Deck 14: Long-Term Financing: an Introduction

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/37

العب

ملء الشاشة (f)

Deck 14: Long-Term Financing: an Introduction

1

The dedicated capital of a corporation is determined by:

A)the sum of the capital in excess of par and the retained earnings.

B)the par value of preference shares.

C)the sum of the treasury stock and the preference shares.

D)the number of shares issued multiplied by the par value of each share.

E)the market price of company's debt.

A)the sum of the capital in excess of par and the retained earnings.

B)the par value of preference shares.

C)the sum of the treasury stock and the preference shares.

D)the number of shares issued multiplied by the par value of each share.

E)the market price of company's debt.

the number of shares issued multiplied by the par value of each share.

2

Shareholders usually have which of the following right(s)?

A)To elect board members, the authorizing of new shares and other matters of great

Importance to shareholders such as being acquired.

B)To share proportionally in regular and liquidating dividends.

C)To share proportionally in any new equity sold.

D)All of the above.

E)None of the above.

A)To elect board members, the authorizing of new shares and other matters of great

Importance to shareholders such as being acquired.

B)To share proportionally in regular and liquidating dividends.

C)To share proportionally in any new equity sold.

D)All of the above.

E)None of the above.

All of the above.

3

Capital surplus usually refers to:

A)the equity's par value.

B)last year's retained earnings.

C)book value per share.

D)the amount of directly contributed equity capital in excess of par value.

E)treasury stock.

A)the equity's par value.

B)last year's retained earnings.

C)book value per share.

D)the amount of directly contributed equity capital in excess of par value.

E)treasury stock.

the amount of directly contributed equity capital in excess of par value.

4

A claim on the assets of a debt issuing company is called:

A)non-recourse debt.

B)mortgage.

C)collateral.

D)a debenture.

E)None of the above.

A)non-recourse debt.

B)mortgage.

C)collateral.

D)a debenture.

E)None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 37 في هذه المجموعة.

فتح الحزمة

k this deck

5

Subordinated debt or junior debt is considered fairly risky for the lenders because:

A)the subordinated lenders will be paid off only after the specified creditors including

Ordinary equity holders have been compensated.

B)in the event of a corporate default, it is unlikely that the subordinated bondholders will

Receive any of their money back.

C)the issuing company is willing to secure the subordinated debt with all of their assets.

D)All of the above.

E)None of the above.

A)the subordinated lenders will be paid off only after the specified creditors including

Ordinary equity holders have been compensated.

B)in the event of a corporate default, it is unlikely that the subordinated bondholders will

Receive any of their money back.

C)the issuing company is willing to secure the subordinated debt with all of their assets.

D)All of the above.

E)None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 37 في هذه المجموعة.

فتح الحزمة

k this deck

6

If a long-term debt instrument is perpetual, it is called a(n):

A)secured debt issue.

B)subordinated debt issue.

C)consol.

D)capital debt issue.

E)indenture.

A)secured debt issue.

B)subordinated debt issue.

C)consol.

D)capital debt issue.

E)indenture.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 37 في هذه المجموعة.

فتح الحزمة

k this deck

7

The book value of the shareholders' ownership is represented by:

A)the sum of the par value of common stock, the capital surplus and the accumulated

Retained earnings.

B)the total assets minus the net worth.

C)the sum of the preference shares, debt and the capital surplus.

D)the sum of the total assets minus the current liabilities.

E)None of the above.

A)the sum of the par value of common stock, the capital surplus and the accumulated

Retained earnings.

B)the total assets minus the net worth.

C)the sum of the preference shares, debt and the capital surplus.

D)the sum of the total assets minus the current liabilities.

E)None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 37 في هذه المجموعة.

فتح الحزمة

k this deck

8

The amount of loan a person or firm borrows from a lender is the:

A)creditor.

B)indenture.

C)debenture.

D)principal.

E)amortization.

A)creditor.

B)indenture.

C)debenture.

D)principal.

E)amortization.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 37 في هذه المجموعة.

فتح الحزمة

k this deck

9

A share certificate often has a stated value on it.This amount is the:

A)book value.

B)stated book value.

C)subordinated liquidation value.

D)par value.

E)None of the above.

A)book value.

B)stated book value.

C)subordinated liquidation value.

D)par value.

E)None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 37 في هذه المجموعة.

فتح الحزمة

k this deck

10

The written agreement between a corporation and its bondholders is called:

A)the collateral agreement.

B)the deed.

C)the indenture.

D)the deed of conveyance.

E)None of the above.

A)the collateral agreement.

B)the deed.

