotor follow.

To manufacture the current quality of the rotors (before ISO 9000 certification), the budgeted selling price and standard cost data per rotor follow.  Unless Stowbridge receives ISO 9000 certification, it will lose Amlan's business of 120,000 units per year. Management estimates that the higher quality of the rotor that meets quality criteria will allow Stowbridge to add 14,000 rotors to its existing sales from new and continuing customers. Stowbridge is currently selling 480,000 rotors per year, including the Amlan sales. The 480,000 current sales amount to 63 percent of plant capacity. The additional 14,000 units sold can be manufactured without exceeding plant capacity. The higher-quality process after ISO 9000 certification is received would apply to all the rotors produced.

Unless Stowbridge receives ISO 9000 certification, it will lose Amlan's business of 120,000 units per year. Management estimates that the higher quality of the rotor that meets quality criteria will allow Stowbridge to add 14,000 rotors to its existing sales from new and continuing customers. Stowbridge is currently selling 480,000 rotors per year, including the Amlan sales. The 480,000 current sales amount to 63 percent of plant capacity. The additional 14,000 units sold can be manufactured without exceeding plant capacity. The higher-quality process after ISO 9000 certification is received would apply to all the rotors produced.Required:

Should Stowbridge seek ISO 9000 certification? Support your recommendation with an analysis of the costs and benefits of certification.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 18 في هذه المجموعة.

فتح الحزمة

k this deck

7

Winter Games

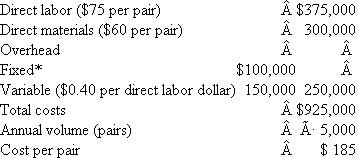

Winter Games manufactures a competitive line of skis and sells its skis to retailers at a price of $225 per pair. Based on an annual volume of 5,000 pairs, the cost per pair is $185: "Composed of depreciation, property taxes, charitable contributions, insurance, and so on.

"Composed of depreciation, property taxes, charitable contributions, insurance, and so on.

Sports Palace, a discount sporting goods store, currently purchases 500 pairs of skis from Winter Games. Sports Palace has asked to purchase 1,000 pairs of skis under a private brand label, at a price of $200 per pair. The skis would be identical to those normally sold for $225.

Winter Games believes that if it accepts the order, Sports Palace will cancel its usual order of 500 pairs. These sales cannot be recouped elsewhere. If this special order is accepted, the direct labor hours for the additional 500 skis would have to be compensated at overtime rates (at 1 1 / 2 times the base rate). Analysis shows that variable overhead varies with total direct labor dollars at the rate of $0.40 per direct labor dollar.

Should Winter Games accept the special order from Sports Palace?

Winter Games manufactures a competitive line of skis and sells its skis to retailers at a price of $225 per pair. Based on an annual volume of 5,000 pairs, the cost per pair is $185:

"Composed of depreciation, property taxes, charitable contributions, insurance, and so on.

"Composed of depreciation, property taxes, charitable contributions, insurance, and so on.Sports Palace, a discount sporting goods store, currently purchases 500 pairs of skis from Winter Games. Sports Palace has asked to purchase 1,000 pairs of skis under a private brand label, at a price of $200 per pair. The skis would be identical to those normally sold for $225.

Winter Games believes that if it accepts the order, Sports Palace will cancel its usual order of 500 pairs. These sales cannot be recouped elsewhere. If this special order is accepted, the direct labor hours for the additional 500 skis would have to be compensated at overtime rates (at 1 1 / 2 times the base rate). Analysis shows that variable overhead varies with total direct labor dollars at the rate of $0.40 per direct labor dollar.

Should Winter Games accept the special order from Sports Palace?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 18 في هذه المجموعة.

فتح الحزمة

k this deck

8

Warren City Parts Manufacturing

Warren City, with sales of $2 billion, produces and sells farm equipment. The manufacturing division produces some parts internally and purchases other parts from external suppliers and assembles farm equipment including tractors, combines, and plows. Within the manufacturing division is parts manufacturing, which fabricates a large variety of parts. Parts manufacturing is further subdivided into 12 departments, including screw products, metal stamping and fabrication, plastic injection molding, and steel castings. Each of these parts departments is headed by a department manager whose performance is evaluated along several dimensions: meeting budgeted costs, meeting delivery schedules, improving quality, achieving affirmative action and employee satisfaction goals, and minimizing inventory adjustments.

Inventory adjustments occur twice a year after internal auditors conduct a physical inventory of the parts department's work in process and compare it with the amount of inventory as reported in the work-in-process (WIP) account. For example, if on June 30 the auditors take a physical inventory count and find $130,000 of physical WIP inventory in the steel castings department but the WIP account reports an inventory balance of $143,000, then a negative inventory adjustment of -9.1 percent (-$13,000 ÷ $143,000) is made. Any inventory adjustment, positive or negative, reflects unfavorably on the parts department manager's performance and results in a reduction in the manager's bonus. The parts department manager is expected to maintain a tight control of WIP inventories, including ensuring the integrity of his or her department's accounting reports of WIP. Large inventory adjustments indicate that the manager does not have good control of WIP.

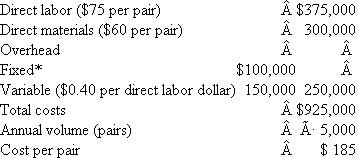

Four years ago Warren City adopted JIT production procedures. The result has been a drastic reduction of WIP inventories. For example, the following data illustrate the steel castings department's WIP account balance before adjustments, inventory adjustment, and throughput for the last seven years.

Warren City Steel Castings Department * Deflated by 12/31 WIP.

* Deflated by 12/31 WIP.

Throughput is the total dollar cost of parts manufactured in the year. It is the sum of the beginning inventory plus direct labor and materials and overhead, less ending inventory. Warren City uses a standard cost system and all inventories are valued at standard cost. When a batch of parts completes production, the WIP inventory is reduced by the standard cost of the part times the standard number of parts in the batch. Each part is manufactured in standard lot sizes.

Inventory adjustments can result for a number of reasons:

1. Different batch sizes. The department manager decides to deviate from standard batch sizes. Unless a special entry is recorded, the accounting system assumes that the number of units in the batch is the standard number. Sometimes the manager has some excess production capacity and decides to increase the standard batch size. In some cases, the manager produces fewer parts than called for by the standard lot size because of machine breakdowns or bottlenecks. For example, suppose a certain part calls for a standard batch size of 150 but the manager decides to produce 200 parts, keeps 50 as spares, but fails to update the WIP account for the additional 50 units. The WIP account contains only 150 at standard cost but the auditors count 200, causing a positive inventory adjustment.

2. Timing differences. The accounting system charges some expenses in a different time period than the department manager expects. This causes the dollar amount of the WIP balance to differ from standard cost.

3. Standard cost revisions. The standard cost of a part is revised and the auditors use a different standard cost in valuing the ending WIP inventory than was used in the WIP account.

4. Audit mistakes. The internal auditors make mistakes in counting the final physical WIP inventory.

The first two reasons are by far the most prevalent causes of inventory adjustments.

Required:

a. Management is concerned that the magnitude of the inventory adjustment has increased over time. What are some likely reasons that the absolute value of the inventory adjustment has grown?

b. Evaluate the use of the inventory adjustment described above to measure a parts department manager's performance.

Warren City, with sales of $2 billion, produces and sells farm equipment. The manufacturing division produces some parts internally and purchases other parts from external suppliers and assembles farm equipment including tractors, combines, and plows. Within the manufacturing division is parts manufacturing, which fabricates a large variety of parts. Parts manufacturing is further subdivided into 12 departments, including screw products, metal stamping and fabrication, plastic injection molding, and steel castings. Each of these parts departments is headed by a department manager whose performance is evaluated along several dimensions: meeting budgeted costs, meeting delivery schedules, improving quality, achieving affirmative action and employee satisfaction goals, and minimizing inventory adjustments.

Inventory adjustments occur twice a year after internal auditors conduct a physical inventory of the parts department's work in process and compare it with the amount of inventory as reported in the work-in-process (WIP) account. For example, if on June 30 the auditors take a physical inventory count and find $130,000 of physical WIP inventory in the steel castings department but the WIP account reports an inventory balance of $143,000, then a negative inventory adjustment of -9.1 percent (-$13,000 ÷ $143,000) is made. Any inventory adjustment, positive or negative, reflects unfavorably on the parts department manager's performance and results in a reduction in the manager's bonus. The parts department manager is expected to maintain a tight control of WIP inventories, including ensuring the integrity of his or her department's accounting reports of WIP. Large inventory adjustments indicate that the manager does not have good control of WIP.

Four years ago Warren City adopted JIT production procedures. The result has been a drastic reduction of WIP inventories. For example, the following data illustrate the steel castings department's WIP account balance before adjustments, inventory adjustment, and throughput for the last seven years.

Warren City Steel Castings Department

* Deflated by 12/31 WIP.

* Deflated by 12/31 WIP.Throughput is the total dollar cost of parts manufactured in the year. It is the sum of the beginning inventory plus direct labor and materials and overhead, less ending inventory. Warren City uses a standard cost system and all inventories are valued at standard cost. When a batch of parts completes production, the WIP inventory is reduced by the standard cost of the part times the standard number of parts in the batch. Each part is manufactured in standard lot sizes.

Inventory adjustments can result for a number of reasons:

1. Different batch sizes. The department manager decides to deviate from standard batch sizes. Unless a special entry is recorded, the accounting system assumes that the number of units in the batch is the standard number. Sometimes the manager has some excess production capacity and decides to increase the standard batch size. In some cases, the manager produces fewer parts than called for by the standard lot size because of machine breakdowns or bottlenecks. For example, suppose a certain part calls for a standard batch size of 150 but the manager decides to produce 200 parts, keeps 50 as spares, but fails to update the WIP account for the additional 50 units. The WIP account contains only 150 at standard cost but the auditors count 200, causing a positive inventory adjustment.

2. Timing differences. The accounting system charges some expenses in a different time period than the department manager expects. This causes the dollar amount of the WIP balance to differ from standard cost.

3. Standard cost revisions. The standard cost of a part is revised and the auditors use a different standard cost in valuing the ending WIP inventory than was used in the WIP account.

4. Audit mistakes. The internal auditors make mistakes in counting the final physical WIP inventory.

The first two reasons are by far the most prevalent causes of inventory adjustments.

Required:

a. Management is concerned that the magnitude of the inventory adjustment has increased over time. What are some likely reasons that the absolute value of the inventory adjustment has grown?

b. Evaluate the use of the inventory adjustment described above to measure a parts department manager's performance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 18 في هذه المجموعة.

فتح الحزمة

k this deck

9

Secure Servers Inc.