C)the indenture.

D)the deed of conveyance.

E)None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 37 في هذه المجموعة.

فتح الحزمة

k this deck

11

Retained earnings are:

A)the amount of cash that the firm has saved up.

B)the difference between the net income earned and the dividends paid.

C)the difference between the market price of the equity and the book value.

D)the amount of shares repurchased.

E)None of the above.

A)the amount of cash that the firm has saved up.

B)the difference between the net income earned and the dividends paid.

C)the difference between the market price of the equity and the book value.

D)the amount of shares repurchased.

E)None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 37 في هذه المجموعة.

فتح الحزمة

k this deck

12

Different classes of shares usually are issued to:

A)maintain ownership control by holding the class of equity with greater voting rights.

B)pay less in dividends between the classes of equity.

C)fool investors into thinking that equity is equity and there is no difference in control or

Value features.

D)extract perquisites without the other class of shareholders knowing.

E)None of the above.

A)maintain ownership control by holding the class of equity with greater voting rights.

B)pay less in dividends between the classes of equity.

C)fool investors into thinking that equity is equity and there is no difference in control or

Value features.

D)extract perquisites without the other class of shareholders knowing.

E)None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 37 في هذه المجموعة.

فتح الحزمة

k this deck

13

The articles of incorporation state the number of shares that may be issued.The corporation:

A)must issue all authorized shares.

B)is unlimited in the number of authorized shares that it may have.

C)needs only board approval to issue authorized shares.

D)Both A and B.

E)Both B and C.

A)must issue all authorized shares.

B)is unlimited in the number of authorized shares that it may have.

C)needs only board approval to issue authorized shares.

D)Both A and B.

E)Both B and C.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 37 في هذه المجموعة.

فتح الحزمة

k this deck

14

If a group other than management solicits the authority to vote shares to replace management, a _____ is said to occur.

A)proxy fight

B)shareholder derivative action

C)tender offer

D)vote of confidence

E)None of the above.

A)proxy fight

B)shareholder derivative action

C)tender offer

D)vote of confidence

E)None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 37 في هذه المجموعة.

فتح الحزمة

k this deck

15

Shares of equity that have been repurchased by the corporation are called:

A)treasury stock.

B)undistributed capital stock.

C)retained equity.

D)capital surplus shares.

E)None of the above.

A)treasury stock.

B)undistributed capital stock.

C)retained equity.

D)capital surplus shares.

E)None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 37 في هذه المجموعة.

فتح الحزمة

k this deck

16

Paying off long-term debt by making installment payments is called:

A)foreclosing on the debt.

B)amortizing the debt.

C)funding the debt.

D)calling the debt.

E)None of the above.

A)foreclosing on the debt.

B)amortizing the debt.

C)funding the debt.

D)calling the debt.

E)None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 37 في هذه المجموعة.

فتح الحزمة

k this deck

17

In the hierarchy or priority of a company's securities, the first and the last capital providers to get a claim on the assets of a bankrupt company are___________and____________respectively.

A)Senior unsecured debt holders / Preference share holders

B)Second lien loan holders / Ordinary equity holders

C)Senior secured debt holders / Ordinary equity holders

D)Senior secured debt holders / Subordinated debt holders

E)Senior unsecured debt holders / Shareholder loans

A)Senior unsecured debt holders / Preference share holders

B)Second lien loan holders / Ordinary equity holders

C)Senior secured debt holders / Ordinary equity holders

D)Senior secured debt holders / Subordinated debt holders

E)Senior unsecured debt holders / Shareholder loans

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 37 في هذه المجموعة.

فتح الحزمة

k this deck

18

Cumulative dividends are:

A)payable on preference shares.

B)carried forward.

C)paid before the ordinary shareholders can receive anything.

D)All of the above.

E)None of the above.

A)payable on preference shares.

B)carried forward.

C)paid before the ordinary shareholders can receive anything.

D)All of the above.

E)None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 37 في هذه المجموعة.

فتح الحزمة

k this deck

19

Debt that may be extinguished before maturity is referred to as:

A)sinking-fund debt.

B)debentures.

C)callable debt.

D)indenture debt.

E)None of the above.

A)sinking-fund debt.

B)debentures.

C)callable debt.

D)indenture debt.

E)None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 37 في هذه المجموعة.

فتح الحزمة

k this deck

20

A grant of authority allowing someone else to vote shares of equity that you own is called:

A)a power-of-share authorization.

B)a proxy.

C)a share authority grant (SAG).

D)a restricted conveyance.

E)None of the above.

A)a power-of-share authorization.