Secure Servers Inc. (SSI) is one of the largest software and service providers directed at providing high levels of backup and security for computer servers to the financial community, military, and other clients requiring off-site backup and security systems. SSI's software packages include encryption, downloading, and data warehousing of large amounts of data to various SSI sites in dedicated locations. SSI backup locations are designed to survive virtually all natural disasters and terrorist attacks.

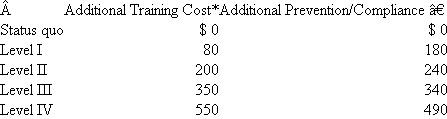

SSI employs 6,000 people in Dayton, Ohio. Being one of Dayton's largest employers, it has a deep commitment to the community and supports local educational, cultural, and philanthropic activities. SSI also believes strongly in both customer and employee satisfaction. To achieve these objectives, SSI employs a balanced scorecard to evaluate and reward senior managers. One-fourth of each senior executive's bonus is tied to the following objectively determined performance measures:

Community engagement (independent survey of local leaders).

Customer satisfaction (independent survey of customers).

Employee satisfaction (independent survey of employees).

Corporate profit (audited net income before taxes).

The annual surveys of local leaders, customers, and employees are conducted by an independent opinion survey firm that reports directly to the board of directors. Corporate profit is the firm's reported net income before taxes as audited by an international public accounting firm. SSI's senior management team believes strongly in the concept of the balanced scorecard and accepts it as a valid and productive performance measurement and incentive tool.

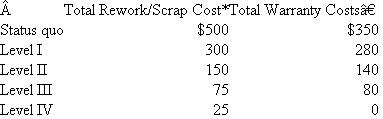

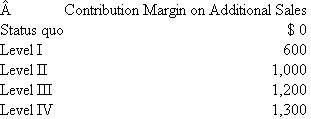

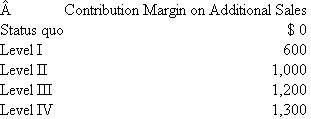

Senior management is tasked with determining how much to spend on further improvements in community engagement, customer satisfaction, and employee satisfaction. The following table captures the relations among additional spending in each area and the expected improvements from such expenditures (in millions).![Secure Servers Inc. Secure Servers Inc. (SSI) is one of the largest software and service providers directed at providing high levels of backup and security for computer servers to the financial community, military, and other clients requiring off-site backup and security systems. SSI's software packages include encryption, downloading, and data warehousing of large amounts of data to various SSI sites in dedicated locations. SSI backup locations are designed to survive virtually all natural disasters and terrorist attacks. SSI employs 6,000 people in Dayton, Ohio. Being one of Dayton's largest employers, it has a deep commitment to the community and supports local educational, cultural, and philanthropic activities. SSI also believes strongly in both customer and employee satisfaction. To achieve these objectives, SSI employs a balanced scorecard to evaluate and reward senior managers. One-fourth of each senior executive's bonus is tied to the following objectively determined performance measures: Community engagement (independent survey of local leaders). Customer satisfaction (independent survey of customers). Employee satisfaction (independent survey of employees). Corporate profit (audited net income before taxes). The annual surveys of local leaders, customers, and employees are conducted by an independent opinion survey firm that reports directly to the board of directors. Corporate profit is the firm's reported net income before taxes as audited by an international public accounting firm. SSI's senior management team believes strongly in the concept of the balanced scorecard and accepts it as a valid and productive performance measurement and incentive tool. Senior management is tasked with determining how much to spend on further improvements in community engagement, customer satisfaction, and employee satisfaction. The following table captures the relations among additional spending in each area and the expected improvements from such expenditures (in millions). For example, by spending an additional $3 million on customer service (improved call centers, training, etc.), a 95 percent customer satisfaction can be achieved. Or, by spending an additional $2 million on employee-related activities (improved child care, athletic facilities, fringe benefits), a 90 percent employee satisfaction can be achieved. Or spending $1 million on additional community projects can raise SSI's community rating survey to 50 percent. Besides raising the satisfaction scores as detailed above, making additional expenditures on these three areas also generates additional net cash flows to the firm. The following table estimates the additional cash flows SSI receives from making the additional expenditures. For example, spending $3 million for community projects yields a community rating index of 90 percent and additional cash flows of $4.0 million, which increases net income before taxes by $1.0 million ($4.0 ? $3.0). To convert audited net income into a percentage index that can be averaged with the other three survey metrics, SSI uses the following formula: Profit index = ?3 + 0.05 × Net income So, if net income is $74 million, the profit index for use in the balanced scorecard is 70 percent [?3 + (0.05 × 74)]. The four indexes are averaged to get an overall index for determining the bonus for each senior executive of SSI. For example, the following four indexes yield a balanced scorecard of 79.75 percent: SSI expects audited net income before taxes for the year before making any additional expenditures on customer satisfaction, employee satisfaction, and community engagement to be $72 million. Required: a. What levels of additional spending do you expect the senior management team of SSI will select for: (1) Customer satisfaction. (2) Community engagement. (3) Employee satisfaction. Be sure to justify your answers with appropriate analysis. b. Given the levels of additional spending on the three items you recommended in ( a ), what is the expected balanced scorecard index? That is, calculate the average balanced scorecard management expects to generate if they make the expenditure decisions you predict in ( a ). Show calculations. c. What level of spending would you expect a profit-maximizing owner of SSI to select for: (1) Customer satisfaction. (2) Community engagement. (3) Employee satisfaction. What is the expected balanced scorecard resulting from these spending levels?](https://d2lvgg3v3hfg70.cloudfront.net/SM1503/11eb559c_84e6_32eb_a8c8_37eddf32638f_SM1503_00.jpg) For example, by spending an additional $3 million on customer service (improved call centers, training, etc.), a 95 percent customer satisfaction can be achieved. Or, by spending an additional $2 million on employee-related activities (improved child care, athletic facilities, fringe benefits), a 90 percent employee satisfaction can be achieved. Or spending $1 million on additional community projects can raise SSI's community rating survey to 50 percent.

For example, by spending an additional $3 million on customer service (improved call centers, training, etc.), a 95 percent customer satisfaction can be achieved. Or, by spending an additional $2 million on employee-related activities (improved child care, athletic facilities, fringe benefits), a 90 percent employee satisfaction can be achieved. Or spending $1 million on additional community projects can raise SSI's community rating survey to 50 percent.

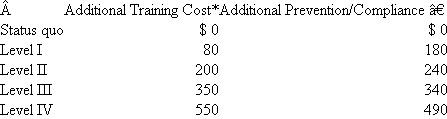

Besides raising the satisfaction scores as detailed above, making additional expenditures on these three areas also generates additional net cash flows to the firm. The following table estimates the additional cash flows SSI receives from making the additional expenditures.![Secure Servers Inc. Secure Servers Inc. (SSI) is one of the largest software and service providers directed at providing high levels of backup and security for computer servers to the financial community, military, and other clients requiring off-site backup and security systems. SSI's software packages include encryption, downloading, and data warehousing of large amounts of data to various SSI sites in dedicated locations. SSI backup locations are designed to survive virtually all natural disasters and terrorist attacks. SSI employs 6,000 people in Dayton, Ohio. Being one of Dayton's largest employers, it has a deep commitment to the community and supports local educational, cultural, and philanthropic activities. SSI also believes strongly in both customer and employee satisfaction. To achieve these objectives, SSI employs a balanced scorecard to evaluate and reward senior managers. One-fourth of each senior executive's bonus is tied to the following objectively determined performance measures: Community engagement (independent survey of local leaders). Customer satisfaction (independent survey of customers). Employee satisfaction (independent survey of employees). Corporate profit (audited net income before taxes). The annual surveys of local leaders, customers, and employees are conducted by an independent opinion survey firm that reports directly to the board of directors. Corporate profit is the firm's reported net income before taxes as audited by an international public accounting firm. SSI's senior management team believes strongly in the concept of the balanced scorecard and accepts it as a valid and productive performance measurement and incentive tool. Senior management is tasked with determining how much to spend on further improvements in community engagement, customer satisfaction, and employee satisfaction. The following table captures the relations among additional spending in each area and the expected improvements from such expenditures (in millions). For example, by spending an additional $3 million on customer service (improved call centers, training, etc.), a 95 percent customer satisfaction can be achieved. Or, by spending an additional $2 million on employee-related activities (improved child care, athletic facilities, fringe benefits), a 90 percent employee satisfaction can be achieved. Or spending $1 million on additional community projects can raise SSI's community rating survey to 50 percent. Besides raising the satisfaction scores as detailed above, making additional expenditures on these three areas also generates additional net cash flows to the firm. The following table estimates the additional cash flows SSI receives from making the additional expenditures. For example, spending $3 million for community projects yields a community rating index of 90 percent and additional cash flows of $4.0 million, which increases net income before taxes by $1.0 million ($4.0 ? $3.0). To convert audited net income into a percentage index that can be averaged with the other three survey metrics, SSI uses the following formula: Profit index = ?3 + 0.05 × Net income So, if net income is $74 million, the profit index for use in the balanced scorecard is 70 percent [?3 + (0.05 × 74)]. The four indexes are averaged to get an overall index for determining the bonus for each senior executive of SSI. For example, the following four indexes yield a balanced scorecard of 79.75 percent: SSI expects audited net income before taxes for the year before making any additional expenditures on customer satisfaction, employee satisfaction, and community engagement to be $72 million. Required: a. What levels of additional spending do you expect the senior management team of SSI will select for: (1) Customer satisfaction. (2) Community engagement. (3) Employee satisfaction. Be sure to justify your answers with appropriate analysis. b. Given the levels of additional spending on the three items you recommended in ( a ), what is the expected balanced scorecard index? That is, calculate the average balanced scorecard management expects to generate if they make the expenditure decisions you predict in ( a ). Show calculations. c. What level of spending would you expect a profit-maximizing owner of SSI to select for: (1) Customer satisfaction. (2) Community engagement. (3) Employee satisfaction. What is the expected balanced scorecard resulting from these spending levels?](https://d2lvgg3v3hfg70.cloudfront.net/SM1503/11eb559c_84e6_32ec_a8c8_ebd250aa3031_SM1503_00.jpg) For example, spending $3 million for community projects yields a community rating index of 90 percent and additional cash flows of $4.0 million, which increases net income before taxes by $1.0 million ($4.0 ? $3.0).

For example, spending $3 million for community projects yields a community rating index of 90 percent and additional cash flows of $4.0 million, which increases net income before taxes by $1.0 million ($4.0 ? $3.0).

To convert audited net income into a percentage index that can be averaged with the other three survey metrics, SSI uses the following formula:

Profit index = ?3 + 0.05 × Net income

So, if net income is $74 million, the profit index for use in the balanced scorecard is 70 percent [?3 + (0.05 × 74)].