B)a proxy.

C)a share authority grant (SAG).

D)a restricted conveyance.

E)None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 37 في هذه المجموعة.

فتح الحزمة

k this deck

21

Corporations try to create hybrid securities that look like equity but are called debt because:

A)debt interest expense is tax deductible.

B)bankruptcy costs are eliminated or reduced.

C)these securities are lower is risk than debt.

D)Both A and C.

E)Both A and B.

A)debt interest expense is tax deductible.

B)bankruptcy costs are eliminated or reduced.

C)these securities are lower is risk than debt.

D)Both A and C.

E)Both A and B.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 37 في هذه المجموعة.

فتح الحزمة

k this deck

22

Holden Bicycles has 1,000 shares outstanding each with a par value of £0.10 each.If they are sold to shareholders at £10 each, what would the additional paid-in capital be?

A)£100

B)£900

C)£9,900

D)£10,000

E)£11,000

A)£100

B)£900

C)£9,900

D)£10,000

E)£11,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 37 في هذه المجموعة.

فتح الحزمة

k this deck

23

If a debt issue is callable, the call price is ____ par.

A)greater than

B)less than

C)equal to

D)unrelated to

E)irrelevant to the value at

A)greater than

B)less than

C)equal to

D)unrelated to

E)irrelevant to the value at

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 37 في هذه المجموعة.

فتح الحزمة

k this deck

24

Rockwell plc had net income of £150,000 for the last financial year.The company decided to pay out 40% of earnings per share as a dividend.Rockwell has 120,000 shares issued and outstanding.

What are the retained earnings?

A)£ 40,000

B)£ 60,000

C)£ 90,000

D)£150,000

E)None of the above.

What are the retained earnings?

A)£ 40,000

B)£ 60,000

C)£ 90,000

D)£150,000

E)None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 37 في هذه المجموعة.

فتح الحزمة

k this deck

25

Technically speaking, a long-term corporate debt offering that features a specific attachment to corporate property is generally called:

A)a debenture.

B)a bond.

C)a long-term liability.

D)a preferred liability.

E)None of the above.

A)a debenture.

B)a bond.

C)a long-term liability.

D)a preferred liability.

E)None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 37 في هذه المجموعة.

فتح الحزمة

k this deck

26

There was an upward trend in the ratio of the book value of debt to the book value of debt and equity throughout the 1990s.Some of this was due to the repurchasing of shares.The market value

Ratio of debt to debt and equity exhibited no upward trend.This can be explained by:

A)the change in the accounting rules of the period.

B)the difference between tax accounting and accounting for financial accounting purposes.

C)a large increase in the market value of equity that was greater than the increase in debt.

D)All of the above.

E)None of the above.

Ratio of debt to debt and equity exhibited no upward trend.This can be explained by:

A)the change in the accounting rules of the period.

B)the difference between tax accounting and accounting for financial accounting purposes.

C)a large increase in the market value of equity that was greater than the increase in debt.

D)All of the above.

E)None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 37 في هذه المجموعة.

فتح الحزمة

k this deck

27

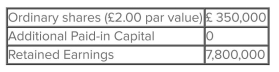

Information on shareholder's equity as currently shown on the books of the Eaton plc is given as:

Rework the shareholder's equity as it appears on the books if the company issues 40,000 new shares of ordinary equity at £ 70 per share.

Rework the shareholder's equity as it appears on the books if the company issues 40,000 new shares of ordinary equity at £ 70 per share.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 37 في هذه المجموعة.

فتح الحزمة

k this deck

28

Corporate financial officers prefer to use book values when measuring debt ratios because:

A)book values are more stable than market values.

B)debt covenant restriction are usually expressed in book value terms.

C)rating agencies measure debt ratios in book values terms.

D)All of the above.

E)None of the above.

A)book values are more stable than market values.

B)debt covenant restriction are usually expressed in book value terms.

C)rating agencies measure debt ratios in book values terms.

D)All of the above.

E)None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 37 في هذه المجموعة.

فتح الحزمة

k this deck

29

If a firm retires or extinguish a debt issue before maturity the specific amount they pay is:

A)the amortization amount.

B)the call price.

C)the sinking fund amount.

D)the spread premium.

E)None of the above.

A)the amortization amount.

B)the call price.

C)the sinking fund amount.

D)the spread premium.

E)None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 37 في هذه المجموعة.

فتح الحزمة

k this deck

30

The written agreement between a corporation and its bondholders might contain a prohibition against paying dividends in excess of current earnings.This prohibition is an example of a(n):

A)maintenance of security provision.