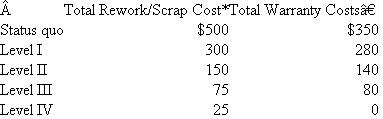

The four indexes are averaged to get an overall index for determining the bonus for each senior executive of SSI. For example, the following four indexes yield a balanced scorecard of 79.75 percent:![Secure Servers Inc. Secure Servers Inc. (SSI) is one of the largest software and service providers directed at providing high levels of backup and security for computer servers to the financial community, military, and other clients requiring off-site backup and security systems. SSI's software packages include encryption, downloading, and data warehousing of large amounts of data to various SSI sites in dedicated locations. SSI backup locations are designed to survive virtually all natural disasters and terrorist attacks. SSI employs 6,000 people in Dayton, Ohio. Being one of Dayton's largest employers, it has a deep commitment to the community and supports local educational, cultural, and philanthropic activities. SSI also believes strongly in both customer and employee satisfaction. To achieve these objectives, SSI employs a balanced scorecard to evaluate and reward senior managers. One-fourth of each senior executive's bonus is tied to the following objectively determined performance measures: Community engagement (independent survey of local leaders). Customer satisfaction (independent survey of customers). Employee satisfaction (independent survey of employees). Corporate profit (audited net income before taxes). The annual surveys of local leaders, customers, and employees are conducted by an independent opinion survey firm that reports directly to the board of directors. Corporate profit is the firm's reported net income before taxes as audited by an international public accounting firm. SSI's senior management team believes strongly in the concept of the balanced scorecard and accepts it as a valid and productive performance measurement and incentive tool. Senior management is tasked with determining how much to spend on further improvements in community engagement, customer satisfaction, and employee satisfaction. The following table captures the relations among additional spending in each area and the expected improvements from such expenditures (in millions). For example, by spending an additional $3 million on customer service (improved call centers, training, etc.), a 95 percent customer satisfaction can be achieved. Or, by spending an additional $2 million on employee-related activities (improved child care, athletic facilities, fringe benefits), a 90 percent employee satisfaction can be achieved. Or spending $1 million on additional community projects can raise SSI's community rating survey to 50 percent. Besides raising the satisfaction scores as detailed above, making additional expenditures on these three areas also generates additional net cash flows to the firm. The following table estimates the additional cash flows SSI receives from making the additional expenditures. For example, spending $3 million for community projects yields a community rating index of 90 percent and additional cash flows of $4.0 million, which increases net income before taxes by $1.0 million ($4.0 ? $3.0). To convert audited net income into a percentage index that can be averaged with the other three survey metrics, SSI uses the following formula: Profit index = ?3 + 0.05 × Net income So, if net income is $74 million, the profit index for use in the balanced scorecard is 70 percent [?3 + (0.05 × 74)]. The four indexes are averaged to get an overall index for determining the bonus for each senior executive of SSI. For example, the following four indexes yield a balanced scorecard of 79.75 percent: SSI expects audited net income before taxes for the year before making any additional expenditures on customer satisfaction, employee satisfaction, and community engagement to be $72 million. Required: a. What levels of additional spending do you expect the senior management team of SSI will select for: (1) Customer satisfaction. (2) Community engagement. (3) Employee satisfaction. Be sure to justify your answers with appropriate analysis. b. Given the levels of additional spending on the three items you recommended in ( a ), what is the expected balanced scorecard index? That is, calculate the average balanced scorecard management expects to generate if they make the expenditure decisions you predict in ( a ). Show calculations. c. What level of spending would you expect a profit-maximizing owner of SSI to select for: (1) Customer satisfaction. (2) Community engagement. (3) Employee satisfaction. What is the expected balanced scorecard resulting from these spending levels?](https://d2lvgg3v3hfg70.cloudfront.net/SM1503/11eb559c_84e6_32ed_a8c8_9141453d16c7_SM1503_00.jpg) SSI expects audited net income before taxes for the year before making any additional expenditures on customer satisfaction, employee satisfaction, and community engagement to be $72 million.

SSI expects audited net income before taxes for the year before making any additional expenditures on customer satisfaction, employee satisfaction, and community engagement to be $72 million.

Required:

a. What levels of additional spending do you expect the senior management team of SSI will select for:

(1) Customer satisfaction.

(2) Community engagement.

(3) Employee satisfaction.

Be sure to justify your answers with appropriate analysis.

b. Given the levels of additional spending on the three items you recommended in ( a ), what is the expected balanced scorecard index? That is, calculate the average balanced scorecard management expects to generate if they make the expenditure decisions you predict in ( a ). Show calculations.

c. What level of spending would you expect a profit-maximizing owner of SSI to select for:

(1) Customer satisfaction.

(2) Community engagement.

(3) Employee satisfaction.

What is the expected balanced scorecard resulting from these spending levels?

Secure Servers Inc. (SSI) is one of the largest software and service providers directed at providing high levels of backup and security for computer servers to the financial community, military, and other clients requiring off-site backup and security systems. SSI's software packages include encryption, downloading, and data warehousing of large amounts of data to various SSI sites in dedicated locations. SSI backup locations are designed to survive virtually all natural disasters and terrorist attacks.

SSI employs 6,000 people in Dayton, Ohio. Being one of Dayton's largest employers, it has a deep commitment to the community and supports local educational, cultural, and philanthropic activities. SSI also believes strongly in both customer and employee satisfaction. To achieve these objectives, SSI employs a balanced scorecard to evaluate and reward senior managers. One-fourth of each senior executive's bonus is tied to the following objectively determined performance measures:

Community engagement (independent survey of local leaders).

Customer satisfaction (independent survey of customers).

Employee satisfaction (independent survey of employees).

Corporate profit (audited net income before taxes).

The annual surveys of local leaders, customers, and employees are conducted by an independent opinion survey firm that reports directly to the board of directors. Corporate profit is the firm's reported net income before taxes as audited by an international public accounting firm. SSI's senior management team believes strongly in the concept of the balanced scorecard and accepts it as a valid and productive performance measurement and incentive tool.

Senior management is tasked with determining how much to spend on further improvements in community engagement, customer satisfaction, and employee satisfaction. The following table captures the relations among additional spending in each area and the expected improvements from such expenditures (in millions).

![Secure Servers Inc. Secure Servers Inc. (SSI) is one of the largest software and service providers directed at providing high levels of backup and security for computer servers to the financial community, military, and other clients requiring off-site backup and security systems. SSI's software packages include encryption, downloading, and data warehousing of large amounts of data to various SSI sites in dedicated locations. SSI backup locations are designed to survive virtually all natural disasters and terrorist attacks. SSI employs 6,000 people in Dayton, Ohio. Being one of Dayton's largest employers, it has a deep commitment to the community and supports local educational, cultural, and philanthropic activities. SSI also believes strongly in both customer and employee satisfaction. To achieve these objectives, SSI employs a balanced scorecard to evaluate and reward senior managers. One-fourth of each senior executive's bonus is tied to the following objectively determined performance measures: Community engagement (independent survey of local leaders). Customer satisfaction (independent survey of customers). Employee satisfaction (independent survey of employees). Corporate profit (audited net income before taxes). The annual surveys of local leaders, customers, and employees are conducted by an independent opinion survey firm that reports directly to the board of directors. Corporate profit is the firm's reported net income before taxes as audited by an international public accounting firm. SSI's senior management team believes strongly in the concept of the balanced scorecard and accepts it as a valid and productive performance measurement and incentive tool. Senior management is tasked with determining how much to spend on further improvements in community engagement, customer satisfaction, and employee satisfaction. The following table captures the relations among additional spending in each area and the expected improvements from such expenditures (in millions). For example, by spending an additional $3 million on customer service (improved call centers, training, etc.), a 95 percent customer satisfaction can be achieved. Or, by spending an additional $2 million on employee-related activities (improved child care, athletic facilities, fringe benefits), a 90 percent employee satisfaction can be achieved. Or spending $1 million on additional community projects can raise SSI's community rating survey to 50 percent. Besides raising the satisfaction scores as detailed above, making additional expenditures on these three areas also generates additional net cash flows to the firm. The following table estimates the additional cash flows SSI receives from making the additional expenditures. For example, spending $3 million for community projects yields a community rating index of 90 percent and additional cash flows of $4.0 million, which increases net income before taxes by $1.0 million ($4.0 ? $3.0). To convert audited net income into a percentage index that can be averaged with the other three survey metrics, SSI uses the following formula: Profit index = ?3 + 0.05 × Net income So, if net income is $74 million, the profit index for use in the balanced scorecard is 70 percent [?3 + (0.05 × 74)]. The four indexes are averaged to get an overall index for determining the bonus for each senior executive of SSI. For example, the following four indexes yield a balanced scorecard of 79.75 percent: SSI expects audited net income before taxes for the year before making any additional expenditures on customer satisfaction, employee satisfaction, and community engagement to be $72 million. Required: a. What levels of additional spending do you expect the senior management team of SSI will select for: (1) Customer satisfaction. (2) Community engagement. (3) Employee satisfaction. Be sure to justify your answers with appropriate analysis. b. Given the levels of additional spending on the three items you recommended in ( a ), what is the expected balanced scorecard index? That is, calculate the average balanced scorecard management expects to generate if they make the expenditure decisions you predict in ( a ). Show calculations. c. What level of spending would you expect a profit-maximizing owner of SSI to select for: (1) Customer satisfaction. (2) Community engagement. (3) Employee satisfaction. What is the expected balanced scorecard resulting from these spending levels?](https://d2lvgg3v3hfg70.cloudfront.net/SM1503/11eb559c_84e6_32eb_a8c8_37eddf32638f_SM1503_00.jpg) For example, by spending an additional $3 million on customer service (improved call centers, training, etc.), a 95 percent customer satisfaction can be achieved. Or, by spending an additional $2 million on employee-related activities (improved child care, athletic facilities, fringe benefits), a 90 percent employee satisfaction can be achieved. Or spending $1 million on additional community projects can raise SSI's community rating survey to 50 percent.

For example, by spending an additional $3 million on customer service (improved call centers, training, etc.), a 95 percent customer satisfaction can be achieved. Or, by spending an additional $2 million on employee-related activities (improved child care, athletic facilities, fringe benefits), a 90 percent employee satisfaction can be achieved. Or spending $1 million on additional community projects can raise SSI's community rating survey to 50 percent.Besides raising the satisfaction scores as detailed above, making additional expenditures on these three areas also generates additional net cash flows to the firm. The following table estimates the additional cash flows SSI receives from making the additional expenditures.