B)collateral restriction.

C)affirmative indenture.

D)restrictive covenant.

E)None of the above.

A)maintenance of security provision.

B)collateral restriction.

C)affirmative indenture.

D)restrictive covenant.

E)None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 37 في هذه المجموعة.

فتح الحزمة

k this deck

31

Financial deficits are created when:

A)profits and retained earnings are greater than the capital-spending requirement.

B)profits and retained earnings are less than the capital-spending requirement.

C)profits and retained earnings are equal to the capital-spending requirement.

D)All of the above.

E)None of the above.

A)profits and retained earnings are greater than the capital-spending requirement.

B)profits and retained earnings are less than the capital-spending requirement.

C)profits and retained earnings are equal to the capital-spending requirement.

D)All of the above.

E)None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 37 في هذه المجموعة.

فتح الحزمة

k this deck

32

The pre-emptive right of shareholders refers to:

A)The right to share proportionally in assets remaining after liabilities have been paid in a

Liquidation.

B)The right to vote on matters of great importance to shareholders, such as a merger, usually

Decided at the annual meeting or a special meeting.

C)The right to share proportionally in dividends paid.

D)The right to share proportionally in any new equity sold.

E)All of the above.

A)The right to share proportionally in assets remaining after liabilities have been paid in a

Liquidation.

B)The right to vote on matters of great importance to shareholders, such as a merger, usually

Decided at the annual meeting or a special meeting.

C)The right to share proportionally in dividends paid.

D)The right to share proportionally in any new equity sold.

E)All of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 37 في هذه المجموعة.

فتح الحزمة

k this deck

33

Last year, Lory Bookstore used internal financing as a source of long-term financing for 80% of its total needs.The company borrowed an additional 27% of its total needs in the long-term debt

Markets.What was Lory's net new share issues in that year?

A)-20%

B)-7%

C)0%

D)20%

E)27%

Markets.What was Lory's net new share issues in that year?

A)-20%

B)-7%

C)0%

D)20%

E)27%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 37 في هذه المجموعة.

فتح الحزمة

k this deck

34

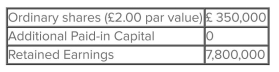

Information on shareholder's equity as currently shown on the books of the Eaton plc is given as:

From this information, calculate Eaton's book value per share.

From this information, calculate Eaton's book value per share.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 37 في هذه المجموعة.

فتح الحزمة

k this deck

35

If a debenture is subordinated, it:

A)has a higher priority status than specified creditors.

B)is secondary to equity.

C)must give preference to the specified creditor in the event of default.

D)has been issued because the company is in default.

E)None of the above

A)has a higher priority status than specified creditors.

B)is secondary to equity.

C)must give preference to the specified creditor in the event of default.

D)has been issued because the company is in default.

E)None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 37 في هذه المجموعة.

فتح الحزمة

k this deck

36

Which of the following statements is false?

A)Creditors do not have voting power.

B)Payment on interest on debt in considered an expense, while payment of dividends is a

Return on capital.

C)Unpaid debt is a liability of the firm, and if not paid, can result in liquidation of the firm.

Unpaid ordinary equity dividends cannot force liquidation.

D)One of the costs of issuing equity is the possibility of financial distress, while no financial

Distress is associated with debt.

E)None of the above.

A)Creditors do not have voting power.

B)Payment on interest on debt in considered an expense, while payment of dividends is a

Return on capital.

C)Unpaid debt is a liability of the firm, and if not paid, can result in liquidation of the firm.

Unpaid ordinary equity dividends cannot force liquidation.

D)One of the costs of issuing equity is the possibility of financial distress, while no financial

Distress is associated with debt.

E)None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 37 في هذه المجموعة.

فتح الحزمة

k this deck

37

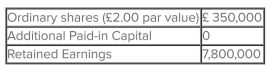

Nelson Company has the beginning equity accounts as follows

Projected income is and the dividend per share to be paid immediately is 40%. What will the ending retained earnings account be?

and the dividend per share to be paid immediately is 40%. What will the ending retained earnings account be?

A)£90,000

B)£92,000

C)£122,000

D)£210,000

E)£242,000

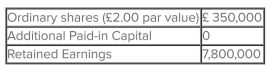

Projected income is

and the dividend per share to be paid immediately is 40%. What will the ending retained earnings account be?

and the dividend per share to be paid immediately is 40%. What will the ending retained earnings account be?A)£90,000

B)£92,000

C)£122,000

D)£210,000

E)£242,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 37 في هذه المجموعة.

فتح الحزمة

k this deck