![Secure Servers Inc. Secure Servers Inc. (SSI) is one of the largest software and service providers directed at providing high levels of backup and security for computer servers to the financial community, military, and other clients requiring off-site backup and security systems. SSI's software packages include encryption, downloading, and data warehousing of large amounts of data to various SSI sites in dedicated locations. SSI backup locations are designed to survive virtually all natural disasters and terrorist attacks. SSI employs 6,000 people in Dayton, Ohio. Being one of Dayton's largest employers, it has a deep commitment to the community and supports local educational, cultural, and philanthropic activities. SSI also believes strongly in both customer and employee satisfaction. To achieve these objectives, SSI employs a balanced scorecard to evaluate and reward senior managers. One-fourth of each senior executive's bonus is tied to the following objectively determined performance measures: Community engagement (independent survey of local leaders). Customer satisfaction (independent survey of customers). Employee satisfaction (independent survey of employees). Corporate profit (audited net income before taxes). The annual surveys of local leaders, customers, and employees are conducted by an independent opinion survey firm that reports directly to the board of directors. Corporate profit is the firm's reported net income before taxes as audited by an international public accounting firm. SSI's senior management team believes strongly in the concept of the balanced scorecard and accepts it as a valid and productive performance measurement and incentive tool. Senior management is tasked with determining how much to spend on further improvements in community engagement, customer satisfaction, and employee satisfaction. The following table captures the relations among additional spending in each area and the expected improvements from such expenditures (in millions). For example, by spending an additional $3 million on customer service (improved call centers, training, etc.), a 95 percent customer satisfaction can be achieved. Or, by spending an additional $2 million on employee-related activities (improved child care, athletic facilities, fringe benefits), a 90 percent employee satisfaction can be achieved. Or spending $1 million on additional community projects can raise SSI's community rating survey to 50 percent. Besides raising the satisfaction scores as detailed above, making additional expenditures on these three areas also generates additional net cash flows to the firm. The following table estimates the additional cash flows SSI receives from making the additional expenditures. For example, spending $3 million for community projects yields a community rating index of 90 percent and additional cash flows of $4.0 million, which increases net income before taxes by $1.0 million ($4.0 ? $3.0). To convert audited net income into a percentage index that can be averaged with the other three survey metrics, SSI uses the following formula: Profit index = ?3 + 0.05 × Net income So, if net income is $74 million, the profit index for use in the balanced scorecard is 70 percent [?3 + (0.05 × 74)]. The four indexes are averaged to get an overall index for determining the bonus for each senior executive of SSI. For example, the following four indexes yield a balanced scorecard of 79.75 percent: SSI expects audited net income before taxes for the year before making any additional expenditures on customer satisfaction, employee satisfaction, and community engagement to be $72 million. Required: a. What levels of additional spending do you expect the senior management team of SSI will select for: (1) Customer satisfaction. (2) Community engagement. (3) Employee satisfaction. Be sure to justify your answers with appropriate analysis. b. Given the levels of additional spending on the three items you recommended in ( a ), what is the expected balanced scorecard index? That is, calculate the average balanced scorecard management expects to generate if they make the expenditure decisions you predict in ( a ). Show calculations. c. What level of spending would you expect a profit-maximizing owner of SSI to select for: (1) Customer satisfaction. (2) Community engagement. (3) Employee satisfaction. What is the expected balanced scorecard resulting from these spending levels?](https://d2lvgg3v3hfg70.cloudfront.net/SM1503/11eb559c_84e6_32ec_a8c8_ebd250aa3031_SM1503_00.jpg) For example, spending $3 million for community projects yields a community rating index of 90 percent and additional cash flows of $4.0 million, which increases net income before taxes by $1.0 million ($4.0 ? $3.0).

For example, spending $3 million for community projects yields a community rating index of 90 percent and additional cash flows of $4.0 million, which increases net income before taxes by $1.0 million ($4.0 ? $3.0).To convert audited net income into a percentage index that can be averaged with the other three survey metrics, SSI uses the following formula:

Profit index = ?3 + 0.05 × Net income

So, if net income is $74 million, the profit index for use in the balanced scorecard is 70 percent [?3 + (0.05 × 74)].

The four indexes are averaged to get an overall index for determining the bonus for each senior executive of SSI. For example, the following four indexes yield a balanced scorecard of 79.75 percent:

![Secure Servers Inc. Secure Servers Inc. (SSI) is one of the largest software and service providers directed at providing high levels of backup and security for computer servers to the financial community, military, and other clients requiring off-site backup and security systems. SSI's software packages include encryption, downloading, and data warehousing of large amounts of data to various SSI sites in dedicated locations. SSI backup locations are designed to survive virtually all natural disasters and terrorist attacks. SSI employs 6,000 people in Dayton, Ohio. Being one of Dayton's largest employers, it has a deep commitment to the community and supports local educational, cultural, and philanthropic activities. SSI also believes strongly in both customer and employee satisfaction. To achieve these objectives, SSI employs a balanced scorecard to evaluate and reward senior managers. One-fourth of each senior executive's bonus is tied to the following objectively determined performance measures: Community engagement (independent survey of local leaders). Customer satisfaction (independent survey of customers). Employee satisfaction (independent survey of employees). Corporate profit (audited net income before taxes). The annual surveys of local leaders, customers, and employees are conducted by an independent opinion survey firm that reports directly to the board of directors. Corporate profit is the firm's reported net income before taxes as audited by an international public accounting firm. SSI's senior management team believes strongly in the concept of the balanced scorecard and accepts it as a valid and productive performance measurement and incentive tool. Senior management is tasked with determining how much to spend on further improvements in community engagement, customer satisfaction, and employee satisfaction. The following table captures the relations among additional spending in each area and the expected improvements from such expenditures (in millions). For example, by spending an additional $3 million on customer service (improved call centers, training, etc.), a 95 percent customer satisfaction can be achieved. Or, by spending an additional $2 million on employee-related activities (improved child care, athletic facilities, fringe benefits), a 90 percent employee satisfaction can be achieved. Or spending $1 million on additional community projects can raise SSI's community rating survey to 50 percent. Besides raising the satisfaction scores as detailed above, making additional expenditures on these three areas also generates additional net cash flows to the firm. The following table estimates the additional cash flows SSI receives from making the additional expenditures. For example, spending $3 million for community projects yields a community rating index of 90 percent and additional cash flows of $4.0 million, which increases net income before taxes by $1.0 million ($4.0 ? $3.0). To convert audited net income into a percentage index that can be averaged with the other three survey metrics, SSI uses the following formula: Profit index = ?3 + 0.05 × Net income So, if net income is $74 million, the profit index for use in the balanced scorecard is 70 percent [?3 + (0.05 × 74)]. The four indexes are averaged to get an overall index for determining the bonus for each senior executive of SSI. For example, the following four indexes yield a balanced scorecard of 79.75 percent: SSI expects audited net income before taxes for the year before making any additional expenditures on customer satisfaction, employee satisfaction, and community engagement to be $72 million. Required: a. What levels of additional spending do you expect the senior management team of SSI will select for: (1) Customer satisfaction. (2) Community engagement. (3) Employee satisfaction. Be sure to justify your answers with appropriate analysis. b. Given the levels of additional spending on the three items you recommended in ( a ), what is the expected balanced scorecard index? That is, calculate the average balanced scorecard management expects to generate if they make the expenditure decisions you predict in ( a ). Show calculations. c. What level of spending would you expect a profit-maximizing owner of SSI to select for: (1) Customer satisfaction. (2) Community engagement. (3) Employee satisfaction. What is the expected balanced scorecard resulting from these spending levels?](https://d2lvgg3v3hfg70.cloudfront.net/SM1503/11eb559c_84e6_32ed_a8c8_9141453d16c7_SM1503_00.jpg) SSI expects audited net income before taxes for the year before making any additional expenditures on customer satisfaction, employee satisfaction, and community engagement to be $72 million.

SSI expects audited net income before taxes for the year before making any additional expenditures on customer satisfaction, employee satisfaction, and community engagement to be $72 million.Required:

a. What levels of additional spending do you expect the senior management team of SSI will select for:

(1) Customer satisfaction.

(2) Community engagement.

(3) Employee satisfaction.

Be sure to justify your answers with appropriate analysis.

b. Given the levels of additional spending on the three items you recommended in ( a ), what is the expected balanced scorecard index? That is, calculate the average balanced scorecard management expects to generate if they make the expenditure decisions you predict in ( a ). Show calculations.

c. What level of spending would you expect a profit-maximizing owner of SSI to select for:

(1) Customer satisfaction.

(2) Community engagement.

(3) Employee satisfaction.

What is the expected balanced scorecard resulting from these spending levels?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 18 في هذه المجموعة.

فتح الحزمة

k this deck

10

British Airways

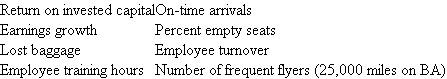

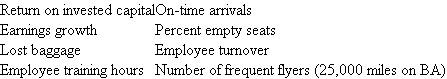

British Airways (BA) has implemented the balanced scorecard. Match the following performance indicators: to these four balanced scorecard perspectives:

to these four balanced scorecard perspectives:  Note: Performance indicators may be used for more than one perspective.

Note: Performance indicators may be used for more than one perspective.

British Airways (BA) has implemented the balanced scorecard. Match the following performance indicators:

to these four balanced scorecard perspectives:

to these four balanced scorecard perspectives:  Note: Performance indicators may be used for more than one perspective.

Note: Performance indicators may be used for more than one perspective.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 18 في هذه المجموعة.

فتح الحزمة

k this deck

11

Kollel Hospital

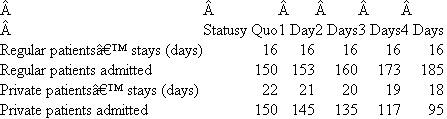

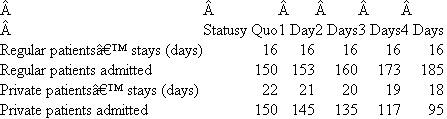

Kollel is a private hospital that operates in a large metropolitan area. The hospital admits "regular" patients and "private" patients. Regular patients are admitted and treated by staff doctors who are fulltime employees of Kollel Hospital. Private patients are admitted and treated by private physicians (physicians in private practice who have admitting privileges to Kollel). To maintain its leadership role in the community, Kollel is deeply committed to its Total Quality Management program. Management and staff form multidisciplinary teams to study various hospital functions. This year, one team reviewed a hospital unit that exclusively treated a particular type of medical admittance. (All patients of this type of admittance were treated in this unit.) The team found that patients preferred to be discharged sooner rather than later and that, overall, the patients felt that they were kept in the hospital too long.